Many trade set-ups doing well and more setting up here. Highlights from mid day trading review;

$SPY – continuation in chart structure build here. Trendline support in place, price targets hitting, 266.65 resistance at 200 MA on 60 min, 267.99 mid quad significant resistance.

$NFLX Netflix – Above wide range pivot resistance, next resistance 313.70 316.92 intra 328.15 later. Primary at 337.75 resistance.

$DIS Disney – Structure in play nicely, buy side alert doing well, 200 MA 103.82 resistance, 50 MA resistance. Check chart for Fib resistance. 103.70 June 31 price target with 110.50 possible but not likely.

$ITCI – 23.73 important pivot resistance and over is a buy side trigger.

$ESPR – 74.79 ish is a pivot and over is long side trigger.

$EOG – 108.90 main pivot above is a buy side trigger. Looking for close on daily above pivot. Trajectory per video / chart is likely diagonal Fib line (quad resistance) resistance 119.87 128.15 134.10 (significant). Timing cycle peaks early Aug.

$AAOI – 32.79 resistance and above is a buy side add.

OIL $USOIL $WTI – 66.69 intra day, 50% retracement resistance Fibonacci mark on monthly chart holding so far (large structural chart),

$TSLA – Another great trade, model in play still. Review chart.

$C Citi – Alerted long side buy side doing well time to trim ahead of earnings.

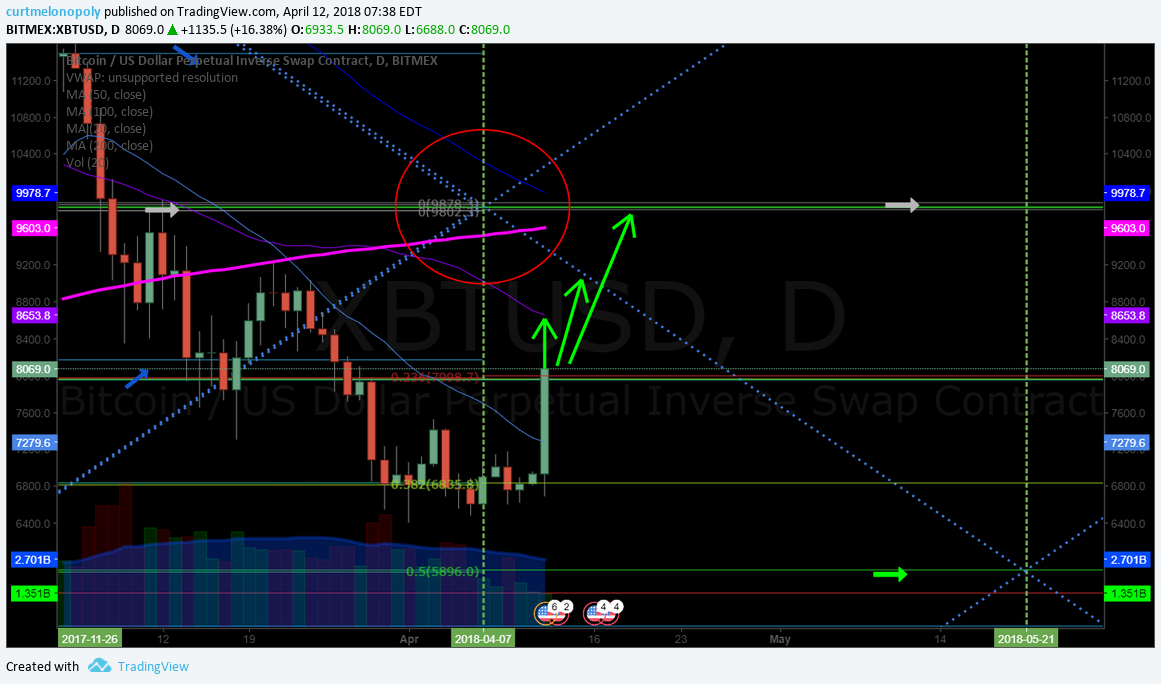

$BTC Bitcoin $XBTUSD – Hit target perfect at time and price. Got it’s jump today off mid support and current structure of support and resistance is discussed. 75.29 uptrending support 79.69 price target on April 17 , 2018 and 88.69 price target (more bullish scenario on same day).

$MARA – Most of the move came premarket was watching 50 MA on daily as important resistance and it never got there. So there wasn’t enough room at open on the technical. In to next week looking for 50 MA on daily on resistance. 2.25 is 200 MA and next week I’m looking for that area as resistance for long side daytrade Friday or even Monday.

$FB Facebook – Wash out snapback trade has been great – buy side alert at bottom in to our price target for time and price then add buy side alerts have done well. April 17, 2018 4:00 167.42 is first target, structured trade in to completion of time cycle and in to price target. 240 Min chart in review on video. All resistance points are on chart (review video and charting posts). 181.46 April 17 Price Target in play also (as bullish scenario).

$BWA – Buy trigger alerted today 54.25 above resistance, 58.23 upside price target April 19, careful its getting near mid quad resistance.

$LITE – Power move in great chart structure, over 65.00 is buy side in to 75.55 June 4 price target (possible target – trade price). Careful with quad trendline resistance above trending upward. 69.60 70.05 73.35 75.85 are the upside resistance points if you’re long.

$IOTS – Love this bullish break out bull structure. Price targets possible are 13.50 and 18.00 range in a perfect bullish extension scenario.

$FATE – Shoulda coulda woulda – like it, but not like I am on top off

And back to OIL – Forward trading bias guess / guidance. Over 67 with structure brings 74.20 June 1st ish back down round trip ending in October 2018. Week of April 9 upside possible target on weekly model was in around 74.00 and that hasn’t hit but when the original model was posted 74.00 seemed impossible.

Crypto $BTC: Daily algorithm model on $BTC Bitcoin, turn could be here, listen to the analysis on the trade action on the chart in the video and you decide. 1374.30 June 21 Price Target moderately bullish, 9900.00 price target 5940.00 bearish same day. Three options for that price cycle peak – trade price in direction of target. If you want to trade BTC listen to this video. Remember when I posted a tweet that I knew where the Bitcoin bottom was? This video explains that.

Our last review that will provide more detail on these and other trading set-ups is here; $NFLX, Swing, trading, setup

Special Swing Trade Report: #OIL, #GOLD, $NFLX, $SPY, $DIS, $GDX, $TSLA, $AAOI, $ESPR, $ITCI, $TAN, $CELG, $C and more.

And for a detailed $FB Facebook setup click here $FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

Most of these charts are on my Trading View account that are discussed in the video (some are private to members but I think many are available).

For more detail on the time cycle peaks for your trade, price targets, and support / resistance points relating to your personal trading plan contact me with any questions you have.

Thanks!

Curt

Subscribe:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Reach Out:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmelonopoly/

Facebook: https://www.facebook.com/compoundtrading/

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin 1.05% , $ETH, $LTC, $XRP,) $DXY -0.05% US Dollar -0.05% and Swing Trading Newsletter. Live trading rooms for daytrading and oil 2.00% traders. Private coaching and live alerts.