Tag: Algorithms

Volatility $VIX Trade Report Tuesday Jan 10 $TVIX, $UVXY, $XIV

Volatility $VIX Trade Update Tuesday Jan 10, 2017 $TVIX, $UVXY, $XIV Charting / Algorithm Observations

Good morning! My name is Vexatious $VIX the Algo. Welcome to my new $VIX trade report.

Notices:

Algorithmic Charting: Below you will find the first in a series of charting posts to come over 2017. Each post will bring more and more detailed indicators.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle (incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price movements of the volatility index (more specifically $VIX).

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the sixth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal [email protected] within 30 days of signing up so they can refund you. If you do chose that option, you can always check back as 2017 progresses when my algorithm processes / indicators for your trading edge will be very extensive.

Is should also note, that specific to the $VIX, this algorithmic modeling work is much different than an indices, a commodity or a currency – each come with their own challenges, but specific to volatility the challenges in modeling predictability are exceptional.

$VIX Trading Observations:

So yesterday we did see some lift in the $VIX and then it came off some. We do expect a volatility increase as we near Jan 20. As it rises we will post levels for intraday trading our traders will be using. Other than that, there are no new indicators to report intraday.

Per yesterday;

Live Chart Link: https://www.tradingview.com/chart/VIX/NagLpI9Y-Vexatious-VIX-Volatility-Algo-Algorithmic-Modeling-Jan-09-134-A/

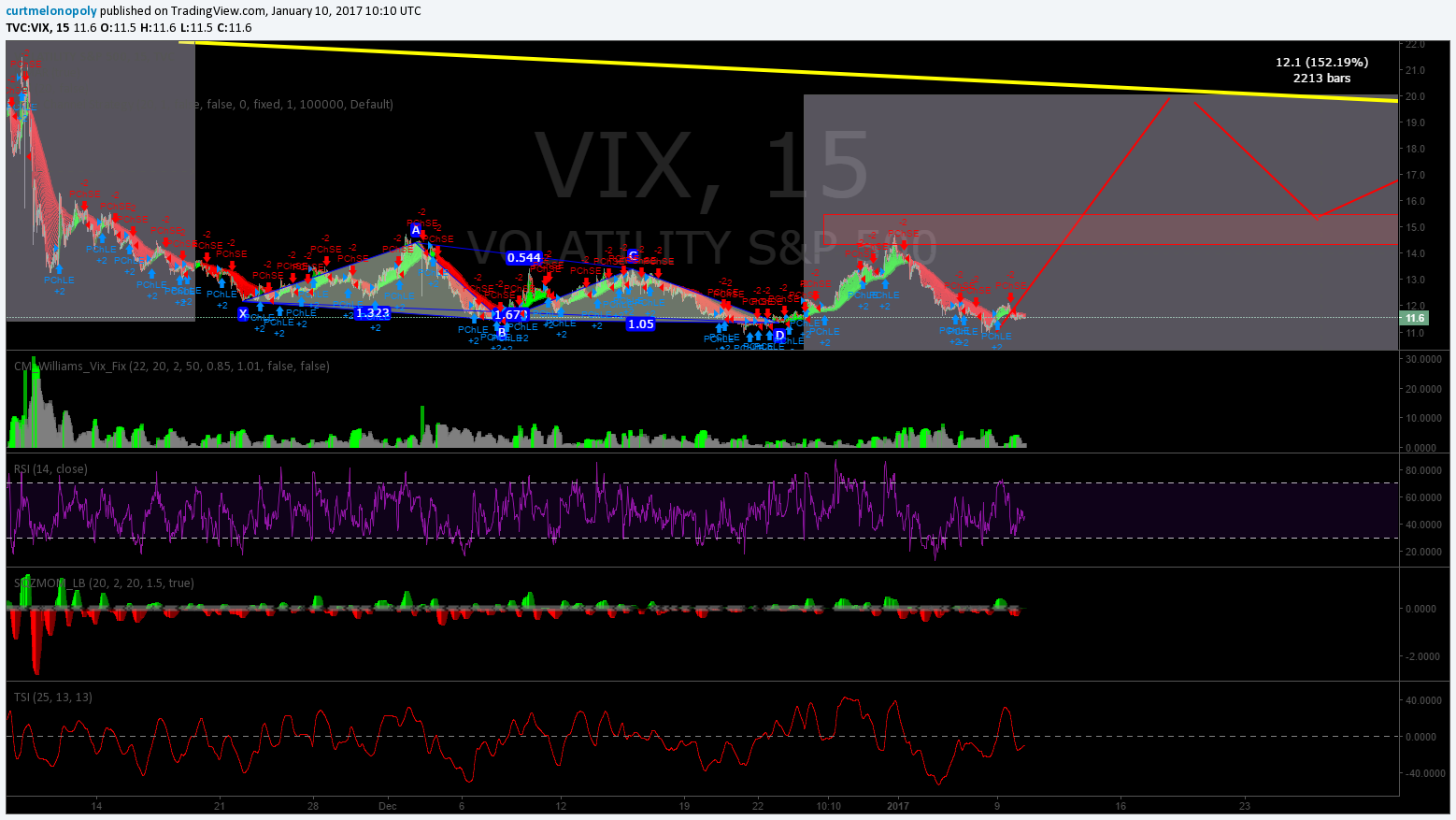

First, it seems volatility (based on probability calculations) is due for an increase – see red line on chart below for the most probable scenario short term.

Until volatility starts to rise this is the best we can do – provide the most probable scenario.

However, as soon as it starts to rise we can then provide historical averages / probabilities and indicators to move with the price action and trade in and out of volatility price action.

If you are shorting volatility, the trend-line in yellow has proven to be effective of the last number of months, however, we would caution relying on it.

So the bottom line with the $VIX as it is intra-day – our traders are waiting for the indicators to turn positive at which time we will be issuing posts relating to intra-day trading ranges – until then we wait.

Other considerations:

Per previous;

Demark exhaustion

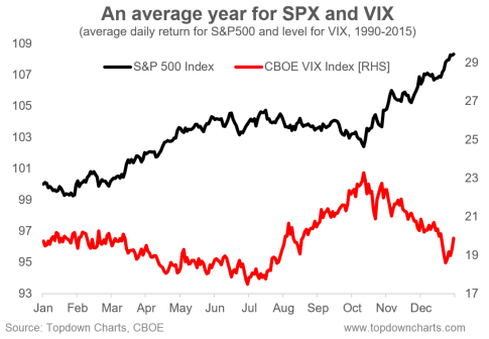

$VIX Tom Demark exhaustion is at its 13th most in last 10 years. Average upside return at these levels is 97% within average thirty-five days on last twelve occasions.

An Average Year for $SPX and $VIX

As of close Friday

$VIX 11.28 #Contango 13.62 %

$XIV gains 0.80% daily from contango

$VXX holds 35% VX1 and 65% VX2 futures

6 trading days to expiration

Volatility indexes finished the first week of the year mostly in the red $VIX $TYVIX pic.twitter.com/ZAEAs9v55X

— Cboe (@CBOE) January 7, 2017

New all-time record for $VIX

futures – avg. daily volume of 238,773 in 2016 (up 16%) https://t.co/9VBEbMGsDo volatility pic.twitter.com/vDfTYIyqrJ— Cboe (@CBOE) January 6, 2017

UVXY Reverse Split Ahead: How To Position When Volatility Spikes

Alpha Algo Trading Lines:

Over the coming days we will establish these based on indicators intra-day price action.

Alpha Algo Trading Targets:

Over the coming days we will establish these based on indicators intra-day price action.

Intra Day Algo Trading Quadrants:

Over the coming days we will establish these based on indicators intra-day price action.

Time / Price Cycle Change Forecast:

Over the coming days we will establish these based on indicators intra-day price action.

Conclusion:

Our indicators all point toward an increase in volatility very soon – days and weeks at most, at which time we will publish intra-day trading ranges for our members

Good luck with your trades and look forward to seeing you in the room!

Vexatious the $VIX Algo

Article Topics: Vexatious $VIX Algo, Volatility, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $TVIX, $UVXY, $XIV

Member GOLD Trade Update Mon Jan 9 $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG

Gold Trading Algorithmic Charting Update Monday Jan 9 GOLD $XAUUSD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations

Jan 9, 2017 Rosie the Gold Algo Trading Report (member edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new member edition Gold trade report.

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

There’s Gold in them thar hills boy!

If you haven’t read part one of “There’s Gold in them thar hills boy!” please do now before reading below. Also, the member edition Gold trade follow up here.

Live Gold Chart on Trading View

Live Gold Miner $GDX Chart on Trading View

Gold Chart Intraday

Gold trade chart. ROSIE the GOLD Algo $GLD – $UGLD $DGLD $GDX $NUGT $DUST $JDST

Trade Considerations to Increase Your Trading Edge

Below are the tight intrday trading ranges in Gold. Also there are three arrows pointing to intraday resistance. The yellow line being a symmetry resistance, the blue is a quadrant resistance and the green is an important Fibonacci extension resistance. The uptrend is intact if the white line is not breached and price stays above 1155 ish region.

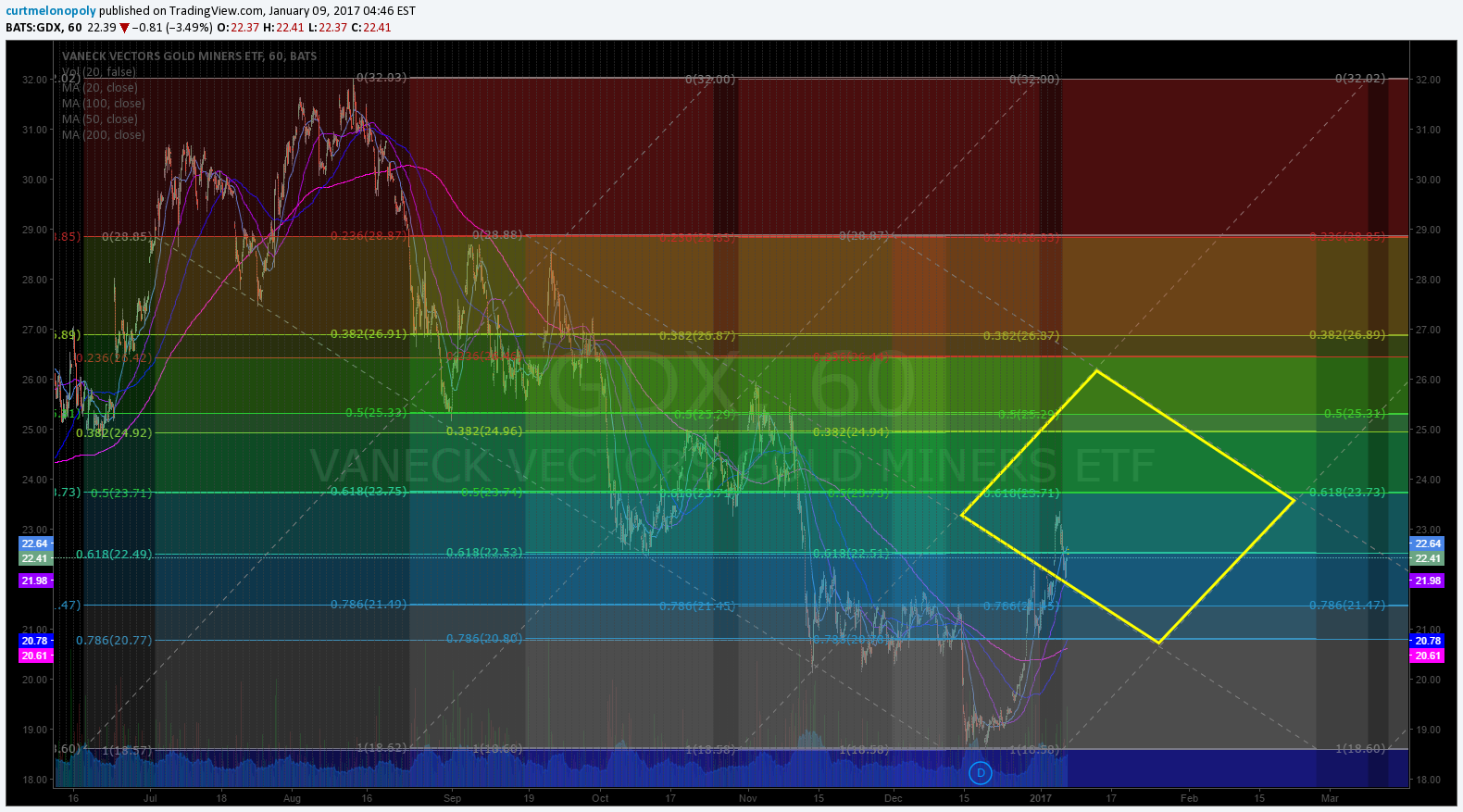

Quadrants. $GDX trade chart. ROSIE the GOLD Algo $GLD – $UGLD $DGLD $GDX $NUGT $DUST $JDST

The math is locking in now on the miner’s.

Current trade quadrant. $GDX trade chart. ROSIE the GOLD Algo $GLD – $UGLD $DGLD $GDX $NUGT $DUST $JDST

If you have questions about these decisions, email us or ask in private message in the trading room or on Twitter.

Below are some of our regular info…. notices etc…

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $XAUUSD, $GOLD, $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG

Volatility $VIX Trade Report Monday Jan 9 $TVIX, $UVXY, $XIV

Volatility $VIX Trade Update Monday Jan 9, 2017 $TVIX, $UVXY, $XIV Charting / Algorithm Observations

Good morning! My name is Vexatious $VIX the Algo. Welcome to my new $VIX trade report.

Notices:

Algorithmic Charting: Below you will find the first in a series of charting posts to come over 2017. Each post will bring more and more detailed indicators.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle (incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price movements of the volatility index (more specifically $VIX).

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the sixth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal [email protected] within 30 days of signing up so they can refund you. If you do chose that option, you can always check back as 2017 progresses when my algorithm processes / indicators for your trading edge will be very extensive (late Jan ish).

$VIX Trading Observations:

Live Chart Link: https://www.tradingview.com/chart/VIX/NagLpI9Y-Vexatious-VIX-Volatility-Algo-Algorithmic-Modeling-Jan-09-134-A/

Volatility is like no other algorithmic modeling we are working with (to date). The modeling as described above is in very, very early stages. Nonetheless, here are some considerations;

First, it seems volatility (based on probability calculations) is due for an increase – see red line on chart below for the most probable scenario short term.

Until volatility starts to rise this is the best we can do – provide the most probable scenario.

However, as soon as it starts to rise we can then provide historical averages / probabilities and indicators to move with the price action and trade in and out of volatility price action.

If you are shorting volatility, the trend-line in yellow has proven to be effective of the last number of months, however, we would caution relying on it.

So the bottom line with the $VIX as it is intra-day – our traders are waiting for the indicators to turn positive at which time we will be issuing posts relating to intra-day trading ranges – until then we wait.

Other considerations:

Demark exhaustion

$VIX Tom Demark exhaustion is at its 13th most in last 10 years. Average upside return at these levels is 97% within average thirty-five days on last twelve occasions.

An Average Year for $SPX and $VIX

As of close Friday

$VIX 11.28 #Contango 13.62 %

$XIV gains 0.80% daily from contango

$VXX holds 35% VX1 and 65% VX2 futures

6 trading days to expiration

Volatility indexes finished the first week of the year mostly in the red $VIX $TYVIX pic.twitter.com/ZAEAs9v55X

— Cboe (@CBOE) January 7, 2017

New all-time record for $VIX

futures – avg. daily volume of 238,773 in 2016 (up 16%) https://t.co/9VBEbMGsDo volatility pic.twitter.com/vDfTYIyqrJ— Cboe (@CBOE) January 6, 2017

UVXY Reverse Split Ahead: How To Position When Volatility Spikes

Alpha Algo Trading Lines:

Over the coming days we will establish these based on indicators intra-day price action.

Alpha Algo Trading Targets:

Over the coming days we will establish these based on indicators intra-day price action.

Intra Day Algo Trading Quadrants:

Over the coming days we will establish these based on indicators intra-day price action.

Time / Price Cycle Change Forecast:

Over the coming days we will establish these based on indicators intra-day price action.

Conclusion:

Our indicators all point toward an increase in volatility very soon – days and weeks at most, at which time we will publish intra-day trading ranges for our members

Good luck with your trades and look forward to seeing you in the room!

Vexatious the $VIX Algo

Article Topics: Vexatious $VIX Algo, Volatility, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $TVIX, $UVXY, $XIV

S&P 500 $SPY Trading Chart Updates Monday Jan 9 $ES_F ($SPXL, $SPXS)

S&P 500 $SPY Trade Update Monday Jan 9, 2017 $ES_F ($SPXL, $SPXS) Charting / Algorithm Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report.

Notices:

Algorithmic Charting: Below you will find the first in a series of charting posts to come over 2017. Each post will bring more and more detailed indicators.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of the S&P500 (more specifically $SPY). Early 2017 I will also provide algo indicators and charting for $ES_F.

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the fifth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo they developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal [email protected] within 30 days of signing on so they can refund you. If you do chose that option, you can always check back early 2017 when my algorithm processes / indicators for your trading edge will be very extensive (mid Jan).

$SPY Trading Observations:

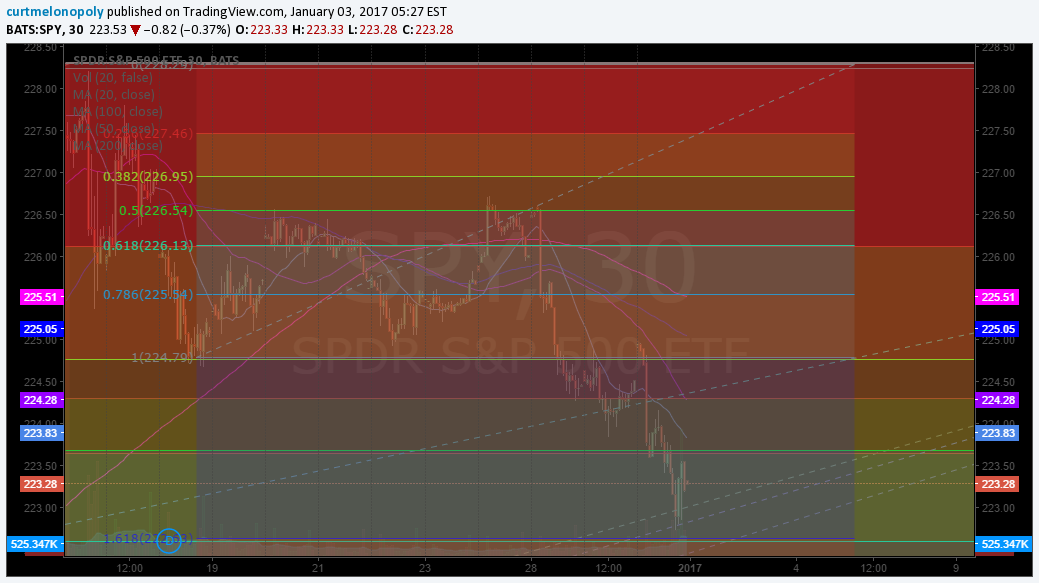

Live Chart Link: https://www.tradingview.com/chart/SPY/N5jyLBJG-Member-S-P-500-SPY-Trading-Chart-Updates-Monday-Jan-9-ES-F-S/

Support and Resistance Lines and Fibonacci

Per previous;

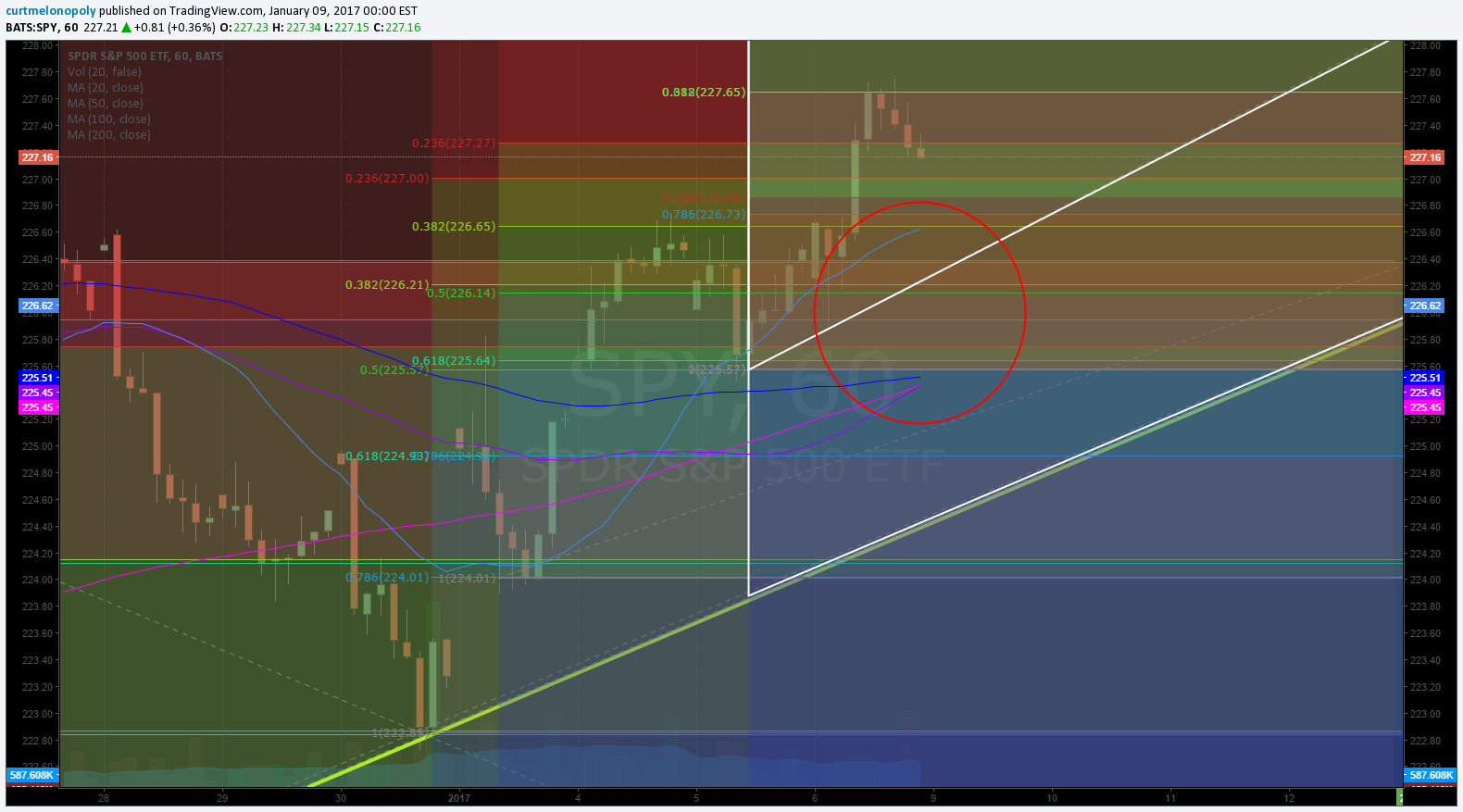

Traditional support and resistance points from previous time cycle and Fibonacci levels to watch.

I know this chart becomes cluttered and difficult to see, but those are the levels our traders use to trade the S&P 500 with primarily – support and resistance from Fibonacci lines from different time / price areas. In fact there are many more they use but it does become really cluttered. Also, pay attention to the diagonal fib represented trend-lines (white dotted) – when price looses a trend-line it usually means price is in downdraft mode. This includes simple diagonal trend-lines shown in chart below also.

Current;

S&P 500 $SPY Support and Resistance on 1 Day – Fibonacci Sun Jan 8 1114 PM $ES_F ($SPXL, $SPXS) Charting – Algo Model Observations

Trade the margins (yellow) on swings and if above top resistance use it as support and we will update levels.

S&P 500 $SPY Support and Resistance on 1 Hour – Fibonacci Sun Jan 8 1114 PM $ES_F ($SPXL, $SPXS) Charting – Algo Model Observations

Trading on 1 hour levels

S&P 500 $SPY Support and Resistance on 15 Min – Fibonacci Sun Jan 8 1131 PM $ES_F ($SPXL, $SPXS) Charting – Algo Model Observations

Levels on the 15 min chart to watch.

S&P 500 $SPY Levels to watch above resistance. – Fibonacci Sun Jan 8 1137 PM $ES_F ($SPXL, $SPXS) Charting – Algo Model Observations

Some levels to watch above resistance.

Time / Price Cycles / Trading Quadrants

These will get much more detailed over the coming weeks and will be represented on different time-frames. For now, watch the price action with us and we will see soon if our algorithmic model is starting to lock in. Once we have them locked in on broad time frames we slowly focus in to the point of being on the minute. Here’s a start….

S&P 500 $SPY trading quadrants – time price cycles Sun Jan 8 1144 PM $ES_F ($SPXL, $SPXS) Charting – Algo Model Observations

Simple Diagonal Trend-Lines (Blue)

If price loses support – watch for these diagonal lines.

Per previous (in case price starts downward);

The reason we start with simple lines (as one of our primary indicators) is that in many instances price will use simple lines for a bounce or further downside. If there are more than one simple line that price is challenging all the more probability for a bounce or further downside. In other words, you will find that price is more probable to find inflection points when it hits a Fib support or resistance line and a diagonal trend-line at the same time.

Building the Probabilities for Buy Sell Signals in Algorithmic Model – We Start With Simple MA’s

With our algorithmic modeling our development philosophy has been to keep it simple. One way we do this is to start with the MA’s and how they might become predictable buy and sell triggers on various time-frames – once we have reviewed them all (which I won’t include all in these posts because there are many hundreds of variations and these posts would become books) we then calculate the win rate % for each win / loss for each time frame for each MA. Simple right? It actually is – the more difficult part is actually processing the information.

Once we have the MA data processed for all time frames we then have buy / sell triggers with probabilities attached to each for our buy / sell alerts. We can then move on to other indicators such a Fibonacci and many more (all of which become part of our probability set for algorithmic targets). So for the next few days we will review some of the more considerable MA’s a trader can look at.

Per Previous;

200 MA Crossing 20 50 100 MA on 1 Hour Chart

Here is the most immediate MA set-up our trader’s our watching intra – when the 200 MA crossed the 20 50 and 100 and price gets above the MA’s on the 1 hour. Watch this close if price action gets lift over the coming days.

Current;

S&P 500 $SPY 20 50 100 200 on 1 Hour Lining Up Mon Jan 9 1200 AM $ES_F ($SPXL, $SPXS) Charting – Algo Model Observations

The 20, 50, 100, 200 are about to line up and this can create a lot of upward pressure. Very bullish.

Alpha Algo Trading Lines:

Over the coming days we will establish these based on indicators intra-day price action.

Alpha Algo Trading Targets:

Over the coming days we will establish these based on indicators intra-day price action.

Intra Day Algo Trading Quadrants:

Over the coming days we will establish these based on indicators intra-day price action.

Time / Price Cycle Change Forecast:

Over the coming days we will establish these based on indicators intra-day price action.

Conclusion:

Over-all, we are bullish. This can change at any moment – but all indicators we watch are indicating higher prices. We will update as the week goes on.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom $SPY Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

GOLD Trade Update Jan 9 (Public Edition) $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG

Gold Trading Algorithmic Charting Update Monday Jan 9 2017 GOLD $XAUUSD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations.

Rosie the Gold Algo Trading Report (public edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new public edition Gold trade report (public editions do not include proprietary algorithmic modeling).

The member edition (that includes the algorithmic trading levels) will be published and in your email inbox soon!

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

There’s Gold in them thar hills boy!

If you have not read my “There’s Gold in them thar hills boy” post – now is a good time before reviewing the below.

A Quick Review

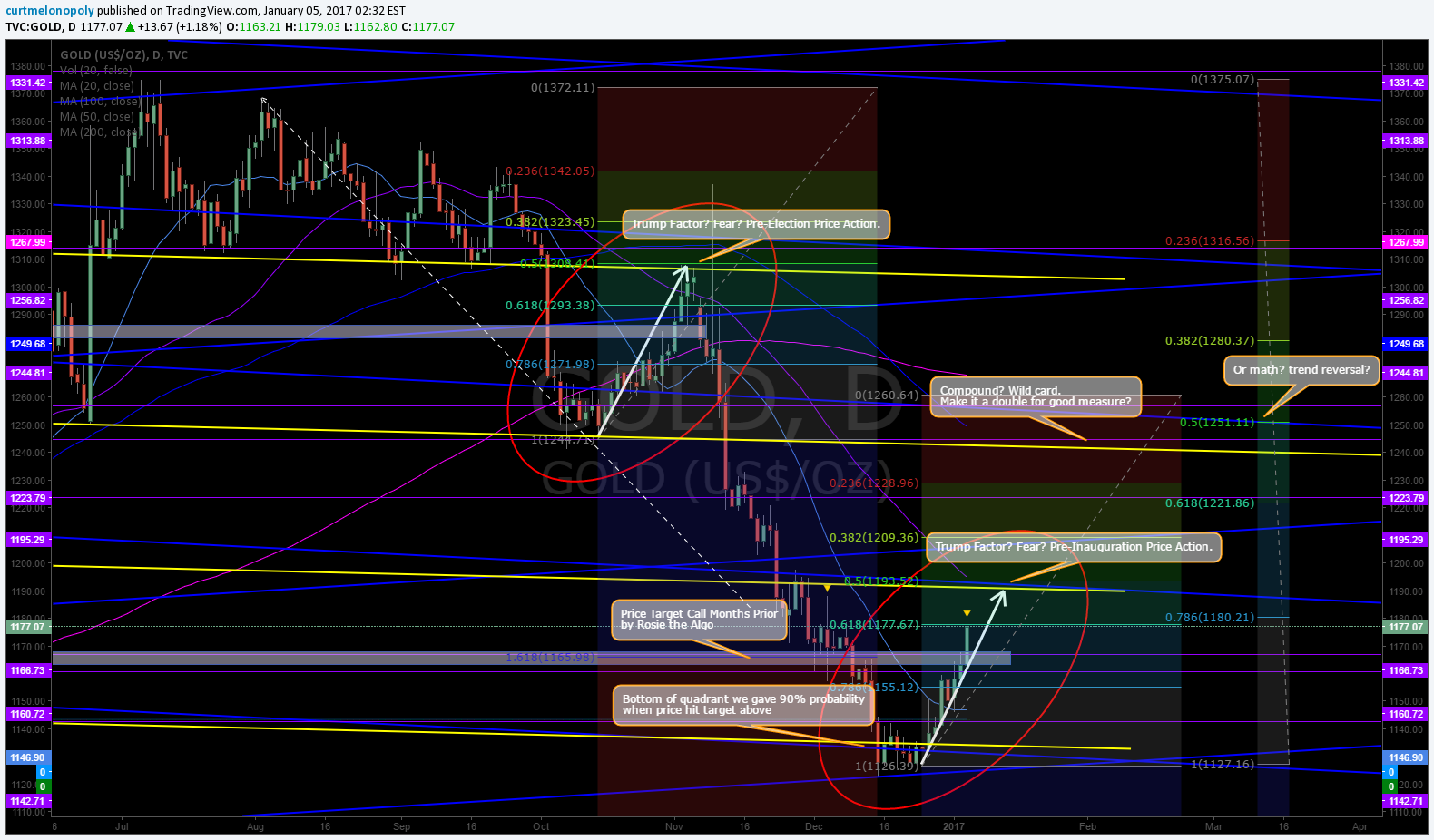

Some time ago, while everyone was panicking about Trump and the end of the world saying Gold was going to the moon, we were politely telling the world that my algorithm was telling us the opposite. Yup, that’s right, I was telling everyone they were wrong. And sure enough, right to the penny her price target was recently hit. But I went further and said, WAIT EVERYONE! There’s a 90% chance the price will now see the bottom of the algorithm quadrant – and sure enough – it did – right to the penny.

So now what?

My recent post (link above) outlined some decisions coming in the trading price of Gold – so you will need to review that, but nonetheless, here’s what has happened since.

Current Gold and Gold Miner’s Trade

Last report I drew the white arrow for you as a most likely scenario (its almost like Gold listens to me 🙂 Which is good I suppose since I am a probability algorithm) – with a resistance area being 1191 – 1193 area to watch for. Price is in fact on its way there and should it arrive there I would be very cautious. There is obviously the possibility price will continue higher and we have those decision levels ready also. But for now, here’s a chart with your most immediate decisions.

$GDX Fibonacci Levels to watch. ROSE the GOLD ALGO $GLD – $UGLD $DGLD $GDX $NUGT $DUST $JDST

I won’t explain my methodology below, but I will say these are some of your levels as the price of Gold Miner’s $GDX trades upward.

Member update with algorithmic model decisions / levels on – deck!

Below are some of our regular info…. notices etc…

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Gold trading between two price targets called months back. $GLD – $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG pic.twitter.com/IFYWmzN6XD

— Rosie the Gold Algo (@ROSIEtheAlgo) January 3, 2017

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $XAUUSD, $GOLD, $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG

Member GOLD Trade Update Jan 5 $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG

Gold Trading Algorithmic Charting Update Thursday Jan 5 GOLD $XAUUSD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations

Jan 5, 2017 Rosie the Gold Algo Trading Report (member edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new member edition Gold trade report.

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

There’s Gold in them thar hills boy! Part Two.

If you haven’t read part one of “There’s Gold in them thar hills boy!” please do now before reading below.

Part one reviews the Gold chart, with the calls I made in the summer for price target that hit recently and second price target for one level down that recently hit.

Now Gold has some lift (which we expected).

The question is, what happens now?

Lets try and figure that out.

Here is The Live Gold Chart on Trading View for You

https://www.tradingview.com/chart/GOLD/lQX3F2Xj-There-s-GOLD-in-them-thar-hills-boy/

Here is the Gold Chart

Trade Considerations to Increase Your Trading Edge – Part Two

Per Part One;

What happened to the price of Gold prior to Trump winning the election? The price of Gold went up. What happened right before he won. The price of Gold went down. What happened after Trump was actually the winner? The price of Gold tumbled. What did everyone expect the price of Gold to do prior to the election? Go to the moon of course.

Okay… so I think we can all agree on the above.

Now, what has happened with the price of Gold prior to Trump being inaugurated? The price of Gold has gone up. What will happen to the price right before the inauguration? Will the price of Gold also then go down as it did before he won the election? Well… do people expect the price to go to the moon or…? Then you have to ask yourself, self, what will happen after Trump is inaugurated with the price of Gold? What do people expect to happen?

Will the price of Gold drop right before the inauguration?

Chance are likely yes. Buy the rumor sell the news.

Will the price of Gold go up after the inauguration?

Chances are no. Buy the rumor sell the news.

What are other factors to consider?

It sure looks like BTC (Bitcoin) has taken some of the Gold buyers in to its frenzy.

The US Dollar / Japanese Yen. This is huge.

Interest rates.

Geo Political.

Per Part One;

So when you work out the most plausible scenarios (or you could work out all scenarios), the question then becomes…. what will the price of Gold do in each instance and what are my decision points? Why? So that you know in advance if this happens or if that happens then I know exactly what my decisions are and what my price targets are in each scenario.

Why? Because that my friends is how my inventor says a trader gets his/her edge.

Lets Look at the Chart

Here’s what we know and what we can assume:

The price of Gold did hit my price target from earlier in 2016.

The price of Gold then hit my 90% probability price target for the bottom of the quadrant.

The price of Gold did bounce (as I expected) and is now near a test of top of quadrant at 1192.72 (intra level – it changes as time goes on – blue lines). This I also published as an expectation.

IF price gets above the quadrant it will then very likely test the top of the next quadrant at 1207.00 intra level (blue line).

IF price gets above that quadrant price will then very likely test the top of the next quadrant at 1256.47 intra level (blue line).

Symmetry says price will stall at 1191.00 before a pull back. If that symmetry doesn’t hold the double-down symmetry says price will stall at about 1242.60. Remember, these levels change as the time goes on so you need to know how to read the chart.

The next decision upward is 1251.11 – at a Fibonacci extension.

And the next at 1294.80 (the top of yet another quadrant).

And if price continues upward the next decision is at 1304.54 – another point of symmetry (yellow line).

So how do you trade this?

Wait for a decision, if price moves to upside go long. If price pulls back go short. That’s it. If price continues in either direction through decision areas then hold or leg in more.

The resistance points I have given you become support decisions if price continues upward.

Some are derived from traditional charting and some are very definitely not.

If price reverses and continues down below the decisions I have given you here, I will update this post with decisions to the downside.

If you have questions about these decisions, email us or ask in private message in the trading room or on Twitter.

Below are some of our regular info…. notices etc…

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $XAUUSD, $GOLD, $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG

GOLD Trade Update Jan 5 (Public Edition) $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG

Gold Trading Algorithmic Charting Update Thursday Jan 5 GOLD $XAUUSD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations

Jan 5, 2017 Rosie the Gold Algo Trading Report (public edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new public edition Gold trade report (public editions do not include proprietary algorithmic modeling).

The member edition (that includes the algorithmic trading levels) will be published and in your email inbox soon!

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

There’s Gold in them thar hills boy!

We have been watching and waiting and watching in waiting since mid summer for an inflection! We know there’s Gold in them thar hills! We know it darn it!

But is there?

Is this sound fundamental trader think? Foolishness? Presumption?

Does history repeat? Rhyme? Double down for good measure? Or, could it really be a trend reversal? Because after all, if it is a trend-reversal… that’s where fortunes are made!

A Quick Review – Forward From Curt

One of our algorithms in development (https://twitter.com/ROSIEtheAlgo) some time ago (while everyone was panicking about Trump and the end of the world saying Gold was going to the moon!) was telling us and we were politely as possible telling the world that Rosie was telling us the opposite. Yup, that’s right, Rosie was telling everyone they were wrong. And sure enough, right to the penny her price target was recently hit. But she went a tad further and said, WAIT EVERYONE! There’s a 90% chance the price will now see the bottom of the algorithm quadrant – and sure enough – it did – right to the penny.

So now what?

Below Rosie will share some of what she’s working on now in the lab – the “decisions” that drive the math she is based on. Which, in our thinking are the same decision considerations traders should be reviewing before BELIEVING ANY OF THE NOISE OUT THERE! Because remember, the noise was wrong before Trump won the election… why would it be right now before inauguration? Hmmm….

Cancel The Noise and Think!

Lets take a look at a simple chart.

There’s Gold in them thar hills boy! Rosie algo report on deck! $GC_F $GLD $XAUUSD $GDX $GDXJ $NUGT $DUST $JNUG $JDST

From a purely scientific perspective, here are SOME of the variables to consider. Once you have the variables in place, then you can run your probabilities for each, get your trading decisions in to place and successfully trade the move.

Price – Trigger – Power – Trade (at least that’s what my inventor says all the time).

Here is The Live Gold Chart on Trading View for You

https://www.tradingview.com/chart/GOLD/lQX3F2Xj-There-s-GOLD-in-them-thar-hills-boy/

Trade Considerations to Increase Your Trading Edge

What happened to the price of Gold prior to Trump winning the election? The price of Gold went up. What happened right before he won. The price of Gold went down. What happened after Trump was actually the winner? The price of Gold tumbled. What did everyone expect the price of Gold to do prior to the election? Go to the moon of course.

Okay… so I think we can all agree on the above.

Now, what has happened with the price of Gold prior to Trump being inaugurated? The price of Gold has gone up. What will happen to the price right before the inauguration? Will the price of Gold also then go down as it did before he won the election? Well… do people expect the price to go to the moon or…? Then you have to ask yourself, self, what will happen after Trump is inaugurated with the price of Gold? What do people expect to happen?

So when you work out the most plausible scenarios (or you could work out all scenarios), the question then becomes…. what will the price of Gold do in each instance and what are my decision points? Why? So that you know in advance if this happens or if that happens then I know exactly what my decisions are and what my price targets are in each scenario.

Why? Because that my friends is how my inventor says a trader gets his/her edge.

Okay, So Now I Know What Scenarios Are Most Possible – What Charting or Levels Should I Prepare?

This is where every trader has to determine their method or methods. Here are some of the trade set-ups I will be preparing for our members to give you some idea (I run up to fifty indicators, but I’ll describe just a few here to get you going).

Fibonacci levels for different time cycles and scenarios will really help you determine your levels.

Symmetry is an excellent study in Gold.

Historical pricing and how geo politics play in to the price.

Moving averages – how has trade action handled the moving averages?

And, most importantly, if the trend does reverse upward – what are my levels and decisions or, if the trend continues down again what then are my levels and decision points?

Oh, and much of this I review in my most recent posts on this blog and my Twitter feed – you may want to take a few minutes and browse.

Hopefully those thoughts and considerations will assist you with your Gold trade in the upcoming weeks before and after the inauguration!

Member update with levels on – deck!

Below are some of our regular info…. notices etc…

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $XAUUSD, $GOLD, $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG

GOLD Trade Update Jan 3 $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG

Gold Trading Algorithmic Charting Update Tuesday Jan 3 GOLD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations

Jan 3, 2017 Rosie the Gold Algo Trading Report (public edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new public edition Gold trade report (public editions do not include proprietary algorithmic modeling).

The member edition (that includes the algorithmic trading levels) will be published and in your email inbox soon!

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

Gold Trading Observations:

Review:

If you have not read the post below, please do so as a foundation to the information contained in this update. This updated post is an add-on for current charting to the previous post.

https://twitter.com/CompoundTrading/status/816124360817676288

Current Trading:

At time of writing Gold is trading at 1157.23. Some thoughts that may help advance you trading edge;

Golden Cross:

The elements of a Golden Cross are setting up in Gold. The 50 MA may cross the 200 MA on the $GLD chart.

Moving Averages:

Trading price on $GLD still way below 100 MA.

Using 50 MA crossing upside 20 MA on 1 week as sell signal.

Fibonacci:

Refer to previous post.

Seasonality:

Refer to previous post for charting.

Gold News:

Carter Worth & @Michael_Khouw make a contrarian call on gold $GLD

Carter Worth & @Michael_Khouw make a contrarian call on gold $GLD pic.twitter.com/9Rhv9SbrdZ

— Options Action (@OptionsAction) December 28, 2016

Algorithmic Modeling Member Section

Alpha Algo Trading Lines:

Proprietary – exclusive to member edition (due before market open).

Alpha Algo Trading Price Targets:

Proprietary – exclusive to member edition (due before market open).

Intra Day Algo Trading Quadrants:

Proprietary – exclusive to member edition (due before market open).

Time / Price Cycle Change Forecast:

Proprietary – exclusive to member edition (due before market open).

Gold and Gold Miner Equities on Watch:

Which Gold Miners Could Provide a Valuation Upside in 2017? A complete listing in early Jan 2017 member editions.

Resource Stock Seasonality:

Included in upcoming member issues early Jan 2017.

Gold Miners Trade Study:

Included in upcoming member issues early Jan 2017.

Algorithmic Modeling Indicators:

As I explained above, my algorithm is a consolidation of up to fifty traditional indicators at any one time – each one given its own weight in accordance to its accuracy (win rate). This “consolidation” is how we establish the probability of specific targets hitting (we call them alpha algo targets / algo lines / algo quadrants / time and price cycles).

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $GOLD $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG

S&P 500 $SPY Trading Chart Updates Tuesday Jan 3 $ES_F ($SPXL, $SPXS)

S&P 500 $SPY Trade Update Tuesday Jan 3, 2017 $ES_F ($SPXL, $SPXS) Charting / Algorithm Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report.

Notices:

Charting: Over the next three to four trading days the algorithmic modeling for $SPY is our priority so you will see the charting fill out over that time with the primary indicators we use. We’re just looking for a little touch of price action and direction to firm up models.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of the S&P500 (more specifically $SPY). Early 2017 I will also provide algo indicators and charting for $ES_F.

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the fifth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo they developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal [email protected] within 30 days of signing on so they can refund you. If you do chose that option, you can always check back early 2017 when my algorithm processes / indicators for your trading edge will be very extensive (mid Jan).

$SPY Trading Observations:

Primary Support and Resistance

We thought considering the last three January trading months in 2014, 2015 and 2016 were full of volatility that we would first focus on main support areas.

Main Support is between 208.17 and 219.38. I know this is a wide range, but that is the support zone. If price action breaks below 208.17 the chart is considered broken. If it breaks below 219.38 it is at risk only – but not broken.

Primary resistance is the most recent high area that still hasn’t broke since we called it the day before Fed speak in December. This resistance is not going to be easily broken.

Support and Resistance Lines and Fibonacci

Traditional support and resistance points from previous time cycle and Fibonacci levels to watch.

I know this chart becomes cluttered and difficult to see, but those are the levels our traders use to trade the S&P 500 with primarily – support and resistance from Fibonacci lines from different time / price areas. In fact there are many more they use but it does become really cluttered. Also, pay attention to the diagonal fib represented trend-lines (white dotted) – when price looses a trend-line it usually means price is in downdraft mode. This includes simple diagonal trend-lines shown in chart below also.

Simple Diagonal Trend-Lines (Blue)

The reason we start with simple lines (as one of our primary indicators) is that in many instances price will use simple lines for a bounce or further downside. If there are more than one simple line that price is challenging all the more probability for a bounce or further downside. In other words, you will find that price is more probable to find inflection points when it hits a Fib support or resistance line and a diagonal trend-line at the same time.

Building the Probabilities for Buy Sell Signals in Algorithmic Model – We Start With Simple MA’s

With our algorithmic modeling our development philosophy has been to keep it simple. One way we do this is to start with the MA’s and how they might become predictable buy and sell triggers on various time-frames – once we have reviewed them all (which I won’t include all in these posts because there are many hundreds of variations and these posts would become books) we then calculate the win rate % for each win / loss for each time frame for each MA. Simple right? It actually is – the more difficult part is actually processing the information.

Once we have the MA data processed for all time frames we then have buy / sell triggers with probabilities attached to each for our buy / sell alerts. We can then move on to other indicators such a Fibonacci and many more (all of which become part of our probability set for algorithmic targets). So for the next few days we will review some of the more considerable MA’s a trader can look at.

200 MA Crossing 20 50 100 MA on 1 Hour Chart

Here is the most immediate MA set-up our trader’s our watching intra – when the 200 MA crossed the 20 50 and 100 and price gets above the MA’s on the 1 hour. Watch this close if price action gets lift over the coming days.

Trading Tight Intra-day

I know the chart is difficult to see with the overlapping charting – but these are the tight intra-day levels our traders are using today.

Alpha Algo Trading Lines:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Alpha Algo Trading Targets:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Intra Day Algo Trading Quadrants:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Time / Price Cycle Change Forecast:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Conclusion:

Over-all, we are actually bullish on the S&P 500 with the understanding that any point the market could dive under pressure with Jan 20 on deck. So take it one decision at a time. Our immediate intra-day bias however is to find an inflection bounce and go with it. The chart is not broken, and if and when it is we will let you know.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom $SPY Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS