Compound Trading Chat Room Stock Trading Plan and Watch List Thursday Jan 4, 2018 $CNET, $COGT, $MNKD, $INSY, $XOMA, $SSW, $JP, $NTEC, $SPXL – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

All charting and reporting for swing and algorithm models are out except $BTC.X, $VIX, $SILVER – they will be out soon. If you have any questions about the reporting or suggestions please send us a note.

We’re emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and the end of our open house Jan 9. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports.

We're emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and the end of our open house Jan 9. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. https://t.co/1CNAfDsAeI

— Melonopoly (@curtmelonopoly) January 1, 2018

Thanks for the support in our start-up year y’all! Our 2018 plans are in this post.

https://twitter.com/CompoundTrading/status/945635490795065344

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Dec 26 swing trading review $SPY, $WTIC, OIL, $DMPI, $APTO, $FTFT, $INSY, $JRJC, $BWA, $ADOM…

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on fly analysis or learn bit about how we model charts and more…. this video is for you.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Recent Educational Videos:

Jan 3 Market Open Trades $SPY, $SPXL, $INSY, $JP trade set-ups, algorithm models, trading plan.

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Looking for large entries as we near Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, Silver, SPY, DXY and others.

Per recent:

Crypto related still on watch. $MGIT, $OSTK, $ROKU, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch:

$CNET, $COGT, $MNKD, $INSY, $XOMA, $SSW, $JP, $NTEC, #EIA report 11:00 AM

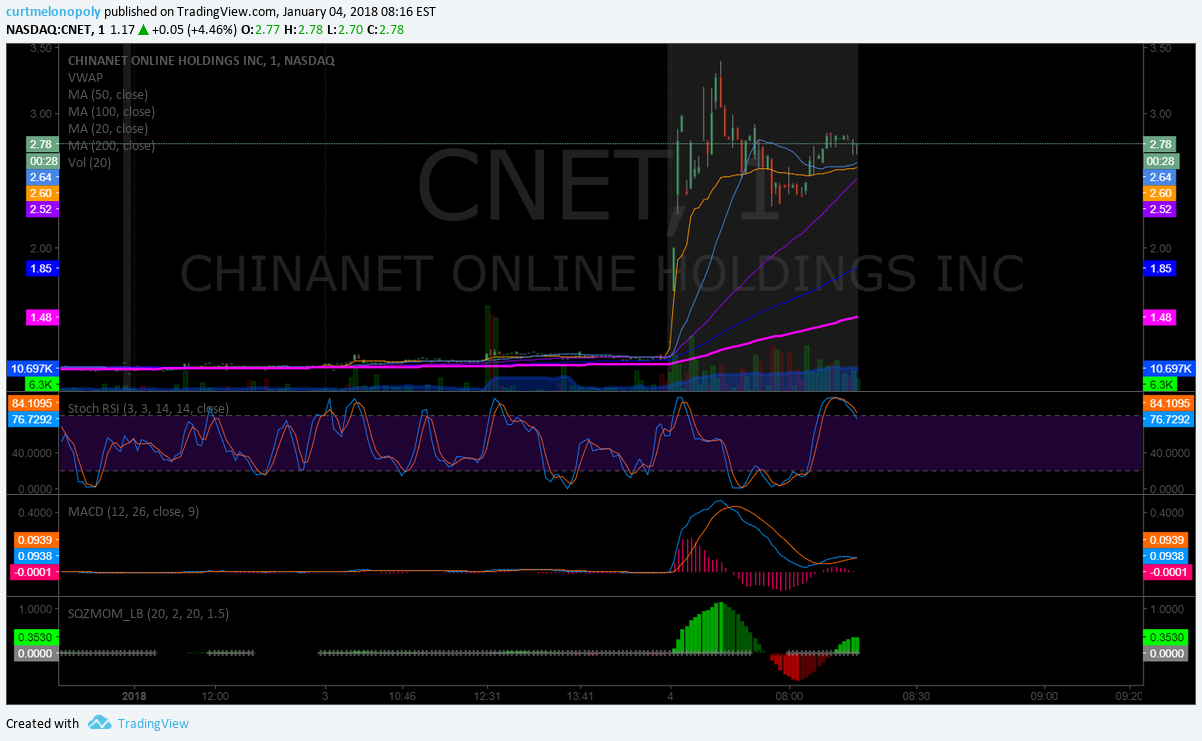

$CNET premarket up 138% on PR partnership trading 2.78

https://finance.yahoo.com/news/chinanet-online-holdings-announces-strategic-123000076.html?.tsrc=rss

Market observation / on watch:

US Dollar $DXY hit model support test yesterday trading 92.15, Oil $USOIL ($WTI) bullish trading at resistance area 61.89, Gold / Silver soft – Gold intra day trading 1312.83, $SPY bulish trading 270.47, Bitcoin $BTC.X $BTCUSD $XBTUSD pensive trading 14448.00 concluded to bullish side out of falling wedge on daily hit 20 MA backed off and needs to hold 50 MA with Jan 9 time cycle peak on deck and $VIX trading 9.2 under continued pressure.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

upcoming #earnings releases with the highest #volatility

$RAD $GBX $SONC $ANGO $CALM $CMC $STZ $RPM $WBA $LW $MON

upcoming #earnings releases with the highest #volatility$RAD $GBX $SONC $ANGO $CALM $CMC $STZ $RPM $WBA $LW $MON https://t.co/lObOE0dgsr pic.twitter.com/cazNDLvGgX

— Earnings Whispers (@eWhispers) January 1, 2018

Recent / Current Holds, Open and Closed Trades

Holding 1/10 size $SPXL and trimmed the rest for a really nice win (massive sizing). Daytrade in $INSY went well Wed for a win at open and holding an $INSY swingtrade small 1/10 position from Wed. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position. Looking for large entries as we near Jan 9 time cycle peak in Oil, VIX, Bitcoin, Gold, SPY, DXY and others.

SP500 time cycle price target couldn’t have bee more precise today – perfect hit on model and swingtrade going exceptionally well. $SPY $SPXL $SPXS #algorithm #model @FREEDOMtheAlgo

SP500 time cycle price target couldn't have bee more precise today – perfect hit on model and swingtrade going exceptionally well. $SPY $SPXL $SPXS #algorithm #model @FREEDOMtheAlgo pic.twitter.com/Lli0mWrh5O

— Melonopoly (@curtmelonopoly) January 4, 2018

Live alerts on $SPXL long swing trade from last week. $SPY #swingtrading

Live alerts on $SPXL long swing trade from last week. $SPY #swingtrading pic.twitter.com/jVPYX7ASA6

— Melonopoly (@curtmelonopoly) January 4, 2018

Closed end of day Tues 1/5 size in $SPXL ($SPY log) and had a daytrade at open I took a small haircut on. Small position.

Per previous;

Long 4.5/10 size $SPXL. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position.

Closed end of day Tues 1/5 size in $SPXL ($SPY log) and had a daytrade at open I took a small haircut on. Small position.

Long 5/10 size $SPXL. Holding in some accounts $AAOI $SPPI long (small) and $OMVS really small position.

Closed $VRX trade – I had scaled in a lot larger than I alerted along the way last Friday – but the alerts were enough to scale and exit and use the signals to bank. Anyway, I followed it all the way down and then back up in the model provided in the room and sold near the recent top. Didn’t get the top though and I knew I was selling prior to the top but that’s how I trade – I take the middle if I can – consistent wins is all I look for. Compound my winnings with consistent low stress model high probability trading.

Opened $VRX trade on Friday that I am partially out and closed $NUGT for a small gain.

Closed $OSTK swing for gain. Holding Gold, $NUGT, $AAOI, $SPPI

Closed rest of $XIV swing trade for a nice win, enter $OSTK 56.50 yesterday trading 62.35 this morning and also entered $MCIG (OTC) yesterday. $NUGT swing up and $AAOI $SPPI still hold. Oh and a flat oil trade overnight and oil trade win yesterday. Looking to enter $BTC at bottom of range.

Overnight trade in oil went really well. Big win.

Chart Set-ups on Watch:

Watching all charts on list above plus the ones listed here:

Perfect timing on short set-up confirmed on model w price under 200 MA Stoch RSI MACD SQZMOM peaked together $USOIL $WTI $CL_F $USO #CL #Oil #OOTT

Perfect timing on short set-up confirmed on model w price under 200 MA Stoch RSI MACD SQZMOM peaked together $USOIL $WTI $CL_F $USO #CL #Oil #OOTT pic.twitter.com/0LsYPjeKLe

— Melonopoly (@curtmelonopoly) January 4, 2018

$BTC.X Bitcoin 20 MA test after falling wedge concludes to upside- price needs to stay above 50 MA on deck or there will be problems in to Jan 9 time cycle peak in daily quad. #Bitcoin #Chart #premarket

$BTC.X Bitcoin 20 MA test after falling wedge concludes to upside- price needs to stay above 50 MA on deck or there will be problems in to Jan 9 time cycle peak in daily quad. #Bitcoin #Chart #premarket pic.twitter.com/nZYaUPYESx

— Melonopoly (@curtmelonopoly) January 4, 2018

Per previous:

$NTEC up 17% Tues testing 200 MA SQZMOM just went green with MACD trending up. #swingtrading

$BTC.X Bitcoin falling wedge on daily concluded to upside bullish and in to resistance at 20 MA test. $BTCUSD #Bitcoin

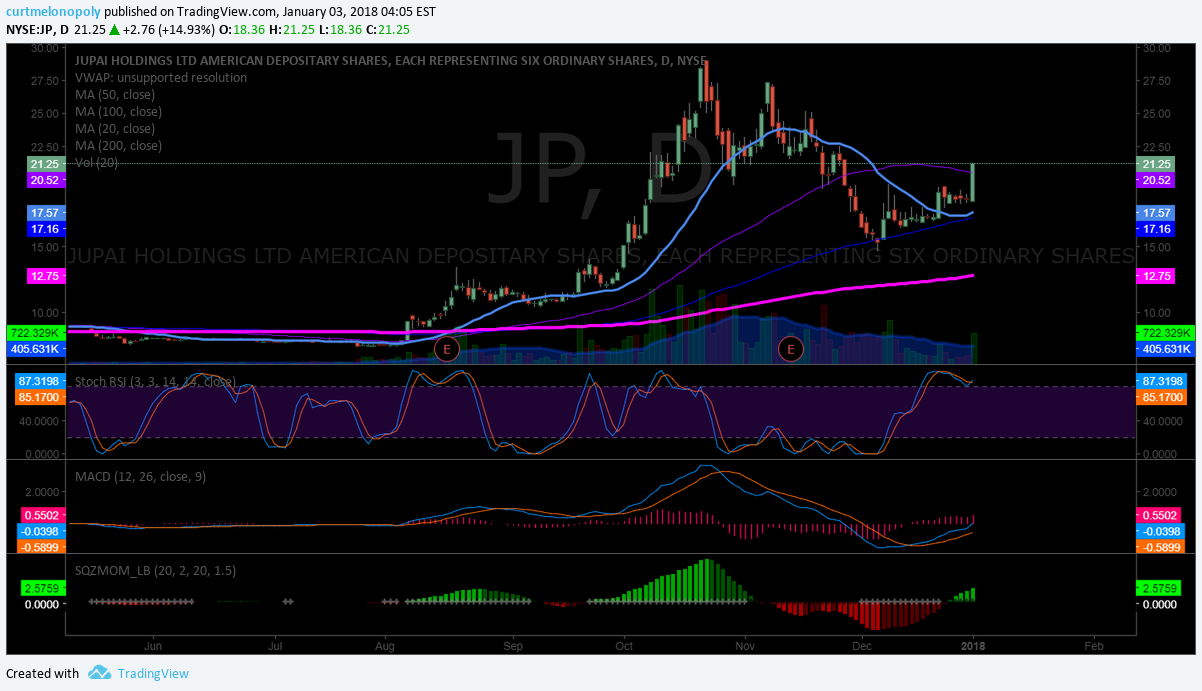

$JP up 14.93% Tues with sidewinder setup, MACD trending up, SQZMOM up, Vol up – great setup. #swingtrading

$MNKD Mankind Corp up 14.5% Tues with MACD about to cross above 200 MA Stoch RSI trending up #swingtrading

$INSY premarket on move and up 19.8% Tues above 200 MA increasing vol MACD trend up SQZMOM ramped #swingtrading

$SKT testing 200 MA trading 26’s with a 31.00 price target if it proves out over 200 MA. #swingtrading

Per recent:

$XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats. #swingtrading

$XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats. #swingtrading pic.twitter.com/XXKMt3ibC3

— Melonopoly (@curtmelonopoly) January 1, 2018

$XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade.

$XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade. pic.twitter.com/0kUx3FrVX1

— Melonopoly (@curtmelonopoly) January 1, 2018

$SSW Swing trade time price targets buy sell triggers (see notes on chart at link) – full analysis on report and mid day swing trade review on YouTube. #swingtrading https://www.tradingview.com/chart/SSW/c83a4j0C-SSW-Swing-trade-time-price-targets-buy-sell-triggers-notes/ …

$SSW Swing trade time price targets buy sell triggers (see notes on chart at link) – full analysis on report due out in an hour. #swingtrading https://t.co/GyvBsYZe2G pic.twitter.com/ffWw7uS8oR

— Melonopoly (@curtmelonopoly) January 1, 2018

Biggest challenge Gold bulls will face in next six months is quad wall at arrow. 403 Jan 1 #Gold $GLD $GC_F $XAUUSD $NUGT $DUST

Biggest challenge Gold bulls will face in next six months is quad wall at arrow. 403 Jan 1 #Gold $GLD $GC_F $XAUUSD $NUGT $DUSThttps://t.co/jQj9YGn0Ga pic.twitter.com/rWoZ5z4HPg

— Melonopoly (@curtmelonopoly) January 1, 2018

Sample Swing Trading Report: Use Code “XOMASWING” Protected: Swing Trading Report Jan 1 – $SNAP, $ARRY, $ARWR, $CDNA, $SENS, $XOMA, $XXII, $NAK, $SHOP… https://compoundtrading.com/swing-trading-report-jan-1-snap-arry-arwr-cdna-sens-xoma-xxii-nak-shop/ … #premarket #swingtrade

Sample Swing Trading Report: Use Code "XOMASWING" Protected: Swing Trading Report Jan 1 – $SNAP, $ARRY, $ARWR, $CDNA, $SENS, $XOMA, $XXII, $NAK, $SHOP… https://t.co/VVCLzSLNvi #premarket #swingtrade

— Melonopoly (@curtmelonopoly) January 2, 2018

Market Outlook:

Goldman Sachs Thinks the Bull Market Is Unstoppable in 2018 https://www.thestreet.com/story/14435605/1/bull-market-to-stampede-onward-in-2018-goldman.html … via @TheStreet

Goldman Sachs Thinks the Bull Market Is Unstoppable in 2018 https://t.co/Rh8qh7A4eL via @TheStreet

— Melonopoly (@curtmelonopoly) January 4, 2018

Strong opening for Asian markets after positive US lead; Nikkei jumps 2%

Strong opening for Asian markets after positive US lead; Nikkei jumps 2% https://t.co/6pR36dowGX

— Melonopoly (@curtmelonopoly) January 4, 2018

Market News and Social Bits From Around the Internet:

Roku shares tank after Morgan Stanley says valuation ‘hard to justify,’ downgrades stock http://cnb.cx/2E49vqw

Bitcoin Futures Flat as Contracts Move Short and Merrill Lynch Imposes Ban http://ift.tt/2lT7plN #Bitcoin

Cogint and Dragonchain announce strategic alliance to combine powerful analytics and intelligence with leading blockchain technology.

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $CNET $COGT $APOP $SKLN $TOPS $CLSN $CMCM $APHB $HTGM $ALIM $USAU $OTIV $FRO $FCAU $JMEI $AMPE $NXTD $PES $XNET $RIOT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $EVH, $C, $RIG, $DPZ, $CVS, $NUVA, $TEVA

(6) Recent Downgrades: $ROKU, $QSII

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $CNET, $COGT, $MNKD, $INSY, $XOMA, $SSW, $JP, $NTEC, $SPY, $SPXL, Bitcoin, Gold, EIA, Oil, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY