Compound Trading Swing Trading Stock Report (with Buy Sell Signals on Select Chart Set-Ups) Thursday April 26, 2018 (Part B). $ARRY, $ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $GTHX, $EXTR, $EDIT, $IPI, $XOMA, $MBRX, $SOHN, $PDLI, $LPSN, $LTRX

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

This swing trading report is Part B of one in five on rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you form a swing trade plan that suites your time frame. If you need private coaching use our contact page and send me a note or email info@compoundtrading.com and we’ll contact you (sometimes there is a short waiting list).

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up (set-up) that signal a trade long entry or an exit. In our case we rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Using the real-time charts – as chart links are made available below, click on link and open viewer. To open a real-time chart beyond the basic “viewer” click on the share button at bottom right (near thumbs up) and then click “make it mine”. To remove indicators at bottom of chart (MACD, Stochastic RSI and SQZMOM) double click chart field area and double click again to return the indicators to the chart.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

$FB Facebook Long Set-Up Testing Buy Sell Trigger

Twitter Trading Plan $TWTR (Part two)

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage

$ARRY – ARRY Biopharma

April 25 – $ARRY down draft scenario from last report playing out almost exactly as charted, we will see if we get bounce here.

13.48 holds it targets 18.41 June 17. And if it doesn’t price targets 8.48 June 17.

My bias is to upside target.

$ARRY News: Is There An Opportunity With Array BioPharma Inc’s (NASDAQ:ARRY) 32% Undervaluation? https://finance.yahoo.com/news/opportunity-array-biopharma-inc-nasdaq-123942473.html?.tsrc=rss

Mar 11 – $ARRY 18.39 mid quad resistance test has to pay out for direction prior to charting shorter time frames for trade – slightly bearish right now.

Feb 11 – $ARRY did in fact break-out of highs post earnings and with market sell-off and has done relatively well considering. When markets signal “calm” this will be a priority watch for a long.

$ARRY if symmetry holds on weekly chart the most probable target is 18.49 June 2019 but a bullish extension to 29.29 is possible. So I will be watching for either a break above 18.39 for the extension above or retrace to 13.46 region for a bounce. Alarmed and ready. I’m leaning toward a break-out to upside. If so I will model it on a shorter time-frame and publish a specific trading plan with buy and sell triggers.

https://www.tradingview.com/chart/ARRY/P4ogFLg4-ARRY-if-symmetry-holds-on-weekly-chart-the-most-probable-target/

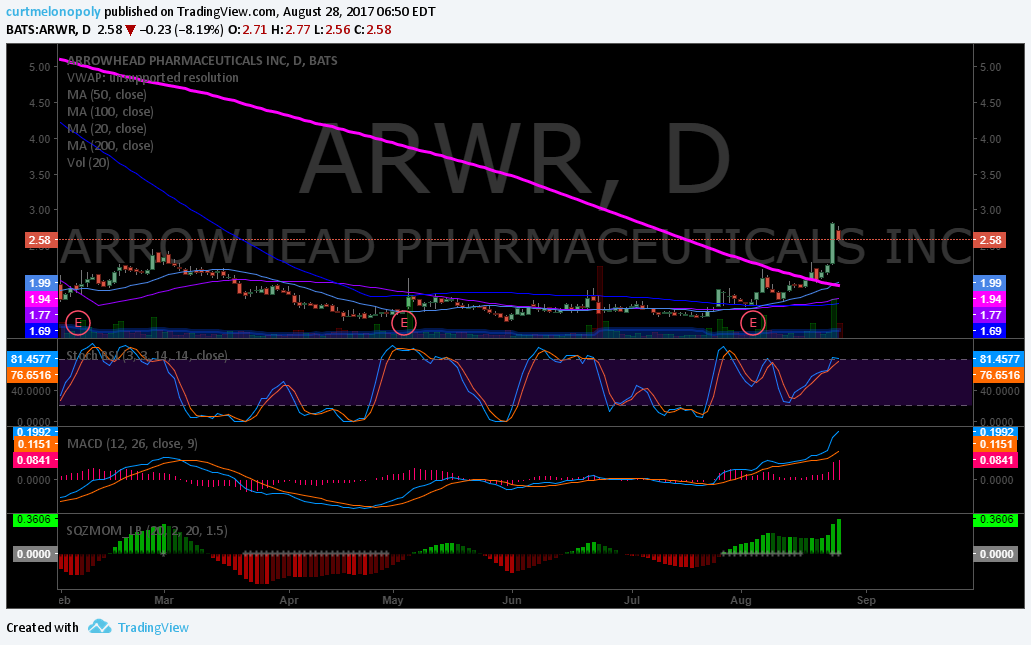

$ARWR – Arrowhead Pharmaceuticals

April 25 – $ARWR trading 6.52 the chart structure is still in play. Watching for an upside move.

Arrowhead Pharmaceuticals to Webcast Fiscal 2018 Second Quarter Results https://finance.yahoo.com/news/arrowhead-pharmaceuticals-webcast-fiscal-2018-200100257.html?.tsrc=rss

Mar 11 – $ARWR testing a series of previous highs on weekly chart w Stoch RSI MACD SQZMOM trend up #swingtrading

This is one of those trades / charts that isn’t easy to set a specific rice target on – the chart history has many scenarios if previous / historical highs break to upside. One way to trade it is long on an uptrend day with a stop set and let it ride the test. The risk reward to bullish side is significant if it breaks the previous highs. All indicators suggest a significant sized move.

Feb 11 – $ARWR weekly chart has price testing 200 MA and gap fill scenario completing. On watch over 200 MA.

$CDNA – Caradex

May 25 – $CDNA very bullish since last report and likely pull back to new all time high (most probable scenario)

Olerup QTYPE® Receives CE Mark Certification https://finance.yahoo.com/news/olerup-qtype-receives-ce-mark-120000842.html?.tsrc=rss

Mar 11 – $CDNA may get a pop short term but is a short until above 20 MA and pivot line. Above the 20 MA and pivot possible long.

How to trade $CDNA – when Stochastic RSI runs up then turns down on weekly its a short.

$NAK – Northern Dynasty Minerals

April 25 – $NAK gone to sleep. Trading .94 above 96.73 targets 1.496, 1.862 July 18. Under targets .28 July 18. #trading #pricetargets

Why Northern Dynasty Minerals, Ltd. Could Be a Gold Mine for Growth Investors https://finance.yahoo.com/news/why-northern-dynasty-minerals-ltd-113200529.html?.tsrc=rss

Mar 11 – $NAK at buy sell trigger for pop or drop – on watch for swing either way. When price trades below line or above trade to next support or resistance line (swing) and test.

Feb 11 – $NAK trading 1.05 with recent drop just can’t seem to get the job done. On watch over 20 MA on weekly chart. Will alert set-up if it forms, but for now it is pensive… but is over the 200 MA on weekly. If anything a trade using the 200 MA as support for a long to the 50 MA on weekly is possible – but not an a set-up IMO so I am waiting.

$XXII – 22nd Century Group

April 25 – $XXII trading 2.05 over 2.20 targets 270 then 3.50 and under targets 1.38 .88 .06 #trading #setup

Food and Drug Law Institute Publishes Public Policy Article by 22nd Century’s Dr. James Swauger https://finance.yahoo.com/news/food-drug-law-institute-publishes-125800933.html?.tsrc=rss

Mar 11 – $XXII on watch for a bounce at Fibonacci support with price targets in clear site. #swingtrading

This chart is really structural and the Fibonacci horizontal lines become excellent buy sell triggers. This is a great set-up for a swing at support and the upper target risk reward is significant if it bounces.

Feb 11 – $XXII weekly chart suggests if a bounce at or near 50 MA occurs then symmetry may be in play for an upside swing trade.

If that set-up forms structurally, I will chart the current chart conditions at that time and alert the trade set-up.

I really like the structure of the daily and weekly charting.

Dec 31 – $XXII Three excellent swing trading set-ups stand out on this chart. 200 MA, MACD and 20 MA breach of 50 MA. The green arrow shows when price breach 200 MA and when 20 MA breached 200 MA with price above that was a clear long signal. The orange arrows show when MACD, Stochastic RSI and Squeeze Momentum Indicators all turned up at same time – that is very bullish also. And the third long set-up was a “sidewinder” when price was above MA’s and 20 MA returned bullish to breach 50 MA with price above.

$XXII weekly chart modelled w fibonacci diagonal trendlines (quads), targets, moving averages.

$SHOP – Shopify

April 25 – $SHOP trading 123.40 holding 200 MA. Over the MA’s I’m long and under 200 MA maybe short.

Shopify Inc’s (NYSE:SHOP) Earnings Dropped -13.12%, Did Its Industry Show Weakness Too? https://finance.yahoo.com/news/shopify-inc-nyse-shop-earnings-212230431.html?.tsrc=rss

March 18 – $SHOP trading 147.22 has done well since we signaled long 106s wash-out in Oct. MACD high – caution longs.

What a great trade signal long for our swing trading platform back in October when everyone panicked on the wash-out.

The problem is now that price on the daily chart is significantly higher than moving averages and the MACD is extended to be sure.

When the Stochastic RSI, MACD and Squeeze Momentum start to trend down this will likely be a decent short to at least the 50 MA.

Feb 11 – $SHOP with earnings around the corner this is a wait and see trade. Will be watching earnings very close.

Jan 1 – $SHOP The easiest and most predictable way to trade SHOP is with Stoch RSI being used as the buy and sell trigger on the daily chart. Great return on two week simple swing trade durations. Alarm set for when Stoch RSI curls back up (currently trending down).

$SSW – Seaspan

April 25 – $SSW trade going really well. Target in play 8.82. #swingtrading

Mar 18 – $SSW keeps failing at 7.73 w/Fib just regained 200 MA targeting 8.60s June 4 #swingtrading

Trading 6.86 this is a high probability trade to the 7.73 area and if it clears that 8.60’s are highly probable going in to early June.

This is a strong long signal.

$SSW also important is to watch the MACD – it recently crossed up signaling long. #swingtrading

Feb 11 – The set-up below with $SSW (SeaSpan Corp) is on high alert with earnings right after the peak in the time – cycle. If markets settle here some this may be one of the better set-ups to at least this mid quad area of chart (purple arrow). Alternatively if under pressure it will target the downside target on chart at blue arrow.

$SSW very interesting set-up with Feb 27 time-cycle peak in play with earnings shortly thereafter.

Link to previous chart published with detail on trade set-up / technicals https://www.tradingview.com/chart/SSW/c83a4j0C-SSW-Swing-trade-time-price-targets-buy-sell-triggers-notes/

Jan 1 – $SSW Swing trading chart on daily with time / price targets and buy / sell triggers.

Price trading above 200 day moving average (pink line) is bullish.

Price trending toward upper apex of quad (white arrow – red circle) and trending toward it at the right time in the cycle is more bullish than trade has been in recent time. It didn’t get there – but it was trending toward upper apex resistance and that is advantage bulls.

Price did not get to mid quad support (gray line – green arrow) – that is a bullish signal also.

Feb 22 2018 price time cycle peak bearish target 5.17 (light blue arrow – red circle).

Feb 22 2018 price time cycle peak bullish bias target is 8.54 at mid quad (green horizontal line – purple arrow).

Feb 22 2018 price time cycle peak full bullish extension price target is 11.94 (orange arrow – gray line). Not a likely target, but in the most bullish instance that is the full extension target in that trading quad.

All fib horizontal lines are support / resistance and act as buy/sell triggers. The quad walls (diagonal fib lines – dotted gray in this instance) are also support and resistance.

Trade above 200 MA favors bulls and long positions at support of fib line while price above 200 MA has excellent risk reward.

Caution as trade nears edge of quad wall – watch for scenario that trade trends down toward lower apex target Feb 22. If it doesn’t, this is a long play all the way.

I should note that this chart represents a simplified explanation of how to trade our most basic chart models (for those interested in trading with an assisted edge and where we are taking our #IA coding in new year also) #tradingprocess

https://www.tradingview.com/chart/SSW/c83a4j0C-SSW-Swing-trade-time-price-targets-buy-sell-triggers-notes/

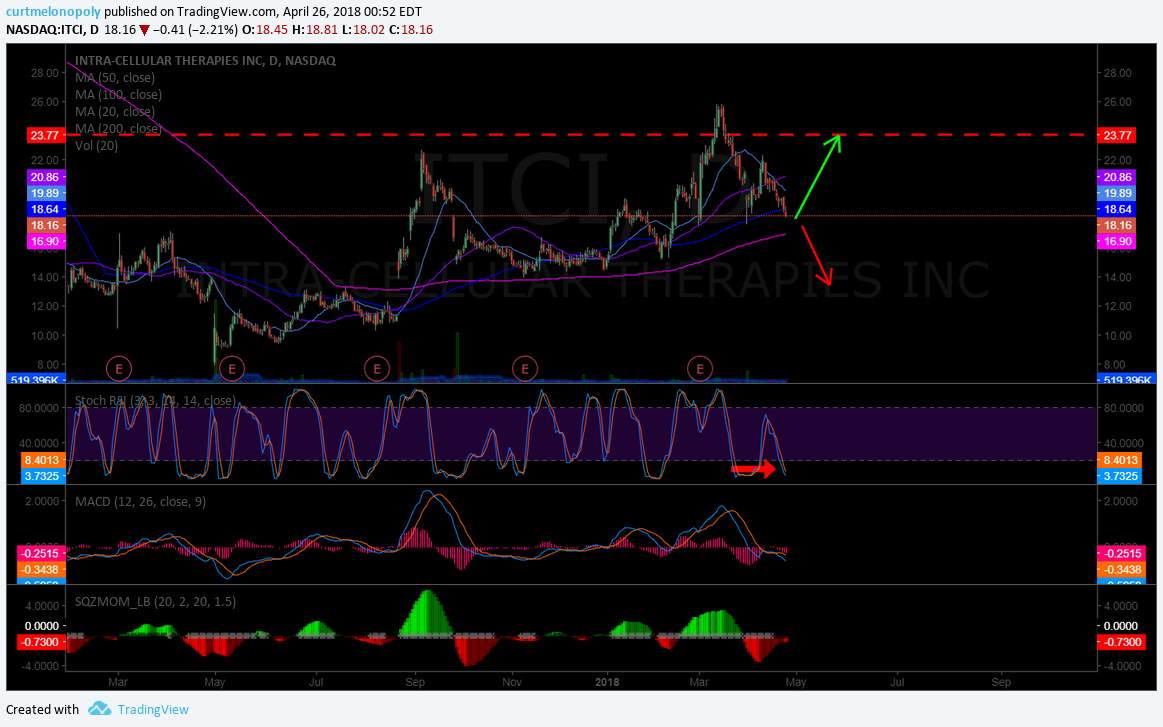

$ITCI – Intra Cellular Therapies

April 26 – Watching for 200 MA support reversal t upside resistance 23 – 24’s. On watch and alarmed. $ITCI #swingtrading #setup

If it dumps the set-up is void and will have to be reconsidered.

There’s a very good chance that $ITCI sell-off was way overdone based on $ALKS FDA set-back. #swingtrading

Here’s Why Alkermes plc and Intra-Cellular Therapies, Inc. Are Crashing Today https://finance.yahoo.com/news/apos-why-alkermes-plc-intra-153500350.html?.tsrc=rss

Mar 18 – $ITCI trading 23.98 has done well since 17s signal… trade the gap with horizontal res line – long at each to resistance.

As price holds each diagonal resistance / support line trade to next level (resistance) line. All the better if it triggers a long off a moving average also. Watch the MACD to be sure it’s turned up and not down. MACD is currently trending up.

$SENS – Senseonics Holdings

April 26 – $SENS Amazing chart structure. The previous alert resolved to upside target. Trade decision now to upper or lower target again.

Above 3.09 is long to upper target and under 3.09 is down to lower target.

Mar 18 – $SENS trading technically perfect with MACD turn down, quad wall test, Fib test advantage shorts – at least for short term.

Under 3.17 is a short to 2.50s April 17 target and above 3.17 is a long to April 17 3.67 target.

Price above 200 MA (pink), price bounced off important mid Fib (grey), price hit target perfect at mid quad (green), and Fib test and quad wall resistance test (red). MACD turn down will give significant advantage shorts. Until at least SQZMOM and preferably other indicators turn up this is a short.

Feb 11 – $SENS perfect mid quad target hit Feb 9 – will watch for direction and then trade in direction of next target noted for April 16.

Jan 1 – $SENS Daily chart with time price cycle targets, Fib support resistance buy sell triggers and moving averages.

As we move toward time cycle on daily peak on Feb 7, 2018 watch for price to trend toward apex (green arrow) or inverse apex (red arrow) – that is your primary clue for trade (beyond the simple MACD on daily)

I have added the Fib support resistance buy sell triggers for range between current trade and Feb 7 peak so that if trade is bullish you have more specific buy sell points you can watch as trade progresses.

In a moderately bullish scenario 3.08 is very likely Feb 7 and the most upper apex target at 3.69 is not as likely but possible. Same would apply to bearish scenario below.

How do you play it? Be sure MACD is turned up before a long entry and anything over 2.48 support at mid quad is a long – try and time long so that Stoch RSI is just turning back up and you are above a Fib support you can use as a stop loss (give your stop some room under the fib to avoid the machines hitting your stop).

$GTHX – GT1 Therapuetics

April 26 – $GTHX hits targets perfect. Trading 39.43, over 39.82 targets 44.36 May 10, 2018 as yet another double extension. #swingtrading

Don’t ignore this stock… the chart structure and ROI ROE is best of class and trades very structural and predictable.

G1 Therapeutics Announces Initiation of Phase 1b/2 Clinical Trial of G1T38 in Combination with Tagrisso for EGFR-Mutant Non-Small Cell Lung Cancer https://finance.yahoo.com/news/g1-therapeutics-announces-initiation-phase-100000266.html?.tsrc=rss

Mar 18 – $GTHX very few stocks trade with this precision and return on equity. Near current target trade white arrow buy sell triggers.

Fantastic double extension to the long side, price is currently cradled in the target zone. From here it is a long through the horizontal Fibs if MACD, Stochastic RSI, and SQAMOM are turned up. If not wait for them all to turn and continue long. See next chart below also.

Also, for side note… if you review the historical reports below you will notice the “black box” component / comment to this charting…. it has played out perfectly technical and in line with “black box” targets. This is a super car trading vehicle if you dial in on its buy sell triggers along with its indicators etc.

$GTHX Stochastic RSI turned down, MACD looks to turn soon, SQZMOM peaked. Short term short advantage then go.

Feb 11 – $GTHX trading 19.38 with MACD turned down targets 16.50 region Mar 15, 2018. #swingtrading

Jan 18 price target hit perfect – precision swing trade set-up – this chart is dialed in.

$EXTR – Extreme Networks

April 26 – $EXTR under significant pressure and the only trade I see with decent ROI is under 10.00 to 7s. Short.

Mar 18 – $EXTR over 12.80 is a long and under a short. Either way trade to triangle quad edge.

It’s a funky model chart but it works. Simply long over 12.80 and short under and then trim when near bright green lines. Consider also your MACD and Stochastic RSI on daily.

Feb 11 – $EXTR Chart structure is not easy to trade but model is holding up and trade targets for Aug 30, 2018 in play.

I will be watching for direction and market stability may provide for a really decent trade here.

Why Extreme Networks Inc. Stock Fell 14.2% Today,

Anders Bylund, The Motley Fool

Motley Fool, February 7, 2018

https://finance.yahoo.com/news/why-extreme-networks-inc-stock-155700511.html?.tsrc=rss

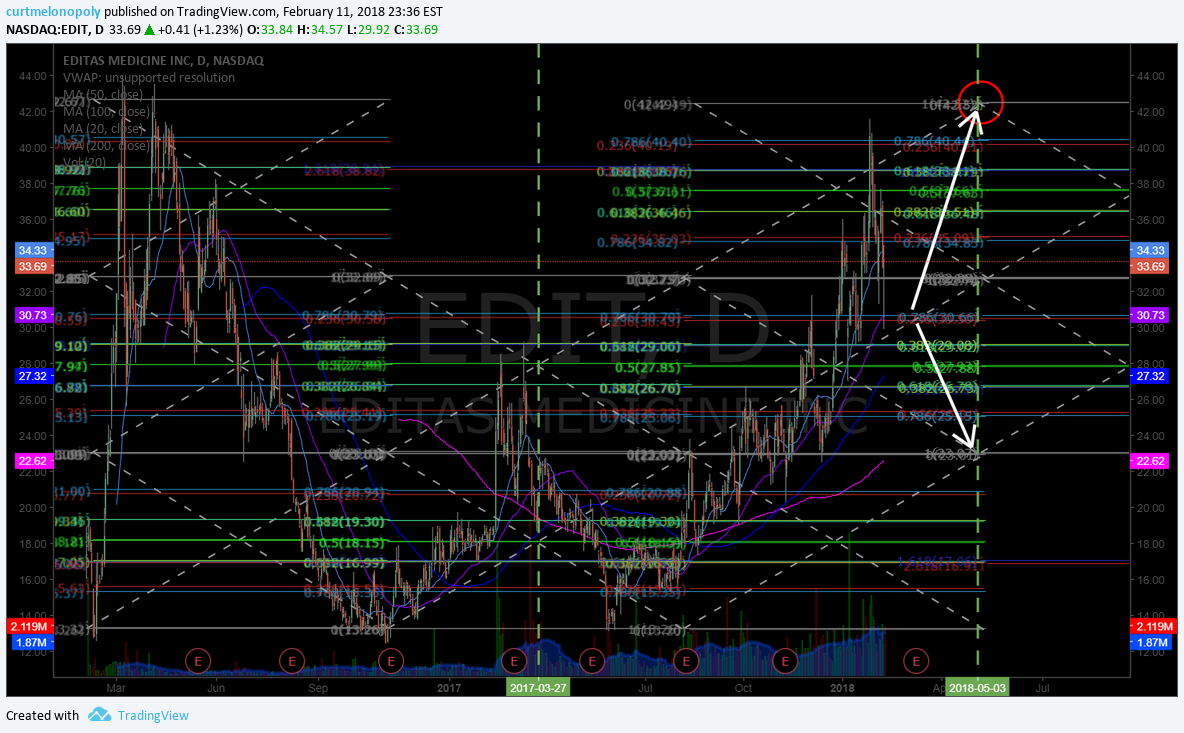

$EDIT – EDITAS

April 26 – $EDIT Clean chart structure channel and target hits, came off as warned, threatening retrace down channel next. Targets on chart.

This was a super clean predictable short from the alert on the last report.

Under 32.80 mid quad targets 27.79 Sept 19 and over 32.80 targets 37.58 Sept 19. Near decision now / mid quad.

Editas Medicine Inc (NASDAQ:EDIT): What Does The Future Look Like? https://finance.yahoo.com/news/editas-medicine-inc-nasdaq-edit-230627623.html?.tsrc=rss

March 18 – $EDIT caution longs as a clear channel has emerged and highs tested. Target from previous reports hit early. Watch 50 MA and indicators very close.

If price breaks above recent highs (which are similar to all time highs) then all bets are off.. but until then the channel wins – short at / near top of channel and long at bottom of channel is highest probability trade. Will review indicators below also (short time frame short bias).

Mar 18 Primary Indicators – $EDIT Short bias until Stochastic RSI, MACD, Squeeze Momentum turn back up. Watch all time high resistance.

$IPI – Intrepid Potash

April 26 – $IPI You can keep this one simple, on the weekly it’s a long until the 200 MA test. Use lower time frame for entry.

Why Intrepid Potash Stock Just Popped 21% https://finance.yahoo.com/news/why-intrepid-potash-stock-just-180000862.html?.tsrc=rss

Mar 18 – $IPI still has 200 MA but Stoch RSI, MACD, SQZMOM all turned down. When they turn up it is and obvious long.

Feb 11 – $IPI on watch with price testing 200 MA and earnings Feb 28.

$MBRX – Moleculin Biotech

April 26 – $MBRX all vitals are flat. No trade until vitals come alive.

Moleculin Announces Patients Treated in FDA Approved Phase I/II Annamycin Clinical Trial https://finance.yahoo.com/news/moleculin-announces-patients-treated-fda-123000005.html?.tsrc=rss

Mar 18 – $MBRX has an obvious pivot region in the 2.43 area of the chart. Long above 2.43 if Stoch RSI turned up on daily.

I really like this set-up long over 2.43 as long as Stoch RSI on daily has also turned up.

$SOHU – SOHU.COM

April 26 – $SOHU Under pressure and RR on short side seems low so I’ll watch and see if chart reconstructs.

Sohu.com Hits 10-Year Low After Rough First Quarter https://finance.yahoo.com/news/sohu-com-hits-10-low-171000650.html?.tsrc=rss

Mar 18 – $SOHU testing historical lows. If all indicators turn up Stoch RSI MACD SQZMOM it is long, if not short.

$PDLI – PDL BIO Pharma

April 26 – $PDLI earnings in 9 days with MACD down riding the 200 MA on daily chart. Short bias but no trade.

Mar 18 – $PDLI near 200 MA test – if it bounces long to Fib resistance areas and trim and short on 200 MA loss.

Feb 11 – Trading 2.40 with earnings on Feb 28 and all indicators are poor. Will watch.

Jan 1 – trading 2.74 with poor / indecisive indicators. Will watch.

$ESPR – Esperion Therapeutics

April 26 – $ESPR Over 75.00 is a long and under 65.20 is a short. Coiling around main pivot. Indecisive.

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Biotech Investors Should Consider The Four Horsemen https://www.forbes.com/sites/moneyshow/2018/04/06/biotech-investors-should-consider-the-four-horsemen/?utm_source=yahoo&utm_medium=partner&utm_campaign=yahootix&partner=yahootix&yptr=yahoo#faf8f4ccfc62

Mar 18 – $ESPR This targets 90.00 if it holds the current area above important pivot area (white horizontal)- power trade is so.

This is an extremely powerful trade if it takes off. Do not ignore this setup.

$LPSN – LivePerson

April 26 – $LPSN Trade played out almost exact as prescribed in last report. New upside and downside buy sell triggers and price targets on chart.

LivePerson to Announce First Quarter 2018 Financial Results on May 3, 2018 https://finance.yahoo.com/news/liveperson-announce-first-quarter-2018-133000537.html?.tsrc=rss

Mar 18 – $LPSN trade rocking, over 15.15 targets 17.35 then over targets 19.60 on bull side. #swingtrading

Another fantastic trade set-up following the previous reporting period.

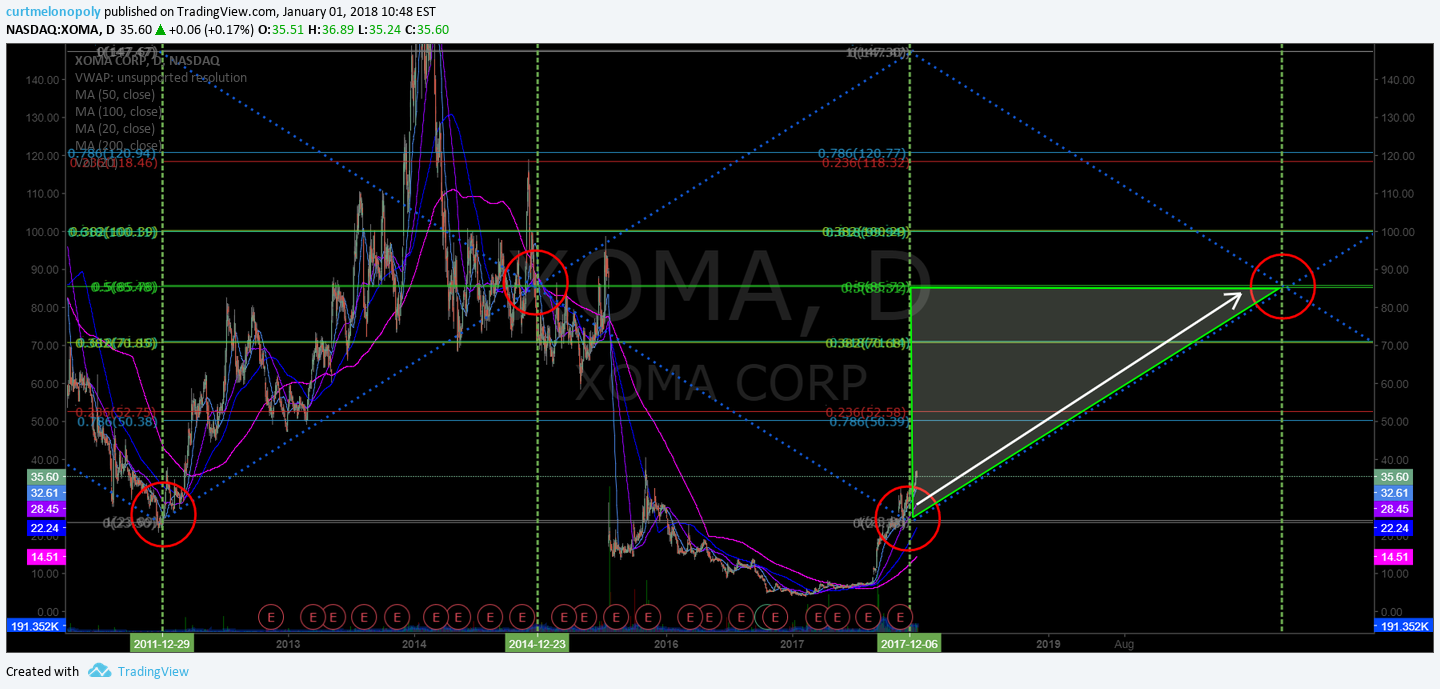

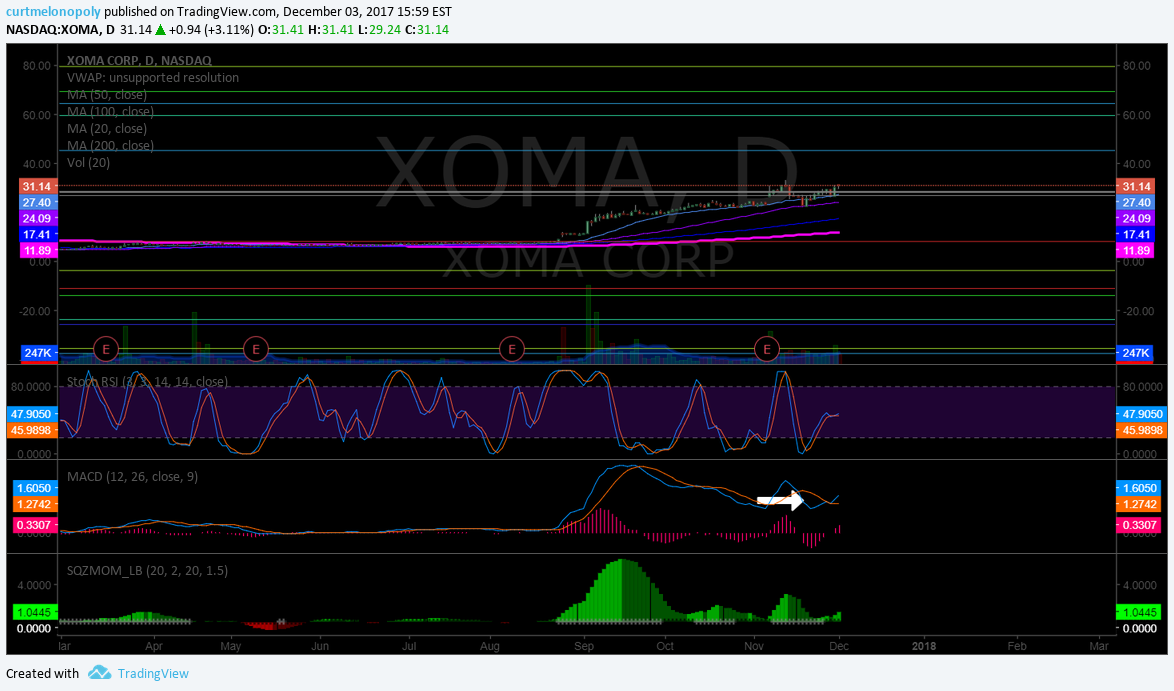

$XOMA – XOMA Corp

April 26 – Trading 24.21 with indecisive indicators. Will watch. No trade.

Mar 18 – $XOMA what an excellent short side trade under that structure and continues short under grey horizontal line.

Feb 11 – Trading 25.46 with chart structure in challenge. Will advise as it plays out. Watching.

Jan 1 – $XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats.

Jan 1 – $XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade.

Subscribe (New member only trial promo price).

Subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

After you have subscribed to specifically the swing trading alerts follow @SwingAlerts_CT on Twitter and then email info@compoundtrading with your telling us your Twitter handle so we can open the feed to you.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Signals, Buy, Sell, Triggers $ARRY, $ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $GTHX, $EXTR, $EDIT, $IPI, $XOMA, $MBRX, $SOHN, $PDLI, $LPSN