Tag: Swing Trading

Part2 – Natural Gas (NATGAS) Trade Alert 2.08 Long Rallied to 2.50s Fast – What’s Next? $NG_F $UGAZ $DGAZ $UNG

The Natural Gas Trade is Heating Up – What a Sweet Trade Set-Up.

Trading natural gas futures or ETN’s / ETF’s like $UGAZ $DGAZ or $UNG can provide excellent returns if you get your trade set-up right. Below we demonstrate what precision trading in natural gas can do for your returns. Our members have enjoyed a series of recent swing trade alerts that have worked well for us. See below.

In our Oct 5, 2020 Natural Gas Swing Trading Newsletter (unlocked) we provided a video from our Weekly Swing Trading Study Webinar and charting for a Natural Gas trade set-up long in the channel.

The Oct 7, 2020 Swing Trade Alert:

NATURAL GAS (NATGAS) 30 min levels, greens and grays are your key levels, will be watching close post oil EIA today #swingtrading $NATGAS

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

The trade alert worked out great and the buy trigger 2.08s hit for long entries and Natural Gas rallied to 2.50s fast.

https://twitter.com/SwingAlerts_CT/status/1315663604667109376

Prior to this, our swing trading platform had traded the Natural Gas falling wedge pattern break-out for excellent returns. See the previous member natural gas newsletter link above.

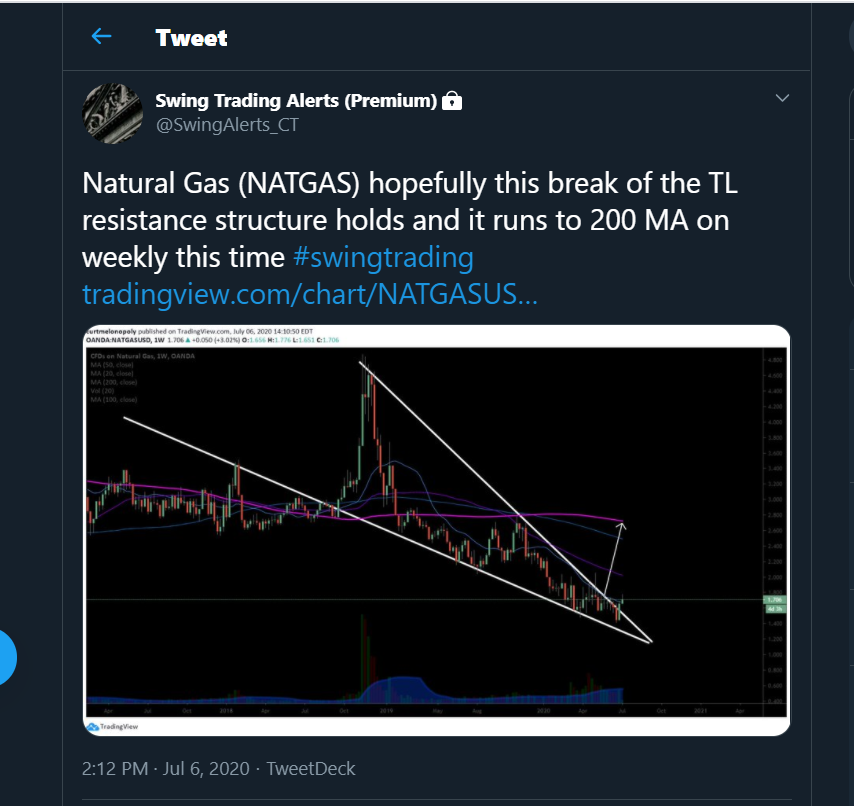

Natural Gas (NATGAS) hopefully this break of the TL resistance structure holds and it runs to 200 MA on weekly this time #swingtrading

Swing trade alert feed:

The question now is, what’s next?

Swing trade members can review the next set-up in Natural Gas trade in newsletter:

Protected: Natural Gas Trading Newsletter (Premium Swing Trading Post) Part 3

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 300.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, newsletter, natural gas, natgas, $NG_F, $UGAZ, $DGAZ, $UNG

Swing Trading Natural Gas Newsletter – Trading Plan, Alerts and Charting.

Natural Gas Trading Newsletter

Weekly Swing Trade Study Sunday Webinar video is below – clip is specific to Natural Gas trade set up..

Natural Gas (NATGAS) falling wedge pattern worked out almost perfect on weekly chart time frame. $NG_F #swingtrading

Natural Gas (NATGAS) 30 minute time frame may have intra week swing set up forming 2.08 – 2.50 ish. On watch. #swingtrading $NG_F

Natural Gas Long Swing Trade Tweets (Private feed that clients only can click and see links)

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Per NATGAS video we did take trims this morning, yes. Trading 2.298 now, difficult to say where pull back will occur, will be in report.

12:50 PM · Aug 17, 2020

https://twitter.com/SwingAlerts_CT/status/1295402694304247808

Swing Trading Alerts (Premium)

@SwingAlerts_CT

My next trim profit (20% on top of 35% yesterday) on Natural Gas will be if we near 100 MA before pulling back. #swingtrading $NATGAS

3:17 PM · Aug 4, 2020

https://twitter.com/SwingAlerts_CT/status/1290728573293268996

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Trimming NATGAS long 2.039 35%

12:23 PM · Aug 3, 2020

https://twitter.com/SwingAlerts_CT/status/1290322319915855873

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Natural Gas (NATGAS) hopefully this break of the TL resistance structure holds and it runs to 200 MA on weekly this time #swingtrading https://tradingview.com/chart/NATGASUSD/2ew8DAGT-Natural-Gas-NATGAS-hopfully-this-break-of-the-TL-resistance-st/

2:12 PM · Jul 6, 2020

https://twitter.com/SwingAlerts_CT/status/1280202942298152965

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Natural Gas (NATGAS) we’ve added longs bit by bit per alerts, thesis is when oil comes off natural gas pops here.

2:14 PM · Jun 11, 2020

https://twitter.com/SwingAlerts_CT/status/1271143770092904449

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Natural Gas (NATGAS) did hold for a double bounce at that diagonal TL as suspected, small pull back I’ll add $NG_F #swingtrading https://tradingview.com/chart/NATGASUSD/YDzO2CiV-Natural-Gas-NATGAS-did-hold-for-a-double-bounce-at-that-diagon/

11:01 AM · Apr 23, 2020

https://twitter.com/SwingAlerts_CT/status/1253338099582558209

Swing Trading Alerts (Premium)

@SwingAlerts_CT

Starting a Natural Gas long swing 2.25s only 5% size and will add on dips. 20 MA first test (light blue) $NATGAS #swingtraidng

9:26 AM · Dec 11, 2019

https://twitter.com/SwingAlerts_CT/status/1204769324671668224

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; swing trading, newsletter, natural gas, natgas, ng_f

Swing Trade Reporting Upgrades Coming October 2020 – Coding, Reporting, Alerts, Price Changes

Swing Trade Reporting Platform Upgrades, What’s Next.

Good day traders,

Our swing trading alert, reporting and webinar platform has done very well. It’s been just shy of five years and our performance year over year continues to go up.

We’re not stopping there.

Next we will be taking what we’ve learned in our machine trading area of crude oil and implementing the strategies to our swing reporting and alerts.

You may or may not know that our most recent version of the EPIC V3.1.1 oil trading algorithm has won 100% of its trades since launch of June 2020. Needless to say, we have developed a structured trading system that comes with considerable success, so we’re excited about bringing this to our swing traders.

Starting in October reporting will include regular reports specific to one stock or commodity at a time that will explain exactly how to trade the instrument on various time frames using both conventional technical analysis and algorithm chart models. As we distribute the specific trading plans we will also start the process of coding them for trade and alert the trades to the private member feed.

Essentially each report will provide a detailed trading plan with charting and will accompany regular trade alerts for that instrument of trade whether it be a stock, commodity, currency, volatility etc.

It is our goal to complete approximately 150 structured reports, alert the trades and start the coding for them all before January 2021.

Our swing trading platform will also still include various other stock alerts, webinars and reporting as our clients have come accustomed to.

New pricing will be posted to the website this weekend that will reflect the expansion of our platform. Current customers (as long as they renew prior to subscription expiry) will always keep their entry price and will not experience price increases. The price increases are for new clients only.

Any questions send me a note anytime to [email protected].

You can expect the new reporting to start rolling out within a week at most.

Thanks

Curt