Review of Compound Trading Chat Room Stock Trading, Algorithm Charting Calls and Live Stock Alerts for Wednesday March 22, 2017; $UNXL, $SNAP – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Per recent;

Weekly Simple Swing Trade Charting is out:

https://twitter.com/CompoundTrading/status/843442032894865408

Overview and Summary Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

In play today in chat room; $UNXL, $SNAP

My morning started with a long in $UNXL right at market open (I liked the chart) with a small loss. In 2500 shares at 1.05 out at .99 for a .06 cent loss or 190.00 or so. Then I had an entry long in $SNAP about 20 minutes later that worked well for 500 shares at 21.27 and closed at 21.95 a 350.00 gain – so not a big day. That was all my trading. I had to travel and our room had an outage so the transcript ends around that point anyway.

Premarket trading plan (member post) for Tuesday’s session can be found here:

https://twitter.com/CompoundTrading/status/844531784218017792

Premarket was all about:

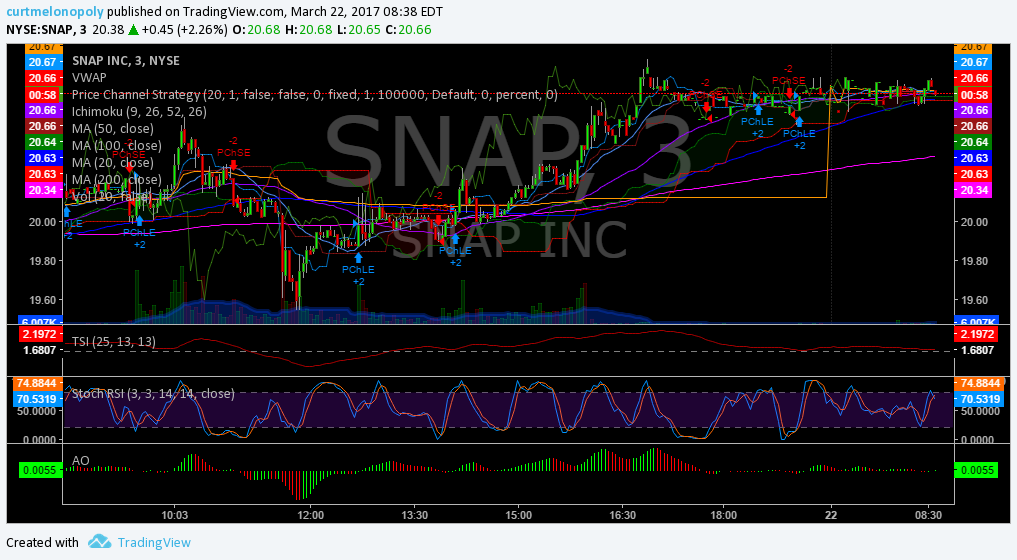

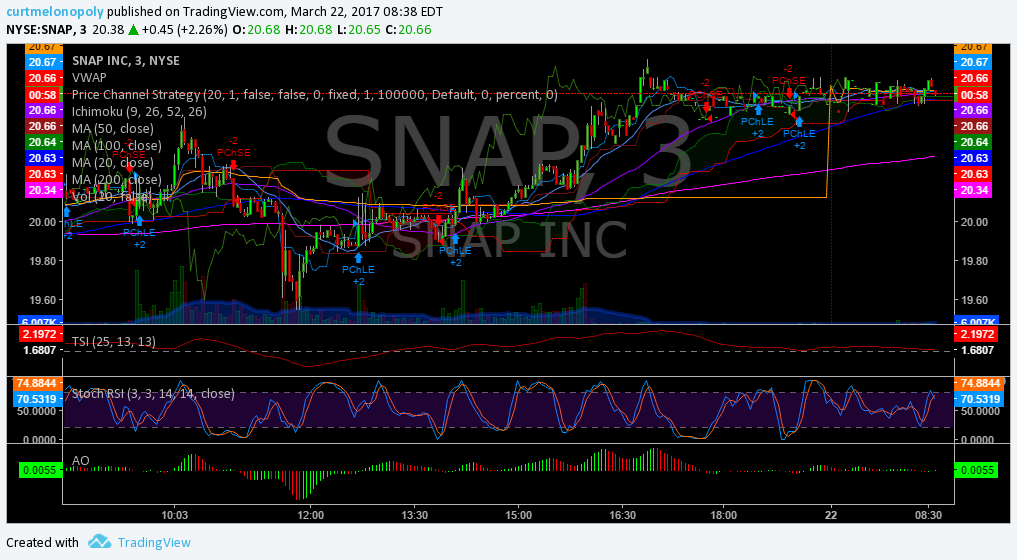

$SNAP Up just under 2% premarket and was up yesterday. pic.twitter.com/74EBDATyEH

— Melonopoly (@curtmelonopoly) March 22, 2017

$DLTH up 19% premarket on Q4 sales increase pic.twitter.com/xNsXXl3qYc

— Melonopoly (@curtmelonopoly) March 22, 2017

Algorithmic Chart Modeling Reports / News:

NA

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| MBRX | 1.33 | 24.30% | 24412900 | Top Gainers | |

| VNCE | 1.90 | 22.58% | 1539100 | Top Gainers | |

| IDRA | 2.49 | 19.14% | 8753210 | Top Gainers | |

| ALBO | 23.78 | 17.14% | 33315 | Top Gainers | |

| CPSH | 1.58 | 17.04% | 172600 | Top Gainers | |

| IDXG | 2.86 | 16.73% | 9904700 | Top Gainers | |

| VRAY | 7.52 | 5.03% | 1588098 | New High | |

| RBCN | 0.87 | 4.15% | 1507496 | New High | |

| XENE | 9.35 | 11.31% | 449300 | New High | |

| CNCE | 18.43 | 8.41% | 874800 | New High | |

| CLNT | 3.08 | 16.23% | 643095 | Overbought | |

| FIZZ | 79.68 | 1.04% | 227141 | Overbought | |

| DDJP | 26.29 | -2.01% | 101838 | Unusual Volume | |

| FTXO | 25.47 | 0.08% | 6153400 | Unusual Volume | |

| SMLR | 2.30 | -22.03% | 347876 | Unusual Volume | |

| MBRX | 1.33 | 24.30% | 24412900 | Unusual Volume | |

| ABBV | 65.52 | 0.26% | 5654400 | Upgrades | |

| ADGE | 0.30 | -7.51% | 91771 | Earnings Before | |

| DCO | 27.17 | -1.63% | 123900 | Insider Buying |

Swing Trading Reports / News:

The quarterly performance report link is above in the intro to this post – we have been killing and below are some of the recent simple swing trading charts.

The Markets Looking Forward:

Last weekend we produced some simple swing charting that keeps me level when looking at the markets (examples below). Simple charting I find grounds you to simple trades which in turn keeps you profitable in toppy or sideways markets.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

https://twitter.com/CompoundTrading/status/843404659993731072

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Results are in for Gold trading vote:

Will the next leg in #Gold trading be up or down? Round 3. Tie breaker! $GC_F $GLD $XAUUSD $GDX $NUGT $DUST $JDST $JUNG

— Melonopoly (@curtmelonopoly) March 13, 2017

https://twitter.com/CompoundTrading/status/843410816565039104

Silver $SLV:

https://twitter.com/CompoundTrading/status/843414571817693184

https://twitter.com/CompoundTrading/status/843415778812604417

Crude Oil $USOIL $WTI:

https://twitter.com/CompoundTrading/status/843409023730835457

https://twitter.com/CompoundTrading/status/843410816565039104

Volatility $VIX:

https://twitter.com/CompoundTrading/status/843405940875444224

$SPY S&P 500:

https://twitter.com/CompoundTrading/status/843402575152013312

https://twitter.com/CompoundTrading/status/843401400084135936

$NG_F Natural Gas:

NA

Live Trading Chat Room Transcript: (on YouTube Live):

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Also, times are Central Mountain below (we’re working on the fix now), so for New York ET time add two hours to all times. Also, most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Important note: Unfortunately we had an outage and only the first part of the day is in this video. We are testing another platform next week FYI.

6:57 AM

Compound Trading PreMarket Trading Plan Wed Mar 22 $DLTH, $UNXL, $MBRX, $SNAP, $PULM, $UWT, $NUGT https://compoundtrading.com/premarket… Password: PRE0322

7:10 AM Flash G Mornin!

7:11 AM MarketMaven M hey snazzy flash

7:13 AM Curtis Melonopoly Morning

7:13 AM Flash G Mornin

7:15 AM Curtis Melonopoly on watch $DLTH $PULM $MBRX $UNXL $SNAP $USOIL $GOLD

7:16 AM Flash G FITCH DOWNGRADES SAUDI ARABIA TO A+ FROM AA-

7:16 AM Flash G BITCOIN down again

7:17 AM Flash G FedEx blamed rising fuel costs for the miss

7:20 AM Curtis Melonopoly Large gap possible for $UNXL

7:21 AM Flash G @bespokeinvest 54s55 seconds ago More FedEx $FDX set to gap up 3.5% on earnings. Will be its 4th big gap higher in reaction to its last six earnings reports:

7:26 AMCurtis Melonopolyon mic

7:29 AMCurtis Melonopolyadd $IDXG $IDRA To watch

7:32 AM MarketMaven M Long $UNXL start 1.01 1000 shares

7:33 AM Curtis Melonopoly 1.05 long $UNXL test 2500

7:35 AM Curtis Melonopoly stop .99

7:38 AM MarketMaven M $IDXG on the move

7:38 AM Curtis Melonopoly stopped .99 should have had stop at .94 like audio explained but don’t trust it

7:39 AM Curtis Melonopoly small loss

7:40 AM MarketMaven M I’m holding – stop under low of day .89

7:42 AM Mathew w Back in CHK after getting stopped out a week or two ago. Many of these names look like they are trying to find a bottom here

7:43 AM Flash G Market may be a flat fay today

7:43 AM Flash G Flat day

7:43 AM Flash G Big wins on those Mathew if they start crackin!

7:43 AM wintonresearch insider buying in miner $GSS

7:44 AM Flash G $IDXG I might play – not my specialty but strong

7:44 AM Flash G Likely not

7:44 AM Mathew w I think so Flash, longer timeline needed but they should get some steam IMO

7:44 AM Flash G How big was the buy Nicholas?

7:44 AM Mathew w Oil market is propped up and XLE showing OK strength for once in a crappy market

7:45 AM Flash G Yes

7:45 AM Mathew w Out my SLW I played for earnings. This thing has been a turd so I’m legging out while I can. I think it goes higher sooner or later but in the past it hasn’t acted well

7:45 AM Flash G @bespokeinvest 6 minutes ago All Four FANG stocks quickly in the green on the day.

7:46 AM Flash G $IDXG VWAP

7:46 AM Flash G $SLW has lots of traders I see like it

7:47 AM MarketMaven M I was stopped btw oh well

7:47 AM Mathew w I like it as well but pull up a chart of the last month and a half and it looks horrible. I’ll put that money elsewhere as I like other miners better

7:47 AM Mathew w Not to say it won’t go higher, I just don’ like how it has been trading

7:48 AM Flash G I’m watching you Maven – you must be up 90 out of 100 you will be fine

7:49 AM Curtis Melonopoly long $SNAP 21.27

7:54 AM Flash G You’re right about the 21.15 entry but it has relative strength intra

7:56 AM Curtis Melonopoly so ya should have watched closer and proper entry was 21.15 so I have to give it more room than I normally would. watching $SNAP for VWAP test at this point and holding.

7:57 AM Curtis Melonopoly EIA on deck 10:30

7:57 AM Flash G You are considering a long position at 10:30?

7:58 AM Curtis Melonopoly watching for that or failure of $USOIL support yes

8:02 AM Flash G $SNAP looks good now Curt

8:05 AM Curtis Melonopoly on mic again sorry forgot to mention

8:05 AM Curtis Melonopoly stop at 21.27

8:08 AM MarketMaven M Long $SNAP 21.75

8:09 AM MarketMaven M haha

8:10 AM MarketMaven M oh come on ?

8:16 AM Curtis Melonopoly $SNAP out 21.95

8:16 AM MarketMaven M ok out with ya

8:16 AM MarketMaven M 21.92

8:17 AM MarketMaven M good call btw on your watchlist pow

8:18 AM Curtis Melonopoly break back for oil in 10 mins

8:19 AM wintonresearch gdx @ 50 dma

8:19 AM wintonresearch trying to break

8:22 AM Flash G Gold and Miners it seems are at do or die points. Up seems more likely.

8:25 AM Flash G So I’ve studied your oil charts Curt – finally. I see the process. A trader just has to be disciplined in it like anything I suppose. I wish you could publish those quadrants on equities.

8:26 AM Curtis Melonopoly on a calm day I’ll show you how to chart them…. they work for your swings with what your trading.

8:26 AM Flash G Appreciate that.

8:27 AM Curtis Melonopol yon mic for petroleum report

8:29 AM Curtis Melonopoly eyes on oil ?

8:36 AM Curtis Melonopoly no trade just watching oil

8:37 AM Flash G Looks bullish to me Curt – being that its holding support area.

8:40 AM Flash G Might leg in to $ES_F soon

8:40 AM Flash Glooks like support area

MarketMaven M $FMC strong

MarketMaven M $RGSE on watch

MarketMaven M Inside buys

wintonresearch 4 insiders in GSS from late Feb bought about 100k shares total

wintonresearch including 22k or so from CEO

Be safe out there!

Follow our lead trader on Twitter:

Tweets by curtmelonopolyArticle Topics: $SNAP, $UNXL – $XOM, $NE, $ONTX, $DUST, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500