Compound Trading Premarket Trading Plan & Watch List Monday August 27, 2018.

In this edition: $TLRY, $CRON, $CGC, $NNDM, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Monday Aug 27:

- Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets).

- Between now and Sept 14 I will only be in the live trading when I notify members (on email, Twitter, Discord). We are processing all the new algorithm models, upgrading all swing and algorithm newsletters, and preparing the content for the Sept 14-16 Trade Coaching event. In other words, we’re reconciling everything for our members over the next 2.5 weeks so that everything is updated, upgraded and distributed on schedule. Alerts will continue to go out on feeds and will also be upgraded to the new models. We will regularly be in member side Discord trading chat rooms as normal also.

9:25 Market Open – access limited to live trading room members12:00 Mid Day Trade Review – access limited to live trading room membersAny other live trading sessions will be notified by email.The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.Link: https://compoundtrading1.clickmeeting.com/livetradingPassword: **** (email for access if you do not have it, password changes will be emailed when changed only)For membership access, options here: https://compoundtrading.com/overview-features/

- Before Sept 14 – New pricing published representing next generation algorithm models (existing members no change).

- Before Sept 14 – Next generation algorithm models roll out (machine trading Gen 1).

- Before Sept 14 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

For those asking, wkly report distribution starts early Sun evening & continues through the wk starting w/Oil, Crypto, SPY, Swing and others. Reports are becoming size-able w new platform developments and as such they will flow on rotation Sun-Sat wkly.

https://twitter.com/CompoundTrading/status/1033822317057650688

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers to read disclaimer.

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Aug 16 – Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Aug 12 – Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Market Observation:

Markets as of 8:25 AM: US Dollar $DXY trading 95.10, Oil FX $USOIL ($WTI) trading 68.74, Gold $GLD trading 1205.81, Silver $SLV trading 14.80, $SPY 288.73 (premarket), Bitcoin $BTC.X $BTCUSD $XBTUSD 6740.00 and $VIX trading 12.3.

Momentum Stocks / Gaps to Watch:

24 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12262324 $TLRY $CRON $CGC $NNDM $AMWD $JT $TSLA $BKE $PBT

24 Stocks Moving In Monday's Pre-Market Session https://t.co/rfk5CIEmqr $TLRY $CRON $CGC $NNDM $AMWD $JT $TSLA $BKE $PBT

— Benzinga (@Benzinga) August 27, 2018

News:

Your Monday morning Speed Read:

– Nokia takes €500M loan to develop 5G tech in bid to get ahead of competitors $NOK

– Tesla shares ⬇️ 3% premarket after abandoning its controversial go-private deal $TSLA

– AMD shares ⬆️ 3.7% premkt after announcing a new graphics card $AMD

Your Monday morning Speed Read:

– Nokia takes €500M loan to develop 5G tech in bid to get ahead of competitors $NOK

– Tesla shares ⬇️ 3% premarket after abandoning its controversial go-private deal $TSLA

– AMD shares ⬆️ 3.7% premkt after announcing a new graphics card $AMD— Benzinga (@Benzinga) August 27, 2018

Esperion announces positive results in trial of cardiovascular treatment.

Tesla plunges in pre-market trading after Musk abandons plan to take company private https://bloom.bg/2MMIoIz

Recent SEC Filings / Insiders:

Recent IPO’s:

Earnings:

#earnings for the week

$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBA

http://eps.sh/cal

#earnings for the week$CRM $BBY $TIF $LULU $BILI $AMWD $DLTR $DKS $AEO $BOX $DSW $DG $NTNX $BNS $BJ $BURL $ANF $TD $ULTA $HPE $CPB $BMO $CTLT $BIG $CIEN $HAIN $EXPR $TLRY $PVH $SIG $KIRK $DY $JT $HEI $SFUN $ZUO $MOV $YRD $MIK $HRB $LCI $CHS $HOME $AMBAhttps://t.co/r57QUKKDXL https://t.co/bvDhbgW1NZ

— Melonopoly (@curtmelonopoly) August 25, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Trade Alerts, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT

Nice quick first oil trade of the week (not at 100% alert win rate for the last number of months as I list last trade of last week, but high 90%) $USOIL $WTI $CL_F $USO $UWTI $DWTI #OIl #Trade #Alerts #OOTT pic.twitter.com/DrhjjCB9Hh

— Melonopoly (@curtmelonopoly) August 27, 2018

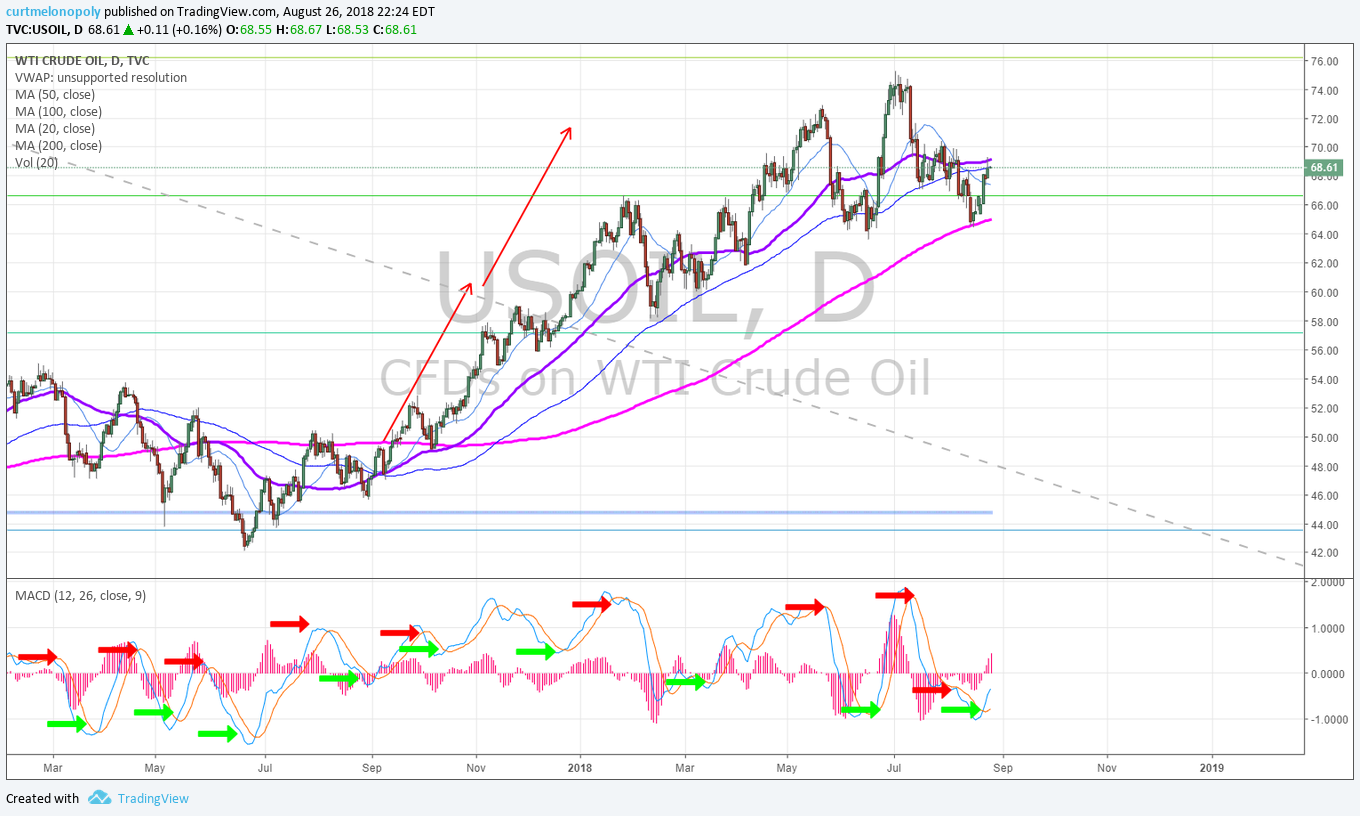

Oil Daily Chart. MACD cross up bullish testing underside of 50 MA. Aug 26 1030 PM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index

Tapped the top of the resistance per below, retraced as predicted below. Move done. Thanks Tony. $DXY $UUP #USD @dxyusd_index https://t.co/JMFbDchqtS

— Melonopoly (@curtmelonopoly) August 22, 2018

$VIX on daily chart MACD crossing up. $TVIX $UVXY #volatility #VIX

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Market Outlook, Market News and Social Bits From Around the Internet:

#5Things

-Mixed fortunes for trade talks

-Musk abandons Tesla plan

-Merkel says its time to step up

-Markets rise

-Lira’s back from holiday

https://bloom.bg/2BPLR4L

#5Things

-Mixed fortunes for trade talks

-Musk abandons Tesla plan

-Merkel says its time to step up

-Markets rise

-Lira's back from holidayhttps://t.co/nqHqCrWiyu pic.twitter.com/0bjIdt7rBT— Bloomberg Markets (@markets) August 27, 2018

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT

Crude #oil was sold for third week with the combined Brent and WTI net-long falling by 31k to 664k lots, an 11-month low. The change was driven by long liquidation in Brent (-16k) and fresh short selling in WTI (+15k). #OOTT pic.twitter.com/eErfrbj3Kk

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April

The #gold net-short hit a fresh record of 79k lots last week, More than 3 times the previous record from Dec-15. The first signs buying was more than off-set by additional short-selling. The #silver short jumped by 26% but stayed well below the previous record from April pic.twitter.com/KSIvqrmgKc

— Ole S Hansen (@Ole_S_Hansen) August 26, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $JMEI $CRON $NNDM $IGC $TLRY $NEPT $PTLA $EIGI $ALNY $YINN $CGC $BILI $AMD $IQ $VIPS $AKS

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $PTLA $AG $CIB

(6) Recent Downgrades: $OMP $QD $HIBB $CIT $AEO $BE

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $TLRY, $CRON, $CGC, $NNDM, $TSLA, Oil $WTI, Bitcoin $BTC, SP500 $SPY, US Dollar $DXY