Trade Set Ups / Current Swing Trade Positions March 19, 2019.

Stocks Covered in this Report: AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT and more. .

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Special swing trade client note:

When this time cycle was starting I was screaming from the rooftops the importance of getting in to play with the trades that were coming, the first leg of the move from Dec 24, 2018 to now has been great and the next COULD BE better in to mid May 2019. Don’t miss out.

Trade Set Ups and Current Swing Trade Positions March 19, 2019.

Anadarko Petroleum (APC) –

Per March 5 Report “this is a symmetry play (see recent special report and alert that went out), trading 44.35 and watching for the support level on video to hold and we’re looking for the 76.00 area for February of 2020 for a price target”.

ALSO, the is a link to a special report below (at bottom of this post) that explains exactly how to trade Anadarko Petroleum.

ANADARKO PETROLEUM CORP (APC) MACD turning up on Weekly Chart, should be ready to go soon. #swingtrade $APC

TerraForm (TERP) –

Per March 5 report “trading 12.60 with earnings in days, algorithmic channel outlined in video and on recent report, trade the channel if it gets bullish on the other side of earnings. This is on high watch with recent trade trajectory and 200 MA near above. Price target on the weekly chart for TERP shown in video is 25.17 range May of next year”.

THERE IS ALSO A LINK TO A SPECIAL REPORT BELOW FOR TERP AT BOTTOM OF THIS POST.

TerraForm Power Caps a Transformational Year With Solid Q4 Results #swingtrading $TERP https://finance.yahoo.com/news/terraform-power-caps-transformational-solid-173600840.html?soc_src=social-sh&soc_trk=tw

TERRAFORM POWER (TERP) This is about to test 200 MA on Weekly Chart, you will want to watch close now. #swingtrade $TERP

Home Depot (HD) –

Per March 5 Report, “240 minute chart is reviewed in video with time cycle completion Mar 26, 2019. This play is on watch with Maven expecting decent upside return. All the price targets and timing are reviewed in the video”.

Home Depot’s Solid 2018 in 3 Charts https://finance.yahoo.com/news/home-depot-solid-2018-3-210500199.html?soc_src=social-sh&soc_trk=tw #swingtrading $HD

HOME DEPOT (HD) holding top of trading box with indicators turning up, looking for a pop here $HD #swingtrading

Gold (XAUUSD, GLD, GC_F) –

Per March 5 report, “Monthly chart reviewed, sideways action is seen on chart, for traders that do trade it I have it shorted and it is going well, price has come off the first resistance in my trade plan (I was expecting to have to average my trade), support is at the red trend line shown. There’s a potential down side 718.00 if it breaks down, it’s very possible it breaks down. I like this trade so far”.

GOLD remains in structure on monthly chart. Watching. $GC_F $XAUUSD $GLD

EXXON (XOM) –

Per March 5 report, “this trade has been going very well, we gt in 73s with 77.13 Feb that hit early, over 200 MA on daily, we have a price target in the 85’s. Details of this trade set up are on the chart in the video and explained by voice. Really really successful trade and it has been going exceptionally well. What a swing trade.

I also explain my sizing and trims and adds to my swing positions in this part of the video (during XOM)”.

EXXON (XOM) This swing trade just keeps giving $XOM #swingtrade #energy

I will be trimming this position in to the red trading box (underside) resistance tomorrow and considering re-entering above the blue line when price is in trading box.

Nike (NKE) –

Per March 5 Report, “this is a break out trade that I alerted as a cautionary set up, the levels and signals for the trade are reviewed in the video. As I’ve said before hold this one tight”.

Breaking Down Nike’s Q3 Earnings Outlook Ahead of March Madness https://finance.yahoo.com/news/breaking-down-nikes-q3-earnings-192407481.html?soc_src=social-sh&soc_trk=tw #swingtrading $NKE #earnings

NIKE (NKE) Will be closing in morning in to earnings, this swing long from 84.84 went well. #swingtrade #earnings $NKE

Alphabet / Google (GOOGL) –

Per March 5 Report, “algorithmic calculated channel is reviewed and price has hit the price target and the trajectory has been very bullish since our alert on GOOGL. The price targets for this swing trade are reviewed in detail on the video”.

Tech giants will have to be regulated in future – EU’s Timmermans https://finance.yahoo.com/news/tech-giants-regulated-future-eus-145838975.html?soc_src=social-sh&soc_trk=tw #swingtrading $GOOGL

Google (GOOGL) Exceptional trajectory (upper scenario) on this swing trade, no reason to liquidate any time soon. $GOOGL

This is another fantastic swing trade. If anything just remember to take profit along the way.

Advanced Micro (AMD) –

Per March 5 Report, “when I alerted this I knew it was going to be a great ROI trade, I don’t like how it trades but I was confident in the price target. It hit the price target early. Resistance and support are reviewed on the video along with future price targets with time cycle completion dates. Another really strong alerted swing trade for 2019”.

AI Stocks to Watch, Including One Under-The-Radar Gem https://finance.yahoo.com/news/ai-stocks-watch-including-one-120000581.html?soc_src=social-sh&soc_trk=tw Gopher Protocol Inc. (GOPH), Five9, Inc. (FIVN), Fortinet, Inc. (FTNT), Advanced Micro Systems (AMD), and Tesla, Inc. (TSLA) #swingtrading #AI

ADVANCED MICRO (AMD) does have symmetry in price targets hit with a channel, upper target may hit #swingtrade $AMD

I don’t like the way this stock trades, however, it has held the channel structure and the price targets are hitting on the model. The upper price target on the chart below could be in play.

https://www.tradingview.com/chart/AMD/w5sN14u2-ADVANCED-MICRO-AMD-does-have-symmetry-in-price-targets-hit-wit/

Twitter (TWTR) –

Per March 5 Report, “didn’t like this one when I put the alert out. I don’t like the way it trades, its crazy. But there is a chart model reviewed on the video. If it functions like a normal equity your price targets are on the video for your review”.

TWITTER (TWTR) continues to struggle in the cluster of support and resistance areas, no trade for me. #swingtrade $TWTR

Facebook (FB) –

Per March 5 Report, “the model has done really well, we will be updatnig the model soon, 175.66 price target March 7 is in play on the 4 hour chart, Maven is in this swing trade and doing well with it. It has been a very successful swing trading structure for us many times in past”.

For now I will leave this one alone considering the mosque attacks. A structured trade just isn’t possible at this point, I will re-look at it the near future.

BP –

Per March 5 Report, “bullish over 43.31 price target 47.99 in to October 2019, we haven’t triggered a swing trade position yet, it may be a decent trade but not the best”.

BP I didn’t execute on this but it does look like a decent trade setting up. #swingtrading $BP #chart

FireEye (FEYE) –

Per March 5 Report, “tagging the down side scenario from our swing report, we haven’t triggered on the trade, 14.80 is in play for April 2019. It’s a good trader when it’s trading well and we’ve done well many time with it”.

FIREEYE (FEYE) Fireeye stuck in a range, watching for now. #swingtrade $FEYE

Arrowhead Pharma ARWR –

Per March 5 Report, “This has been a fantastic long term swing trade, the returns are very high and we are looking for much more in this trade. The trading channel is reviewed on the video”.

ARROWHEAD PHARMA (ARWR) Looking for top of trading box resistance to break for a move to next, great swing trade. $ARWR

TESLA (TSLA) –

Per March 5 Report, “I have been bearish on it since the recent report and it has come off on the chart significantly since, 281.47 is the main pivot and anything over is bullish and under bearish. The trade scenarios are reviewed on video”.

TESLA (TSLA) hasn’t hit my 231.00 price target yet but it has come off really hard so far. $TSLA #stock

Alibaba (BABA) – the bullish thesis I laid out has transpired but not complete, watch the video for all the signals on this swing trade. This is a great set-up.

ALIBABA (BABA) This couldn’t be a better swing trade, hasn’t hit 206.00 price target yet but it is in play $BABA #swingtrade

Microsoft (MSFT) –

Per March 5 Report, “per my previous guidance I am not really exited about it but I am watching for a potential break out trade in Microsoft so at this point it is only on watch”.

This stock has done really well, but I missed taking the trade, so I won’t review the chart at this time.

Eagle Materials (EXP) –

Per March 5 Report, “was looking for a trade entry long trigger in the support line reviewed on the video, price got away on me before I took the trade, I was trying to get a too perfect entry. Support and resistance reviewed on the video.

I missed my execution on this one so I won’t review the chart set-up at this time.

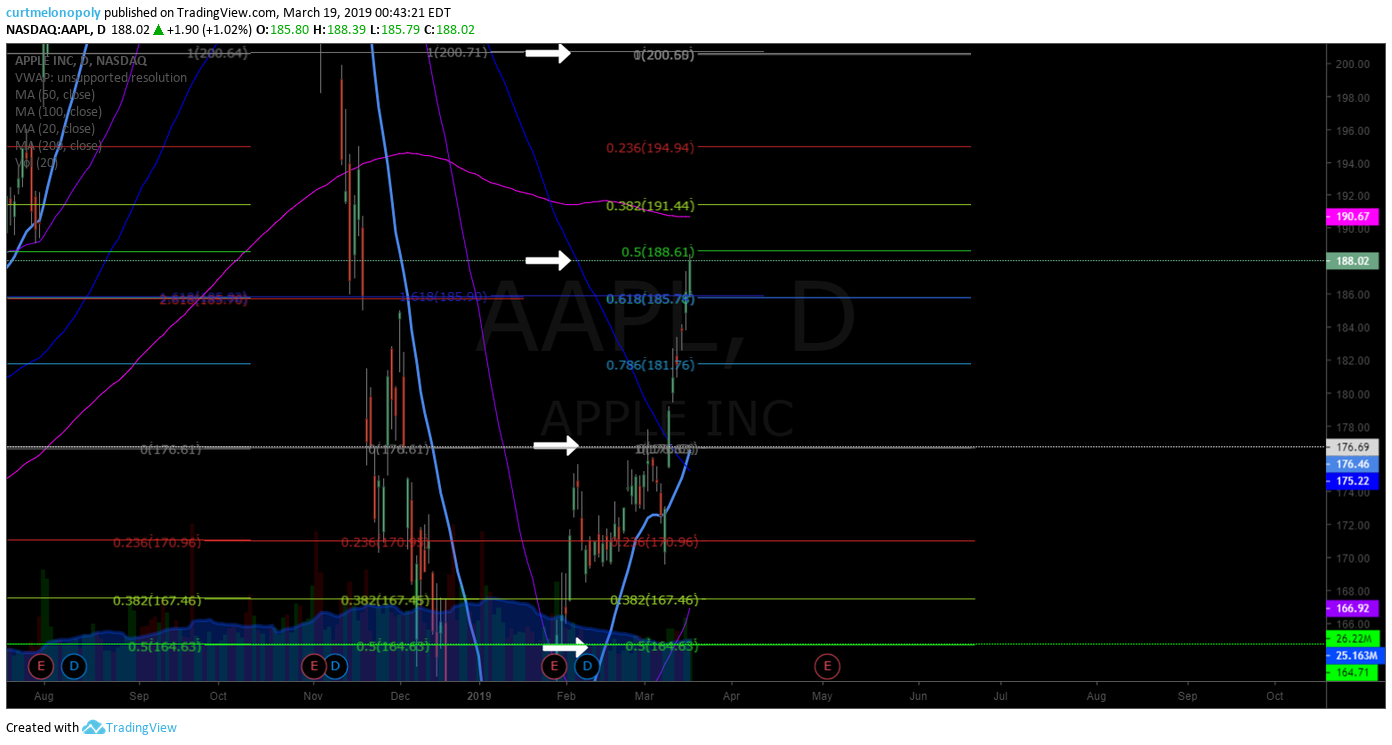

APPLE (AAPL) –

Per March 5 Report, “direction of trade per alert has been near perfect, it has the full range of the price extension and is at the test area, if it gets above resistance noted you can go long again, price targets reviewed on the video”.

APPLE (AAPL) The gift that keeps giving, take profit at each gray and green and add above. Simple. $AAPL #swingtrading

Allergan (AGN) –

Per March 5 Report, “has not done as well as I wanted, made money on the trade but had to trim out in its down turn, I still like it to a point but its a tough set up now”.

ALLERGAN (AGN) Bounce off key support after sell-off, working its way up channel. $AGN #swingtrade #chart

AK Steel (AKS) –

March 5 Report, “potential trajectory on video and it isn’t my favorite type of set-up. Just on watch”.

AKS isn’t doing much of anything, not trading it anytime soon.

Netflix (NFLX) –

March 5 Report, “very structured model, hitting price targets no problem, but right now on daily chart in support area. Price targets reviewed with trajectory of swing trade reviewed on video”.

NETFLIX (NFLX) Continues to trend towared price target for late May. Take profit along the way. $NFLX #stock #chart

American Express (AXP) –

Per March 5 Report, “great trade alert set up from swing trade service, hit price targets early, really strong trade structure”,

AMERICAN EXPRESS (AXP) great trade set-up and above current resistance it has lots of room to run $AXP

The 3 below I am not interested in trading any time soon.

Morgan Stanley (MS) – trading at support channel and if you like the set-up now is the time to trigger long in this trade, it has a 75.00 range price target in 2021.

Delta Airlines – hasn’t been a great trade set-up. Early on in the trade it provided an excellent return for our clients but it fell apart later.

Bank of America (BAC) – really took off at our trigger point from the special report, but its in to resistance and not trading the best but a swing trade thesis is outlined in the video.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Other Recent Reports:

If you are a current swing trade bundle (or newsletter) member and you need an access code for any of the below (that may be locked) please email us at compoundtradingofficial@gmail.com for the password(s).

Feb 26 – Protected: The Home Depot Stock Trade | Earnings Sell-Off | Trade Set-Up Alert

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, AAPL, GOOGL, NFLX, GOLD, OIL, BABA, ARWR, FB, TWTR, TSLA, MSFT