Compound Trading Monday April 3, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $NVCR, $XIV, $AKTX, $MMEX, $USOIL, $WTIC, $DWT – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is trading group involved with day trading, swing trading and algorithmic model chart trading.

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

New lead trader blogpost: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Trade risk management psychology and mechanics is a discipline itself. I am convinced a small study library could be filled on the topic.

— Melonopoly (@curtmelonopoly) April 1, 2017

Big Changes: Even though we post my trades and trading room transcript and video daily (which has been a massive time investment) as of now we are posting intra-day small videos to our Twitter feed and YouTube – every trade as they happen. Each will have details of setup and reasoning for each trade. We will still post complete trading room session to Youtube also.

Even though we post my trades and trading room transcript and video daily (which has been a massive time investment lol) starting Monday…

— Melonopoly (@curtmelonopoly) April 1, 2017

If you missed it, here is the Previous Day Stock Trading Results Friday Mar 31:

https://twitter.com/CompoundTrading/status/848800429085536256

Premarket Trading Plan – Watchlist (member post) for Monday April 3 session can be found here:

https://twitter.com/CompoundTrading/status/848882029701869568

The Weekly Simple Swing Trade Charting (public edition) is out. This week however had a lot of indecision in the charts:

Summary Review of Markets, Chat Room, Algorithm Charting, Trades and Alerts:

Premarket watch-list for me was all about:

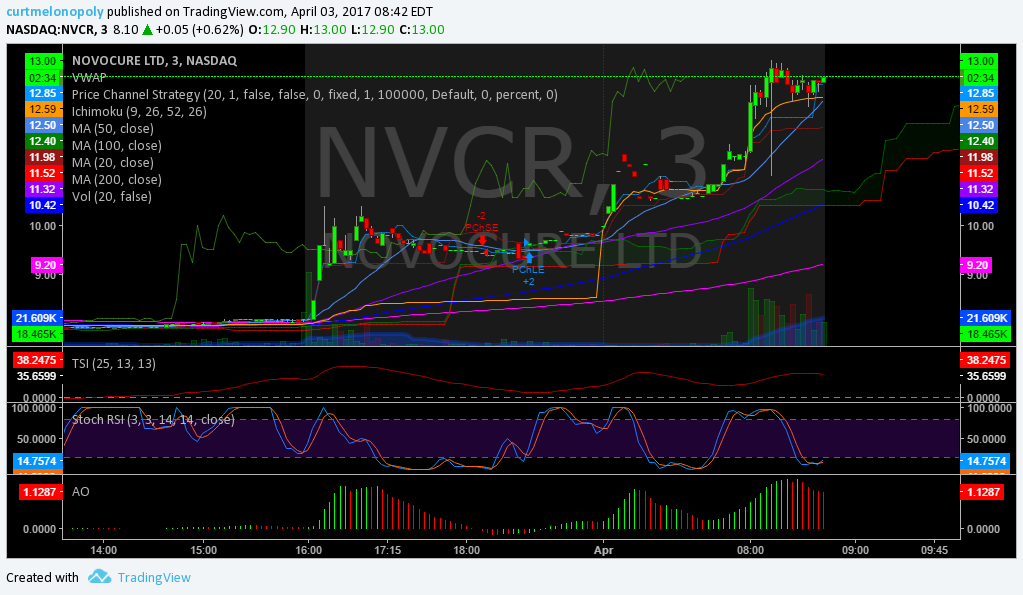

$NVCR, $STDY, $DVAX, $APOP, $TSLA, $XIV, $DWT

Protected: PreMarket Trading Plan Mon Apr 3 $NVCR, $STDY, $DVAX, $APOP, $TSLA, $XIV, $DWT https://t.co/OFSBwHFNs0

— Melonopoly (@curtmelonopoly) April 3, 2017

In play today in chat room and on markets:

$NVCR, $XIV, $AKTX, $MMEX, $USOIL, $WTIC, $DWT

I traded $NVCR in momo open for small paper cut and $XIV flat to start day, then $AKTX for a small 160.00 win, then $AKTX for a -460.00 loss and $XIV for a 1535.00 win so I was up 1235.00 on the day not including my swing plays. Tough day actually.

Took a paper cut on first Crack at bat this morning on $NVCR with 10% size test.

— Melonopoly (@curtmelonopoly) April 3, 2017

I found most of the momentum stocks ran in premarket so market open was tough to say the least and then when I did lock on a momentum it liquidity and power would dry up.

Today is about position sizing and risk management for me. Go figure. A winner in $XIV this afternoon and a loser in $AKTX. #daytrading

— Melonopoly (@curtmelonopoly) April 3, 2017

So today was about trade size management and risk loss management.

The two I wish I would have hit that were both on my watchlist was the oil $USOIL $WTIC related short in $DWT or $DWTI (our algorithm had it set perfectly for me) and $MMEX I had on watch and should have never missed.

$MMEX OTC up 90% today. Straight from trading plan. BUT…… I was distracted. Yes, I am that guy. Fark. 🤔

— Melonopoly (@curtmelonopoly) April 3, 2017

ANY EARLY TRADER should strongly consider the video snippets on YouTube from today’s session EVEN THOUGH we had a problem with mic quality and echo and the market was not exciting. The management of technicals, indicators and personal emotional intelligence required to execute with-out a loss and a profit on a day like Monday is mega. Not my ego at work there – it takes a lot of work to harness what is required to do that.

So the videos will help you learn how to trade if you are not an expert – I guarantee you.

So I embed one of the videos below, but there is a better one that came at the end of day when I was scaling in to $XIV that Sartaj will be uploading to our YouTube page sometime Tuesday – DO NOT MISS IT if you’re trying to get over the wall! It got very detailed and it has secrets in it – I am telling you, do not miss it if you are struggling with your trade account.

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so. I am now 95% cash in daytrading account.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| CYCC | 6.42 | 74.46% | 12552135 | Top Gainers | |

| GBSN | 0.00 | 64.29% | 432482433 | Top Gainers | |

| NVCR | 11.10 | 37.04% | 23436179 | Top Gainers | |

| STDY | 7.50 | 29.31% | 4920876 | Top Gainers | |

| JOB | 6.39 | 29.09% | 464168 | Top Gainers | |

| CALI | 1.84 | 21.85% | 323218 | Top Gainers | |

| COOL | 16.55 | 21.07% | 1301000 | New High | |

| IGC | 0.60 | 27.72% | 2211851 | New High | |

| PNRA | 282.63 | 7.93% | 4863263 | New High | |

| AZRE | 21.75 | 16.56% | 10100 | New High | |

| FIZZ | 84.53 | 0.00% | 271447 | Overbought | |

| PNRA | 282.63 | 7.93% | 4863263 | Overbought | |

| STDY | 7.50 | 29.31% | 4920876 | Unusual Volume | |

| CYCC | 6.42 | 74.46% | 12552135 | Unusual Volume | |

| NVCR | 11.10 | 37.04% | 23436179 | Unusual Volume | |

| AIA | 53.11 | 1.14% | 2835700 | Unusual Volume | |

| AMC | 31.85 | 1.27% | 2420300 | Upgrades | |

| RADA | 1.16 | 3.57% | 130080 | Earnings Before | |

| HQY | 41.73 | -1.70% | 527561 | Insider Buying |

The Markets Looking Forward:

$SPY $TLT https://t.co/W9Q6sZDwwy

— Melonopoly (@curtmelonopoly) April 4, 2017

$SPX $SPY Bull https://t.co/ocVCQomqVP

— Melonopoly (@curtmelonopoly) April 4, 2017

$SPY. To rip or not to rip. Conventional charting says it's ready 👌. Great post.⤵ Our models see challenges but doesn't mean it won't rip. https://t.co/O0QWqqn6nH

— Melonopoly (@curtmelonopoly) April 4, 2017

Our issue with a market rip is primarily the once in a decade resistance cluster not far over head for oil, and it’s slowly downtrending.

Our issue with a market rip is primarily the once in a decade resistance cluster not far over head for oil, and it's slowly downtrending.

— Melonopoly (@curtmelonopoly) April 4, 2017

Algorithmic Chart Model Trading / News:

Systematic Algorithmic Modeling 40% ⤴ https://t.co/KYkvBrxUFU

— Melonopoly (@curtmelonopoly) April 4, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

Simple swing charting that keeps me level when looking at the markets (examples below). Simple charting I find grounds you to simple trades which in turn keeps you profitable in toppy or sideways markets.

https://twitter.com/CompoundTrading/status/848756853169283073

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

{40 year} Gold Seasonality Chart. #Gold $GLD $SLV $GDX $GDXJ $NUGT $DUST #Silver https://t.co/bJnAoWCHPS

— Melonopoly (@curtmelonopoly) April 2, 2017

#Gold managed money. $GC_F $GLD https://t.co/V6k09rpTww

— Melonopoly (@curtmelonopoly) April 2, 2017

Silver $SLV:

Silver Gold Platinum Palladium money pos. https://t.co/JGMkj0oLb8

— Melonopoly (@curtmelonopoly) April 2, 2017

Crude Oil $USOIL $WTI:

https://twitter.com/EPICtheAlgo/status/847857046430953472

$WTI $CL_F $USOIL net long short https://t.co/hpRZPGo4fM

— Melonopoly (@curtmelonopoly) April 2, 2017

Volatility $VIX:

$VIX delay… https://t.co/2aT85XuyXo

— Melonopoly (@curtmelonopoly) April 1, 2017

$SPY S&P 500:

$SPX P/E Ratio above 10 year average. https://t.co/3BzGNUugvs

— Melonopoly (@curtmelonopoly) April 3, 2017

$NG_F Natural Gas:

NA

Live Trading Chat Room Transcript: (on YouTube Live):

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix.

Note: Apologies, some of the morning (first part) is missing from transcript again (if we get time to transcribe it from the video we will, but nevertheless the video is available above).

HedgehogTrader: $LTBR slicing higher again, though low vol

Curtis M: Off mic no trade on halt

Curtis M: $CYCC halt volatility

HedgehogTrader: i think LTBR is gunning for 200dma at some point

Curtis M: Watching $CYCC for premarket high break out

HedgehogTrader: among miners, an interesting chart is $EXK which is curling up and up (backed by good fundies if metals perk)

Curtis M: Looking for 6 with right indicators on $CYCC

Flash G: Added to $LIT swing trade earlier

Flash G: $ADAP new highs again

Flash G: no trade $CYCC

Curtis M: Dont blame you Flash

Flash G: Was looking at it.

Flash G: I like their story.

Sammy T: Decent company and sttory.

Flash G: Opening $URRE long today at some point likely.

Flash G: Need proper entry point.

lenny: $MMEX OTC looking good – chart intact for a move higher

Flash G: Celebrating $TSLA all time highs here!

Curtis M: Congrats Flash!

Curtis M: I’m in it on swing trading side. Nice action.

OILK: Looks like thats a morning open rap!

Curtis M: May have to wait for oil to test resistance before I try a short in oil related $DWT or $DWTI

Flash G: Curt, our $AMZN swing trade s approaching HOD

MarketMaven: $LIGA OTC long

Sartaj Hundal: FYI Curt: Mic echo was a bit loud

Curtis M: How does one adjust such a thing lol?

Sartaj Hundal: Are you using your headset? I think maybe we’ll have to deal with it after-hours, if it is what I think it is

Curtis M: yes on headset

Flash G: $DWT was a good call on your watchlist Curt

Nicole M: market looks uck

Curtis M: $SPY took signal from Oil for sure

HedgehogTrader: $EXK which i mentioned this morning, beginning a run +4%

Curtis M: Looks like oil is heading back down to support test in that channel so I was hoping it would pop to the dotted white line so I can take a $DWT $DWTI position

Flash G: Early lunch. Back at 12:15 for afternoon.

Michael: Yepp me too Flash

Curtis M: Looks like good timing

HedgehogTrader: $MUX is starting to perk

HedgehogTrader: btw EXK had really good news in the am- significant increase in resources and reserves

HedgehogTrader: today’s rally on the news suggests the bottom is in and the worst was already baked into the shares on the last dip

Dave: Looks good Hedgehog

Dave: Strong trading in it

Ned: $MLP 52 week highs

Shafique: Curt was dead on wth his warnings this weekend with market outlook.

Curtis M: $EXK jiggy again

Curtis M: Nice volume

Curtis M: HOD

HedgehogTrader: $FCEL looks like a good one to keep an eye on this week

Ned: Just looked at $FCEL Hedge good one

Curtis M: Small cap solars on watch here

Curtis M: $ADAP new highs too

Curtis M: $USDJPY reversal possible – Watching $XIV

HedgehogTrader: EXK is up 75% of the time in April and avg gain is 16% in April, it’s best month of year

Curtis M: interesting

OILK: Very quiet day.

Curtis M: $XIV Long 500 712.26 to start

Curtis M: On mic in a min>>>>>>

Curtis M: In mic >>>>

Curtis M: 71.26 500 $XIV

Curtis M: Off mic for now re: $XIV play >>>>>>

Curtis M: $ZBZZT Halt – Volatility

MarketMaven: $XII lift

Flash G: You have a stop on that Curt?

Curtis M: LOD

Curtis M: Back on mic in a min re: $XIV >>>>>>

Curtis M: add 500 $XIV 71.135

Curtis M: $XIV avg cost 71.19

Curtis M: Off mic >>>>> Publishing $XIV charts so folks can use the indicators if they like for themselves.

$XIV Trade long cost basis 71.19 pic.twitter.com/Ozhesv0RYX

— Melonopoly (@curtmelonopoly) April 3, 2017

One indicator set up for folks that asked – live chart https://t.co/gVVFS2MWJt

— Melonopoly (@curtmelonopoly) April 3, 2017

2nd set of indicators for those that asked – live chart $XIV https://t.co/03M9enYAlX

— Melonopoly (@curtmelonopoly) April 3, 2017

HedgehogTrader: $TOPS could be an interesting buy low candidate, now at low end of its range; while macd curling up

Curtis M: On mic re $XIV >>>>>>>

HedgehogTrader: (traders should watch platinum which Curtis mentioned via etf $PPLT and platinum producer $PLG which is showing a strong chart)

HedgehogTrader: fwiw my signals get a strong likelihood $PLG rallies this month

Curtis M: $XIV stop 71.19

Curtis M: Stop 71.19 triggered flat trade +- 0.00

Curtis M: $XIV watching now >>>>>>

Curtis M: Looking for power

Curtis M: and Stoch RSI at bottom of range

Curtis M: We;re working on that echo FYI

Curtis M 2: $AKTS 11.56 1000 LONG

Curtis M 2: Stop set 11.09 $AKTS

Curtis M 2: Stop 10.99 changed

Curtis M 2: Stop 11.56

Curtis M 2: Stop 11.72

Curtis M 2: Out 11.72 small win + 160.00

Picked up a small win intra on $AKTX spike there.

— Melonopoly (@curtmelonopoly) April 3, 2017

Curtis M 2: Echo wont be fixed until tomorrows session

Curtis M 2: $AKTX bulls are still in it to win it

Curtis M 1: On Mic $AKTX break out

Sammy T: $TRCH had PR today Curt (your swing)

Curtis M 1: 12.16 1000 shares $AKTX

Curtis M 1: Stop set 11.50 $AKTX

Curtis M 1: Stop changed 11.47 $AKTX

Curtis M 1: Long 11.57 add 1000 shares $AKTX add

Curtis M 1: Correction 12.57

Curtis M 1: Stop 11.80 2000 shares set

lenny: In $CYCC play here Curt really impressive

Sammy T: Curt your $LGCY on the move too

MarketMaven: $TSLA killing the shorts

Flash G: You trading $TSLA now?

MarketMaven: Nope just watching cheering you guys on:)

MarketMaven: I was in $CYCC for a nice winner haha

Sammy T: $CBIO HOD w vol

Curtis M 1: Watching $AKTX on another monitor while I stalk $XIV on the room feed

Curtis M 2: Wondering if I should exit stage left $TSLA

Curtis M 2: nah

Curtis M 1: Long $XIV 71.63 500

Curtis M 1: $XIV stop 71.35

MarketMaven: Good meat and potatioes trading knowldge today Curt even though it isn’t big money day.

MarketMaven: 500 Shares add $XIV 71.99

Curtis M 1: Thanks for doing that

Curtis M 1: Bulldog just left lol so I can

Curtis M 1: Long 72.27 $XIV add 500

Curtis M 1: $AKTX 11.90 stop hit loss – 460.00

Curtis M 1: The machines just ate all the stops $XIV

Curtis M 1: Add final 1000 $XIV here 72.34

Curtis M 1: Stop on all 72.34 $XIV

Curtis M 1: Close $XIV 72.60 for a decent intra win + 1535.00

Closed $XIV intra day trade here for a nice win.

— Melonopoly (@curtmelonopoly) April 3, 2017

Curtis M 1: Off mic >>>>>>>>

Sammy T: Good trade management lessons there Mr Curt.

Curtis M 1: 10-4 Sam

lenny: Looks like your exit was decent timing.

Sammy T: have a great night guys

Sartaj Hundal: See you all tomorrow

lenny: Cya everybody

Curtis M 2: catch you in mornin

Be safe out there!

If this post was of benefit to you, be kind and share it on social media for us please!

Have a great night traders✌. Cheers🍻! Go hug a loved one🤓. We post daily trade results here https://t.co/nGEATPKgUb ….#stocks #daytrading

— Melonopoly (@curtmelonopoly) April 3, 2017

Follow our lead trader on Twitter:

Article Topics: $NVCR, $XIV, $AKTX, $MMEX, $USOIL, $WTIC, $DWT – $XOM, $NE, $ONTX, $DUST, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500