Compound Trading Thursday April 13, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $OCRX, $NVET, $CALI, $USOIL, $WTI, $DWT, $GLD, $XIV, $VIX – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Most recent lead trader blog posts:

Trading Checklist (Rules) I Follow Before Triggering. Part 2 of “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853217228237422592

Now I’m Inspired! My Guarantee to Struggling Traders (and Yours). Part 3 “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853764002584944640

Yesterday’s Post Market Trading Results can be found here:

https://twitter.com/CompoundTrading/status/852422340994453504

Today’s Premarket Trading Plan Watch-list can be found here:

Protected: PreMarket Trading Plan Thurs Apr 13 $OCRX $EYES $AAOI, $SPY, $GLD, $GDX, $USOIL, $WTIC #trading https://t.co/5NRj8SuKCu

— Melonopoly (@curtmelonopoly) April 13, 2017

Most Recent Swing Trading Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket watch-list for me was all about:

$OCRX $STAF $EYES $AAOI $TVIA

Premarket Momentum: $OCRX $STAF $EYES $AAOI $TVIA Time to strap in! GLGL!!! Day off tomorrow!

— Melonopoly (@curtmelonopoly) April 13, 2017

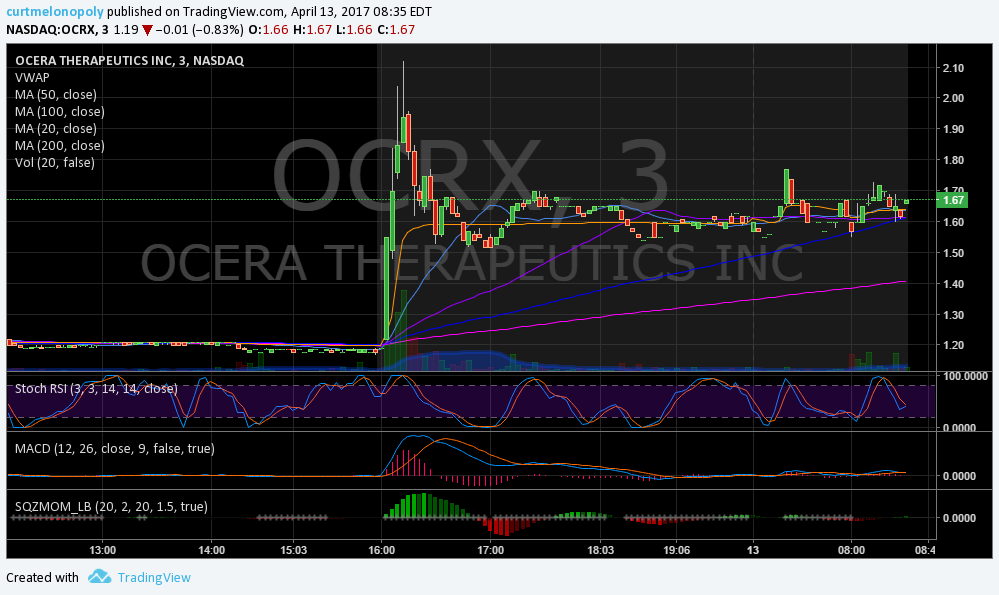

$OCRX Premarket Chart

In play today in chat room and on markets:

Premarket was in $OCRX $STAF $EYES $AAOI $TVIA and then on the day it was $NVET, $CALI, $STRM, $VSTM and a few others. I didn’t trade any day-trades but did some Swing Trading management on that platform.

On the OTC side my $LIGA call was playing out well.

Also on top of $USOIL, $WTI intensely of course because I am in $DWT and Gold $GLD because I am in 1/5 small position in $DUST and $XIV, $VIX, $SPX, $SPY play getting interesting to me so watching very closely.

$LIGA Beast

— Melonopoly (@curtmelonopoly) April 13, 2017

How-to Trade Stocks, Lessons and Educational:

It’s not about picking the right stocks. Focus should be mechanics of the trade – indicators for entry, exit, sizing, timing, trailing etc.

It's not about picking the right stocks. Focus should be mechanics of the trade – indicators for entry, exit, sizing, timing, trailing etc.

— Melonopoly (@curtmelonopoly) April 14, 2017

What a great post ???⤵ #trading #success

What a great post 📣🎯💯⤵ #trading #success https://t.co/q4diKfUgAJ

— Melonopoly (@curtmelonopoly) April 14, 2017

“Rules Based Approach” If there was only one thing I could drive home w/ new traders (that I speak to all day every day) is this one thing.

"Rules Based Approach" If there was only one thing I could drive home w/ new traders (that I speak to all day every day) is this one thing. https://t.co/mOSklMr1Zw

— Melonopoly (@curtmelonopoly) April 15, 2017

Never blame, never complain, never lack gratitude for the opportunity to learn. Be a good loser, dust off and move on to the next trade.

Never blame, never complain, never lack gratitude for the opportunity to learn. Be a good loser, dust off and move on to the next trade.

— Melonopoly (@curtmelonopoly) April 15, 2017

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $DUST, $DWT, $XIV, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| NVET | 6.62 | 63.46% | 1675615 | Top Gainers | |

| CALI | 2.99 | 25.10% | 5173259 | Top Gainers | |

| OIBR-C | 6.73 | 19.54% | 19104 | Top Gainers | |

| CO | 8.01 | 15.09% | 971070 | Top Gainers | |

| STRM | 1.31 | 14.20% | 821419 | Top Gainers | |

| VSTM | 1.85 | 14.20% | 1075600 | Top Gainers | |

| IMNP | 2.55 | 1846.56% | 326704 | New High | |

| NVET | 6.62 | 63.46% | 1675615 | New High | |

| CO | 8.01 | 15.09% | 971070 | New High | |

| MDXG | 10.74 | 8.48% | 4540807 | New High | |

| STRP | 91.70 | -0.33% | 326559 | Overbought | |

| NVET | 6.62 | 63.46% | 1675615 | Overbought | |

| NVET | 6.62 | 63.46% | 1675615 | Unusual Volume | |

| SRNE | 1.80 | -38.98% | 9131264 | Unusual Volume | |

| SPU | 2.94 | -44.84% | 2244165 | Unusual Volume | |

| RORE | 15.43 | -0.06% | 88200 | Unusual Volume | |

| CPE | 12.51 | -4.72% | 7838100 | Upgrades | |

| APOG | 50.72 | -12.67% | 2068900 | Earnings Before | |

| APO | 25.62 | -0.70% | 2800200 | Insider Buying |

Market Outlook:

Our futures?⤵

Our futures🎯⤵ https://t.co/ZXK0OCcqAH

— Melonopoly (@curtmelonopoly) April 16, 2017

#earnings $BAC $NFLX $GS $UNH $JNJ $IBM $GE $QCOM $VZ $SCHW $MS $CUDA $BX $PGR $V $MTB $HOG $ABT $UAL $CMA $RF $USB ⤵

#earnings $BAC $NFLX $GS $UNH $JNJ $IBM $GE $QCOM $VZ $SCHW $MS $CUDA $BX $PGR $V $MTB $HOG $ABT $UAL $CMA $RF $USB ⤵ https://t.co/5HsPVsjNGU

— Melonopoly (@curtmelonopoly) April 16, 2017

Selling ahead of tax day is normal. So is a bounce after. We discuss here ….

Selling ahead of tax day is normal. So is a bounce after. We discuss here …. https://t.co/A1f2mTyBMT

— Ryan Detrick, CMT (@RyanDetrick) April 13, 2017

Algorithm Charting News:

⤵ That tweat cause our $SPY algorithm warned us /members TWO WEEKS before last high we’d not return to high for some time?? @FREEDOMtheAlgo

⤵ That tweat cause our $SPY algorithm warned us /members TWO WEEKS before last high we'd not return to high for some time🎯🔥 @FREEDOMtheAlgo https://t.co/cfxBXmcOKB

— Melonopoly (@curtmelonopoly) April 14, 2017

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

⤵Epic nailed the top when the world was screaming this. @EPICtheAlgo

Bulls can end up on a plate too though… Oil Markets Turn Bullish Amid Spiking Geopolitical Risk https://t.co/0IzL7HxI0Q #oilprice

— Melonopoly (@curtmelonopoly) April 11, 2017

I wouldn’t get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

When I started talking leaning in to oil related short 4 days ago LOT of people, well you know. EPIC the Oil Algo ?? $USOIL $WTI $CL_F #OIL

When I started talking leaning in to oil related short 4 days ago LOT of people, well you know. EPIC the Oil Algo 🎯🔥 $USOIL $WTI $CL_F #OIL pic.twitter.com/c8RXMY65HD

— Melonopoly (@curtmelonopoly) April 14, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD $XAUUSD

$GLD: SPDR Gold Shares Testing Post-2011 Down Trendline (linear scale) $GC_F

$GLD: SPDR Gold Shares Testing Post-2011 Down Trendline (linear scale) $GC_F pic.twitter.com/woDHVquqCJ

— Dana Lyons (@JLyonsFundMgmt) April 15, 2017

Keeping it simple doesn’t hurt??⤵ #Gold $GLD $XAUUSD $GC_F #Commodities

Keeping it simple doesn't hurt🎯💯⤵ #Gold $GLD $XAUUSD $GC_F #Commodities https://t.co/SQLmjfEafx

— Melonopoly (@curtmelonopoly) April 14, 2017

Gold Miner’s $GDX:

For those buying GDX on war concerns. Gold production tends to collapse during wars. Resources diverted to war efforts.

https://twitter.com/PolemicTMM/status/853374500083294208

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

#IEA >>More oil on the market than last year, a report finds

🤔#IEA >>More oil on the market than last year, a report findshttps://t.co/lOD1dxOSpd #OOTT pic.twitter.com/VhBrw1hsXQ

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) April 15, 2017

HEDGE FUNDS’ ratio of long to short positions in NYMEX WTI rose to 5.4:1 on Apr 11 from 3.6 prior week and recent low of 3.1 on Mar 28

HEDGE FUNDS' ratio of long to short positions in NYMEX WTI rose to 5.4:1 on Apr 11 from 3.6 prior week and recent low of 3.1 on Mar 28 pic.twitter.com/IwRAVAgds0

— John Kemp (@JKempEnergy) April 15, 2017

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil https://t.co/ct6jIXfsM6

— Melonopoly (@curtmelonopoly) April 14, 2017

U.S. Oil Rig Count Climbs to Highest in Almost Two Years

U.S. Oil Rig Count Climbs to Highest in Almost Two Years https://t.co/05Wuxx2OVH pic.twitter.com/Zv4XeRhadA

— Bloomberg Markets (@markets) April 13, 2017

WTI producers have trimmed their net short position in 2017 (mainly through more long exposure)

$WTI Producer net short. #oil https://t.co/FCOWIeE0om

— Melonopoly (@curtmelonopoly) April 14, 2017

Volatility $VIX:

$VIX Market Bottoms ? …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia

$SPY $VIX $VXX

$VIX Market Bottoms 🎯 …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia $SPY $VIX $VXX https://t.co/JELaLXDTdV

— Melonopoly (@curtmelonopoly) April 14, 2017

Stat Of The Day>Record $VIX Term Structure Skew: 1Mo/3Mo (VIX/VXV) @ Extreme High;8-Day/1MO (VXST/VIX) @ Extreme Low

Stat Of The Day>Record $VIX Term Structure Skew: 1Mo/3Mo (VIX/VXV) @ Extreme High;8-Day/1MO (VXST/VIX) @ Extreme Low pic.twitter.com/lVqwCHTak0

— Dana Lyons (@JLyonsFundMgmt) April 14, 2017

$SPY S&P 500 / $SPX:

A number of notable short-term extremes suggest $SPX is near a point of reversal higher.

A number of notable short-term extremes suggest $SPX is near a point of reversal higher. New from the Fat Pitch https://t.co/x8JPdGMjNP pic.twitter.com/R0PW6hghrq

— Urban Carmel (@ukarlewitz) April 14, 2017

$NG_F Natural Gas:

NA

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

Optionsavvy: gm

Optionsavvy: I am looking for a calculated buy off yesterdays low as support. Mkts need to open near here or the RR wont be in my favor

Optionsavvy: UVXY also at a top of range here which supports a short VIX and a long mkts

Flash G: morning

Optionsavvy: Mkts closed tomorrow so watch your options exp

lenny: Good morning! Shopping day.

eddie: morn

Curt M: Protected: PreMarket Trading Plan Thurs Apr 13 $OCRX $EYES $AAOI, $SPY, $GLD, $GDX, $USOIL, $WTIC Link: https://compoundtrading.com/premarket-trading-plan-thurs-apr-13-ocrx-eyes-aaoi-spy-gld-gdx-usoil-wtic/ PASSWORD: PRE0413

Curt M: Open watchlist: $OCRX $STAF $EYES $AAOI $TVIA on mic at 9:28 for open >>>>>>>>>>>>>>

Curt Melonopoly: $OCRX http://finance.yahoo.com/news/ocera-therapeutics-announces-presentation-data-200500336.html?.tsrc=rss

Curt Melonopoly: $EYES http://finance.yahoo.com/news/second-sight-argus-ii-retinal-110000258.html?.tsrc=rss

Curt Melonopoly: $AAOI http://www.marketwatch.com/story/the-cloud-boom-is-still-raining-money-on-optical-networking-companies-2017-04-12?siteid=yhoof2&yptr=yahoo

lenny: Looks calm. Some fear perhaps.

Curt M: Snowing here. Mountain snow. Huge flakes.

MarketMaven: Ut sucks.

MarketMaven: SNowboarding this weekend:)

mathew: Hey curt, here’s a VIX chart with levels to watch http://tos.mx/4qaoMO

MarketMaven: Thanks Mathew – he’s outside doing something.

MarketMaven: Mad.

MarketMaven: Snow.

Curt M: Back

Curt M: Thanks

Optionsavvy: Snow?

Optionsavvy: ha ha whats that ?

mathew: With the VIX I like to keep charts simple and only chart major levels. Im watching to see if we can make it to that down trend which I doubt but that would be a vol short for me

Curt M: Piss me off

Curt M: Surfer stuck in mountain snow land

Optionsavvy: what a difference a day makes. IWM short was money yesterday because it was weak. today is strong on rel basis so will be my long if I try at open

Cara: uck

mathew: /NG on a ripper from yesterdays lows

Curt M: $BLTO halt

Optionsavvy: long $QQQ here

Flash G: $DIS bullish tape

mathew: Short term gold shouldn’t have much room to the upside here with large divergences from real rates. More war premium can pop it but I’m cautious on gold. Miners have also played like crap thus far in the most recent run

Sammy T: all over $LIGA since last week it will be a multi bagger

Sammy T: lens in it to

Flash G: Adding to $BABA swing today

Flash G: Possibly $QQQ

Curt M: $XLNX scanner firing off on this

Curt M: We have a new 200 MA scanner coming out FYI – our coding

Optionsavvy: taking off half QQQ calls +100%

Curt M: nice

Curt M: MACD turns up on $XLNX on daily I’ll likely take it long

Flash G: $QCOM MA chatter on $XLNX

Flash G: $SHOP has chatter also

Flash G: You might be right about NASDAQ next week Curt.

Hedgehog Trader: what about Nasdaq next wk?

Hedgehog Trader: morning gents

Hedgehog Trader: and lasses

Curt M: Looking at adding to $XIV late today. Also looking at possibly adding to $DWT. And some tech stocks.

Curt M: Hey Nich.

Curt M: Next week I was saying I’m bullish $SPY and NASDAQ

lenny: $RTTR multi bagger on the way

Hedgehog Trader: yup and we have an astrological reason to start being bullish next week – Venus which also governs business and relations (think geo tensions) ends a 6 week retrotgrade period on Saturday

Flash G: $AAPL chart repairing

Curt M: Agreement is powerful.

Flash G: $NFLX chart repairing

Flash G: I think you guys hit it on the head. Next week could be very big.

Curt M: 10:03 Off mic – no momo plays – scanning – will do chart review at 12:00 EST – 1:00 EST in preparation for next week >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Hedgehog Trader: Curt, one of my forecasts on $IWC microcap index shows a very high magnitude one month move after Apr 17th

Curt M: Nice

Hedgehog Trader: so my guess is we see pressure relieved and a huge rally

Curt M: Lets review charts over lunch if you can (any you like) for next week set-ups. List them here if you got em everyone.

Curt M: Hedge is on it:)

MarketMaven: GOOD I need some momos

Hedgehog Trader: what may surprise some is that i do think the miners will also rally

Optionsavvy: out QQQ .44 2nd half from .12 +266%

MarketMaven: Banka!

MarketMaven: haha congrats savvy!

Optionsavvy: 🙂 my day is done. will look for setups for you guys though

Hedgehog Trader: very savvy Savvy!

Curt M: Nice way to cap the week Scott

Optionsavvy: ty ty

Curt M: Look at $XLNX bull power

Optionsavvy: ENTL on scan

Optionsavvy: prob more of a reversal / swing 1-2 weeks

Optionsavvy: these gold names still all over my scans

Optionsavvy: TRX candian miner coiled up off lows

Optionsavvy: Canadian even

Hedgehog Trader: $THM

Optionsavvy: eyeing IWM short but going to be a small pos

Optionsavvy: missed it

Flash G: I took the entry on $XLNX – looks good

MarketMaven: haha they’re going to run the china plays

MarketMaven: all over the scanner

lenny: $RTTR is going to rip in to next week – adding here

Flash G: Every tech name I follow is repairing or about to rip as you say.

Optionsavvy: saw a few china plays on my scan this morning Maven. I discard them because I dont trade them but let me see whats on there

MarketMaven: 🙂

Optionsavvy: JMEI not bad

Optionsavvy: http://www.finviz.com/screener.ashx?v=211&f=geo_china,sh_avgvol_o50,sh_price_u15,sh_relvol_o1.5,ta_perf_dup&ft=4

MarketMaven: I know theyre all junk

MarketMaven: sometimes i will just scalp em

Flash G: $SHOP break out likely to hold IMO

MarketMaven: Careful with $ZENO

Flash G: Curt, $SPY may turn up here – its possible.

Flash G: If it does that may be the trigger for the buys for next week instead of waiting until EOD.

Curt M: I think I’ll wait – but it looks decent.

Curt M: Its got the 20 MA up through the 200 on the 3 there

Curt M: SQZMOM not confirming

Optionsavvy: SPY at hard res 234.35 imo

Curt M: agree

Optionsavvy: next res above have marked is 234.15

Optionsavvy: oops 235.15

Curt M: yup

Optionsavvy: SPY trying

Curt M: there was a decent block there just now

Optionsavvy: mkts going to run now. my QQQ is HUGE now oops

Optionsavvy: DOW might get a bump here next major res 20745

Flash G: All my charts repaired in Tech and some on DOW too now.

Optionsavvy: move failing. may try some IWM puts now

Sammy T: $URRE tape coming alive

Optionsavvy: that auto loan default comment on your feed sounded a LOT like what they were saying in 05-07 about housing. its an asset and has a tangible value. think we all know how that worked out

Sammy T: yes

Flash G: Doesn’t look good the autos. Canadian housing prices too.

Flash G: Toronto and Vancouver.

Flash G: $GOOGLE strong now

Optionsavvy: cyclical trade would be short GM and F . auto values will collapse and noone buying anything

Flash G: $SPY still might take off from here.

Flash G: 50 MA about to cross up through 100 on the 3 there you never know

Optionsavvy: imo DOW would have to get moving for anything meaningful to happen today

Flash G: Thats a fact

Optionsavvy: starting to look like I’m heading to golf course early 🙂

Flash G: Well enjoy! I will be in the scotch at 1PM for an early tip.

Optionsavvy: this AXSM is setup nicely. got long it early in the week but might cut it loose if it doesnt wake up soon

MarketMaven: haha I’d like to see you take a puff Flash

MarketMaven: that would be funny

lenny: $CERU hit scan

lenny: $ESEAS gets a buy rating

lenny: $CNBX adding here

Optionsavvy: ok stepping away for a bit. stop back later GL all

Curt M: k

Flash G: Going for lunch

MarketMaven: Me too

Curt M: Theres not enough juice in the market to do chart reviews today so I am setting that off to first day back next week.

Sammy T: I agree.

Flash G: Thats good because I want out early I think.

Flash G: Still convinced SPY take off soon.

Sammy T: on lunch

Curt M: $USRM 5MM Funding news

Hedgehog Trader: $THM volume picking up (Alaskan goldie like $NAK)

Hedgehog Trader: i wonder if $LIT fills the gap before the next run begins

Flash G: Like $LIT

Hedgehog Trader: platinum trading at a good discount to gold $PPLT

Hedgehog Trader: miner $PLG a nice entry

Sammy T: so slow

Flash G: $TSLA

lenny: Curt – your $LIGA call hit.

MarketMaven: yup thats a good one – still in

Curt M: yepp

lenny: BLDP HOD

lenny: $CBIS +35%

Flash G: $TSLA the start f the ramp imo. Then $GOOGL and the others between close now and Monday EOD and all repaired.

Flash G: my theory

Hedgehog Trader: folks look at that MJ breathalyzer play i mentioned yesterday $BLOZF

Hedgehog Trader: volume increasing and a spike earlier

Hedgehog Trader: going to really run

Curt M: Looked at it last night

Curt M: Its bullish

Sammy T: ya nice chart

Flash G: I kept chearing for it but no luck today:) $SPY

MarketMaven: Positive man. Who knows maybe Monday if more bombs don’t go off.

Hedgehog Trader: Venus retrograde ends Saturday, so i expect hostilities to wind down

Sammy T: awesome

Hedgehog Trader: yeah it’s been going on 6 weeks so i think we’ll start to see better business news and improved foreign relations, translating into a big mkt rally as a sigh of relief

Hedgehog Trader: is exhaled

Curt M: Thats what I’m expecting Nich. Tough day to get grip. I did lots of swing trade babysitting but no daytrading.

Hedgehog Trader: yeah a good day to sit on the deck with a drink

gary y: I like this chat better than the tradinview one lol

Curt M: haha

Curt M: a lot of chatter

gary y: they’re all over the place

Flash G: Was going to say.

Shafique: I should jump in an rattle their chat once in a while.

Shafique: actionable is better

Hedgehog Trader: mmmm chocolate cake

Sandeep: Speaking of action… I took your $LIGA call Curt – like it a lot and I like $BLOZF thanks Nich

Hedgehog Trader: cool Sandeep, it’s been showing great relative strength BLOZF

Hedgehog Trader: vs sector

Hedgehog Trader: plus, it’s essentially a technology play with little risk regarding actual MJ

Sandeep: great

Sandeep: actionable is better too I agree

Sandeep: as the chat grows try and keep it that way

Curt M: yes

Curt M: in slow times I’ll feature chat rooms from around the world on the monitor lol for laughs

Curt M: but actionable I agree is the nly way when you’re in it to win it

Hedgehog Trader: emerging mkts are also strong i love $GREK

Hedgehog Trader: it completed a long 4-5 year bear mkt and has been consolidating since

Hedgehog Trader: but it’s been edging higher and is set to break out

Hedgehog Trader: you’ll never see a CNBC special on buying Greece guaranteed lol

Curt M: ha

Hedgehog Trader: i imagine we’ll see Gartman shorting the entire world by week’s end

Hedgehog Trader: long term charts of $GREK and $NBGGY look ready to do some serious rampaging

Hedgehog Trader: $THM major volume

Hedgehog Trader: now over 50 dma

Hedgehog Trader: mentioned it yesterday

Curt M: $IMGN one of the only good looking charts from the leaders today IMO

Curt M: even that isn’t great

lenny: $RTRR for Monday

eddie: off to buy eggs:) see ya mon

Curt M: cya eddie good to have ya back

Hedgehog Trader: ciao Eddie

Curt M: Well theyre going to leave $SPY on the pivot:)

Curt M: cya monday folks have a great easter

MarketMaven: bye bye

Hedgehog Trader: bye MM gary Curt

gary y: see you later

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $OCRX, $EYES, $NVET, $CALI, $USOIL, $WTI, $DWT, $GLD, $XIV, $VIX – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

3 thoughts on “Post-Market Thurs Apr 13 $OCRX, $NVET, $CALI, $USOIL, $WTI, $DWT, $GLD, $XIV, $VIX”

Comments are closed.