Volatility $VIX Charting / Algorithm Observations Report Tuesday Feb 13, 2018 $TVIX, $UVXY, $XIV, $VXX

Good morning! My name is Vexatious $VIX the Algo. Welcome to my new $VIX algorithmic modeling charting trade report for Compound Trading.

Volatility Charting Observations:

Specific to the last model…. we are not updating it because the $VIX is not functioning within a model. With the allegations and probes in progress (that have surfaced over the last 48 hours) we are simply using conventional charting for now (see below). The next update will include a revised model.

News flow for $VIX

Whistleblower alleges manipulation of Cboe volatility index $VIX $XIV $TVIX $UVXY https://finance.yahoo.com/news/whistleblower-alleges-manipulation-cboe-volatility-013011037.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

Whistleblower alleges manipulation of Cboe volatility index $VIX $XIV $TVIX $UVXY https://t.co/rP6WixH9Xg via @YahooFinance

— Melonopoly (@curtmelonopoly) February 14, 2018

Wall Street regulator scrutinizes alleged manipulation of VIX, the stock market ‘fear index’ $VIX $XIV $TVIX $UVXY https://www.wsj.com/articles/wall-street-regulator-probes-alleged-manipulation-of-vix-a-popular-volatility-gauge-1518547608 via @WSJ

Wall Street regulator scrutinizes alleged manipulation of VIX, the stock market ‘fear index’ $VIX $XIV $TVIX $UVXY https://t.co/w4MUE5frvW via @WSJ

— Melonopoly (@curtmelonopoly) February 14, 2018

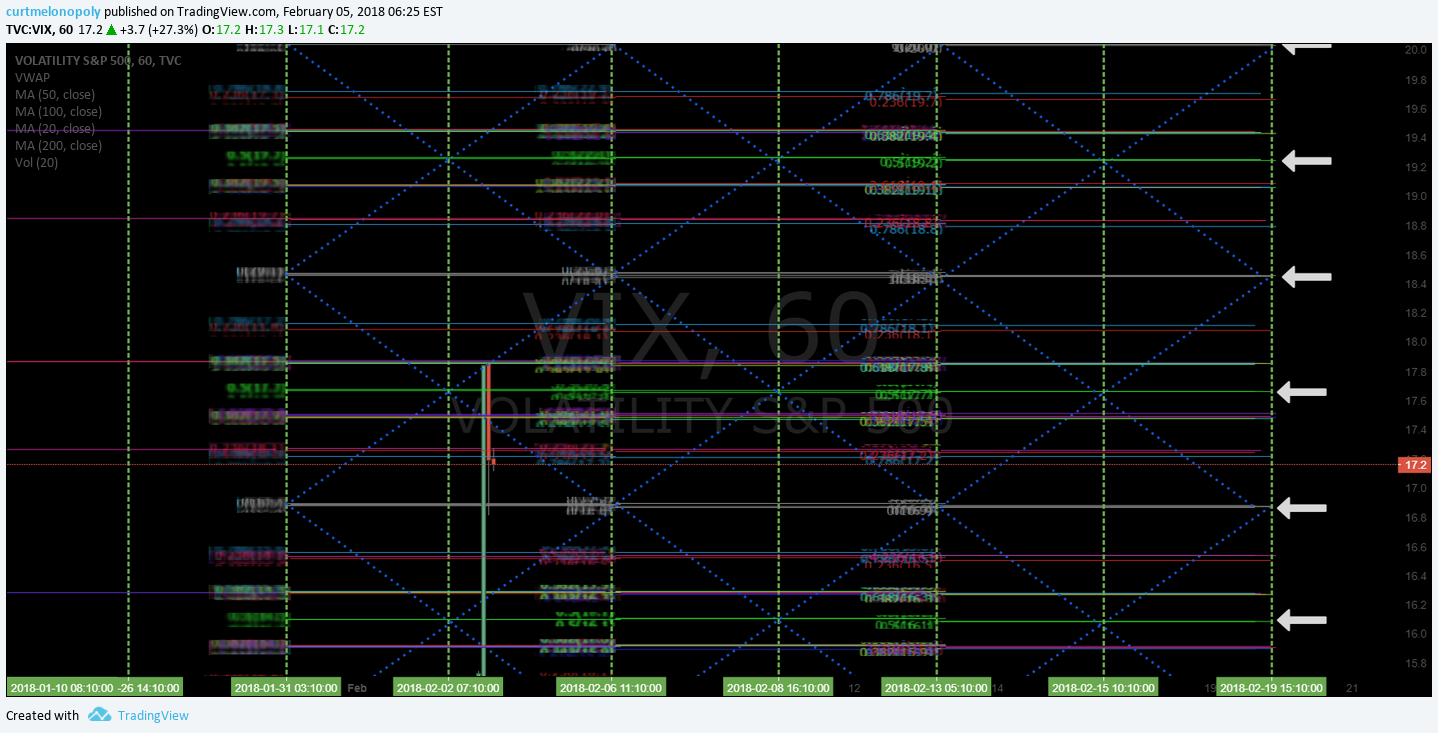

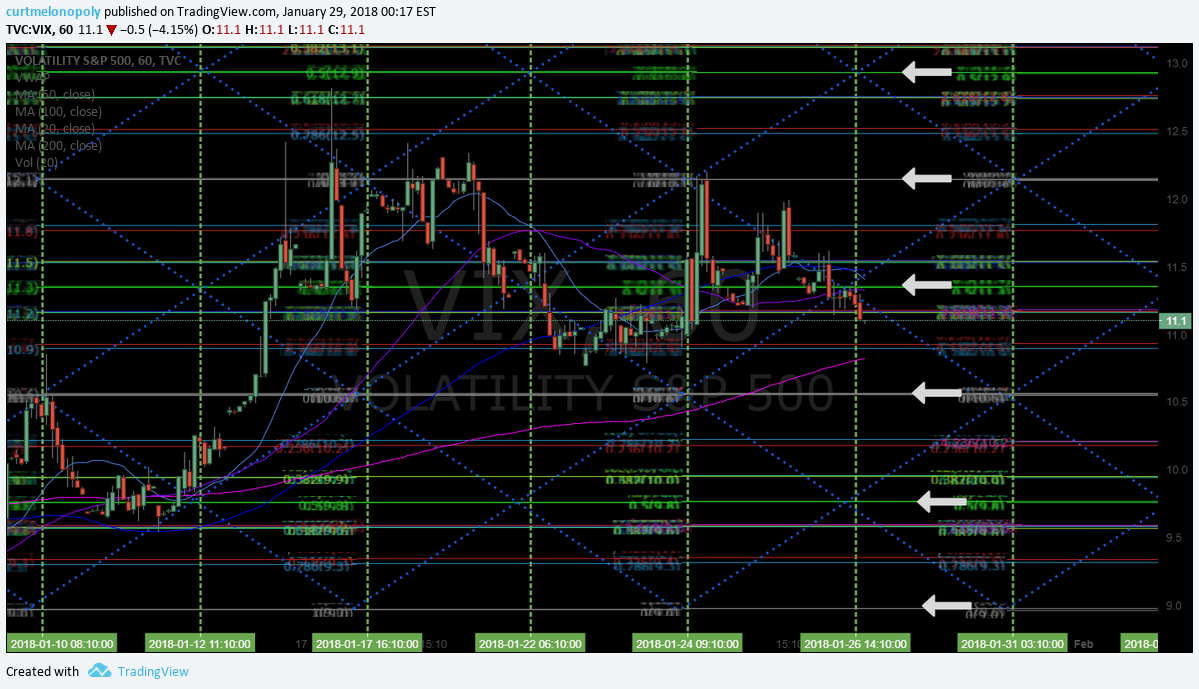

Volatility $VIX Charting – Current Trading Range Mon Feb 5 $TVIX, $UVXY, $XIV, $VXX

Real – time $VIX charting link:

Buy sell swing trading triggers for $VIX:

23.2

22.4

21.6

20.8

20.1

19.3

18.5

17.7

16.9

16.1

15.3

14.5

13.7

12.9

12.1

11.4

10.6

9.8

9.0

Volatility $VIX Charting – Current Trading Range Mon Feb 5 624 AM $TVIX, $UVXY, $XIV, $VXX

Recent;

$VIX Volatility Index Conventional Charting

$VIX over upper bollinger band creates excellent short side risk-reward. Use additional MACD signal. Feb 13 933PM $TVIX $UVXY $XIV #volatility

$VIX Real-time chart link:

Per previous;

$VIX over upper bollinger band creates excellent short side risk-reward. Use additional MACD signal. $TVIX $UVXY $XIV #volatility https://www.tradingview.com/chart/VIX/hk3sz7iL-VIX-over-upper-bollinger-band-creates-excellent-short-side-risk/

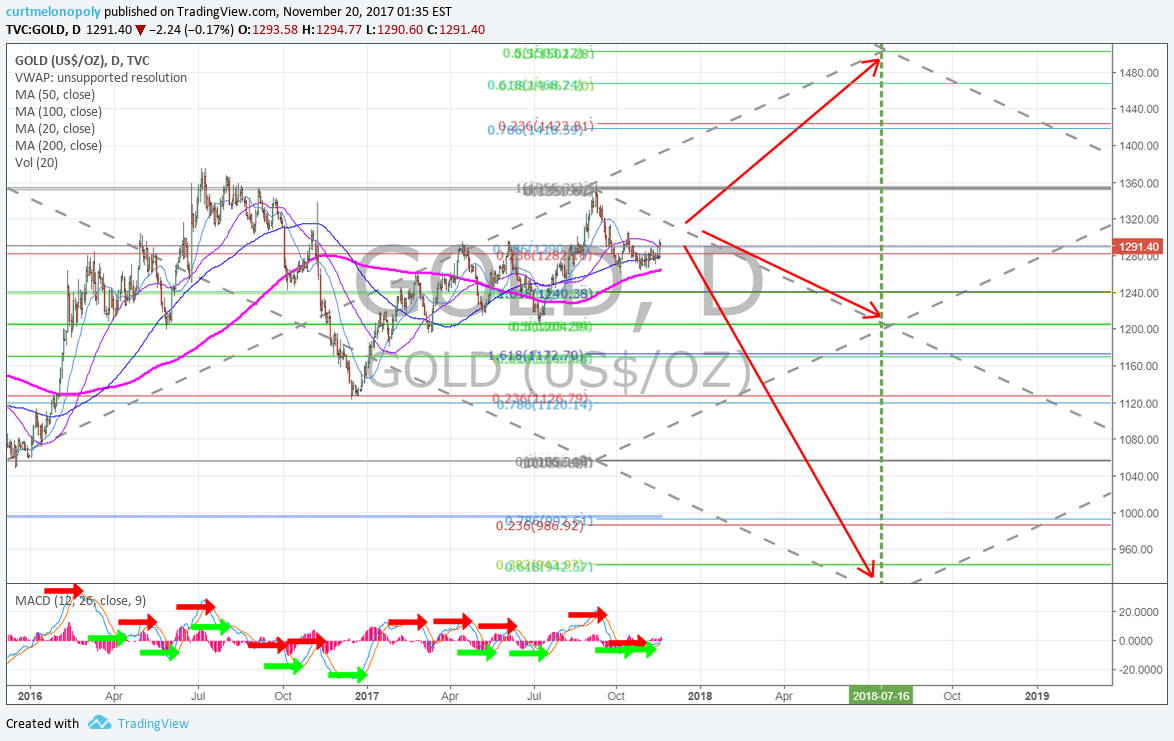

$VIX Weekly Chart

$VIX weekly I see Stoch RSI too high, divergent spike (too early) & next spike mid late July $XIV $TVIX $UVXY $SVXY $VXX You can’t hide anomalies. Everything has a nature. Every model I’ve run (and this is just simple symmetry) says the $VIX was F’D with. But I’ll watch for now.

$VIX weekly I see a Stoch RSI too high, divergent spike (too early) and next spike mid to late July $XIV $TVIX $UVXY

Per previous;

$VIX Weekly chart. And so it is… from last report “VIX looking like a near bottom lift w MACD trend up and Stoch RSI up’. #volatitily #chart https://www.tradingview.com/chart/VIX/9sQyBtFP-VIX-Weekly-chart-And-so-it-is-from-last-report-VIX-lookin/

$VIX Weekly chart looking like a near bottom lift w MACD trend up and Stoch RSI up. #volatility #chart

Good luck with your trades and look forward to seeing you in the room!

Vexatious the $VIX Algo

Article Topics: Vexatious, $VIX, Algo, Volatility, Stocks, Trading, Algorithms, $TVIX, $UVXY, $XIV, $VXX