Tag: $AXDX

Post-Market Fri Feb 24 $CEMP, $AXDX, $RH, $TST, $IPCI, $EARS, $OWCP

Review of Compound Trading Chat Room Stock Trading, Algorithm Stock Charting Calls and Alerts for Friday Feb 24, 2017; $CEMP, $AXDX, $RH, $TST, $IPCI, $EARS, $OWCP – $UWT, $BSTG, $ONTX, $DUST, $VRX, $TRCH, $LGCY, $SSH, $ASM etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

https://twitter.com/CompoundTrading/status/835668331772313600

We are working on a series of videos that include trades from week of Feb 20 – 24 and various educational topics that we expected to complete weekend of 25 – 27th but it seems it will take a few more days.

Momentum / Notable Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| CEMP | 4.05 | 28.57% | 21584676 | Top Gainers | |

| RH | 31.34 | 24.41% | 14826552 | Top Gainers | |

| AAOI | 45.98 | 22.71% | 6548873 | Top Gainers | |

| BBW | 10.10 | 21.69% | 1180754 | Top Gainers | |

| OLED | 81.00 | 20.09% | 4784078 | Top Gainers | |

| ZSAN | 2.61 | 18.64% | 9597064 | Top Gainers | |

| AAOI | 45.98 | 22.71% | 6548873 | New High | |

| KEM | 11.00 | 5.77% | 3491804 | New High | |

| TVTY | 29.60 | 8.50% | 1938379 | New High | |

| OLED | 81.00 | 20.09% | 4784078 | New High | |

| LMIA | 13.71 | 0.22% | 101563 | Overbought | |

| WOOF | 90.98 | 0.08% | 737230 | Overbought | |

| NAO | 1.25 | -39.02% | 13366169 | Unusual Volume | |

| MAUI | 24.35 | 1.04% | 11155 | Unusual Volume | |

| EARS | 0.94 | 2.17% | 4236508 | Unusual Volume | |

| HCLP | 17.35 | -15.57% | 18062362 | Unusual Volume | |

| AMCX | 60.95 | 1.85% | 1035774 | Upgrades | |

| ALQA | 0.46 | -0.65% | 344275 | Earnings Before | |

| AVY | 80.25 | -0.50% | 585917 | Insider Buying |

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderately small to small sizing) $UWT, $BSTG, $ONTX, $DUST, $VRX, $TRCH, $LGCY, $SSH, $ASM:

Trading and The Markets Looking Forward:

Recent notes in post market reports that still apply,

“The small and micro momentum stocks continue to pop, however, traders need to be cautious because often its the low floats and thin trade can be difficult to chip out of positions – caution warranted in many ways.”

“These low float micros have in past signaled the end of a cycle in the market – keep that in mind.”

“Our standard plays that reflect the six algorithm charting we do are all at decisions at either support or resistance so this should get really interesting soon.”

Per yesterday, “Our swing trading side continues to outperform all my expectations for 2017 (you can find the most recent unlocked swing trading newsletter on our blog) – I had a feeling it was going to do well, just didn’t quite expect a grandslam. We’re in the middle of compiling our next set of stock picks for the swing trading members and will have them out over next few days – hopefully that batch will bring the same type of returns as the new year batch did and continue to in most instances.

US Dollar $DXY $USDJPY $UUP:

Per recent; $DXY US Dollar is threatening to the trend reversal side, but not confirmed, awaiting market direction.

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Per recent; Gold and Miner’s are both at what we consider key resistance.

Silver $SLV:

Per recent; Silver is at what consider key resistance.

Crude Oil $USOIL $WTI:

Per recent; Crude oil continues to threaten a key support and resistance area that we have used as an area of accumulation long (we’re long as long as the trend is in place – the trend is your friend and we’re trading the range until it isn’t).

Volatility $VIX:

Per recent; Volatility continues its flat line.

$SPY S&P 500:

Per recent, “$SPY continues the break-out. Trade the Fibs and buy the dip until you can’t. Respect stops.”

Natural Gas:

Watch 2.44 – 2.57

$NG_F $NATGAS $UGAZ $DGAZ $UNG range to watch. https://t.co/xDTcrUqyiG

— Melonopoly (@curtmelonopoly) February 27, 2017

$NG_F $NATGAS $UGAZ $DGAZ $UNG https://t.co/pZ0tyXYvR5

— Melonopoly (@curtmelonopoly) February 27, 2017

Momentum Trades:

Per recent; As noted above, the low float micros and small cap issues continue in momo.

Swing Trading:

Per recent; As noted above, our Swing Trading service has sent one out of the park after another. Continues to look good forward.

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Compound Trading Stock Chat-room Transcript:

Miscellaneous chatter may be removed.

Announcements in room:

07:50 am Curtis M : Morning team! Just arrived back from my trip so there won\’t be time to get any updates out. All new updates out on the weekend and new webinar series to be posted to YouTube also.Do my best to get a quick premarket trading plan out before open though.ThanksCurt

08:59 am Curtis M : Protected: PreMarket Trading Plan Fri Feb 24 $CEMP, $AXDX, $RH, $TST, $IPCI, $EARS https://compoundtrading.com/premarket-trading-plan-fri-feb-24-cemp-axdx-rh-tst-ipci-ears/ PASSWORD: PREMARKET022417

Transcript:

06:38 am ibrahim ibrahim : morning

07:48 am Sandy S : From Curt in case you didn’t get it on email…. Morning team!Just arrived back from my trip so there won’t be time to get any updates out. All new updates out on the weekend and new webinar series to be posted to YouTube also.Do my best to get a quick premarket trading plan out before open though.ThanksCurt

07:48 am Jake R : thx

08:56 am Sandy S : Protected: PreMarket Trading Plan Fri Feb 24 $CEMP, $AXDX, $RH, $TST, $IPCI, $EARS https://compoundtrading.com/premarket-trading-plan-fri-feb-24-cemp-axdx-rh-tst-ipci-ears/ PASSWORD: PREMARKET022417

09:00 am Carol B : morning all!

09:16 am OILQ K : morning all

09:17 am Mathew Waterfall : Morning everyone

09:17 am OILQ K : I see we are all a little richer with Gold up again. That makes the day brighter.

09:18 am Cara R : Except Curt haha but he’s rich enough

09:18 am OILQ K : lol

09:19 am Mathew Waterfall : Strength in the bonds as well which is a sight for sore eyes

09:20 am Curtis M : wealth at my expense – ‘m good with that… taking one for the team

09:20 am Curtis M : morning

09:21 am Curtis M : between me you and the fence post…. i’m going to try and double up small account between now and end of Tues – 3 days aggresive – not likely but gonna try and I’kk video t all and post excerpts for new traders on youtube

09:22 am OILQ K : ok great

09:23 am seth m : ya not easy but lets do it

09:24 am Sandy S : seth u new?

09:24 am Curtis M : k guys focus open on deck thx

09:26 am Curtis M : on mic

09:28 am seth m : add $NUGT

09:30 am Sandy S : with y curt

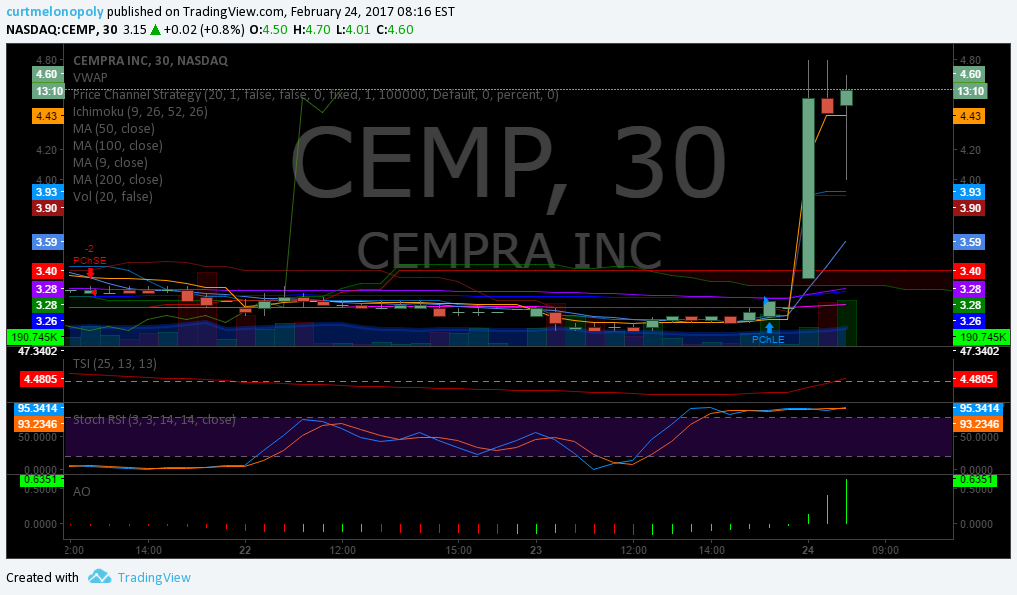

09:31 am Curtis M : L $CEMP 1000 shares start 4.22

09:31 am Jake R : right behind you huys

09:31 am Jake R : guys

09:32 am Curtis M : out 4.46

09:32 am Jake R : lol holding

09:33 am Sandy S : holding

09:35 am Sandy S : cool thanks

09:37 am Sandy S : had no idea thanks

09:38 am Sandy S : out

09:38 am Jake R : me too

09:38 am OILQ K : small win closed

09:41 am Jake R : $PULM very activer

09:49 am MarketMaven M : nice im in with ya

09:51 am OILK K : wow learning today

09:56 am Curtis M : closed 1.82 $OWCP from 1.63 buy nice

09:57 am Jake R : you make that look simple

09:57 am Curtis M : its not

09:59 am Sandy S : I’m out Thanks CURT!

09:59 am Flash G : that was awesome thank you

10:01 am Leanne Arnott : what broker do you use?

10:05 am Sandy S : schools in session

10:06 am Leanne Arnott : I use Cdn bank also but is waaay to slow for this kind of trading, can’t get in and out fast enough

10:16 am Jake R : Thanks Curt

10:18 am Leanne Arnott : it’s not one click, but i’ll try this afternoon,

10:22 am Curtis M : scanning back in a bit

10:22 am seth m : learned a lot there wow answered many of my questions

10:22 am Mathew Waterfall : Boring day continuing the lack of movement this week for me. Huge metals moves with miners not biting yet. I an taking a longer view and will sit on my miners likely at least into mid next month and they will play catch up with chasers flooding in. Will detail a couple things I’m seeing at the 11 o’clock update

10:23 am seth m : will this be on video on weekend?

10:23 am Curtis M : yes seth

10:24 am seth m : i finally understand how the indicators on your charts work awesome

10:25 am seth m : so theres VWAP test! right?

10:25 am Curtis M : yup

10:25 am Curtis M : k focus plz thx

10:26 am Mathew Waterfall : In some $NWGFF small for a start and a run back into the .20’s

10:26 am Curtis M : looking fwd to your 11am update Mat – feel disconnected with the travel

10:27 am Mathew Waterfall : There’s a lot of disconnect in this market right now so we’re on all on the same page lol

10:27 am Ed D : Seth is right – that was really good – good understanding now for me will help a lot

10:27 am Curtis M : ya

10:28 am Ed D : Curt, I have to ask quick, you just randomly say this morning i’m going to double small account in 3 days hopefully like its no big deal at 10 trades at 10% each – this is a regular thing for you guys?

10:29 am Curtis M : um…

10:29 am Curtis M : I’ll explain that on weekend video

10:29 am MarketMaven M : lol its regular

10:30 am MarketMaven M : he’s sniping w right indicators – tight trading is tight haha

10:30 am Curtis M : any momos out there guys?

10:31 am Sandy S : haha that means focus

10:31 am Curtis M : 🙂

10:35 am Curtis M : on mic

10:44 am OILQ K : learnin cool stuff guys

10:53 am NewbieHH O : hi guys

10:55 am NewbieHH O : Just want to say Have a Nice weekend !

10:56 am NewbieHH O : take care! logging out

10:56 am Curtis M : kk

10:56 am Mathew Waterfall : have a good weekend nice and early lol

11:00 am Mathew Waterfall : on the mic

11:01 am banka tronic : I’m keen on the momo trades

11:01 am Sandy S : agree

11:02 am Sandy S : mathews updates help me center too lol

11:02 am seth m : ya Mathew rocks

11:02 am seth m : 🙂

11:02 am banka tronic : ($TOPS is an example of so of these low float runners that are technical b/os )

11:03 am Curtis M : hey banka thanks for dropping in:)

11:03 am banka tronic : Thank you kindly for this trading forum :))

11:03 am Curtis M : 🙂

11:04 am Sandy S : I trade $TOPS lots like that one

11:05 am Jake R : $TOPS just came off a bit intra

11:06 am banka tronic : I look for the pre-market pops on the low floats usually under 25 million float + catalyst:some news…

11:06 am OILK K : $VIX LOL

11:07 am OILQ K : luv those plays banka

11:07 am banka tronic : Keeping an eye on the 13EPA 50&200 MAs using 1 to 5 min trendlines when volume hits5k & builds

11:07 am banka tronic : for momo trades.

11:07 am Curtis M : nice share banka:)

11:08 am Curtis M : some nuggets in there

11:08 am seth m : Mathew I’ll likey send you a few questions this weekend

11:09 am banka tronic : np 🙂 Also watch the 1Y: D chart with those indicators for possible support/resistance levels

11:09 am seth m : $CEI poppin

11:09 am Mathew Waterfall : Send me questions anytime on twitter @quadzilla_jr

11:09 am Jake R : Thanks Mathew!!

11:09 am banka tronic : Very cool info Mathew!

11:09 am OILQ K : agree

11:10 am OILQ K : learning in here everyday thanks guys and ladies

11:10 am Mathew Waterfall : you bet. quick break back in a few

11:13 am banka tronic : If those low floats that pop up on the pre market scanners are over 25% I weigh pros/cons for red to green moves where they dip then poss test market open. Too high of gap ups have a tendency to gap & crap

11:14 am banka tronic : Yet some climb pre market to 40-60 and sometimes have a .10-.20 pop if overall futures are solid hard green…

11:14 am banka tronic : 40-60%

11:16 am banka tronic : Also watch for dojis on the 1 & 5 min chart for p/a price action bullish confirm candles using a 1 or 5 min trendline for .10-.40ish scalps on those momos. Hope this info helps !

11:16 am Jake R : Thans Banka!

11:16 am Jake R : Hopefully we can see you in action in here.

11:16 am OILK K : ya

11:16 am OILK K : lol

11:16 am Sandy S : yup

11:17 am banka tronic : And then again I check the short squeeze.com just to see if there might be a nice squeeze factor if those llow floats have @ 20% shares short ;))

11:17 am Curtis M : on mic

11:18 am Curtis M : ya would be nice to have Banka do some trading yup yup 🙂

11:19 am banka tronic : I am working on these still learning only averaging $125 per trade as I dont want to risk more than $1500- $2k per trade with all the stress in my life. lol This amount also helps me cut losses quick to about $50-$100 w/o major pain. I am an activist so have to balance & keep the goooood vibes.)

11:19 am sandeep a : $NAO pop

11:20 am Sandy S : this is a good vibes room:) haha

11:20 am banka tronic : That amount also catches big time runners on those low floats w news to some $1k-$2k profits tho peeps)

11:20 am banka tronic : Ok enough from me-just wanted to put the info out there quick.

11:20 am Jake R : looking at $FUEL for aft intra scalp

11:20 am Jake R : awesome banka

11:21 am Phillip H : ya nice info

11:22 am Curtis M : a lot of the GURUS out there got chopped up this morning fyi

11:22 am Sandy S : ya noticed that curt

11:22 am Sandy S : we didn’t lol:)

11:22 am banka tronic : Also have been noticing that some of these low float spikers tend to have a culmination point that drops off at exactly 11:15am anyone notice this?

11:23 am Sandy S : yes always time of day

11:23 am Curtis M : for sure TOD huge

11:23 am John M : we ee that all the time

11:24 am Cara R : time fo day really important Curt is always preaching it

11:25 am banka tronic : $BLPH had that b/o quick 1 min trendline run up & profits got out before that 1 min trendline broke at 11:04 tho so its not an exact thing

11:26 am Cara R : ya $BLPH was one that we were in really early in cycle

11:26 am banka tronic : Ok I’m here to learn lol its easy to talk but I need to grow my profit chart as well. I ‘m still learning.

11:26 am Sandy S : haha

11:28 am OILK K : looking at $UGAZ for an add

11:28 am OILK K : and $TLT add

11:29 am Curtis M : $EDAP halt

11:31 am Curtis M : on mic

11:35 am banka tronic : Might retest that 2.70 candle on the 1 year

11:37 am Sandy S : curt makes most his green on halts banka… maybe not maybe his swings cause he uses big account in swings

11:37 am banka tronic : vol is almostmorte altough spead tightened

11:37 am Sandy S : hes a halt expert for sure

11:37 am banka tronic : *although

11:38 am banka tronic : good call MMtricks to lure look how 2.11s came in

11:38 am Sandy S : yes

11:39 am seth m : ya that one sucked

11:39 am sandeep a : $JAGX pops

11:39 am sandeep a : like your style banka

11:40 am OILQ K : $JAGX been on curts watchlists i think

11:41 am Sandy S : ya it has

11:41 am OILQ K : Silver swing going awesome

11:42 am banka tronic : thank you $JAGX is a very nice mover on news. Some of these co.s seem to put out *news as per the chart. Nice channel on that 1h chart

11:43 am OILQ K : decreasing vol

11:43 am banka tronic : Just tend to be weaker bounces when overall markets are blah. Mid day b/o tend to be fake outs

11:43 am Flash G : yeah

11:46 am Phillip H : how a bout that SILVER trade wow did we nail that

11:46 am Phillip H : :):)

11:47 am Phillip H : i dont say much but that makes me happy

11:48 am Mathew Waterfall : Notable options flow. GLD/SLV solidly call side. $TZA seeing some call side. $miners mostly call side but more split. Utes and bonds call side. People positioning for some carnage

11:48 am Jake R : correction time mat?

11:50 am Mathew Waterfall : I have a very hard time getting super bearish here as we have been gringing. My bias has been down for the past month but I haven’t played it outside of some small Vix plays for some small wins here and there. I think we are due for a correction but not loading the boat that direction outside of my metals.miners and bond plays

11:50 am Mathew Waterfall : I think the market starts to realize the smoke and mirrors show that has been Trump thus far, and starts to figure out how long it will be before any meaningful tax cuts or anything else to spur the economy

11:51 am Mathew Waterfall : We are also pricing out rate hikes as noted earlier and just overall dealing with a tired extended market

11:52 am Mathew Waterfall : This has kept me from getting long the past month, but market strength has kept me from getting too short. I think the risk is to the downside for at least a 5% move or so

11:52 am Jake R : interesting

11:53 am Jake R : wise advice i think

11:53 am Mathew Waterfall : What I want to see is some selling to the downside, then a bunch of people jump in long only to make a lower high. That’s ideal for a short set up

11:54 am Curtis M : yup

11:55 am OILQ K : shorting next $NVDA pop

11:56 am OILK K : pools in $CBIS

11:56 am Ed D : watching $ADBE for ss

11:57 am Curtis M : whoa the bears are coming out:)

11:59 am seth m : Curt I don’t know where u found banka but good add lol 🙂

11:59 am seth m : 9 our of 10 of you guys in this room are pro

11:59 am seth m : not like most rooms i been in

12:00 pm OILQ K : curts style seth

12:01 pm OILQ K : $AAOI buyers

12:02 pm Jake R : caught the $XLU move looking for more

12:02 pm Jake R : on the swing last 2 weeks:) not intra

12:03 pm Jake R : watching YEN here

12:03 pm OILK K : $ATEC set for a bounce

12:04 pm OILK K : NQ action

12:05 pm Taylor Y : soooo $TSLA mathew

12:05 pm Taylor Y : possible good entry point?

12:05 pm banka tronic : $CEMP sideways p/a price action below VWAP looks like shorts really want it to crack

12:05 pm Mathew Waterfall : I don’t trade $tsla often but hate the company long term

12:05 pm Sandy S : shorts out to play

12:05 pm Mathew Waterfall : Thinking short?

12:06 pm Taylor Y : long

12:06 pm Taylor Y : oversold?

12:06 pm Mathew Waterfall : Nope. also MACD bearish cross and 9/15 going to cross soon

12:06 pm sandeep a : $DLTR call buyers heavy

12:07 pm Taylor Y : ok thanks I’ll revisit:)

12:07 pm sandeep a : like $RH action today

12:07 pm Mathew Waterfall : You could use yesterdays bar as a quide and put a stop if it breaks back below it, I would be more comfortable with a 2 day range

12:07 pm Taylor Y : yes better idea there

12:08 pm Mathew Waterfall : I just don’t like the post earnings action and that they might need another funding raise. Such a manipulated stock though

12:08 pm Taylor Y : i like the clan part of the thesis

12:08 pm Taylor Y : so i trade it

12:08 pm Taylor Y : die hards

12:09 pm Mathew Waterfall : You’re not wrong. Cult stock with very high insider ownership

12:09 pm sandeep a : watch $DLTH here

12:09 pm Taylor Y : ya

12:09 pm Mathew Waterfall : I say 215’s before 300’s

12:09 pm Taylor Y : ya i c that

12:10 pm sandeep a : retail action serious too

12:10 pm Mathew Waterfall : Hard to tell if that retail is shorts or what. Probably a squeeze in $RH and $JWN

12:11 pm sandeep a : $EYEG on the move

12:18 pm banka tronic : I’ll tell everyone right now that I am not pro. Have some good calls but am here to learn & add what bits I find as chart/pattern truth . Eatting humble pie diet everyday for trading health lol 😉

12:21 pm Mathew Waterfall : The learning never stops and the market will always find a way to humble you. It seems the losses stick out more than the wins but that’s not always a bad thing

12:22 pm Flash G : agree

12:27 pm Mathew Waterfall : There’s a lot of wisdom in thsi room, and I’m not talking about myself. Many have learned the expensive lessons. Best thing about a community like this is we can learn from eachother and short cut so of those painful lessons

12:27 pm Sandy S : so true

12:28 pm Ed D : for sure

12:29 pm OILQ K : looks like a decent set up there curt in $COH the 200 day

12:30 pm Curtis M : ya just taking a peak really

12:31 pm OILQ K : DJI r to gr

12:36 pm banka tronic : $KEM new hod

12:40 pm Jake R : 52 week highs in $DTLA and I closed my swing days ago jeez

12:43 pm Curtis M : $GRAM halt sec viol

12:45 pm OILQ K : $PRKR insider buys

12:48 pm Sandy S : wow lol bye bye

12:53 pm Curtis M : $CBMX r to g possible

12:55 pm Jake R : curt u hit the sell on cbmx perfect

12:56 pm Curtis M : LLong $GRAM 3.56

12:59 pm OILQ K : $ULTA decent intra

12:59 pm OILQ K : in some $GRAM with ya fyi

12:59 pm Sandy S : yup diddddo

01:00 pm Curtis M : hopefully it curls on the 9 day

01:11 pm Jake R : in some $PKRK small order]

01:19 pm Curtis M : $CMLS halt

01:23 pm sandeep a : Long $NVAX

01:31 pm Ed D : market seems to want to bounce imo

01:31 pm OILK K : looking at $MSFT swing long

01:32 pm OILK K : block on $CBIX also 100k

01:32 pm Sandy S : theres the curl curt

01:32 pm Sandy S : and the chart bot buy!

01:33 pm Jake R : Long $SRPT

01:33 pm johnny r : in $SRPT also

01:34 pm johnny r : like the $MSFT idea also as i think market will bounce

01:36 pm Mathew Waterfall : Weak internals. I though after yesterday we would get some action to the upside today. bulls and bears both look unmotivated here so far

01:38 pm OILQ K : $AAQI

01:42 pm MarketMaven M : time to BTD?

01:43 pm Mathew Waterfall : If this doesn’t get bought the close could be ugly. Ugly close today equals coninuation over the weekend

01:46 pm Ed D : Thinking $FIT long if market gets moving if and when

01:47 pm sandeep a : $VUZI HOD

01:48 pm Mathew Waterfall : This $GDX move is garbage. MM’s holding it down seems to me. Explosion on tap next week

01:49 pm sandeep a : $INCY nHOD

01:51 pm seth m : $PCLN time

01:53 pm Curtis M : touhg play this $GRAM should pop or drop within 30 mins at most

01:54 pm Taylor Y : $AUPH jiggy

02:07 pm Curtis M : shoot i missed the $OWCP bounce ugh

02:09 pm Curtis M : $GRAM too a .26 loss puts me even on day don’t like that

02:24 pm Curtis M : long $CEMP 4.47

02:24 pm Curtis M : real tight

02:26 pm Curtis M : stop 4.35 ish

02:39 pm Jake R : $VIX crush time

03:01 pm Sandy S : curt u got me busting a gut on twitter

03:01 pm Curtis M : lol sorry

03:01 pm Curtis M : but ya

03:02 pm sandeep a : world has gone mad

03:03 pm Curtis M : argh lol

03:10 pm Curtis M : out 4.35 loss

03:10 pm Jake R : OMG your rant

03:10 pm Jake R : umm ya thats the way it was

03:10 pm Jake R : in my day

03:16 pm sandeep a : hate to say it publicly but i agree with you curtis

03:16 pm sandeep a : things upside down lately

03:17 pm sandeep a : people afraid to say it

03:21 pm Sandy S : now I’m completely cracking up

03:21 pm Sandy S : crying laughing so hard

03:21 pm Mathew Waterfall : Dollar getting some action here but bonds remain strong. Market this week has been very uninspiring for me. Might have to go back to scalp plays until we get some direction

03:26 pm sandeep a : someone had to say it lol kudos

03:28 pm sandeep a : ok now im rying

03:28 pm sandeep a : crying

03:28 pm Curtis M : lol

03:32 pm Mathew Waterfall : This market seems unbreakable. Why I commented yesterday and today not to get too bearish too quickly. I still hate it here but can’t short it yet. Likely another boring week next week

03:33 pm sandeep a : i love how curt talks like hes old hahaha

03:33 pm sandeep a : Mathew you got wisdom many times your age with market.

03:34 pm Mathew Waterfall : Thanks. Seen these moves many times before but not enough to bypass the frustration apparently lol

03:34 pm Jake R : ha

03:35 pm Curtis M : missed $OWCP because of my rant lololololol

03:35 pm Curtis M : ugh

03:35 pm Mathew Waterfall : I’m shutting it down for the day. Going to take this weekend to get some mojo back. Shoot me a note on twitter if you have any questions. Have a good weekend all

03:36 pm Curtis M : kk

03:36 pm Sandy S : thanks Mathew

03:36 pm sandeep a : yes thank you mat!

03:36 pm OILK K : bye mathew

03:36 pm Mathew Waterfall : Always happy to help

03:36 pm Jake R : that mats a good guy

03:37 pm Jake R : curtis makes me cry

03:37 pm sandeep a : omg

03:37 pm sandeep a : curt ruffled some feathers

03:38 pm Sandy S : Curtis your 49?

03:38 pm Curtis M : yes

03:38 pm Sandy S : That is funny you’re a spring chicken

03:40 pm Leanne Arnott : If 49 is a spring chicken you just made my day!

03:40 pm Sandy S : Not going to tell you guys how old I am my lord

03:42 pm Jake R : 49 is young

03:43 pm Jake R : curt talks like hes 80 sometimes:)

03:54 pm sandeep a : great close for $OWCP

03:54 pm Curtis M : yup

03:57 pm Ed D : well guys and gals i am out of here – best to u all!

03:57 pm Curtis M : cya ed

04:00 pm Curtis M : t may gap Monday morning

04:00 pm sandeep a : likely will

04:00 pm sandeep a : i see why you like it

04:00 pm Curtis M : night everyone

04:00 pm Jake R : bye

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $CEMP, $AXDX, $RH, $TST, $IPCI, $EARS, $OWCP – $UWT, $BSTG, $ONTX, $DUST, $VRX, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

PreMarket Trading Plan Fri Feb 24 $CEMP, $AXDX, $RH, $TST, $IPCI, $EARS

Stock Trading Plan for Friday Feb 24, 2017 in Compound Trading Chat room. $CEMP, $AXDX, $RH, $TST – $UWT, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

No algo or swing trading updates today, just arrived back from my trip and no time be market open. Lots of videos being done this weekend that will be posted to YouTube.

Current Holds / Trading Plan:

All small to mid size holds in this order according to sizing – $UWT, $NE, $BSTG, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA.

$NE Noble Is my newest position and I think it went up about 6% on Thursday – haven’t had a moment to check.

$DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

As per previous $CBMX I am now out for huge gains.

As noted before I may exit $VRX and $UWT.

Market Outlook / Trading Plan:

Yesterday I posted $NE Noble Chart on watchlist on morning premarket and it was up 6% or so yesterday last I looked – hope ya banked on it! I got a few thank you’s from our Swing Trading side cause they had it on their morning Swing Trading updates from me also.

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $CEMP, $AXDX, $RH, $TST

Cempra’s CEM-102 successful in late-stage ABSSSI study; shares ahead 49% premarket http://seekingalpha.com/news/3246318-cempras-cemminus-102-successful-late-stage-absssi-study-shares-ahead-49-percent-premarket?source=feed_f … #premarket $CEMP

Oil supply to 'return with a vengeance' – Barclays https://t.co/sCQpjXUzsM #premarket $USO $OIL $UCO $SCO

— Seeking Alpha Market News (@MarketCurrents) February 24, 2017

Canada CPI jumps in January, blasting past forecasts – https://t.co/5NVPKH37wX

— Investing.com News (@newsinvesting) February 24, 2017

25 Stocks Moving In Friday's PreMarket https://t.co/xW1pcHf8C1 $ACIA $AETI $CEMP $RH $OLED $URBN $JWN $FN $JCP $FL $HPE $WSO $SPLK $DRYS

— Benzinga (@Benzinga) February 24, 2017

https://twitter.com/Quarry_Rock/status/835120574238179328

Will the next leg in #Gold trading be up or down? $GLD $XAUUSD $GC_F

— Melonopoly (@curtmelonopoly) February 23, 2017

Commodity weekly: Precious metal rally resumes while #oil stumbles #gold #OOTT https://t.co/bkjr8GPAdu pic.twitter.com/VnuSVl4yxl

— Ole S Hansen (@Ole_S_Hansen) February 24, 2017

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $CEMP, $AXDX, $RH, $TST $OLED $AAOI $NAK $GEVO $TVIX $UVXY $PSO $JNUG $PLUG $NUGT $INCY $AUY $UGAZ

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $CEMP, $AXDX, $RH, $TST – $UWT, $NE, $BSTG, $ONTX, $VRX, $SSH, $ASM, $TRCH – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F