Stock Trading Plan for Friday Mar 3, 2017 in Compound Trading Chat room. $ONCS, $HABT, $SNAP, $USRM, $GLD, $GDX, $NFLX – $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

https://twitter.com/CompoundTrading/status/836917297809805313

Instructions for onboarding to new trading platform are in your email. Any questions DM Sartaj or email us.

Morning! We cont to test YouTube Live trading at this link today! https://t.co/p5dE2gQING Open to public til Tues. #stocks #premarket

— Melonopoly (@curtmelonopoly) March 3, 2017

Also, the educational video series we are working on we do not expect to have posted until this Sunday FYI. Also hope to get PL’s out and all the great review letters out this weekend also.

Well that was really nice…. just had a chat with an @EPICtheAlgo subscriber that has done really well financially w algorithm charting 🙂

— Melonopoly (@curtmelonopoly) March 2, 2017

And finally, all the algo reports and swing reports will be caught up and reset this weekend for a big week next week!

Current Holds / Trading Plan:

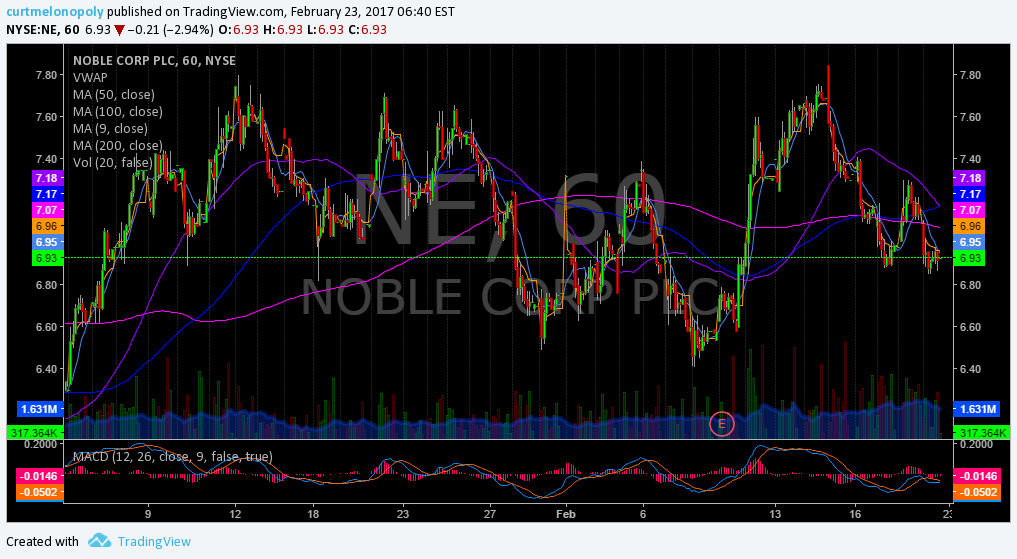

All small to mid size holds in this order according to sizing – $BSTG, $ONTX, $DUST, $USRM, $XOM, $NE, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA.

$USRM got a nice 40% rip on Thursday – we added at daily low for a nice play – holding. Risky!

$USRM We're on a rip today kids. +20% pic.twitter.com/g8gc4IvE1D

— Melonopoly (@curtmelonopoly) March 2, 2017

Per recent’ $DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

$DUST – finally got some grip lol.

My $DUST position has been on a rip last 2 weeks. Nice change. $GDX, $NUGT, $JDST, $JNUG pic.twitter.com/NfQRf8qlVK

— Melonopoly (@curtmelonopoly) March 2, 2017

Market Outlook / Trading Plan:

Earnings on deck:

Friday's #earnings $BIG $CTSO $URRE $BIOS $SPKE $CGG $HMTV $AHC $ABR $LXRX $TAC $WPPGY $FVE https://t.co/1gOQeLltlM

— Melonopoly (@curtmelonopoly) March 3, 2017

$SNAP traded lots on Thursday will be watching for daytrading range today also.

Back in $SNAP 25.47 2000 shares and $DUST $USRM rocking too. https://t.co/YxgPP08Lql

— Melonopoly (@curtmelonopoly) March 2, 2017

Shorting NetFlix? $NFLX

We're conspiring about a $NFLX big short here…. hmmmmm….

— Melonopoly (@curtmelonopoly) March 2, 2017

Watching Gold, Miner’s and Silver once again very close – possible failure.

Gold broke broke at 1215.38 on intra – still has room to recover.

— Melonopoly (@curtmelonopoly) March 2, 2017

$GDX not completely broke until it loses 21.47.

— Melonopoly (@curtmelonopoly) March 2, 2017

Volatility is now on my radar again $TVIX $UVXY.

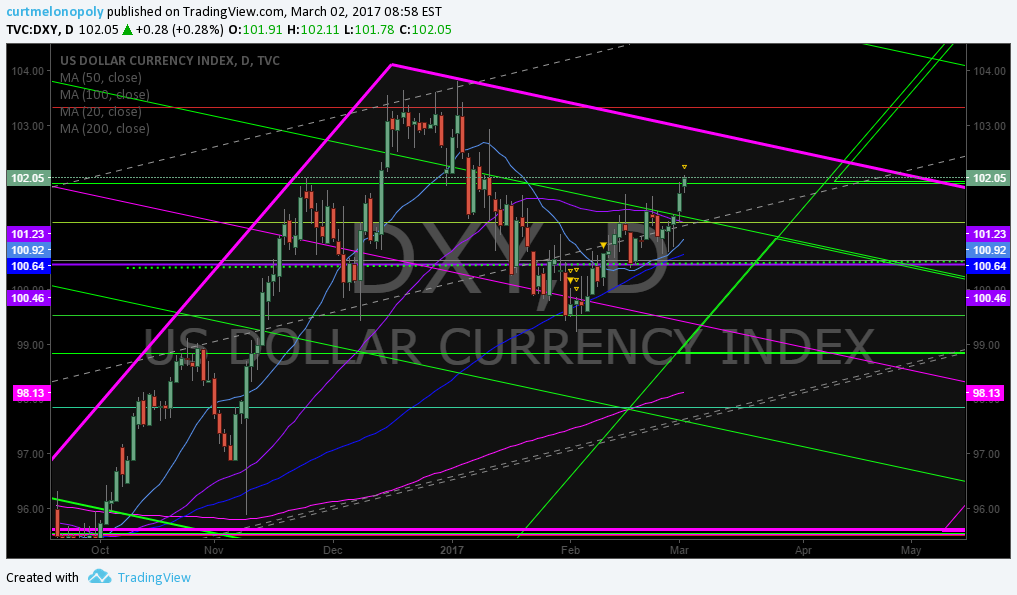

$DXY starting to look potentially dangerous.

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $ONCS $HABT $LIFE $PPHM $DRYS

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $ONCS $HABT $LIFE $PPHM $DRYS $ING $BIG $OCLR $VIPS $MRVL $BRZU $LXRX $BBVA $SAN $CS $UBS $GFI $BBL $DUST

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: as time allows I will update before market open or refer to chat room notices.

(6) Downgrades:as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $SNAP, $USRM, $GLD, $GDX, $NFLX, $ONCS, $HABT – $NE, $XOM, $USRM, $ONTX, $VRX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F