Compound Trading Friday May 19, 2017 Review of Chat Room Day Trading, Swing Trading, Algorithm Charting, Videos and Live Alerts. $DYN, $CALA, $GLYC, $EXP, $USOIL, $WTIC – $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Team goals. Win. Pay it forward. ♾

Team goals. Win. Pay it forward. ♾ pic.twitter.com/dvm8EMzdkV

— Melonopoly (@curtmelonopoly) May 19, 2017

Compound Trading Webinar Schedule: Day Trading, Swing Trading. Oil, Gold, Silver, SPY, VIX, USD, Equities…

https://twitter.com/CompoundTrading/status/866406995775148033

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS

Update: We are on schedule here and the complete model will be assembled his weekend and released Sunday night for next week. Then I think Gold is next (it will take less than two weeks to publish it in whole as the math is complete on it also. Actually the math is complete and tested on five of six of the algorithms so they will all be published in whole very shortly now). $SPY will be getting it’s own 24 hour trading room also – not sure when, but $SPY and Gold will get their own 24 hour trading rooms like EPIC sometime before end of 2017.

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS https://t.co/M3aaGpDRSK

— Freedom $SPY Algo (@FREEDOMtheAlgo) May 16, 2017

Learn How to Trade Stocks (Build a Small Account) Following my Journey. Part 5 “Freedom Traders” Series.

Update: Just for those that have asked, the near future posts coming for Freedom Traders series focuses on trading disciplines and technical set-ups that many have asked for. I’m actually going to try and write a book this Christmas consolidating it all (see mid day chart reviews on our YouTube channel and that will give you some insight as to direction – although the series will cover so much more). At minimum we’ll consolidate it in to a training seminar series with video set etc to make it easy for new traders and more experienced alike I suppose to digest it all.

Learn How to Trade Stocks (Build a Small Account) Following my Journey. Part 5 “Freedom Traders” Series. https://t.co/3WOEzWx3Gi

— Melonopoly (@curtmelonopoly) May 13, 2017

Last market trading session Post Market Stock Trading Results can be found here:

Stock Trading Results Thurs May 18 $GLYC, $ETRM, $AMBA, $USOIL, $WTIC, $SPY, $XIV https://compoundtrading.com/stock-trading-results-thurs-may-18-glyc-etrm-amba-usoil-wtic-spy-xiv/ …

https://twitter.com/CompoundTrading/status/866451303387590657

Most recent Premarket Trading Plan Watch-list can be found here (locked to respect members and unlocked to public about a week later for transparency):

Protected: PreMarket Trading Plan Fri May 19 $DYN, $PTXP, $ARNA , $USOIL, $WTI, $EXP, $CALA

https://twitter.com/CompoundTrading/status/865548750973878272

Please note, for the next while, you will have to review the raw trading room footage (vs. snippet footage) to catch Premarket Chart Set-Ups, Market Open Trades, Intra-day Trades and Mid Day Chart Set Ups. Our staff time are being utilized up for other components of the platform and we also are producing the high quality learning library for our premium members. Once done, we’ll return to publishing the segments daily.

Premarket Session:

Home late last night after traveling all week. Didn’t even get to my office and off again today. Road warrior life?

Home late last night after traveling all week. Didn't even get to my office and off again today. Road warrior life😂 pic.twitter.com/PcNQfFUIsA

— Melonopoly (@curtmelonopoly) May 19, 2017

$DYN Premarket up 24%

$DYN Premarket up 24% pic.twitter.com/7brnUAU2Ul

— Melonopoly (@curtmelonopoly) May 19, 2017

Market Day, Chat Room Trades and Personal Trades:

I was up on the second day momo on $GLYC just over 600.00 on the day and took a long position in $CALA at end of day. It was one of the quieter days we’ve had in the trading room in a long time. I was traveling after market open and after I spoke to a lot of our traders they reported either doing swing trade management and charting for next week or simply taking a long weekend and wrapped it up early on Friday.

Curt M_1: Long 13.02 500 $GLYC

Curt M_1: Stop at 12.82

Curt M_1: Long 13.26 1000

Curt M_1: Stop 13.12

Curt M_1: Closed 13.44 1500 shares for win

Curt M_1: 14.26 L $GLYC 500 share

Curt M_1: Stop at 14.19

Curt M_1: Stop 14.28

Curt M_1: Closed 14.39

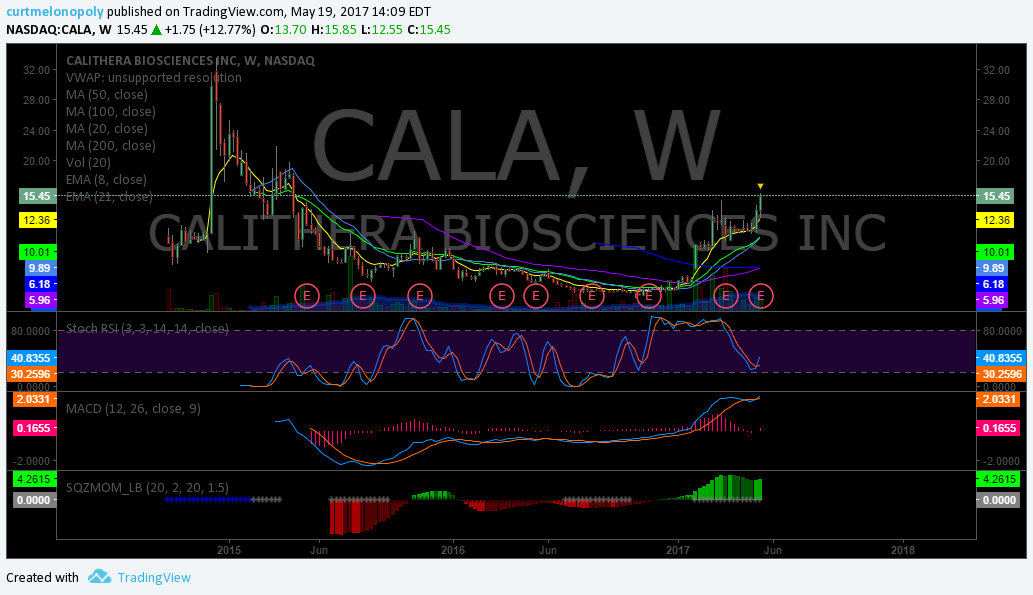

Curt M_1: EOD Long $CALA 15.55 This is a break out play high risk 1/5 size 500 shares 1/5 size only to test set up

Learning How-to Trade Stocks, Chart Set-Ups, Lessons and Educational:

When you know the rules, you can then develop a rules based trading system that suits your needs and personality. Then bow to it. #trading

When you know the rules, you can then develop a rules based trading system that suits your needs and personality. Then bow to it. #trading

— Melonopoly (@curtmelonopoly) May 21, 2017

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics http://www.tradeciety.com/24-statistics-why-most-traders-lose-money/ …

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics https://t.co/InI5PmC5pa

— Melonopoly (@curtmelonopoly) May 21, 2017

Always appreciate the opportunity to be of service✌

proud to be one from that little nation in Europe #learning from you #thx

— Geert Jansen (@GeertJansen20) May 20, 2017

Note to self. Always short $VIX when outside upper Bollinger band. That’s it – just do that – go to beach enjoy a margarita till next time.

Note to self. Always short $VIX when outside upper Bollinger band. That's it – just do that – go to beach enjoy a margarita till next time.

— Melonopoly (@curtmelonopoly) May 19, 2017

No Midday Chart Review Fri May 19 – I will be traveling. Midday reviews resume Monday!

No Midday Chart Review Fri May 19 – I will be traveling. Midday reviews resume Monday!

— Melonopoly (@curtmelonopoly) May 19, 2017

If there’s anything I can do to help with your trading drop me a line on contact page or DM https://compoundtrading.com/contact/ #howto #trade #stocks

If there's anything I can do to help with your trading drop me a line on contact page or DM https://t.co/1CNAfDsAeI #howto #trade #stocks

— Melonopoly (@curtmelonopoly) May 8, 2017

Stocks, ETN’s, ETF’s I am holding:

Been holding these small bags wayyyy tooo long. I am holding (in order of sizing – all moderately small size – under 5% of my daytrading acounts) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| QHC | 3.98 | 38.19% | 3593933 | Top Gainers | |

| DYN | 9.12 | 25.62% | 32630259 | Top Gainers | |

| SPWH | 5.70 | 20.51% | 7401082 | Top Gainers | |

| VTL | 3.13 | 20.19% | 227889 | Top Gainers | |

| DXLG | 2.40 | 20.00% | 1571895 | Top Gainers | |

| GLYC | 12.76 | 19.59% | 36109097 | Top Gainers | |

| GLYC | 12.76 | 19.59% | 36109097 | New High | |

| NBEV | 5.32 | 16.16% | 671649 | New High | |

| ADSK | 109.91 | 14.69% | 10082388 | New High | |

| LL | 29.13 | 11.14% | 4010449 | New High | |

| GLYC | 12.76 | 19.59% | 36109097 | Overbought | |

| NURO | 3.99 | -0.25% | 28287 | Overbought | |

| PTXP | 19.88 | 19.40% | 8475123 | Unusual Volume | |

| GLYC | 12.76 | 19.59% | 36109097 | Unusual Volume | |

| BICK | 25.65 | 2.72% | 371158 | Unusual Volume | |

| HFXE | 19.61 | 0.94% | 1903891 | Unusual Volume | |

| ATHN | 130.41 | 0.26% | 1068369 | Upgrades | |

| CHKR | 2.65 | 1.92% | 55449 | Earnings Before | |

| STRS | 28.10 | 1.81% | 6660 | Insider Buying |

Algorithm Charting News (Artificial Intelligence, Intelligent Assistants, Big Data and More):

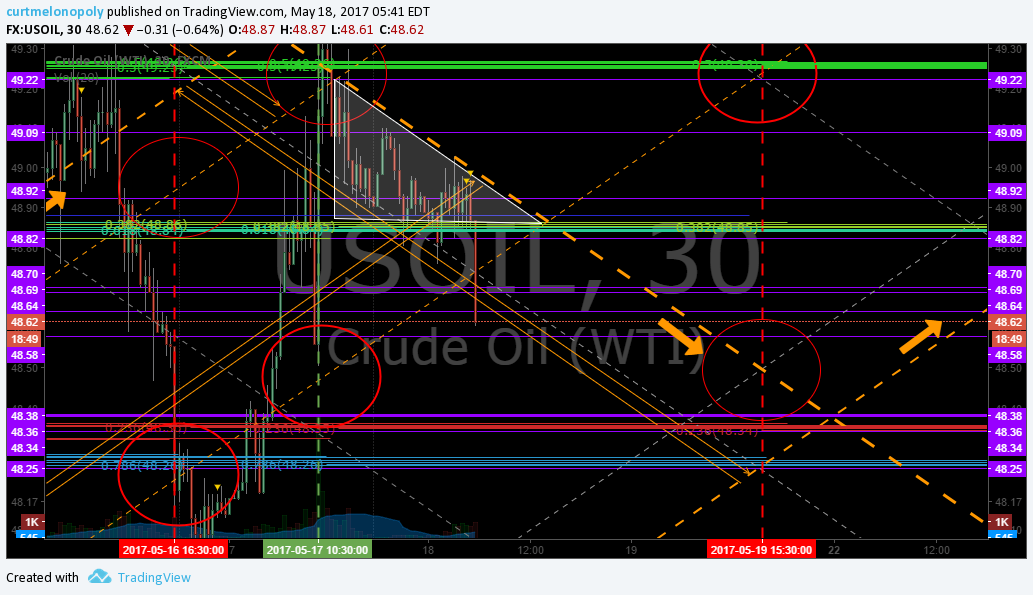

Price entering Fri algo target now. EPIC the Oil Algorithm Chart May 19, 2017 640 AM FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algo

https://twitter.com/EPICtheAlgo/status/865517696389005313

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS

Complete $SPY S&P 500 Algorithm Rolls-Out this Week. A New Milestone at Compound Trading. #premarket $ES_F $SPXL $SPXS https://t.co/M3aaGpDRSK

— Freedom $SPY Algo (@FREEDOMtheAlgo) May 16, 2017

Half top investment firms use #IA. What article doesn’t cover is near 100% of top dark pools / private funds do.

Half top investment firms use #IA. What article doesn't cover is near 100% of top dark pools / private funds do. https://t.co/BudI4HenVs

— Melonopoly (@curtmelonopoly) May 21, 2017

Famous Venture Capitalist on #AI ??

Famous Venture Capitalist on #AI 🎯💯 https://t.co/fmupVFlhMY

— Melonopoly (@curtmelonopoly) May 21, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News / Chart Set-ups:

$EXP Holding from 95.90 trading 100.88 MACD could cross up and boom time. We’ll see. #swingtrading

$EXP Holding from 95.90 trading 100.88 MACD could cross up and boom time. We'll see. #swingtrading pic.twitter.com/FrsCfb0Gd4

— Melonopoly (@curtmelonopoly) May 19, 2017

$CALA Earnings surprise. Weekly 50 MA about to breach 100 MA, Stoch RSI crossed up, SQZMOM Green, MACD peaked. I #powertrade #swingtrades

$CALA Earnings surprise. Weekly 50 MA about to breach 100 MA, Stoch RSI crossed up, SQZMOM Green, MACD peaked. I #powertrade #swingtrades pic.twitter.com/gIdxXtvKUh

— Melonopoly (@curtmelonopoly) May 19, 2017

Hope this firms up and we get a good run here. Nice setup. $CALA after tweet up 17.52% Friday and up another 1.55% after market.

Hope this firms up and we get a good run here. Nice setup. $CALA after tweet up 17.52% Friday and up another 1.55% after market. https://t.co/FagjxvEsGi

— Melonopoly (@curtmelonopoly) May 20, 2017

Took a lot of heat when I published this for members when 811.00 … it may actually happen $GOOGL “Feb 3 – 1003.17 Price Target in 2017”

Took a lot of heat when I published this for members when 811.00 … it may actually happen $GOOGL "Feb 3 – 1003.17 Price Target in 2017"

— Melonopoly (@curtmelonopoly) May 19, 2017

Most recent swing trading platform publications:

Protected: Swing Trading Thurs May 18 $HIIQ, $AMBA, $EOG, $COTY, $FSLR, $AAOI, $XRT, $GOOGL, $AMZN, $VFC, $GREK …. #premarket

Protected: Swing Trading Thurs May 18 $HIIQ, $AMBA, $EOG, $COTY, $FSLR, $AAOI, $XRT, $GOOGL, $AMZN, $VFC, $GREK …. #premarket https://t.co/0eD6c1Bsp6

— Swing Trading (@swingtrading_ct) May 18, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

Regular Watch List Updates / News:

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

Leveraged funds increased bullish dollar bets by 23% in wk to May 16, ahead of the turmoil. JPY selling was particularly strong #FOREX

Leveraged funds increased bullish dollar bets by 23% in wk to May 16, ahead of the turmoil. JPY selling was particularly strong #FOREX pic.twitter.com/K2ro5E3p6E

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

Gold $GLD, $XAUUSD, $GC_F :

#Gold selling continued in wk to May 16 despite emerging safe-haven demand. Net-long hit eight week low following a 30k lot reduction

#Gold selling continued in wk to May 16 despite emerging safe-haven demand. Net-long hit eight week low following a 30k lot reduction pic.twitter.com/g57EhVWfyG

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

Gold Miner’s $GDX:

NA

Silver $SLV:

A fifth week of #silver fund selling reduced the net-long from a record 99,000 lots to just 18.300 lots.

A fifth week of #silver fund selling reduced the net-long from a record 99,000 lots to just 18.300 lots. pic.twitter.com/e8kzslVxqL

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

Crude Oil $USOIL $WTI:

Baker Hughes Rig Count

Oil Rigs +8 to 720

Nat Gas Rigs +8 to 180

#OOTT #Oil #NATGGAS

Baker Hughes Rig Count

Oil Rigs +8 to 720

Nat Gas Rigs +8 to 180#OOTT #Oil #NATGGAS— Melonopoly (@curtmelonopoly) May 19, 2017

Fund net-selling of WTI #oil cont. but slowed in wk to May 16. Driven by short-selling which hit a fresh six-month high. #OOTT

Fund net-selling of WTI #oil cont. but slowed in wk to May 16. Driven by short-selling which hit a fresh six-month high. #OOTT pic.twitter.com/KwhU5fwfWz

— Ole S Hansen (@Ole_S_Hansen) May 21, 2017

Volatility $VIX ($UVXY, $TVIX, $XIV):

The Simplest Reason Behind Collapsing Volatility: Hedge Funds Are Barely Trading | Zero Hedge

The Simplest Reason Behind Collapsing Volatility: Hedge Funds Are Barely Trading | Zero Hedge https://t.co/lnDoYvW40r

— Melonopoly (@curtmelonopoly) May 20, 2017

$SPY S&P 500 / $SPX:

NA

Markets Looking Forward:

Gross hedge fund leverage is at new all time highs

Gross hedge fund leverage is at new all time highs pic.twitter.com/rmgdETFqlc

— zerohedge (@zerohedge) May 20, 2017

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day).

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

Curt M_1: Morning. Today I am traveling again from approx. 11:00 AM and on. So midday chart review will not be possible but I will be in room all day. As I travel and switch between wifi locations the charting may go down but it will be temporary. I will re-enter room on each occasion. Expected to be in office all day but no such luck:)

Curt M_1: $VRX Valeant’s Brodalumab Has Won EMA Approval Recommendation

Curt M_1: Today’s Fed speakers:- 9:15am: Bullard speaks about Economy and Monetary Policy- 1:40pm: Williams speaks to High School in SF

Curt M_1: 1pmBaker-Hughes Rig Count

Curt M_1: Deutsche Bank coming around to Valeant https://seekingalpha.com/news/3268757-deutsche-bank-coming-around-valeant?source=twitter_sa_factset … #premarket $VRX

Curt M_1: $DYN Premarket up 24%

Curt M_1: Protected: PreMarket Trading Plan Fri May 19 $DYN, $PTXP, $ARNA , $USOIL, $WTI, $EXP, $CALALINK: https://compoundtrading.com/premarket-trading-plan-fri-may-19-dyn-ptxp-arna-usoil-wti-exp-cala/PASSWORD: DYN

Curt M_1: On mic 9:10 – making coffee getting packed for journey:) Let market set up a bit.

Ben: Could be a good Friday setting up.

Leanne: good morning

Ben: morning Leanne

Curt M_1: Morning guys and gals – I’ll be about 6 mins or so

quarryrock: good morning

Curt M_1: hey QR

Curt M_1: Heads up” if you have been accessing our charts direct on trading view (going to my trading view account) as of Monday all locked and only accessible thru provided portal links etc… just thought I’d mention quick just in case. In other words public being shut out as of Monday:)

Curt M_1: $GLYC day 2 on deck 🙂

Curt M_1: Okay set – on mic in 2 mins 9:18 ET.>>>>>>>>>>>>>>>>

Market Maven: $DYN Long

Tradergirl: gm all

Hedgehog Trader: morning all

Hedgehog Trader: gold silver spiking

Hedgehog Trader: LACDF had 275k insider buying this week

Tradergirl: twitter been acting up here too, gonna start kickstart for better version of twit for traders lol

Hedgehog Trader: silver up 27c yow

Hedgehog Trader: gold up $8

Tradergirl: lot of emotion/sentiment onstream is what i’ve noticed. permabull vs nervous bulls

Tradergirl: like both ends of spectrum

Hedgehog Trader: nervabulls

Tradergirl: nervabulls hh!!! with the little tm sign

Hedgehog Trader: 🙂

Tradergirl: i’m stealing that hh

Hedgehog Trader: sure thing!

quarryrock: BABA is amazing ! in calls that came all the way back from the dead

Tradergirl: ya Q that wuz nuuuuts. i’ve got it on short watch tho

coleman: oil getting to channel resistance

quarryrock: banked nicely today on UVXY P’s gorgeous vol drop

Curt M_1: Long 13.02 500 $GLYC

quarryrock: all out of $BABA just made my entire week!

Curt M_1: Stop at 12.82

Curt M_1: Long 13.26 1000

Curt M_1: Stop 13.12

Curt M_1: Closed 13.44 1500 shares for win

quarryrock: all i got left is some $AMD Cs looking for it to push up later today

quarryrock: $NVDA pre mkt Gap up was one of the most impressive ive seen lately

quarryrock: it was trading $132 around 3:30 pm yesterday. now $137.30 wow

Curt M_1: 14.26 L $GLYC 500 share

Curt M_1: Stop at 14.19

Curt M_1: Stop 14.28

Curt M_1: Closed 14.39

Curt M_1: up about 500.00 on $GLYC I think – nothing great

Tradergirl: Q wooooooot baba! gawd if u caught the bottom, that is just.

quarryrock: oh yes it was a beauty !!!

quarryrock: i didnt catch bottom but was in both $121 and $122 Cs weeklies

Tradergirl: kk now i have meas move to 52-3 usoil, going to TL top it seems

sbrasel: $EWZ is flying moved .50 is 3 sec

Tradergirl: does bh move it much? don’t usu pay attention

Tradergirl: rig cnt

coleman: baker huges

coleman: hughes

Tradergirl: baker hughes

Tradergirl: right, like eia super-volatile

coleman: if rigs surprised down, would expect a rally

Tradergirl: ya, coleman, i’ve noticed the headlines almost always match the inflection point, ie when they’re done jamming, all of a sudden rigs will go up

Tradergirl: that’s the thing, is when they finally drop this, don’t think it will b easy to get in

coleman: do you know roughly percentage of market that is algo vs. human?

Tradergirl: u talking singularity kk?

Tradergirl: ‘so how are retail like us supposed to survive? this is the only job i’ve enjoyed, cannot imagine life w/o

coleman: yes ^ how long do you think we have left?

coleman: you rock for sharing with us, thank you!!

Tradergirl: lots of quants looking for and creating multiple income streams/selling robots/algos whatevs, guessing they know the clock is running

Tradergirl: sartaaaaaaj bro!

Tradergirl: i have higher

Tradergirl: i took cut last nite

Tradergirl: if they get it up there i’m shorting in size and riding to 30s

coleman: when is that rolling otu?

coleman: out*

coleman: exciting

Tradergirl: weird, such the mysterious business, where u going kk

sbrasel: Buy $uwt?

coleman: how do you guys define a “fail”?

Tradergirl: ya that’s where it’s going wld think 53s imho

Curt M_2: back on in 5 changing wifi

quarryrock: wow $UVXY is getting killed! sold those $14.5 puts too soon folks. the Bankometer would have been exploding

quarryrock: one of the toughest things for me is knowing how to take my profits when in options

Hedgehog Trader: $NBGGY Curt

quarryrock: they come and go so fast you have to really be on your toes

Curt M_2: /charts back up in 5 moving locations

Curt M_1: With OPEC on 25th oil might levitate until then

Market Maven: micro cap oils starting to fire up

Market Maven: curt will not be happy about missing that if it happens

Market Maven: $HUSA $ENRJ small oil may pop

Market Maven: BH 2 mins

Curt M_1: I actually stopped here to watch 🙂

Curt M_1: I’m sure its a non event

Curt M_1: non event

Curt M_1: #BakerHughesRigCount#OilRigs +8 to 720#NatGasRigs +8 to 180#OOTT

Sartaj: How’s everyone doing

Tom: Hello Sartaj, this is very interesting, a whole new way of looking at charts

Sartaj: We appreciated that. In terms of retail land, yes. Check this video out: https://www.ted.com/talks/jim_simons_a_rare_interview_with_the_mathematician_who_cracked_wall_street

Sartaj: In statistical circles, random time series (like stock markets) are considered unpredictable

Sartaj: but there have been advanced in stochastic geometry and 3D/4D modeling which allow us to achieve these representations

Sartaj: advances*

Sartaj: 52wk Highs: $TCMD

Sartaj: Drop us a line anytime, Tom: info@compoundtrading.com

Sartaj: 52wk Highs: $FBR

Market Maven: $CALA up 13% from today’s watchlist. That was a great set up. May still go long. https://twitter.com/curtmelonopoly/status/865632330303406080

Market Maven: Good one Curt.

Sartaj: 52wk Highs: $LNG

Sartaj: 52wk Highs: $INFO

Curt M_1: EOD Long $CALA 15.55 This is a break out play high risk 1/5 size 500 shares 1/5 size only to test set up

Market Maven: Great fn call Im in from earlier today haha

Market Maven: Have a good night

Curt M_1: cya all

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $DYN, $CALA, $GLYC, $EXP, $USOIL, $WTIC, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500