Compound Trading Chat Room Stock Trading Plan and Watch list for Wedneday July 5, 2017; $MTBC, $MORE, $CARA, $USOIL, $WTI, $SOXL, $NATGAS, GOLD – $XIV, $WMT, $NFLX, $UUP, $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it. Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Algorithms:

All next phase algorithms are complete but we had a minor earthquake / tremor here this morning which delayed release. We were in the middle of publishing / sending reports at the time and the “issue” has caused a three hour unexpected delay. Anyway the reboot on everything takes some time and with market open coming fast any not published before market open will be published this evening after market at some point through the evening / night.

Connect with me on Discord and lets take this up a notch!

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video posts:

Oil trading session with EPIC the Oil Algorithm in oil trading room. $USOIL $WTI $CL_F #CL $USO $UWT $DWT #OIL #OOTT #IA #EPICEDGE

Oil trading session with EPIC the Oil Algorithm in oil trading room. $USOIL $WTI $CL_F #CL $USO $UWT $DWT #OIL #OOTT #IA #EPICEDGE pic.twitter.com/tddfB6fhAH

— Melonopoly (@curtmelonopoly) July 3, 2017

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades $USOIL $WTI $CL_F $USO #OIL #OOTT

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades $USOIL $WTI $CL_F $USO #OIL #OOTT https://t.co/LCzv9RisxI

— Melonopoly (@curtmelonopoly) June 30, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watch Lists.

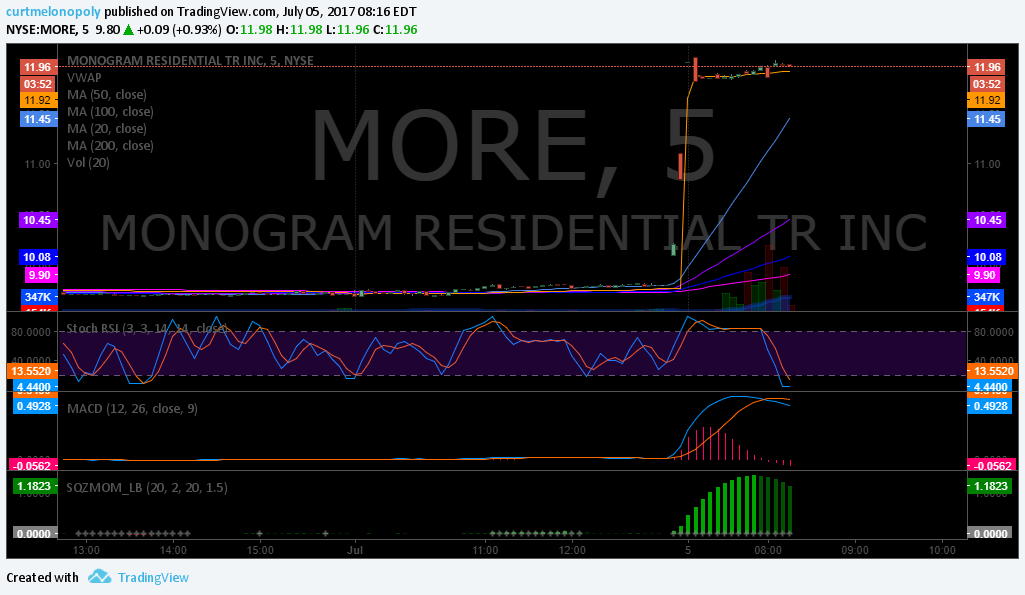

Morning momentum stocks on watch so far: $MORE, $MTBC

Bias toward / on watch: Watching $SOXL very close, Continued watch on $CARA for a possible bounce (it worked well on Monday), Natural Gas should get a bounce soon, Oil should come off soon, Dollar should get moving soon, and Gold should get wacked soon. Soon being in next 30 days inflection on watch.

OTC on watch:

Gapping Premarket:

Recent Momentum Stocks to Watch:

Stocks with News: $MORE, $MTBC

Recent SEC Filings to Watch: $PSTG Jun 22, CFO Sells 8255 Shrs; Net: -108.43k; Acq’d: 0; Disp’d: 8255 13.14/s https://is.gd/cQHEjO

Earnings On Deck:

Holds (specifically on day trading side): $WMT, $XIV, $UUP test starter swings. All other holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including my swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch: $TRCH, $ESPR, $FEYE, $SLX, $CLLS, $IMDZ, $VRX, $HIIQ, $FSLR, $JUNO, $CELG, $VFC and many more on the mid day reviews on You Tube. We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

Market Outlook:

U.S. stock index #futures mixed after holiday, Nasdaq pressured – https://t.co/zJuZX5ZVrh

— Investing.com News (@newsinvesting) July 5, 2017

Market News and Social Bits From Around the Internet:

10am

Factory Orders

2pm

FOMC meeting minutes

Economic Data Scheduled For Wednesday

Economic Data Scheduled For Wednesday pic.twitter.com/QBdwjjwbOU

— Benzinga (@Benzinga) July 5, 2017

Oil’s longest winning streak this year slows as Russia opposes more cuts

https://www.bloomberg.com/news/articles/2017-07-05/oil-slows-longest-win-streak-in-2016-as-russia-opposes-more-cuts

$TRIL Provides Update on Small Molecule Programs

http://www.marketwatch.com/story/trillium-provides-update-on-small-molecule-programs-2017-07-05 …

Athenex submits IND application of Oraxol to Chinese FDA https://seekingalpha.com/news/3276951-athenex-submits-ind-application-oraxol-chinese-fda?source=feed_f … #premarket $ATNX

$TSLA pt lowered to 180 from 190 @ GS, Raised to 430 from 380 at Guggenheim

$ARRY Submits New Drug Applications To FDA For Binimetinib And Encorafenib In Advanced Melanoma

Worldpay and Vantiv reach agreement on merger terms http://on.mktw.net/2sp5lnL

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $MDSI 34%, $MTBC 33%, $MORE 21%, $DRYS $OPXA $DSLV $BIDU $BHP $DB $BBL $P $DWT $CS $TZA $MT $DGAZ $CAB $NOK $HMY I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $SPEX -14%, $PZC -6%, $BAA $AMZA $GUSH $CHFS $USLV $CYRN $FTI $UWT $CHK $STO $LYG $CHL $SLV $TNA $UGAZ $UVXY I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $ORCL $OKE $TER $CEO $CC $NEM $ECA $SFNC $OKSB $MATW $BHP $TDY $BLFS as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $NVS $GSK $BWLD $EQT $WY $PGH $IMO $CVE $BTE $COF $RATE as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $MTBC, $MORE, $CARA, $USOIL, $WTI, $SOXL, $NATGAS, GOLD – $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD