Welcome to the Compound Trading Swing Trade Report for Tuesday March 10, 2018 (Part B). Swing Trading Stock Picks, $IBB, $JKS, $FEYE, $CTSH, $NVO, $SNAP, $TSLA, $AMMJ, $AAU, $VGZ, $AGN, $LAC, $EWZ, $PCRX and more …

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Below is Part B of this post.

This report is 1 of 5 in rotation.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading room at mid-day and ask questions by text in the chat area of the room.

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required. If nothing else you can always book some coaching time and I’ll assist.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines.

Also, as live charts are made available below, click on link and open viewer. Then to use the chart click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates are in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

#SwingTrading Midday Review – Compound Trading: $LTBR, $ANF, $MOMO, $APTO, $USOIL, $WTI, $BA, $NFLX

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

#SwingTrading Midday Review: $NFLX $BTCUSD $SPY $VCEL $COT $DXY #GOLD $GLD $SLV $USOIL $WTI

#SwingTrading Midday Review: $BZUN $SPY $COT $AMRC

Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

How I executed volatility trade with precision. $VIX $XIV #Volatility #Trading $TVIX, $UVXY, $SPY

@EPICtheAlgo #EIA Report, January 24, 2018: Inverse Hedge Between #CL and $SPY

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Swing Trading Stock Watch list

$AAPL – Apple

Mar 6 – $AAPL Price a magnet to the major pivot support resistance 176.67 – decision up or down in play. Go with price. #swingtrading

Jan 30 – $AAPL Apple trading buy sell triggers I am watching for earnings. #swingtrading #earnings

Earnings bullish scenario – 164.59 area is a buy long if it holds after earnings for a first target of 176.56 and then 188.67.

Bear scenario – 164.59 fails targets a swing lower to 152.63.

Real-time chart link: https://www.tradingview.com/chart/AAPL/wsVdwBgD-AAPL-Apple-trading-buy-sell-triggers-I-am-watching-for-earnings/

Secondary buy / sell triggers per Fib horizontal lines on chart below.

Dec 18 – Apple looks good here. Trade was strong Friday and premarket it’s on the move here Monday – I’ll likely wait for highs to break and then watch the buy / sell Fib levels for a decision from there.

$AAPL MACD is turning up with Stoch RSI and SQZMOM up – buy sell triggers at fib levels on break out on chart.

https://www.tradingview.com/chart/AAPL/pfXeZHyS-AAPL-MACD-is-turning-up-with-Stoch-RSI-and-SQZMOM-up-buy-sell/

Buy / sell triggers to watch for a swing trade with Apple stock:

176.56

181.71

185.73

188.56

181.38

184.87

200.52

$AMD Advanced Micro

Mar 6 – $AMD targeting 12.23 Mar 13 as most probable sideways trade. Other price targets noted on chart. #swingtrading

Jan 30 – $AMD important levels to watch for trading earnings. Bull scenario targets first 14.95 and bearish 12.25 first #premarket

Will be watching earnings close. Upside target is 17.00 if 14.95 is gained and held post earnings.

Five Reasons to Buy AMD (AMD) Ahead of Earnings https://finance.yahoo.com/news/five-reasons-buy-amd-amd-231411295.html?.tsrc=rss

Dec 18 – $AMD trading 10.30 bounced off important support under 200 MA with MACD turning up. Tough call here.

Indecisive action because price is under 200 MA but it will likely see the outside wall of the quadrant – which makes it difficult to state a sell trigger because the quad is diamond shaped so you would have to watch how price handles the diagonal fib related quad wall resistance as trade approaches.

$WMT – Wallmart

Mar 6 – $WMT Wallmart most probable price target 91.00 April 11, 2018. Other buy sell triggers noted. #swingtrading

Jan 30 – $WMT Important trading levels for Wallmart earnings in 21 days. #earnings #trade

Wal-Mart Sharpens Online Edge, Join Forces With Rakuten – Zacks Equity Research January 29, 2018

Wallmart Buy / Sell Triggers:

124.77

116.23 – tighter time-frame

108.06

99.56 – tighter time-frame

91.20

74.25

Real-time live chart link for Wallmart https://www.tradingview.com/chart/WMT/KvzsVZHm-WMT-Important-trading-levels-for-Wallmart-earnings-in-21-days/

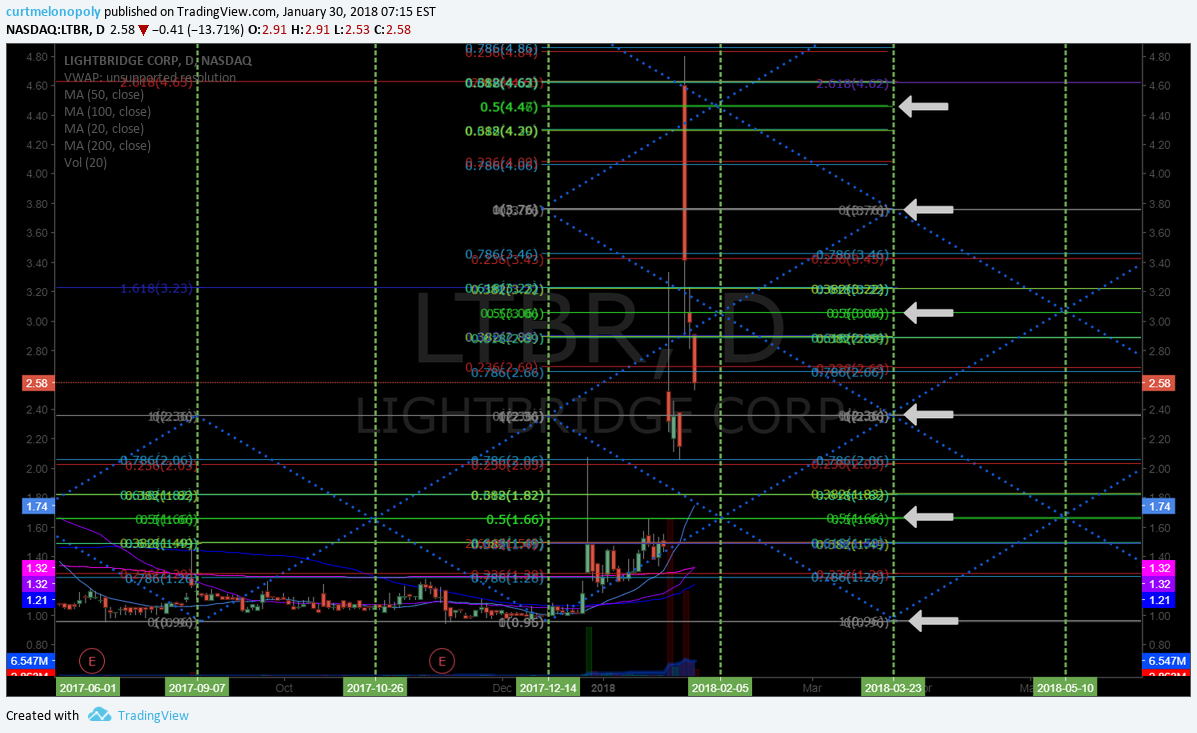

$LTBR – Lightbridge Corp.

Mar 6 – $LTBR Lightbridge psychedelic chart structure with specific buy sell triggers at arrows. Big range likely.

Price is sitting above 200 MA with a significant risk reward scenario setting up if it starts an up move.

Jan 30 – $LTBR LightBridge If 2.36 holds it targets 3.06 first price target and then 3.77 #trading

Lightbridge Provides Video Footage and Photos of Press Conference Announcing Enfission Joint Venture with Framatome

Real-time $LTBR chart with buy sell price triggers:

Dec 18 – $LTBR chart trading 1.06 under 200 MA with indecisive indicators. No trade signal.

$RCL – Royal Caribbean

Mar 6 – $RCL trading above 200 MA with targets in play swingtrading in to July 18 2018. #swingtrading

If price holds 200 MA and breaches that diagonal Fibonacci trendline at next quad wall (dotted gray line) near range overhead then at minimum the first upside if not the full extension target upside is possible.

If price turns down at quad wall then it targets the lowest area target to bearish side.

Jan 30 – $RCL Royal Caribbean buy sell triggers and diagonal resistance lines we established months back have proven profitable for our swing traders.

Buy sell triggers for $RCL swing trading are as follows:

98.91

115.00

131.09

147.04

163.28

Plus the secondary horizontal lines you see on the chart.

Real-time chart link: https://www.tradingview.com/chart/RCL/9YwFkoBq-RCL-Royal-Caribbean-buy-sell-triggers-and-diagonal-resistance-l/

$RCL Trading 133.55 with Stoch RSI turning down MACD and SQZMOM still trending but against diagonal resistance.

With resistance diagonal just over-head an entry long is not the best risk reward. Will be looking for a pull-back to enter long.

$RCL I have set MACD cross up as trigger for long – will assess at that point – weekly MACD just crossed up also FWIW.

Dec 18 – $RCL trading 125.09 with MACD on daily still trending down. Will wait for a proper trade set-up.

Nov 27 – $RCL Royal Caribbean Buy Sell Triggers on chart – Waiting for buy trigger and MACD SQZMOM and Stoch RSI to confirm.

Preferably enter long at white arrow *grey horizontal line) vs grey arrow. Price recently ran up to a sell trigger so now it is a matter waiting for price to test support at a buy trigger (or breaches a buy trigger for break out) for a long as long as MACD is turned up and the SQZMOM is trending up.

$JKS – Jinko Solar

Mar 6 – Price under pressure with earnings Mar 22. Current indicators and price say watch with no preferred direction.

Jan 30 – $JKS Solar Weekly chart – waiting for MACD to to cross up on the weekly for possible long trade. #swingtrading

Dec 18 – $JKS trading 24.37 with MACD about to turn up waiting for price over moving averages for swing trade.

Some of our traders did report taking that ounce off the 200 MA – I didn’t because at minimum I was looking for MACD to confirm or have price over the MA’s. On watch now.

$PCRX – PacIra Pharma

Mar 10 – $PCRX trading 31.90 post earnings with MACD turned up. Long risk reward preferred. #swingtrading

Set-up isn’t strong enough to warrant a specific model, however, price is at historical support so odds are in favor in long here.

Jan 30 – $PCRX on daily chart trading 36.45 – waiting on MACD to cross up for long side trade assessment.

Dec 18 – $PCRX trading 43.85 ideal swing set-up with 200 MA bounce test and if MACD turns buy sell triggers at Fibs on chart.

$EWZ – I Shares Brazil ETF

Mar 10 – $EWZ under 49.50 is a short to next test on chart and over is long to next test on chart.

Jan 30 – $EWZ Brazil ETF weekly chart, ttrading 46.31, over 48.18 with indicators lined up is a long or on proper pull back. On watch for swing trade.

Dec 18 – $EWZ Brazil ETF trading 38.76 testing 200 MA and not likely a great risk reward here but I will watch.

$FEYE – Fire Eye Inc.

Mar 10 – $FEYE Buy trigger at 14.75 proved well, next trigger at 17.65 triggered for 19.44 target. #swingtrading

Jan 30 – $FEYE trading 15.10 above buy trigger at 14.75 – indecisive but clean chart and on 200 MA.

Real-time $FEYE chart link: https://www.tradingview.com/chart/FEYE/iNjl2yjy-FEYE-trading-15-10-above-buy-trigger-at-14-75-indecisive-but/

Dec 18 – $FEYE premarket trading 14.50 testing 200 MA underside over 14.76 it moves above Fib and enters gap play. On high watch.

Nov 27 – $FEYE watching for over 14.76 over 200 MA with MACD turn up for gap fill and beyond long. The upper extension sell trigger isn’t shown but is at 22.32.

$LAC – Lithium Americas

Mar 10 – $LAC trading 6.35, over 6.52 targets 7.21 and 7.77, under targets 5.40 #pricetargets

Jan 30 – $LAC Lithium Americas Daily chart with horizontal Fibs, diagonal Fibs, quads, moving averages for tighter trade. Over 8.00 long.

Real-time $LAC charting https://www.tradingview.com/chart/LAC/DTV8PsnK-LAC-Lithium-Americas-Daily-chart-with-horizontal-Fibs-diagonal/

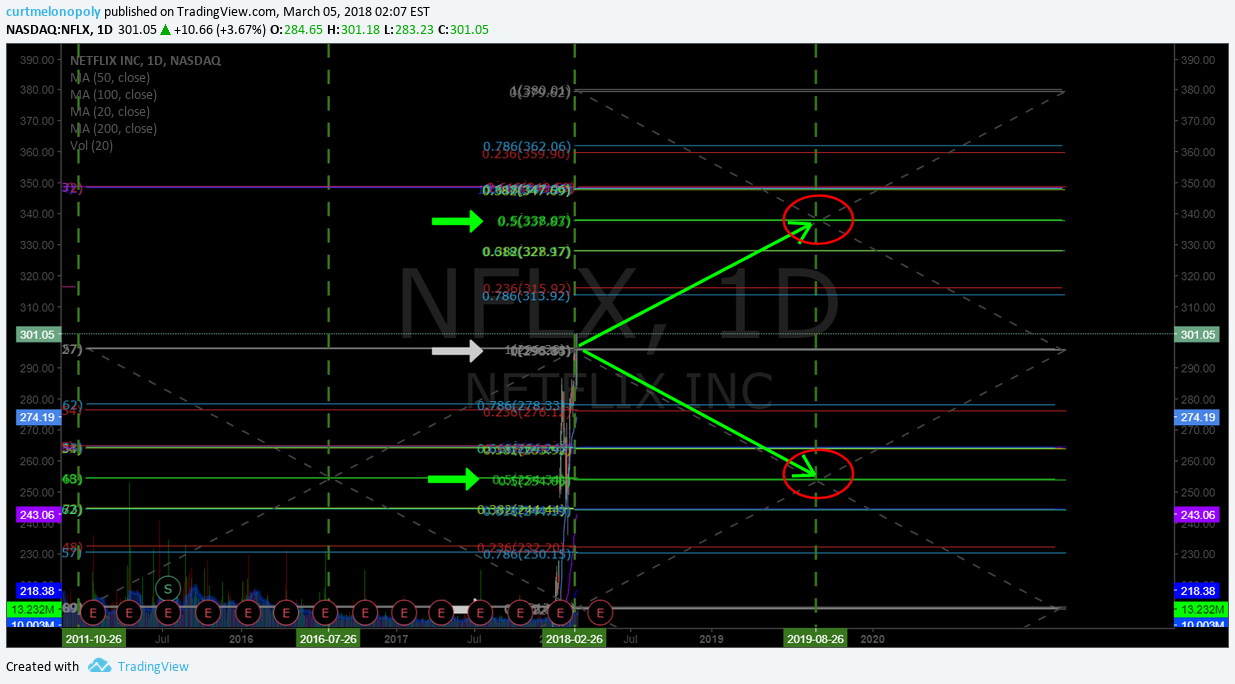

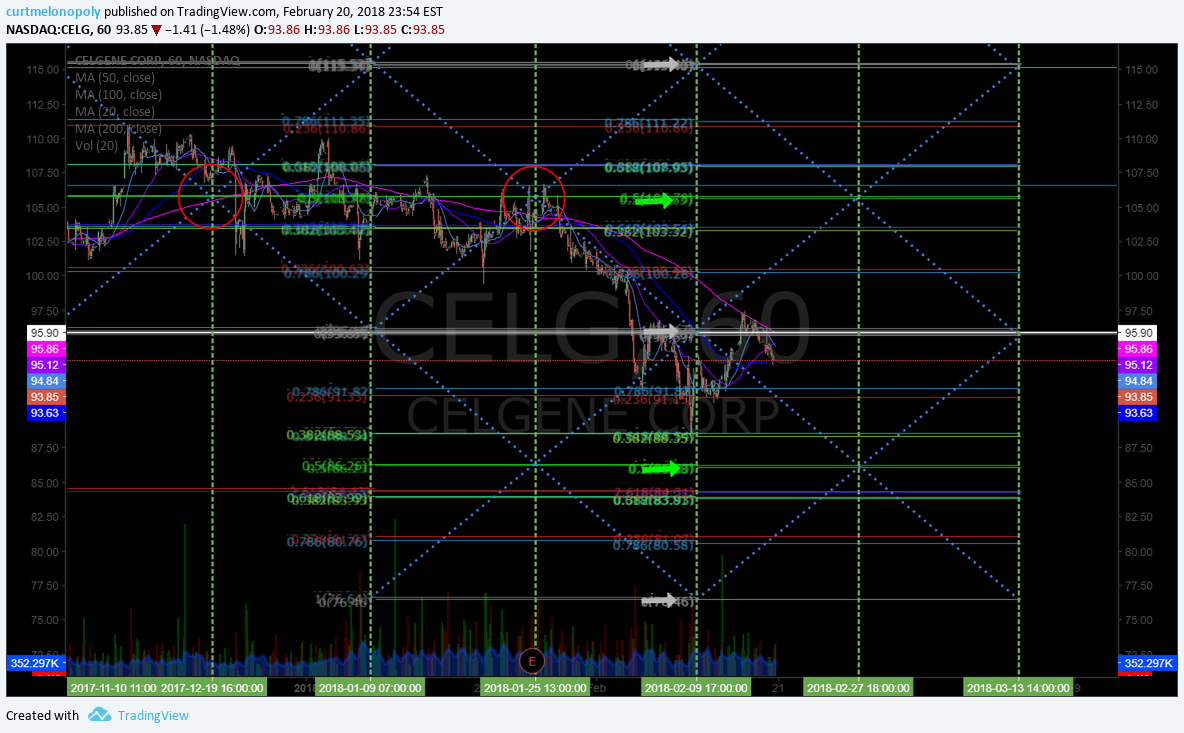

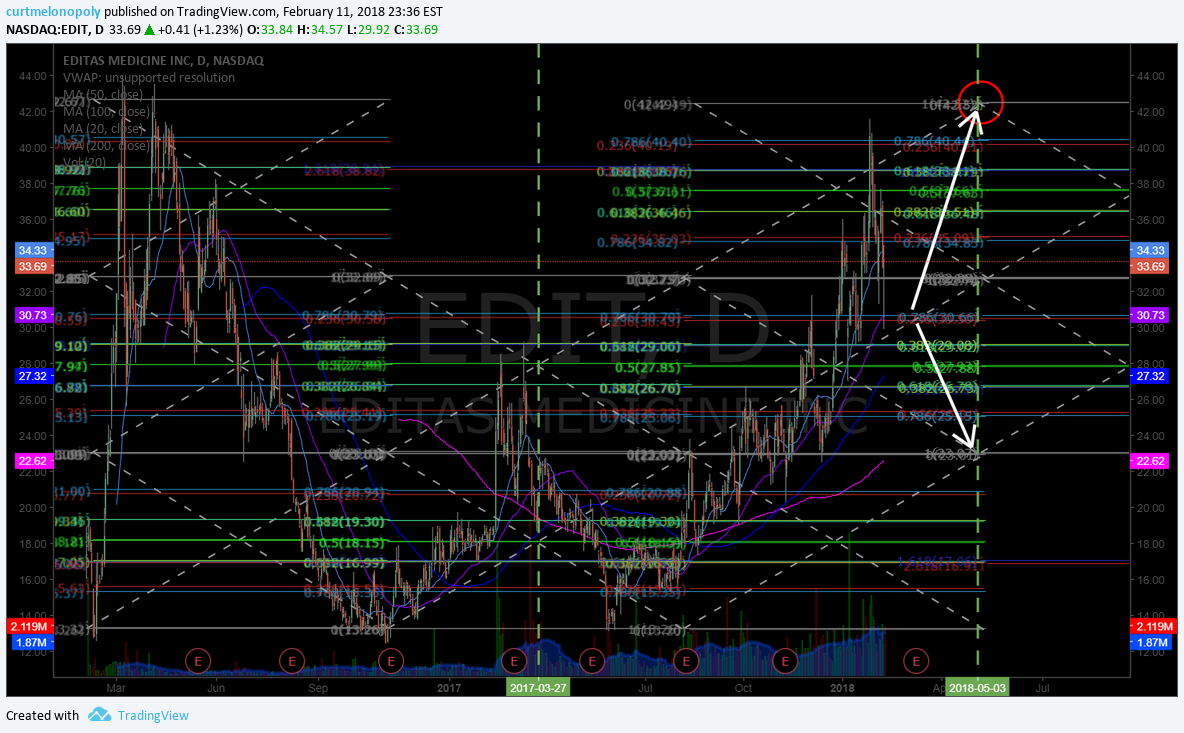

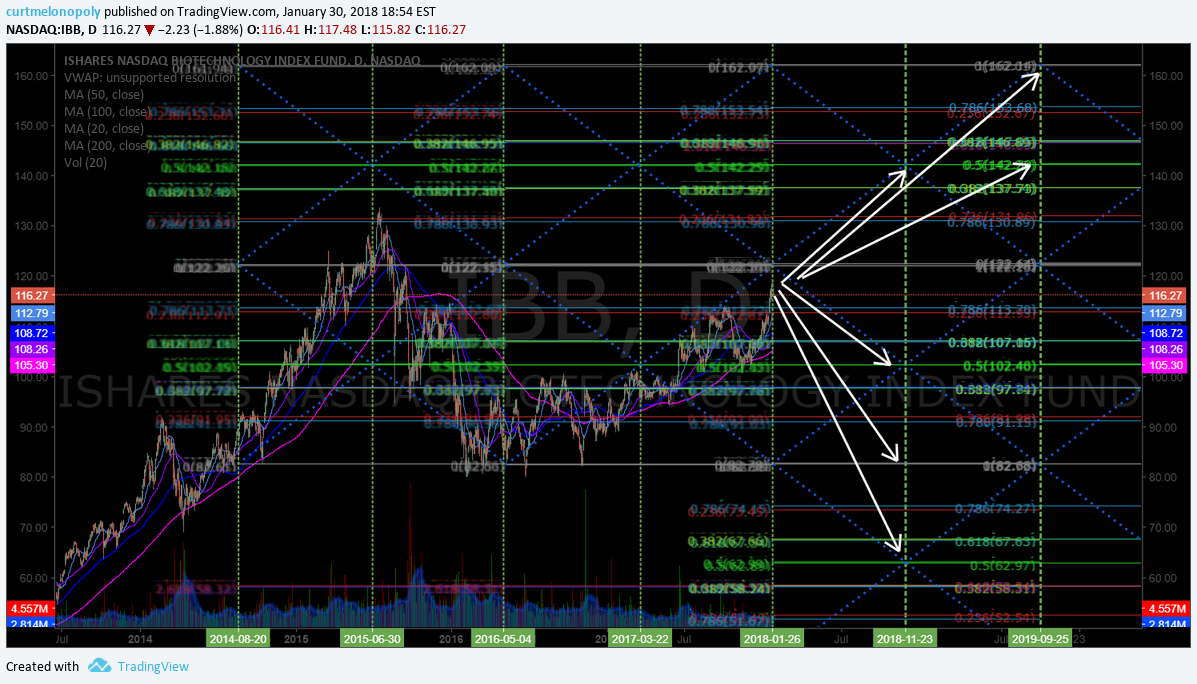

$IBB – BioTechnology Index Fund

Mar 10 – $IBB trading 114.36 triggered long at and if holds 113.78 for 118.88 and 124.70.

Jan 30 – Key resistance test on $IBB Biotech Index Fund. Channel scenario targets up 142.00 or 162.00 down 83.00 or 103.00 #charting #stocks #swingtrading https://www.tradingview.com/chart/IBB/U8HEYQvC-Key-resistance-test-on-IBB-Biotech-Index-Fund-Channel-scenario/

Over 122.50 targets the upper trending channel targets and below 112.71 lower targets are in play. $IBB #swingtrading #pricetargets

$IBB real-time chart link with indicators https://www.tradingview.com/chart/IBB/1TKf04sH-IBB-weekly-chart-indicators-suggest-a-rest-and-go-MACD-Stoch/

$IBB weekly chart indicators suggest a rest and go (MACD, Stoch RSI, SQZMOM) – upper targets from previous chart most probable. #swingtrading

Dec 18 – $IBB premarket trading 106.93 above 200 MA with 110.73 in sight and other swing trade targets on chart. MACD trending up.

$AGN – Allergan

Mar 10 – Trading 157.28 so the previous post downside worked, however, indicators are now indecisive. Watching.

Jan 30 – $AGN Weekly chart suggests more near term down before things get better.

Dec 18 – $AGN Trading 171.80 premarket indecisive with MACD up Stoch RSI high under MA’s.

Likely a decent bottom side trade with decent risk reward if you want to manage it through the moving averages.

$CTSH – Cognizant Technology

$CTSH – Trading 84.71 still vertical move intact. Enter long, set stop, close eyes and hope or wait for pull back at MA’s for a bounce to long.

Jan 30 – $CTSH trading 77.76 continues in uptrend on daily and weekly suggest more up trend trade. Watching for stoch RSI cross up to time a long. On high watch here.

Yahoo news:

Cognizant Scales New 52-Week High: What’s Driving the Stock?

$NVO – Novo – Nordisk

Mar 10 – $NVO above 50 MA is a long and below is a short.

Jan 30 – $NVO near previous all time highs and indicators suggest a pull back.

Nov 3 – Trading 49.48 Trending stock above all ma’s with MACD trending down. Waiting for the cross up on the MACD for re evaluation.

$TSLA – Tesla

Mar 10 – $TSLA monthly chart – trade range in triangle model and follow price to up or down target. #swingtrading

Jan 30 – $TSLA Tesla trading 345.82 with weekly chart MACD turn up, SQZMOM trend up and Stoch RSI near top. Suggests a pop and rest then test most probable. #trading #TESLA

Real-time Tesla $TSLA chart analysis :

Tesla News: $TSLA Tesla Tests Money Managers’ Demand for $546 Million Bond Deal https://finance.yahoo.com/news/tesla-tests-money-managers-demand-180753134.html?.tsrc=rss

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

Mar 10 – $SNAP over 18.05 bullish to next resistance line and under is bearish to next support.

Jan 30 – Buy sell trading triggers on simple $SNAP chart model have worked well. #swingtrading #charting https://www.tradingview.com/chart/SNAP/qJ0gRCyt-Buy-sell-trading-triggers-on-simple-SNAP-chart-model-have-worke/

$SNAP swing trading plan: Long as it nears 12.27 for 14.63 Mar 12, 2018.

$VGZ – Vista Gold

Mar 10 – Trading .76 under 20, 50, 200 MA’s with MACD trending down on daily – watching.

Jan 30 – $VGZ chart structure is slowly building – on watch now – waiting for structure to form and then I will model it.

NA

Sept 14 – Trading .78 with indicators trending down.

Aug 14 – Trading .79 with indicators post earnings slightly looking positive and price under all MA’s. Watching.

$AAU Almaden Minerals

Mar 10 – Trading .85 under all MA’s on daily. Watching.

Jan 30 – $AAU trading .87 is still on a sell signal on weekly chart.

$AMMJ – American Cannabis

Mar 10 – trading .90 with sideways action on chart. Watching.

Jan 30 – $AMMJ Ammerican Cannabis buy sell triggers at white arrows for your swing trade. Triggers and targets have been spot on. #swingtrading #cannabis https://www.tradingview.com/chart/AMMJ/T7F2Rgmg-AMMJ-Ammerican-Cannabis-buy-sell-triggers-at-white-arrows-for-y/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AAPL, $AMD, $WMT, $LTBR, $RCL, $IBB, $JKS, $FEYE, $LACDF, $CTSH, $NVO, $SNAP, $TSLA, $AMMJ, $AAU, $VGZ, $AGN, $LAC, $EWZ, $PCRX