A Real-Life Simple to Reproduce, Consistent Example of a Winning Crude Oil Day Trading Strategy From Our Lead Trader.

How Algorithmic Trading Can Help You Win Consistently (from our trading room on Friday). Man and Machine.

Day trading crude oil futures is not easy… but it is at the same time. The most difficult for me is executing trades based on what I know is right – the most probable winning trade set-ups for buy/sell signals as provided by our algorithmic oil trading model.

This is why I always tell our clients to study the rule-set and use trade alerts only for a heads-up and to use your own trading plan based on your understanding, sizing, comfort area etc. Behind the alerts is a real trader too (at least as it applies to my alerts, our machine trading alerts are a different story going forward).

The buy/signals provided by our algorithm provide structured day trading that increases my win rate greatly – but only when I respect the rules of the model.

I have published a number of articles now detailing the basic rules of the model to assist traders with a better win rate. My personal win rate went from (at best) 60% to approximately 90% (it fluctuates between 80%-95% on an annual basis – there is an ebb and flow). All time stamped live trade alerts.

In our oil trading room last Friday I was triggering trades as was our machine trading technician – man vs. machine (again).

The bottom line: the machine (without effort) won (following the rule-set), and I won – that is until I got greedy.

Both the machine trading technician and I were triggering long side positions near the same time in to the Friday regular market open (my long entries were adds to the previous night futures trade I was already in).

The trade worked well and when the trade met its price target area of the algorithmic model structure (resistance) the machine trade trimmed and then closed on some pull-back and I closed completely.

But I started looking for a further break-out above the algorithmic model signal of resistance as provided by EPIC the Crude Oil Algorithm (after I already had a winning trade). This was the error.

But I started looking for a further break-out above the algorithmic model signal of resistance as provided by EPIC the Crude Oil Algorithm (after I already had a winning trade).

So yes, my day was affected negatively (not that bad because I recovered some by trading bounces during the intra-day reversal sell off), but not good because my trading day could have been very positive vs. negative / stressful on the day.

There is a low stress easier way – just follow the rules of the model. The algorithmic trading model provides a consistent, simple, highly profitable structure for day trading (and even swing trading) crude oil.

Below I explain what I did right and what I did wrong, how easy it is to trade crude oil using proven strategies (with EPIC Oil Algorithm) and how easy it is to get greedy – hopefully my real-life experience helps your trading.

#CrudeOil #AlgorithmicTrading #TradingStrategy FX: $USOIL $WTI $CL_F $USO

The Trade Details (actual screen shots of the alert feed, charting and commentary).

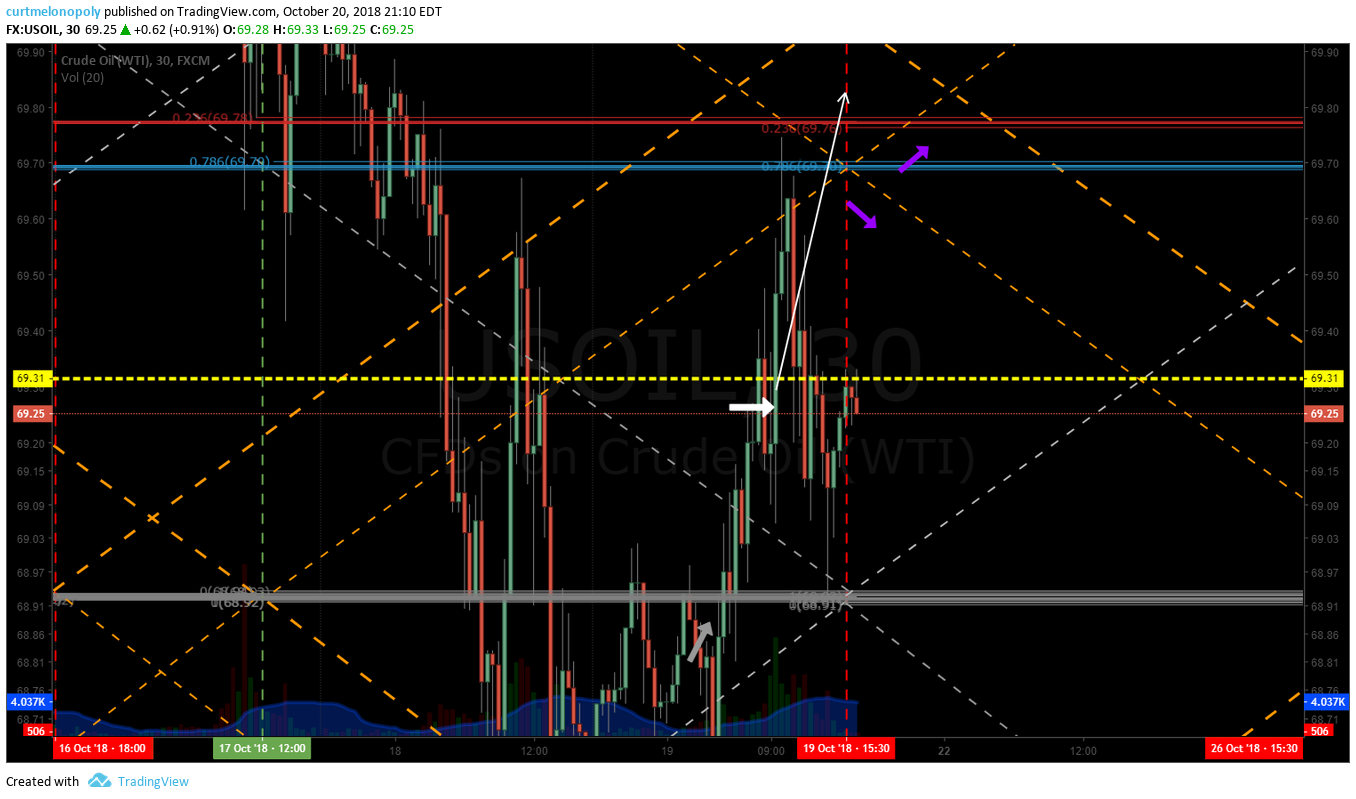

Below is the initial alert (screen shot from our trade alert feed on Twitter) by our oil machine trading technician at 9:17 AM on Friday October 19, 2018. The technician alerted a trade signal long machine buy program in to the regular market open at 69.25 on the algorithmic charting.

Our algorithmic charting is produced on crude oil FX USOIL WTI and this can be used for trading oil futures CL, ETNs / ETFs such as United States Oil Fund (USO), SCO, UCO, UWTI, DWTI and more.

At 9:20 PM October 18, 2018 in futures trade the night prior (Thursday night) I alerted to the feed a long side trade entry at 68.93 as a test trade for the break of upside resistance area. So at this point I was in at 68.93 long and the technician was in the trade at 69.25 the next morning.

Less than one minute later (after the technician alerted) I was alerting adds to my existing trade (we were obviously loading our trades and alerts at near the exact same time).

The Buy Signals Triggering a Long Oil Trade Alert:

On a conventional crude oil 1 minute chart for FX USOIL WTI, the long side trade entry alert signal sent out to members of our oil trading service was based on a number of signals that combined (in momentum and confirmed with the algorithm model) provide high probability to a winning day trade – the signals are as follows:

- Intra day trade in to regular market open breached the Fibonacci trend-line resistance (grey dotted line),

- Trade breached the trading box to the upside (red box on chart),

- The Squeeze Momentum Indicator turned green again,

- The MACD turned up again,

- The Stochastic RSI had turned back up after near bottom (the closer to bottom the better in most instances),

- Trade was above the 200 MA (moving average) having just retested its support (pink on chart),

- Trade was above VWAP (orange on chart),

- Trade was above the intra-day trend support line (yellow line on chart).

- Positive buy flow volume was increasing in to open (volume bars on chart with blue highlights),

- The momentum of trade was subsequently on the bullish side,

- The algorithmic model was also in agreement (shown below and to understand the model takes some study).

On the crude oil algorithmic charting model the following reasons were in play to confirm the long trade:

- The upside price target area on the chart that had a time cycle concluding on Friday at 1:00 PM (see white arrow on chart) was most probable considering the fact that trade was above the mid trading quadrant horizontal support line (thick grey horizontal line). Which in this instance was also a primary support line for the wider time-frame for swing trading oil (which makes it a significant support area on the chart).

- In futures trade the night before, oil trade had broke to the upside of the mid quad resistance area (grey horizontal line as described above and shown on chart below).

- There was a hidden pivot (not shown on the algorithm charting but highlighted here for demonstration purposes in bright yellow – horizontal dotted yellow line on chart). The idea being that if trade momentum was turned up in to open that this hidden pivot was likely to be breached to the upside and would then become yet another support confirming the bias to the upside target on the model.

The algorithmic charting model price target described above is the “easy” trade signal I refer to in the title of this post. At any given time of trade intra-day we can provide the most probable price target for the coming time cycle conclusions. I won’t go in to detail here (that is a completely different article). You can read our other oil trading posts, become a member, watch our videos on how to use the oil algorithm, get some trade coaching or attend a boot camp for more details to this process.

The algorithmic charting model price target described above is the “easy” trade signal I refer to in the title of this post.

Another thought (off-topic a tad), consider the trading quadrant – there were four or five excellent long and short entry points on the model at the quad wall resistance and support areas. This week our machine trading technician is alerting to the EPIC Private Member Twitter Feed those trades (I will also continue as normal).

AND if you look at my original long entry the night prior in futures trade, that trade signal is an even easier trade signal – price was breaching the mid pivot on the trading quad of the model (gray line) which is also the wide swing trading support and resistance area of the charting.

I then provided our members with the trade strategy (guidance) with price targets at 69.70, 69.78 and 69.80 at 9:24 AM (right after the market opened). The price targets are where there are resistance areas of the algorithm chart provided above.

At 9:35 AM I provided further trade strategy / guidance explaining that I was looking for a reversal in the recent trend of crude oil trade (I had distributed a 4 hour chart to our membership by email the night before that I reference in the alert).

At 9:40 I publish the 4 hour oil chart with intra day trade and the two trend line support areas of the chart I was watching. Providing trade guidance that if the current support was lost in trade that we were likely turning down to the next support area on the chart in the 67’s.

Below is the 4 hour USOIL WTI chart provided to members that shows the general trend line support area of crude oil trade.

At 9:42 AM Oct 19, 2018 (25 minutes after the trade alert long oil) the machine trading alert was posted to the Twitter feed with guidance to trim at 69.58 in trade and then possibly add to the long position at 69.58 (obviously if the indicators provided a buy signal).

The reason for the trade alert issued to members to trim long positions on oil algorithm was that trade intra-day was nearing the Fibonacci trend-line resistance area on chart model (trading quadrant wall). Trade was also nearing the peak of the algorithm trading range intra-day (the apex of the model.) These are the same reasons I exited my long trade as provided below in the next section.

Notice on the chart below trade had hit 69.75’s and the trade alert (as above) price targets for the trade strategy for the day in crude oil based on the algorithmic model were published as “price targets for day trade 69.70, 69.78, 69.80 in upside scenario.”

At 9:45 AM I closed my trade at 69.57. Not a bad trade considering my entries at long crude oil at 68.93 with adds in 69.25’s. A 45 tick trade average in oil is a decent day trade (450.00 on 1 contract or in this instance about 4x that).

At 9:58 the technician trade closed on a pull back (the other half of the trade) at 69.43 – a 26 tick average. A decent trade profit, especially considering it lasted just over 30 minutes and it was low stress. It took me 12 hours to close a 45 tick trade and the tech 35 minutes to close a 26 tick trade – obviously the technician’s use of time was more efficient.

It gets worse for me though, because I thought I’d try and get a break upside primary resistance on the algorithmic oil charting. The technician followed a simple rule-set (wait for trade to prove out and then enter) and didn’t follow me in to my trade (he can’t because he is obligated to a specific rule-set for triggering trades).

The additional trade I entered I won’t detail here with screen shots etc, but I will say that it turned against me almost immediately and I should have exited the trade immediately.

As oil sold off some intra-day I held my position and added on a bounce and sold on the bounce and chiseled my way to a small loss – but a loss nonetheless. It was a waste of time.

The two primary mistakes I made in my second trade:

- I entered a long trade at the resistance of the algorithmic trading model. That is not a correct way to position a trade. I closed the previous trade properly but did not start the new trade properly.

- When intra day trade went against my position I should have closed for a small loss, but I did not.

There are other details and reasons for the trading decisions that were made, however, for simplicity and to keep this instructional post to a digestible size I will leave it here.

To increase your crude oil trading skill-set we have a number of tools you can use.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing info@compoundtrading.com. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading On Our Website That Will Help You Trade Oil Successfully:

Find more posts like this one on our Oil Trading Academy Page – there you will find links to numerous oil trade strategy reports.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

Article Topics: Crude Oil, Algorithmic, Trading, Strategy, Day trading,Trading Room, Alerts, Signals, USOIL, WTI, CL_F, USO