Last week I was involved in a friendly oil trading challenge. The live alert trading challenge was between myself and our coding team (the team coding our oil algorithm charting models to a machine trading software platform).

The results are mind-boggling – learn to trade oil with the one or two set-ups explained below and you will realize returns so significant that you will likely never turn back.

This (and the follow-up) are the most significant trade reviews and analysis we have done since our inception. Take the time you need to study this report if you want to be profitable trading crude oil.

In this challenge we both used exactly the same charting – conventional crude oil charts and algorithm oil charts (courtesy of EPIC Oil Algorithm).

The coding team realized oil trading profit was hundreds of percent greater than mine. We both won – but they won big.

The coding team won big – with less time invested, less stress and they used a simple, absolute, rigid rules based oil trading system.

How they did it is explained in detail below.

This report could easily have been titled, “How to Trade Crude Oil in Today’s Market – With Intelligent Assisted Technology (EPIC Oil Trading Algorithm).” However, it was a friendly competition between myself (lead trader) and our coding team, hence the title I used.

As you will see below, the results are absolutely astounding.

Allow me to explain who this article is suitable for, what data is reviewed in this report, the charting used and what trading rules were used.

This report is suitable for the following reader(s);

- If you want to learn to trade crude oil,

- If you already trade oil, are struggling to be profitable, and in need of a proper rules based trading process to be sure you win,

- If you are a pro oil trader exploring other profitable oil trading systems that may assist your ROI / ROE objectives,

- If you are researching what the future of the best oil trading systems will look like,

- And of course this report is a great study guide for current EPIC the Oil Algorithm clients.

Below I review in detail the following (with real chart examples, copies of our trading alerts and more);

- The surprising final results of our oil trading challenge between man and machine algorithm (both using the same information),

- The rules based trading process used,

- My personal learning experience after last week’s trading challenge.

How Trades Were Executed and the Information Used by The Traders (charts, algorithms).

As I explained above, this was a competition between our algorithm coding technicians trading crude oil with EPIC the Oil Algorithm chart models (algorithmic oil charting) vs. myself (lead trader at Compound Trading Group) using the exact same algorithmic charting and conventional charts. We both had access to the identical charting – algorithmic oil charting and conventional charting on various time frames.

In fact, the coding team executed their trades manually (as did I, of course). They were not executing their trades automatically (machine trading).

The massive difference in the trading results (the profit achieved) after the week of trading is directly a result of

- How the charts were used (interpretation),

- What charts were used and why (which charts were given more or less weight in decisions), and

- How trades were executed within the charting time-frames and structure.

In other words, we both had exactly the same information at our disposal, we both executed our trades manually, but we executed our trades on a slightly different rule-set within the same structured rules based trading system.

I was executing trades manually and intuitively (as a pro trader- in my mind) using EPIC the Oil Algorithm Charting Models (even on different time frames) and I also used conventional crude oil charting.

The coding team used the exact same oil charts, but the difference was that they executed their crude oil trades under a very strict system – using only the rules as prescribed by and under the reporting that is distributed to our clients in the weekly EPIC Oil Algorithm newsletter reports (the reports for those unaware include a rules based system along with various charting for the week).

The system of trading oil the coding team implemented was rigid to the rules of our algorithm model and my system was more pro trader intuitive – I flexed the rules as I felt I needed to. That was the simple and only difference.

Learning to trade crude oil successfully is not an easy task because conventional charting rules do not apply in many instances. Crude oil trading can be very volatile and as a result oil trading can be very profitable if you are on the winning side in most trades. If you loose as an oil trader it can be very punishing.

To trade oil successfully you need to know the structure of oil trade – the rules book and the playing field. Understanding the structure of oil trading charts, how to execute trades properly within that structure and when to cut losses and trim gains is critical to your return on investment (ROI) or return on equity (ROE).

Specifically how the coding team beat me so bad last week.

Lets review real life examples of the price of crude oil over the last week, how we each traded it, the conventional charting we used, the intelligent assisted algorithm charting we used, the trade alerts sent out, when and how each of us executed crude oil trades for excellent winning side returns, but with significantly different results.

The week prior to this challenge something interesting happened, our coding team foreman was allowed to start alerting oil trade alerts to our Twitter alert feed and wouldn’t you know it, in his first two alerts he lost big (I think he had a few small wins also). I on the other hand have been on the winning side of my trade alerts for months now. Of course our members enjoy that predictability… but there is a much bigger story here.

When our coding foreman lost, he was on the losing side of his first two alerts of his career because he didn’t follow one simple rule:

He did not close the trade when it went against him and as a result he lost big.

He alerted the trade entry properly, but when the trade of oil went against him he didn’t alert to close the losing trade.

This caused significant stress, challenged our team and much discussion ensued. We rolled around our work, the charting, the algorithm models, machine trading software scenarios, alerts, trading rules and more – over and over and over.

On my side of the story, I am alerting winning oil trades for months now with-out fail, but my trades are quick and only on the winning side of 10 cents to approximately 40 cents… about 20 cents on average. Now in oil futures a 20 cent or 30 cent win consistently is a fantastic living and in my thinking that’s great because I near always win and if you near always win that’s just fine…

but it doesn’t nearly take advantage of the power of the trading algorithm model charting I have at my disposal.

So before our challenge last week we both had a problem, I was leaving the majority of the obvious profit on the table even though my trade alerts were winners every time and he was not following the rule of closing a losing trade side alert that goes against you, and closing it fast.

We were both breaking the rules and we both would have much higher ROE if we adjusted some very simple things… our coding foreman adjusted perfectly – me, not so perfect – but this week is a new week so watch out!

Anyway, so we agreed to a challenge, he would not alert to the client oil alert feed for now and he would show me that he could trade explicitly to the rules as set out in the EPIC Oil Algorithm reports. And I would also do the same, but alert my trades and with a caveat that I could use my pro trader bias to over-rule the algorithm charting rules at will (my error).

A detailed account of our recent oil trades / alerts;

New traders should know that EPIC the Oil Algorithm chart models are charted on FX $USOIL $WTI but can be used to trade oil futures contracts $CL_F or leveraged oil derivative market products such as $USO, $UCO, $UWT, $DWT, $UWTI, $DWTI and more. I typically use CL contracts and will daytrade at times $UWT or $DWT if I am confident that I won’t be holding over-night.

Okay, first lets look at my trades / alerts (this is almost embarrassing to review – humility engaged).

In the examples below and the follow up report you will see actual screen shots of the live twitter oil trade alert feed (time stamped, real-time), screen shots of the private oil chat room and screen shots of EPIC the Oil Algorithm charting we were using (with notes).

Also it is important that the profit / loss represented are approximate as our team is trading various environments (read our disclosure) – we are testing and trading many platform scenarios, instruments (oil contracts, market derivatives, etc), with various traders, various accounts (real world and/or model platforms for testing purposes) in the team (as our work is toward achieving a machine trading environment and intelligent assisted trader platform – read about our mandates on our website) that it would take days to explain. Additionally, there are trades executed for win or loss that are never alerted to our members.

So for the purpose of this exercise I keep the analysis below simple and to what applies specifically to this exercise ensuring that we cover what the public (our member clients) would have had opportunity to act on in their own trading environment (actionable trading alerts) and if one did in fact act on the alerts what the expected returns may be vs. trading what the rules-based trading system of EPIC the Oil Algorithm reports prescribe to our members in the weekly reporting they receive from Compound Trading Group.

There will be a member only follow-up to this report published within 7 days that will show the 1 minute conventional charting used with exact entry and exit areas detailed on the charting with the thought process by the trader in each trade and this report will also include the machine trading charting that influenced our trade.

Oil Trade Alert # 1

The first trade that was marked as a tech trade was, but it was alerted internally by me and authorized to the tech to alert. So for the purpose of our competition it was my trade by origin (we’ve decided this in team discussion). So I’ll take it as I need all the help I can get here.

The first trade was 24 cent win at 2 oil contracts (avg) so it was a gain of about 510.00.

Oil trade alert to start the week 68.61 long, 68.85 closed (the initial alert).

Oil trade alert to start the week 68.61 long, 68.85 closed (the closing alert on #1 for the week).

Oil Trade Alert # 2

The second trade of the week was a timing cycle issue, price didn’t react soon enough so I closed the trade for a small profit.

A 5 cent win with two contracts for 100.00 win (approx).

Long 69.19 lead trader test size.

Closed 69.24 not holding in to time cycle when it is this soft.

Oil Trade Alert #3

The third trade alert has a type o that was obvious, but more important than that is that this is where the difference in the fine details put the coding team way ahead of me. At this point the trading was so intense that I had to generalize the tweet alerts, but you will get the point with what was alerted. There is more explanation below that clarifies the calculations here;

66.49 to 55.57 with contract sizing average of 3 contracts on about 3 times = 800.00 profit approx.

Long test 66.49 lead trader will cut fast as needed and trade chop.

This was obviously 66.57 and there were various type o’s, it should have read something like this…

Chipping out some 55.57 and waiting for next leg to go again.

At this point I alerted the member private Twitter feed that we would for the time alert in the live trading room (where I can speak on live mic broadcast to our oil traders) – this is specifically in a Click Meeting conference room (it is our main trading room that our EPIC Oil Algorithm bundle members can access as they like). We also have a private oil chat room in Discord and a public side on Discord.

At this point there were a number of trades, I will only include screen shots in this report specifically of what was alerted to only the Twitter feed (there isn’t time to get the audio from live trading room right now for the various occasions I was in that room last week – that will all be in a reconciled report from Jen in our offices). It won’t make a difference to the main point of this report – I was beat by the coding team so badly it doesn’t matter.

The real point of this exercise (this report) is to help oil traders with a rules based system to win and win with the highest return.

We’re trading possible turn in live oil trading room isn’t time to alert on feed.

Oil Trade Alert #4

The fourth oil trade of the week was a win. Short from 67.17 and cover at 66.80 for a 37 cent win at 3 contracts.

Win side 1100.00 approx.

Short test lead trader.

Short oil trade alert at 67.17.

Covered 66.80 lead trader – nice quick win on that alert.

Oil Trade Alert #5.

Oil trade number five was a decent trade from 67.13 (average) to 67.29 with trims starting at 67.27.

8 contracts at approx 14 cent profit = 1200.00 gain (approx).

Long lead trader break out test 67.09 – 67.18 4/10 sizing.

Trimming long positions 67.27.

Oil Trade Alert #6

There we many trades here and the range was .30 cents to the win side on the original alert. For simplicity it was 5 trades at an average size of 2 contracts at an average win of .10 cents.

Oil trade number six approx. profit = 1200.00

Long oil trade again here.

Trimming long oil positions here.

Too busy to alert all legs in and trims but we got a nice break up there 67.20s to 67.50s.

Summary of Lead Trader Alerted Trades to Live Twitter Feed P/L

So specific to only what was alerted as trade alerts on the live feed and the contract sizing for those trade alerts the total gains for the week = approximately 4900.00 for this account scenario.

Now lets look at what our coding team foreman was able to do with the exact same charting information (that I and our members can use).

In his instance he traded specifically to the rule-based system as prescribed to our members in the weekly EPIC Oil Algorithm reporting.

There were many trades in each leg. He started trades at 2/10 sizing then as the trade progressed he trimmed 1/10 size at resistance and if it failed would exit the other 1/10 at about have the trade range. As trade got above the key resistance he would add above key resistance 1 size and continue. And if the trade went against him right away he would cut fast. So he had a number of losses, but his losses were small and the wins far outweighed the gains.

The week started with an uptrend so he traded the key range support and resistance as prescribed in EPIC the Algorithm reports (gray horizontal line you see on chart below). As trade failed or at key resistance he would trim as noted above.

The key to his trading process was using the key range support and resistance as the launch area for longs, the short area for shorting oil and if the trade went against him he closed the trade for a loss.

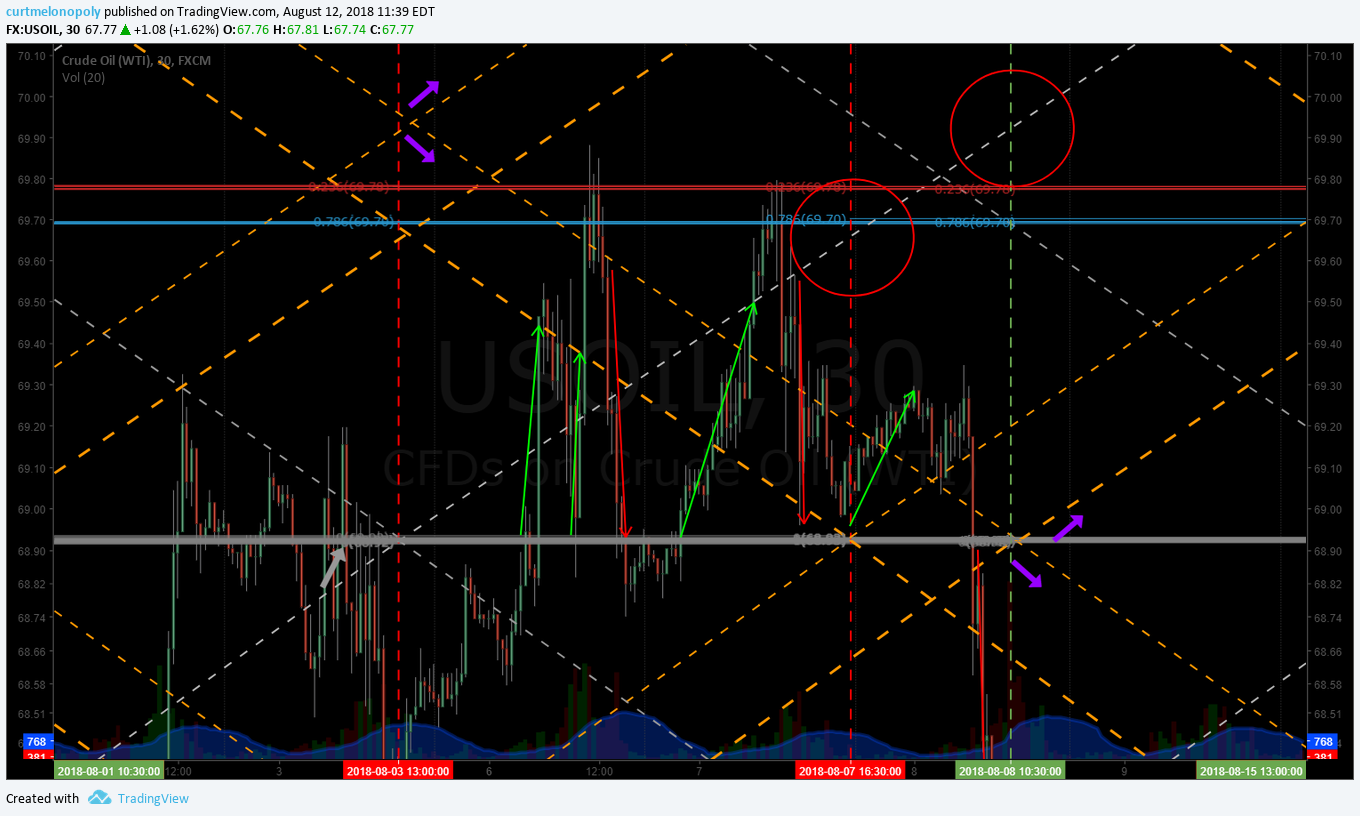

The EPIC Algorithm Chart he was using (the gray horizontal line is the main support and resistance pivot prescribed to members and the other indications on the charting). How to trade crude oil applying the rules based process in this report can be reviewed in detail on our web site blog under EPIC Oil Algorithm and scroll down to unlocked historical charting – the more recent reports are locked to the general public. The EPIC reports explain specifically the rules based process in point form.

The first chart is the initial trading range for the week that our tech was using. The day and time is noted at the bottom of the chart. You can see how is bias for trade direction was specific to the main pivot area as provided on the algorithm charting.

Charting used by technician (EPIC Oil Trading Algorithm Charting). Bias for trades is noted with green and red arrows.

You can see in the charting below that each time trade breached the main pivot on the charting model that his trading was to the long side bias until trade hit a significant resistance in the model (at which point he trimmed).

The first two on the chart are green arrow long side trades were off the main pivot and trimmed at the quad wall resistance area.

The the third is a red arrow on the chart as a short side trade bias because trade was already at the marked target price for the Tuesday 430 algorithmic target. In other words, there was a low probability of further upside gain prior to Tuesday at 430 so his short term bias was short.

Then the fourth arrow (green) and fifth (red) were a rinse and repeat of the bias explained above.

The sixth arrow (or trading bias area) was long in to the Wednesday 10:30 AM EPIC Oil Algorithm price target (for the up channel scenario) but trade turned and when it turned and lost the main pivot (gray) and the trading quadrant (orange dotted) he turned short bias in a significant way. There were many failures to the long side in the algorithmic model at this time in the trading week.

The short side bias was solidified with the expiry of the main time cycle in trade (purple arrows that separate the up channel scenario or lower channel scenario in the oil algorithm weekly reports).

The next time frame of the week (second) charting used by technician in his trading system with noted areas of trading bias with red and green arrows.

As trade moved to either side of the main pivot his bias is represented (per the process prescibed in the EPIC Oil Algorithm weekly reports) and then in to the bottom of a trading quadrant (he used the rules for trading quadrants) after oil selling off to extreme levels on the week.

As oil sold off the tech simply trimmed at support areas on the algorithm charting and added to short side bias as trade lost each support.

On the way down oil trade hit the Wednesday 10:30 AM EIA price target as published in the previous weekend EPIC report for the lower channel scenario.

The final chart time cycle used by technician in his trading system for week.

The last time frame was text book how to trade crude oil class. For this the tech moved to the prescribed trading process rules in the trading quadrant (the orange dotted lines that form a diamond). He simply took long side positions at the support of the quadrant and trimmed at the main resistance areas. Trade got in to the Friday 1:00 PM target but did not perfectly hit the center.

Trade ended the week at the top of the trading quadrant – near the quadrant basket where he assumed with trade direction and historical algorithmic chart from EPIC that trade was most likely to complete the week.

It’s obvious the technician using the rules based system prescribed to our members had significantly higher returns last week than I did. Our members will be receiving the full report.

As explained above;

There will be a member only follow-up to this report published soon that will show / explain the 1 minute conventional charting used with exact entry and exit areas detailed on the charting with the thought process by each trader in each trade and this report will also include the machine trading charting that influenced each trade.

The follow-up report will provide our members and our team staff opportunity to learn in great detail how to time the entries and exits of the trades. It will hopefully bring members in to the mind of each trader. This is a member only report because proprietary machine coding charting and various other proprietary information will be shared.

Also, please note that over the coming weeks in to the fall season that our techs will be alerting more and more to the live alert feed under and will be doing such exclusively under the rules based system as prescribed in the EPIC Oil Algorithm weekly reports to members.

Some Important Final Thoughts.

It is easy to look back and criticize your trades – especially when the trade direction is so obviously apparent on an algorithmic charting model such as EPIC’s as in this report.

I personally won’t be hard on myself (as you should not also) because it is impossible to be a machine and if I am on the winning side more than losing and my accounts are consistently green that is what matters most.

However, in my continuing quest to learn how to trade crude oil to my best ability I will be adjusting my oil trading style this week to more reflect the prescribed rules based system as prescribed in the EPIC Oil Algorithm weekly reporting. It obviously works and the science proves that – so I need to adjust to continue to get better as an oil trader and coach that teaches others how to trade oil.

I look forward to the follow-up report that Jen is writing now for our members that will provide in detail how last week trades were decided. She just finished interviewing me about each of my trades and is interviewing our tech team later today for the report.

Best with your trading and if there is anything you need from me reach out anytime on any of my personal social feeds or by email [email protected].

Thanks

Curtis (Lead Trader at Compound Trading Group).

To Learn More About Trading Oil:

Learning to Trade Links on our Site and/or YouTube.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

Oil Trading Room – How to Use EPIC the Oil Algorithm June 21, 2017 (video).

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades June 29, 2017 (video).

Here we unlock historical member reports at intervals after time cycles have expired for traders that are learning to trade oil. When you clock on link scroll down at landing page on blog section you will be transferred to so that you can get to reports that are unlocked over time: https://compoundtrading.com/category/epic-the-oil-algo-chart-report/

Off-site Learning Site Links:

Learn how to trade crude oil in 5 steps https://www.investopedia.com/articles/investing/100515/learn-how-trade-crude-oil-5-steps.asp

How to Trade Oil on Stock Exchange https://finance.zacks.com/trade-oil-stock-exchange-4532.html

How to trade oil. Learn everything you need to know about speculating on oil and gas markets. We explain how oil trading works, with a step-by-step guide to trading oil. https://www.ig.com/au/commodities/oil/how-to-trade-oil

Subscribe Here:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Temporary Discount Offers (New members only – ending Aug 14, 2018):

30% Off Oil Newsletter: Use Promo Coupon Code “epic30” When Subscribing to our Weekly Oil Newsletter Here: https://compoundtrading.com/product/standalone-epic-newsletter/ (cancel anytime, for new members only to trial the service).

30% Off Oil Alerts: Use Promo Coupon Code “oilalerts30” for Real-Time Oil Trade Alerts via Private Twitter Feed @OilAlerts_CT Here: https://compoundtrading.com/product/live-oil-trading-alerts/?attribute_plan=One+Month (cancel anytime, for new members only to trial the service).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow: