Oil Trading Newsletter – Live Oil Trading Room Example of Day Trading Alerts with Video, Charts, Commentary.

#oiltradingroom #oiltradealerts #oildaytrading

After five years of development, our oil trading software most recent version (EPIC V3.1.1) has not lost a trade since deployed June 1, 2020. Below is an example of how our oil trade alerts are broadcast live in the oil trading room. Screen shots of the trade alert feed and oil chat room are also included in the article.

The video below is 4 hours long, to find the trades as alerted by voice by our lead trader simply look at the time on the alerts or charts and go to that time on the video. Between trades there is no discussion on the video.

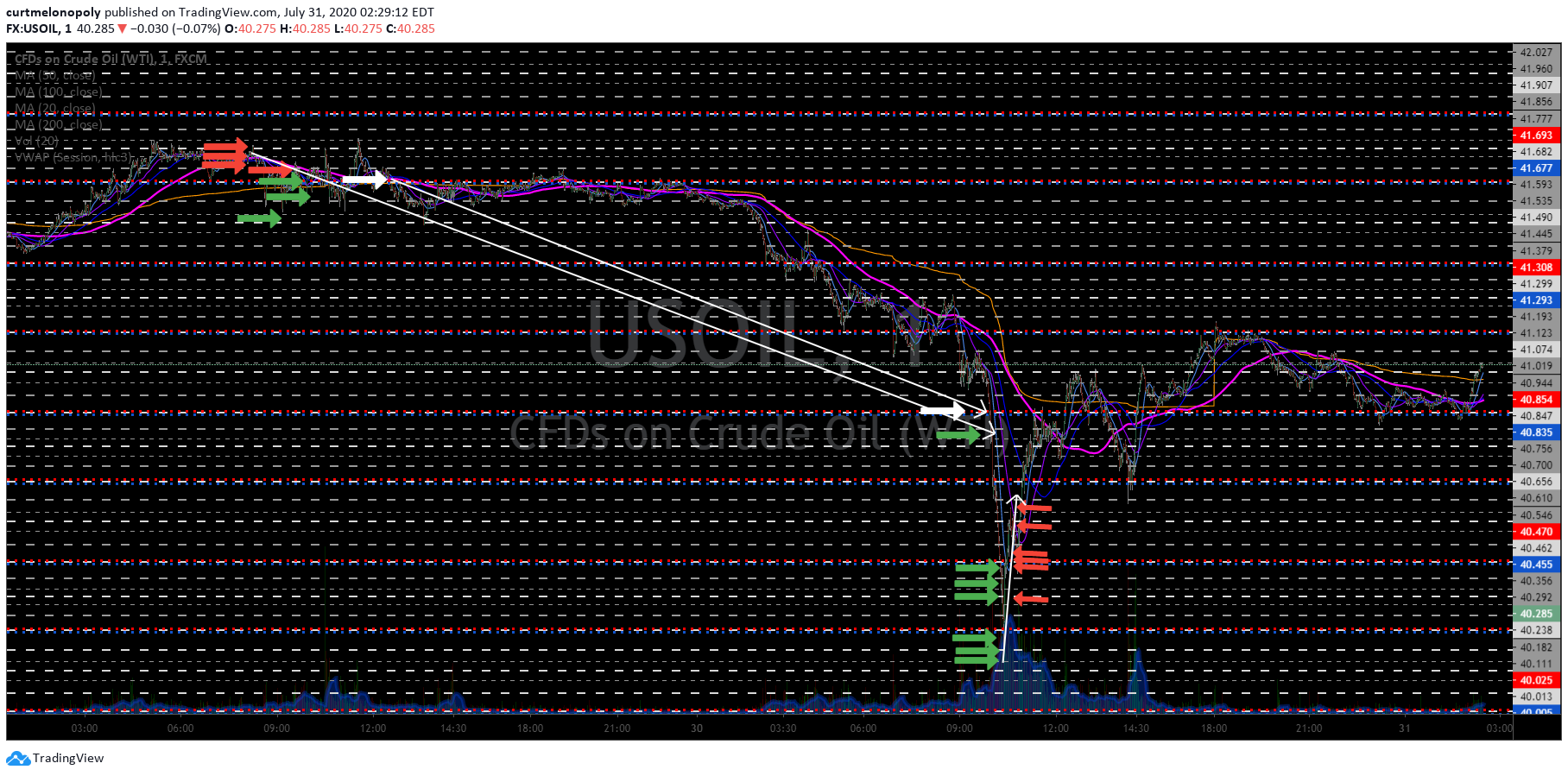

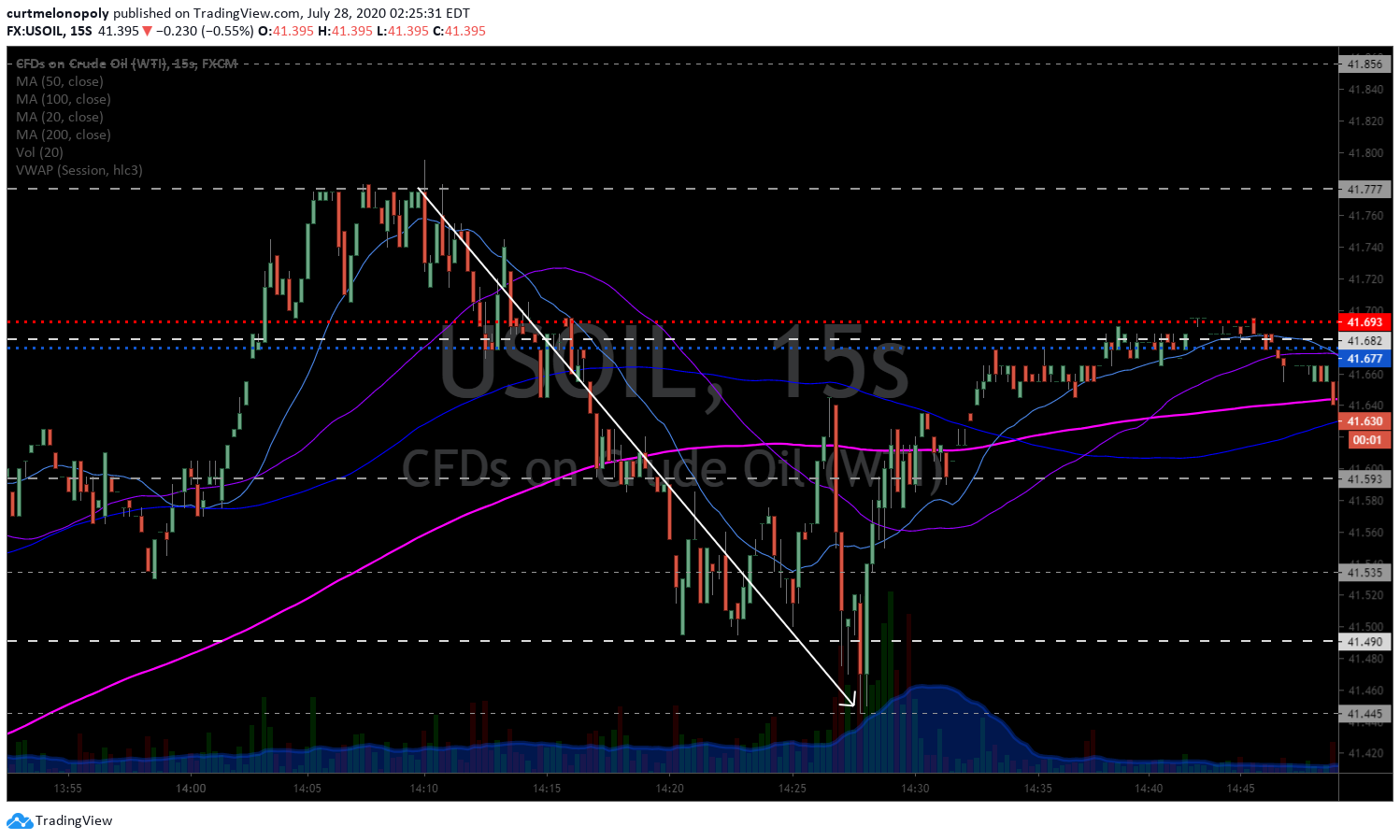

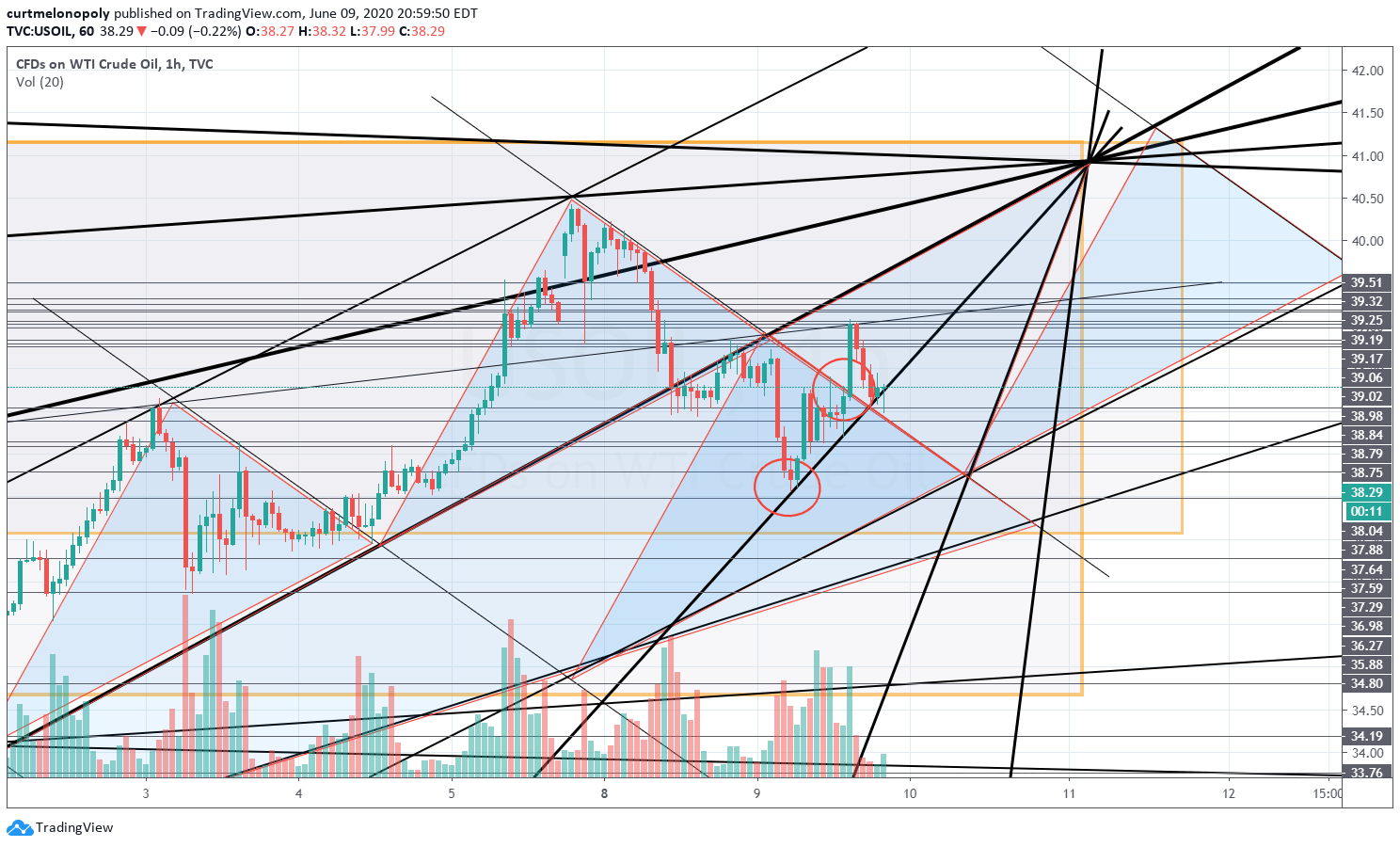

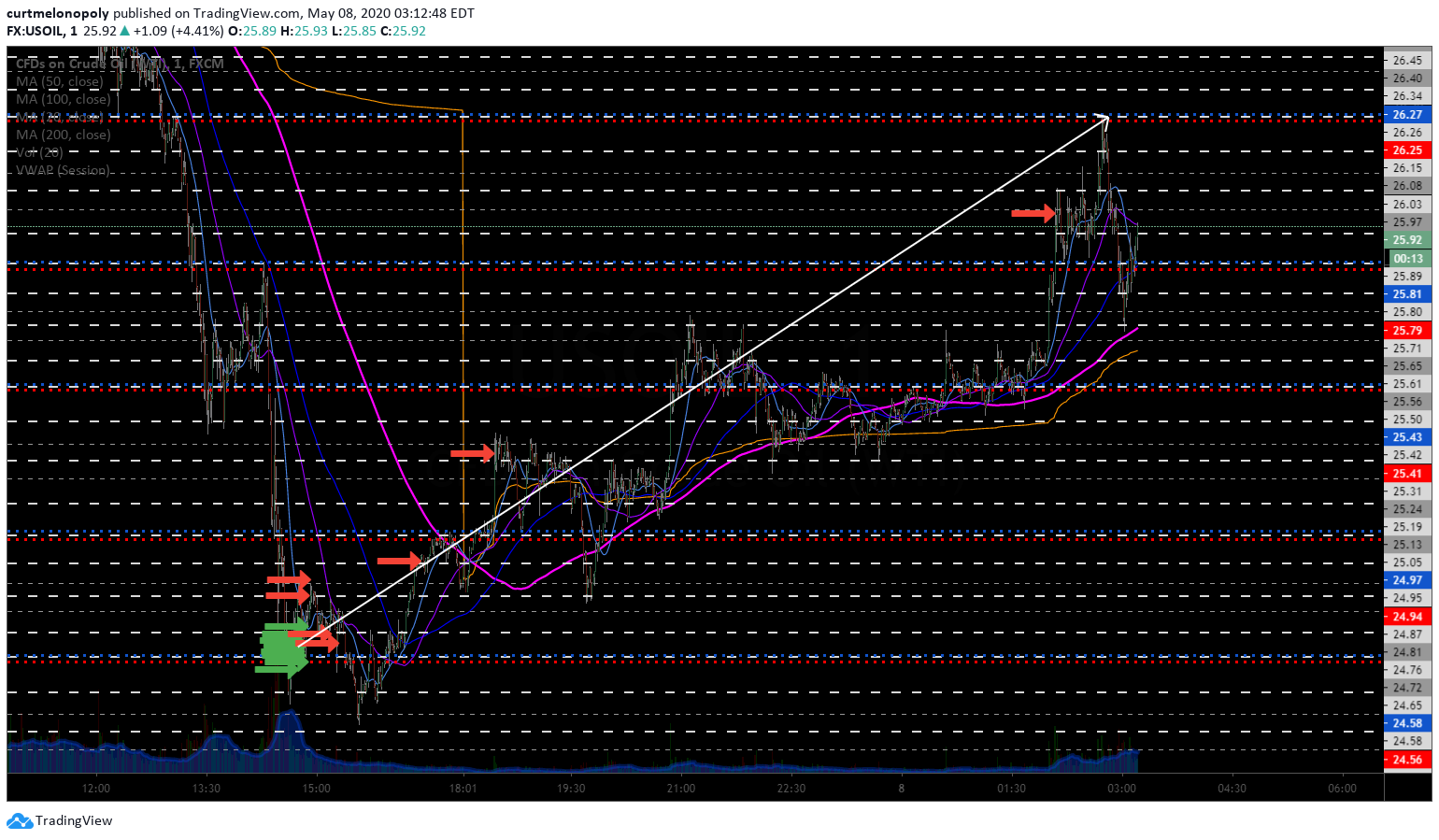

Oil trading room alerts shown on the charting for day trades for the win. #OOTT $CL_F $USOIL $USO

Below is the guidance and trade alerts as it happened live (screen shots of live oil chat room):

Curt MelonopolyToday at 7:23 AM

Good morning traders,

We’re hunting for structure in markets, for now watching. We’re loaded to the gills in $VIX long as you know. As we’ve been discussing on Study videos for weeks.Take profits as you go.

When the markets bounce we’ll have the structure pinned down and start trading it. For now we’re deep in data.

Mail server should be up and running tonight.

Long list of WIP but we’re getting there.

Emails will come from [email protected] when done.

The fall reporting we wanted done at latest last Sunday I am hoping will be done through out the week (all models updates etc).

For now we’ll alert as opportunities arise.

Curt

Curt MelonopolyToday at 8:26 AM

Symmetrical extension, so we see what the bulls got now

and if 30 min is dominant

the sell off was a perfect symmetrical move on 30 Min

this is a good sign – symmetry, means we may get in to a pocket of exceptional trading here this week

I will be active in live trading room when EPIC starts firing. Lots of symmetry on models, machines are in control, so I would expect an exceptional week.

Curt MelonopolyToday at 8:44 AM

bulls took it a couple ticks early on bounce

nice structure

JeremyToday at 8:57 AM

progressive order flow

JeremyToday at 8:57 AM

progressive order flow

Curt MelonopolyToday at 8:58 AM

retail bulls could get wrecked here we’ll see

watching 36.909 for possible bounce

if area doesnt hold 36.15 FX USOIL WTI 30 min support

gray is at 36.15 thats intra week range support

Curt MelonopolyToday at 9:53 AM

3/40 long 36.69 not expected to hold, position trade only, only on intra day.

There is 1 secondary on IDENT on order flow to long side in here now so EPIC so following intra day. But 36.16 – 36.60 is expected so prepare for pressure.

Curt MelonopolyToday at 10:05 AM

If it does bounce in this range we’re looking for 37.80 to upside today.

secondary came in again 36.37 on long side on IDENT

would be nice to see the other 2 come in here

Curt MelonopolyToday at 10:30 AM

Sell 1 36.88 hold 2/40 long

Curt MelonopolyToday at 11:01 AM

Buy 2 hold 4/40 long 36.17

prepare for more pressure

Curt MelonopolyToday at 11:10 AM

Sell 1 36.46 hold 3

correction: here’s the right sequence thus far

Curt MelonopolyToday at 12:02 PM

Sell 1 36.60 holds 2

symmetrical on 1

Today’s sequence. Nice and smooth.

+1340.00

So now the software will look for the bulls to get too positive and when order flow changes it will likely start shorting.

Did bounce at swing range support BTW, that’s very structured trading.

I’m on break for a bit.

Below is the guidance and trade alerts as it happened live (screen shots of live oil trade alert subscriber feed)::

EPIC V3.1.1 did some day trading today

Oil trade alert screen shots from sub feed below. Green arrows buy & red sell.

EPIC V3.1.1 version software has still not lost a trade sequence since launch June 1, 20.

#OilTradeAlerts #MachineLearning #OOTT $CL_F $USOIL $USO

https://twitter.com/EPICtheAlgo/status/1303406969823399937

Our goal is to develop the best oil trading room and alerts service available with the highest win rate % and the most repeatable strategies for consistent wins.

“In pursuit of this goal we are providing our oil traders with articles like this series to help our oil traders with mastery of trading set-ups. Once a trader masters these strategies their win rate goes way up, their returns explode and their lives are changed.”

We have published a number of oil trading strategy articles to assist our subscribers with how to trade crude oil and win. You will find in the articles at this link “Crude Oil Trading Academy” videos from the live oil trading room, profit and loss of our trading, various trade alert examples and more.

If you are not progressing in such a way that your win rate is going up and your returns are steadily increasing you may want to consider some short term trade coaching. Even the best traders in the world have trade coaches for times they are struggling.

Below is a recent video from a webinar we recorded in our Oil Trading Room, “How to Use Our Oil Trading Services. Oil Trade Alerts, Oil Trading Room, Oil Reports, Trade Coaching” and for more specific trading strategies there are more specific video links below.

https://www.youtube.com/watch?

The recently released white paper about EPIC V3 performance explains also its method of execution of trades, see the report here;

White Paper: How EPIC v3 Crude Oil Machine Trading Outperforms Conventional Trading Methods

Anything else we can do to assist you in your trading journey please email us at compoundtradingofficial@gmail.

Thank you.

Curt

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (Member Charting Reports sent out weekly at times in report form or updated on email regularly).

Real-Time Oil Trading Alerts (Private Twitter feed and Discord Private Server Chat Room).

Oil Trading Room Bundle (includes Weekly Newsletter, Trading Room, Charting and real-time Trading Alerts on Twitter and private Discord Chat Room Server).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Follow:

Article Topics; oil trading room, oil trade alerts, oil day trading