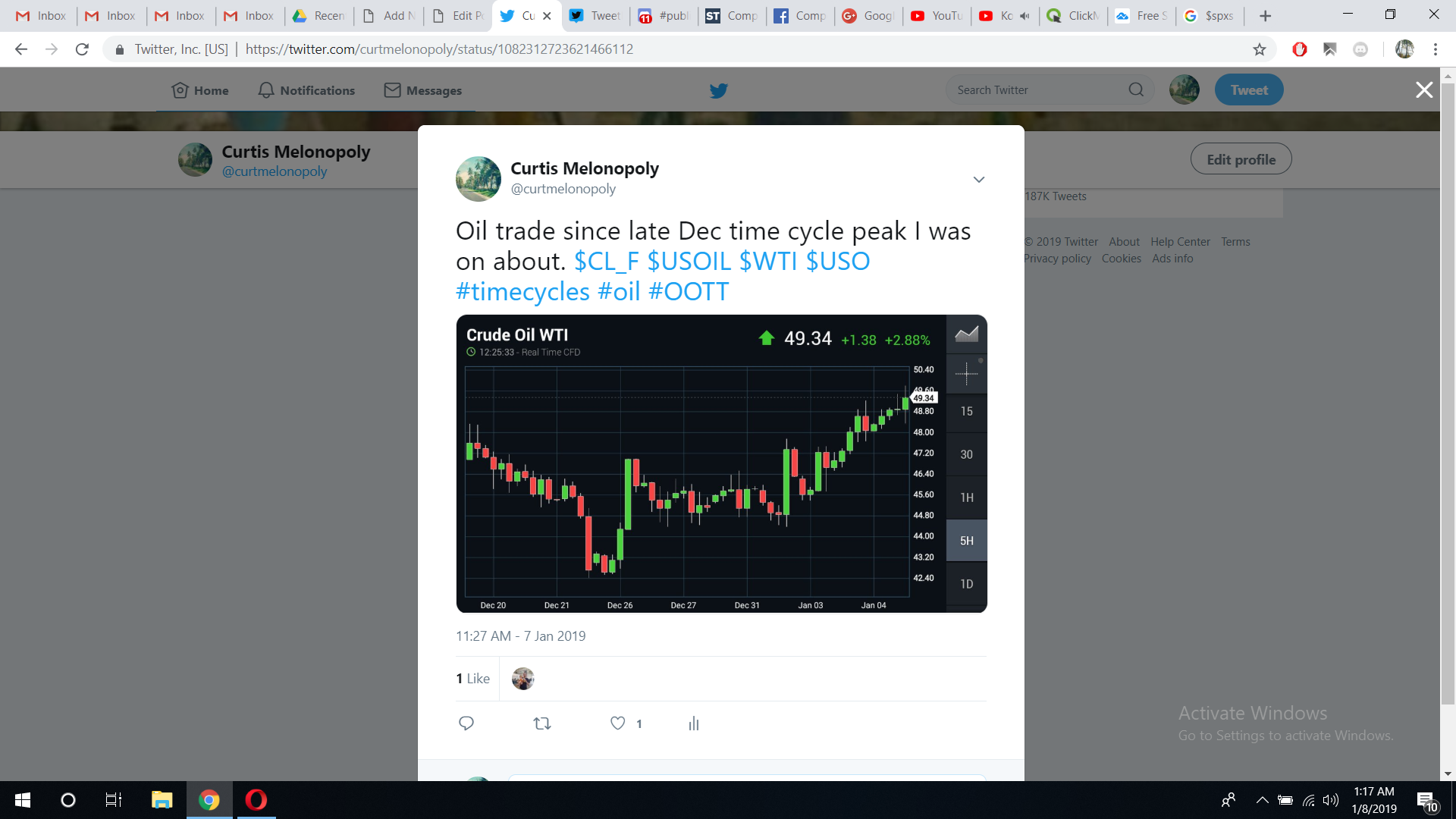

January 7, 2019 Crude Oil (CL_F WTI USOIL) Trading Strategies and a Review of Oil Trade Alerts from Mid Day Review in the Main Trading Room With Lead Trader.

THIS IS A VERY IMPORTANT TRADING SIGNAL VIDEO FOR CRUDE OIL.

Voice starts at 3:15 on video. Bad cold today, my apology for the cold I am suffering from.

There is an overview on this video also of market wide perspective and current reporting etc. We’re looking for markets to settle in post time cycle completion and post holidays over the next few days and then mid to late week start our entries in equity swing trades.

We are looking for 50.00 near term FX USOIL WTI and we near hit it today. There was a report out on oil out recently with the trajectory I expect.

After the 50.00 touch (or near – which has occurred at time of writing) we are looking for a pull back to support in to 20 MA or just over trading box at worst and then a run in to 52.00 – 55.00 as our next targets with a possible bullish scenario in to May 2019 in 83s.

Today the Saudis started talking about hope for 80.00 oil this year.

Natural gas BTW I am looking for a short term long on inflection of when oil turns down.

Some notes on Silver and Gold here on the video and VIX DXY BTC and general markets.

I may long VIX, long NatGas, long DXY all for a short period and short SPY for a short period and then when I think oil is going to turn back up and reverse the other trades. Details are discussed on video.

There is a detailed explanation on the video of the different scenarios of the trade alerts and how to use the signals best.

Please refer to these two most recent posts for crude oil trade strategy and signals:

Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

About the Crude Oil Trade Alerts Today

Earlier today we did take a trade long in oil. I personally traded oil and our machine trading did also trade. I followed the machine trade.

The video discusses this detail (how to use the alerts).

When the machine trade is signalling long or short high frequency you have to know that things can change quick so you as a trader have to be very careful with that. Jeremy can’t alert every high frequency trade until the APIs are working.

We did okay today on that trade but there was an upside target very close.

This was a break out trade and what can happen in the squeeze scenario, risk reward and why it can turn quick is discussed in detail on video.

VERY IMPORTANT: Also discussed in detail on this video in crude oil trade is reversals, trends, time cycles, price targets, chart model structure, sizing, quad intra day trading, the rules based system, trades at support in pull backs, and break outs for squeeze trade scenarios.

#CrudeOil #TradingStrategies #TradeAlerts