Strategies for Crude Oil Futures Trade February 12, 2019. Includes Rule-Set Instructions.

Below is the oil futures trading battle plan for day trading, swing trading intra-day and longer term swing trading.

This report includes a section that breaks out much of the rule-set for the 1 minute model with an actual trade progression as alerted in the oil trading room and on the Twitter alert feed. The report on whole provides key insight in to the rule-set we are using.

If you want to learn how we traded for over 63% gains last month, study this report and any recent reporting and videos closely. Our software techs believe 500% is not out of the question. I know it’s lofty, but when you consider the current win rate (over 90%) and that last months trading gains were only as a result of trading less than 10% of the time you can then begin to appreciate the power of a winning systematic oil trading rule-set.

The EPIC Crude Oil Algorithm Reporting below is an alternate format to the regular format – we will be using alternate formats during a period of establishing simplified trading strategies for our members (the trade rule-set).

Links for the 1 minute model and the 30 minute EPIC model are provided separate of this report to members as they are slightly different for different distribution lists (retail, commercial, institutional variations). If you need either please message us preferably at compoundtradingofficial@gmail.com.

Oil Trading Strategies Below are in Large Part Based on the EPIC Oil Algorithm Charting Model.

We Weigh Trade Probabilities on all time-frames against the EPIC model. This is important to consider when assessing our trade alerts for your own trading plan.

The EPIC Crude Oil Trading Algorithm Model below is by far the most predictable model we use for trade (30 Minute chart model).

The 30 minute EPIC model provides a general trading structure for the day. Important areas of support and resistance should be considered. It is common for the outside quad walls to be tested on the upside and downside. Long trades at the bottom support and short trades at the top of each quad or channel should be considered. Specific points of trade execution should be considered on lower time frame charting models.

On the EPIC Algorithm model a trade in to top of quad range is probable if price is over mid quad.

Refer to historical EPIC reporting and videos on yYouTube for ways to structure trades in the model.

- Trading the Range of the Quadrants and Range of the Channels:

- Respecting the key resistance and support areas of the oil trading model at quadrant walls (orange dotted), channel support and resistance (orange dotted), mid quad horizontal support and resistance (horizontal line that cuts through middle of quad) and the mid channel lines (light gray dotted).

- We are finding that when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot that trade will often test the mid channel lines (gray dotted) of the model. This causes the predictability of the quadrant support and resistance to be less (trade at quad support and resistance can be “sloppy”). This trade action in the model makes logical sense as a trend is not in play for an up or down channel. Another way to describe it would be trade using half quadrant support and resistance. While trade is in a sideways pattern on the daily your intra-day crude oil trading strategy should reflect this scenario. See examples from trade below:

-

“the predictability of the quadrant support and resistance to be less #crude #oil #trading #strategies” -

“when oil trade is not in an uptrend or downtrend and is trading sideways around a pivot (as it has the last eight or so trading days) that trade will often test #oil #trade”.

-

- Trade Size.

- Sizing should be considered at key support and resistance of the EPIC model structure. The model can be used to determine sizing bias on tighter time frames on one minute below. Sizing can also be a consideration for short term swing trading oil in the model.

Per previous;

Screen capture of trade moving through EPIC Crude Oil Algorithm range Jan 16 – 20. The quadrant walls and mid channel lines are support and resistance.

Timing Trades Using the One Minute Oil Chart Model.

- Volume.

- Wait for volume. Low volume periods have lower predictability in the models. Often early in futures trade and after 2:30 oil settlement daily are commonly low volume periods of trade.

- Trend.

- Determine the intra-day direction (trend) of trade. Strong bias should be considered for long or short positioning based on intra-day trend. Upward trend bias to long positions and down trend intra-day bias to short positions.

- Determine the trend on the daily chart also, some bias should be toward that. Watch the MACD on the daily, although it is a moderately late indicator it does confirm bias / trend.

- Check important timing for key global market open hours (inflections in intra-day trend can occur there, especially going in to New York regular market open).

- Support and Resistance.

- In an uptrend try and execute on support of the range on the one minute trading box (short term pull back) – the opposite is true in a downtrend. Break-up or break-down trades are more risky but can return positive results as long as a trader closes losing positions quickly.

- Trade Size and Positioning.

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. Our software for instance will enter with 10 contracts and release size as trade proves. See example below:

- Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- “M – Machine sell program initiated. Short 52.44. Stop 52.61 or buy program detected. 1 Min model price targets 52.29 52.11 51.88 51.66. Support 51.73 on recent 30 min model in trading room and 52.50 52.38 52.19 51.75 EPIC. Resistance 52.62 52.75 53.04 53.16 53.51 EPIC.”

-

Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- Our trader in crude oil trading room providing signals for trade alert that went out to members – screen capture.

- Position size and trimming to take profits as you go should also reflect key resistance and support on the EPIC algorithm model.

- Trim positions at mid trading box and top of trading box on the one minute chart model for long positions and the opposite is true in shorting. In a squeeze or sell-off this is more difficult and typically a trader will have to trade the break upside at resistance or downside as support is breached because pull-backs are not as likely in a squeeze.

- In a predictable structure sizing intra-day should be maximum at entry and trims at mid trading box and top or bottom of trading box – specific to the 1 minute chart model. Our software for instance will enter with 10 contracts and release size as trade proves. See example below:

- Using Trade Stops.

- From the example above, you will see the stop was set at 52.61 with allowance for a stop also to be triggered if momentum change was detected. “Stop 52.61 or buy program detected”.

- From the oil trading room see also this comment “M – there is a directional move component of the code (that will be included on rule-set that is in final edit tonight). If a move starts and doesn’t directionally continue with prescribed velocity, program will close at entry or prior.”

- The screen capture of the one minute chart below shows you the determined location for the stop for the trade.

- The stop was set just above VWAP and the resistance on the pivot trading box. Above is important to allow for other stops. Your stop will be a total of about 13 – 19 ticks depending on exact entry point.

- You will also notice that I have drawn the Fibonacci retracements on the chart to determine where the trading box pivot resistance is on the one minute model. If you do not know how to do this, be sure to either watch the videos we have on our You Tube channel, read through recent reporting or obtain some private coaching. We do not include the Fibonacci levels on the model because it makes the chart difficult to load on many machines – especially laptops.

-

The stop for the oil trade was set just above the pivot resistance and just above VWAP.

- The stop was moved to the trade entry point in the example below, as trade proved itself below the pivot support. “M – Machine stop at entry”.

- The stop at entry now put us in a no loss position. It was not moved until trade was below the pivot support AND trade hit the first Fibonacci support. Oil trade then bid up to 1 tick under the stop and entry point a number of times before continuing down intra-day.

- To be even more precise about the trade short entry point and the location of the stop you would have to view a fractal of the Fibonacci levels one down. This is not required or reasonable for the day trader executing orders manually to do, it would be too cumbersome for most traders. However, if you want to learn how to do this you can either get in to some trade coaching or ask at our next webinar for oil trading that will be held late February. I am simply pointing out that the precise entry and stop was not coincidental and the fact that trade returned to just under by one tick and ran sideways for nearly 30 minutes was no coincidence. That is machines in the oil trading market.

-

Oil trade dropped below pivot trading box support and hit first Fib mark and stop was now set to trade entry point.

- From the example above, you will see the stop was set at 52.61 with allowance for a stop also to be triggered if momentum change was detected. “Stop 52.61 or buy program detected”.

- Timing Trade Entry.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are).

- Below is an example screen shot of oil trade from the oil trading room example above that shows the intra-day trend of oil trade and the entry point short under the support which is now resistance.

- Trade was trending down in futures from open. Oil was now trading under support on 1 minute chart model, now resistance.

-

Crude oil trade short example chart shows intra-day trend, breach of support and execution of trade on chart.

- Below is an example screen shot of oil trade from the oil trading room example above that shows the intra-day trend of oil trade and the entry point short under the support which is now resistance.

- To pin point timing to the second you can use the pivot areas (top and bottom of range) and monitor the coil around the main support and resistance areas and use the smaller trading box around the pivots. Recent blog posts / videos discuss this and I will discuss further in near term video / blog posts.

- Indicators on the one minute that I use are the Stochastic RSI, MACD and Squeeze Momentum Indicator. The nature of these indicators on a short time frame like the one minute can be deceiving for even the more advanced trader. Use them with caution.

- The main trading box on the one minute is the support and resistance of the range (where the red and blue dotted and white dotted are).

- Using the Oil Trade Alerts.

- You can utilize our oil trade alerts in three main ways;

- The live trading room provides charting and voice broadcast from our lead trader. This is not a chat room – it is intended for traders to be able to hear our lead trader call trades live and view the charting he is using. Any chat is specifically kept to key signals from traders in attendance. This is primarily used by full time traders, institutional or private trading firms.

- The oil trade chat room (private Discord server) is for chat and oil trade signals etc. You can get push notifications to your phone for quick alerts. This is faster than the Twitter oil alert service provided but not as fast as being in the oil trading room with our lead trader. But the lead trader is not always in the live room so Discord provides fast alerts.

- The Twitter EPIC oil alert feed is also used by some of our traders.

- Trade alerts as shown in oil trading room (specifically the chat room private server on Discord) for trimming the short position as it proves out.

Trade alerts as shown in oil trading room for trimming the short position as it proves out. - Screen image of the oil trade alert feed on Twitter as the trade progressed.

-

Screen image of the oil trade alert feed on Twitter as the trade progressed.

- You can utilize our oil trade alerts in three main ways;

- Trimming Positions.

- In the example above (the screen shot of the Discord private member chat room), you see a series of trade alerts from our trader signalling position trimming.

- First Price Target Achieved. “M – first target hit 52.29 trim 10%.”

- The position was trimmed at 52.29 per the original alert signaled as follows “1 Min model price targets 52.29 52.11 51.88 51.66.”

- The amount or size of trim (cover) on the trade was determined to be 10% because this was only the first target in a highly probable trade. The probability rule-set encompasses about 5700 rules so we won’t go in to that here and is not needed for the oil trader to be highly successful using this trading system.

- The first price target alerted was 0.5 retracement on Fibonacci on 1 min oil trading model.

- Notice how trade reversed after the target was hit and was denied at the bottom of the pivot trading box and just under VWAP. Comment from lead trader in the chat room “when it dumped at 52.37 that was a VWAP touch at resistance – boom.”

The first price target alerted was 0.5 retracement on Fibonacci on 1 min oil trading model.

- Price Target 2 Hit. “M – Trim 20% 52.17 at target 2 @ 52.11 short time frame momo reversal”.

- When price misses a target and reverses, which is what it did in this instance (by a fraction), our rule-set in the strategy is to trim the position.

- The size of the trim was in accordance to price target 2 trim size in the rule-set, which is 20%.

- Below is the oil chart model showing the location of the alert to trim size and trade reversing intra-day after meeting price target objective.

Location of price target 2 was the trading box support on oil chart. Trade reversed a fraction before.

- At 30 minute candle expiring trade alert was sent to trim 10% because oil trade held support. In this case pivot trading box support. See chart below that coincides with alert “M – trim 10% 52.03 on timing”.

-

At 30 minute candle expiring trade trim 10% because oil trade held support. In this case pivot trading box support. - Remaining oil trade alerts to trim winning trade. Strategy works well. Oil trading room screen image is below.

- Alerts provided were as follows; “M – trim at 51.94 on timing (target 2 @ 51.88), 30%.

M – Correction: target 3 at 51.88

M – trim 10% 51.88 target 3 hit

M – stop on remaining 52.13 or 51.67 if hit.”

- Alerts provided were as follows; “M – trim at 51.94 on timing (target 2 @ 51.88), 30%.

-

Remaining oil trade alerts to trim winning trade. Strategy works well. Oil trading room screen image. - Trade alert to close oil trade position. “M – stop activated on remaining position 52.13″.

- Oil chart showing where to trim short trade at next Fibonacci support line.

-

Oil chart showing where to trim short trade at next Fibonacci support line. - Oil trade alert produced a 57 point move for an excellent win. Chart shows the trade progression.

-

Oil trade alert produced a 57 point move for an excellent win. Chart shows the trade progression.

Per previous;

Day Trading Crude Oil Futures One Minute Strategy Model Jan 27 504 PM FX USOIL WTI $CL_F $WTI $USO #Crude #Oil #Daytrading

Per previous;

The main trading box range is shown in chart below with purple arrows and the pivot at support and resistance trading box is shown with white arrows (for micro timing decisions).

Also Monitor Oil Resistance and Support Levels on the 4 Hour, Daily, Weekly and Monthly Chart Models.

Beyond using the EPIC Oil Algorithm model for weekly / daily trading strategy / structure and the one minute chart model for timing day trades, use the daily, weekly and monthly chart models for important decisions in oil trade.

The longer the charting time-frame the more serious support and resistance areas should be considered. In other words, key resistance on the monthly or weekly charts trump consideration on the daily and 4 hour and so on.

Trading trend, indicators, support and resistance, support and resistance, indicators and more should have bias to your trade sizing and positioning.

Crude oil trading strategy on 4 hour chart model, key areas of support and resistance noted with white arrows.

Although a test chart (for our machine trading), the 4 hour oil chart below has been responding well to the bounce trend in oil trade so I continue to use it. The key areas of support and resistance are noted, however, all lines are support and resistance levels.

Symmetry on 4 hour oil chart model should be considered. Currently trading over 50 MA.

Oil trade met the price target on the 4 hour model perfect to timing. See charts below.

Per previous;

4 Hour Crude Oil Chart – 20 MA seems the most logical support test for a long trade entry test likely 52.90 area on West Texas.

The previously published chart shows primary support areas to watch (per below).

Per previous;

Symmetry on this 4 hour oil chart model should be considered also. There are 3 options for trade trajectory here.

Per previous;

Key resistance and support for day trading crude oil futures on 4 hour test chart for sizing strategy on machine orders.

Symmetry on this chart structure says 55.30 on West Texas Crude is likely near Feb 1 and down to target. #oil #trading #strategy.

Per previous;

And with this chart also, it is responding well but also is a test chart. I’ve been watching it closely as the support and resistance areas on the charting do seem to be in play. Our techs are back testing test charts.

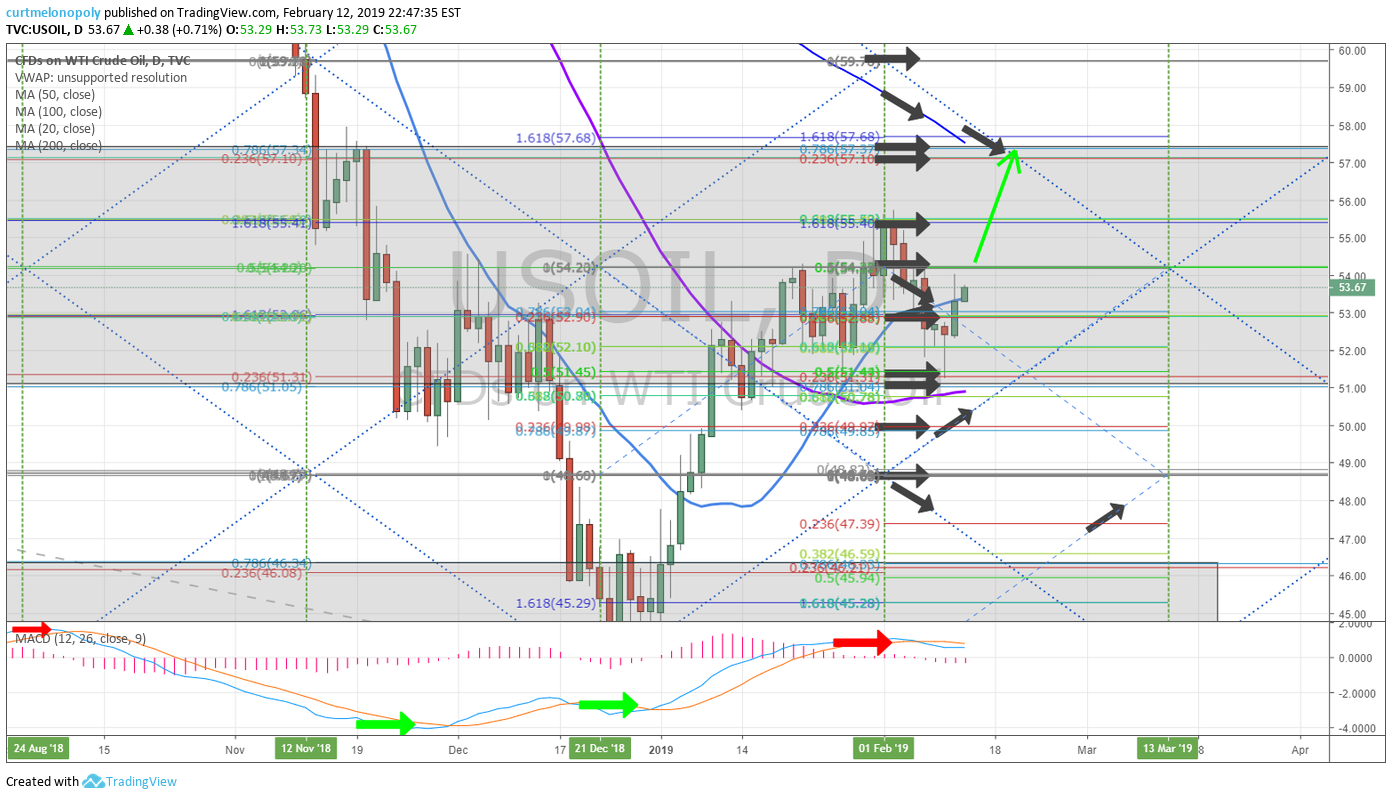

Daily crude chart resistance 54.23, above that holds and 57.32 is in play for Feb 20, 2019 price target.

Per previous;

Daily FX USOIL WTI chart shows 54.14 Feb 1 price target still in play, look for spike or drop in to date. #crude #oil.

A pull back to 20 MA on daily chart is most probable.

Per previous;

Key support and resistance on daily crude oil chart is noted for day trading strategy.

Various points of resistance and support on weekly oil chart. Watch the red trend lines close.

Per previous;

Weekly FX USOIL WTI crude oil chart has been responding well also to market support and resistance areas for trade.

Per previous;

Key support and resistance noted on weekly crude oil chart for futures trade strategy.

Other charts are used in decisions for bias toward trade, some are included below and for others visit the private oil chat room on Discord.

30 minute intra-day crude oil sketch chart from Curtis’ trading desk.

https://www.tradingview.com/chart/USOIL/etSPbOpT-30-minute-doodle-chart/

4 Hour chart structure shows sideways trade in crude oil of late. Also shows timing coming due this candle.

It is also highly recommended that you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

January 2019 Oil Trading Alert Profit / Loss.

Feb 6 – Day Trading Short for a Break to Downside Price Targets (How to with video).

How I Day Trade Crude Oil Short | Downside Break (Waterfall) | Oil Trading Strategies (w/video).

Jan 31 – Day Trade Timing Strategies for Crude Oil Trade Around Time Cycles and EIA.

Jan 28 – Day Trading the Support and Resistance of the Model. How to.

100 Tick Move | Crude Oil Day Trading Strategies | Trade Model Support and Resistance

Jan 27 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 23 – Day Trading Crude Oil Futures for Compound Gains.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow: