Compound Trading Monday May 8, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading, Videos and Live Stock Alerts. $HOTR, $AXSM, $INXP, $STRP – $PVCT, $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Members. We Have Big News About our Oil, Swing Trading, SPY, Gold, and Alerts packages!

https://twitter.com/CompoundTrading/status/861573420613603328

Accepting interest for mods for upcoming 24 hr Oil trading lounge launch info@compoundtrading.com $CL_F $USOIL $WTI #Oil #Trading #OOTT

https://twitter.com/EPICtheAlgo/status/860210973570850816

Notice: Our lead trader coaching schedule is fully booked and waiting list started. Keep that in mind if enrolling or email in advance.

https://twitter.com/CompoundTrading/status/858970678342451200

Monday was day six of trading challenge.

Prolly biggest week of trading for Q this year so far Having a blast being a guest in the @compoundtrading room for the 2 week challenge!

https://twitter.com/Quarry_Rock/status/861763086021251072

We Want (Need) You! Apply to Nearest Recruiting Station. Part 4 “Freedom Traders” Series. https://compoundtrading.com/want-need-apply-nearest-recruiting-station-part-4-freedom-traders-series/ …

https://twitter.com/CompoundTrading/status/858581529727049730

Last market trading session Post Market Stock Trading Results can be found here:

Stock Trading Results Fri May 5 – Day Five of Two Week Trading Challenge $TVIX, $OLED, $WKHS

https://twitter.com/CompoundTrading/status/861449936407113729

Premarket Trading Plan Watch-list can be found here (locked to respect members and unlocked to public about a week later for transparency):

Protected: PreMarket Trading Plan Mon May 8 $STRP, $ARRY, $MRK, $COH, $KATE, $CRSP, $FCSC, $ITCI, $AXSM, $REGN, $INO

https://twitter.com/CompoundTrading/status/861557044809265152

$STRP Straight Path’s stock up 26% premarket after receiving superior buyout bid.

Please note, for the next while, you will have to review the raw trading room footage to catch Premarket Chart Set-Ups, Market Open Trades, Intra-day Trades and Mid Day Chart Set Ups. Our staff time is being used up for other components of the platform and we also are producing the high quality learning library for our premium members. Once done, we’ll return to publishing the segments daily.

Most Recent Public Swing Trading K.I.S.S Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket Session:

Protected: PreMarket Trading Plan Mon May 8… $STEP, $ARRY, $MRK, $CIH, $KATE, $CRSP, $FCSC, $ITCI, $AXSM

Protected: PreMarket Trading Plan Mon May 8… $STEP, $ARRY, $MRK, $CIH, $KATE, $CRSP, $FCSC, $ITCI, $AXSM https://t.co/Lz6YJktm7K

— Melonopoly (@curtmelonopoly) May 8, 2017

Popular: $STRP, $SLV, $COH, $XLRN, $HCC, $PTCT, $INO, $BABA, $FDC, $BCO, $EA, $AME, $SBGI, $MTZ #premarket

Popular: $STRP, $SLV, $COH, $XLRN, $HCC, $PTCT, $INO, $BABA, $FDC, $BCO, $EA, $AME, $SBGI, $MTZ #premarket https://t.co/7WjeWMOuFs

— Melonopoly (@curtmelonopoly) May 8, 2017

Market Day, Chat Room Trades and Personal Trades:

Today I broke so many of my rules. The first two trades I took in $HOTR and $AXSM I went long assuming the momo would go my way not following the indicators AT ALL. And I paid. The stops list were hit – so I paid for my stupidity. It felt like I did when I first learned. Terrible feeling not being in control of your trade.On $HOTR lost 280.00 and $AXSM lost 350.00.

Then later I took a intra-day break out trade in $INPX and completely broke the get out quick rule when the break-out trade goes against you and I held and got VERY LUCKY. Made 1050.00 on it.

If the was a shining star it was in my swing trades from the other side of our platform. But the swing trades and our algorithm model trades don’t count in the trading challenge:)

$HOTR, $AXSM, $INXP

Curt M_1: .63 long $HOTR 2000

Curt M_1: 1000 $AXSM long 4.64

Curt M_1: Stop set .49 $HOTR

Curt M_1: Stop $ASTM 4.29

Curt M_1: $INPX closed 4.22

Curt M_1: 5000 at .21 c

Curt M_1: Did it the hard way but got it the bugger

Curt M_1: up about 500.00 on day lol

Learning How-to Trade Stocks, Chart Set-Ups, Lessons and Educational:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … #freedomtraders

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://t.co/nf8mdGBvpT #freedomtraders

— Melonopoly (@curtmelonopoly) May 7, 2017

Momentum stocks. Learn when to buy, hold, sell, short. It’s more predictable than many think. How to use indicators.

Momentum stocks. Learn when to buy, hold, sell, short. It's more predictable than many think. How to use indicators. https://t.co/TEErRdgR15

— Melonopoly (@curtmelonopoly) May 7, 2017

If there’s anything I can do to help with your trading drop me a line on contact page or DM https://compoundtrading.com/contact/ #howto #trade #stocks

If there's anything I can do to help with your trading drop me a line on contact page or DM https://t.co/1CNAfDsAeI #howto #trade #stocks

— Melonopoly (@curtmelonopoly) May 8, 2017

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size – under 5% of my daytrading acounts) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| DRAM | 4.79 | 292.62% | 38266 | Top Gainers | |

| INPX | 4.44 | 148.04% | 10397640 | Top Gainers | |

| STRP | 214.74 | 32.97% | 1212493 | Top Gainers | |

| BRID | 16.50 | 32.74% | 24453 | Top Gainers | |

| PETS | 30.38 | 25.43% | 5026146 | Top Gainers | |

| CGI | 2.25 | 21.62% | 3085960 | Top Gainers | |

| STRP | 214.74 | 32.97% | 1212493 | New High | |

| PETS | 30.38 | 25.43% | 5026146 | New High | |

| BRID | 16.50 | 32.74% | 24453 | New High | |

| ASYS | 8.19 | 13.28% | 130700 | New High | |

| DRAM | 4.79 | 292.62% | 38266 | Overbought | |

| IAC | 100.55 | 0.10% | 1042935 | Overbought | |

| INPX | 4.44 | 148.04% | 10397640 | Unusual Volume | |

| SGOC | 1.65 | 3.12% | 1536946 | Unusual Volume | |

| SHE | 66.28 | -0.11% | 255896 | Unusual Volume | |

| HOTR | 0.49 | 20.99% | 11364484 | Unusual Volume | |

| BPL | 67.39 | 1.60% | 401521 | Upgrades | |

| ADES | 9.99 | 6.39% | 239163 | Earnings Before | |

| TNAV | 8.55 | -0.58% | 85875 | Insider Buying |

Algorithm Charting News:

“The day my life changed forever. They had told me that prices are random and that no one could beat the market.”

"The day my life changed forever. They had told me that prices are random and that no one could beat the market." https://t.co/uYEkFW5vup

— Melonopoly (@curtmelonopoly) May 9, 2017

Conventional charts draw lines on charts after price occurs. My charts – days wks in advance. Big difference. $USOIL $WTI #OIL #OOTT #future

https://twitter.com/EPICtheAlgo/status/861262645281869824

Wowza. Live video of direct price and time target hit Wed 10:30 #EIA report. $USOIL $WTI #Algo #OIL #OOTT

Wowza. Live video of direct price and time target hit Wed 10:30 #EIA report. $USOIL $WTI #Algo #OIL #OOTT https://t.co/mqNh8T6QVb

— Melonopoly (@curtmelonopoly) May 4, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

$GOOGL Long since 859.01 Trading 948.45 with SQZMOM green MACD ramped and decent vol. #holding #swingtrade Kings Queens and Castles.

$GOOGL Long since 859.01 Trading 948.45 with SQZMOM green MACD ramped and decent vol. #holding #swingtrade Kings Queens and Castles. pic.twitter.com/U04zmOBX1f

— Melonopoly (@curtmelonopoly) May 4, 2017

Swing trade members published forecast for $GOOGL “Feb 3 – 1003.17 Price Target in 2017”

Swing trade members published forecast for $GOOGL "Feb 3 – 1003.17 Price Target in 2017"

— Melonopoly (@curtmelonopoly) May 4, 2017

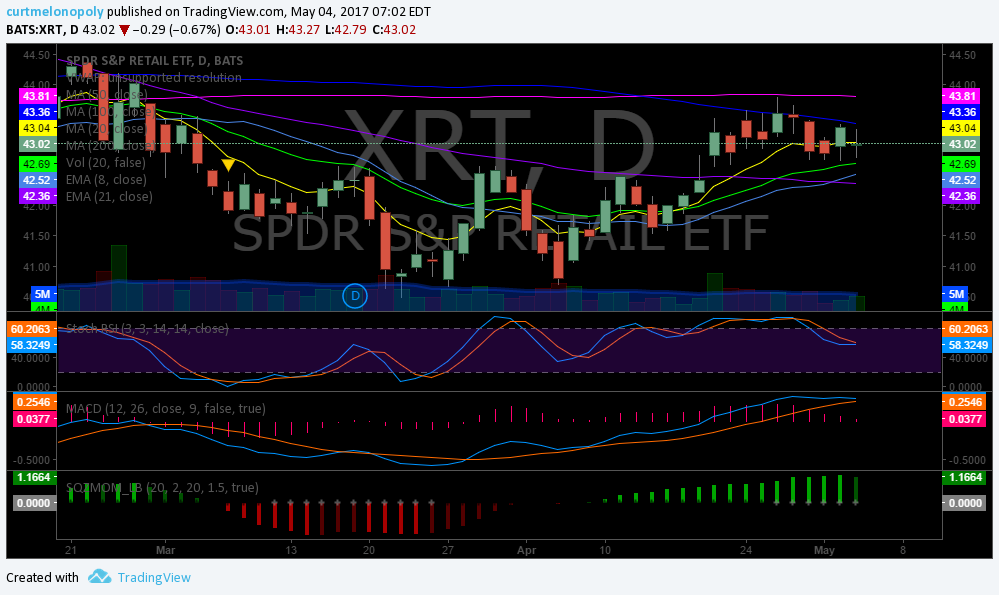

$XRT SPDR S&P Retail ETF Trading 43.02. Holding from 41.67 but MACD may turn down any second, and if so I will likely close. #swingtrade

$XRT SPDR S&P Retail ETF Trading 43.02. Holding from 41.67 but MACD may turn down any second, and if so I will likely close. #swingtrade pic.twitter.com/O42X5699wg

— Melonopoly (@curtmelonopoly) May 4, 2017

$VFC Swing trade went well, now we watch. Closed 57.84 April 27 before earnings.from 53.50 entry no hold through earnings. #swingtrading

$VFC Swing trade went well, now we watch. Closed 57.84 April 27 before earnings.from 53.50 entry no hold through earnings. #swingtrading pic.twitter.com/K4nHusKQUS

— Melonopoly (@curtmelonopoly) May 4, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD, $XAUUSD, $GC_F :

NA

Gold Miner’s $GDX:

NA

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

Why OPEC Lost The War Against Shale, In Four Charts

Why OPEC Lost The War Against Shale, In Four Charts https://t.co/PG1sIyfLt0 pic.twitter.com/Ec2NLbfgKR

— zerohedge (@zerohedge) May 8, 2017

Oil down 68.2% from July 2008. $CL_F $USOIL $WTI #OIL #OOTT

In Play: $IMMU, $SHAK, $PBYI, $AAOI, $ZNGA, $UWT, $NAK, $UCO High Uncertainty: $APHB, $NUGT, $UE https://t.co/8LlEjFGCrW

— Melonopoly (@curtmelonopoly) May 5, 2017

Volatility $VIX:

Volatility Index closes at its 4th lowest level in history (9.77). Only Dec 1993 saw a lower $VIX close than today.

Volatility Index closes at its 4th lowest level in history (9.77). Only Dec 1993 saw a lower $VIX close than today. pic.twitter.com/tiXhGGggBw

— Charlie Bilello (@charliebilello) May 8, 2017

$SPY S&P 500 / $SPX:

NA

$NG_F Natural Gas:

NA

Markets Looking Forward:

#earnings $NVDA $VRX $DIS $JCP $PCLN $ACIA $TSN $ON $NTES $PLUG $KITE $TEVA $SNAP $AGN $NWL $TSEM $JD $HZNP $SYY ??

#earnings $NVDA $VRX $DIS $JCP $PCLN $ACIA $TSN $ON $NTES $PLUG $KITE $TEVA $SNAP $AGN $NWL $TSEM $JD $HZNP $SYY 🎯🚀 https://t.co/lRUHPnPhh5

— Melonopoly (@curtmelonopoly) May 7, 2017

Judging by sell-side sentiment, we still have a long way to go in stocks. BofAML:

Judging by sell-side sentiment, we still have a long way to go in stocks. BofAML: pic.twitter.com/tHNKp0AqqG

— Tracy Alloway (@tracyalloway) May 9, 2017

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day).

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

Curt M_1: $ERS halt

Market Maven: mornin

Curt M_1: Hey maven

Curt M_1: looks good out there

Flash G: action for sure

Flash G: news

Curt M_1: $SBGI Halt

lenny: Lots of halts lots of news.

Curt M_1: Start premarket review at 9:15 there’s a lot going on here.

Flash G: I’ll say

Hedgehog Trader: Hi everyone

Market Maven: morn

Spiegel: Good mornin everyone

Flash G: GM

Flash G: The MA’s are here.

Market Maven: mornin all

Market Maven: What’s hot in OTC land Spiegel?

quarryrock: good am folks!

Market Maven: hey qr

Curt M_1: morn

Sandra: $HOTR is hot

Spiegel: FNBC again

Spiegel: and FNCX

Curt M_1: What r u showing for $FNCX?

Spiegel: down to .89 now. has to break $1.00 to be good

Sandra: $TOPS action again today

Hedgehog Trader: $LAC.TO / $LACDF looks like it will open higher

Spiegel: CGIX launched a new multi-gene, liquid biopsy lung cancer test that is supposedly changes the paradigm for monitoring them

Curt M_1: Still scanning etc be a few mins here

Hedgehog Trader: wonder if $ESEA gets a Europe bump

Hedgehog Trader: both $ESEA and $TOPS are based in Greece

Curt M_1: On mic in 3 mins for open>>>>>>>>>>>>>>>

mat: GM all. Oil algos nice and alert this AM it looks like lol

Curt M_1: morn

Tradergirl: gm kk

Market Maven: lol

Flash G: mornin girl!

Flash G: in pearls

Tradergirl: i saw kate in email and HAD to pop in lol

Flash G: hahahaha

Flash G: tell us the way:)

Curt M_1: .63 long $HOTR 2000

Market Maven: right in behind ya

Flash G: $AAPL time

Curt M_1: 1000 $AXSM long 4.64

Sandra: 4.47 I’m in at lol

Spiegel: in at 4.50

Spiegel: should I sign up for oil now or do you think I have a few hours?

Flash G: adding to $AAPL swing

mat: 5 cent tick pilot as well which can make things screwy

quarryrock: added $SLW $19.50 Cs .40

mat: Like that play QR. Looking at some adds on the common side this am in the miners

quarryrock: long $MEET shs $6.09

mat: CHK looking nice, looking for a clear and close over the 50

Spiegel: Curtis, If I buy the 6 month EPIC bundle for $1599 do I still get the 24 hour room or is the 24 hour room only on a monthly basis for $399 with promo code?

Spiegel: ok

quarryrock: BTO $DIS $112 $1.90 5/12

Flash G: $WKHS shorting any lift

Spiegel: FNBC is the one- So dm to Curtis Melanopoly twitter?

Spiegel: yes

Spiegel: it was from pre-market

Spiegel: Ok, I DM’d you

Spiegel: yes

Spiegel: World Traveller

Spiegel: no

Spiegel: no World Traveller @ JorgeSamosa

Tradergirl: world traveller, ‘nuf said, best handle 😉

Tradergirl: see kk always bet on hopium

Tradergirl: and me

Spiegel: wasn’t me

Curt M_1: $SIEB halt

Curt M_1: Stop set .49 $HOTR

Curt M_1: Stop $ASTM 4.29

Spiegel: looking forward to it

Spiegel: I’m an EPIC member!

Spiegel: Hurts paying with Canadian dollars

Sandra: $NAK is on

Sandra: yeehaw me too

Sandra: made a lot of money with that thing lately hahaha

Flash G: You and the Shieks

Market Maven: oh my

Flash G: its ture

Flash G: true

Flash G: they’re in EPIC heavy duty big

Market Maven: ya

Spiegel: that AAOI I mentioned from last week still going

Spiegel: 🙂

Market Maven: I actually shorted $AAP Flash – and Won!

Tradergirl_1: FlashG, u mean literally /opec/ etc

Market Maven: ha

Flash G: yes um

Tradergirl_1: get. out. lol.

Hedgehog Trader: yes sir

Hedgehog Trader: it’s been volatile for sure

Curt M_1: Back in 5>>>>>>>>>>>>> 10:29

OILK: Just got my EPIC reg – coupon code worked nice – hopefully room opens early

Curt M_1: likely will – brb

Spiegel: If you have Irish remorse if you lose then I have German angst

Tradergirl_1: Curt, are these oil scalps u r discussing now? or swings? a bit lost

Spiegel: AXSM dropping

Tradergirl_1: right, thx, level to level atm then, not predicting more distant tgts

Tradergirl_1: yep same here ok same pg thx

Tradergirl_1: ya, I use h4, but don’t wanna fade epic lol

Spiegel: So if you went short where you want to, would you just hold through everyone quadrant bounce or would you get out, back in, out…back in etc.?

Spiegel: so channels within channels within channels

Spiegel: HOTR tanking

quarryrock_1: lol just patient here

quarryrock_1: bit of a snoozer today

Tradergirl_1: bonds tanking

Tradergirl_1: urre!

Spiegel: I had LQMT on my top 10 charts but forgot to mention it this morning

Spiegel: and that will all be part of this room?

Tradergirl_1: never traded otc, aren’t commish-intensive? not even sure how trading works

Spiegel: not commish intensive unless with the wrong broker

Tradergirl_1: $LQMT great find Spiegel. what broker is good for these? halts seem scary

Spiegel: I’m Canadian so I can’t help an American.

Tradergirl_1: ok np

Curt M_1: C ya at noon:) for chart set up intensive tighter time frames for daytrading swing set ups! >>>>>>>>>>>>> off mic 11:01

Spiegel: IB charges .005 per trade up to .5% of trade value. So not good with really low priced stocks. So not good if buying over 2000 shares of something

Spiegel: Look into TD Ameritrade. Get thinkorswim with it.

Spiegel: $7 flat if do 150+ trades per Q

Deb: too bad that pen sucked back at lunch

Dave: I agree with you guys on LMQT very nice play

quarryrock: $EFA fading – right at the money now so need a bit more to capture this trade

quarryrock: still in those puts

Sammy T: $VIX drop is crazy

Sammy T: Man Flash you’re on the right side of this trade again

Market Maven: Flash been around for a while:)

quarryrock: added more $DIS $112s goal is to exit before the report on 50%

quarryrock: $1.23

quarryrock: i want some $MEET $6 but refuse to pay more than .40

quarryrock: fill at .40 or no trade

quarryrock: quick note on Disney there has been massive call buying in June at the $120 strike weeks ago. someone is bullish

quarryrock: open interest is 69,000 contracts Jun 16

Hedgehog Trader: $NAK movin

Curt M_1: On mic at 12:10 for mid day – sorry – one more quick call :):)

Tradergirl: Thx Spiegel, I have old tos account, might consider, on TradeStation atm, loathe it, tos way better

Curt M_1: on mic for mid day charts >>>>>>>>> 12:09

Tradergirl: well done Flash

Tradergirl: KK do u ever sell option premium, ex: credit spreads for summer $

Tradergirl: selling option premium for u kk

Spiegel: living the life!

Tradergirl: lol

Tradergirl: cld u pls quickly peek at kate, haven’t looked at in ages, bottoming maybe

Tradergirl: obsessed w her stuff

Tradergirl: guessing fundys awful, haven’t checked

Tradergirl: gorgeous bull candle early 17, buyer commitment

Leanne: Curtis

Tradergirl: moody as heck looooool

Hedgehog Trader: haha

Hedgehog Trader: opportunity and danger

Leanne: just remember that a happy wife is a happy life

Tradergirl: ya, looking at flush to 15ish, guessing fundys awful, ya no kidding hedgehog, lol Leanne!

quarryrock_2: BTO starter position in $KSS

quarryrock_2: 5% div yielder reprting thurs looks tasty

Curt M_1: lol going to be nice when these new systems arrive omg

Curt M_1: 5000 Long 4.01 $INPX Daytrade tight

quarryrock_2: House of Mouse through vwap

Hedgehog Trader: wonder how $ICLD moving averages look

Hedgehog Trader: looks like it’s basing

Curt M_1: $ICLD 200 ma on 30 min if it gets up above and keeps it then that’s likely the start of the turn

Curt M_1: imo

Market Maven: No Shares to short $INPC on IB

Market Maven: $INPX

quarryrock: cramer pumpin $KSS

Hedgehog Trader: Cramer danger

quarryrock: lol

Hedgehog Trader: 🙂

quarryrock: $MEET implied move is 14%

quarryrock: AAPL cured cancer apparently

quarryrock: what a beast

Dan: haha

Hedgehog Trader: $NAK booming

Curt M_1: $INPX closed 4.22

Curt M_1: 5000 at .21 c

Curt M_1: Did it the hard way but got it the bugger

Curt M_1: up about 500.00 on day lol

Market Maven: lucky

Sandra: $OPTT ITHG set up

quarryrock: $MEET HOD

Sandra: Correction: $OPTT ITG setup

Spiegel: TSLA on the move the last few minutes

Spiegel: 306 to 309+ almost 310

Spiegel: over 310 now

Spiegel: Even UWT up almost 5% from the lows just before noon

Curt M_1: looks like these algo charts and screen recorder just wont run at same time on these laptops – going to have to run that software you talke about speigle until laptops come

Spiegel: give it a shot. It’s good to have anyway

Curt M_1: ya

Market Maven: should work

Spiegel: keeps computer running smooth although even it can be overwhelmed with too much running at once

Flash G: $TSLA sure looks good

Flash G: market looks like it will be very bullish tomorrow

Curt M_1: you’re likely right falsh

Sandra: $NAK having an outstanding day

the lion: hello all and everybody

Market Maven: hey lion

the lion: mnkd is this shortsqweez ??????

quarryrock: Curt thoughts on $SLV ?

Curt M_1: On $SLV I personally would wait for the MACD on daily to curl up but I typically miss first 15% of a move because of it….

Curt M_1: $SLV on a daytrade basis….

quarryrock: im stalking USLV

Curt M_1: MACD on 60 min $SLV is trending up and price hasn’t moved – that’s actually still bearish but…. hmmmm price action says short term bottom so it’s undecided imo

quarryrock: ok TY

Curt M_1: Even the 5 min is tough

Curt M_1: its a tough chart all around – it says indecision lol

Curt M_1: $MNKD sure got lift wow

Curt M_1: coming off hard now tho

OILK: Curt your $CBMX is HOD

Spiegel: Just signed up for Swing Trading service too!

Flash G: now that you will like

Flash G: my specialty

OILK: wow $CBMX

OILK: ya I make money off swing and oil all the time I daytrade for fun lke curt

Curt M_1: back in 20

Curt M_1: good to hear spiegel!

Spiegel: Thanks. Although you’ll probably lose me in here once my one month trail is over on the 17th. The oil room and the swing will be enough to handle I think.

Spiegel: Plus I’ll be travelling all summer and won’t have time to watch 9:30 to 4 markets

quarryrock: if $MEET beats tonite expect this to fly to $8 tomrrow as players will pounce

quarryrock_1: could attract alot of MOMO bees

quarryrock_1: BTO $TGT $57.50 .37 weeklies

quarryrock_1: calls

quarryrock_1: if the strips beat this will pop ahead of their earnings

quarryrock_1: cheaper way to play the retail names if bullish

quarryrock_1: im bullish M KSS and JWN fyi

quarryrock_1: only playin KSS and TGT tho

quarryrock_1: interesting $MEET CEO and CFO are presenting tomrrow in San Fran at Internet and Digital Media Conf.

quarryrock_1: webcasting the presentation live too apparently FWIW

quarryrock: BTO $YELP $36 Cs $2.15

Curt M_1: Back for the close lol sorry bout that

Market Maven: pretty calm close

Curt M_1: Quarry…. you kicking my butt today>>

Flash G: I think he is:)

quarryrock: lol nope im just diversifying my plays to increase bankable opptys

Curt M_1: nice

Curt M_1: I’m going for the grandslam on Turn around tuesday haha

quarryrock: this week is loaded with trades

Curt M_1: yup

quarryrock: nice!

Spiegel: no singles…no doubles……just grand slams!

Curt M_1: yup one hit thats all I need lol to catch him lol

Curt M_1: $INPX kept going

quarryrock: im holding $MEET into ER ! they better not failing me ! 🙂

Curt M_1: wow

Market Maven: u should be ok

Sandra: i considered it too

Curt M_1: good luck QR

Hedgehog Trader: iirc $MEET tends to do well with Valentine’s Day ramping up biz- but we’ll see

quarryrock: nice!

Hedgehog Trader: but i haven’t followed as much lately

quarryrock: everything ive read up on them has been bullish the analysts anticipate a strong qtr and guide we shall see

Hedgehog Trader: good stuff

Sandra: $SNAP snapped

Curt M_1: Y’all have a GREAT NIGHT!!!

OILK: see ya guys

Market Maven: bye bye

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $HOTR, $AXSM, $INXP, $STRP – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500