Welcome to the Compound Trading Weekly Swing Trading Stocks for the Week of Aug 28, 2017. Compound Trading, Swing, Trading, Stock, Picks, $ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $SOHN, $PDLI, $LPSN, $LTRX

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

This report is the new list in 1 of 5 weekly, the other 4 reports will be out within the next 24 hours. We plan to have an exceptional September to finish the quarter

We will categorize our coverage soon as we are following more stocks weekly than we expected when we first started the service.

Swing Trading Quarterly Performance P/L Report Swing Trading Q2 Performance P/L Report $NFLX $TWLO $BABA $BA $GOOGL $AMZN $XIV and more.

https://twitter.com/swingtrading_ct/status/841079400485478400

July 2017 Trading Challenge P/L Report $NFLX, $XIV, $AAOI, $AKCA, $BWA, $SRG, $MCRB, $UGLD, $IPXL, $HIIQ and more

https://twitter.com/CompoundTrading/status/895889454212108289

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) or email me (info@compoundtrading.com) with specific questions regarding trades you are considering for assistance.

It is critical however that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

Mid Day Trade Set Ups Aug 25 $CDNA, $SPY, $GOLD, $ARWR, $NAK, $RTNB etc

Mid day trade set-ups Aug 24 $ARWR, $XXII, $SHOP, $PETS, $PSTG, $BZUN, $EDIT etc

Aug 11 Trade Set Ups $SPY, $BTCS, $BTSC, $BITCF, $CALA, $ERGX, $USOIL, $SGMO, $TWLO, $AAOI

Aug 9 Trade Set Ups $BOFI, $ACHN, $AMMJ, $USOIL, $WTI, $GLD, #GOLD, $XIV, $CBLI …

Aug 8 Mid Day Trade Set-Ups $TWLO, $USOIL, #GOLD, $VRAY, $KORS, $OMVS, $BSTG, $XXII, $ESPR…

Aug 7 Part 2 Trade Set-up Review $HIIQ, $ZAGG, $WTW, $SPWR, $YELP …

Aug 7 Part 1 Trade Set-ups $OMVS, $TMPS, $XXII, $ARWR, $BBRY, $MYOK…

Fri Aug 4 Mid Day Chart Set-up Review $CSTM, $SPNE, $OMVS, $SRG, $XII, $YWLP, $WTW, $SENS, $ESPR …

Aug 3 Trade Set-ups $USOIL, $PTN, $ROX, $GIII, $RIG, $ATVI, $NLSON

Aug 2 Trade Setup Review $USOIL, $LL, $IPI, $PZZA, $AEGN, $SPWR, $GLUU, $OMVS, $XIV ….

Stock Pick Coverage

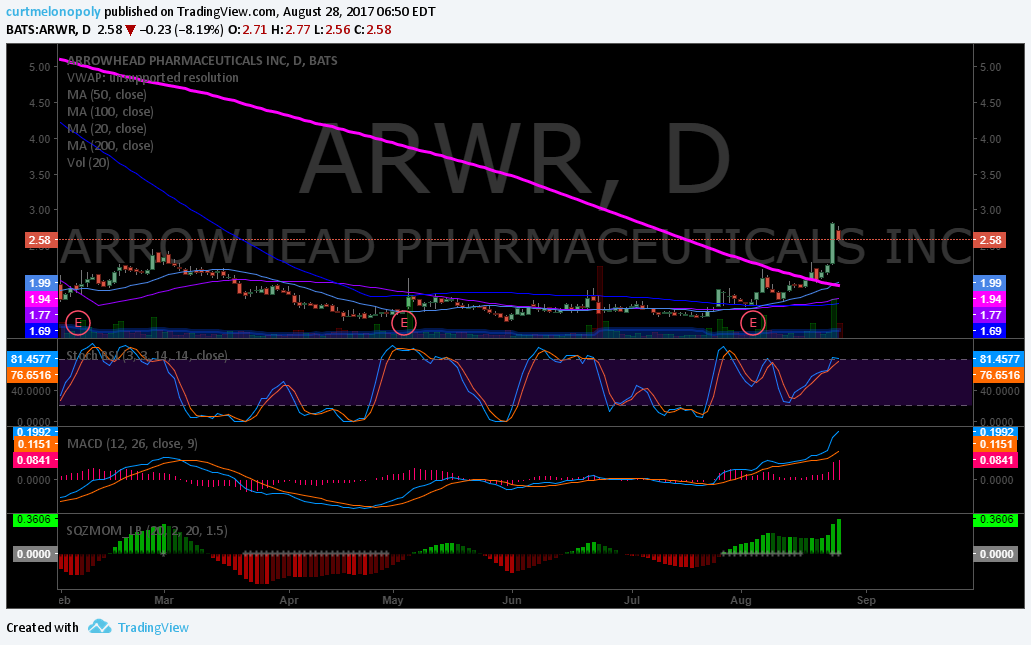

$ARWR – Arrowhead Pharmaceuticals

Aug 28 – Trading 2.58. $ARWR Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. #swingtrading

https://www.tradingview.com/chart/ARWR/7GYmLwsD-ARWR-Over-200-MA-watching-for-follow-through-MACD-SQZMOM-and-S/

$CDNA – Caradex

Aug 28 – Trading 2.98. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$NAK – Northern Dynasty Minerals

Aug 28 – Trading 1.78. Regained and over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$XXII – 22nd Century Group

Aug 28 – Trading 2.23 over 200 MA watching for follow through. Waiting for MACD to curl back up.

$SHOP – Shopify

Aug 28 – Trading 103.74 This is a break out – over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Watching for break out follow-through.

$SSW – Seaspan

Aug 28 – Trading 7.34 Test the 200 MA watching for a break. MACD SQZMOM and Stoch RSI trending up.

$ITCI – Intra Cellular Therapies

Aug 28 – Trading 15.02. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$SENS – Senseonics Holdings

Aug 28 – Trading 2.70. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$HCN – Welltower

Aug 28 – Trading 71.92. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up but under 50 and 100 Ma’s – on watch.

$GTHX – GT1 Therapuetics

Aug 28 – Trading 17.25 Over what would be 200 MA and a relative new issue (IPO) watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$EXTR – Extreme Networks

Aug 28 – Trading 10.87 in premarket. This is a break out – over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Watching for break out follow-through.

$EDIT – EDITAS

Aug 28 – Trading 19.30 premarket. Waiting for MACD and SQZMOM to turn back up and run.

$IPI – Intrepid Potash

Aug 28 – Trading 3.54. This is a trending stock over 200 MA retesting 20 MA on pull back. Watching bounce and indicators like MACD for a turn.

$MBRX – Moleculin Biotech

Aug 28 – Trading 2.36. Over 200 MA on pull back waiting for MACD and SQZMOM to turn back up.

$SOHU – SOHU.COM

Aug 28 – Trading 54.66. This is a trending stock over 200 MA and on pull back to 20 MA. Watching MACD and SQZMOM to turn back up.

$PDLI – PDL BIO Pharma

Aug 28 – Trading 3.00. Over 200 MA with all indicators trending and filling a gap with natural resistance on deck. Watching for follow through.

$ESPR – Esperion Therapeutics

Aug 28 – Trading 48.27. Over 200 MA trending and waiting for MACD and SQZMOM to curl up.

$LPSN – LivePerson

Aug 28 – Trading 12.65. Over 200 MA trending and on pull back waiting for MACD and SQZMOM to curl up. Recently hit natural resistance so it is on test.

$LTRX – Lantronix

Aug 28 – Trading 2.34 Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Under 100 MA so watching that test also.

$XOMA – XOMA Corp

Aug 28 – Trading 10.71. Had a large pop last week. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Daily volume is the main issue. Watching.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $SOHN, $PDLI, $LPSN, $LTRX