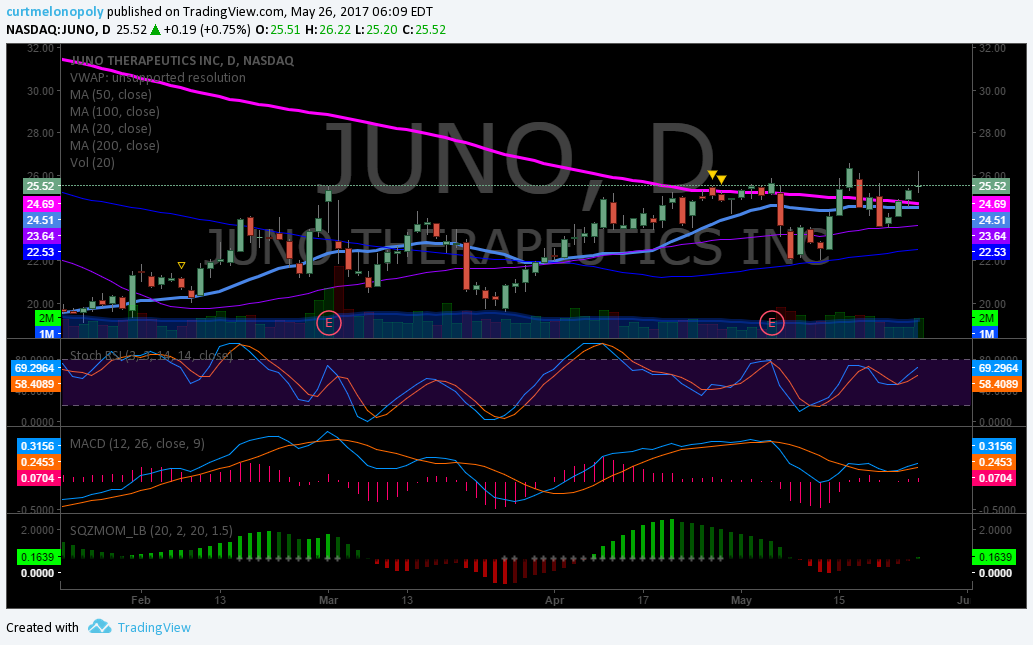

Tag: $JUNO

PreMarket Trading Plan Mon June 5 $LOXO, $DVAX, $TGTX, $LTBR, $JUNO, $GLD, GOLD

Compound Trading Chat Room Stock Trading Plan and Watch list for Monday June 5, 2017; $LOXO, $DVAX, $TGTX, $LTBR, $JUNO – $SSH, $LGCY, $TRCH, $ESEA, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Swing Trading and Day Trading are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to [email protected] and ask Sartaj to get you info. Most of those I spoke to are opting for email only, but the Twitter alert system is available for those that want it.

Post Market Reports:

Sorry we’re running behind on them – we’ll get them caught up this week. Getting the 24 hour oil room ready took a bit more manpower than we expected. But we’re on for June 12 launch!

Most recent lead trader blog posts:

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series.

Trading Set-ups. Video Explains Predictable Winning Process. Part 6 b) “Freedom Traders” Series. https://t.co/7XFIQ68CoY

— Melonopoly (@curtmelonopoly) May 29, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Trading Plan (Buy, Hold, Sell) and Watchlists:

Morning momentum stocks on watch so far: $LOXO, $DVAX, $TGTX

Bias toward / on watch: Watching to possibly close some longer term swings I have done well with such as $GOOGL, $AMZN and others. Watching Gold with a possible chart set up and looking for a bounce in oil (trading at 47.33 7:51 ET).

Markets: $SPY $ES_F $SPX I continue to be cautiously optimistic grinding up, $GLD, $GDX, $SLV continue in indecision but the charts say it could be up soon. $USOIL, $WTI ran up and tanked again overnight so we’re watching for a bounce. $DXY and $VIX no significant news.

OTC on watch: Randoms I am still watching.. $PGPM, $BRNE, $ELED, $PVCT, $LIGA (I hold),$AMLH, $BLDV $UPZS $OPMZ $MMEX $ACOL $BVTK $USRM $ORRV $JAMN $PFSD

Gaps to Watch:

Recent Momentum Stocks to Watch:

Stocks with News: $LOXO, $SRRA, $TGTX, $PBMD

Recent SEC Filings to Watch: $LACDF Lithium Americas Corp Director Acquires C$266,750.00 in Stock

Short Term Trader’s Edge: $LTBR, $JUNO

Some Earnings Today: $ASNA $CASY $COUP $THO

Holds: All holds are small size (less than 5% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA, $PVCT

Various Recent Chart Set-ups on Watch: $LTBR, $RCL, $JKS, $CALA, $LITE, $JUNO, $PCRX, $CTSH, $FEYE, $TSLA, $NVO, $FSLR, $AAOI, $HIIQ, $JASO, $VIPS – We are working on these and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day.

Midday Chart and Trade Setup Review June 1, 2017:

Midday Chart and #SwingTrading Setup Review, June 1, 2017: $JUNO $USOIL $WTI $GOOGL $VIPS $AGN $SNAP and more.

https://twitter.com/CompoundTrading/status/869275423879958530

Market Outlook :

Watch those large and mega caps – when they stall things could change. And don’t forget our $SPY algo warned about recent highs.

Market News and Social Bits From Around the Internet:

8:30am

-Productivity/ Costs

-US Consumer Spending

9:45am

PMI Services Index

10am

-Factory Orders

-Non-Mfg Index

-Market Conditions Index

$LOXO premarket up 40.77 % trading 68.95 on positive cancer drug trial news.

$SRRA Sierra Oncology Reports Encouraging Initial Progress from Ongoing Phase 1 Clinical Trials of Chk1 Inhibitor SRA737

$TGTX Announces Positive Data from Phase 3 GENUINE Trial of TG-1101 in Combination with Ibrutinib

$PBMD LAG-3Ig (IMP321) DEMONSTRATES POSITIVE SAFETY AND EFFICACY QUALITIES IN BREAST CANCER CLINICAL TRIAL

$XAUUSD 100 MA breaching 200 MA on Daily. SQZMOM green and MACD trending up. #GOLD $GLD pic.twitter.com/VThOIKY12j

— Melonopoly (@curtmelonopoly) June 5, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List :$LOXO, $DVAX, $NAKD $CLSN $HMNY $PBYI $TGTX $FOR $GIMO $PERI $RNN $MBVX $HAL $AEHR $MNKD $ARRY $HTGM $P I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $UWT $SPY $XIV $LABD $JDST $DUST $JKS $SNAP $CHK I will update before market open or refer to chat room notices.

(3) Other Watch-List: $LABU $LOXO $DVAX $PBYI $TGTX $HMNY

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Recent Upgrades: $WEX $LOXO $STT $OUT $EC $OMAM $PB $PBCT $FOE $UFS $RFP $GPS $NAV $STI $IVZ $EBAY $EV $INCR $MDP $CW $SKX $YELP as time allows I will update before market open or refer to chat room notices.

(6) Recent Downgrades: $PRGO $VEEV $AAPL $AMG $FII as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $LOXO, $DVAX, $TGTX, $LTBR, $JUNO – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD

Swing Trading Fri May 26 $AMBA, $FSLR, $AAOI, $GOOGL, $AMZN, $CALA, $LITE, $JUNO, $HIIQ, $EOG, $COTY, $GREK ….

Good Morning Swing Traders and Welcome to the Compound Trading Weekly Swing Trading Report (3 of 3) for Week of May 22, 2017. $AMBA, $FSLR, $AAOI, $GOOGL, $AMZN, $CALA, $LITE, $JUNO, $HIIQ, $EOG, $COTY, $GREK …………

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Important Service Upgrade Notice: To receive alerts be sure we have your email and you have followed our Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us as we integrate and orientate ourselves to this new function in our daily routines.

This report is part 3 of 3 reports weekly. It is not complete! Will complete it this evening.

We will categorize our coverage soon because we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

A note toward the alerts! Please be aware the sell triggers will regularly not be alerted live because they are triggered as stops. And on days like Wednesday so much happens so quickly there is no way to alert the closing of trades. Every member should have stops on their own trades anyway so it isn’t the closing of a trade that is critically alerted anyway, it is the netry – the stop is your own comfort level of risk.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Our Q1 2017 Swing Trading Results are available here:

https://twitter.com/swingtrading_ct/status/841079400485478400

$AMBA

May 25 – $AMBA Weekly set-up looking really bullish. 50 MA breaches 100 MA with price above. Earnings 12 days caution there. #swingtrading

I just about executed a long position just now in anticipation but didn’t. I’ll wait for the cross up on MA’s.

May 18 – $AMBA The 20 MA and price are racing to the 200 MA. And then….

Price will either pop or drop…. watching with keen eyes on this.

May 11 – $AMBA Price above 200MA with 20 MA about to breach 50 MA. Long today likely. There’s a chance I’ll let it retest 200 MA but I doubt it.

$COTY

May 25 – No change.

May 18 – Watching. The 200 MA is coming down on price soon.

May 11 – $COTY On Watch. MACD SQZMOM Stoch RSI Vol all up. 200 MA at 21.08 as res and 20 MA may breach 50MA. If 20 MA breaches 50 MA ad price is above I will go long. This is a whisper brought to us by TraderGirl.

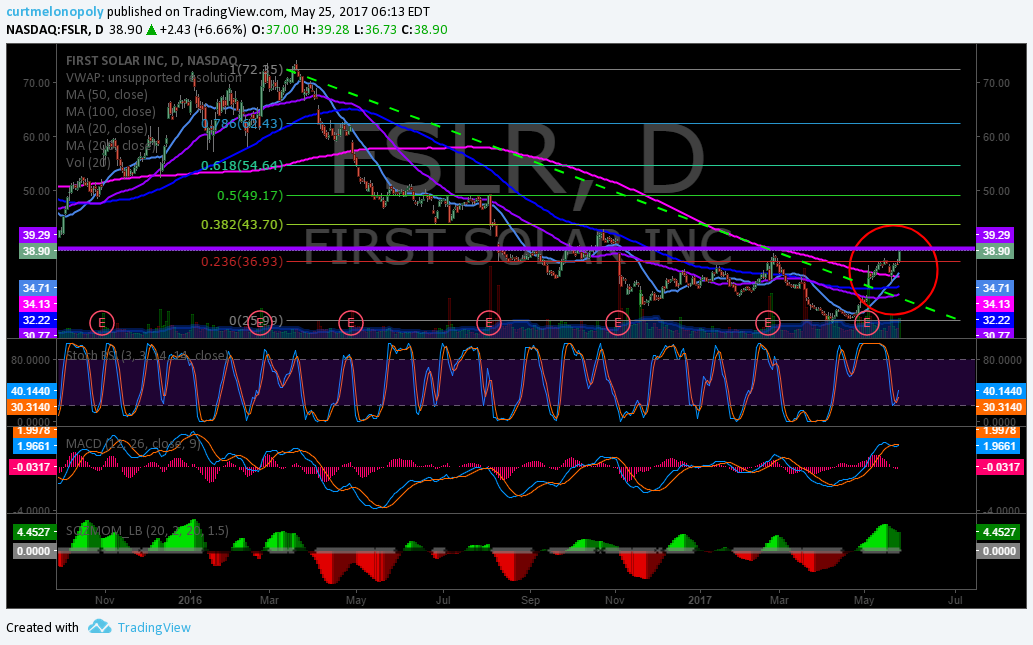

$FSLR – First Solar

May 25 – $FSLR Set up is playing out perfect. Price over 200 MA with 20 MA breached. Testing natural horizontal resistance.

May 18 – Same thing. 20 MA coming up underside of 200 MA so we will wait for that to see what happens. The 20 did breach the 50 MA per last report but with market downdraft that ruined that quick.

May 10 – $FSLR 20 MA about to breach 50 MA going long there. Also has price above 200 MA extremely bullish. MACD and SQZMOM trending up.

This one comes to us from our daytrading room from a member by the name of Spiegel. Great find.

$AAOI – Applied Opto Electornics Inc

May 25 – Trading 68.40. Waiting on a pull back. Extremely aggressive.

May 18 – Trading 60.01. Possible support at 59.44 – we will watch how it handles that level first.

May 11 – $AAOI Extremely bullish but could be a bit extended. Waiting for 20 MA (light blue) to breach 50 MA and be sure indicators confirm for long.

This one was also referred by Spiegel I do believe.

$HIIQ – Health Ins Innovations

May 26 – Trading 21.20. Indicators are still bullish but we are waiting for this to play out and take a long on pull back.

May 18 – This is moving to positive in premarket and chart is very bullish. May trade this long today.

May 11 – $HIIQ Watching for 20 MA to cross 100 MA for possible long. A tad overbought but will see how indicators look at that time.

$CELG

May 24 – Trading 116.74. Same as below.

May 18 – Trading 117.69. Just above 200 MA. Going to watch the 200 MA test play out.

May 10 – Trading 120.03. Watching. Same as below (just above 200 MA now)

May 4 – Trading 123.10. Watching. Waiting on indicators to turn up and then assess.

April 25 – Trading 123.15. Earnings in two days. Watching close.

April 20 – Trading 123.01. Testing 50 MA. Watching for MACD, Stoch RSI and SQZMOM to turn up. High watch now.

April 11 – Trading 125.92. MACD pinch and SQZMOM about to turn green – continue on high watch!

Mar 27 – Indicators have now started to cool and waiting for bottom turn. On high watch!

Mar 19 – status remains same as Mar 12.

Mar 12, 2017 – The Stoch RSI hasn’t cooled, in fact it has heated since last report. Also below is the MACD, it’s near pinching so it may be best to take a short position soon and flip to long when MACD turns to buy signal.

$CELG MACD Swing Trade Chart: https://www.tradingview.com/chart/CELG/KS53j1IE-CELG-MACD-almost-on-sell-Short-at-cross-and-long-at-turn-up/

Mar 7, 2017 – Looking for Stoch RSI to cool to bottom range for swing trade.

$CELG Live Trading Chart: https://www.tradingview.com/chart/CELG/u99gKSpz-CELG-looking-for-Stoch-RSI-to-cool-to-bottom-for-swing-trade/

$LITE

May 26 – Trading 56.45. Watching a support area around 55.86 ish and whether we can get a strong daily close above that and then consider indicators and possible long.

May 19 – MACD continues up, SQZMOM continues green, Stoch RSI turned down on daily, 20MA about to breach 50 MA with price over. Considering a long today.

May 10 – $LITE MACD turned up after earnings with a pop and off 200 MA, SQZMOM green, vol, waiting for 20 MA breach 50 MA w price above. #swingtrade Great earnings trade there however. I just didn’t trade it.

May 4 – Trading 43.00. Watching for a possible bounce off 200 MA and MACD to turn up – then assess.

$LITE Earnings day. Holding 200 MA, MACD at bottom, SQZMOM trending up, decent vol. #watchlist #premarket

$LITE Live chart https://www.tradingview.com/chart/LITE/2YbQ7s87-LITE-Earnings-day-Holding-200-MA-MACD-at-bottom-SQZMOM-trend/

April 25 – Trading 47.45. $LITE Earnings 9 days, Daily. MACD turn up? Price needs over 20MA and 50 MA and further confirmation. #earnings #watch #swingtrading

April 30 – Trading 42.61. Testing 100 MA support. Waiting for MACD, SQZMOM, Stoch RSI to turn.

Mar 30 – Closed 700 shares 54.48 as indicators turned negative. Watching now for indicators to turn again for long.

Mar 27 – Mar 22 Entered long position at 50.11 of 700 shares trading 53.65 in premarket, watching test of previous high.

Mar 19 – MACD is pinching and threatening to turn up now! On High watch!

Mar 12, 2017 – 20 MA did not hold and MACD on a sell. Wait for MACD to signal buy and review then.

$LITE MACD Chart https://www.tradingview.com/chart/LITE/6mOiMa4Z-20-MA-did-not-hold-MACD-on-sell-Wait-for-MACD-to-signal-buy/

Mar 7, 2017 – $LITE I’m looking for 20 MA to hold for entry long swing trade.

$LITE Live Swing Trading Chart : https://www.tradingview.com/chart/LITE/nU0igzAu-LITE-I-m-looking-for-20-MA-to-hold-for-entry-long-swing-trade/

$CALA

May 26 – Trading 15.30 holding 15.55. Coming off a bit now on daily and Stoch RSI possibly trending down. Watching close for an add if we get continuation.

Long $CALA 15.55 This is a break out play high risk 1/5 size 500 shares 1/5 size only to test set up

3:52 PM – 19 May 2017

https://twitter.com/SwingAlerts_CT/status/865656397467328512

May 19 – See notes below. Weekly and daily look good. May take a trade today.

$CALA live chart with indicators mentioned

$CALA Earnings surprise. Weekly 50 MA about to breach 100 MA, Stoch RSI crossed up, SQZMOM Green, MACD peaked. I #powertrade #swingtrades

May 10 – Trading 11.30. Indicators are flat though, even on an earnings surprise to the positive. Waiting on MA’s and indicators.

May 4 – Trading 11.05. Earnings in 5 days. Will watch how earnings goes.

April 25 – Trading 11.10. On watch per below.

April 20 – Trading 11.60. Bounce off 50 MA Stoch RSI crossed up, MACD pinch, SQZMOM may turn green, increasing volume. ON HIGH ALERT. May take an entry TODAY.

April 11 – Waiting on SQZMOM and MACD to turn up – getting closer now. Trading 10.75.

Mar 27 – Same

Mar 19 – Good call on Mar 12 MACD turning down.

Mar 12, 2017 – $CALA Declining volume, MACD likely turn down, 9 MA just holding. No resolution. Caution.

$CALA chart https://www.tradingview.com/chart/CALA/ma6v15V7-CALA-Declining-vol-MACD-likely-turn-down-9-MA-just-holding/

Mar 7, 2017 – $CALA Waiting for Stoch RSI to cool for a swing trade.

$CALA Live trading chart: https://www.tradingview.com/chart/CALA/8q5LxIls-CALA-Waiting-for-Stoch-RSI-to-cool-for-a-swing-trade/

$XRT – SPDR S&P Retail ETF

May 26 – Trading 40.81 Watching.

May 19 – Trading 40.97.Closed 43.30 May 11 when MACD turned down per below. Currently testing support so we are watching for a reversal.

May 10 – $XRT swing trade going well. Trading 43.79 holding from 41.67.April 10. 200 MA test. 20 MA breach 100 MA w price over 200 MA I will add. #swingtrading This is an example of taking the swing trade early. By early I mean before price is confirmed over 200 MA. If you do this you have to typically manage the trade tighter than otherwise. And watch it at each test of ma’s, especially at the 200 MA test.

Live Chart: https://www.tradingview.com/chart/XRT/up9npBct-XRT-swing-trade-going-well-Holding-from-41-67-April-10-200-MA/

May 4 – $XRT SPDR S&P Retail ETF Trading 43.02. Holding from 41.67 but MACD may turn down any second, and if so I will likely close. #swingtrade

April 25 – Trading 43.15. Holding from 41.67

$XRT Trade going well. Long 41.67 Apr 10. Holding on MACD trend & SQZMOM trend. Short term Stoch RSI may come off. 200 MA test #swingtrading

.April 20 – Trading 42.43. Hold. Indicators still positive.

April 11 – Long 41.67 April 10 for a test. 300 shares. Trading 42.11.

Mar 27 – Double bottom test in progress on high watch now.

Mar 19 – Sames status as Mar 12.

Mar 12, 2017 – The Stoch RSI is starting to pinch at bottom of range (see Mar 7 chart), MACD is still on sell however. On close watch here.

Mar 7, 2017 – Watching close for a bounce. Stoch RSI on chart is near bottom so on high watch here.

Feb 27, 2017 – Trading at 43.72 this beat up sector seems to be ripe for a bounce. If we execute a trade on Monday it will be to test the waters and watch the market sentiment day to day – this and price action will determine how long we are in it. An interim target however would be 46.80 and would likely change as the trade progresses.

$XRT Retail Live Chart – https://www.tradingview.com/chart/0oELdpX1/

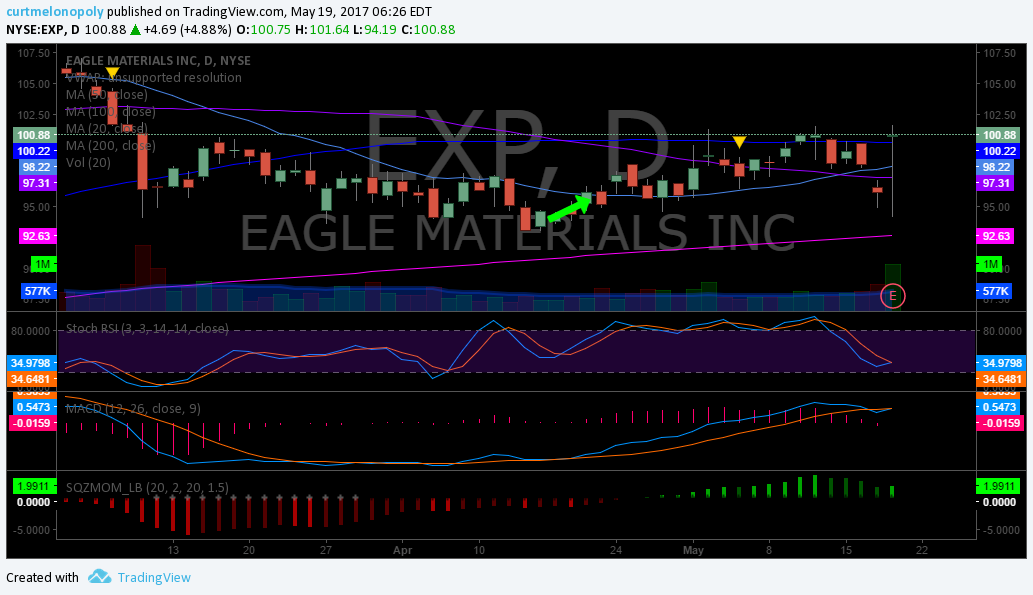

$EXP Building Materials

May 26 – Closed at MACD turn down per below 98.70 May 23 from 95.90 300 shares.

May 19 – Trading 100.88 post earnings. We missed the add after the small tester long at 95.90. Watching MACD for turn down to complete tester swing.

$EXP Holding from 95.90 trading 100.88 MACD could cross up and boom time. We’ll see. #swingtrading

May 10 – Trading 99.76. Same status. Earnings in eight days.

May 4 – Trading 98.42. $EXP SQZMOM green, MACD turned up good vol, 50 MA support test. #watchlist #swingtrading #premarket

When the MACD turned up recently that was reason enough for an add to our long trade. We did not take the entry and now that we haven’t we are waiting for the price to be above the MA’s (still has to clear 100 MA – blue) and for he 20 MA (light blue) to cross up through the 50 MA (purple – with price above) and then likely a long position.

$EXP live chart link : https://www.tradingview.com/chart/EXP/6SW59pgo-EXP-SQZMOM-green-MACD-turned-up-good-vol-50-MA-support-test/

April 25 – Trading 97.63. $EXP Small test long at MACD turn up 95.90 April 21. Above 200 MA, SQZMOM may turn green 50 and 20 above price. #swingtrading

April 20 – Trading 94.45. Failed 20 MA test. Near 200 MA now. Waiting on indicators to turn up.

April 11 – Trading 96.37. Waiting on MACD and SQZMOM to turn up. Testing 20 MA now.

March 27 – 100 MA failed. Watching.

March 19 – Same status but on high watch for MACD because 100 MA held.

March 12, 2017 – $EXP Eagle Building Materials MACD still on sell, but expanding volume in play with 100 MA test. On watch for bounce.

Mar 7, 2017 – $EXP Building Materials watching close for a bounce.

Feb 27, 2017 – “Eagles Materials Posted Record Revenues, Record Net Earnings and Record Net Earnings per Diluted Share. Its stock grew 60% in 2016 and still looks cheap.”

Eagle Materials is a riskier play than most we will add to our swing portfolio, but our DD on this one has us excited and we likely will take a long position early this week with a target of minimum 10% upside in next 90 days. We will however keep our stop tight.

http://finance.yahoo.com/news/post-earnings-coverage-eagles-materials-131500431.html

$EXP Live Trading Chart – https://www.tradingview.com/chart/EXP/TpeK4yNK-EXP-Building-Materials-Watching-close-for-bounce-swing-trading/

$FIT

May 24 – Trading 5.40 same.

May 19 – Trading 5.41 Same.

May 10 – Trading 6.25 Same as below.

May 4 – Trading 6.16 + 8% premarket. We are going to let this firm up a bit and see how it trades.

April 25 – Trading 5.86 premarket. On Watch.

April 20 – Same

April 11 – Same. Trading 5.77.

Mar 27 – Same.

Mar 19 – Same status as Mar 12. This one may never come back.

Mar 12, 2017 – $FIT FitBit Under 9 MA, MACD pinch, no volume expansion yet. On high watch.

Mar 7, 2017 – It hasn’t got its bounce yet – still watching. Trading at 6.00.

Feb 27, 2017 – We find the $FIT trade interesting. Although we would never otherwise consider it and if we do enter today a long position it will be looked at as short term, we think there may be opportunity to swing trade it because it should be much lower considering its recent quarter… lower in that we expected a panic that did not occur. This seems bullish, or at minimum a likely “bargain” in our opinion.

$FIT Swing Trade Target 6.99. Trading at 6.15.

$VFC

May 24 – Trading 53.19 MACD may cross up any second. On Watch.

May 19 – $VFC not near ready.

May 10 – $VFC On high watch now. Waiting for price to breach 200 MA and 20 MA to breach 200 MA for long.

May 4 – $VFC This swing trade went well, now we watch. Closed 57.84 April 27 before earnings. 500 shares.from 53.50 entry. Never hold through earnings. #swingtrading

April 25 – Trading 55.92. Testing 200 MA with earnings in 3 days.

April 20 – Trading 55.52. Hold. About to test 200 MA – caution.

April 11 – Hold from long 53.50 500 shares trading 54.70.

Mar 27 – Hold. Trading at 54.06

Mar 19 – Trading at 53.95 holding position long. Next test 100 MA crossing 20 MA. No adds yet.

Mar 12, 2017 – $VFC Holding but trade tentative as MACD pinching and declining volume.

Mar 12, 2017 – $VFC Quarterly Swing Trading Performance Review. Long Feb 23 53.50 500 Shares. Unrealized loss 785.00. #SwingTrading

Mar 7, 2017 – Holding long per Feb 23, 2017.

Feb 23, 2017 – $VFC Swing long 53.50 average with 58.10 as first upside target. More targets in upcoming reports.

$NE – Noble Corp

May 24 – Trading 4.25 Watching.

May 19 – $NE Bottom bottom bottom bounce?

May 10 – Trading 4.75. Same as below. On watch. Under 20 MA so chart has a way to go before its a long swing trade.

May 4 – Trading 4.60. Earnings today. On close watch.

April 25 – Trading 4.92. Watching for a possible double bottom?

April 20 – Closed 2000 shares 5.52 for loss when it broke recent low.

April 11 – Holding from 6.95 2000 shares. Trading 6.31 and may have to cut at loss if oil resistance on deck holds.

Mar 27 – Hold. Trading 5.38

Mar 19 – It’s a bad trade but the MACD is so close to the bottom that we are holding for a bounce. One of our few bad swings in 2017.

Mar 12, 2017 – $NE Trade has turned against us with a sell signal on MACD. Holding on conviction. We believe it is near over-sold and this sector of the industry is near a turn in profit divergence.

Mar 12, 2017 – $NE Quarterly Swing Trading Performance Review. Long Feb 22 6.95 2000 Shares. Unrealized loss 1920.00. Hold.

Mar 7, 2017 – Holding long. Trading at 6.46.

Feb 23, 2017 – $NE Swing long opened 6.95 average for a 9.00 upside target.

Alphabet (Google) $GOOGL, $GOOG

May 26 – Trading 993.00 long since 859.01. Watching for MACD turn up any second for possible add.

May 19 – Trading 955.00 Holding. May add when Stoch RSI crosses back up on daily.

May 10 – Trading 956.71 holding at 859.01. Indicators not saying sell yet.

May 4 – $GOOGL Long since 859.01 Trading 948.45 with SQZMOM green MACD ramped and decent vol. #holding #swingtrade Kings Queens and Castles.

Swing trade members published forecast for $GOOGL “Feb 3 – 1003.17 Price Target in 2017”

$GOOGL Live Chart https://www.tradingview.com/chart/GOOGL/gGpTTSi7-GOOGL-Long-since-859-01-Trading-948-45-with-SQZMOM-green-MACD-r/

April 25 – $GOOGL 879.00. Long 859.01 when MACD turn up SQZMOM turn green 20 MA punch thru 50 MA w price above? Wow what a champ move. #swingtrading. April 21 200 shares.

April 20 – Trading 857.20. MACD turned up, Stoch RSI turned up. SQZMOM just turned green. Waiting on 20 MA to cross up 50 MA for long.

April 11 – Watching MACD and SQZMOM to turn up for long.

Mar 27 – 863.99 Closed position 200 shares Mar 21 when previous high was lost. On watch for MACD turn.

Mar 19 – Trading at 872.37 holding – looking for dips to possibly add. MACD flat so this is a concern.

Mar 12, 2017 – $GOOGL Swing trade going well. In at 848.91 – holding and adding on dips (will advise). MACD on buy.

Mar 12, 2017 – $GOOGL Quarterly Swing Trading Performance Review. Long Feb 22 848.91 200 Shares. Unrealized gain 2570.00. Hold.

Mar 7, 2017 – Holding long per Feb 22, 2017. Trading at 847.27.

Feb 22, 2017 – We entered a long position starter at 848.91 200 shares. Stops will be managed manually and will be held tight until trade is to upside of current range. Pensive about short term market range.

Feb 21, 2017 – Price is to the topside of the break-out and I will likely enter a long position over the next day or two. Bullish on this stock.

Feb 12, 2017 – We still like the $GOOGL stock / chart. Price recently broke to the upside of the triangle and didn’t hold but is threatening to trade above again at Friday close. We’re watching for an upside break that holds for an entry or a visit to the 200 MA (pink line) for an entry.

Feb 7, 2017 Member Update: We expect a signal from the Trump camp soon (late this week), and if positive, this will be a very strong play – watch close! This needs to be high on your radar going forward!

We like this chart. Watch for an upside break out of the triangle. The principles apply the same to $GOOG and $GOOGL charts fyi. Also, watch the MACD close, it looks primed for a move. Earnings are Thursday. If price breaks to downside I will update with levels to watch. Also, the is a chart below that shows upside target.

Link to live $GOOGL chart in TradingView.

https://www.tradingview.com/chart/GOOGL/isvDnbTQ-Swing-Trading-Member-Chart-GOOGL/

1003.17 Price Target in 2017 with upside break-out. Alphabet (Google) $GOOGL

Technically, the price target (should price break to upside) is 1003.17 before Jan 29 2018.

Amazon $AMZN

May 24 – Trading 995.00 long from 822.74.

May 19 – Trading 962.50 may add when Stoch RSI on daily turns back up.

May 10 – $AMZN Swing trade going well. Trading 952.45 in 822.74. May add at next pull back. #swingtrading

April 26 – $AMZN Premarket trading 907.04. Swing trade going well. In at 822.74. Stoch RSI revved, MACD mid flat, SQZMOM green. #swingtrading

April 20 – Trading 900.29. Hold per below.

April 11 – Trading 909.40 holding 100 shares from 822.72. When MACD and SQZMOM return to bottom and turn up I will likely add 100 long. Missed an execution on last dip.

Mar 27 – Hold trading at 845.39. Mar 21 lost 20 MA and almost sold but did not. Loss of 20 MA is a concern. Watching for 50 MA failure.

Mar 19 – Trading 852.31 holding. MACD pinching to downside so this is a concern.

Mar 12, 2017 – $AMZN Amazon Swing Trade going well. In at 822.72 trading 852.46. MACD on sell will add when MACD bottoms and turns (will advise).

Mar 12, 2017 – $AMZN Quarterly Swing Trading Performance Review. Long Feb 10 822.72 100 Shares. Unrealized gain 2930.00. Hold.

Mar 7, 2017 – Holding long and may add on dips now. Trading at 846.46.

Feb 21, 2017 – Trading at 839.48 in premarket we’re on the right side of this swing so far. Depending on price action I will look to add at pull backs. Very bullish this stock.

Feb 12, 2017 – Trade Alert! We entered a trade long at a cost average 822.72 for 100 shares as soon as price was upside the 20 MA. This is an aggressive trade (being that we didn’t wait for a pull-back to 50, 100 or 200). We have a tight stop on the trade at 804.00 (just below its recent low (this would be a broken trade in our opinion at that point). So we are hoping this week is a strong week for Amazon. If not our aggressive move will cost us.

Amazon Swing Trading Live Chart: https://www.tradingview.com/chart/AMZN/ZQt7CJMs-AMZN-Amazon-Swing-Trading-Member-Chart/

Feb 7, 2017 Member Alert! We haven’t got a pull back to the 200 day and depending on how tech does with Trump we may or may not, however, in overnight trade (premarket) price is close to the 100 day and I may take a test long position. This is one of our favorite picks so we will be quite aggressive with our attempts to get in at an inflection – so we are thinking sometime in the next few days looks decent.

My fourth priority is Amazon. I don’t want to over simplify this trade – but the bottom line is I’m looking for a pull-back and an entry as close to that 200 day (pink line with green arrow) as possible. I don’t think this stock will stop anytime soon. DD to follow soon.

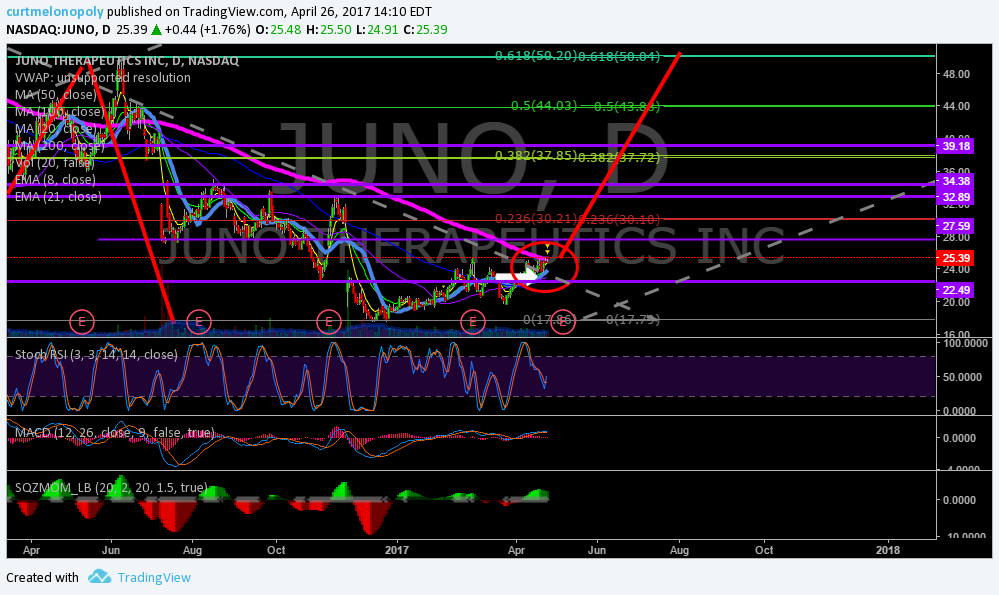

Juno $JUNO

May 26 – $JUNO On close watch. Daily 20 MA could cross up 200 MA w Stoch RSI trending up, MACD trending and SQZMOM JUST TURNED GREEN

May 19 – Price is above 200 and 20 MA. Waiting for 20 to cross 200 MA with price above. ON WATCH

May 11 – Trading 22.89. Closed 25.04 from 23.22 entry long. on May 6 when MACD crossed down. Now waiting on indicators to turn up – they’re all turned down so it will likely be a while.

April 26 – Trading 25.32 Premarket. Swing trade going well from 23.22 entry. Will be fireworks if price above 20 MA crosses up 200 MA. KAPOW time if that sets up!

Live chart set-up link for that possible follow-through on $JUNO #freedomtrade https://www.tradingview.com/chart/JUNO/zvsFtKho-JUNO-Trade-25-32-Premarket-Swing-trade-going-well-23-22-entry/

April 20 – Trading 24.61. Hold per below.

April 11 – Trading 24.89. April 6 23.22 Long 500 start as SQZMOM turned green and MACD crossed up. Testing. Tight stop. 200 Day test on deck.

Mar 27 – No Change.

Mar 19 – No change.

Mar 12 – Member Alert! We will look at a re-entry on this when MACD turns back up!

Mar 12 – $JUNO Quarterly Swing Trading Performance Review. Long Dec 22 18.32. Closed Feb 15 23.88. 1000 Shares. + 5,560.00 P/L 31% gain.

Feb 21, 2017 – On Feb 16 we closed our position at 23.88.

Feb 12, 2017 – We have been long since late December at 18.32 (1000 shares) and it trades at 21.95 now – will be ratcheting up stops soon, the trade has done well but in the short term we don’t see a lot of upside for entries now, unless trade returns to the 50 day MA.

$JUNO Another Swing Trade Winner. Swing Trade Member Stock Pick is up 20%.

Feb 7, 2017 Member Update: $JUNO since my first entry mid December 2016 has consistently moved in an upward trend, and from that perspective has been a good stock pick. But it hasn’t been excellent like many of my other picks. It does have a gap fill coming soon so if you are long I would ratchet up your stops as you near 22.70 area.

$JUNO Live Chart Link: https://www.tradingview.com/chart/JUNO/W0WEYDQJ-JUNO-Swing-Trade-Member-Stock-Pick/

CombiMatrix Corp $CBMX

May 26 – Trading 5.45 holding and stop is set at entry.

May 11 – $CBMX Swing trade going well. Trading 6.05. Long 5.20 3000 May 5 when MACD crossed up. Will add after Stoch RSI comes down and curls back up as long as MA’s stay on rights side. Will close if MACD crosses down. New live alert service this weekend will be soon enough for members to catch this add.

April 26 – Watching. Trading 5.05. Since 20 MA crossed up 200 MA on $CBMX it has almost doubled! Perfect this trade set-up say bye to day job. #freedomtraders #chart #setups

Since 20 MA crossed up 200 MA on $CBMX it has almost doubled! Pefect this trade set-up say bye to day job. #freedomtraders #chart #setups pic.twitter.com/WnOhLiG336

— Melonopoly (@curtmelonopoly) April 26, 2017

April 20 – Trading 4.90. Waiting on SQZMOM to turn green and MACD to turn up.

April 11 – Trading 5.30. There was a trade there when MACD and SQZMOM recently turned up. We didn’t take it. Watching.

Mar 27 – No Change

Mar 19 – No Change

Mar 12 – Member Alert! We will look at a re-entry on this when MACD turns back up!

Mar 12, 2017 – $CBMX Quarterly Swing Trading Performance Review. Long Dec 6 2.59. Closed Feb 22 5.01. 10000 Shares. + 24,200.00 P/L 93% gain.

Feb 22, 2017 – We closed our long positions in late trade and extended hours at 5.01 average.

Feb 21, 2017 – It is trading at 3.90 in premarket and recently as high as 4.23. Holding.

Feb 12, 2017 – This stock hasn’t slowed down since our entry at 2.59 (10000 shares) and doesn’t seem to want to return to the trendline support so our swing trade members can get in. It is trading perfectly in our prescribed range (albeit at the top) and closed at 3.90 on Friday – we have a 5.57 PT on it so I don’t if it is best to enter now – I wouldn’t unless it returns to the support line but some of the more aggressive swing trading members may want to consider it. Also, we will be ratcheting stops before earnings and even though earnings are expected to be strong we likely will not hold through earnings (or if we do it will be with tight stops).

$CBMX news – http://finance.yahoo.com/news/cbmx-expect-record-revenue-profit-140000918.html

$CBMX Swing Trade Stock Pick Doing Well up 50% Now.

My second priority is $CBMX. I am already in this swing and plan to enter in dips at the diagonal trend line (blue). Initial target area is around 5.57 with much greater potential upside. The Trump factor may cause this to come off a bit so my bias is toward late spring for first price target.

https://www.tradingview.com/chart/CBMX/qtdyUyY0-CBMX-Swing-Trade/

OakTree Capital $OAK

May 11 – Trading 44.95. All indicators trending down. Watching for turn.

April 26 – Trading 46.55. Closed position yesterday 47.34 200 shares for small win. Earnings on deck and will watch.

April 20 – Trading 46.70. Hold per below.

April 11 – Trading 46.35. 45.59 Long small starter 200 shares when SQZMOM and MACD turned up – not really crazy positive about this trade so we have a tight stop on it. Earnings conference call on April 27th.

Mar 27 – No change.

Mar 19 – On high watch for MACD to turn up again.

Mar 12, 2017 – $OAK on swing trade high watch now. 200 MA may cross 50 MA. Watch MACD for turn up.

Mar 12, 2017 – $OAK Quarterly Swing Trading Performance Review. Long Jan 3 37.80. Closed Feb 15 46.04. 1000 Shares. + 8240.00 P/L 21.8% gain. #swingtrading

Feb 21, 2017 – We closed our position last week at 46.04 because sentiment in this sector started to turn. We may look at a re-entry, however, we are waiting for the crude oil resistance test to play out and would like to monitor sentiment.

Feb 12, 2017 – This has been a fantastic swing trade and many of our members have profited from it. We are holding and have moved up stops to a 5% drop.

It is currently trading at 45.70 and is up considerably for our members – our 2017 price target was 49.58 and our short term price targets were easily met.

It is also currently trading just above its 200 MA so we are watching close – if it loses the 200 MA we will exit likely. So if you are thinking of adding or a long trade here you want to watch the 200 MA.

$OAK OakTree Capital Group Swing Trading Alert for Members has done well with 25% gains in 2017

Oaktree Capital Group, LLC (OAK) today announced that it will report fourth quarter and full year 2016 financial results prior to the opening of the New York Stock Exchange on Tuesday, February 7, 2017.

http://finance.yahoo.com/news/oaktree-schedules-fourth-quarter-full-133000267.html

Was trading at 37.57 – 38.00 when we originally started to look at it, currently trades at 41.65.

42.71 – 43.50 is our short term swing target (less than 3 months).

Feb 7, 2017 Member Alert! $OAK has met this swing trade target for our members – caution forward please!

49.58 is our 2017 target. No target date.

Our traders will be watching earnings (much like we did with Google last week and we will be doing with Amazon this week). Pending earnings and price action this will be when we enter a trade. Some of our swing traders have obviously seen decent gains since we first put this on our swing trading list a number of weeks back (good timing actually), but our traders have not taken a position yet.

Oaktree Capital Trading View Live Charting:

https://www.tradingview.com/chart/OAK/w2CBerv2-Swing-Trading-Newsletter-Oaktree-Capital-OAK/

VanEck Vectors Russia ETF $RSX

May 11 – Very, very slowly trending up on the 200 MA – watching for indicators to turn up (they are all mid flat no action).

April 26 – Trading 20.80. Watching. SQZMOM still red but almost ready and MACD just turning up now.

April 20 – Trading 19.79. Watching.

April 11 – Closed April 7 20.76. Syria issues more than anything caused us to close it. Will watch.

March 27 – Hold. Trading 20.95. Watching for 50 MA test. SQZMOM green. MACD turned up.

March 19 – The MACD did turn up and we opened a starter position long 19.94 1000 shares March 15, 2017.

March 12, 2017 – $RSX On high watch now. Price testing 200 MA, increasing volume, MACD may turn, 20 MA to cross 200 MA.

Feb 21, 2017 – Still monitoring – no position.

Feb 12, 2017 – Decided considering geo political sentiment that I will consider a long at 50 MA or a break to upside now.

Feb 7, 2017 Alert! Although this has done exceptionally well since my first entry late 2016 I am now out of my position and am awaiting a pull back to 100 day at minimum.

$RSX Swing Trade Stock Pick – Waiting for Test of 50 MA or break to upside.

$RSX Live Chart – https://www.tradingview.com/chart/RSX/rjR7GATQ-RSX-Swing-Trade-Stock-Pick-Waiting-for-Test-of-50-MA-or-break/

BOFI Holdings $BOFI

May 11 – Trading 23.79. Under 200 MA and all indicators are indecisive / bearish. Watching.

April 26 – Trading 26.35. Watching close now.

April 20 – Trading 25.03. Bounced off 200 MA, about to test 20 MA. Waiting for SQZMOM to turn green. Earnings on deck also so likely wait for that to pass first.

April 11 – Trading 24.12. TESTING 200 Day! On high watch here for MACD and SQZMOM to turn up.

Mar 27 – Same.

Mar 19 – Same status as Mar 12.

Mar 12, 2017 – $BOFI Waiting for MACD to turn up for another long entry.

Mar 12, 2017 – $BOFI Quarterly Swing Trading Performance Review. Long Dec 19 27.84. Closed Mar 10 29.90. 1000 Shares. + 2060.00 PL 7.4% gain.

Feb 21, 2017 – Watching.

Feb 12, 2017 – $BOFI Swing Trading Stock Pick After Dec Entry – Now Waiting for 200 MA PB test on 60 minute chart below or break out.

$BOFI Live Chart: https://www.tradingview.com/chart/BOFI/krBzI22u-BOFI-Swing-Trading-Stock-Pick-After-26-18-Dec-Entry-Waiting-for/

Feb 7, 2017 Member Update! Here is another I have done well since my first entry late 2016 and I am now waiting for another pullback to at least the 50 day if not 100 day to add. Holding full position and expect a return of 6% approximately (from today’s price) in 2017. If I can get a pullback I will be very happy.

Sunoco Logistics Partners $SXL

May 11 – Chart is down for maintenance on Trading View.

April 26 – Trading 24.09. MACD looks to almost be there. Watching very close now.

April 20 – Trading 23.53. Watching.

April 11 – Trading 24.12. SQZMOM and MACD just turned up. 20 MA just below. Waiting – on on high watch here now!

Mar 27 – MACD starting to pinch. On watch for regaining 20 MA etc. Trading 24.10.

Mar 12, 2017 – $SXL Quarterly Swing Trading Performance Review. Long Dec 16 23.25. Closed Mar 8 25.10. 1000 Shares. + 1850.00 P/L 7.95% gain.

Mar 7, 2017 – Holding Long.

Feb 21, 2017 – Watching the 200 MA – may add pending crude oil price action.

Feb 12, 2017 – $SXL Sunoco Swing Trading Stock Pick is Performing Excellent Since Late Dec Long Position and Jan addition to this list. We are currently waiting for a test of the 200 MA on the 60 day for an add to 1000 shares or a sell. Excellent trade so far.

$SXL Live Trading Chart: https://www.tradingview.com/chart/SXL/Zxq4BCtJ-SXL-Sunoco-Swing-Trading-Stock-Pick-is-Performing-Excellent-Sin/

$SXL Sunoco Swing Trading Stock Pick is Performing Excellent Since Late Dec Long Position

US Silica Holdings $SLCA

May 11 – Trading 39.08. Well below 200 MA but MACD is about to cross up. May take a trade through the MAs clutter above if MACD turns up.

April 26 – Trading 43.00 premarket. Watching for indicators and MA’s to start to line up.

April 20 – Trading 42.76. Closed flat 47.38 April 13. Watching. 200 MA lost.

April 11 – 47.38 Long April 6 200 share tester when MACD and SQZMOM turned up and it bounced off 200 MA. Always take a bounce off 200 MA with indicators that turn up unless there is some very compelling reason not to! Trading 50.07.

Mar 27 – Same.

Mar 19 – Same status as Mar 12.

Mar 12, 2017 – $SLCA On long position high alert watchlist for 200 MA to hold and MACD to turn up (will advise).

Mar 12, 2017 – $SLCA Quarterly Swing Trading Performance Review. Long Feb 8 55.77. Closed Feb 23 55.77. 500 Shares. +0.00 P/L 0% gain.

Mar 7, 2017 – We stopped out flat and are keeping it on watch list for now.

Feb 21, 2017 – Hold, managing stop. We like it, but it may stop out flat.

Feb 12, 2017 – We have our first entry in $SLCA at the 50 day 55.77 500 shares. We are going to watch how it handles the 20 MA. If it returns to our buy at 55.77 area we may cut bait.

$SCLA Live Trading Chart: https://www.tradingview.com/chart/SLCA/kYwi9RAO-SLCA-Swing-Trade-Member-Stock-Pick-Entry-at-50-MA-long-for-a-t/

Feb 7, 2017 Member Alert! We never did get that pull back, and I appreciate the notes from members that have done well with this swing nonetheless! However, caution is warranted entering this play with-out a pull-back.

My fifth priority is $SLCA. Again, another simple chart and it will require some patience. I see a pull-back coming and huge upside under the Trump inertia in to summer. I am looking for a pull-back to the 50 day (yellow arrow) or the 100 day preferably (blue arrow). If it gets away on me I’ll likely chase it and scale in 1/5th at a time.

$EOG EOG Resources

May 11 – ON WATCH. $EOG Testing 200 MA resistance. If price gets above 200 MA when 20 MA breaches 50 MA I will be long if MACD curled up.

April 26 – Trading 95.27. Watching.

April 20 – Trading 93.29. Watching.

April 11 – Trading 98.22. March 29 had solid bounce off 200 MA and MACD and SQZMOM turned up. We didn’t take trade but it was a solid set-up.

Mar 27 – Regained 200 MA )per previous) waiting for MACD, Stoch RSI, SQZMOM to turn up. High alert!

Mar 19 – MACD is pinching at bottom and about to turn up! On high alert!

Mar 12, 2017 – $EOG On high alert watchlist for swing trade. 200 MA test has held. Waiting for MACD to turn up.

Mar 12, 2017 – $EOG Quarterly Swing Trading Performance Review. Long Feb 12 98.77. Closed Feb 17 98.77. 300 Shares. +0.00 P/L 0% gain. #swingtrading

Feb 21, 2017 – Stopped flat. Keeping on watch.

Feb 12, 2017 – New Entry! $EOG Resources Long entry 98.77 at 100 MA 300 shares starter. Swing Trade Stock Pick. If it fails at our entry price we will exit and re-evaluate.

$EOG Resources Live Chart – https://www.tradingview.com/chart/EOG/5pnQP44r-EOG-Resources-Long-entry-98-77-at-100-MA-Swing-Trade-Stock-Pic/

$GREK Global Greece ETF

May 11 – Per below, it did break out and we did not take a piece of it. Now waiting for indicators to cool and then turn back up for a long. What a great break out.

April 26 – Trading 8.47. All indicators up and ready and price got a pop. But I want to wait on confirmation. Maybe some back tests to MA’s. Unless a true break out continues here.

April 20 – Trading 7.98. Closed 8.14 1500 shares April 12 when Stoch RSI turned down. Waiting on indicators MACD and Stoch RSI now.

April 11 – March 27 Long 7.91 1500 share long when MACD turned up. Trading 8.15 and tight stop. Watching close. May close on next downturn and re-enter. Interesting.

March 27 – Same. Watching.

March 19 – Same status as Mar 12.

March 12, 2017 – On high alert watchlist now – MACD about to pinch. Watching for MACD turn up.

Feb 21, 2017 – Watching.

$TRCH Torchlight Energy

May 11 – Trading 1.36 still holding from 1.50 2000 shares. MACD looks like it may turn up here and it is holding 200 MA.

April 26 – Trading 1.53 Holding.

April 20 – Trading 1.54 Holding.

April 11 – $TRCH Interesting premarket here also. Holding from 1.50 so not underwater now but #oil is getting really close to a YUGE wall Setting stop at entry likely.

March 27 – Same. Hold. Will add at bottom of MACD turn and other indicators turn.

March 19 – Trading 1.41 holding.

Mar 12, 2017 – Holding position. MACD turned down and will add when MACD turns up. Holding 2000 at 1.50 trading at 1.36. Near the stop loss area but for myself this is a conviction trade based on Trump and this specific company. It is also a relatively small position.

Mar 7 2017 – Holding.

Feb 21, 2017 – Holding, watching for possible add.

https://www.tradingview.com/chart/TRCH/xxpZ4uPM-TRCH-Swing-Trade/

$NG Nova Gold

May 11 – Trading 4.10 MACD just crossed up and considering a trade with MAs above.

April 20 – Same.

April 11 – Trading 4.88 watching indicators for life.

March 12, 2017 – $NG Quarterly Swing Trading Performance Review. Long Jan 12 5.14. Closed Feb 27 5.81. 2000 Shares. +1340.00 PL 13% gain.

March 7, 2017 – We figured in our last report we may close. Feb 27, 2017 we closed for 5.81.

Feb 21, 2017 – Hold, watching, may close position.

Feb 7, 2017 – $NG Nova Gold Swing trade members are pleased with stock pick 5.14 buy alert trade up to 6.21 (22% gain) at 5.98 now.

$NG NovaGold Live Chart – https://www.tradingview.com/chart/NG/7sroM8Ai-NG-Nova-Gold-Swing-trade-members-are-pleased-with-stock-pick-5/

The first swing of 2017 I will be entering (likely today) is NovaGold. First target is 6.46 area and second target is 7.30 area. It is currently trading at 5.10. It’s full extension is over 8.50.

https://www.tradingview.com/chart/NG/1Sz7RDKg-NG-Novagold-Swing-Trade/

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AMBA, $EOG, $COTY, $FSLR, $AAOI, $HIIQ, $CELG, $LITE, $CALA, $SBUX, $XRT, $EXP, $FIT, $NE, $VFC, $ASM, $GOOGL, $AMZN, $JUNO, $CBMX, $OAK, $RSX, $BOFI, $SXL, $SLCS, $EOG, $NG, $TRCH, $GREK

Swing Trading Thurs May 25 $AMBA, $FSLR, $AAOI, $GOOGL, $AMZN, $CALA, $LITE, $JUNO, $HIIQ, $EOG, $COTY, $GREK ….

Good Morning Swing Traders and Welcome to the Compound Trading Weekly Swing Trading Report (3 of 3) for Week of May 22, 2017. $AMBA, $FSLR, $AAOI, $GOOGL, $AMZN, $CALA, $LITE, $JUNO, $HIIQ, $EOG, $COTY, $GREK …………

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Important Service Upgrade Notice: To receive alerts be sure we have your email and you have followed our Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us as we integrate and orientate ourselves to this new function in our daily routines.

This report is part 3 of 3 reports weekly. It is not complete! Will complete it this evening.

We will categorize our coverage soon because we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

A note toward the alerts! Please be aware the sell triggers will regularly not be alerted live because they are triggered as stops. And on days like Wednesday so much happens so quickly there is no way to alert the closing of trades. Every member should have stops on their own trades anyway so it isn’t the closing of a trade that is critically alerted anyway, it is the netry – the stop is your own comfort level of risk.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

$AMBA

May 25 – $AMBA Weekly set-up looking really bullish. 50 MA breaches 100 MA with price above. Earnings 12 days caution there. #swingtrading

I just about executed a long position just now in anticipation but didn’t. I’ll wait for the cross up on MA’s.

May 18 – $AMBA The 20 MA and price are racing to the 200 MA. And then….

Price will either pop or drop…. watching with keen eyes on this.

May 11 – $AMBA Price above 200MA with 20 MA about to breach 50 MA. Long today likely. There’s a chance I’ll let it retest 200 MA but I doubt it.

$COTY

May 25 – No change.

May 18 – Watching. The 200 MA is coming down on price soon.

May 11 – $COTY On Watch. MACD SQZMOM Stoch RSI Vol all up. 200 MA at 21.08 as res and 20 MA may breach 50MA. If 20 MA breaches 50 MA ad price is above I will go long. This is a whisper brought to us by TraderGirl.

$FSLR – First Solar

May 25 – $FSLR Set up is playing out perfect. Price over 200 MA with 20 MA breached. Testing natural horizontal resistance.

May 18 – Same thing. 20 MA coming up underside of 200 MA so we will wait for that to see what happens. The 20 did breach the 50 MA per last report but with market downdraft that ruined that quick.

May 10 – $FSLR 20 MA about to breach 50 MA going long there. Also has price above 200 MA extremely bullish. MACD and SQZMOM trending up.

This one comes to us from our daytrading room from a member by the name of Spiegel. Great find.

$AAOI – Applied Opto Electornics Inc

May 25 – Trading 68.40. Waiting on a pull back. Extremely aggressive.

May 18 – Trading 60.01. Possible support at 59.44 – we will watch how it handles that level first.

May 11 – $AAOI Extremely bullish but could be a bit extended. Waiting for 20 MA (light blue) to breach 50 MA and be sure indicators confirm for long.

This one was also referred by Spiegel I do believe.

$HIIQ – Health Ins Innovations

May 18 – This is moving to positive in premarket and chart is very bullish. May trade this long today.

May 11 – $HIIQ Watching for 20 MA to cross 100 MA for possible long. A tad overbought but will see how indicators look at that time.

$CELG

May 18 – Trading 117.69. Just above 200 MA. Going to watch the 200 MA test play out.

May 10 – Trading 120.03. Watching. Same as below (just above 200 MA now)

May 4 – Trading 123.10. Watching. Waiting on indicators to turn up and then assess.

April 25 – Trading 123.15. Earnings in two days. Watching close.

April 20 – Trading 123.01. Testing 50 MA. Watching for MACD, Stoch RSI and SQZMOM to turn up. High watch now.

April 11 – Trading 125.92. MACD pinch and SQZMOM about to turn green – continue on high watch!

Mar 27 – Indicators have now started to cool and waiting for bottom turn. On high watch!

Mar 19 – status remains same as Mar 12.

Mar 12, 2017 – The Stoch RSI hasn’t cooled, in fact it has heated since last report. Also below is the MACD, it’s near pinching so it may be best to take a short position soon and flip to long when MACD turns to buy signal.

$CELG MACD Swing Trade Chart: https://www.tradingview.com/chart/CELG/KS53j1IE-CELG-MACD-almost-on-sell-Short-at-cross-and-long-at-turn-up/

Mar 7, 2017 – Looking for Stoch RSI to cool to bottom range for swing trade.

$CELG Live Trading Chart: https://www.tradingview.com/chart/CELG/u99gKSpz-CELG-looking-for-Stoch-RSI-to-cool-to-bottom-for-swing-trade/

$LITE

May 19 – MACD continues up, SQZMOM continues green, Stoch RSI turned down on daily, 20MA about to breach 50 MA with price over. Considering a long today.

May 10 – $LITE MACD turned up after earnings with a pop and off 200 MA, SQZMOM green, vol, waiting for 20 MA breach 50 MA w price above. #swingtrade Great earnings trade there however. I just didn’t trade it.

May 4 – Trading 43.00. Watching for a possible bounce off 200 MA and MACD to turn up – then assess.

$LITE Earnings day. Holding 200 MA, MACD at bottom, SQZMOM trending up, decent vol. #watchlist #premarket

$LITE Live chart https://www.tradingview.com/chart/LITE/2YbQ7s87-LITE-Earnings-day-Holding-200-MA-MACD-at-bottom-SQZMOM-trend/

April 25 – Trading 47.45. $LITE Earnings 9 days, Daily. MACD turn up? Price needs over 20MA and 50 MA and further confirmation. #earnings #watch #swingtrading

April 30 – Trading 42.61. Testing 100 MA support. Waiting for MACD, SQZMOM, Stoch RSI to turn.

Mar 30 – Closed 700 shares 54.48 as indicators turned negative. Watching now for indicators to turn again for long.

Mar 27 – Mar 22 Entered long position at 50.11 of 700 shares trading 53.65 in premarket, watching test of previous high.

Mar 19 – MACD is pinching and threatening to turn up now! On High watch!

Mar 12, 2017 – 20 MA did not hold and MACD on a sell. Wait for MACD to signal buy and review then.

$LITE MACD Chart https://www.tradingview.com/chart/LITE/6mOiMa4Z-20-MA-did-not-hold-MACD-on-sell-Wait-for-MACD-to-signal-buy/

Mar 7, 2017 – $LITE I’m looking for 20 MA to hold for entry long swing trade.

$LITE Live Swing Trading Chart : https://www.tradingview.com/chart/LITE/nU0igzAu-LITE-I-m-looking-for-20-MA-to-hold-for-entry-long-swing-trade/

$CALA

May 19 – See notes below. Weekly and daily look good. May take a trade today.

$CALA live chart with indicators mentioned

$CALA Earnings surprise. Weekly 50 MA about to breach 100 MA, Stoch RSI crossed up, SQZMOM Green, MACD peaked. I #powertrade #swingtrades

May 10 – Trading 11.30. Indicators are flat though, even on an earnings surprise to the positive. Waiting on MA’s and indicators.

May 4 – Trading 11.05. Earnings in 5 days. Will watch how earnings goes.

April 25 – Trading 11.10. On watch per below.

April 20 – Trading 11.60. Bounce off 50 MA Stoch RSI crossed up, MACD pinch, SQZMOM may turn green, increasing volume. ON HIGH ALERT. May take an entry TODAY.

April 11 – Waiting on SQZMOM and MACD to turn up – getting closer now. Trading 10.75.

Mar 27 – Same

Mar 19 – Good call on Mar 12 MACD turning down.

Mar 12, 2017 – $CALA Declining volume, MACD likely turn down, 9 MA just holding. No resolution. Caution.

$CALA chart https://www.tradingview.com/chart/CALA/ma6v15V7-CALA-Declining-vol-MACD-likely-turn-down-9-MA-just-holding/

Mar 7, 2017 – $CALA Waiting for Stoch RSI to cool for a swing trade.

$CALA Live trading chart: https://www.tradingview.com/chart/CALA/8q5LxIls-CALA-Waiting-for-Stoch-RSI-to-cool-for-a-swing-trade/

$XRT – SPDR S&P Retail ETF

May 19 – Trading 40.97.Closed 43.30 May 11 when MACD turned down per below. Currently testing support so we are watching for a reversal.

May 10 – $XRT swing trade going well. Trading 43.79 holding from 41.67.April 10. 200 MA test. 20 MA breach 100 MA w price over 200 MA I will add. #swingtrading This is an example of taking the swing trade early. By early I mean before price is confirmed over 200 MA. If you do this you have to typically manage the trade tighter than otherwise. And watch it at each test of ma’s, especially at the 200 MA test.

Live Chart: https://www.tradingview.com/chart/XRT/up9npBct-XRT-swing-trade-going-well-Holding-from-41-67-April-10-200-MA/

May 4 – $XRT SPDR S&P Retail ETF Trading 43.02. Holding from 41.67 but MACD may turn down any second, and if so I will likely close. #swingtrade

April 25 – Trading 43.15. Holding from 41.67

$XRT Trade going well. Long 41.67 Apr 10. Holding on MACD trend & SQZMOM trend. Short term Stoch RSI may come off. 200 MA test #swingtrading

.April 20 – Trading 42.43. Hold. Indicators still positive.

April 11 – Long 41.67 April 10 for a test. 300 shares. Trading 42.11.

Mar 27 – Double bottom test in progress on high watch now.

Mar 19 – Sames status as Mar 12.

Mar 12, 2017 – The Stoch RSI is starting to pinch at bottom of range (see Mar 7 chart), MACD is still on sell however. On close watch here.

Mar 7, 2017 – Watching close for a bounce. Stoch RSI on chart is near bottom so on high watch here.

Feb 27, 2017 – Trading at 43.72 this beat up sector seems to be ripe for a bounce. If we execute a trade on Monday it will be to test the waters and watch the market sentiment day to day – this and price action will determine how long we are in it. An interim target however would be 46.80 and would likely change as the trade progresses.

$XRT Retail Live Chart – https://www.tradingview.com/chart/0oELdpX1/

$EXP Building Materials

May 19 – Trading 100.88 post earnings. We missed the add after the small tester long at 95.90. Watching MACD for turn down to complete tester swing.

$EXP Holding from 95.90 trading 100.88 MACD could cross up and boom time. We’ll see. #swingtrading

May 10 – Trading 99.76. Same status. Earnings in eight days.

May 4 – Trading 98.42. $EXP SQZMOM green, MACD turned up good vol, 50 MA support test. #watchlist #swingtrading #premarket

When the MACD turned up recently that was reason enough for an add to our long trade. We did not take the entry and now that we haven’t we are waiting for the price to be above the MA’s (still has to clear 100 MA – blue) and for he 20 MA (light blue) to cross up through the 50 MA (purple – with price above) and then likely a long position.

$EXP live chart link : https://www.tradingview.com/chart/EXP/6SW59pgo-EXP-SQZMOM-green-MACD-turned-up-good-vol-50-MA-support-test/

April 25 – Trading 97.63. $EXP Small test long at MACD turn up 95.90 April 21. Above 200 MA, SQZMOM may turn green 50 and 20 above price. #swingtrading

April 20 – Trading 94.45. Failed 20 MA test. Near 200 MA now. Waiting on indicators to turn up.

April 11 – Trading 96.37. Waiting on MACD and SQZMOM to turn up. Testing 20 MA now.

March 27 – 100 MA failed. Watching.

March 19 – Same status but on high watch for MACD because 100 MA held.

March 12, 2017 – $EXP Eagle Building Materials MACD still on sell, but expanding volume in play with 100 MA test. On watch for bounce.

Mar 7, 2017 – $EXP Building Materials watching close for a bounce.

Feb 27, 2017 – “Eagles Materials Posted Record Revenues, Record Net Earnings and Record Net Earnings per Diluted Share. Its stock grew 60% in 2016 and still looks cheap.”

Eagle Materials is a riskier play than most we will add to our swing portfolio, but our DD on this one has us excited and we likely will take a long position early this week with a target of minimum 10% upside in next 90 days. We will however keep our stop tight.

http://finance.yahoo.com/news/post-earnings-coverage-eagles-materials-131500431.html

$EXP Live Trading Chart – https://www.tradingview.com/chart/EXP/TpeK4yNK-EXP-Building-Materials-Watching-close-for-bounce-swing-trading/

$FIT

May 19 – Trading 5.41 Same.

May 10 – Trading 6.25 Same as below.

May 4 – Trading 6.16 + 8% premarket. We are going to let this firm up a bit and see how it trades.

April 25 – Trading 5.86 premarket. On Watch.

April 20 – Same

April 11 – Same. Trading 5.77.

Mar 27 – Same.

Mar 19 – Same status as Mar 12. This one may never come back.

Mar 12, 2017 – $FIT FitBit Under 9 MA, MACD pinch, no volume expansion yet. On high watch.

Mar 7, 2017 – It hasn’t got its bounce yet – still watching. Trading at 6.00.

Feb 27, 2017 – We find the $FIT trade interesting. Although we would never otherwise consider it and if we do enter today a long position it will be looked at as short term, we think there may be opportunity to swing trade it because it should be much lower considering its recent quarter… lower in that we expected a panic that did not occur. This seems bullish, or at minimum a likely “bargain” in our opinion.

$FIT Swing Trade Target 6.99. Trading at 6.15.

$VFC

May 19 – $VFC not near ready.

May 10 – $VFC On high watch now. Waiting for price to breach 200 MA and 20 MA to breach 200 MA for long.

May 4 – $VFC This swing trade went well, now we watch. Closed 57.84 April 27 before earnings. 500 shares.from 53.50 entry. Never hold through earnings. #swingtrading

April 25 – Trading 55.92. Testing 200 MA with earnings in 3 days.

April 20 – Trading 55.52. Hold. About to test 200 MA – caution.

April 11 – Hold from long 53.50 500 shares trading 54.70.

Mar 27 – Hold. Trading at 54.06

Mar 19 – Trading at 53.95 holding position long. Next test 100 MA crossing 20 MA. No adds yet.

Mar 12, 2017 – $VFC Holding but trade tentative as MACD pinching and declining volume.

Mar 12, 2017 – $VFC Quarterly Swing Trading Performance Review. Long Feb 23 53.50 500 Shares. Unrealized loss 785.00. #SwingTrading

Mar 7, 2017 – Holding long per Feb 23, 2017.

Feb 23, 2017 – $VFC Swing long 53.50 average with 58.10 as first upside target. More targets in upcoming reports.

$NE – Noble Corp

May 19 – $NE Bottom bottom bottom bounce?

May 10 – Trading 4.75. Same as below. On watch. Under 20 MA so chart has a way to go before its a long swing trade.

May 4 – Trading 4.60. Earnings today. On close watch.

April 25 – Trading 4.92. Watching for a possible double bottom?

April 20 – Closed 2000 shares 5.52 for loss when it broke recent low.

April 11 – Holding from 6.95 2000 shares. Trading 6.31 and may have to cut at loss if oil resistance on deck holds.

Mar 27 – Hold. Trading 5.38

Mar 19 – It’s a bad trade but the MACD is so close to the bottom that we are holding for a bounce. One of our few bad swings in 2017.

Mar 12, 2017 – $NE Trade has turned against us with a sell signal on MACD. Holding on conviction. We believe it is near over-sold and this sector of the industry is near a turn in profit divergence.

Mar 12, 2017 – $NE Quarterly Swing Trading Performance Review. Long Feb 22 6.95 2000 Shares. Unrealized loss 1920.00. Hold.

Mar 7, 2017 – Holding long. Trading at 6.46.

Feb 23, 2017 – $NE Swing long opened 6.95 average for a 9.00 upside target.

Alphabet (Google) $GOOGL, $GOOG

May 19 – Trading 955.00 Holding. May add when Stoch RSI crosses back up on daily.

May 10 – Trading 956.71 holding at 859.01. Indicators not saying sell yet.

May 4 – $GOOGL Long since 859.01 Trading 948.45 with SQZMOM green MACD ramped and decent vol. #holding #swingtrade Kings Queens and Castles.

Swing trade members published forecast for $GOOGL “Feb 3 – 1003.17 Price Target in 2017”

$GOOGL Live Chart https://www.tradingview.com/chart/GOOGL/gGpTTSi7-GOOGL-Long-since-859-01-Trading-948-45-with-SQZMOM-green-MACD-r/

April 25 – $GOOGL 879.00. Long 859.01 when MACD turn up SQZMOM turn green 20 MA punch thru 50 MA w price above? Wow what a champ move. #swingtrading. April 21 200 shares.

April 20 – Trading 857.20. MACD turned up, Stoch RSI turned up. SQZMOM just turned green. Waiting on 20 MA to cross up 50 MA for long.

April 11 – Watching MACD and SQZMOM to turn up for long.

Mar 27 – 863.99 Closed position 200 shares Mar 21 when previous high was lost. On watch for MACD turn.

Mar 19 – Trading at 872.37 holding – looking for dips to possibly add. MACD flat so this is a concern.

Mar 12, 2017 – $GOOGL Swing trade going well. In at 848.91 – holding and adding on dips (will advise). MACD on buy.

Mar 12, 2017 – $GOOGL Quarterly Swing Trading Performance Review. Long Feb 22 848.91 200 Shares. Unrealized gain 2570.00. Hold.

Mar 7, 2017 – Holding long per Feb 22, 2017. Trading at 847.27.

Feb 22, 2017 – We entered a long position starter at 848.91 200 shares. Stops will be managed manually and will be held tight until trade is to upside of current range. Pensive about short term market range.

Feb 21, 2017 – Price is to the topside of the break-out and I will likely enter a long position over the next day or two. Bullish on this stock.

Feb 12, 2017 – We still like the $GOOGL stock / chart. Price recently broke to the upside of the triangle and didn’t hold but is threatening to trade above again at Friday close. We’re watching for an upside break that holds for an entry or a visit to the 200 MA (pink line) for an entry.

Feb 7, 2017 Member Update: We expect a signal from the Trump camp soon (late this week), and if positive, this will be a very strong play – watch close! This needs to be high on your radar going forward!

We like this chart. Watch for an upside break out of the triangle. The principles apply the same to $GOOG and $GOOGL charts fyi. Also, watch the MACD close, it looks primed for a move. Earnings are Thursday. If price breaks to downside I will update with levels to watch. Also, the is a chart below that shows upside target.

Link to live $GOOGL chart in TradingView.

https://www.tradingview.com/chart/GOOGL/isvDnbTQ-Swing-Trading-Member-Chart-GOOGL/

1003.17 Price Target in 2017 with upside break-out. Alphabet (Google) $GOOGL

Technically, the price target (should price break to upside) is 1003.17 before Jan 29 2018.

Amazon $AMZN

May 19 – Trading 962.50 may add when Stoch RSI on daily turns back up.

May 10 – $AMZN Swing trade going well. Trading 952.45 in 822.74. May add at next pull back. #swingtrading

April 26 – $AMZN Premarket trading 907.04. Swing trade going well. In at 822.74. Stoch RSI revved, MACD mid flat, SQZMOM green. #swingtrading

April 20 – Trading 900.29. Hold per below.

April 11 – Trading 909.40 holding 100 shares from 822.72. When MACD and SQZMOM return to bottom and turn up I will likely add 100 long. Missed an execution on last dip.

Mar 27 – Hold trading at 845.39. Mar 21 lost 20 MA and almost sold but did not. Loss of 20 MA is a concern. Watching for 50 MA failure.

Mar 19 – Trading 852.31 holding. MACD pinching to downside so this is a concern.

Mar 12, 2017 – $AMZN Amazon Swing Trade going well. In at 822.72 trading 852.46. MACD on sell will add when MACD bottoms and turns (will advise).

Mar 12, 2017 – $AMZN Quarterly Swing Trading Performance Review. Long Feb 10 822.72 100 Shares. Unrealized gain 2930.00. Hold.

Mar 7, 2017 – Holding long and may add on dips now. Trading at 846.46.

Feb 21, 2017 – Trading at 839.48 in premarket we’re on the right side of this swing so far. Depending on price action I will look to add at pull backs. Very bullish this stock.

Feb 12, 2017 – Trade Alert! We entered a trade long at a cost average 822.72 for 100 shares as soon as price was upside the 20 MA. This is an aggressive trade (being that we didn’t wait for a pull-back to 50, 100 or 200). We have a tight stop on the trade at 804.00 (just below its recent low (this would be a broken trade in our opinion at that point). So we are hoping this week is a strong week for Amazon. If not our aggressive move will cost us.

Amazon Swing Trading Live Chart: https://www.tradingview.com/chart/AMZN/ZQt7CJMs-AMZN-Amazon-Swing-Trading-Member-Chart/

Feb 7, 2017 Member Alert! We haven’t got a pull back to the 200 day and depending on how tech does with Trump we may or may not, however, in overnight trade (premarket) price is close to the 100 day and I may take a test long position. This is one of our favorite picks so we will be quite aggressive with our attempts to get in at an inflection – so we are thinking sometime in the next few days looks decent.

My fourth priority is Amazon. I don’t want to over simplify this trade – but the bottom line is I’m looking for a pull-back and an entry as close to that 200 day (pink line with green arrow) as possible. I don’t think this stock will stop anytime soon. DD to follow soon.

Juno $JUNO

May 19 – Price is above 200 and 20 MA. Waiting for 20 to cross 200 MA with price above. ON WATCH

May 11 – Trading 22.89. Closed 25.04 from 23.22 entry long. on May 6 when MACD crossed down. Now waiting on indicators to turn up – they’re all turned down so it will likely be a while.

April 26 – Trading 25.32 Premarket. Swing trade going well from 23.22 entry. Will be fireworks if price above 20 MA crosses up 200 MA. KAPOW time if that sets up!

Live chart set-up link for that possible follow-through on $JUNO #freedomtrade https://www.tradingview.com/chart/JUNO/zvsFtKho-JUNO-Trade-25-32-Premarket-Swing-trade-going-well-23-22-entry/

April 20 – Trading 24.61. Hold per below.

April 11 – Trading 24.89. April 6 23.22 Long 500 start as SQZMOM turned green and MACD crossed up. Testing. Tight stop. 200 Day test on deck.

Mar 27 – No Change.

Mar 19 – No change.

Mar 12 – Member Alert! We will look at a re-entry on this when MACD turns back up!

Mar 12 – $JUNO Quarterly Swing Trading Performance Review. Long Dec 22 18.32. Closed Feb 15 23.88. 1000 Shares. + 5,560.00 P/L 31% gain.

Feb 21, 2017 – On Feb 16 we closed our position at 23.88.

Feb 12, 2017 – We have been long since late December at 18.32 (1000 shares) and it trades at 21.95 now – will be ratcheting up stops soon, the trade has done well but in the short term we don’t see a lot of upside for entries now, unless trade returns to the 50 day MA.

$JUNO Another Swing Trade Winner. Swing Trade Member Stock Pick is up 20%.

Feb 7, 2017 Member Update: $JUNO since my first entry mid December 2016 has consistently moved in an upward trend, and from that perspective has been a good stock pick. But it hasn’t been excellent like many of my other picks. It does have a gap fill coming soon so if you are long I would ratchet up your stops as you near 22.70 area.

$JUNO Live Chart Link: https://www.tradingview.com/chart/JUNO/W0WEYDQJ-JUNO-Swing-Trade-Member-Stock-Pick/

CombiMatrix Corp $CBMX

May 11 – $CBMX Swing trade going well. Trading 6.05. Long 5.20 3000 May 5 when MACD crossed up. Will add after Stoch RSI comes down and curls back up as long as MA’s stay on rights side. Will close if MACD crosses down. New live alert service this weekend will be soon enough for members to catch this add.

April 26 – Watching. Trading 5.05. Since 20 MA crossed up 200 MA on $CBMX it has almost doubled! Perfect this trade set-up say bye to day job. #freedomtraders #chart #setups

Since 20 MA crossed up 200 MA on $CBMX it has almost doubled! Pefect this trade set-up say bye to day job. #freedomtraders #chart #setups pic.twitter.com/WnOhLiG336

— Melonopoly (@curtmelonopoly) April 26, 2017

April 20 – Trading 4.90. Waiting on SQZMOM to turn green and MACD to turn up.

April 11 – Trading 5.30. There was a trade there when MACD and SQZMOM recently turned up. We didn’t take it. Watching.

Mar 27 – No Change

Mar 19 – No Change

Mar 12 – Member Alert! We will look at a re-entry on this when MACD turns back up!

Mar 12, 2017 – $CBMX Quarterly Swing Trading Performance Review. Long Dec 6 2.59. Closed Feb 22 5.01. 10000 Shares. + 24,200.00 P/L 93% gain.

Feb 22, 2017 – We closed our long positions in late trade and extended hours at 5.01 average.

Feb 21, 2017 – It is trading at 3.90 in premarket and recently as high as 4.23. Holding.

Feb 12, 2017 – This stock hasn’t slowed down since our entry at 2.59 (10000 shares) and doesn’t seem to want to return to the trendline support so our swing trade members can get in. It is trading perfectly in our prescribed range (albeit at the top) and closed at 3.90 on Friday – we have a 5.57 PT on it so I don’t if it is best to enter now – I wouldn’t unless it returns to the support line but some of the more aggressive swing trading members may want to consider it. Also, we will be ratcheting stops before earnings and even though earnings are expected to be strong we likely will not hold through earnings (or if we do it will be with tight stops).

$CBMX news – http://finance.yahoo.com/news/cbmx-expect-record-revenue-profit-140000918.html

$CBMX Swing Trade Stock Pick Doing Well up 50% Now.

My second priority is $CBMX. I am already in this swing and plan to enter in dips at the diagonal trend line (blue). Initial target area is around 5.57 with much greater potential upside. The Trump factor may cause this to come off a bit so my bias is toward late spring for first price target.

https://www.tradingview.com/chart/CBMX/qtdyUyY0-CBMX-Swing-Trade/

OakTree Capital $OAK

May 11 – Trading 44.95. All indicators trending down. Watching for turn.