Day Trading Crude Oil Strategy – Trading the Model Support and Resistance.

Monday we seen a one hundred point move in crude oil (a snap-back reversal intra-day) after a sell-off that started in futures Sunday night.

Below is a detailed description of how to trade the signals for this re-occurring pattern in crude oil intra-day trade.

Voice broadcast starts at 1:40 on video.

The Oil Day Trade Set-Up

Oil was selling off through the day. Intra day price is very near a lower price target and has bounced.

We didn’t catch the sell-off because our team took a 5 hour break in futures.

The trading box example is reviewed at 3:00. Trade action on the 1 minute model (trading box). Trading patterns are reviewed.

Price targets on the EPIC Algorithm Model are reviewed at 4:35 on video. This is an important part of the video to watch. The upper and lower price targets on the model are reviewed. Twelve hours later as I write both targets (up and down price targets) have been in fact hit. The range of the trading quads are reviewed.

Price targets on the EPIC Algorithm Model are reviewed at 4:35 on video. This is an important part of the video to watch.

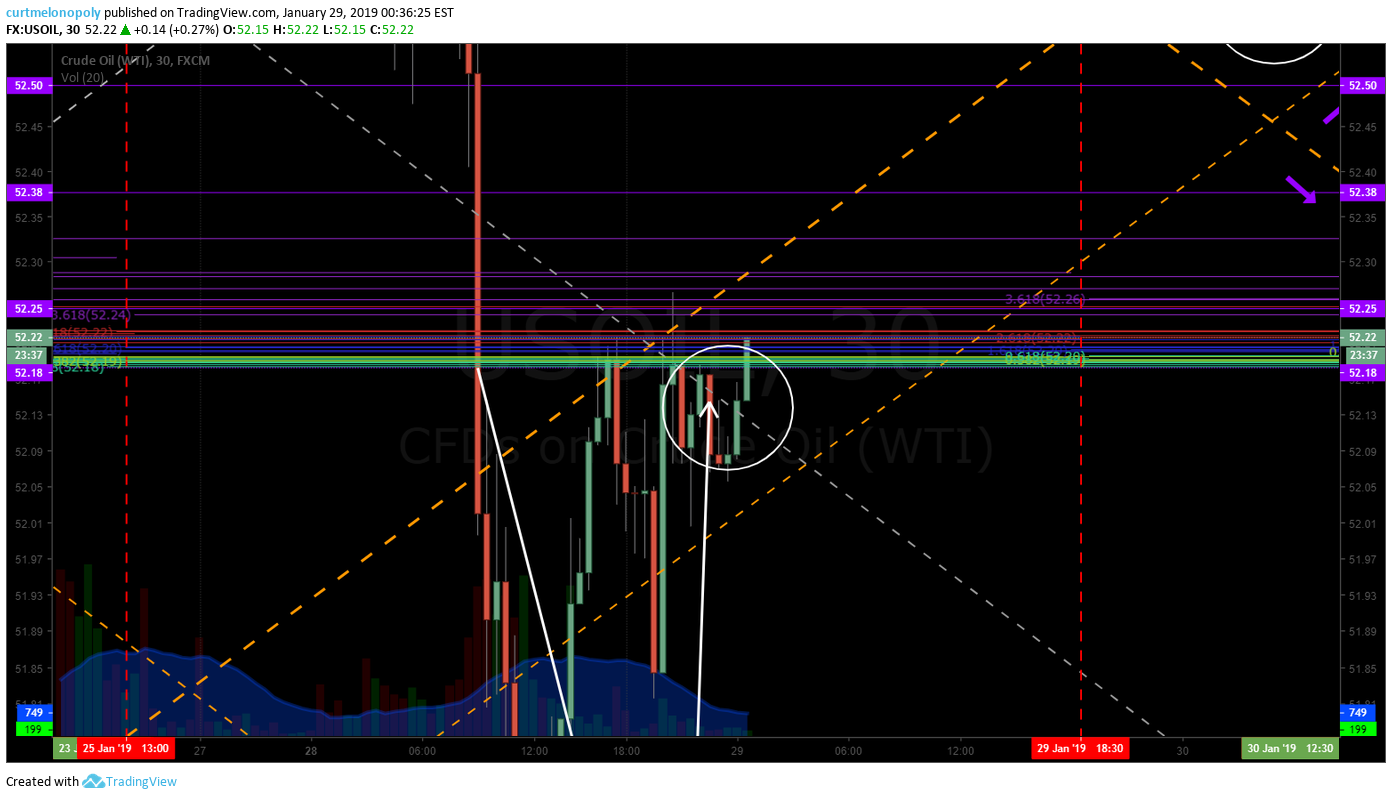

The price targets in the quad area of the crude oil trading model are shown below. The price target to lower support is shown (trade hit near the price target early) and then bounced to upper price target and resistance on the model.

At 6:20 on the video the 4 hour oil chart is reviewed. We were looking for a little lower on the day in this specific range, support was at 50.89 trading 51.57 on West Texas Oil. The timing at the time this video was recording looked short and it wasn’t likely it would hit (it didn’t). The symmetrical move to the upside and a sling shot move to the downside (opposite) is also reviewed as a scenario. In this down scenario that would bring price to down side of EPIC Algorithm quad trade is in (even lower to a point).

At 9:20 is the 4 hour oil test chart. Support 50.90 on West Texas or 51.10 on FX USOIL WTI.

At 10:20 on the video the weekly oil chart is reviewed. The weekly pivot at top and bottom of weekly candles previous are reviewed. Trade held the area intra-day and bounced.

At 19:00 on the video I review the one minute oil trading chart. A coil is in play which is usually a sign of an intra day turn. Price did in fact turn and run up to the top side quad resistance after this video ended through the rest of the afternoon.

Here, like the sell-off in overnight trade Sunday night, we didn’t catch the move because we were on break for the day. Two missed trades.

The four hour candle expiry is commented to also.

I explained that at the expiry of the 4 hour if it traded to upside that I would trade it, but I didn’t. Should have.

It is highly recommended you review recent reporting, discord room chat (regular guidance is posted in the oil chat room private server) and the various videos that are released on a regular basis.

Jan 27 – Premium Member Private Post (Weekly Reporting & Guidance).

Oil Trade Strategies | Day Trading Crude Oil | Premium Member Weekly Guidance.

Jan 22 – Compounding Gains Day trading Crude Oil.

Not Just Concept: Day Trading Crude Oil 10K – 1 Million in 24 Mos at 10 Ticks Day (Compound Gains).

Jan 20 – Weekly Crude Oil Trading Strategy Guidance Private Post for Premium Members.

Oil Trade Strategy | Day Trading Crude Oil Futures | Premium Weekly Guidance.

Jan 19 – A detailed inside look at our day traders’ strategies in crude oil day trading room.

How I Day Trade Crude Oil +90% Win Rate | Friday’s 158 Tick Move | The Strategy We Used To Trade It.

Jan 18 – By far one of the most important videos for day trading crude oil since our inception;

How I Day Trade Crude Oil on One Minute Chart | Trading Signals | Alerts (with video).

Jan 14 – Oil day traders need to see this article;

Crude Oil Day Trading Strategy | Oil Trading Room Video | Lead Trader Guidance.

If you have any questions send me a note please!

Best and peace!

Curt

PS Remember to protect capital at all cost, cut losers fast and know that when you win you really win. Use the 1 min charting model for entry timing, cut losers fast and re-enter if you have to. Do that until you learn how to be a regular win-side trader.

Further Learning:

If you would like to learn more, click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our top crude oil traders that includes learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Day Trading, Crude, Oil, Futures, Strategy, USOIL, WTI, CL_F, USO

Follow: