Proven Day Trading Strategies For Crude Oil Futures Contracts (CL).

Included Below and In Trading Room Video:

Live Trading Room Video Footage Jan 9, 2019. Trade Alert Screen Shots. Charts I Used to Win. Voice Broadcast. Screen Share. Chat Logs. Trade Coach Advice.

Five trades, Five wins, 90 ticks in just over an hour of trade yesterday in live trading room. If you traded with me listening to my voice alerts in the room, trading 1 oil futures contract size, you could pay for our oil alerts for approximately 6 months or our live trading room for one month. In one hour of learning (approximate).

I want to start this post with a personal note – something that I feel deeply about:

One of the things many of my trading students ask me is,

“How do YOU day trade crude oil, how do you SPECIFICALLY make decisions to get in to a trade and close each trade?”

I understand why / what they are asking because I had to learn how to trade to win myself, so of course I understand.

There are a few things many students don’t understand in the beginning. These and other things can become road blocks to success if not learned quickly.

They are critical points to understand, accept and have as a part of your very being.

You have to get these trading rules deep down in your psyche.

Understand These Rules Before Day Trading Crude Oil (there are more, but these are what I am most often dealing with lately when in coaching sessions).

1. When You Lose – Lose Small. This Requires Clicking The Mouse. Now.

2. Protect Your Capital At All Cost – There’s Always Another Day. Click The Mouse.

3. When You Think You’re Good, You’re Not There Yet.

4. Good Enough Is Possible With A Systematic Rules Based Proven Process. Focus Only On Proven Systems. There Are People That Learn To Win Fast. It Can Be Done. Ask Me Who AND I WILL CONNECT YOU.

5. If You Follow A Proven Winning Process and You Lose A Trade, DO NOT Think About It.

6. When You Don’t Follow The Process, STOP TRADING, Dig Deep in Review Before Trading Again, Even If It Takes Days.

7. Shut Off ALL Noise And Focus. DO NOT TRADE When Emotionally Challenged. Focus Is An Absolute Must.

8. Never Listen To Anyone That Doesn’t Encourage You In This Journey.

9. Never Blame A Loss On Anything Other Than These Two Possibilities:

a) You didn’t follow the process or b) The process was followed and sometimes the process doesn’t work – now move on quick.

10. Execute Your Trading To A Proven Process Equals Good Enough.

11. Good Enough Equals You Are Now In The Top Tier Category of Earners.

12. Good Enough (in trading) Equals Freedom. Many Freedoms That Few Ever Experience.

13. Prepare For Personal War With Self. Pride, Self, I Has To Die To Be Good Enough.

14. Do Not Give Up. Never Give Up. You Will Thank Yourself On The Other Side.

15. Never Is A Big Word. Never Means Never. Think About That Before Starting.

15 RULES to TRADING (inspired via trade coaching session I just completed, there's more, but here's 15 for the traders learning). I have to do this, hope it helps someone out there, here goes…

— Melonopoly (@curtmelonopoly) January 11, 2019

We recently went on our own learning journey coding software to machine trade oil. When we embarked on the project I thought I was an expert oil trader, I thought I knew how to trade oil.

What I learned was how little I actually knew about how oil actually trades and why. The structure of the instrument.

In short, our machine trading software now has to make 2559 decisions to trigger a trade (of course this will be adjusted for risk reward tolerance and more as we move on in our development).

My point – I learned 2559 rules for trading crude oil and I now know that I can’t possibly make perfect decisions on every trade every time. I can’t process that many decisions instantly and under pressure – it isn’t possible.

I need a system that is simple, that may put me on the losing side “sometimes” but if I lose I lose small. A system that is easy to become an expert at. A system that puts me in the top 10%.

I don’t need to be in the top 1% like our software mandate. Top 10% puts me in a great position.

This series of posts will teach you how to use our tools in such a way that you can easily be in that top tier of traders.

Respect Your Opponent. You Will Get Your As* Kicked. You Need To Learn Proven Methods – Fast.

To the same point but I like to address it as a separate point, if you want to trade (any trading on any markets)… here is what you are actually doing when you learn how to trade oil or any other trading… you are stepping in to the game, on the ice, in to the ring, the court with the best in the world. It is a zero sum game.

The best traders make their money taking your money.

Imagine never playing basketball and playing with the best in the world – instantly. That’s trading. You only need a computer and a trade account at your broker and you are now trading against the best traders in the world.

Why am I addressing this first before showing you how I trade oil?

A few reasons, one is that you need to respect it for what it is, trading against the best means that you are going to lose more than you win at first – my job is to equip you with tools only the best in the world have, this will help your learning curve to win faster and lose less when you do lose.

You need to learn fast how to limit losses. If you use a rules based trading system like I am teaching (in this series of posts, on the videos, in the live trading room, in newsletter reports, premarket reports, mid day reviews in trading room, in Discord chat where I share guidance, during private coaching and at coaching events and more…)

IF YOU ACTUALLY dig in to the documentation that I have been producing for more than two years now – you will learn a process of trade that will equip you to trade with the worlds best.

Mix our knowledge, tools, and strategies for trading oil in with what you already know – use what works for you and ignore what doesn’t.

How do I know that you can trade against the worlds best and actually do that moderately soon?

I have many students that were red that are now winning.

I also know that I am a much better technician than trader, if I can win anyone can win.

I have been documenting our journey of algorithm development, software development and live trading for over two years and we win. We’ve done it publicly, we document it, we trade live and we are one of the more transparent trading groups you can study.

Many of our winners have now agreed to share their trades in the live trading room, they rarely lose – they are expert day traders and swing traders with a long history of winning.

But it isn’t easy, you have no choice, you have to dig in and learn.

If you are a member and you need one of our historical blog posts unlocked send an email to Jen at compoundtradingofficial@gmail.com and she’ll send you the access code. It’s critical you put in the time to learn.

That’s my stern lecture, now lets to it and see what happened in Wednesday crude oil trade in the trading room and hopefully it will assist you in becoming financially independent and on to a life better equipped for true freedom.

The Live Video from The Trading Room

Video Transcript Summary With Trade Alert Feed Screen Shots and Chat Room Screen Shots:

Note: The screen shots of the Twitter feed are Eastern New York Time and the Oil Chat Room screen shots are an hour later (I am trading from the Dominican Republic).

16:48 on trading room video voice broadcast starts 928 AM right before open.

Prior to this on the video I was reviewing charts on screen preparing for market open after sending out the premarket report to our subscribers (no voice).

My bias in morning trade was for oil to see resistance for a short term pull back, resistance to come in to SPY (over sold to over supply) and a possible near term upside in VIX, Essentially we were entering a possible short term inflection after oil running since Dec 24, 2018.

Also EIA was scheduled for 10:30 AM so this was a consideration for my daytrades.

You can listen to video to get an idea of what I was watching, there is lots of blank space because I don’t broadcast for entertainment like many do, I provide only guidance and trade information as absolutely required because many of my clients are private equity funds that need only actionable guidance. No noise. We have a separate chat room for that.

To learn about the charting and indications I was using for this five win day correlate the time on the screen shots below (of the alerts) and to the time on the video at bottom right of the screen.

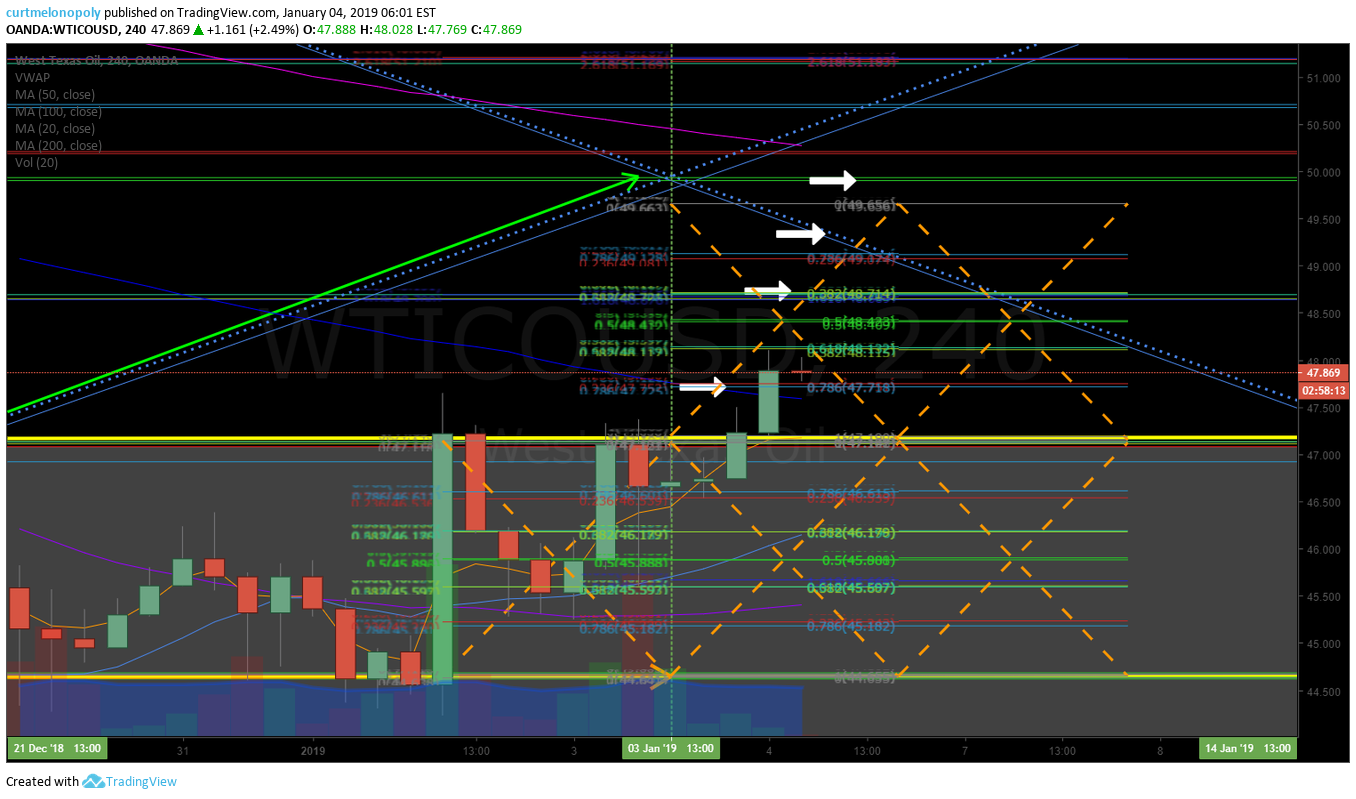

At 21:00 mins on the video I’m monitoring oil trade nearing the 200 MA on the weekly chart.

Then I’m scrolling to the daily chart model and the 240 min charting model.

At 22:00 on the video I explain the price target on oil as 52.67 if trade holds over 51.15 intra day. It was trading 51.29 on West Texas crude.

At 22:20 I review oil trade daily charting to correlate the 50 MA resistance to the price target described from the 240 minute chart at 22:00 on the video.

At 22:27 I review the 200 MA on the weekly and how the simple daily algorithmic model chart 50 MA and the 240 Minute chart resistance (bottom of trading box) correlate with the resistance on the weekly trend line chart.

At 22:40 I am reviewing the Volatility VIX daily chart support area (Bollinger bands) and how inflections can concur also for trade verification.

At 23:00 I show our traders how to bring the trading structure down to the daytrading level for shorter time frames for daytrading levels of support and resistance. This is key to your trading skill set for day trading crude oil – to be able to do this on all the charting on all time frames “on the fly”. This is your daytrading zone. VERY VERY IMPORTANT. We have a master class series of videos (20 hours) available at 1599.00 to learn how to do this like a pro.

At 1:17:00 on the video we are getting ready for the EIA report with guidance for our traders.

At 1:21:27 I am reviewing various charts for support as trade came under pressure when the weekly oil report EIA was released.

At 1:22:00 I re-chart the 240 minute oil chart again for a lower time frame to prepare for a day trade I can see coming in trade intra-day.

At 1:23:48 on video (10:36 AM Eastern New York time) I explain exactly where the next support to watch is on 1 minute chart as oil sells off.

At this point I am watching the Stochastic RSI very close, the MACD and the Squeeze Momentum indicator on the 1 minute chart. They are the three indicators at the bottom of the chart you see in the video. Stochastic then MACD then SQZMOM at bottom.

I’m looking for Stoch RSI to turn up, MACD near a turn up and SQZMOM to turn a darker red indicating a possible turn up.

At 1:26:34 the initial buys start to come in to trade (short covering likely also), I continue to watch.

At 1:32:30 this is a VERY CRITICAL PART OF THE VIDEO – I BEGIN CHARTING THE “On the fly” TRADING STRUCTURE ON THE 1 MINUTE CHART IN PREPARATION FOR TRADE.

Then I explain my trading plan.

At 1:46:30 I am continuing the charting of the trading structure of the 1 minute chart because I know the trade is getting closer.

At 1:48:40 on the video (11:00 AM Eastern time) I am charting the legs of the chart structure for preparation of trade.

At 1:50:00 on the video the bulls are starting to buy and I am frantically trying to finish my on the fly charting model for trade.

At 2:02:38 the machines are kicking in at the bottom of the trading box (resistance test) on the 1 minute chart model and I comment to it to trading room.

At 2:03:20 is the turn of the 15 minute candle and I start my position at 51.20 and alert the trade entry to the private member Twitter feed per below, the oil chat room and verbally in the oil trading room.

The remaining time on this video shows you in detail the charting I am using and as I trigger in and out of each of the five trades for five wins.

The screen shots below show you the alerts that went out to members.

There are many, many other indicators, charts and models I use to trade oil – this video shows some and will help any trader that really wants to dig in and get serious to be on the winning side on a regular non stressful basis.

Live Twitter Alert Feed Screen Shots

Below is the 9:38 AM alert from EPIC the Oil Algorithm Twitter Feed (Oil trade alerts) for support and resistance areas on crude oil chart (sent to members just after open while we were waiting for a decision / direction in trade).

Below is a screen shot of the Twitter alert feed – it was my first trade position of the day alerted to the live feed and broadcast in the trading room live at 11:16 AM.

“Oil trading alert – Selling 51.21 If it reverses I am long to 61.64 at 51.27 ish.”

The trade was a short position with a possibility of reversal.

There were a few other tweets on the feed about reversal areas and support / resistance and then the alert for closing the trade.

The trade reversed and we won and closed here with this alert on the trade – out of reversal long 51.60

Then at 11:33 AM this alert went out to the private member feed, “This was the second trade position of the day in crude oil, alerts as follows long 51.67 t o 51.87 PT then 52.07” – it was also broadcast live in trading room for members.

Below is the screen shot of the first price target being hit (on second oil trade of day) and my alert to trim 50% of the long position.

After some other alerts about stops and the like at 11:37 AM I closed the oil trade at 52.06 per alert in screen shot below for another win.

At 1147 AM Jan 9 I was alerting the third crude oil trade of the day as follows “selling 52.45 tight” per short selling screen shot below.

After some guidance comments alerted to members, at 1150 AM I was covering the short in oil and put the third win for the day on the books alerted as cover 52.21.

Confirming swing trade position in oil for members “yes, holding DWT short swing, want to see a pull back for size in to that.”

The fourth trade I was “selling 51.98 & 52.05 tight careful” at 12:24 PM and covered quick at 51.87 because I didn’t like the action for the next win.

At 1227 PM I alerted the close of the trade as covered 51.87 looking fr another entry #crude #oil #alert

My fifth trade was a 3 tick win (that I won’t post here) and that was my oil trading session for the day.

Below are the screen shots from the Discord private server oil chat room (guidance and alerts I was providing members in chat room).

Note: the live trading room video is a trading room where I use voice broadcast and screen sharing for charting etc and the Discord room is for chat to keep our live trading room actionable for the funds that attend the room.

Oil Chat Room Transcript for Alerts:

Curt MelonopolyYesterday at 12:15 PM

selling 51.21 short term

tight stops

if it reverses I’m long to 51.64 at 51.27 ish

50.82 is a support area, 50.64, 50.46

out of reversal long 51.60

long 51.67 t o 51.87 PT then 52.07

sorry happened fast

trim 51.87 50%

stop at 51.75

closed 52.06

Curt MelonopolyYesterday at 12:47 PM

selling 52.45 tight

52.13 1st target

closed 52.21

yes, holding DWT short swing, want to see a pull back for size in to that

I will publish my active crude oil trading session from today so members can study how I chart the crude oil daytrading models on the fly and why / how I’m structuring the swing trading and day trading side even though the trades can be opposite on different time frames. $CL_F $USO $USOIL $UWT $DWT #Oil #Trading

Curt MelonopolyYesterday at 1:24 PM

selling 51.98 & 52.05 tight careful

51.48 target but this is a risky short intra

covered 51.87 looking fr another entry

5 trades – 5 wins.

Any questions don’t hesitate to reach out anytime. Email me now compoundtradingofficial@gmail.com.

For a similar article I wrote click here: One of The Best Crude Oil Day Trading Strategies – 200 MA One Minute Chart Time Frame #OOTT $CL_F $USO $USOIL

Peace and best,

Curt, Lead Trader. Compound Trading Group.

Further Learning:

If you would like to learn more click here and visit our Crude Oil Trading Academy page for complimentary oil trading knowledge – posts from our lead traders that include learning systems, blog posts and videos.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Best, Crude, Oil, Day Trading, Signals, Strategy, USOIL, WTI, CL_F, USO

Follow: