Compound Trading Premarket Trading Plan (Trade Alerts, Stock Market News & Chart Set-Ups) Monday Jan 7, 2019.

In this premarket trading edition: AXSM, LOXO, LXFT, LLY, AAPL, TSLA, AMZN, Oil, SPY, VIX, BTC, Gold, Silver, DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading Group.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events / Platform Development / Team Work in Progress:

- Main Trading Room

- Jan 7 – I am in session in main trading room today for market open, mid day review, during active trading and overnight futures.

- Team Work in Progress:

- Jan 6 – Members please review Lead Trader 2019 Trading Guidance Report (Time Cycles) & Trading Platform Updates

Premarket Reporting: Per lead trader availability basis only (the pre-market reports are not published every market day – they are a way for our team to communicate with our member clients and update market conditions when time allows).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds.

Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure, Terms of Use:

Blog / Video / Social Posts / Learn to Trade:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See YouTube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

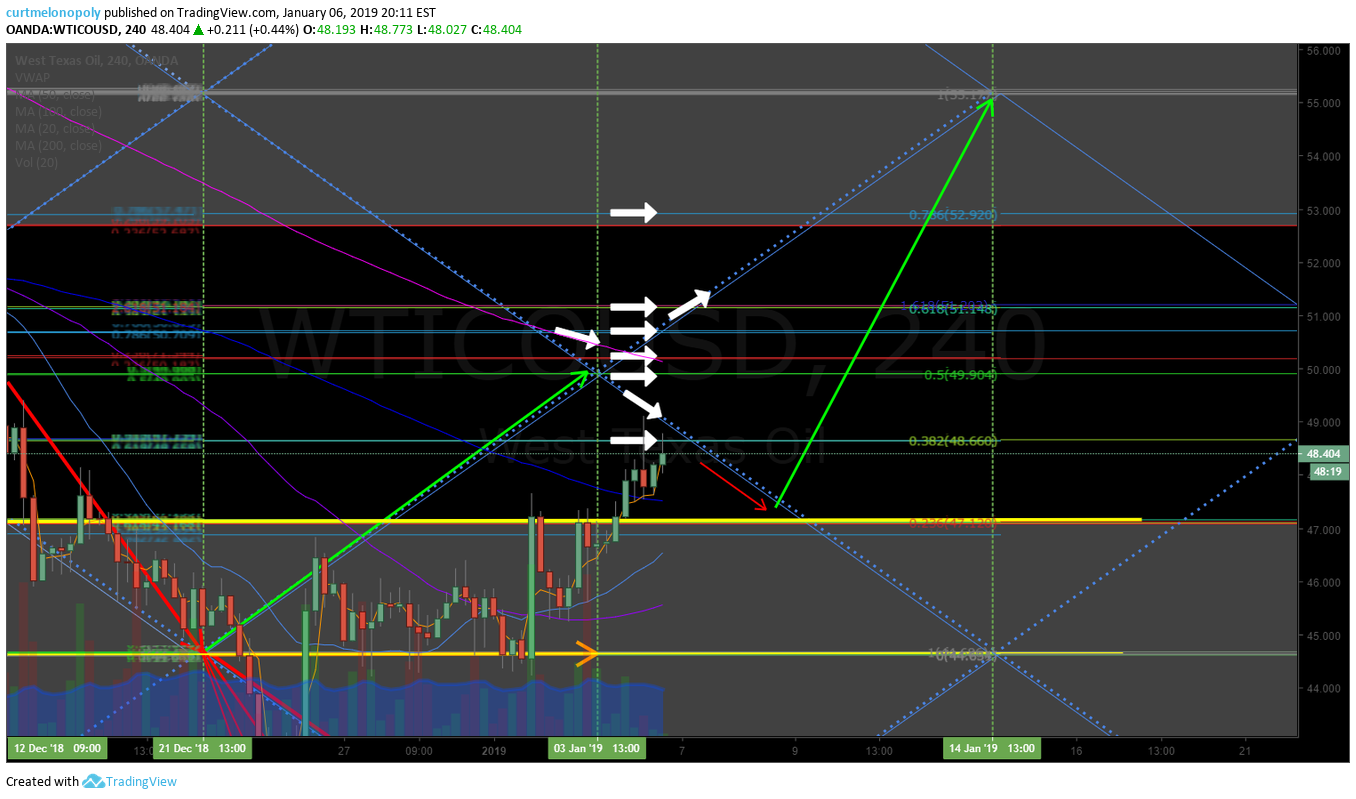

Jan 6 – Protected: Crude Oil Trading Strategies | 240 Min Simple Chart Model Structure & Trade Plan

Jan 3 – Protected: Crude Oil Trading Strategies | Oil Trading Room | Trade Oil Review

Jan 3 – Protected: Gold Trading Strategies | Live Trading Room | Chart Review

Jan 3 – Protected: SP500 SPY Trading Strategies | Live Trading Room | Chart Review

Dec 11 – Current Trades Reviewed: Oil, SPY, VIX, NatGas, Time Cycles, Gold, Silver, DXY… https://www.youtube.com/watch?v=7mWMFTprLqQ

Nov 7 – Swing Trading Special Report Series (Part C) Nov 7 AAPL, BABA, AMD, EDIT, CARA, OSIS, BZUN, NIHD…

Oct 28 – Crude Oil Trading Strategy | Technical Analysis & Guidance.

Oct 23 – Crude Oil Trading Strategy: Career Trade Set-Up. Technical Analysis Trading Room w/ Video.

Oct 20 – Crude Oil Algorithmic Trading: A Simple Strategy That Wins – Real Life Example.

Oct 17 – Daytrading Crude Oil: Buy Sell Signals Strategy for Intra-day Sell Off Reversal.

Oct 15 – Crude Oil Trading Strategies: This Is It. How To Trade Crude Oil’s Next Move.

Oct 8 – Crude Oil Trading Strategy – How I Will be Trading Oil in to Time Cycles.

Oct 7 – How I Will Be Trading Bitcoin in to Increased Volatility (We Expect) Next Two Quarters.

Oct 4 – Day Trading: Trading Momentum Stocks With A Catalyst Using Technical Analysis. Case Example $ROKU.

Oct 2 – Swing Trading Alerts (w / video) VIX, Gold, Silver, Tesla $TSLA, $LEVB, $BTC, $EDIT, $PYX and more.

Oct 3 – Oil Trading Room – Oil Trading Signals with Lead Trader (plus video).

Recent Educational Articles / Videos:

I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Trading Plan / Watch Lists. Morning Momentum / Gaps / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Monday Jan 7 – Two days to let market structure settle and the report flow for the next six month time cycles starts. #patience #caution.

Fri Jan 4 – If Fed pauses hikes and US-China trade relations improve oil should run in to May targets oil bundle members have (especially if OPEC cuts remain in play), the markets should run up in to May. Gold, Silver, VIX, DXY and Bitcoin may (are likely) to get soft and equities will be a stock pickers environment (traded properly within instrument structure) during that period (Q1 2019). Generally this is how it looks currently. But yet to be seen in to next week forward – this is one scenario. Reporting and alerts (either way) will become very active as next week rolls out and in to next 6 months. We will have the structure of trade for our coverage (the algorithm models and swing platform) so that we can trade either scenarios (up or down in each, including swing trading).

Market Observation:

Markets as of 7:48 AM: US Dollar $DXY trading 95.86, Oil FX $USOIL ($WTI) trading 48.87, Gold $GLD trading 1292.00, Silver $SLV trading 15.73, $SPY 252.29 (premarket trade), Bitcoin $BTC.X $BTCUSD $XBTUSD 4015.00 and $VIX trading 22.4.

Momentum Stocks / Gaps to Watch:

$TSLA (+1.4% pre) Tesla CEO Musk breaks ground at Shanghai Gigafactory to launch China push – Reuters

$LXFT (+82.5% pre) Luxoft’s stock soars after DXC $DXC buyout deal valued at $2 billion, or 86% premium – MW

$LOXO (+65.4% pre) Lilly to buy Loxo Oncology in a $8 billion deal, for a 68% premium – MW

$SAGE (+39.5% pre) SAGE Therapeutics (SAGE) Surges on Positive SAGE-217 Phase 3 Data – SI

$KMPH (+19.8% pre) KemPharm (KMPH) Announces FDA Approval of sNDA for Two Additional Strengths of APADAZ – SI

$HCLP (-14.7% pre) Reports prelim Q4 volumes 2.0M v 2.8M q/q; Board suspends quarterly distribution

$EXAS (+10.4% pre) Exact Sciences to report $454-455M in total revenue, 71-percent growth for 2018 – PRN

$CFRX (+6.2% pre) ContraFect Reports Positive Topline Results from Phase 2 Clinical Trial of Exebacase (CF-301)

21 Stocks Moving In Monday’s Pre-Market Session https://benzinga.com/z/12942028 $AXSM $LOXO $SAGE $NEPT $EXAS $GE $PCG $HCLP $NHTC $CMC $MOGU $BDC

Stocks making the biggest moves premarket: LLY, AAPL, TSLA, AMZN & more –

Stocks making the biggest moves premarket: LLY, AAPL, TSLA, AMZN & more – https://t.co/F4Ioq8ujYO

— Melonopoly (@curtmelonopoly) January 7, 2019

News:

Tesla $TSLA CEO Musk breaks ground at Shanghai Gigafactory to launch China push #swingtrading https://www.streetinsider.com/Corporate+News/Tesla+CEO+Musk+breaks+ground+at+Shanghai+Gigafactory+to+launch+China+push/14979166.html

Tesla $TSLA CEO Musk breaks ground at Shanghai Gigafactory to launch China push #swingtrading https://t.co/WONmZDWWAw

— Swing Trading (@swingtrading_ct) January 7, 2019

Recent SEC Filings / Insiders:

Recent IPO’s, Private Placements, Mergers:

$LXFT To be acquired by DXC for $59.00/shr in cash valued at ~$2B (Luxoft Holdings)

Earnings:

Abiomed’s stock climbs after preliminary revenue reported above expectations.

#earnings scheduled for the week

$STZ $BBBY $SGH $LEN $KBH $CMC $FCEL $HELE $AYI $AZZ $LNN $SCHN $SNX $MSM $PLUG $WDFC $EXFO $GBX $PSMT $SAR $INFY $FC $NTIC $KSHB $VOXX $SLP $MPAA

#earnings scheduled for the week$STZ $BBBY $SGH $LEN $KBH $CMC $FCEL $HELE $AYI $AZZ $LNN $SCHN $SNX $MSM $PLUG $WDFC $EXFO $GBX $PSMT $SAR $INFY $FC $NTIC $KSHB $VOXX $SLP $MPAAhttps://t.co/r57QUKKDXL https://t.co/CdQw0J0oUi

— Melonopoly (@curtmelonopoly) January 7, 2019

A look at Jan #earnings calendar.

$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN

http://eps.sh/cal

A look at Jan #earnings calendar.$NFLX $BAC $BA $BBBY $KBH $SGH $STZ $MA $JPM $C $GS $JNJ $UNH $WFC $AA $LRCX $CJPRY $SLB $ABT $LEN $UNF $AKS $BMY $LW $VLO $RPM $AXP $SMPL $SNX $MSM $WYI $CMC $HELE $FAST $PHM $CSX $INFO $CALM $LNN https://t.co/r57QUKKDXL https://t.co/rBfBzOCeAu

— Melonopoly (@curtmelonopoly) January 2, 2019

Trade Set-ups, Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Refer to date at top left of each chart (charts can be carried forward for some time). Trade alerts and stock chart set-ups should be traded decision to decision process – when trade set-up fails cut position fast. Leg in to winners at key resistance and support (at retracement or breach) and exit losers fast based on technical support and resistance. Not all set-ups work, the purpose of technical analysis is to provide a framework to trade (chart structure enables a trader to set stops where a trade has failed or leg in to winners and trim winners). Purpose of trade alerts is to bring awareness of a trade set-up in play but you have to execute the trade based on your trading strategy (which should be harnessed in your rules based process).

Crude oil resistance points, trade technically should come under pressure in to the 10th and then possibly bounce to target.

Closed $DGAZ long at 86.79 (NatGas short) from 52.30. Nice trade. #swingtrading #premarket

Gold (Monthly) Structure seems to suggest near term resistance at diagonal FIB TL, yet to be seen. #GOLD $GC_F $XAUUSD $GLD $UGLD $DGLD #swingtrading

Last trading session in crude oil trade alerts screen shot. Will be more active now that not sick and Jan 1 near. #oiltradealerts

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading

Chewing around the edges of volatility $VIX $TVIX $UVXY Short #tradealerts #swingtrading pic.twitter.com/tbbunu8VGB

— Melonopoly (@curtmelonopoly) December 13, 2018

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT

I love EPIC FX USOIL WTI $CL_F $USO #Oil #trading #alerts #algorithm #OOTT pic.twitter.com/s84TakajSQ

— Melonopoly (@curtmelonopoly) December 13, 2018

Machine trading crude oil with EPIC Oil Algorithm at premarket open. Tues 4:30 price target hit perfect also from weekend reporting #Oil #TradingAlerts $CL_F FX USOIL WTI $USO #OOTT

https://twitter.com/EPICtheAlgo/status/1072722068075102209

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT

Machine trading day today FX USOIL WTI $CL_F $USO #Oil #trading #premarket #OOTT pic.twitter.com/FCj73Q40wQ

— Melonopoly (@curtmelonopoly) December 11, 2018

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO

Our machine trading was making money today, but as a human trader that was no easy trading session in oil. Even the machine trading had some cuts (small) but won over no problem. #oil #machinetrading $CL_F FX USOIL WTI $USO pic.twitter.com/tE6JDg8hZS

— Melonopoly (@curtmelonopoly) December 4, 2018

Machine trading screen shots from oil alert feed tonight. FX USOIL WTI $CL_F $USO #Oil #Trading #Alerts #OOTT #machinetrading

We are short DWT (short oil ETN) from last week $USOIL $WTI $CL_F $USO $UWT #oil #trade #alerts

Volatility short TVIX trade went well. $VIX $TVIX Looking for a bounce in to Dec 5 #volatility #trading

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO

To catch a knife 🙂 Daytrading crude oil #OOTT #oiltradealerts $CL_F FX USOIL WTI $USO pic.twitter.com/R8n63CV72i

— Melonopoly (@curtmelonopoly) November 13, 2018

Where can you find a trading setup that executes for a 150+ tick day trade in crude oil with back tested win side probability 90%. Test it and tell us we’re wrong. Member report below. $USOIL $WTI $CL_F #OIL #trading #OOTT

https://twitter.com/EPICtheAlgo/status/1057464025750138881

Market Outlook, Market News and Social Bits From Around the Internet:

Some interesting stats on fund flows

Some interesting stats on fund flows pic.twitter.com/oj2ud9g8eL

— Ronnie Stoeferle (@RonStoeferle) January 7, 2019

1/ Summary of major asset classes and their 2018 calendar performance. Treasuries made a super late comeback, but it was really a “cash outperformed all” kind of a year.

Export-dependent countries like China, Germany & Frontier Markets performed the worse due to trade tariffs.

1/ Summary of major asset classes and their 2018 calendar performance. Treasuries made a super late comeback, but it was really a "cash outperformed all" kind of a year.

Export-dependent countries like China, Germany & Frontier Markets performed the worse due to trade tariffs. pic.twitter.com/jhqX5ImjB4

— Tiho Brkan (@TihoBrkan) January 5, 2019

‘Geopol environment is most dangerous it’s been in decades,’ is first sentence of this year’s Eurasia Risk Report: ‘2019 could turn out to be the year the world falls apart.’ Tail risks higher than they’ve been at any point since launch of Eurasia in 1998. https://www.eurasiagroup.net/files/upload/Top_Risks_2019_Report.pdf …

'Geopol environment is most dangerous it’s been in decades,' is first sentence of this year's Eurasia Risk Report: '2019 could turn out to be the year the world falls apart.' Tail risks higher than they’ve been at any point since launch of Eurasia in 1998. https://t.co/NNSwmEHYkM pic.twitter.com/Ge9x8KWLGm

— Holger Zschaepitz (@Schuldensuehner) January 7, 2019

Hedge funds dump crude and diesel as economic outlook darkens: Kemp

https://twitter.com/EPICtheAlgo/status/1082265019956502533

Goldman sounds the China alarm and cuts metals outlook.

Read: https://goo.gl/bcbPB1

Goldman sounds the China alarm and cuts metals outlook.

Read: https://t.co/YSrIta6eg3

— Rosie the Gold Algo (@ROSIEtheAlgo) January 7, 2019

Gold: An unexpected story to start the week:

China end-December #gold reserves rise 0.32Moz to 59.56Moz

First increase since October 2016.

(h/t @JGCCrawley )

Gold: An unexpected story to start the week:

China end-December #gold reserves rise 0.32Moz to 59.56Moz

First increase since October 2016.

(h/t @JGCCrawley ) pic.twitter.com/yckmTzOUob

— John Reade (@JReade_WGC) January 7, 2019

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AXSM $LOXO $MYND $INSM $NEPT $AXON $EPZM $UWT $DGAZ $GE $CHK $APHA $KTOV $VALE $USO $NBEV $X $JNUG $TSLA

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades: $BOOT $IPG $CRM $ADBE $GOOGL $DG $ECA $PDCE $TPX $MU $CNP $NI $EPZM $LGIH $C $GM $FANG $CLR $FIVN $ANET $ROCK $PHM $LEN $AGCO $EOG $EAT $BJRI $MAS $ALVR $LABL $STZ $DDS $WP

(6) Recent Downgrades: $SNAP $SWKS $RH $KIRK $OAS $CRZO $RRC $ALV $SPOT $MSGN $NJR $AEP $SR $OGE $CWEN $INN $RES $SPN $BAC $THRM $BIG $DK $EQT $WEN $GEF $GG $QTRH $PNC $EVR $MO $BTI $OI $POWI

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Stocks, Trading Plan, Trade Alerts, Trading Room, Swing Trading, Day Trading, AXSM, LOXO, LXFT, LLY, AAPL, TSLA, AMZN