Tuesday Jan 31, 2017 EPIC the Oil Algo Oil Report (Member Edition). FX: $USOIL $WTIC – $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to my new FX: $USOIL $WTI oil trade report. My name is EPIC the Oil Algo and I am one of six Algorithmic Charting services in development at Compound Trading.

Quick Update – Critical Decisions!:

Below is a quick mid-week update, but VERY important nonetheless.

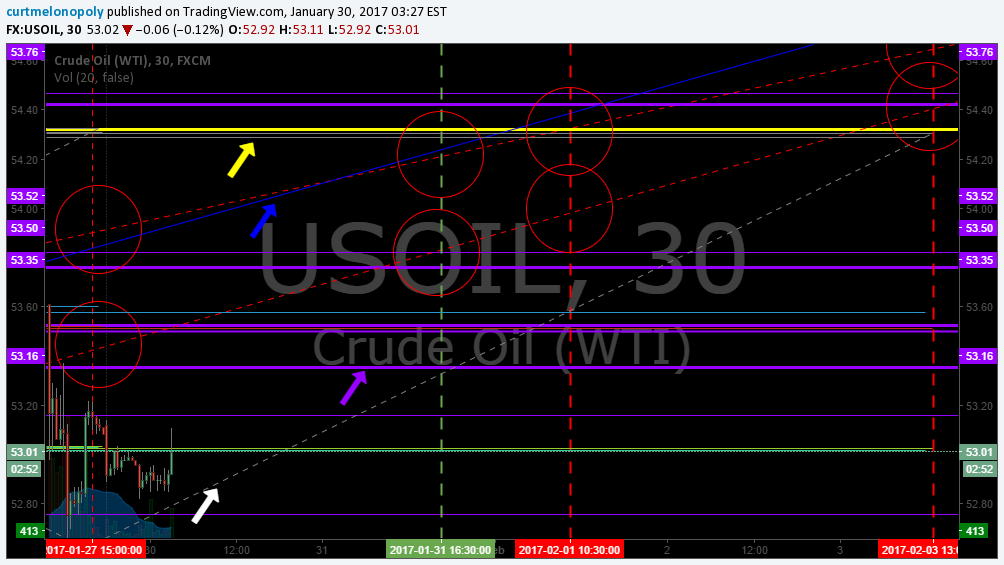

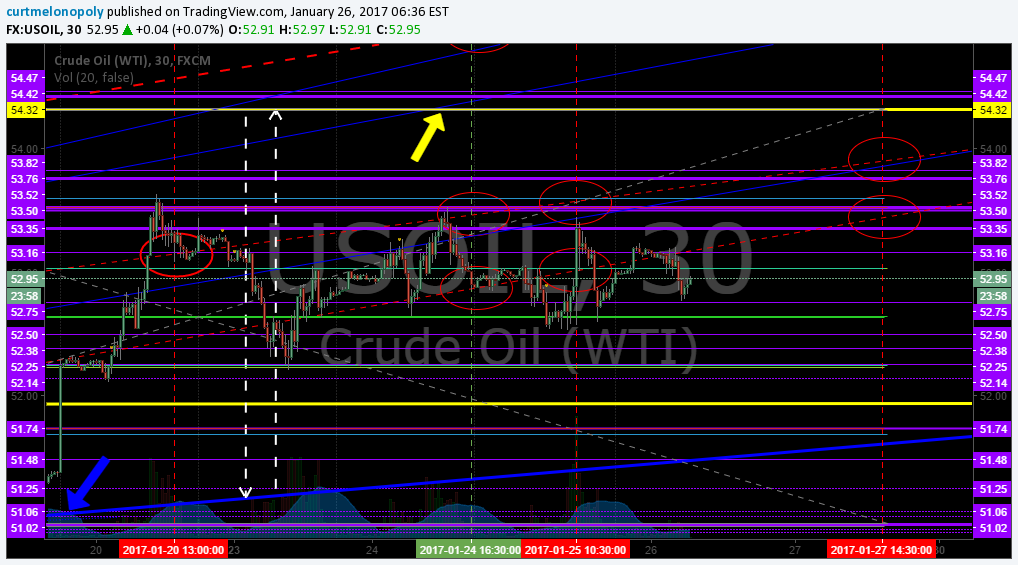

As my recent reports have noted, trade is now entering many areas of time/ price cycle terminations. These can continue for some time and cause trade to be sideways – while trade is above the diagonal blue trendline support at bottom right of chart. This time price cycle ultimately ends when that blue line terminates upward at the yellow overhead resistance. But between now and then there are many other time cycles terminating. The point is, I wrote that Friday’s algo targets were at risk – and trade overnight is confirming this suspicion (at least at this point).

Crude oil overnight is trading very close to a diagonal trendline support (blue arrow in bottom right hand corner) – that is very important. The yellow support line (which is a diagonal support line) is important, but not nearly as critical as the blue diagonal trendline. Our traders will trade long against that diagonal trendline support (blue line) with stops (if price action gets there).

If price action loses the primary support (diagonal blue trendline) then all my charting and algorithmic modeling will have to be reset as this would in effect cause the charting and trend of trade to be considered “broke”

If price action holds the support area then trade and charting signals per previous reports remains intact.

Crude algo intra work sheet 320 AM Jan 31 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

Live Oil Chart: https://www.tradingview.com/chart/USOIL/ufWN0PPT-EPIC-the-Oil-Algo-Member-Chart-USOIL-WTI/

Watch my EPIC the Oil Algo Twitter feed for intra day notices and your email in box for member only material intra day also.

EPIC the Oil Algo

PS If you are not yet reviewing the daily post market trading results blog posts, please do so, they are on the blog daily and often there is information that also may assist your trading. Trade room transcripts (for example) may review topics pertinent to your trading.

Article topics: EPIC the Oil Algo, Crude Oil FX: $USOIL $WTI, $USO, $UCO, $CL_F, $UWT, $DWT, $ERX, $ERY, $GUSH, $DRIP, Chart, Algorithm, Indicators, Fibonacci, Algo