Wednesday Jan 25, 2017 EPIC the Oil Algo Oil Report (Member Edition). FX: $USOIL $WTIC – $USO $CL_F $UWT $DWT $UCO $SCO $ERX $ERY $GUSH $DRIP

Welcome to my new FX: $USOIL $WTI oil trade report. My name is EPIC the Oil Algo.

A quick update as all signals and decisions remain the same as reports over last week.

NEW MEMBERS be sure to read reports going back at least five days so you know what to watch for. We are getting emails and DM’s with many questions that are answered in the reports! Do not trade if you do not know the support, resistance and signals I have provided for you in this trading range. To be in a trade and then ask, especially asking questions when the reports are provided for you specific to what has been hammered numerous time in reports is simply irresponsible trading and not fair to other members because our time should be used for questions and helping members with forward thinking decisions not what is already clearly laid out in reports. We know if you are reviewing the reports so if you ask questions that are already in the report and we know you haven’t reviewed the reports (internet is smart) and we know you have not looked at the algo charting provided (internet is smart) then we are going to have to start declining help to those that won’t do their homework first. Read the reports please. And for those that are doing their Study congratulations!

The Machines are Back!

How do we know? There are at least fifty indicators that we use and the consistency of those signals hitting are how we know. They are back. Why is this important? Because this enables my algorithmic charting to be precise and it also means there is a big move looking upside or down. Be ready.

Trade the Range

We get endless questions about whether you should go long or short. We can’t tell you. We can provide algorithmic charting that will increase your edge however. The recent reports tell you exactly where your trading range is – read them. If you’re trading mid range / halfway between range edges – then prepare for being chopped up or you better be an expert trader.

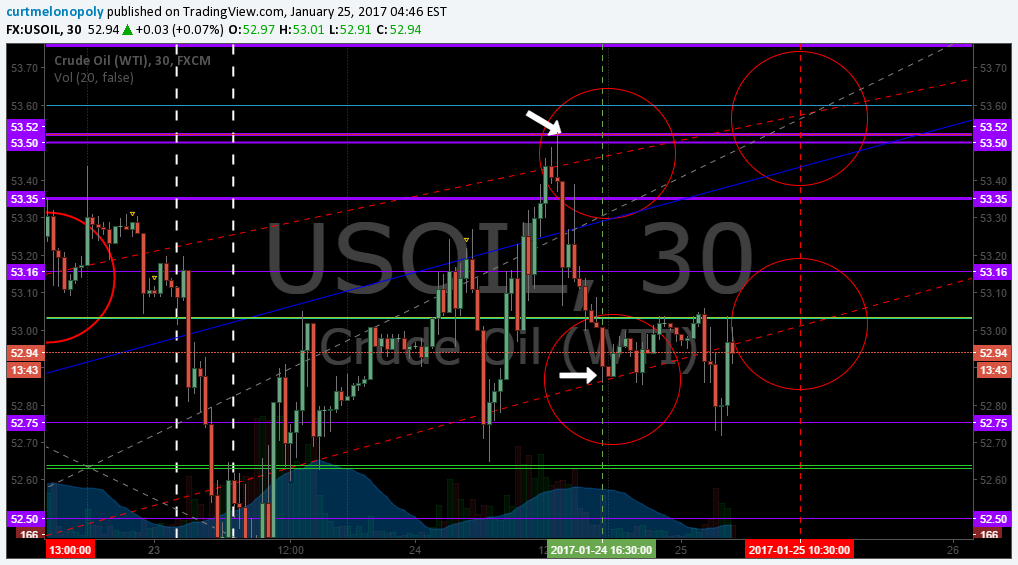

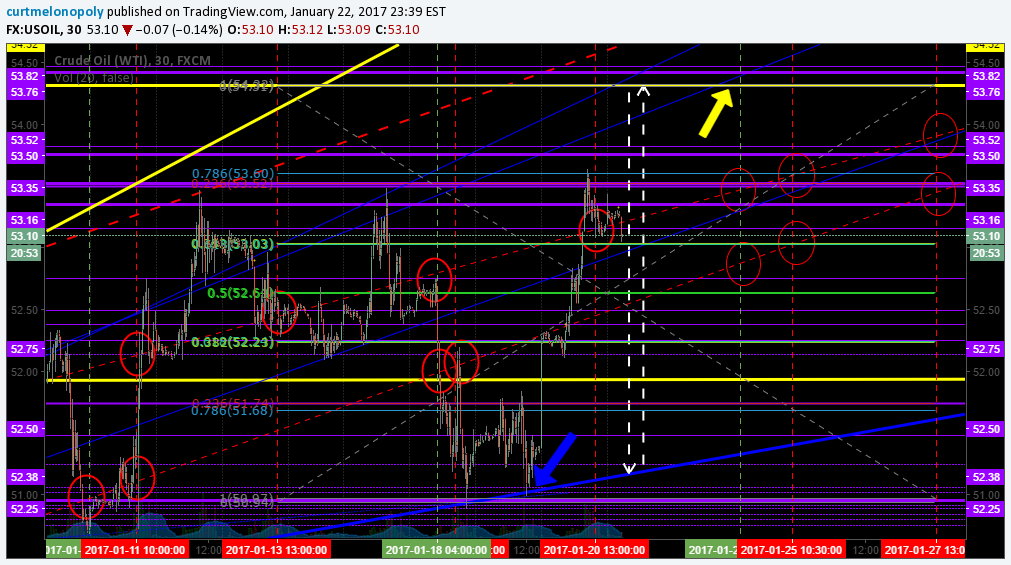

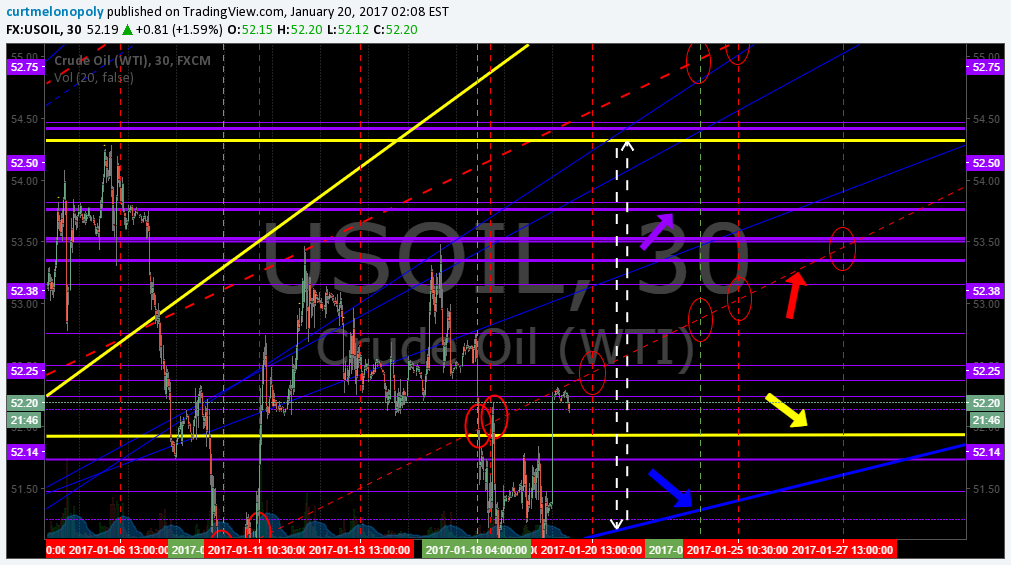

Below is a Chart Update for Current Trade. I will update algorithmic charting with targets, algo lines, time and price cycles etc in more detail when trade breaks out to upside or down from current range.

Trade the range. Blue arrow long bias and yellow arrow short bias until break out or break down in price. Crude algo intra work sheet 510 AM Jan 25 FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

You also need to know what the other indicators on this chart tell you – sorry I’m a broken record in this report but do your homework, read my previous posts so you know exactly what each indicator on this chart is for.

Here is the latest EPIC the Oil Algo Live Oil Chart;

https://www.tradingview.com/chart/USOIL/EVbbvjxF-EPIC-the-Oil-Algo-Member-Chart-USOIL-WTI/

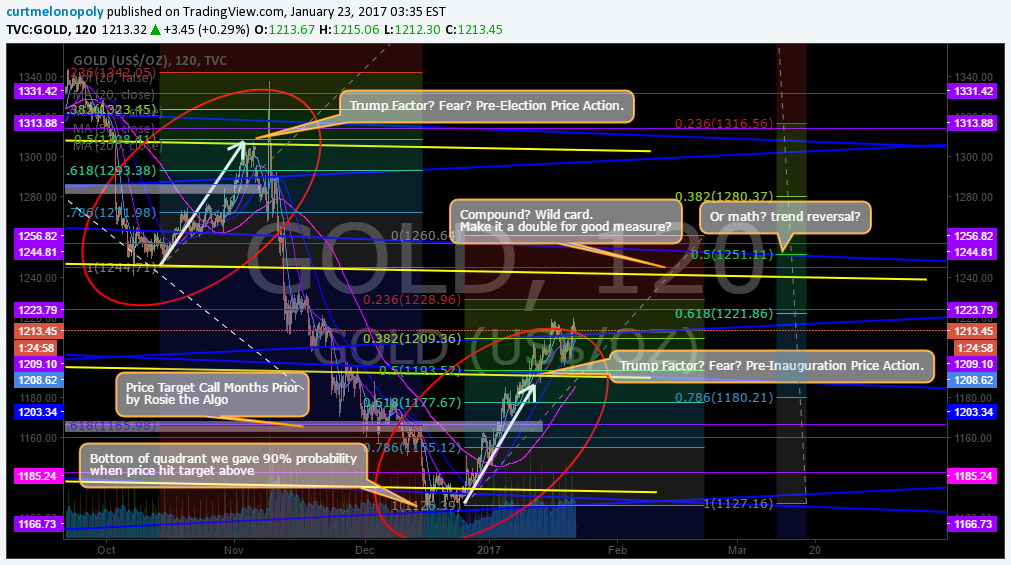

The Targets are Ringing

Per Previous;

Just a quick chart update and that is it for today! All signals and levels remain the same! Refer to recent reports for levels to trade, targets etc!

EPIC the Oil Algo

Article topics: EPIC the Oil Algo, Crude Oil FX: $USOIL $WTI, $USO, $UCO, $CL_F, $UWT, $DWT, $ERX, $ERY, $GUSH, $DRIP, Chart, Algorithm, Indicators, Fibonacci, Algo