Tag: $XBTUSD

Swing Trading Set-Ups | Premium | BITCOIN (BTC, XBTUSD), GERMANY ETF (EWG), ALLERGAN (AGN), JETBLUE (JBLU), SPDR S&P 500 (SPY)

Swing Trading Set-Ups.

Below are Swing Trades On Watch This Week (in addition to the others in recent reporting) BITCOIN (BTC, XBTUSD), GERMANY ETF (EWG), ALLERGAN (AGN), JETBLUE (JBLU), SPDR S&P 500 (SPY).

BITCOIN ($BTC, $XBTUSD, $XB_F)

We alerted the bottom long trade on Bitcoin Jan 30, 2019 at $3449.50 and it has now successfully cleared a number of areas of resistance on the model below – it traded as high as $9442.00 this weekend.

At each area of resistance we trim our long swing position in to the resistance and add above.

Trade has now hit a key area of resistance on the model (the trading box), this is typically considerable resistance. Up and over this area look to trade being range bound within the trading box until it breaks up or down from the trading box.

The move is obviously very bullish and following our trend trajectory near perfect from previous alerts and posts.

“Reasons we bot Bitcoin $BTC at bottom – luck, TA but mostly rumor of Zuck Coin $FB #cryptocurrency . Theory, if Fed gonna allow Zuck they likely take invisible hand off BTC price & not tarnish crypto fwd. Also why we’re coding crypto machine trade after oil #OOTT (90 days out).”

Reasons we bot Bitcoin $BTC at bottom – luck, TA but mostly rumor of Zuck Coin $FB #cryptocurrency . Theory, if Fed gonna allow Zuck they likely take invisible hand off BTC price & not tarnish crypto fwd. Also why we're coding crypto machine trade after oil #OOTT (90 days out). pic.twitter.com/jgBeuEnlJY

— Melonopoly (@curtmelonopoly) June 14, 2019

Anonymous Analyst That Predicted Bitcoin’s Price Surge Says It Could Reach $16,000 #swingtrading $BTC $XBTUSD https://usethebitcoin.com/anonymous-analyst-that-predicted-bitcoins-price-surge-says-it-could-reach-16000/

BITCOIN (BTC, XBTUSD) hit key resistance in trade this weekend, trim in to and add above for your swing trade. $BTC #swingtrading

GERMANY ETF (EWG) and VGK, EZU.

This could be a nice trend trade if the bulls continue the bounce from recent and get up over the 200 MA on the weekly charting. It is a touch and go scenario and would have to be managed closely because a break-down could be considerable in my opinion.

If the signal on this set up triggers a long trade alert I will likely model the charting for specific areas of trade entries, exits, trims and adds – key resistance and support areas and time cycles to watch. We do not at current have a model for this instrument of trade.

Mario Draghi: Is another ‘Whatever It Takes’ Moment at Hand? – Market Realist #swingtrading $EWG $VGK $EZU https://marketrealist.com/2019/03/mario-draghi-is-another-whatever-it-takes-moment-at-hand/?utm_source=yahoo&utm_medium=feed&yptr=yahoo

Mario Draghi: Is another ‘Whatever It Takes’ Moment at Hand? – Market Realist #swingtrading $EWG $VGK $EZU https://t.co/toxZxuam1V

— Swing Trading (@swingtrading_ct) June 16, 2019

GERMANY ETF (EWG) above 200 MA on weekly is a long for a possible trend trade in channel. On watch. $EWG #swingtrade

ALLERGAN (AGN)

ALLERGAN (AGN) After significant sell-off this looks ready for a bounce near key over sold support now $AGN #swingtrade

The area of support just below trade (see white arrow) looks to be a key area that is likely to find support and bounce. If it does bounce then I see three areas of key snap back for bullish trade. A general trajectory of trade possible in a bullish scenario is included below with 3 white arrows. We will see how trade near term is, but I like it for a bounce to at least the first price target (first white uptrending arrow).

7 Stocks Ripe for M&A as Trade War Pushes Market Off Record Highs https://www.investopedia.com/7-stocks-ripe-for-m-and-a-as-trade-war-pushes-market-off-record-highs-4689910?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

JETBLUE (JBLU)

Companies to watch: McDonald’s gets upgraded, JetBlue in buyback deal, Apple CEO meets Trump $JBLU $AAPL $MCD #swingtrading https://finance.yahoo.com/news/companies-to-watch-mcd-jblu-aapl-fcau-145511692.html?soc_src=social-sh&soc_trk=tw

JETBLUE (JBLU) Over 200 MA on weekly chart I will look to 22.00 then a move to 27.00. #swingtrading $JBLU

I really like this structured set-up, it does however need to get above and hold the 200 MA on weekly. You could trade it on a lower time-frame (such as daily), but considering where the markets are right now with Fed on deck and time cycle completion, I am playing safe until we’re over the hump of this time cycle inflection. I’ll get much more aggressive over the next week or two.

SPY SPDR S&P 500 (SPY)

SP500 (SPY) With time cycle completions behind us and the Fed on deck, expect a big move $SPY $ES_F $SPXL $SPXS #SwingTrade

We’re expecting a significant move with time cycle peaks on large time frames now in our rear view mirror (officially completely in the review view mirror at end of this week, allowing for a week either way of peak).

The two arrows representing large moves, one scenario up and one scenario down are on watch for the S&P 500. If you have access to our Volatility charting you want to consider it in your trade. The SPY chart also includes the model for structured trade and most considerable are the areas of support and resistance (marked with a series of arrows) and the TL support and resistance areas in red.

There is more SPY model charting in process right now with Jen back testing some newer models on other time frames FYI.

The Fed may break a lot of stock-market investors’ hearts this week https://on.mktw.net/2KkLBOG

https://twitter.com/CompoundTrading/status/1140373914931138561

Thanks

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing Trading, Set Ups, Strategies, BITCOIN (BTC, XBTUSD), GERMANY ETF (EWG), ALLERGAN (AGN), JETBLUE (JBLU), SPDR S&P 500 (SPY)

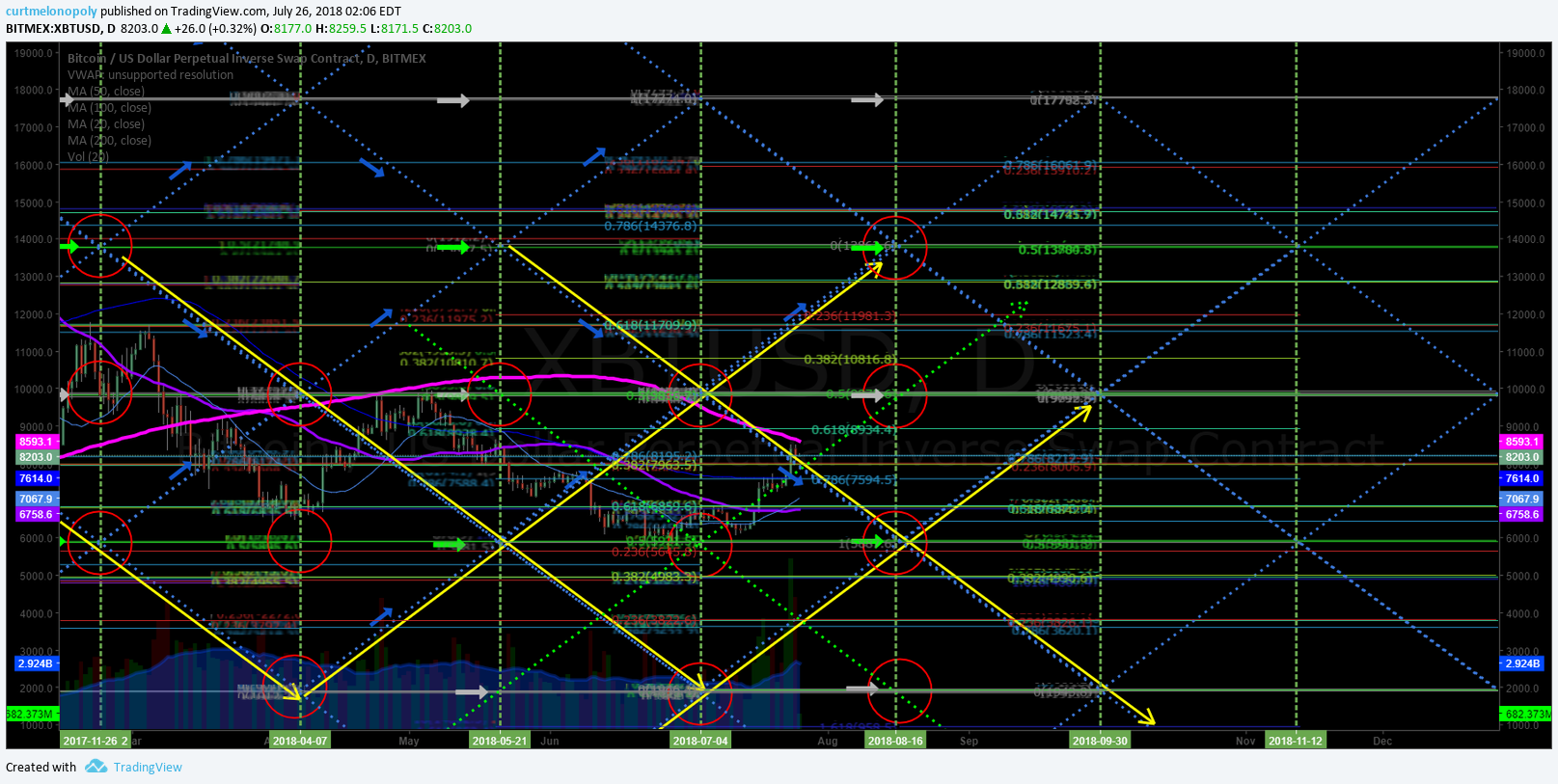

Bitcoin Algorithm (Crypto). Thurs July 26. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Thursday July 26, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn up channel. 207 AM July 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn. 302 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Trading Plan (Observations / Chart Indicators):

July 26 – As with the last two previous reports, it is a 50 MA resistance test but the trajectory of downdraft is changing and a turn is possible soon. Watching.

July 17 – As with previous, it is a 50 MA test but the trajectory of downdraft is changing and a turn is possible soon. Patiently watching.

July 9 – Trading just under 50 MA, watching for a decision at the 50 MA test for direction.

June 26 – Range bound trade – waiting for a direction.

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 324 AM July 26 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 327 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 136 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

July 26 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. Price testing 50 MA resistance, in channel. On watch. July 26 26 332 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. 625 resistance 418 support July 9 316 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

July 26 – No significant change to below;

Litecoin Algorithm. LTC showing signs of possible bottom turn reversal. July 17 332 AM $LTCUSD #Litecoin #Algorithm

Litecoin Algorithm. LTC still in down trend channel. July 9 324 AM $LTCUSD #Litecoin #Algorithm

Ripple Basic Algorithm Charting Model $XRP

July 26 – No noteworthy change.

July 17 – No noteworthy change.

July 9 – No noteworthy change.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles

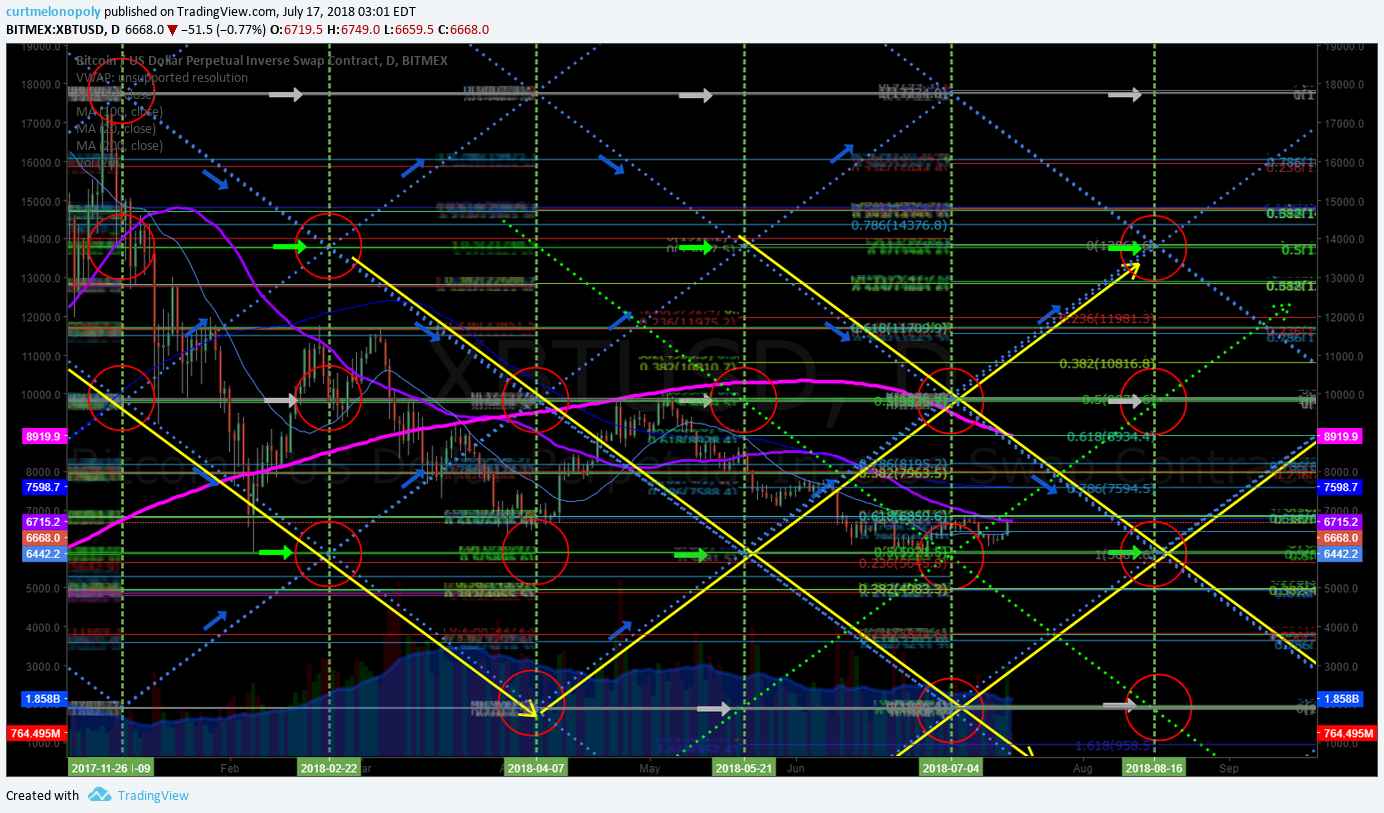

Bitcoin Algorithm (Crypto). Tues July 17. $BTC $XBTUSD $XBT $ETH $LTC $XRP #Bitcoin #Algorithm

Bitcoin Algorithm Report (Crypto). Tuesday July 17, 2018. Includes Time Cycles, Price Targets and Buy / Sell Triggers.

$BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello, my name is Crypto the Bitcoin Algorithm. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders. My algorithm charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD, Bitcoin related equities and you will find additional preliminary algorithmic modeling for $ETH, $LTC and $XRP in this report.

Note: The $XBTUSD (Bitcoin swaps) model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room server on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm – Daily Chart (Suitable for Swing Trading):

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Algorithm. Daily chart model testing 50 MA resistance in possible turn. 302 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daily chart model. 208 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Trading Plan (Observations / Chart Indicators):

July 17 – As with previous, it is a 50 MA test but the trajectory of downdraft is changing and a turn is possible soon. Patiently watching.

July 9 – Trading just under 50 MA, watching for a decision at the 50 MA test for direction.

June 26 – Range bound trade – waiting for a direction.

June 19 – My current bias and trading plan is exactly what it was last report (range bound trade)

June 11 – If Bitcoin $XBTUSD dumps lower than 5900.00 then high probability it continues in down channel (illustrated down channel with yellow arrows). It holds and up channel is in play (also illustrated on charting).

On the daytrading chart below it seems too early to comment on a bias… looking for structure to build.

My personal bias is it should turn up channel, conventionally that makes sense in trading after a dump, however, the 5900.00 is key as a mid quad area.

A few tweets / comments in private Bitcoin member serve recently reflecting my bias:

And we’re there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto

And we're there 🙂 Bitcoin $BTC #BTCUSD #Bitcoin #Charting #crypto pic.twitter.com/fK3u1dM7mx

— Melonopoly (@curtmelonopoly) June 10, 2018

Bitcoin Algorithm. 30 Minute Charting (Suitable for Daytrading BTC).

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 327 AM July 17 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading 30 min chart with buy sell triggers (white arrows) 136 AM July 9 $BTC $XBTUSD #Bitcoin #Algorithm

Bitcoin Algorithm. Daytrading chart with buy sell triggers (white arrows) 428 AM June 26 $BTC $XBTUSD #Bitcoin #Algorithm

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

July 17 – Alert examples will be updated soon.

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading

Intra bottom call. White arrow – alert sent. Green arrow – buy trigger. Red arrow – resistance (mid quad) on chart per alert sent. $BTC $XTUSD #Bitcoin #Cryptotrading pic.twitter.com/RM68yktgur

— Melonopoly (@curtmelonopoly) May 20, 2018

May 13 – Will post recent alerts soon when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

Ethereum Algorithm. Basic Charting Model on Daily Time Frame:

Ethereum Algorithm. Daily Chart. 625 resistance 418 support July 9 316 AM $ETH $ETHUSD #Ethereum #Algorithm

Ethereum Algorithm. Daily Chart. Price in channel, with weak trade. On watch. June 26 434 AM $ETH $ETHUSD #Ethereum #Algorithm

Per recent;

Ethereum Algorithm. Daily Chart. Price may test upside moving averages resistance. On watch. June 19 350 AM $ETH $ETHUSD #Ethereum #Algorithm

Litecoin Algorithm. Basic Charting Model.

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

Litecoin Algorithm. LTC showing signs of possible bottom turn reversal. July 17 332 AM $LTCUSD #Litecoin #Algorithm

Litecoin Algorithm. LTC still in down trend channel. July 9 324 AM $LTCUSD #Litecoin #Algorithm

Ripple Basic Algorithm Charting Model $XRP

July 17 – No noteworthy change.

July 9 – No noteworthy change.

May 13 – Ripple needs .932 for a chance for a bullish structured run. $XRP $XRPUSD.

I put some tighter time from Fib structure in the model for those that asked for daytrading signals.

Per recent;

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

Crypto News:

Crypto Markets Recover After Weekend Losses Saw Bitcoin at Lowest 2018 Level

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, Algorithm, BTC, Bitcoin, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, trade, price targets, time cycles