Yes, You Read That Right, This Crude Oil Signal Sees 153 Tick Day Trade Win in Crude Oil.

And the best part – it is a winning alert signal approximately 90% of the time. Back-tested and proven.

You can investigate the validity of my claim by studying our oil newsletter (algorithm model posts) – we make them public – they are unlocked historically).

On my last crude oil trading strategy report two days ago (October 28) I wrote;

“I wouldn’t be surprised at this point to see a bounce in price, however, the weekly wedge support now becomes resistance. If price breaches the previous support (now resistance) then trades should be ready for a retest of previous support before possible higher”.

Today there was an intra-day 153 tick move in trade of crude oil for a fantastic day trading set-up. The signals on the algorithm model were very clear.

Unfortunately for us I was in a business conference meeting and our tech (Jeremy) was on a conference with a broker programming one of the last Python API’s for the machine trading platform – we didn’t execute on the signal for a trade.

But that doesn’t mean we didn’t know the set-up was in play.

The oil trading algorithm report explains this very set-up in detail (members receive the report weekly) and the set-up was signaled to members in the oil trading room.

Rich (a long time member at Compound Trading) at 9:39 AM alerted the crude oil trade signal for the day-trade long in the oil trading room on Discord.

Below is a snap-shot (screen shot) of the chat in the oil chat room.

Here’s how the trade set-up was in play:

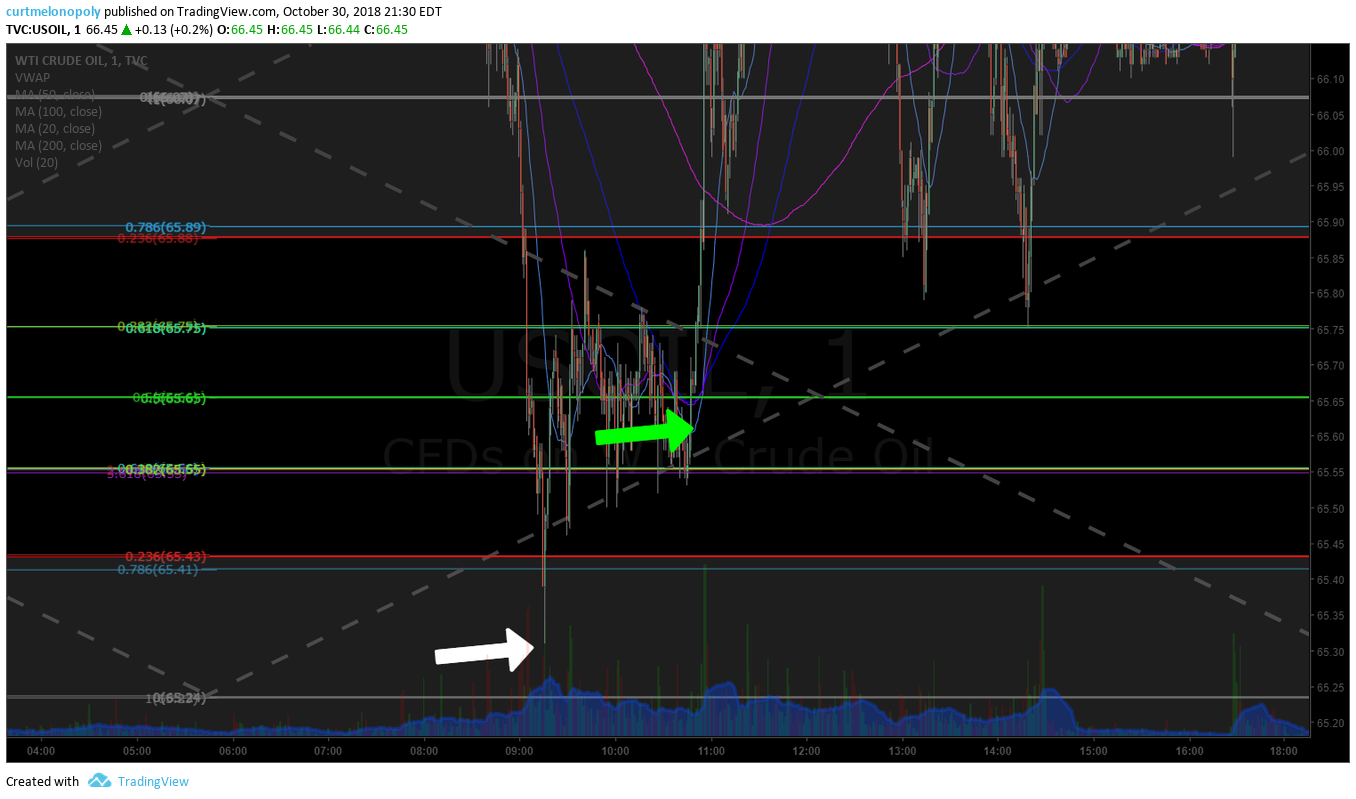

Crude oil sold off heavy in to open. It then sells off through the quadrant support on the oil algorithm but in to the main swing trading support range on the algorithm. Oil trade bottomed at 65.31 of FX USOIL WTI at 9:15 AM (white arrow on chart below).

On the 1 minute chart below at 10:46 AM trade pops (green arrow on chart) out of tight consolidation (after popping at support on the model) and runs to a high of day at 12:07 PM to 66.84.

Rich’s signal alert above in the oil chat room was for trade to hit 67.10 by Wednesday morning (at time of writing it is late Tuesday night and that target hasn’t hit yet but is very possible at the time he quoted possible for tomorrow morning).

Crude oil trade high of day was 66.84 at 12:07 PM near trend-line resistance on 1 minute oil chart for a 153 tick gain – what a daytrade!

Above were two conventional one minute oil charts to show you what happened on the day. Below are screen shots of the oil algorithm and how clear the signals were for the trade.

Crude oil trade touches main swing trading support on EPIC Crude Oil Trading Algorithm and bounces (gray thick horizontal line on the chart and yellow arrow).

The next day-trading signal and further confirmation for a long position on the day was the 10:30 AM 30 minute candle when trade bounced perfect off the machine trading support line (yellow diagonal line on chart and green arrow).

Then the signal to close the long crude oil day-trade was much clearer and precise – it was when the price of crude oil hit the key intra-day resistance on the EPIC Crude Oil Algorithm charting highlighted with a red arrow on the chart below.

As in the previous report I continue in this bias, “until there is a bounce, retrace and confirmed reversal the bias is short at resistance. The opposite will be true when a reversal is confirmed”.

But nothing beats this best of class trade signal for crude oil traders (I repeat from my previous post);

“Bottom line, the EPIC Crude Oil Algorithm continues to reward those that take long positions at support (channel support and quad support) and short at resistance areas of the algorithmic trading model. This will be my focus and I know the machine trading tech(s) will be focused primarily to those areas of trade also”.

Our oil algorithm is now near two years old and has proven time and time again that it provides the most predictable oil trading signals I have been able to find on the market, and this specific signal (outlined in this article) is the most predictable best crude oil signal of them all.

Where can you find a trading set-up that executes for a win at 150+ ticks intra-day in crude oil trade with a probability of approximately 90%? Test it and tell me I’m wrong.

One trade a month pays 1500.00 per month at 1 oil futures contract size.

Follow this link for a detailed description of my longer term crude oil trading strategy review at this post.

Increase Your Crude Oil Trading With These Tools.

- There is a link below to our oil trading academy page that has a number of links to articles on our site,.

- You can book private online trade coaching via Skype.

- Join our live trading room.

- Sign on to our oil trading alert feed subscription, (alerts are on a private member Twitter feed).

- Sign on to our weekly algorithm reporting that provides the algorithm model, conventional charting, guidance for the week etc.

- Attend a trading boot camp (in person or online).

- Request via email the videos of our most recent trading boot camp or the master class series videos (both sets are approximately 20 hours each). They are available only by email request at this time by emailing [email protected]. Soon they will be posted to our shop on website.

Thanks

Curt

Any questions let me know!

Further Reading to Help You Trade Oil:

Find more posts like this one on our Oil Trading Academy Page – links to numerous oil trade strategy reports.

Welcome to NYMEX WTI Light Sweet Crude Oil Futures.

Subscribe to Our Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Article Topics: Best, Crude, Oil, Day Trading, Signals, Strategy, USOIL, WTI, CL_F, USO

Follow: