Oil sell-off today, EPIC Oil Algorithm buy side oil trade alerts 64.50 buy side at day lows for members. #oil #trade #alerts FX $USOIL $WTI $CL_F $USO #OOTT #Algorithm

How did we know in a heavy intra-day sell-off where oil would bottom and turn? Learning to trade crude oil is not easy if you try and trade it with conventional trading strategy, you need to know how oil trades and why.

Below are the details to help you with your crude oil trading strategy.

Let’s look at what happened and then I will explain how I knew where the reversal intra-day in crude oil trade would be.

Below you will find the intra-day sell-off in crude oil, the member trade alerts, member chat room guidance and charts – and then I’ll explain how we knew in advance with high probability where the bottom would be.

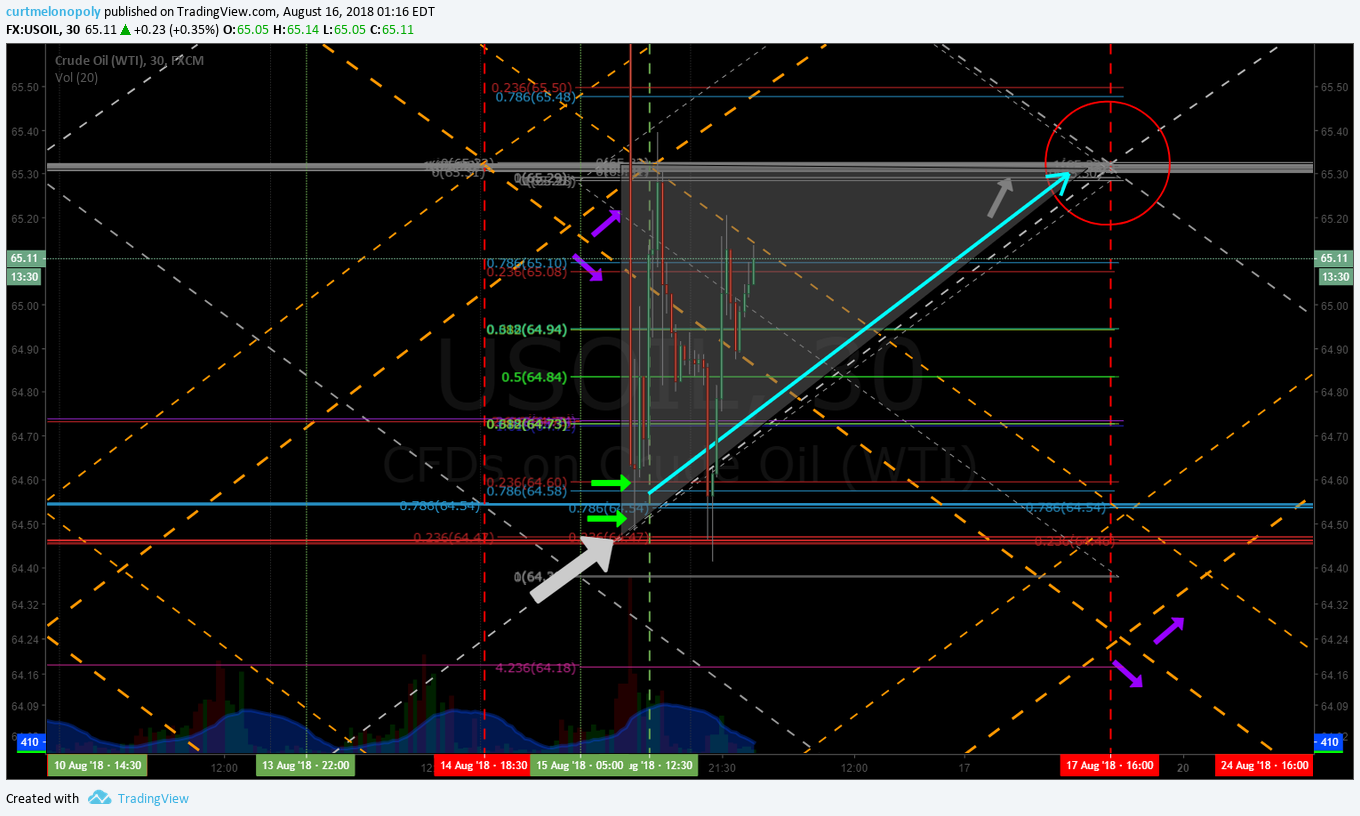

Crude oil chart (FX USOIL WTI). The sell off in crude oil trade today was extreme.

Crude Oil Chart – Crude oil sell-off today, EPIC Oil Algorithm called buy side for 64.50 at day lows (on way down).

On the way down we alerted our members on the EPIC Twitter crude oil trade alerts member service of where the possible bottoms were. There was an initial possible area and then the buy side area a touch down. The chart below shows the sell-off (with red arrow) and the buy side long entries alerted to members (green arrow).

Alert – Oil trade alerts on the EPIC Oil Trading Alerts Feed – Starting buys in here careful will cut fast 64.50 – 58, hit low in sell off perfect.

Below is a screen shot of the private member trade alert feed on Twitter showing the member alert that our buys were starting in the 64.50 – .58 area (after we had provided the oil trade strategy in the private discord oil chat room server). Buy side alerts started at 64.50 and the low of day in crude oil was 64.44 (FX USOIL WTI).

Chat Room Strategy – Oil chat room member guidance for buy side at bottom of sell-off today.

Below is a screen shot of the private member oil trading chat room.

“if it dumps i’ll look for 64.52 area ish”

This comment was after significant guidance by myself (lead trader at Compound Trading Group). I was looking for confirmation of a bottom trade strategy for a reversal in oil trade intra-day.

“hoping in to 1130 candle expiry i get entry”

Trade had been in sell-of prior to the Wednesday 10:30 AM EST EIA Petroleum Status Report and after the report was released trade in crude oil continued. Prior to this alert to watch the start of the 11:30 AM EST candle on the oil chart I had given significant member guidance in the chat room. If you look at the chart posted above you will see that the reversal turn in oil was in fact at the 11:30 candle on the chart.

“looking for volatility in to 64.52 and turn of 30 and long tail and volume buys”

As with the prior comment above, I’m explaining in the quote specifically what I am looking for to confirm my trade execution long for the reversal. By the way, we use a 30 minute chart for EPIC Oil algorithmic charting purposes.

“starting buys in here careful will cut fast 64.58 area”

This is the alert in the chat room that my buys started at 64.58 (this was the first alert) then on Twitter I had alerted buys 64.50 – 64.58 because price came off a bit and I was buying in to 64.50 so the Twitter alert reflected that also.

“trimmed 64.72 looking for another entry”

Then as I was trimming longs I had alerted the chat room. At this time I was also in the main trading room on voice broadcast alerting my trades to the chat room (we have the member discord chat room and a main chat room that has live oil charting for the algorithm and also voice broadcast – members can choose to be in either / or as they need).

So in a nutshell I called the bottom for members in an aggressive intra-day sell-off and provided strategy for the trade on its way down. There is many more comments prior to these from the chat room.

So the questions is, how did I know where to execute the long side trade in crude oil? How was the reversal confirmed? How can you learn to trade oil with the correct market and charting signals?

Reason Number 1 – The US Dollar.

“resistance on USD should provide moderate support for oil prices

but thats a moderate consideration”“you could consider this area divergent right now for USD – there’s a special report out tonight, but this is resistance on DXY now on main wide structure it should calm down very soon

on intra day short time frame who knows

intra day resistance white arrow on DXY”

The correlation between the US Dollar and the trade of commodities is not always correlated. I tend to check in on our US Dollar Algorithm whenever executing oil trades. Today the dollar was trading near a critical resistance area, so I took that information in to consideration.

Oil trading strategy in chat room started with resistance approaching on US Dollar trade intra-day explained to members with charts.

“wider structured resistance on DXY at orange line”

Screen shot of US Dollar Algorithm charting showing members in chat room where main resistance in DXY is.

How the Dollar Impacts Commodity Prices

“The vast majority of these materials use the dollar as a pricing mechanism for global trade because the U.S. is the strongest and most stable economy in the world. When the dollar strengthens, it means that commodities become more expensive in other, nondollar currencies. This tends to have a negative influence on demand. Conversely, when the dollar weakens, commodity prices in other currencies move lower, which increases demand.”

https://www.thebalance.com/how-the-dollar-impacts-commodity-prices-809294

Reason Number 2 – Support for Oil Trade on the Weekly Chart (moving averages).

“62.30 50 MA on weekly”

The second reason is more a consideration for downside risk than it was a reason for trade.

I was reviewing the weekly chart our algorithm reporting service provides members – taking a mental note of my downside risk. I was also weighing the upside resistance on the weekly chart. Because of the weekly downside risk being considerably lower than the price of intra-day trade my risk tolerance to more sell-off was very low. I alerted that to members and would have closed a losing trade very quickly had that happened.

The 50 day moving average in this chart example shows a considerable down-side risk to a long trade. The 50 MA is the purple line on the chart in the screen shot below. More about moving averages here.

Screen shot of weekly oil chart support for trading strategy consideration – 62.30 50 MA on weekly chart.

Reason Number 3 – EIA confirmed the build in crude oil inventory.

#EIA

Crude: 6.805M

Cushing: 1.643M

Gasoline: -0.740M

Distillates: 3.566M

#oott

And then the EIA Petroleum figures were available online at 10:30 AM and this confirmed a large build in crude oil inventories. This is bearish but at 4:30 the day before the initial forecast provided a surprise build (hence the sell-off that started in trade prior). This isn’t a reason for a long side trade at first glance until you consider the trader’s mentality.

The sell-off that continued after EIA was announced was obviously an over committed intra-day scenario because everyone already knew that a large build was expected, so I didn’t expect it to sell off much more intra-day. My longer term bias is considerably different, but specifically intra-day in the trade of crude I didn’t expect much more sell-off.

Then the EIA Petroleum Report figures were available and the build in crude was higher than expected (screen shot of chat room).

Also note in the screen shot below of the chat room the coding tech updating the algorithm charting for members on the intra-day time frame and posting it to the room. He did this because he knew a trade was setting up so he provided the most recent machine trading data for myself and our trading community members to use when executing the trades.

Reason Number 4 – Crude Oil Algorithmic Charting Support Areas to Watch.

64.60 FX USOIL buy target intra day – we’ll see how it looks trading 64.88 intra

Then I provided the members the first area of trade to watch (at 64.60) for on the charting that could have been the support area intra-day for the reversal long trade (see the member chat room screen shot above).

And sure enough, intra-day trade stalled at the 64.60 market and below is the charting we were watching. The green arrow on the charting below shows the area of trade.

Chat room screen shot – shows two EPIC Oil Algorithm charts and price target area where trade stalled for a test.

Gray arrow shows diagonal trendline support area that has acted as support historically many times. EPIC Oil Trading Algorithm.

The gray arrow shows an area on the oil algorithm that has been used by the machines to buy intra-day sell-offs over and over again.

One of the benefits of our work is that we look at historical charts and process that big data for our clients. This work provides insight to what specific signals to use at various intervals of trade intra-day and for swing trading that the human trader simply can’t discern because the data involved is too much for the brain to process. This would take a book of 500 pages to explain. In short, this specific area in the algorithmic oil charting model has been used consistently by the machines. I include some recent examples below for demonstration purposes.

Also note the green arrows on the chart. The first being the first area of support I was watching and the second being the second area. The first area of support did see a bounce in trade intra-day but failed the pull-back back test so we didn’t execute. The second area we did execute trades on and did alert to our members. This was so close to the ideal buy trigger that we nailed it. Our members will tell you that we alert the buy zones in sell-offs near perfect nearly 100% of the time. Our feed tells the story for us – it is time stamped and transparent so there is no way to trick anyone with false signals of record.

The chart below has recent examples of trade where the machines have bought the sell-off in crude oil with significant liquidity. The sell-off and subsequent area of reversal today was exactly the same area of the algorithm model.

Oil trade algorithm and the recent areas of trade machines have taken long positions in oil during sell-offs.

Reason Number 5 – Confirmation in Intra-Day Trade of Oil to Confirm Signal to Enter Long Side Trade.

Chat room screen shot – explaining to members indicators I was watching on charting for back-test confirmation in oil trade.

Crude oil trade hit 64.74 within 14 cents of the price target I was wanting to see to possibly confirm the trade (see above the 64.60 area I was watching for).

Then the price target of 64.60 was hit and I explained to chat room members to wait and see how the bounce in trade handled the upside 20 MA resistance area and to watch the expected back test (pull back in trade) to previous support before executing a trade. This is a process of watching intra-day trade for various confirmations in trade to be sure as you can be that your entry execution is not too early (or late for that matter).

Conclusion:

We knew well in advance of the oil sell-off today the area of trade that was most probable to be the right buy signal.

We alerted the buy side trade for our members on the private member oil trading alerts feed.

We provided trading strategy in the oil chat room well in advance of trade achieving the price target for the long side trade alert.

I provided live charting and voice broadcast to members in our main trading room as I executed trades.

Our algorithm charting provided us the buy area well in advance as part of a rules based trading process as a result of big data processing by our team of experts in this field.

In large part, this is why I haven’t been on the losing side of an oil trade alert in many months. Every trade alert is documented in real time, recorded, live alerted and time stamped for evidence of our claims.

Are You Learning to Trade Oil?

My best advice is to join our service on a trial and view real-time how we analyse our trades.

We have a clear trading process that is rules based and has proven to win.

I am far from the best trader I know, in fact I would rate myself about a 5 or 6 out of 10 – I am an expert technician but not top shelf trader. But I am one of the highest winning percentage oil trade alerting services available simply because our algorithm models are that good – and it takes more than that, it takes a team of committed individuals to provide clear winning trading signals to the members.

Interpretation of the algorithm models as a result of experience and historical big data processing is why we win and win often. And when we loose, it is small because we know when a trade has failed. In our work we know before the crowd where to buy and why and where to close and why. We know where to add to your trades and where to trim you trades.

And finally, if you need more help getting on the winning side of your trades then I would seriously consider 3 hours of private coaching. Even the best traders in the world have a coach because a trading coach will keep your psychological game in check as it relates to following the trading of a rules based process. A trading coach is critical to success as a winning trader.

Best with it and let me know if you need anything.

Curtis

To Learn More About Trading Oil:

Learning to Trade Links on our Site and/or YouTube.

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

Oil Trading Room – How to Use EPIC the Oil Algorithm June 21, 2017 (video).

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades June 29, 2017 (video).

Here we unlock historical member reports at intervals after time cycles have expired for traders that are learning to trade oil. When you clock on link scroll down at landing page on blog section you will be transferred to so that you can get to reports that are unlocked over time: https://compoundtrading.com/category/epic-the-oil-algo-chart-report/

Subscribe Here:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

Article Topics: Crude, Oil, Trade, Alerts, Chat Room, Reversal, Strategy, Algorithm, Learn to Trade