Compound Trading Wednesday April 19, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $SNGX, $USOIL, $DWT, $GOLD, $DUST, $TWLO, $BABA – $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Most recent lead trader blog posts:

Now I’m Inspired! My Guarantee to Struggling Traders (and Yours). Part 3 “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853764002584944640

Last market trading session Post Market Stock Trading Results can be found here:

https://twitter.com/CompoundTrading/status/854593188098691072

Premarket Trading Plan Watch-list for this session can be found here (locked to respect members and unlocked to public about a week later for transparency):

https://twitter.com/CompoundTrading/status/854673230946291713

Most recent Premarket Chart Set-Up Video (most recent available to public – there may be other exclusive’s in member newsletters):

https://twitter.com/CompoundTrading/status/854695312367243264

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters):

https://twitter.com/CompoundTrading/status/854703199017725952

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters):

https://twitter.com/CompoundTrading/status/854761895269740544

Most Recent Public Swing Trading Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket Session:

Premarket momo.

Premarket $NVLS, $SNGX, $RARE

— Melonopoly (@curtmelonopoly) April 19, 2017

$SNGX premarket up 32% on positive news.

$SNGX premarket up 32% on positive news. pic.twitter.com/B2pqjwU5ki

— Melonopoly (@curtmelonopoly) April 19, 2017

PreMarket ? Trading Plan Wed Apr 19 $MS, $SNGX $UPZS, $OPMZ, $LIGA, $MMEX, $USOIL, $WTI, $GDX #trading

Protected: PreMarket 🔥 Trading Plan Wed Apr 19 $MS, $SNGX $UPZS, $OPMZ, $LIGA, $MMEX, $USOIL, $WTI, $GDX #trading https://t.co/7ZlcdQKocD

— Melonopoly (@curtmelonopoly) April 19, 2017

Morning! Premarket member chart set-up review in trading room 9:00! Charts. Live voice broadcast. https://compoundtrading.com #freedomtraders

Morning! Premarket member chart set-up review in trading room 9:00! Charts. Live voice broadcast. https://t.co/d1TrWCgBiP #freedomtraders

— Melonopoly (@curtmelonopoly) April 19, 2017

In Play: $SNGX, $IMGN, $UGAZ, $DGAZ, $BOLD, $SBGL, $AGIO, $UVXY High Uncertainty: $EWZ, $SRNE, $X premarket

In Play: $SNGX, $IMGN, $UGAZ, $DGAZ, $BOLD, $SBGL, $AGIO, $UVXY High Uncertainty: $EWZ, $SRNE, $X premarket https://t.co/154aIVxEob

— Melonopoly (@curtmelonopoly) April 19, 2017

In play today in chat room and on markets: $IDXG , $GNC $DWT, $DUST, $USOIL, $WTIC, $GDX

Curt M: Long $SNGX 1000 4.51

Curt M: Long 4.57 3000

Curt M: Out 4.83 4000 shares

$SNGX market open momo went fantastic – waiting on 100%. Primary indicators.

$SNGX market open momo went fantastic – waiting on 100%. Primary indicators. https://t.co/uBUrUXPstn

— Melonopoly (@curtmelonopoly) April 19, 2017

Leaderboard: $SNGX 72% $EGT 23.5% $CALI 14.5% $CAMP 14% $IMGN 12.6% $AIRI 9%

Leaderboard: $SNGX 72% $EGT 23.5% $CALI 14.5% $CAMP 14% $IMGN 12.6% $AIRI 9%

— Melonopoly (@curtmelonopoly) April 19, 2017

Closing my $DUST and $DWT positions

How-to Trade Stocks, Lessons and Educational:

$SNGX trade

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

NA

Algorithm Charting News:

Direct algo target hit Tues 430 and Wed 1030 ? Crude algo intra work sheet FX $USOIL $WTIC #OIL $CL_F $USO $UCO $SCO $UWT $DWT #OOTT

Direct algo target hit Tues 430 and Wed 1030 🔥 Crude algo intra work sheet FX $USOIL $WTIC #OIL $CL_F $USO $UCO $SCO $UWT $DWT #OOTT https://t.co/eq34Nt9uVt

— Melonopoly (@curtmelonopoly) April 19, 2017

EPIC the Oil Algo called the top in oil almost to the cent ten weeks in advance. Not bad. $UWOIL $WTI $CL_F $OOTT #OIL @EPICtheAlgo

EPIC the Oil Algo called the top in oil almost to the cent ten weeks in advance. Not bad. $UWOIL $WTI $CL_F $OOTT #OIL @EPICtheAlgo

— Melonopoly (@curtmelonopoly) April 19, 2017

This morning “experts” still on TV “Buy #oil right now!” Ugh. I sat there thinking, you must have access to same chart models we have. #OOTT

This morning "experts" still on TV "Buy #oil right now!" Ugh. I sat there thinking, you must have access to same chart models we have. #OOTT pic.twitter.com/oNLKE9xPGW

— Melonopoly (@curtmelonopoly) April 20, 2017

Algorithmic chart model reset tonight. Massive data processing w aggresive downdraft today. @EPICtheAlgo ? $USOIL $WTI $CL_F $USO #OOTT #OIL

Algorithmic chart model reset tonight. Massive data processing w aggresive downdraft today. @EPICtheAlgo 🎯 $USOIL $WTI $CL_F $USO #OOTT #OIL pic.twitter.com/7kTgTbfpJ0

— Melonopoly (@curtmelonopoly) April 20, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

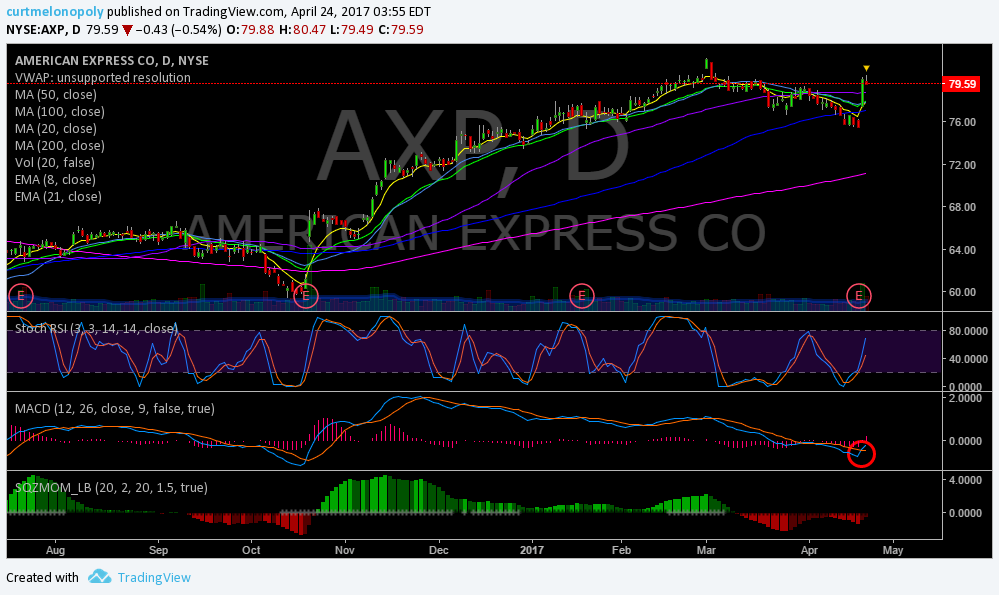

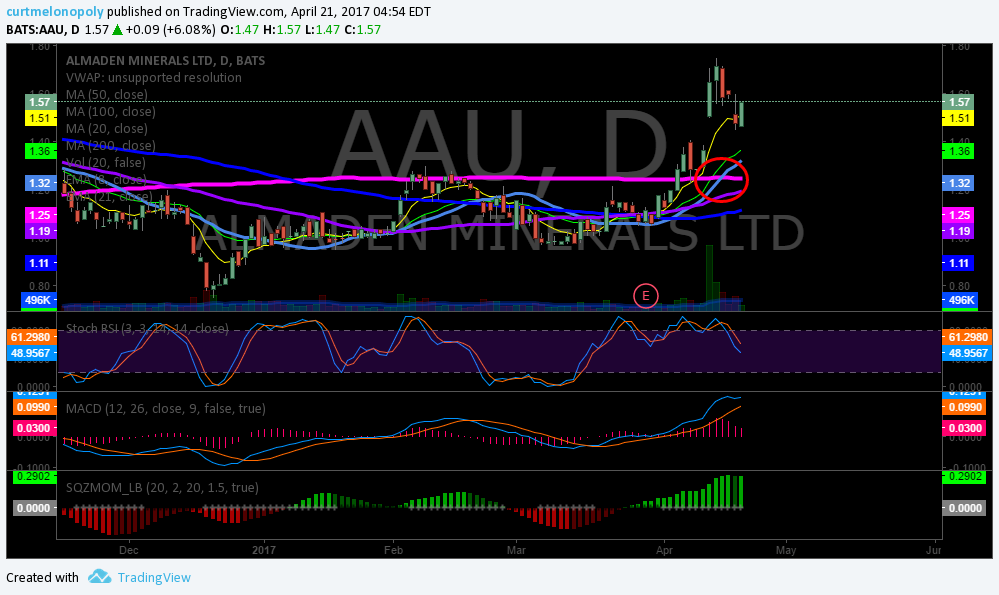

$TWLO Swing Trade going well. Trading 30.51. April 12 MACD turned up opened long 29.60 tight stop.

$TWLO Swing Trade going well. Trading 30.51. April 12 MACD turned up opened long 29.60 tight stop. pic.twitter.com/SFhzLaS6PK

— Melonopoly (@curtmelonopoly) April 19, 2017

$BABA Closed trade at 111.40 at target from 104.64 cost average #swingtrading

$BABA Closed trade at 111.40 at target from 104.64 cost average #swingtrading pic.twitter.com/dFvk6ilY9o

— Melonopoly (@curtmelonopoly) April 19, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD, $XAUUSD, $GC_F :

Gold. Sometimes simple charts better. #Gold $GC_F $GLD $XAUUSD $NUGT $DUST #Commodities

Gold. Sometimes simple charts better. #Gold $GC_F $GLD $XAUUSD $NUGT $DUST #Commodities pic.twitter.com/gPQwwWhhWf

— Melonopoly (@curtmelonopoly) April 19, 2017

Gold Miner’s $GDX:

For those buying GDX on war concerns. Gold production tends to collapse during wars. Resources diverted to war efforts.

https://twitter.com/PolemicTMM/status/853374500083294208

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil https://t.co/ct6jIXfsM6

— Melonopoly (@curtmelonopoly) April 14, 2017

Volatility $VIX:

$VIX Market Bottoms ? …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia

$SPY $VIX $VXX

$VIX Market Bottoms 🎯 …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia $SPY $VIX $VXX https://t.co/JELaLXDTdV

— Melonopoly (@curtmelonopoly) April 14, 2017

$SPY S&P 500 / $SPX:

A number of notable short-term extremes suggest $SPX is near a point of reversal higher.

A number of notable short-term extremes suggest $SPX is near a point of reversal higher. New from the Fat Pitch https://t.co/x8JPdGMjNP pic.twitter.com/R0PW6hghrq

— Urban Carmel (@ukarlewitz) April 14, 2017

$NG_F Natural Gas:

NA

Markets Looking Forward:

NA

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

Sartaj: Pre-Market Chart Setup Review begins in five minutes

Curt M: Premarket chart review 9:05 start – waiting on a coffee brew sorry lol >>>>>>>>>>>

Sartaj: Okay

Curt M: Get any in here ya want to review pls.

Curt M: A lot of stragglers this morning.

Curt M: back in a few.

Sartaj: Anyone have requests? Nows your chance

Spiegel: it works

Curt M: thanks

sbrasel: chk ?

Curt M: Going to get coffee b r back

Sartaj: Okay, so far we have $CHK

Sartaj: Any other requests?

Curt M: On mic in 1 minute premarket chart set up review >>>>>>>>>>>>

Curt M: Hoping some stragglers get in here that need to be lol

sfkrystal: hi everyone first day here 🙂

Curt M: hey krystal

deb: mornin krystal

Spiegel: I took some SPY calls near the close yesterday. Projections of how far rally should go today or for rest of week?

Spiegel: Hey krystal. My 2nd day.

mat: XLE looks primed and ready. My main focus for today

Spiegel: $BVTK or $DOLV please

mat: XLE yesterday bottomed on a long tern channel going back a year and a half or so

mat: Here’s the 3 year weekly of what I was talking about in XLE http://tos.mx/FJXJdu

sfkrystal: love the technicals. pretty. $IDXG looks bearish for today?

Curt M: Premarket review complet>>>>>> on mic in 1 min for open

Sartaj: Hello, Gary

Curt M: On mic for open >>>>>>>>>>>>

gary y: good morning everyone

Curt M: Long $SNGX 1000 4.51

Shafique: in w ya

Flash G: $GS action

MarketMaven: In too

Flash G: $FB tape strong

Hedgehog Trader: enjoying your analysis Curt

Flash G: $BIDU big blocks

Curt M: Stop set 3.99

Shafique: $VHC momo

lenny: PRKR also

mat: manipulation at its finest on this one

mat: Clearly not all but those are some funny candles

mat: Gold getting smashed

Hedgehog Trader: $SINO shipper very low vol but chart looks great

Curt M: Long 4.57 3000

Curt M: Out 4.83 4000 shares

MarketMaven: holding

deb: nce play

sfkrystal: brilliant, thank you!

cara: yeeehaw

Spiegel: Excellent. I can see I joined the right room.

sfkrystal: yes me too, thanks again

Curt M: thanks guys and gals:) be back soon

Flash G: You youngsters will do well in here. Just follow the rules so you don’t get burnt. Stops always. #1

MarketMaven: Flash is the wisdom guy:)

lenny: I’m just adding this is going to be huge hahaha maybe hopefully – but nice play

Spiegel: Flash, I just wrote in black magic marker on a piece of paper in bold letters “USE STOP LOSS ORDERS ON EVERY TRADE!!!”

Flash G: Yes

Curt M: Sartaj you around?

Spiegel: Do you guys use sfixed % stops or do you base them on MA’s or on support?

gary y: stops take the emotion out of the trade

Flash G: Gary should be listened to btw – he’s no begginer

Sartaj: I am here

Curt M: I’m going to get on mic with a chart save how to use session for 10 mins at most if you’re ready

Sartaj: Okay, I’m ready

Curt M: need to ublish this for new users

Curt M: On mic 10:23 >>>>>>>>>>>> using tradingview charts

Curt M: Off mic back in 20 mins – running scans >>>>>>>>> 10:34 AM

MarketMaven: I closed btw big win might re-enter

Shafique: holding 50%

lenny: hold 30%

deb: enjoyed that thanks

Shafique: closed $SNGX

Sartaj: Algo target is on course for a direct hit, oil subs

Curt M: Leaderboard: $SNGX 72% $EGT 23.5% $CALI 14.5% $CAMP 14% $IMGN 12.6% $AIRI 9%

Shafique: EPIC is…. well yes EPIC

Sartaj: Excited for the coding phase

Curt M: wow serious bandwith challenge lol

Sartaj: There it is

Sartaj: Direct hit

Curt M: yup

Curt M: EPIC is EPIC haha

Sartaj: I think Spiegel must have made up for yesterday. He seems to have disappeared

Curt M: haha

Curt M: hopefully he made out ok

Flash G: Watching $VZ for possible entry

Curt M: My $DUST play is up again. 3 days in a row. nice

Curt M: I might add to $DUST soon – when Stoch RSI is at bottom on 5 min and curls up

Curt M: But MACD is too high and SQZMOM is turning down come to think about it

Curt M: $CBLI is back lol its up 14% trading at 3.97

Curt M: thats on watch again for afternoon

Spiegel: I was able to add your charts to my tradingview account no problem

Curt M: Nice. Hopefully that helps.

Spiegel: thanks

Curt M: No prob. A little technical helps.

Curt M: I look at technicals like a GPS lol

Curt M: #EIA report is over so $SPY could get lift between now and 2:40 IMO

Curt M: If $SPY holds green between now and pit close at 2:30 it will get lift for sure after 2:30 at latest – but it has to hold green.

Curt M: If it stays green and gets lift over that 20 MA then momo stocks will fly

Curt M: So be careful listening to bear chatter.

Shafique: For members that may not realize, when Curt puts that bull picture on Twitter, you know the momentum plays are coming. I think it was Monday he posted the bull again.

yehodap: but more now mysz

Curt M: Closing my $DUST and $DWT positions – nice profit – will re-enter again soon.

Curt M: EPIC called the top almost to the penny 10 weeks in advance – not bad.

MarketMaven: EPIC hahahahaha hasn’t missed

Curt M: $CBLI gonna run or what? off VWAP

Curt M: There is ZERO good about the $MYSZ chart. ZERO.

Sartaj: And FYI: http://finance.yahoo.com/quote/MYSZ/community?ltr=1

yehodap: MYSZ …..YES YES— AKK THE BAD AND ALL THE GOOD! THIS IS TOTAL MACHINE STOCK.

Spiegel: So for CBLI, a good buyback place would have been when stochastic started to turn up again at 5.07 OR wait for it to cross 8 ema at 5.13?

Curt M: That was your only warning Yegodap. No pumps or permanently banned.

gary y: thank you

Spiegel: and typing all in caps doesn’t make your point any stronger

yehodap: SORRY

yehodap: sorry

Curt M: 🙂

Curt M: Okay 2:47 lets get one

Spiegel: So back to CBLI. So a good buyback place would have been when stochastic started to turn up again at 5.07 OR wait for it to cross 8 ema at 5.13? Thanks.

Curt M: tough play

yehodap: cbli , put short xxxx stock .fo rmy eyes the stock can go back.

Curt M: give me a sec

Curt M: I don’t think I’ll trade it unless it changes.

Curt M: BUt I know 4 people in room are still in it

MarketMaven: It looks done for the day.

MarketMaven: Power hour may do something

Spiegel: Buying th stochastic turn up also coincided with a break up through a trendline drawn from the highs.

MarketMaven: true

MarketMaven: lol

Curt M: need to focus

Sartaj: Sorry to our members, we haven’t had to deal with something like that in the room before. I guess it was to be expected at some point.

Curt M: $SPY is at moderately important support FYI. Not critical but important.

Curt M: TL support. Diagonal. And algorithmic.

Curt M: Trading the new channel in oil pressure should provide a decent set of trades over coming days.

Curt M: Just realized my $DUST position was underwater – orginal position 1/5 caused that. Will be on post market report. But $DWT banked.

MarketMaven: I knew that I just thought you meant the second position was positive.

Curt M: lol ya

Curt M: Lots of resetting in the charts tonight wow.

Curt M: Nasdaq still green

Curt M: funny kinda

Curt M: I have peeps DMing me “what the f happened today” ummm oil hit resistance folks – big resistance EIC been saying biggest in more than ten years:)

Curt M: When oil gets near the 200 day you can expect rumors from OPEC

Sandara Q: yup

Curt M: Well they’ll hold $SPY up if they have to and oil may come off to 200 day but the rumors will start and we’ll go for another while. It’s all about trying to get oil through the resistance.

Flash G: Pretty much summarizes it.

Flash G: Until the oil bounce…. ?

Curt M: Morning momentums, shippers likely, OTC likely, trade oil down the channel until the bounce. Swing plays will be tough with exception of some selective ones. All my opinion of course.

Flash G: Selective swings like selective hearing

Flash G: I won’t expound

Leanne: my kids and dogs have selective hearing

Curt M: ha I think Flash was hinting too

Flash G: at least your husbands listens

Leanne: happy wife is a happy life says my husband

Flash G: kinda like loch ness

MarketMaven: omg

MarketMaven: Flash needs a drink

MarketMaven: Well that was a great week so far. Made my year.

Shafique: it was a great week maybe it will continue tomorrow

sbrasel_1: is Xiv a good swing trade at 64.55?

Curt M: i’ll look

Curt M: To trade $CIX what I do is wait for $SPY to get to it’s low – or support, Oil to be at support or low (on the timeframe you are trading) and wait for VIX to be outsideits upp bollinger band and preferrably at upside resistance on the downwar TL

Curt M: Sorry not CIX XIV lol

sbrasel_1: ok

Curt M: I’ll get you some numbers

Curt M: 229.60 on $SPY is where I’ll be targeting. With $VIX preferrably at upside resistance.

Curt M: I know 229.60 sounds aggressive but thats the number we have.

Curt M: And that algo has been hitting the upside and downside moves for months to the penny almost

sbrasel_1: Thanks

Curt M: no prob

Curt M: Only thing is if $SPY hits that number $VIX will likely be way over TL resistance lol but who knows

Curt M: On a daytrade may be different

Flash G: In large part Curt is right about managed markets. They will ikely find a way to hold $SPY near and OPEC rumors etc.It find some downside but not likely much. Then $XIV is the entry.

Shafique: That is the way I see it also.

Shafique: It all changed in 2009

Spiegel: Although Another OTC type we should have caught today is COTE. Amazing chart

Curt M: lol don’t tell me ugh

Spiegel: lol

Curt M: I’ll be studying OTC all night 🙂

Spiegel: give it a look

Spiegel: Right now the excitement is in the triple zero stocks

Curt M: Yes

Curt M: Typical for when markets are at extended highs in my experience should have known

Spiegel: that first bar with volume wouldve been perfect to get ini

Curt M: less than 2 hours ago

Curt M: 540%

Spiegel: not a bad return

Curt M: I’ll be up all night lol they’re hot

MarketMaven: Well you know me – throw the ball

Flash G: This will be fun to watch.

Curt M: $STUDY night

Spiegel: OTC pinx

Curt M: ya just checking the regs even theyre hot

Curt M: not like the pinks

Curt M: lol

Curt M: Tonight I’ll go through them and maybe swing at a few in morning

Curt M: Have a great night

MarketMaven: You too Curt

Shafique: Good night Israel!

Spiegel: Have a good one!

lenny: lol peace guys and gals! to all!

Curt M: cya

Sartaj: Peace

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $SNGX, $USOIL, $DWT, $GOLD, $DUST, $TWLO, $BABA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500