Stock Trading Plan for Tuesday Feb 14, 2017 in Compound Trading Chat room. $UGAZ, $MRNS, $AEZS, $ZIAS, $CBIO – $UWT, $ONTX, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $JUNO – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session!

Notices:

Trade Results: Be sure to review trade results post market report from yesterday.

Weekend Webinar Videos: The webinars from weekend that explain how our algorithmic chart models for each of six ($SPY, $DXY, $USOIL, $GOLD, $SILVER, $VIX) work, our Swing Trading and our Live Trading Room are now posted on our You Tube Channel.

Current Holds / Trading Plan:

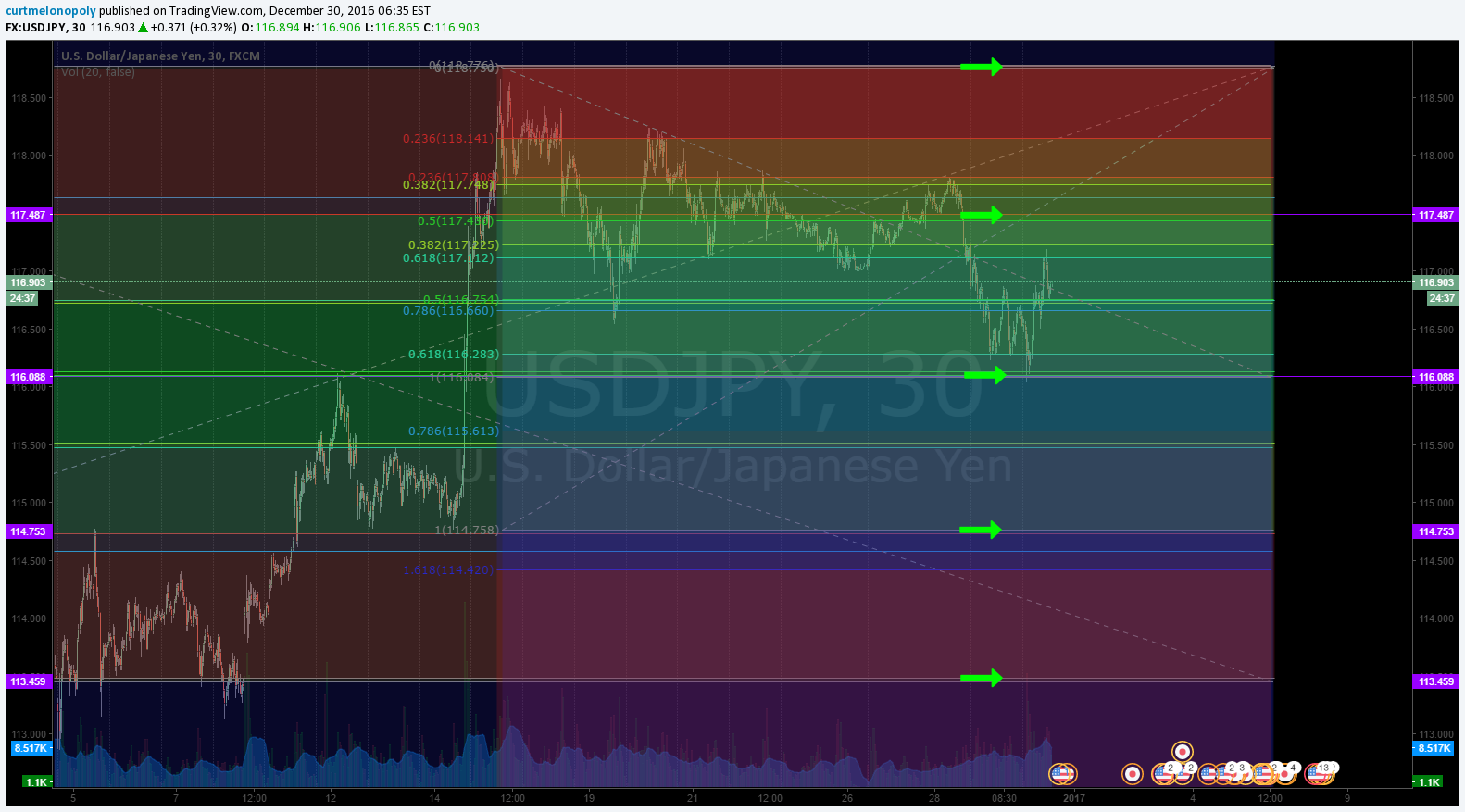

All small size – $UWT, $ONTX, $VRX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

General Market Outlook:

Most of my outlook is similar to yesterday, Fed is on deck so you never know how that will affect things.

$SPY has been active and markets continue to improve for daytrades a bit, $VIX dead so watching for spikes, $OIL in multi-week range (if they stop manipulating it will drop) – I took a long position in oil related $UWT at support and will add at support as long as it doesn’t fail support and will close trade at multi-week resistance, $GOLD and $SILVER everyone has gone bull so we will see, $USDJPY $DXY most say is going down so we’ll see, and natural gas looks like its near an interim bottom.

Morning Momo / News and Social Bits From Around the Internet:

Momo Watch: $UGAZ, $MRNS, $AEZS, $ZIAS, $CBIO

#earnings $TEVA $GRPN $TMUS $AMAT $CSCO $PEP $TSEM $ON $MGM $FDC $SHOP $ABX $INCY $QSR $MRO $LNCE $WEX $DCIX $TAP https://t.co/lObOE0dgsr pic.twitter.com/QuvZZLvneN

— Earnings Whispers (@eWhispers) February 11, 2017

S&P -0.02%.

10-yr -0.04%.

Euro +0.22% vs. dollar.

Crude +0.83% to $53.37.

Gold +0.71% to $1,234.45.

http://seekingalpha.com/news/3243129-hour

Incyte revenues up 34% in Q4; updates guidance http://seekingalpha.com/news/3243150-incyte-revenues-34-percent-q4-updates-guidance?source=feed_f … #premarket $INCY

Hologic takes out Cynosure for $1.65B ($66/share) http://seekingalpha.com/news/3243145-hologic-takes-cynosure-1_65b-66-share?source=feed_f … #premarket $HOLX $CYNO

Report: China’s announced steel capacity cuts were fake http://seekingalpha.com/news/3243147-report-chinas-announced-steel-capacity-cuts-fake?source=twitter_sa_factset … #premarket $X $MT $AKS $NUE

Freeport halts production at Indonesian copper mine http://seekingalpha.com/news/3243158-freeport-halts-production-indonesian-copper-mine?source=twitter_sa_factset … #premarket $FCX

$CS +1.6% #premarket after pre-tax profits beat expectations,boosted by a strong #quarter in investment banking and capital

Popeyes Louisiana Kitchen falls after NY Post tips no QSR buyout http://seekingalpha.com/news/3243161-popeyes-louisiana-kitchen-falls-ny-post-tips-qsr-buyout?source=twitter_sa_factset … #premarket $PLKI $QSR

Carnival starts to ring the register on Cuba business http://seekingalpha.com/news/3243174-carnival-starts-ring-register-cuba-business?source=feed_f … #premarket $CCL

CAE beats by C$0.03, beats on revenue http://seekingalpha.com/news/3243173-cae-beats-c-0_03-beats-revenue?source=feed_f … #premarket $CAE

Catalyst Bio +23% on trial plans http://seekingalpha.com/news/3243178-catalyst-bio-plus-23-percent-trial-plans?source=twitter_sa_factset … #premarket $CBIO

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $CGA 24%, $ZAIS 24%, $RELV 17%, $CBIO 15%, $GIG 13%, $RNN 12%, $SINO 11% $MRNS $AXSM $KOOL $DCIX $GALE $OHRP $AGEN

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: $GEVO -24%, $TTM -6%, $PFLT -3%, $PLX $JDST $UGAZ $DWT $DUST $AZN $MU $NVS I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $UGAZ, $MRNS, $AEZS, $ZIAS, $CBIO – $UWT, $ONTX, $VRX, $SSH, $ASM, $CBMX, $JUNO, $DUST, $TRCH, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD, $NG_F, $SLV, $GLD, $DXY, $XAUUSD, $GC_F