Compound Trading Chat Room Stock Trading Plan and Watch list for Wednesday May 17, 2017; $XGTI, $CBIO, $JACK – $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link: http://compoundtrading1.clickmeeting.com/livetrading

Wed 12:00 Mid Day Review | Current Trade in Oil hosted by Epic Oil Algo. Public Welcome $USOIL $WTI $CL_F #OIL #OOTT

Wed 12:00 Mid Day Review | Current Trade in Oil hosted by Epic Oil Algo. Public Welcome $USOIL $WTI $CL_F #OIL #OOTT https://t.co/YKdnQHngZp

— Melonopoly (@curtmelonopoly) May 17, 2017

Live Alerts for Swing Trading Service Registrants and Day Trading side are now available only on either email and/or by following alert Twitter feed. If you did not get an email send an email to info@compoundtrading.com and ask Sartaj to get you info. Most of that I spoke to myself are opting for email only, but the Twitter alert system is available for those that choose that.

Two Week Trading Challenge is Over (34% vs. double up) and I Started a New One Monday. This time the trading challenge is six months.

Likely it now for two week 20k double small account trading challenge +6772.00. No double but 30%+ is okay ROI #tradingchallenge

I failed. My goal was a two week double up. BUT 34% I did hit IF done every two weeks is 1M 1,000,000.00 in 6 mos. That's my new challenge. pic.twitter.com/2fzD5nzRl0

— Melonopoly (@curtmelonopoly) May 13, 2017

Most recent lead trader blog posts:

Learn How to Trade Stocks (Build a Small Account) Following my Journey. Part 5 “Freedom Traders” Series.

Learn How to Trade Stocks (Build a Small Account) Following my Journey. Part 5 “Freedom Traders” Series. https://t.co/3WOEzWx3Gi

— Melonopoly (@curtmelonopoly) May 13, 2017

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L. The Algorithms Quarterly Performance Reports will be out soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Most recent Keep it Simple Swing trade Charting (MACD, MA, Stoch RSI, SQZMOM focus):

https://twitter.com/CompoundTrading/status/853551912599400448

Trading Plan (Buy, Hold, Sell) and Watchlists:

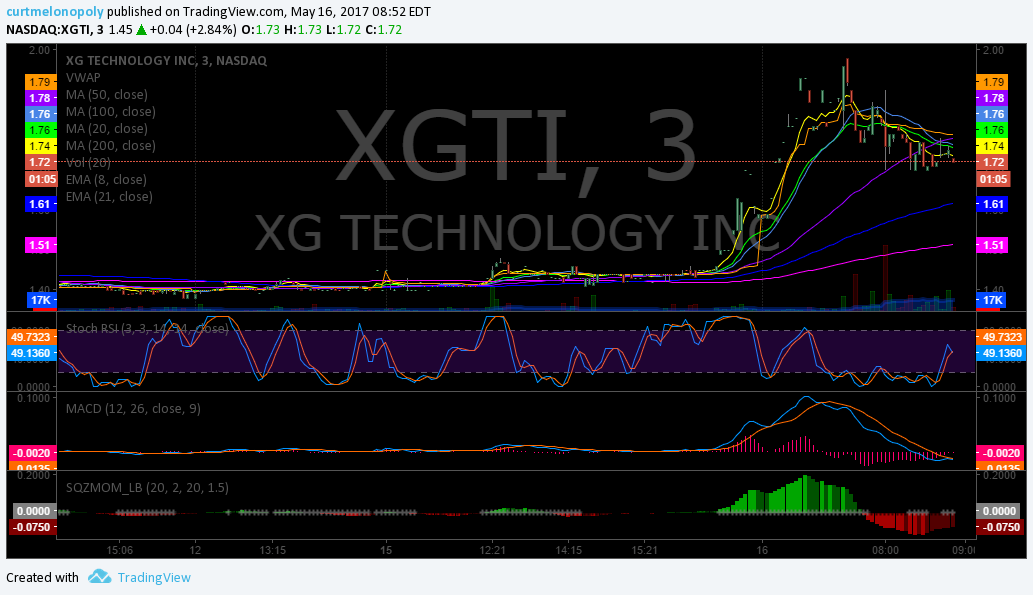

Morning momentum stocks on watch so far: $XGTI, $CBIO, $JACK

Bias toward / on watch:

Markets: $SPY $ES_F $SPX trending sideways but also toward upward price extension of our SPY algo, $GLD, $GDX some life. $SLV Getting some lift here. $USOIL, $WTI came off and out of channel it was in as I suspected it would. $DXY is testing critical support area again and $VIX is in lowest range in decades.

OTC on watch:Randoms I’ve noticed over last few weeks… $PGPM, $BRNE, $ELED, $PVCT, $LIGA (I hold),$AMLH, $BLDV $UPZS $OPMZ $MMEX $ACOL $BVTK $USRM $ORRV $JAMN $PFSD

Gaps to Watch:

Recent Momentum Stocks to Watch: $XGTI $SSYS

Stocks with News: $BMY, $JACK

SEC Filings to Watch:

Short Term Trader’s Edge:

Holds: Most holds are small to mid size (less than 5% of day trading account) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA, $PVCT

Various Chart Set-ups on Watch: $PCRX, $PBR, $CTSH, $FEYE, $TSLA, $NVO, $EWZ, $AMBA, $EOG, $COTY, $FSLR, $AAOI, $HIIQ, $JASO Golden Cross, $VIPS – We are working on these and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to Youtube of each trading day.

$LIT Trading 29.43. MACD turned up last Friday and all indicators on weekly and daily flashing bullish. #swingtrading

$LIT Trading 29.43. MACD turned up last Friday and all indicators on weekly and daily flashing bullish. #swingtrading pic.twitter.com/PKBrfN4dzR

— Melonopoly (@curtmelonopoly) May 17, 2017

$ATHM Weekly Stoch RSI turn up near top, MACD turn up, SQZMOM up, Vol up, Post earnings, 50 MA near 100 MA breach. #swingtrading

$ATHM Weekly Stoch RSI turn up near top, MACD turn up, SQZMOM up, Vol up, Post earnings, 50 MA near 100 MA breach. #swingtrading pic.twitter.com/X9WxKDAiV1

— Melonopoly (@curtmelonopoly) May 17, 2017

Market Outlook :

Watch those large and mega caps – when they stall things could change. And don’t forget our $SPY algo warned about recent highs.

Note to all of the FANG critics: Having AAPL lead the advance is NOT a bad thing. If AAPL were lagging, THAT would be bad.

Note to all of the FANG critics: Having AAPL lead the advance is NOT a bad thing. If AAPL were lagging, THAT would be bad. pic.twitter.com/w0mCgzAelL

— Tom McClellan (@McClellanOsc) May 17, 2017

Market News and Social Bits From Around the Internet:

7am

MBA Mortgage Apps

10:30am

Petroleum Status Report

Both Jack in the Box and Red Robin surging after earnings. $JACK up 10% #premarket. $RRGB up 17%.

$BMY Health Canada Approves OPDIVO (nivolumab) for the Treatment of Squamous Cell Carcinoma of the Head and Neck

$QCOM $AAPL Qualcomm Files Breach of Contract Complaint against Apple’s Manufacturers for Non-Payment of Royalties

Target earnings: $1.21 a share, vs 91 cents EPS expected.

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List :$RRGB 17%, $CBIO 11%, $JACK 9% $CHRS $QIWI $UVXY $TVIX $BDSI $TGT $XGTI $NUGT $JNUG $HMY $CLVS $VXX $CL $VIXY $TZA I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List : $SPY $XIV $LABU $JDST $DUST $DWT $AMD $NVDA $ABBV $AAOI $SVXY $DGAZ $ETSY $AEO $FAS $WFC $SQ $SNAP $GS $XLF $AKS $X $ESRX $P $DIS $TTD I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $WIN $COP $TS $CLVS $RIO $WWW $TJX $RRGB as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $DLR $MRO $AVB $FOXF $DIS $ETSY $WSR $SQ $AMD $SSYS as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: – $PVCT, $LIGA, $MGTI, $ONTX, $SSH, $LGCY, $TRCH, $ESEA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD