Compound Trading Swing Trading Stock Report (with Buy Sell Signals on Select Chart Set-Ups) Monday June 4, 2018 (Part A).

In this Edition; $ARRY, $SHOP, $XXII, $SSW, $ARWR, $CDNA, $NAK and more.

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

This swing trading report is Part A of one in five on rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you form a swing trade plan that suites your time frame. If you need private coaching use our contact page and send me a note or email [email protected] and we’ll contact you (sometimes there is a short waiting list).

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up (set-up) that signal a trade long entry or an exit. In our case we rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Using the real-time charts – as chart links are made available below, click on link and open viewer. To open a real-time chart beyond the basic “viewer” click on the share button at bottom right (near thumbs up) and then click “make it mine”. To remove indicators at bottom of chart (MACD, Stochastic RSI and SQZMOM) double click chart field area and double click again to return the indicators to the chart.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage

$ARRY – ARRY Biopharma

June 4 – ARRAY Biopharma (ARRY) Continues to trade between important buy sell triggers on model (Fib mid quads) $ARRY #swingtrading #chart

It did in fact get a bounce (per last report and I missed execution) and now is testing upside resistance at 17.29. 17.29 holds and 18.40 is the main price target / resistance.

The downside scenario is a support test at 15.76 then 15.54 and 13.44.

The range and predictability in this model is decent so I will try and get an entry on over 17.29 or a failure.

Also of importance, the MACD appears to be ready to turn (this is a weekly chart so it is significant structure so if MACD does turn then bias is clearly bullish). Also of note, the Stochastic RSI recently turned up from near bottom. My bias is long for now.

Key FDA Events in June Investors Need to Watch Out For $VRX $ARRY $GWPH $MERK #FDA https://finance.yahoo.com/news/key-fda-events-june-investors-195607348.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

ARRAY Biopharma (ARRY) Real-Time Chart Link:

April 25 – $ARRY down draft scenario from last report playing out almost exactly as charted, we will see if we get bounce here.

13.48 holds it targets 18.41 June 17. And if it doesn’t price targets 8.48 June 17.

My bias is to upside target.

$ARRY News: Is There An Opportunity With Array BioPharma Inc’s (NASDAQ:ARRY) 32% Undervaluation?

https://finance.yahoo.com/news/opportunity-array-biopharma-inc-nasdaq-123942473.html?.tsrc=rss

Mar 11 – $ARRY 18.39 mid quad resistance test has to pay out for direction prior to charting shorter time frames for trade – slightly bearish right now.

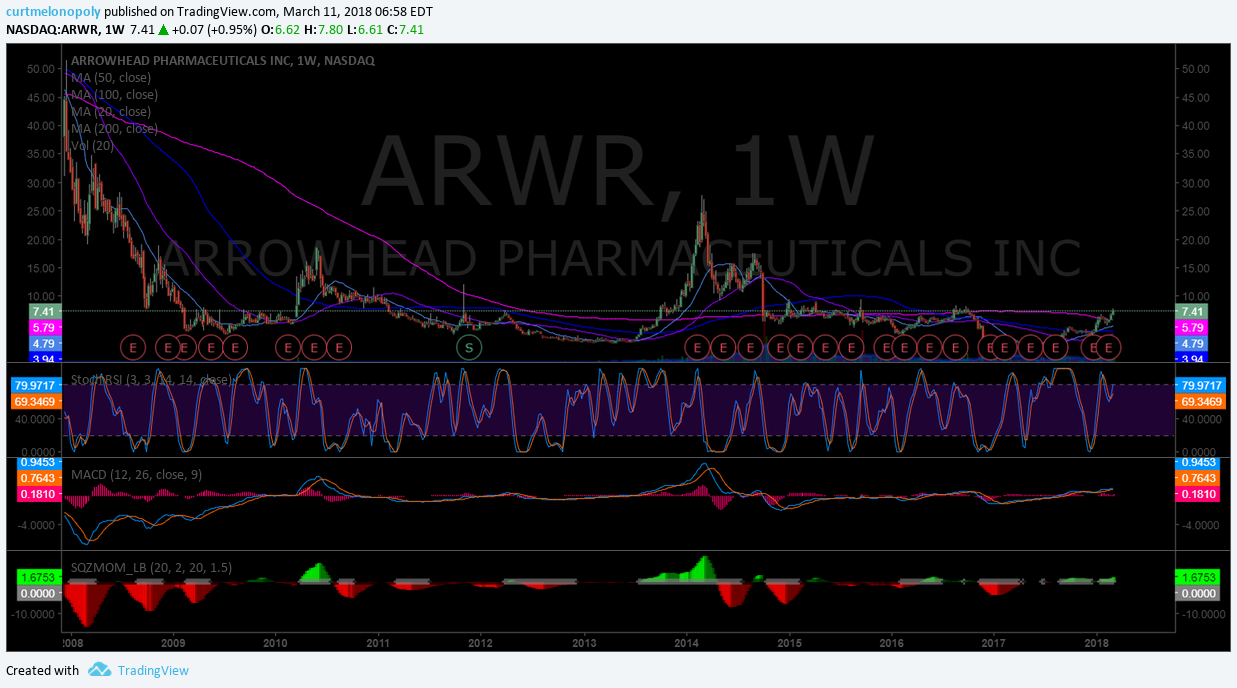

$ARWR – Arrowhead Pharmaceuticals

June 4 – Arrow Pharmaceuticals (ARWR) Chart. Monthly 200 MA resistance overhead at 17.17 trading 10.92. Bullish bias. $ARWR #swingtrading

It seems logical to me that trade will test the upside 200 MA on the monthly chart again. I refer to this resistance because a clear trading model isn’t established yet (working on it).

Arrowhead Pharmaceuticals to Present at Upcoming June 2018 Conferences

Arrow Pharmaceuticals (ARWR). Daily chart simple model seems to suggest over 10.63 targets 16.32 Nov 26 2018 $ARWR #swingtrading

April 25 – $ARWR trading 6.52 the chart structure is still in play. Watching for an upside move.

Arrowhead Pharmaceuticals to Webcast Fiscal 2018 Second Quarter Results https://finance.yahoo.com/news/arrowhead-pharmaceuticals-webcast-fiscal-2018-200100257.html?.tsrc=rss

Mar 11 – $ARWR testing a series of previous highs on weekly chart w Stoch RSI MACD SQZMOM trend up #swingtrading

This is one of those trades / charts that isn’t easy to set a specific rice target on – the chart history has many scenarios if previous / historical highs break to upside. One way to trade it is long on an uptrend day with a stop set and let it ride the test. The risk reward to bullish side is significant if it breaks the previous highs. All indicators suggest a significant sized move.

$CDA – CareDx

June 4 – CAREDX (CDNA). Trade did get the new all time highs expected. Extended now and entry very difficult. $CDNA #swingtrading

I did also go over this likely scenario on the mid day review videos but I did not execute as I was really busy at the time with other more structured trades. Will watch for a pull back to previous highs and see if we get a bounce near there for a swingtrade.

April 25 – $CDNA very bullish since last report and likely pull back to new all time high (most probable scenario)

Olerup QTYPE® Receives CE Mark Certification https://finance.yahoo.com/news/olerup-qtype-receives-ce-mark-120000842.html?.tsrc=rss

$NAK – Northern Dynasty Minerals

June 4 – Northern Dynasty Minerals (NAK) Chart – Trending toward lower price target .28 Jul 18, 2018. $NAK #swingtrading

April 25 – $NAK gone to sleep. Trading .94 above 96.73 targets 1.496, 1.862 July 18. Under targets .28 July 18. #trading #pricetargets

Why Northern Dynasty Minerals, Ltd. Could Be a Gold Mine for Growth Investors https://finance.yahoo.com/news/why-northern-dynasty-minerals-ltd-113200529.html?.tsrc=rss

Mar 11 – $NAK at buy sell trigger for pop or drop – on watch for swing either way. When price trades below line or above trade to next support or resistance line (swing) and test.

$XXII – 22nd Century Group

June 4 – 22nd Century Group (XXII) trade not giving clear bias on weekly chart. Watching downtrend MACD for possible turn. $XXII #chart

April 25 – $XXII trading 2.05 over 2.20 targets 270 then 3.50 and under targets 1.38 .88 .06 #trading #setup

Food and Drug Law Institute Publishes Public Policy Article by 22nd Century’s Dr. James Swauger https://finance.yahoo.com/news/food-drug-law-institute-publishes-125800933.html?.tsrc=rss

Mar 11 – $XXII on watch for a bounce at Fibonacci support with price targets in clear site. #swingtrading

This chart is really structural and the Fibonacci horizontal lines become excellent buy sell triggers. This is a great set-up for a swing at support and the upper target risk reward is significant if it bounces.

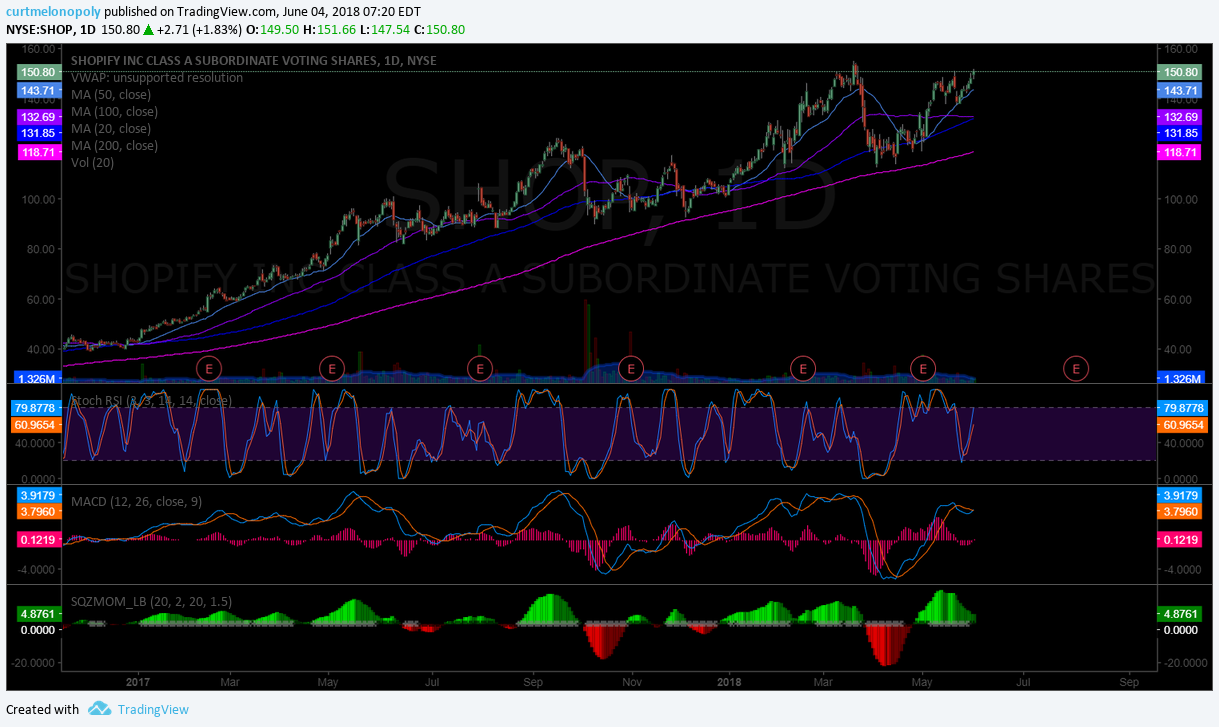

$SHOP – Shopify

June 4 – SHOPIFY (SHOP) Chart. This is a really aggresive structure that will either break out with a full extensions or retrace. $SHOP #swingtrading

I’m bias to an upside extension. Watching the MACD on daily and will watch a potential break to upside. Likely enter long in increments on the break. Yet to be seen.

April 25 – $SHOP trading 123.40 holding 200 MA. Over the MA’s I’m long and under 200 MA maybe short.

Shopify Inc’s (NYSE:SHOP) Earnings Dropped -13.12%, Did Its Industry Show Weakness Too? https://finance.yahoo.com/news/shopify-inc-nyse-shop-earnings-212230431.html?.tsrc=rss

March 18 – $SHOP trading 147.22 has done well since we signaled long 106s wash-out in Oct. MACD high – caution longs.

What a great trade signal long for our swing trading platform back in October when everyone panicked on the wash-out.

The problem is now that price on the daily chart is significantly higher than moving averages and the MACD is extended to be sure.

When the Stochastic RSI, MACD and Squeeze Momentum start to trend down this will likely be a decent short to at least the 50 MA.

Feb 11 – $SHOP with earnings around the corner this is a wait and see trade. Will be watching earnings very close.

$SSW – Seaspan

June 4 – Seaspan (SSW) Chart. MACD on weekly chart now in downtrend. Watching support and resistance for trade. $SSW #chart

That swing trade went really well – targets all achieved and now I have a moderate bias to some form of retrace as the MACD on weekly chart is trending down. But only watching at this point.

Seaspan (SSW) Chart. MACD on weekly chart now in downtrend. Watching support and resistance for trade. $SSW #chart

April 25 – $SSW trade going really well. Target in play 8.82. #swingtrading

Mar 18 – $SSW keeps failing at 7.73 w/Fib just regained 200 MA targeting 8.60s June 4 #swingtrading

Trading 6.86 this is a high probability trade to the 7.73 area and if it clears that 8.60’s are highly probable going in to early June.

This is a strong long signal.

$SSW also important is to watch the MACD – it recently crossed up signaling long. #swingtrading

$ITCI – Intra Cellular Therapies

April 26 – Watching for 200 MA support reversal t upside resistance 23 – 24’s. On watch and alarmed. $ITCI #swingtrading #setup

If it dumps the set-up is void and will have to be reconsidered.

There’s a very good chance that $ITCI sell-off was way overdone based on $ALKS FDA set-back. #swingtrading

Here’s Why Alkermes plc and Intra-Cellular Therapies, Inc. Are Crashing Today https://finance.yahoo.com/news/apos-why-alkermes-plc-intra-153500350.html?.tsrc=rss

Mar 18 – $ITCI trading 23.98 has done well since 17s signal… trade the gap with horizontal res line – long at each to resistance.

As price holds each diagonal resistance / support line trade to next level (resistance) line. All the better if it triggers a long off a moving average also. Watch the MACD to be sure it’s turned up and not down. MACD is currently trending up.

$SENS – Senseonics Holdings

April 26 – $SENS Amazing chart structure. The previous alert resolved to upside target. Trade decision now to upper or lower target again.

Above 3.09 is long to upper target and under 3.09 is down to lower target.

Mar 18 – $SENS trading technically perfect with MACD turn down, quad wall test, Fib test advantage shorts – at least for short term.

Under 3.17 is a short to 2.50s April 17 target and above 3.17 is a long to April 17 3.67 target.

Price above 200 MA (pink), price bounced off important mid Fib (grey), price hit target perfect at mid quad (green), and Fib test and quad wall resistance test (red). MACD turn down will give significant advantage shorts. Until at least SQZMOM and preferably other indicators turn up this is a short.

Feb 11 – $SENS perfect mid quad target hit Feb 9 – will watch for direction and then trade in direction of next target noted for April 16.

Jan 1 – $SENS Daily chart with time price cycle targets, Fib support resistance buy sell triggers and moving averages.

As we move toward time cycle on daily peak on Feb 7, 2018 watch for price to trend toward apex (green arrow) or inverse apex (red arrow) – that is your primary clue for trade (beyond the simple MACD on daily)

I have added the Fib support resistance buy sell triggers for range between current trade and Feb 7 peak so that if trade is bullish you have more specific buy sell points you can watch as trade progresses.

In a moderately bullish scenario 3.08 is very likely Feb 7 and the most upper apex target at 3.69 is not as likely but possible. Same would apply to bearish scenario below.

How do you play it? Be sure MACD is turned up before a long entry and anything over 2.48 support at mid quad is a long – try and time long so that Stoch RSI is just turning back up and you are above a Fib support you can use as a stop loss (give your stop some room under the fib to avoid the machines hitting your stop).

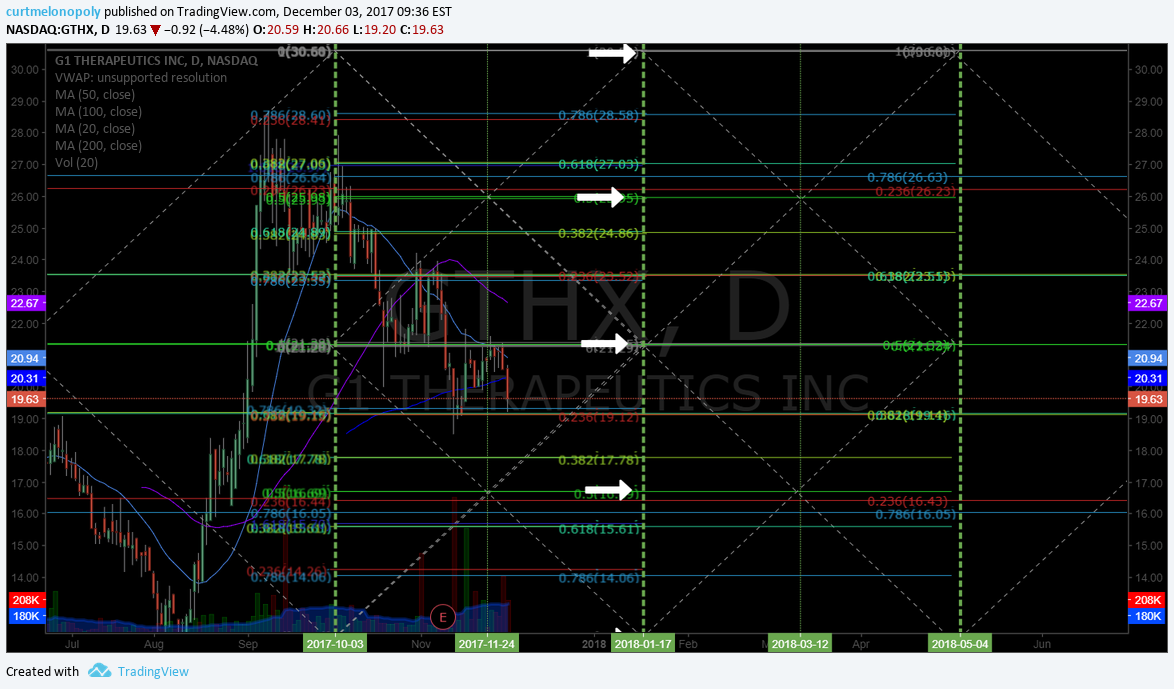

$GTHX – GT1 Therapuetics

April 26 – $GTHX hits targets perfect. Trading 39.43, over 39.82 targets 44.36 May 10, 2018 as yet another double extension. #swingtrading

Don’t ignore this stock… the chart structure and ROI ROE is best of class and trades very structural and predictable.

G1 Therapeutics Announces Initiation of Phase 1b/2 Clinical Trial of G1T38 in Combination with Tagrisso for EGFR-Mutant Non-Small Cell Lung Cancer https://finance.yahoo.com/news/g1-therapeutics-announces-initiation-phase-100000266.html?.tsrc=rss

Mar 18 – $GTHX very few stocks trade with this precision and return on equity. Near current target trade white arrow buy sell triggers.

Fantastic double extension to the long side, price is currently cradled in the target zone. From here it is a long through the horizontal Fibs if MACD, Stochastic RSI, and SQAMOM are turned up. If not wait for them all to turn and continue long. See next chart below also.

Also, for side note… if you review the historical reports below you will notice the “black box” component / comment to this charting…. it has played out perfectly technical and in line with “black box” targets. This is a super car trading vehicle if you dial in on its buy sell triggers along with its indicators etc.

$GTHX Stochastic RSI turned down, MACD looks to turn soon, SQZMOM peaked. Short term short advantage then go.

Feb 11 – $GTHX trading 19.38 with MACD turned down targets 16.50 region Mar 15, 2018. #swingtrading

Jan 18 price target hit perfect – precision swing trade set-up – this chart is dialed in.

$EXTR – Extreme Networks

April 26 – $EXTR under significant pressure and the only trade I see with decent ROI is under 10.00 to 7s. Short.

Mar 18 – $EXTR over 12.80 is a long and under a short. Either way trade to triangle quad edge.

It’s a funky model chart but it works. Simply long over 12.80 and short under and then trim when near bright green lines. Consider also your MACD and Stochastic RSI on daily.

Feb 11 – $EXTR Chart structure is not easy to trade but model is holding up and trade targets for Aug 30, 2018 in play.

I will be watching for direction and market stability may provide for a really decent trade here.

Why Extreme Networks Inc. Stock Fell 14.2% Today,

Anders Bylund, The Motley Fool

Motley Fool, February 7, 2018

https://finance.yahoo.com/news/why-extreme-networks-inc-stock-155700511.html?.tsrc=rss

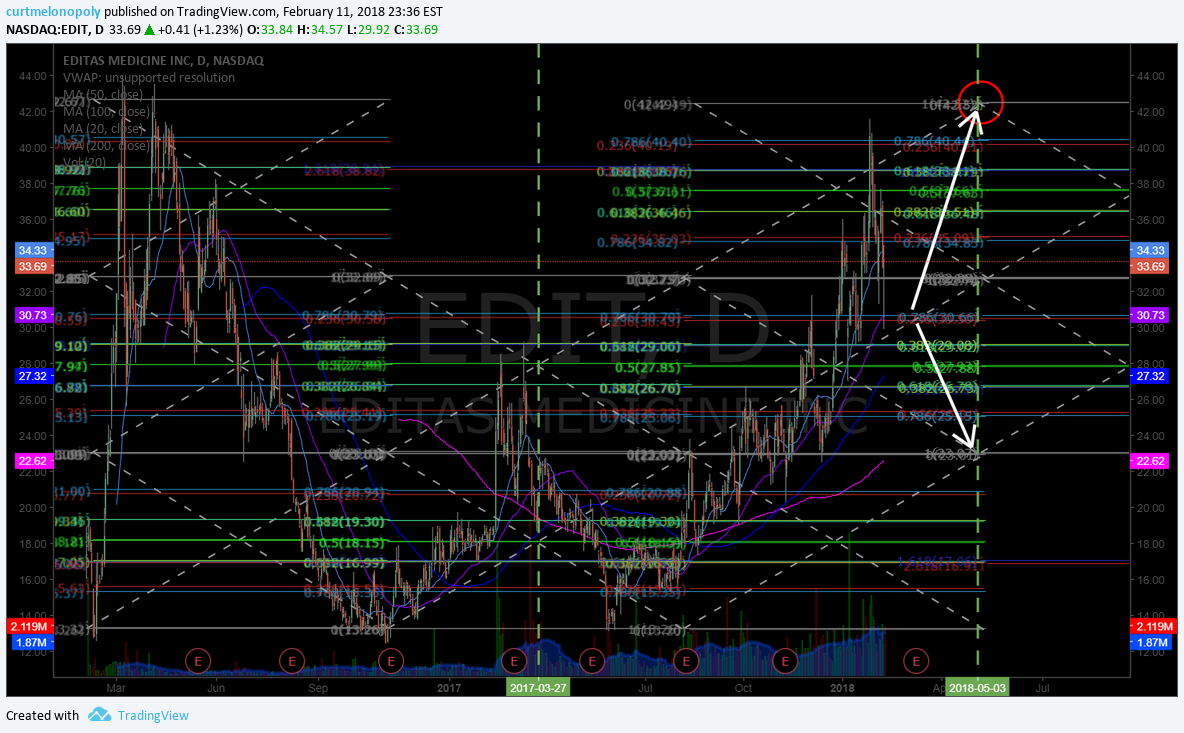

$EDIT – EDITAS

April 26 – $EDIT Clean chart structure channel and target hits, came off as warned, threatening retrace down channel next. Targets on chart.

This was a super clean predictable short from the alert on the last report.

Under 32.80 mid quad targets 27.79 Sept 19 and over 32.80 targets 37.58 Sept 19. Near decision now / mid quad.

Editas Medicine Inc (NASDAQ:EDIT): What Does The Future Look Like? https://finance.yahoo.com/news/editas-medicine-inc-nasdaq-edit-230627623.html?.tsrc=rss

March 18 – $EDIT caution longs as a clear channel has emerged and highs tested. Target from previous reports hit early. Watch 50 MA and indicators very close.

If price breaks above recent highs (which are similar to all time highs) then all bets are off.. but until then the channel wins – short at / near top of channel and long at bottom of channel is highest probability trade. Will review indicators below also (short time frame short bias).

Mar 18 Primary Indicators – $EDIT Short bias until Stochastic RSI, MACD, Squeeze Momentum turn back up. Watch all time high resistance.

$IPI – Intrepid Potash

April 26 – $IPI You can keep this one simple, on the weekly it’s a long until the 200 MA test. Use lower time frame for entry.

Why Intrepid Potash Stock Just Popped 21% https://finance.yahoo.com/news/why-intrepid-potash-stock-just-180000862.html?.tsrc=rss

Mar 18 – $IPI still has 200 MA but Stoch RSI, MACD, SQZMOM all turned down. When they turn up it is and obvious long.

Feb 11 – $IPI on watch with price testing 200 MA and earnings Feb 28.

$MBRX – Moleculin Biotech

April 26 – $MBRX all vitals are flat. No trade until vitals come alive.

Moleculin Announces Patients Treated in FDA Approved Phase I/II Annamycin Clinical Trial https://finance.yahoo.com/news/moleculin-announces-patients-treated-fda-123000005.html?.tsrc=rss

Mar 18 – $MBRX has an obvious pivot region in the 2.43 area of the chart. Long above 2.43 if Stoch RSI turned up on daily.

I really like this set-up long over 2.43 as long as Stoch RSI on daily has also turned up.

$SOHU – SOHU.COM

April 26 – $SOHU Under pressure and RR on short side seems low so I’ll watch and see if chart reconstructs.

Sohu.com Hits 10-Year Low After Rough First Quarter https://finance.yahoo.com/news/sohu-com-hits-10-low-171000650.html?.tsrc=rss

Mar 18 – $SOHU testing historical lows. If all indicators turn up Stoch RSI MACD SQZMOM it is long, if not short.

$PDLI – PDL BIO Pharma

April 26 – $PDLI earnings in 9 days with MACD down riding the 200 MA on daily chart. Short bias but no trade.

Mar 18 – $PDLI near 200 MA test – if it bounces long to Fib resistance areas and trim and short on 200 MA loss.

Feb 11 – Trading 2.40 with earnings on Feb 28 and all indicators are poor. Will watch.

Jan 1 – trading 2.74 with poor / indecisive indicators. Will watch.

$ESPR – Esperion Therapeutics

April 26 – $ESPR Over 75.00 is a long and under 65.20 is a short. Coiling around main pivot. Indecisive.

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Biotech Investors Should Consider The Four Horsemen https://www.forbes.com/sites/moneyshow/2018/04/06/biotech-investors-should-consider-the-four-horsemen/?utm_source=yahoo&utm_medium=partner&utm_campaign=yahootix&partner=yahootix&yptr=yahoo#faf8f4ccfc62

Mar 18 – $ESPR This targets 90.00 if it holds the current area above important pivot area (white horizontal)- power trade is so.

This is an extremely powerful trade if it takes off. Do not ignore this setup.

$LPSN – LivePerson

April 26 – $LPSN Trade played out almost exact as prescribed in last report. New upside and downside buy sell triggers and price targets on chart.

LivePerson to Announce First Quarter 2018 Financial Results on May 3, 2018 https://finance.yahoo.com/news/liveperson-announce-first-quarter-2018-133000537.html?.tsrc=rss

Mar 18 – $LPSN trade rocking, over 15.15 targets 17.35 then over targets 19.60 on bull side. #swingtrading

Another fantastic trade set-up following the previous reporting period.

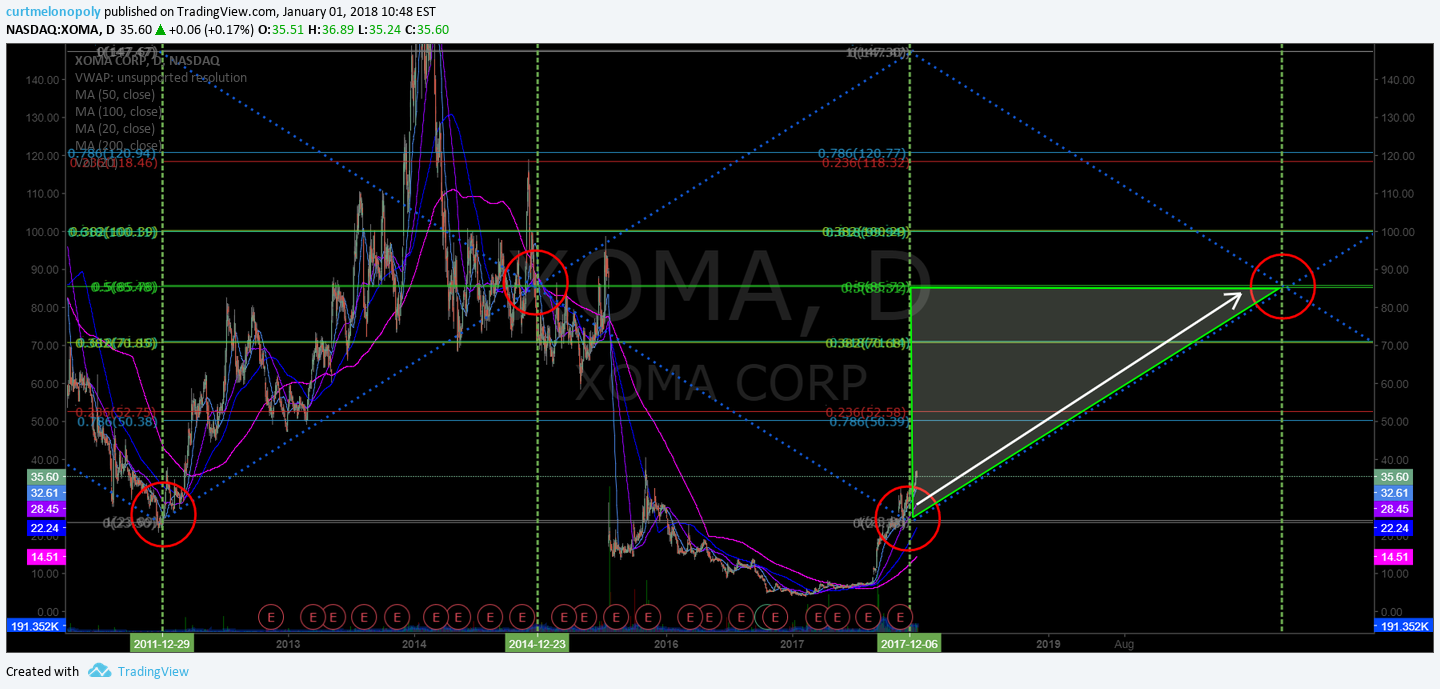

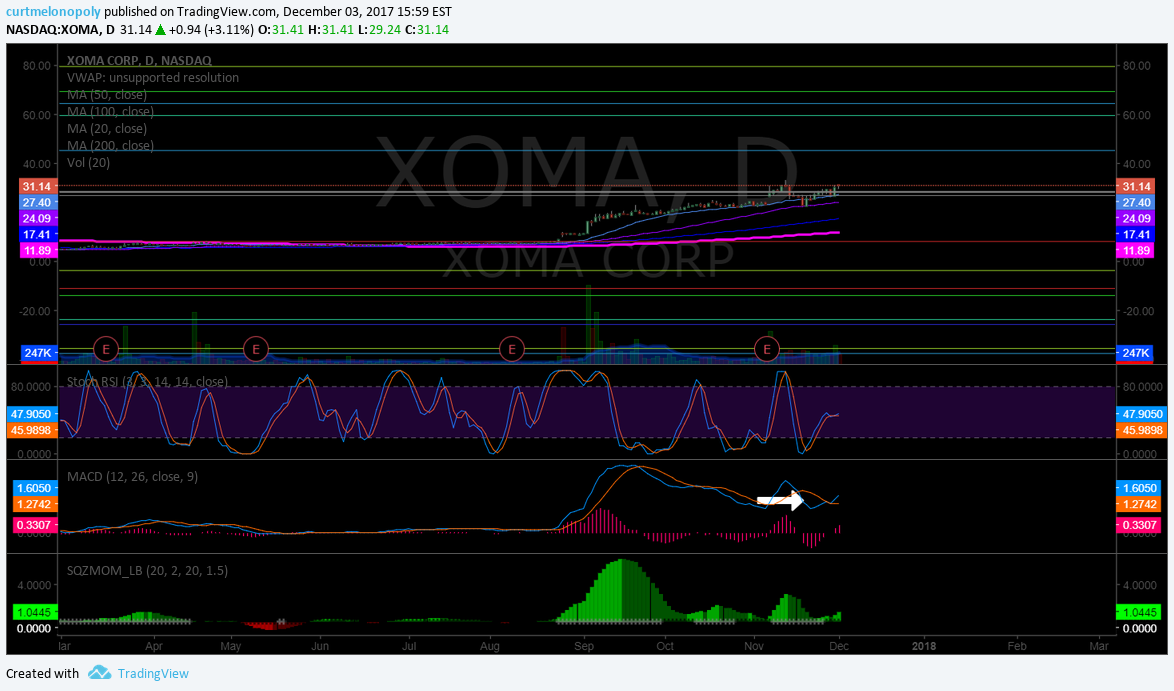

$XOMA – XOMA Corp

April 26 – Trading 24.21 with indecisive indicators. Will watch. No trade.

Mar 18 – $XOMA what an excellent short side trade under that structure and continues short under grey horizontal line.

Feb 11 – Trading 25.46 with chart structure in challenge. Will advise as it plays out. Watching.

Jan 1 – $XOMA The symmetry in daily chart shows a clean swing trade long here if history holds or repeats.

Jan 1 – $XOMA This chart provides a zoom in of all horizontal fib buy sell triggers and a trend line to follow Enter long near trend line use fibs as buy sell triggers and watch your indicators for a successful trade.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Signals, Buy, Sell, Triggers $ARRY, $SHOP, $XXII, $SSW, $ARWR, $CDNA, $NAK