7:49 AM EST Friday Crude Oil Started Sharp Intra-Day Sell-Off Dropping 200 Points in 40 minutes. We Went Long Live in Oil Trading Room and Alerting Buys in To Sell-Off and Nailed the Low Price and High Price of Day.

In the article below (one of the most important we have written) we detail the oil day trading strategy, trade positions (mapped on a chart) we executed short and long, screen capture images of oil trade alerts feed, technical charts, strategy comments, and live oil trading room raw video.

The Strategy Set-Up.

Thursday night going in to Friday morning (in CL futures trade) we alerted members by email and oil trade chat room (Discord server) there was a high probability of a significant sell-off coming in the over-night futures trading session (in to regular US market open). It was a channel resistance and symmetry set-up.

Oil did plunge in to the early morning on USA-China Trade War Escalation;

Oil plunged on trade-war escalation https://finance.yahoo.com/news/oil-plunges-trade-war-escalation-190000557.html?.tsrc=rss.

This set-up strategy we had been alerting to our members for some time as the trading channel resistance on the 30 minute chart time-frame was being challenged by oil bulls.

The key point is that there was also a significant algorithmic chart model symmetrical set-up developing, hence the alerts and trade guidance in the oil trade room (broadcast by voice).

You can see in the chart below the large red arrow and the green lighter arrows pointing down to a support area on the 30 minute chart. The red arrow is the area on the chart model to watch for the possible short selling set-up (as alerted) and the green arrows are the possible trajectory of the short trade.

The symmetry our models identified targeted this area of the chart model and time.

If you review the live oil trading room raw footage you will hear about the short set-up and strategy (which I know is cumbersome because we haven’t had time to splice short time frame snippets for you yet). But if you’re serious about wanting to become an expert oil trader the time is well invested.

Below is one alert to our members (screen shot capture) from the oil trading room. Our software did fire but this set-up is still being tweaked in the code (it was only a small win), but the subsequent long side oil futures buys were exceptional in that we nailed the low of day, each low of day and high of day thereafter.

Thursday night in to Friday (in CL futures trade) alerted members oil trade chat room high probability significant sell-off in over-night futures trade.

As mentioned, we executed a short position prior to the sell-off (see trade locations below) but closed the position shortly before the 200 point tumble in oil price (the v3 EPIC software IDENT program had also alerted us to the order-flow turning down).

The code in our software is slowly being tweaked to move with the sharp intra-day crude oil sell-offs, it won’t be long and we will be hitting most sell-offs (for those that are unaware we now nail near all low of day reversals so we are tweaking the code for the other side of the trade, the sell-offs).

In the article below we highlight how we hit the low of day trade during the sell-off, how we hit the low in each bounce thereafter and how we closed our final oil long position at the high of day.

Our most recent article to this deals with the opposite scenario, selling in to resistance during an intra-day crude oil rally, read it here.

Before reading this article, please read the introductory article (for context) to this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are emailed direct to our mailing list – click here to register.

Recent Trading Profit/Loss Results v3 EPIC Oil Machine Trade For 100K Sample Account:

For August 23, 2019 Profit & Loss Daily +$862 YTD+$11,463 Projected $89,020 or 89% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts

For August 23, 2019 Profit & Loss Daily +$862 YTD+$11,463 Projected $89,020 or 89% Per Annum. v3 Oil Machine Trade 100k Sample Account (v4 period excluded) #OOTT $CL_F $USOIL $WTI $USO #machinetrading #oiltradealerts pic.twitter.com/g1l6TUbrpM

— Melonopoly (@curtmelonopoly) August 25, 2019

The Power of Compounding Returns With a Systematic Compound Trading Process.

Crude Oil Trading Compound Return Projection Based on Current Results 100K Sample Acct #OOTT $CL_F $USOIL $WTI $USO #OilTradeAlerts #MachineLearning

Crude Oil Trading Compound Return Projection Based on Current Results 100K Sample Acct #OOTT $CL_F $USOIL $WTI $USO #OilTradeAlerts #MachineLearning pic.twitter.com/DCSGkBAC6U

— Melonopoly (@curtmelonopoly) August 25, 2019

Friday Oil Trading Room Session.

Please note:

- When we alert 1/10 that means (for example) on an account of 100,000.00 that would normally execute a trade size of maximum 10 contracts, 1/10 size then represents 1 contract. We use a 100k account for our sample set for simplicity.

- Trades and the strategy therein are alerted to a live trade broadcast room by voice (by a leader trader) and published as time allows to an oil trading alert feed on Twitter and in a Discord private member server.

The Trade Strategy Set-Up – Buying Crude Oil in to the Intra-day Sell-Off.

As mentioned above, the real key to this oil trade strategy story (the set-up and trades on the day) wasn’t the short side but how we managed to nail the bottom on a vicious sell-off, then nail each subsequent bottom and high of day while buying oil in to the sell-off plunge.

Key take-away rules for trading long in to the sell-off:

- Know the technical support on all chart time-frames (conventional and algorithmic).

- Know which support areas are most probable areas for an intra-day reversal by way of historical back-tested data.

- When order flow and price action reverse (bulls are buying and shorts are covering during the sell-off) is a key indicator that the low-of-day in oil trade may be in place.

- When systematic market wide machine liquidity starts progressive buy programs, this is the low of day near 100% of the time (IDENT program). This is by far our best intra-day crude oil trading signal (proprietary and in development).

- Manage trade sizing and sequence – releasing size of trade, adds, closing position etc.

- Manage stops properly and know when to hold some or most of your trade size.

Below is a screen image capture of some oil chat room guidance alerts as the sell-off progressed in premarket and then the buying started at support (see other screen images below).

Curt MelonopolyLast Friday at 8:04 AM

Price target hit on that previous alert, we didn’t hold through the whole range as it was later than predicted, JeremyToday at 5:03 AM

Sell 55.37 1/10 on order flow protocol, 1st price target 54.80 6:30 AM. Will advise.

Example of algorithmic modeling (30 min doodle), symmetry alert at red arrow from earlier, follow green arrows down to bottom of channel.

nice move

What are the Probabilities of Trading The Low of Day, Each Low at Each Bounce and Closing High of Day?

Machine learning (as it applies to trading) is not like human learning and execution in that once the software begins to master a set-up it will rarely lose that similar set-up in future and it will increasingly extract more profit each time.

If you don’t want to use machine learning to enhance your trading (engaging a firm like our partners at Sovoron) then perhaps you can learn from the machine software (via alerts or oil trading room) to enhance your own oil day trading strategy.

Some of our clients do both – they have machine learning automation and mechanical human executed day trading in their over-all strategy.

Either way, below is a summary time-line with screen image shots of how it was done.

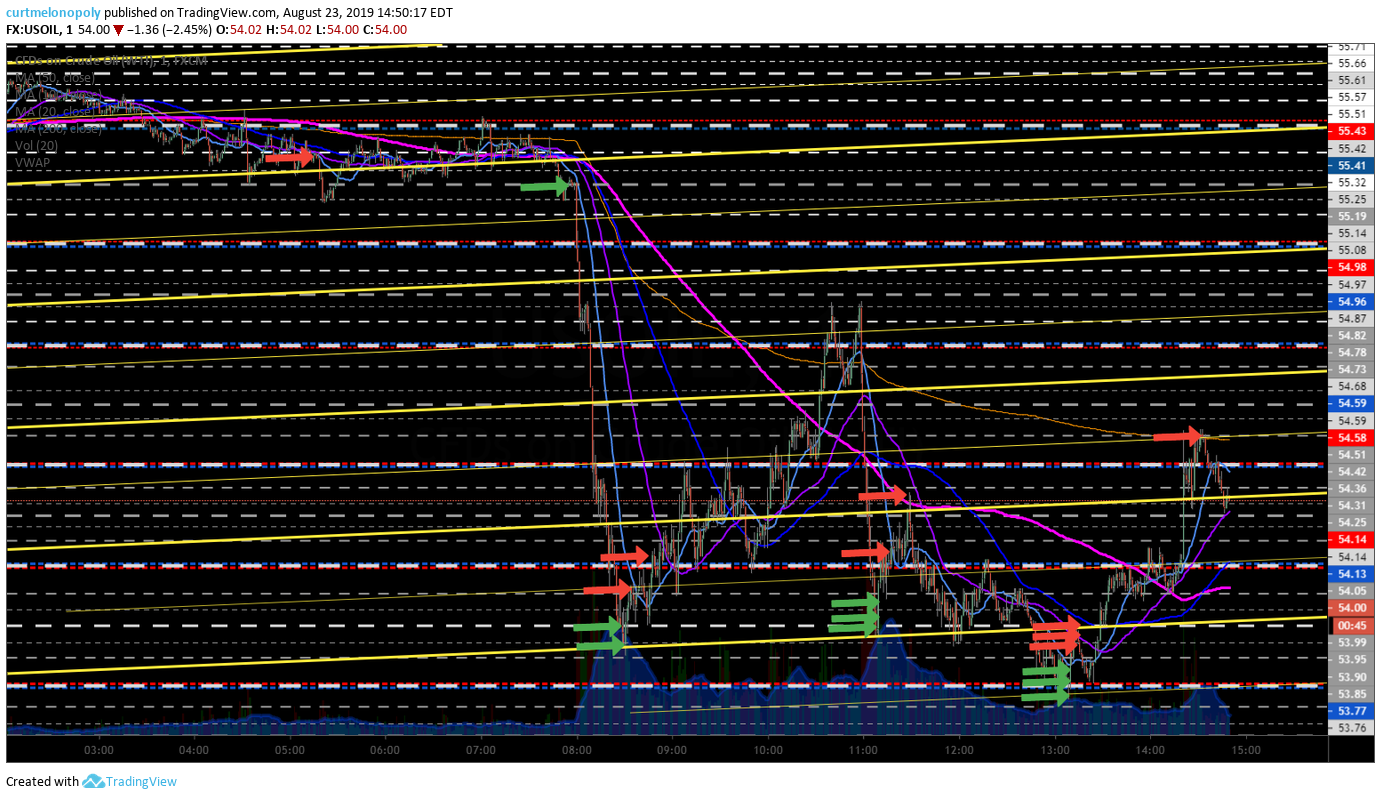

Below is a chart showing the oil trades for the day that were alerted to the feeds and broadcast live in the oil trading room.

Location (plotted on 1 minute chart) of EPIC v3 crude oil trade alerts. Green arrows on the chart are long entries and red are selling executions of trade #OOTT $CL_F $WTI $USOIL $USO #machinelearning #oiltradealerts

Oil Trade Alerts Feed Screen Capture Images for Friday Daytrading Sequence

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 8:39 AM

Sell 1/10 53.66 hold 0

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Sell 1/10 53.65 hold 1

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 8:27 AM

Long 2/10 53.56 tight stops

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Price target hit on that previous alert, we didn’t hold through the whole range as it was later than predicted, “JeremyToday at 5:03 AM

Sell 55.37 1/10 on order flow protocol, 1st price target 54.80 6:30 AM. Will advise.”

EPIC Alerts

@OilAlerts_CT

·

Aug 23

JeremyToday at 7:50 AM

Cover 55.19 1/10 hold 0

EPIC Alerts

@OilAlerts_CT

·

Aug 23

JeremyToday at 5:03 AM

Sell 55.37 1/10 on order flow protocol, 1st price target 54.80 6:30 AM. Will advise.

As day trading oil continued Friday the image below shows a screen shot of the trade alerts sent out to members. Each low of day in trade was bought by our lead trader and software and profit trimmed and sold as price of oil went up.

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Long 2/10 53.53 sold 1/10 53.61

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 11:04 AM

Long 1/10 54.00

Screen shot of oil trade alerts in to the end of the day trading sequence on Friday from oil trading room. The last trade alerted was the high of day which concluded trade for the day in the oil trading room.

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 2:21 PM

Sold 54.11 1/10 hold 0

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 1:11 PM

Sell 1/10 53.47 holds 1

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 1:04 PM

Long 53.32 3/10, sell 1/10 .37, sell 1/10 .40 , hold 1 add and 1 hold for 2/10 hold

EPIC Alerts

@OilAlerts_CT

·

Aug 23

Curt MelonopolyToday at 11:19 AM

Sold 1/10 53.86 hold 1

Intra-Day Time Cycles Are Key for Oil Traders.

Curt MelonopolyLast Friday at 11:45 AM

Sell off cam in perfect at 11:00 mid time cycle inflection

So How Did We Nail the Short Oil Prediction in Over Night / Premarket Session, Nail The Low of Day Price Target Trade, Subsequent Low of Day Trades and High of Day Trade?

We have thousands of rules in our algorithmic models to which each rule is weighted against the others, so this is no short answer.

But if you read the article above closely, you look at the alerts and if you are a member look at all the other charting and information sent out prior to and during this trade set-up you will begin learning (or add to your oil day trading strategy too-kit) many excellent additions to help you increase your profits.

The live trading room videos also help, reviewing past articles will help you, having all the conventional and algorithmic charts available to you for immediate reference during intra-day trade, trade coaching helps (I’ve never had a complaint) and being in the live trading room is key if you are really serious about learning our rule-set.

The oil trading rule-set that our v3 EPIC machine learning software uses is one of the best in the world, we know this because we did the hard work in back-testing every trading rule it uses and designing a trading strategy that weighs the rules one against the other.

The win rate, the return rate, the stability and the precision of the oil trading software is evidence of this fact.

You now just have to put in your part of the work – we have already done the heavy lifting for you.

Welcome to the matrix.

Live Oil Trading Room Video.

Please note: The video below is a raw feed only of the oil trading room for the whole day-trading session (we run the live video feed from 7am to 5pm EST). To listen to comments by the lead trader that contain specifics to his/her oil trade strategy / thinking as he/she and/or the software are trading and sending out alerts, look at the time stamp on the oil trade alert, chart, trading room screen capture image etc in this or any other report and correlate that to the video and go to that part of the video.

If you are struggling with your trading and need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com.

Remember also that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

https://twitter.com/EPICtheAlgo/status/1163213528867770369

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategy,alerts, trading room, technical support, daytrading, machine trading, $CL_F, $USOIL, $WTI, $USO, CL