In this Special Earnings Season Swing Trading Report: OIL, $RIOT, $TORC, $SPY, $DXY, $EDIT, $GTHX, $ARWR, $PSTG, $AMBA, $COTY, $FSLR, $AAOI, $HIIQ, $LITE, $CALA and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: Do not miss listening to the actual video for earnings trade levels on these charts. Reviewing just the notes below is not sufficient. Many of these set-ups will be traded and as was so the last earnings and times before significant ROI for the year is gained setting up positions during earnings season. Also, even if the video was recorded days earlier the trading structure of the charts is still in play for the earnings trade set-up.

Mid Day Member Webinar Chart Swing Trading Set-ups Summary (from July 25 mid day, published July 29):

Swing Trading Special Earnings Season Report (member version) that will become the premise for our next major entries.

Reviewed: Crude OIL, $WTI, $USOIL, $RIOT, $TORC, $SPY, $DXY, $EDIT, $GTHX, $ARWR, $PSTG, $AMBA, $COTY, $FSLR, $AAOI, $HIIQ, $LITE, $CALA.

This is the mid day review video from Wednesday July 25, 2018 of last week. The charting updates apply today as they are focused toward the swing trading platform. We didn’t have time to post the video and report until now.

We continue in this series to review the 100 equities on our swing trading platform in about ten days in lieu of the one regular weekly swing trading report (covering about 1/5 per week). The objective is to cover all the charting trade set-ups during earnings season. This doesn’t mean we can include new charting for each as each are reviewed on the video.

The equities on this report are in reference to our regular Swing Trading report that was last published June 20, 2018 on regular rotation (for referencing charts as you need).

Not reviewing the video details (trading plans) is not advised because there is detailed trading plan information in this video.

FX $USOIL $WTI #CL #OILTrading – A quick look at the oil algorithm charting. I had about ten trades today, our machine trading side had 30 – 40 oil trades. My personal monthly month oil trading win streak continues. See special report to follow, the report will also have an intra day chart for members (charting our machine trading thesis is formed via).

$RIOT – See special report (to follow) on the daytrade and how we did it.

RIOT BLOCKCHAIN (RIOT) over 200 MA on 240 Min chart closed 8.40 with trade entries 7.30s today. #trading $RIOT

US Dollar $DXY – Dollar is at main pivot in structure of chart.

$SPY – SPY is at pivot also. Review recent videos. Near buy trigger trim near 284.94.

$TORC – was the the premarket momo, we didn’t take a trade, it did nothing at open.

$TORC Premarket up 142% trading 21.79 on lock up exp, results, short interest. $TORC #daytrading

$EDIT – I am in 33.43 1/3 sizing. 34.86 resistance on model. Will add on pull backs at supports or channel. I think it will get near bottom of channel and then I’ll add. Earnings in 18 days. Video shows trading plan on EDIT chart.

EDITAS MEDICINE (EDIT) Sell-off nears key support 27.95 for an add to swing, trading 29.70 Friday $EDIT #swingtrade #alerts

$GTHX – Long swing trade entry 49.63 1/3 sizing. Total sizing is never more than 3% of account sizing. So at 1/3 there is no stress. Set a trim 50.99 alerted it and trade missed trim trigger by 2 cents. Details of GTHX trading plan shown on video.

G1 THERAPEUTICS (GTHX) Over mid quad key support in swing trade long here. Targets on chart. $GTHX #swingtrade

$ARWR – Long swing trade from yesterday 17.24 entry, over mid quad support, Resistance at 19.50 quad wall and Fib line, pivot 16.42, main support 12.84. Trade coaching comments toward using our charting at this point in the video. Important comments here on the video.

Trade coaching comments toward using our charting at this point in the video. Important comments here on the video.

ARROWHEAD Pharna (ARWR) Took first long side entry today on swing trade over mid quad pivot $ARWR

$PSTG Pure Storage – trading 23.84 earnings 32 days, in the pinch in the quad, looking for 25.90 in to Oct 1 in trading plan – looking for trade. 29.13 would be ideal price target Oct 1 top of algorithmic channel on chart.

PURE STORAGE (PSTG) Closed Friday just above key support. Below targets 19.25 Oct 1 above 25.92. $PSTG #swingtrading

$AMBA – there was a special report published previously. Video shows users how to clone a simple trading model. Sitting on quad wall, price targets Aug 1 40.00, 30.63, 31.61. Looking for a pop around 36.09 and the possible long thereafter. Support 36.15 resistance 40.16 over 44.00 resistance. Time cycle Aug 1 termination. Earnings 39 days. 49.30 upside target in a long scenario. Video details the trading plan in AMBA.

Ambarella (AMBA) Above the mid quad just above is a long in to earnings and under a short – trade in direction of price targets on chart. $AMBA #earnings #swingtrading

Ambarella (AMBA) Note the chart symmetry in last sell off hitting mid quad each rotation in structure. $AMBA #chart #symmetry

$COTY – has been in our coverage for about a year, hasn’t been great and not looking at trading it.

$FSLR First Solar – trading on 200 MA weekly chart structure, Stochastic RSI is up, indicators are week, if price gets above the 20 and 50 MA and 20 MA breaches 50 then it is a long. Sidewinder setup possible and on watch. Video explains the trading plan. Resistance 86.42 if it gets bullish. Earnings in a day.

FIRST SOLAR (FSLR) Looking for a trade either side of 200 MA on the weekly chart. Testing now. $FSLR #swingtrading

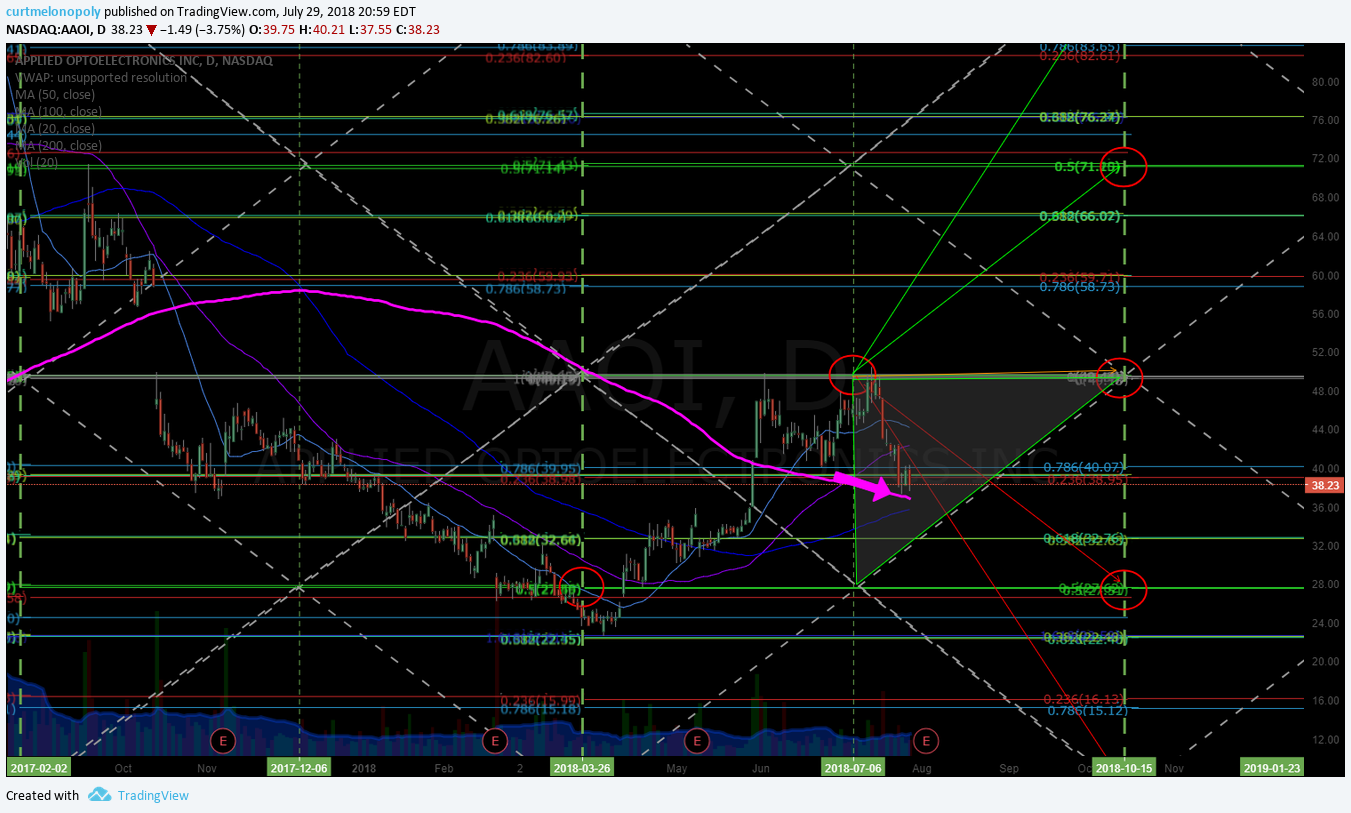

$AAOI – was my nemesis from last year, AAOI over it’s 200 MA earnings in 8 days, history reviewed on video on company over last year, if this earnings hits 49.37 is the first price target, 71.48 is my personal target (aggressive hope), most bullish (not likely) 92.77 all Oct 16, 2018. Trading 38.83 intra day, in a sell-off support 27.59, 200 MA support and 100 MA support in play 35.35, horizontal FIB support 32.86, 33.01 quad wall support, range support 27.59 (major range support). Double bottom 22.90 area – would hit that very hard if it occurs.

APPLIED OPTOELCTRONICS (AAOI). It’s all about earnings in 3 days now. Looking for a sizeable trade on other side of ER. $AAOI #trading #earnings

September 7th Options Now Available For Applied Optoelectronics (AAOI) https://www.thestreet.com/partner/september-7th-options-now-available-for-applied-optoelectronics-aaoi–14663833

$HIIQ – mid quad main pivot for structure is where trade is and earnings are coming in 11 days, trading 31.90 intra day, moving from buy sell trigger to buy sell trigger, if it holds that 31.05 it’s a long side trade with a target 35.70 Aug 13 right after earnings, downside 31.10 price target in sell-off and 26.65 for same time frame mid Aug. Trading plan discussed on video.

Health Innovations (HIIQ) Testing key support with earnings in four days, will be looking for a trade post earnings $HIIQ chart. #swingtrade #earnings

$LITE – I’m watching this one close for a sizeable trade in Q3 and Q4. MACD cross down Stoch RSI near bottom. trading 53.75 at mid quad pivot, earnings 16 days, would be surprised if it doesn’t gap up, Recent downtrend was over done in my opinion. 51.25 support, 53.85 pivot, 56.55 resistance then 200 MA, then 60.00 ish range. 65.05 price target in upside trade scenario.

LUMENTUM HOLDINGS INC (NASDAQ LITE) Coming in to earnings at key mid quad, looking for trade other side of ER $LITE #swingtrade #earnings

$CALA – on other side of July 9 time cycle expiry, trading 4.40, nailed the price target on the short side alerted, 10.75 is a price target May 23, 2019 on upside move if it happens. This is a possible double ROI trade. 2.76 support. Main resistance 8.55. Fib resistance 6.20. Quad wall support. This is a long for sure if it turns bullish. I don’t hold through earnings typically.

CALITHERA BIOSCIENCES (CALA) Time cycle switch here should see some upside. Price targets on chart. $CALA #swingtrade

#swingtrading #charting #tradecoaching

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me: