Trading Intra-Day Range Can Be A Profitable Day Trading Strategy For Oil Traders.

Below is a real world example from our oil trading room last Thursday that highlights trade of the important intra-day trading range (in this instance the range of trade is a technical trading box structure).

Today (Monday) there were no trades in the trading room so I am going back a few market days and using it for our example.

Before digging in to this article, please read the introductory article for this series here: How Oil Day Traders Can Learn to Trade Better Using Success & Failure of Our Trading Development Team – Part 1.

The articles in this series are sent direct to the mailing list – so be sure to register now, click here.

The most recent oil trade profit loss for v3 sample set is here;

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts

For Aug 9, 2019: v3 Profit & Loss: Daily +$995 YTD +$8,526 Projected $94,306 or 94% Per Annum. Oil Machine Trade 100k Account (v4 period excluded) #OOTT $CL_F $WTI $USO #MachineTrading #OilTradeAlerts pic.twitter.com/bPJVI49MIL

— Melonopoly (@curtmelonopoly) August 11, 2019

Overview of Thursday’s Oil Trading Session.

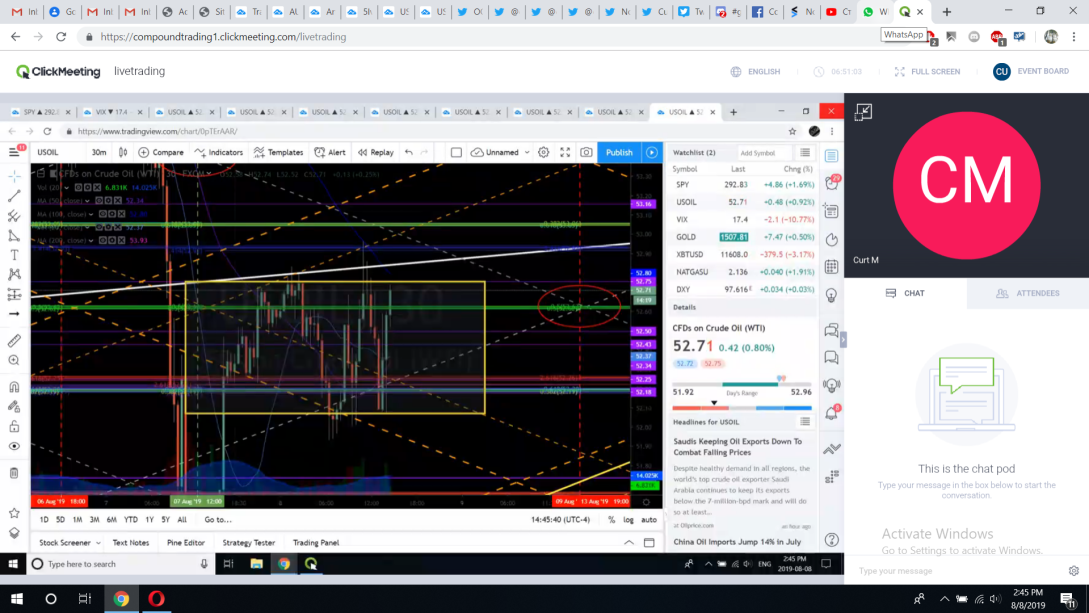

The image below (a screen capture) from the oil trading room shows oil trading within a chart trade box – a range of trade (see yellow box on chart) on the day.

This post is intended to bring to the forefront of the oil traders mind a clear image example of an intra-day trading range structure and how to day trade that range.

Learning how to trade the intra-day range of crude oil is a vital area of study for anyone that wants to be consistently profitable in this game.

The biggest challenge is identifying the range and then once identified execution of your trades becomes easier. Identifying a range is not easy before trade has happened or even during trade – it is much easier to identify after the fact (after trade has clearly drawn in the lines on the chart so to speak).

In short, we traded successfully on Thursday but it was a bit choppy. Both I with manual executed trades and the machine trading software were green on the day.

Lead Trader Guidance in Private Member Server, Oil Trading Broadcast Room and to Alert Feeds.

In Regular US Market Premarket I Provided Range Trade Guidance to our Oil Trading Chat Room Attendees (a private member Discord server for sharing charts etc), to the Live Oil Trading Broadcast Room (this is where I trade live and broadcast trades over a mic) and to the Private Member Twitter Oil Alert Feed with a Daily Chart.

The buy triggers on watch I am sharing with the day traders are on various chart model time frames, the 1 minute, 5 minute, 30 minute, and Daily charts.

This article is not specifically about various support buy triggers on different chart model time-frames as described in this guidance, however, it is part of the intra day set up in crude oil trade and vital to the architecture of our v3 software and ROI (and vital to the daytrader) so I include these details in this article.

For those really wanting to dig in to how we find support areas on the charting simply look at the time stamp on the chart image captures in any of these articles and correlate that time with the raw oil trading room video feed included in these articles and listen to what the lead trader (in this instance myself) is saying about the set up.

There were specific trend lines on the daily chart that crude oil was respecting, that we had communicated to our members about prior that was my primary watch going in to the regular US market day.

Curt MelonopolyLast Thursday at 9:08 AM

Today’s range per daily chart on recent report (TL’s), upside 53.86, downside 50.40, trading 52.44, pivot in 52.11 range. Yesterday’s 52.11 PT easily hit (from trading room)

As trade progresses I am starting to share preferred buy triggers to the oil trading room and on alert feeds.

The image below from our oil trade chat room highlights buy triggers on the 5 minute algorithmic chart model.

Details of this set up and how we determine the areas of support for possible triggers are discussed on the raw video feed from the oil trading room below. We previously covered this in some detail in other articles available here “Crude Oil Trading Academy : Learn to Trade Oil” and will cover intra-day support areas for buy triggers in greater detail in future posts.

I Also Outline in Detail to Oil Trading Room Attendees Support Buy Triggers on Watch on the 1 Minute Oil Daytrading Chart Time-Frame.

Oil machine trade buy trigger on watch shared alerted to oil trading room for the daytraders information- screen image below. The image below is showing the EPIC Oil Algorithm Chart Model.

Oil Trade Example – Lessons Learned.

I will state that before I explain as best as possible below in writing and using screen shot images from the private member Discord chat server, oil trading room and oil alert feed that if you are serious about learning how we trade to a win rate higher than 90% that I highly recommend investing the time to match the time stamps you see on the images in these articles to the time of day on the raw oil trading room video and listen to the set up as explained over the mic.

I know that we are all busy, but this is the best way to really learn what we are doing and why our win rate is so high with the v3 oil daytrading software. Alternatively you could register for private coaching lessons as this would be more time efficient but more expensive also.

The challenge with these reports is that they are time intensive to reconcile, the screen shot images, the details, reviewing the videos and P&L’s, then explaining etc takes a lot of time so there is considerable information not included in these articles that you would otherwise garner if you had the time available to review the raw trading room footage – but I get it, it is a slow process and life is busy for most of us.

First trade of the day in oil trading room alerted was a short at 52.75 and we close soon thereafter at .72 for a time cycle decision. The time cycle decision we won’t get in to in this article (time cycles are advanced technical indicators we will cover at a later date). What is most specific to this article is why we shorted at 52.75. First see the alert below and then we’ll look at the chart range structure.

Screen capture image of live oil trading room, 30 minute oil chart trend line resistance for crude oil day trade alert short.

The image below from the oil trading room at 11:41 shows that intra-day oil was trading in to structural resistance trend line on the 30 minute EPIC Oil Algorithm Chart Model. This is a significant sell signal. We closed shortly thereafter because there was an intraday time cycle decision coming on the 5 minute model (again, time cycles we will cover in a later article) and you can always re-enter a trade.

Image from oil chat room server showing discussion confirming that oil price did in fact trade down but buys were coming in.

So in short, at 12:24 (after the time cycle decision on the 5 minute chart) trade did respect the 30 minute larger chart structure resistance trend line and was in fact trading down intra-day. The chart image in the example below is the one minute chart.

So if trade was in fact selling off intra-day then why did we not re-enter short?

This is also explained below, the bulls were still buying at each support at this time in the day. Our software is programmed to trade and alert the most probable wins only. The v3 win rate is well over 90% for this reason. So often the trade set up will play out as expected but I myself and/or the software may not alert a trade because it isn’t a premium trade with a super high probability of a win.

In this instance, trade then started to really sell of on a short time frame and within a small structure. So the trade set-up worked, but we did not re-enter after the time cycle decision at 12:00.

But what we did do is then alert a new buy signal approaching on a time cycle decision…

Alerting our members in oil trading room and on alert feeds that a buy signal on timing is approaching and the initial buys shown.

You can see on the one minute daytrading chart model below the green arrows are the buys and the red selling locations from the alerted oil trade.

You will notice that we alerted our members 4 minutes in advance of the timing so they could be ready.

This alert typically goes to the private member Twitter feed, the Discord Private Server (shown below) and in to the Live Trading room (as time allows for each – this can be difficult at times so we do our best, obviously the live mic trading in the oil trading room is best but the alert feeds do receive about 80% or more of our trade set-ups alerted).

We then communicate on mic verbally in the oil trading room the complete set up as time allows. This may include various charting, order flow detail etc.

The trade size was 2/10 (so this means that with an account that is approximately 100k in size or would trade approximately 10 contracts at max this would be a 2 contract long daytrade in crude oil futures).

We alerted that we were 2 contracts in size long (assuming a 100k account size for simplicity) at 52.56 on FX USOIL WTI charting (we use this as a single source for various traders using various instruments).

We then sold 1 contract at 52.65 and held one contract long at this point (alert is shown in screen capture below).

The screen capture image below is the actual Twitter Crude Oil Alert Feed that shows the daytrading alerts at this time of day.

At this point, if you are following along and really in it here, you may wonder why we executed a trade long when the price of oil was relatively close to the resistance on the daily range?

The answer is simple, but more detailed than I can get in to here (here again review of raw trading room footage is key).

Nevertheless, basically the reasons were that trade intra-day was bullish and a break out was increasingly more probable, our order flow software had identified considerable progressive buy side accumulation (hence why we knew a break out was coming – see the previous post for more detail) and the trade itself was taken at a clear support area of our one minute day-trading chart model with progressive increasing buy side order flow.

See the screen capture below from our trading room that shows the support area on the one minute daytrading chart that triggered (in part) the long trade. You will also notice that we then alerted to the members that there was a sell signal time cycle decision approaching.

Next, as you will see below, the real day trading action started. Reviewing just the alerts (as seen below) is not the best way to study this, the best way is to listen to the video raw feed from the trading room. Again, I get it if you don’t have time.

During intraday trade we alert what we can but we often go in to great detail in the live trading room for the set ups as they are progressing.

In this specific instance what was happening was that there was an accumulation of bulls starting to buy to force a break out and volatility was starting. Most of our members understand where the resistance areas are so it is easier for them to see that a resistance is coming and would understand the alerts below (the reasoning) than a casual observer.

Anyway, what was happening is a possible run for a break out, but in that instance it is possible for the break out to fail a number of times before it may succeed, so what you see below is our oil trading machine software and myself (manually executing oil daytrades) trading with price action and order flow relative to resistance areas on the chart (also taking in to consideration time cycles etc).

In short, what occurred as shown below in the alerts is that we reversed the long trade short and then reversed again long and added to the long trade as the buy side order flow took over the short sellers in intra-day crude oil trade.

You will see notes from the oil trading room below that reference what time stamps one should refer to on the recorded trading room raw footage to study out how we did what we did. It was a successful day of trading and it was not a beginner trading environment. But what I can say is that our members have the advantage of simply executing along with us and / or our machine software trading it.

And here the daytrading session is coming near to a close and the oil trade alert goes out to liquidate the last of the long trade size in to resistance on one minute chart and range intraday – after all, if price breaches the resistance shown below on the two models (the one minute chart and 30 minute chart) then you can always re enter the trade right?

Some Important Final Thoughts.

- There are many, many more lessons to learn about how this was done than what is included in this article. Again, if you’re serious about study, defer to the live trading room raw feed video below.

- The v3 software was only rebooted a few days before this trading session…. think “re-birth”, it was in its early learning process and a week later would have executed this set up with far greater precision. But that is the nature of machine trade development. It did well, but it will do so much better within days – it doesn’t take long for the learning curve to inflect vertical.

- The whole trading range rule set on the day can be summarized in much simpler form by simply saying that once you have identified an intra-day range of trade you simply buy the bottoms and sell the tops. Release size at various resistance decisions and DO NOT HOLD LOSERS. The challenge of course is that it isn’t quite that easy – it is much easier to see an intraday structure on a chart after the fact than it is to see the range structure before or during trade within that structure. Back seat drivers need not comment, try driving it first. After the fact you get to see the map – that’s easy.

Live Oil Trading Room Video

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed compoundtradingofficial@gmail.com and remember that I am doing an oil trading information webinar once a week for now on (covering our software status and trading techniques) so email me if you would like to attend this next one – you will need a special link and access code to attend.

Thanks,

Curt

Other Reading:

NYMEX WTI Light Sweet Crude Oil futures (ticker symbol CL), the world’s most liquid and actively traded crude oil contract, is the most efficient way to trade today’s global oil markets. https://www.cmegroup.com/trading/why-futures/welcome-to-nymex-wti-light-sweet-crude-oil-futures.html

Further Learning:

Learning to Trade Crude Oil is Like No Other. At this link you will find select articles from our oil traders real life day-to-day experience in our oil trading room. Crude Oil Trading Academy : Learn to Trade Oil

Subscribe to Oil Trading Platform:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; crude oil, trading, strategies, daytrading, trade box, machine trading, $CL_F, $USOIL, $WTI, $USO, CL, how to trade, alerts, trading room