Review of my Chat Room Stock Day Trades, Algorithm Charting Calls and Alerts for Thursday Feb 2, 2017 $NAKD, $BNTC, $DFFN, $PULM, $UWT , $DUST, $JUNO, $CBMX, $TRCH, $LGCY – $SPY, $GLD, $GDX, $SLV, $USDJPY, $DXY, $USOIL, $WTIC, $VIX, $NG_F…

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Trading Room News Memo – There is a new member memo out that updates our members on trading room news and upcoming events. It also discusses our upcoming announcement of weekly webinars for existing members that wish to use our work in a more in depth manner and prospective members that would like to understand more about what we do. These webinars will be weekly for all six algorithmic charting models, our swing trading service and our trade room – each being 30 minutes in length. You will find the memo here:

Compound Trading Stock Trading Room Member Memo Feb 3, 2017

Also, for those that have been asking about our systems… starting weekly webinar schedule to explain how our algorithmic modeling works.

— Melonopoly (@curtmelonopoly) February 3, 2017

Trading Room Transcripts and Post Market Trading Reports – Some members have asked about trading room transcript accessibility, we are currently interviewing providers and should have an announcement early next week. The post market trading result reports that we haven’t posted over the last few weeks we will catch up on this weekend and going forward will do our best to get them out daily, but I get it, the more convenient and timely the data is the better – so we’re working on that solution right now.

Overview Perspective & Review of Chat Room, Algo Calls, Trades and Alerts:

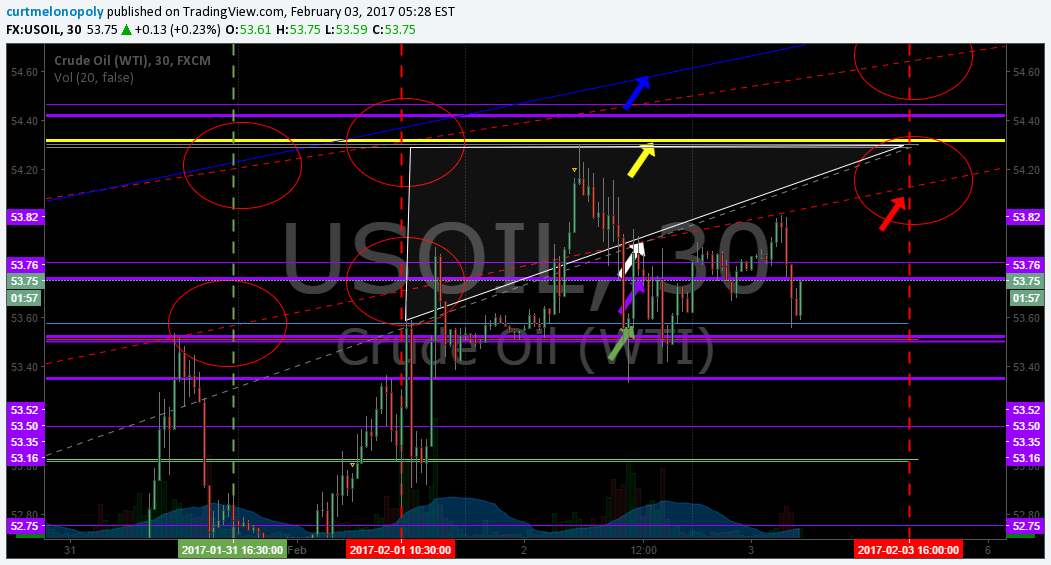

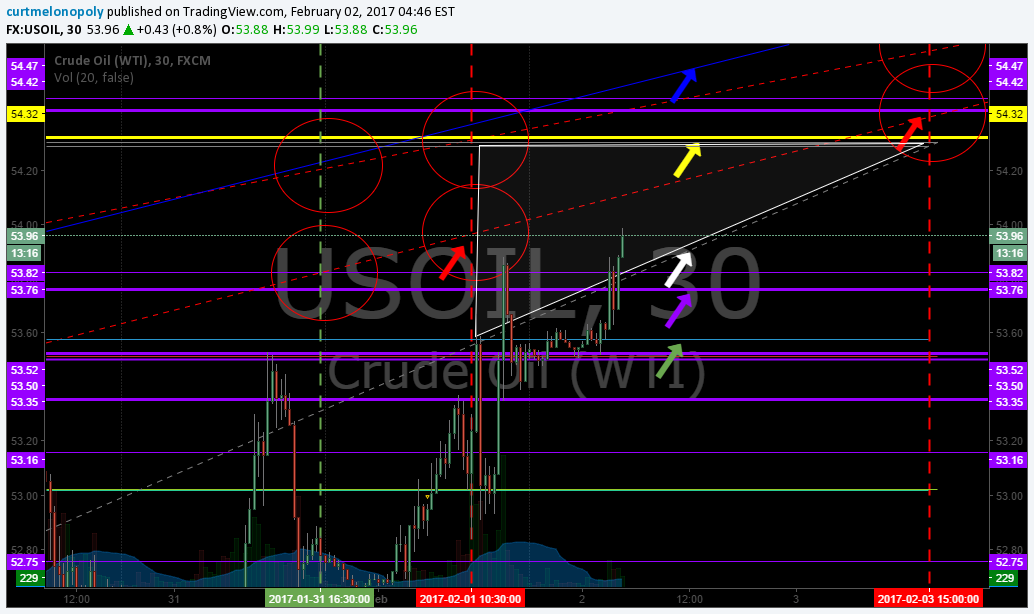

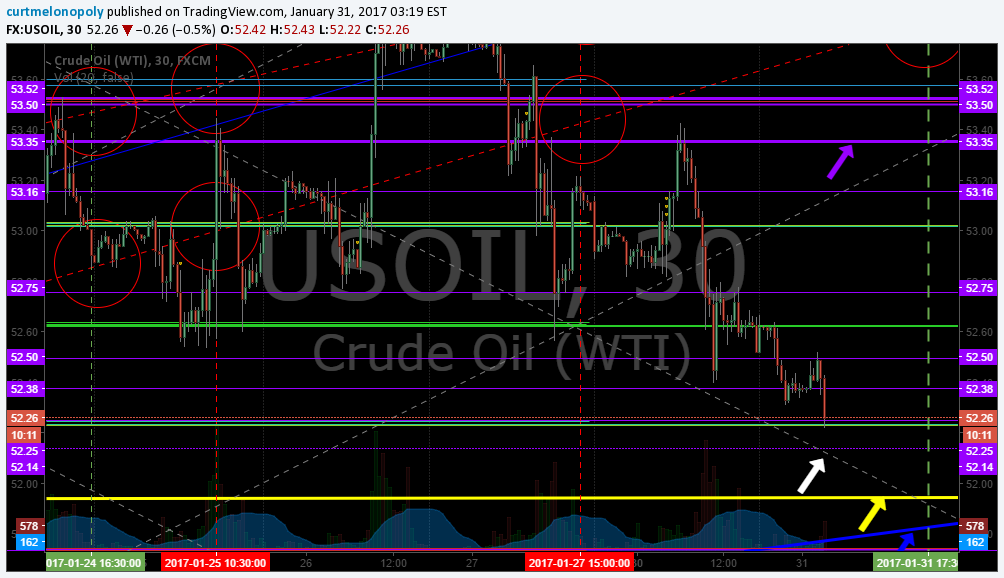

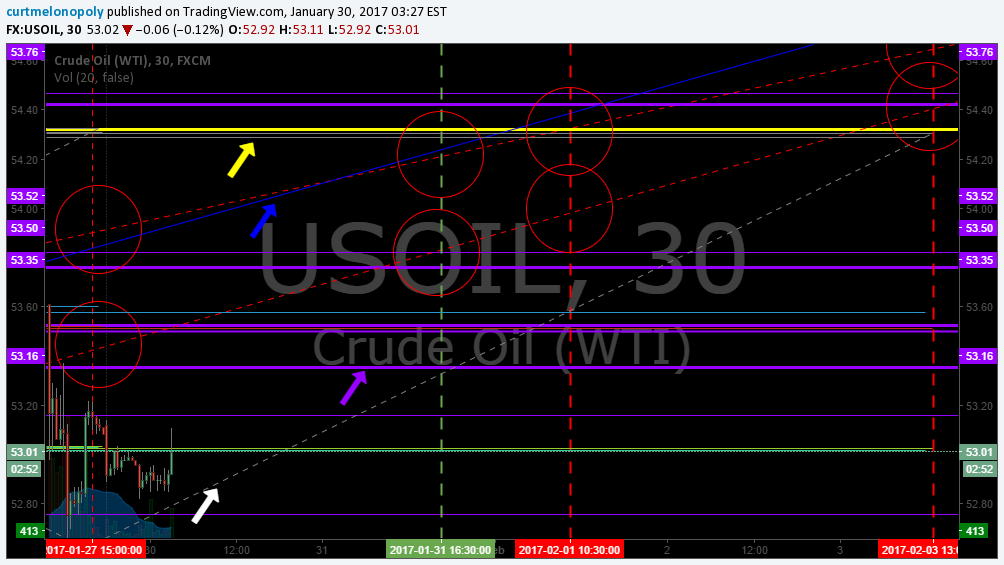

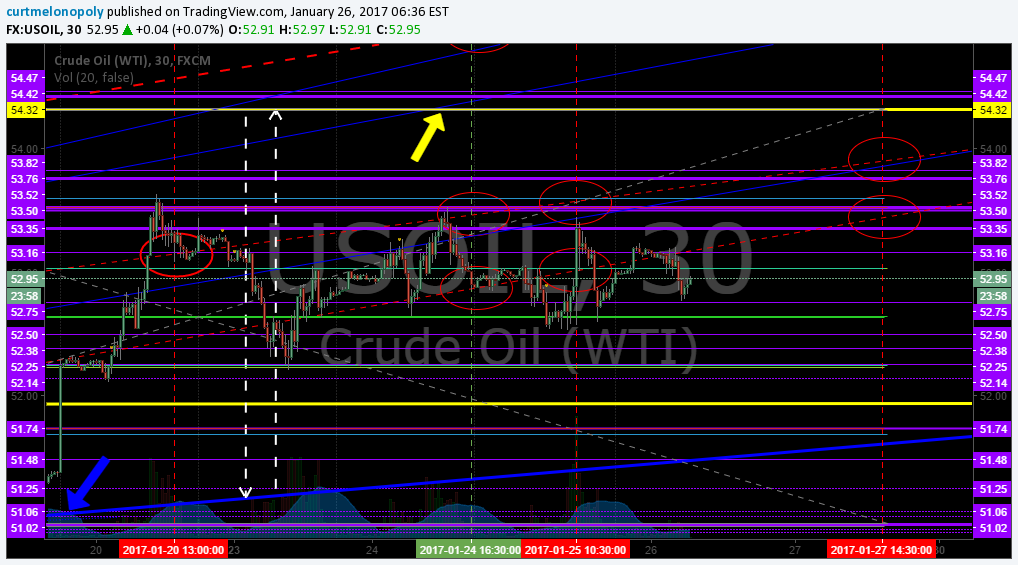

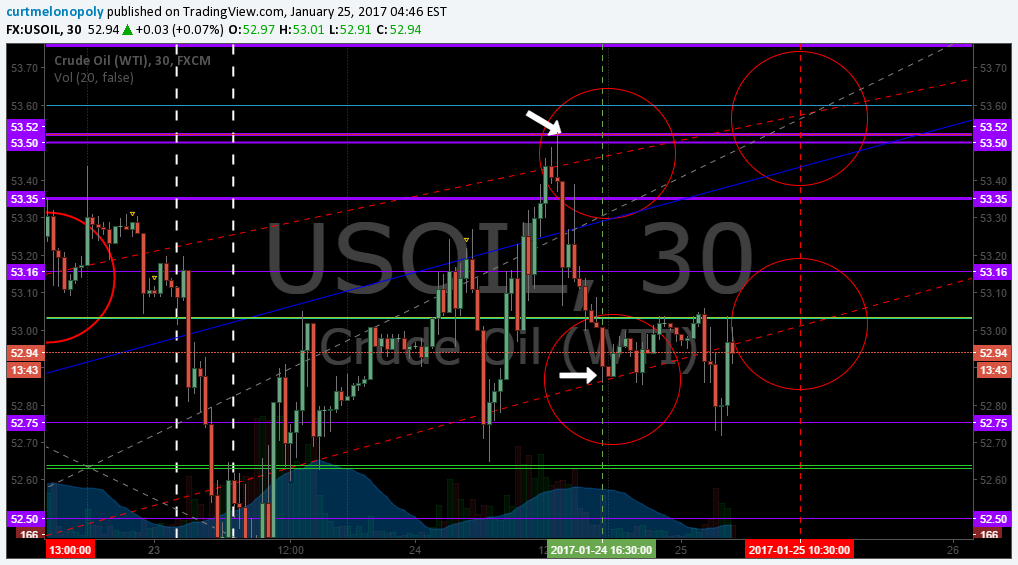

I took a trade in oil related on Thursday and it was a perfect entry – couldn’t have been better. My sell was close to the top of the intra-day range also. THE MISTAKE I MADE was not re-entering after oil washed out again because in overnight trade oil held up. My concern of course is that we are getting so close to significant resistance on the oil chart that I didn’t want to hold. Oh wait, I did take the second trade (timed right) but I cut it flat and didn’t hold. That’s what happened sorry bout that. Anyway, the initial trade I reviewed on Periscope while in progress. You can find it here:

Long Oil related trade on washout support. $USOIL $WTI $UWT Algo signals. https://t.co/1bDubjph3L

— Melonopoly (@curtmelonopoly) February 2, 2017

Also, I’m still on the wrong side of that Gold / Miners / Silver trade and I have absolutely no excuse because I knew months in advance the bottom call from Rosie the Gold Algo and SuperNova Silver Algo – and I even doubled down on $DUST the other day. HOWEVER, Gold does have two very significant hurdles coming overhead that have low probabilities of price action clearing – unless of course geopolitical reasons change that.

Biggest #trading regret: not listening to our algorithmic models – think I'm smarter. Would b ⤴100% in 2017 vs 20% ish. #humilityrequired

— Melonopoly (@curtmelonopoly) February 3, 2017

Momentum / Noteable Stocks Today:

| Ticker | Last | Change | Volume | Signal | |

| NAKD | 2.78 | 137.61% | 17191500 | Top Gainers | |

| BNTC | 3.75 | 134.37% | 9886100 | Top Gainers | |

| DFFN | 4.77 | 55.88% | 793500 | Top Gainers | |

| PULM | 5.10 | 36.73% | 52421606 | Top Gainers | |

| WINT | 1.69 | 27.07% | 933900 | Top Gainers | |

| PZRX | 1.75 | 25.90% | 1033500 | Top Gainers | |

| CALA | 8.45 | 21.58% | 1454600 | New High | |

| BRKS | 20.36 | 15.09% | 3727600 | New High | |

| IDXX | 139.07 | 13.25% | 2755300 | New High | |

| AAMC | 80.49 | 23.83% | 13767 | New High | |

| WOOF | 90.57 | -0.07% | 2473500 | Overbought | |

| PAM | 49.07 | 3.22% | 753500 | Overbought | |

| HSCZ | 26.00 | -0.12% | 213077 | Unusual Volume | |

| NAKD | 2.78 | 137.61% | 17191500 | Unusual Volume | |

| BNTC | 3.75 | 134.37% | 9886100 | Unusual Volume | |

| SCIN | 16.16 | 2.34% | 188000 | Unusual Volume | |

| ACIA | 57.34 | 4.29% | 2218400 | Upgrades | |

| ADHD | 1.16 | -8.66% | 1370500 | Earnings Before | |

| OPK | 8.51 | -1.39% | 2422054 | Insider Buying |

Holding:

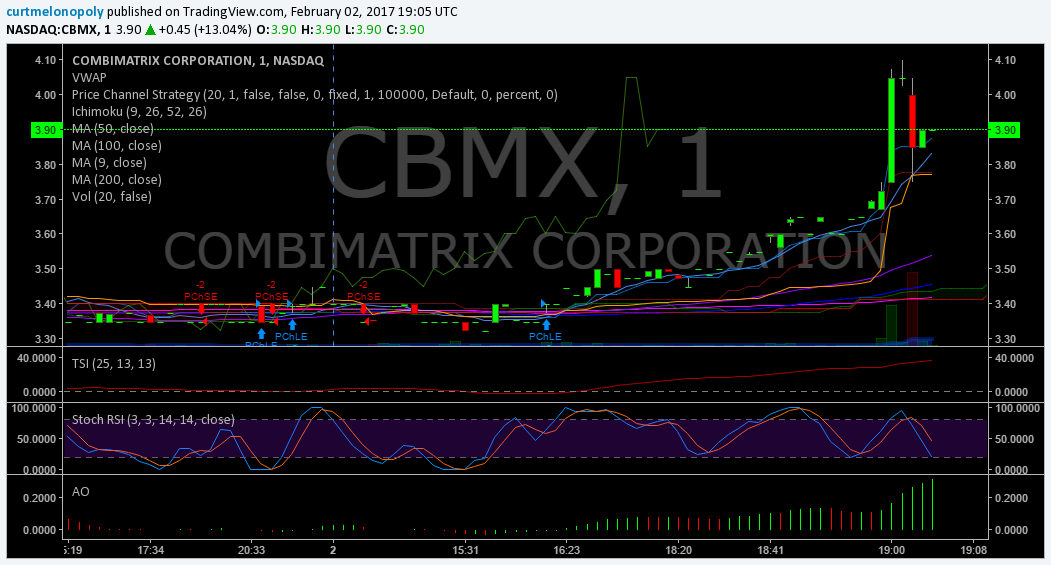

I am holding $DUST, $JUNO, $CBMX, $TRCH, $LGCY after coming off those aftermarket earning scalps. $GOOGL I dumped when it dipped and $ROKA I sold the other day.

Looking Forward:

Everything is at decision time. US Dollar $DXY and $USDJPY at support decision, $GOLD $SILVER at decision support, $OIL at decision resistance, $VIX is almost dead, $SPY seems dead. Still playing morning momos and waiting for the current decisions to play out.

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Announcements in Trading Room:

Stock Chat-room Trading Transcript:

Miscellaneous chatter may be removed.

09:12 am Sash A : LULU got an upgrade

09:12 am Sash A : Urban Outfitters tanking

09:14 am Rome O : $ETRM pullback premarket

09:16 am emily m : Watching $AMD again was a good winner yesterday

09:23 am Mathew Waterfall : Will be looking for a way out of my $TLT calls expiring tomorrow early this AM on this gap up. May also trim a few $NUGT calls but want to see what kind of action we get in the dollar here. A retest of 99.82 wouldn’t be a shock

09:26 am Sash A : $SUNW on watch

09:30 am darnel p : L $XGTI

09:32 am Mathew Waterfall : $NUGT caalls .81 from .5. I’m going to exit at a double if we get there

09:33 am Mathew Waterfall : $SPY just entered my short area. Taking small $TVIX as a short here. Out of it clears HOD, $SPY that is

09:35 am Carol B : $NVCN rocking

09:35 am Mathew Waterfall : $FB lol

09:37 am Mathew Waterfall : Out $TLT calls expiring tomorrow. Still in the Mar 17 126’s of course

09:37 am Mathew Waterfall : Those were small loss but wanted to close them. Small position as well so not a big deal

09:39 am Stan T : $NVCN pylled back

09:40 am emily m : Want a pullback in $PULM here

09:41 am Curtis M : Pit close will be interesting today if Oil tradng up in here

09:43 am Curtis M : Looking at one more $DUST hit – likely not but watching

09:43 am Curtis M : $PULM nicewin guys

09:44 am BAxter A : I’m in $PULM on the PB

09:45 am Curtis M : Congrats!

09:45 am Stan T : I want to add but

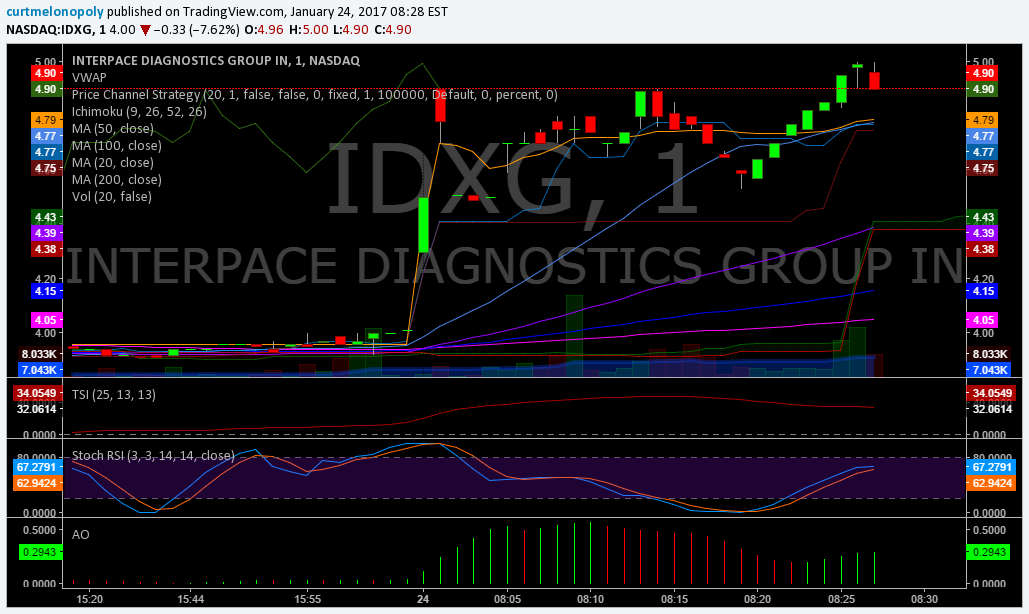

09:47 am Kevin E : $IDXG getting jiggy

09:48 am Curtis M : wow

09:49 am Curtis M : $NAKD 53%

09:50 am Mathew Waterfall : Watching $UAA here. In with a break of yesterdays high

09:52 am Curtis M : $BNTC halt

09:58 am Rome O : Sold $PULM nice nice n

10:01 am Sash A : $BNTC 130%

10:07 am Mathew Waterfall : Raising stops on $PLG here. up 20 cents from 1.68 entry

10:08 am Curtis M : I can’t bring up $BNTC on this computer but I have t on my others and its off heavy anyway

10:08 am Curtis M : Tradingview doesn’t like it lol

10:17 am darnel p : $NAKD pulled back here at 50 day

10:26 am Stan T : Awesome day

10:32 am Ashton S : $APOP halt

10:35 am Mathew Waterfall : Stopped on that $ETRM play few cent loss. I’ll let Curt handle these momo’s lol

10:36 am Curtis M : Watching crude close on another monitor for possible long

10:44 am Curtis M : Crue may turn here

10:48 am Mathew Waterfall : Break time. Back in a few after scanning

10:48 am Curtis M : k

10:53 am Curtis M : Long $UWT

11:06 am Kevin E : haha just watched you video!

11:06 am Kevin E : nice play curt

11:06 am BAxter A : I followed lol

11:07 am OILQ K : ya me too

11:07 am OILQ K : OF COURSE!

11:19 am Mathew Waterfall : Back in action over here. Just sold some $OPXA 1.0666 from .95 entry last week

11:19 am Kevin E : action man lets get at it:)

11:20 am Deb E : Mat buys with 8 arms and sells with 8 legs

11:20 am Kevin E : ha

11:20 am OILK K : True

11:21 am OILK K : This play is going well thanks Curt!

11:21 am Curtis M : yeehaw

11:21 am Curtis M : resistance here tho

11:21 am Mathew Waterfall : I guess Im a spider then Deb?

11:22 am Curtis M : I was thiinking octo

11:22 am Kevin E : spider better

11:22 am Kevin E : crude getting through this curt?

11:22 am Mathew Waterfall : If we can trade legs for tentacles I’ll take octopus

11:23 am Curtis M : no idea

11:23 am Mathew Waterfall : I just don’t know what that means but I do leg into trades if that’s what you’re getting at lol

11:23 am BAxter A : This afternoon should be good

11:23 am Rome O : Oh ya

11:23 am Stan T : Oil will likely go here imo guys

11:23 am Stan T : I’m in

11:23 am Mathew Waterfall : $UAA getting some buys. Will add over yesterdays high, anotehr over Tiesday high

11:24 am Kevin E : $UAA nice

11:24 am Sash A : Here comes oil

11:24 am emily m : great play

11:24 am Mathew Waterfall : Leg one a bit earlier as I said on the Mic, legs 2/3 coming up. Won’t make it to 8 here though unless things get real weird

11:24 am OILQ K : $UAA has upside IMO also

11:25 am Curtis M : Careful with bottom side of that white triangle just saying

11:26 am Curtis M : Indicators look good tho

11:26 am Curtis M : wow power there

11:27 am Curtis M : Powered right in to it

11:27 am Curtis M : algo mania

11:28 am Curtis M : heres the test

11:30 am Mathew Waterfall : $JNUG small tester against LOD

11:33 am Mathew Waterfall : Trailer on that $JNUG. Was looking for gold to make a high over 1221. Out if gold turns down again here

11:35 am Curtis M : Toch RSI turning up on oil

11:35 am Curtis M : battleground

11:35 am Curtis M : Good buy spot on Gold chart long

11:36 am Mathew Waterfall : Lined up between usd/jpy and $GDX. Both went in favor of gold/miners up so I took it

11:36 am Mathew Waterfall : we’ll see

11:37 am Curtis M : Theres some decent sentiment in the news today on oil related so I’m hpoing for a break up in to new zone overhead

11:37 am Mathew Waterfall : You think this Iran action is going to drive prices up?

11:37 am Curtis M : My news feed vanished lol

11:38 am Curtis M : Its gone on my othe rmonitors too

11:39 am Curtis M : I’ll send u over some stuff

11:39 am Mathew Waterfall : Cool

11:48 am Mathew Waterfall : $UAA trying. Would love to seer/g on the day

11:49 am Kevin E : it should

11:49 am Mathew Waterfall : If not it’ll be a inside and down most likely on the daily which aint no good

11:53 am Mathew Waterfall : $GDX needs over that fib at 24.38 with some juice to get going here

11:54 am Curtis M : Getting up to the top of that quad we taled about a week or so ago

11:54 am Curtis M : 9 out of 10 times lol

11:55 am Mathew Waterfall : Im looking for at least a final push here. Gold is cooperating so far

12:00 pm Curtis M : sold

12:00 pm Curtis M : fark

12:01 pm Curtis M : Ill reenter if it goes

12:02 pm Mathew Waterfall : $UAA dip buy here. Through lows and yesterdays premarket lows and Im out

12:02 pm Mathew Waterfall : 10 OPEC members are forging ahead, implementing 83% of cuts, but Iran, Nigeria and Libya are dragging them backwards https://www.bloomberg.com/news/articles/2017-02-02/opec-cuts-oil-production-but-more-work-needed-to-fulfill-

12:03 pm Curtis M : interesting

12:03 pm Mathew Waterfall : Yea I thought so to. Nothing mindblowing but confirmation on both sides

12:04 pm Curtis M : I’ll renter if it gets in to that triangle

12:10 pm Kevin E : I holding $UWT

12:10 pm Kevin E : like the $UAA idea too

12:10 pm Cara R : We’re long $UAA from yeserday

12:11 pm Curtis M : rebooting a server f you guys get shut out or cant chat fyi

12:20 pm Mathew Waterfall : Out $JNUG 6-7 cent loss. Gold breaking to lows so I’ll sit and wait for now

12:27 pm Kevin E : $PULM 🙂 nice washout

12:34 pm Mathew Waterfall : $GDX/$JNUG/$NUGT relative strength on gold weakness. Lots of buying there

12:34 pm Mathew Waterfall : Dislocation can be a good thing when gold gets another pop

12:35 pm Mathew Waterfall : Also Q’s continued wekaness and $IWM still red. Keeping my eyes open here even as SPY fights for green again

12:37 pm John M : $RSX up Russa

12:38 pm John M : Also thinking $FB here maybe

12:40 pm Mathew Waterfall : Yepp $RSX and the ruble loved that news

12:58 pm John M : Spice in news re Iran

12:58 pm John M : Curts Twitter I seen it haha

12:58 pm Curtis M : yup

01:06 pm Curtis M : Long $UWT

01:18 pm Mathew Waterfall : Seeing some call flows into the oil and gas space. $XOM with some heaters

01:18 pm Curtis M : intereresting

01:19 pm Curtis M : was just chatting wth oil traders everyone very keen right now

01:19 pm Curtis M : polorized better descrp

01:19 pm Mathew Waterfall : A lot of people trying to catch the bottom and there’s lots of support right below in many of those names

01:30 pm Mathew Waterfall : Gold vertical. The metals and miners have been a tough trade today lots of washing machine actions up and down chop

01:32 pm Mathew Waterfall : Now seeing some bull bets in volitility products. This action gets me all excited we might have some action on the horizon!

01:39 pm Sash A : Hope afternoon session better than yesterday

01:40 pm Curtis M : We need volatility

01:40 pm Curtis M : sooooo bad

01:41 pm Curtis M : out flat

01:41 pm Curtis M : well paid the broker fees and 2 hotdogs

01:41 pm Curtis M : now it will go to the moon

01:44 pm Mathew Waterfall : Today is a bit of a snoozer after those gaps and early plays. Good day to practice pateince and discipline if nothing else

01:45 pm Curtis M : Just like when I was young and though with wrong head and got really bullish lol thats how I get with the market now that Im old – pent up is an understatement

01:45 pm Curtis M : when something goes the right way I will be leveraged ten houses deep

01:45 pm Curtis M : lol

01:46 pm Stan T : i feel ya

01:46 pm Curtis M : i have to get some scale lol size plz

01:46 pm Mathew Waterfall : I had a trader once tell me” The market doesn’t owe you anything, and you can’t make it pay you”. After reading Jessie Livermore’s book he basically ripped that off from him but that doesn’t make it any less true

01:46 pm John M : Its coming

01:47 pm Ashton S : true

01:47 pm Mathew Waterfall : I like to keep that in mind when I think I’m right and want the market to move how I think it should. It’s not my sandbox I’m just playing in it

01:48 pm Curtis M : jiggy

01:49 pm Curtis M : maybe my imagination but that $SPY chart is moderately bullish

01:52 pm Mathew Waterfall : Ticks are to the upside here so I wouldn’t disagree

01:54 pm Curtis M : $CBMX HOD

02:00 pm Curtis M : Add $CBMX

02:00 pm Curtis M : Swing from weeks ago

02:05 pm Mathew Waterfall : I got an alert on that at 3.65 and it was up 40 cents before I could even get an order in lol so I didn’t chase

02:06 pm Mathew Waterfall : It likes to popto 4 and settle back in the low 3’s so I’ll wait it out. One of these days it’ll run huge though IMO

02:07 pm Mathew Waterfall : $FB double top in progress. This is just liek $GOOGL last week

02:08 pm Mathew Waterfall : $CBMX 33k block 3.95

02:11 pm Mathew Waterfall : Smells like short cover at that speed but who knows

02:13 pm Curtis M : $TRIL HOD

02:17 pm Curtis M : $DRYS lift

02:18 pm Mathew Waterfall : Dollar almost made 99.82 target not backing off a bit. Still watching that as direction for almost everything else I’m doing

02:29 pm Mathew Waterfall : $TENX small bio entry at .85. Stop is all the way down at .4 for new lows so I’m giving this some rope

02:40 pm Mathew Waterfall : $TENX is a swing bottoming play for me as usual. It will run but probably not today

02:42 pm Stan T : Its like market shut off or something

02:43 pm John M : Yeah I have used the time for study might call it

02:43 pm John M : Amazon coming

02:43 pm Mathew Waterfall : These last couple weeks feel very strange to me. Like you said it seems like the market is off, and has felt like we were directionless a number of times

02:44 pm Curtis M : 10 4 to that

02:44 pm Mathew Waterfall : Maybe the algos aren’t running wild, or maybe people are quitely positioning for something, but it doesn’t make me want to jump into positions with both feet

02:45 pm Mathew Waterfall : Like it would in the week between christmas and new years, except for most of the month of January. Most moves shut down, just grinding around. Vix smashed. Odd to me and I can’t get a decent read

02:45 pm Curtis M : Its been 12 sessions – the only obvious plays I’ve missed related to the Gold bottom turn – have no excuse for that but everything else for 12 days tough most everythinh

02:45 pm Curtis M : ya

02:45 pm Stan T : so true

02:46 pm Mathew Waterfall : Dollar hit my level should come off here

02:47 pm Curtis M : SPY is fixed I dont know if it will ever drop again

02:48 pm Cara R : haha

02:48 pm Cara R : It can drop

02:49 pm Mathew Waterfall : In theory you’re not wrong, but in practice I’ll believe it when I see it

02:49 pm Mathew Waterfall : It almost feels like players are jumping ship before a big correction. That’s the only thing that can make sense here

02:52 pm trent p : odd

02:53 pm Curtis M : Crude near support but I’m not taking trade because of pit close

03:02 pm BAxter A : $NAKD all kinds of power hour action up down

03:02 pm Stan T : roulette

03:17 pm Flash G : GoPro mojo

03:17 pm Mathew Waterfall : $GPRO has earnings today I think after the bell

03:18 pm Flash G : yes

03:22 pm Rome O : thats it for more me – see ya fri i predict a big day after earnings

03:25 pm Mathew Waterfall : See ya Rome. Im done trading as well just watching from the sidelines here and letting positions work

03:52 pm Mathew Waterfall : $TWTR rumors spike. In some lotto’s for tomorrow to see if this gets weird over night

03:53 pm BAxter A : See ya in morn

03:53 pm Sash A : ya i guess its that time see yall

03:58 pm Mathew Waterfall : Night all, Im out of here. Currency watch will commence gain tonight though not expecting as big og moves across the board. Again watching credfit spreads to see if we get more tightening and see what the bonds have in store

03:59 pm Mathew Waterfall : New keyboard, same old typos lol

03:59 pm Curtis M : cya

03:59 pm Jack D : bye bye

04:00 pm darnel p : later

Be safe out there!

Follow our lead trader on Twitter:

https://twitter.com/curtmelonopoly

Article Topics: $NAKD, $BNTC, $DFFN, $PULM, $UWT $DUST, $JUNO, $CBMX, $TRCH, $LGCY – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500