Twitter Trading Plan $TWTR (Part two)

Twitter Trading Plan

Step 1. Chart Resistance. Know your upside resistance points.

My bias is long so I am charting upside only. IF it comes under pressure I will re-think a plan and publish separately. The chart below has the MAIN resistance points for upside trade (red dotted).

Step 2. Gap Fill. The gap area on the daily Twitter chart below (27.48 to 29.68) is my initial bias trading range.

Here is the real-time chart link https://www.tradingview.com/chart/TWTR/4kwf0zt1-Twitter-gap-fill-in-progress-on-daily-and-upside-resistance-poin/

Step 3. Chart Indicators. Twitter Long bias will be confirmed when SQZMOM, MACD, Stochastic RSI on daily all turn. $TWTR #charting

Additionally, I will watch the moving averages.

In all instances before taking the trade I will watch these indicators for trade timing on all time-frames first. 1, 15, 30 min, 1, 2, 4 hour charting etc.

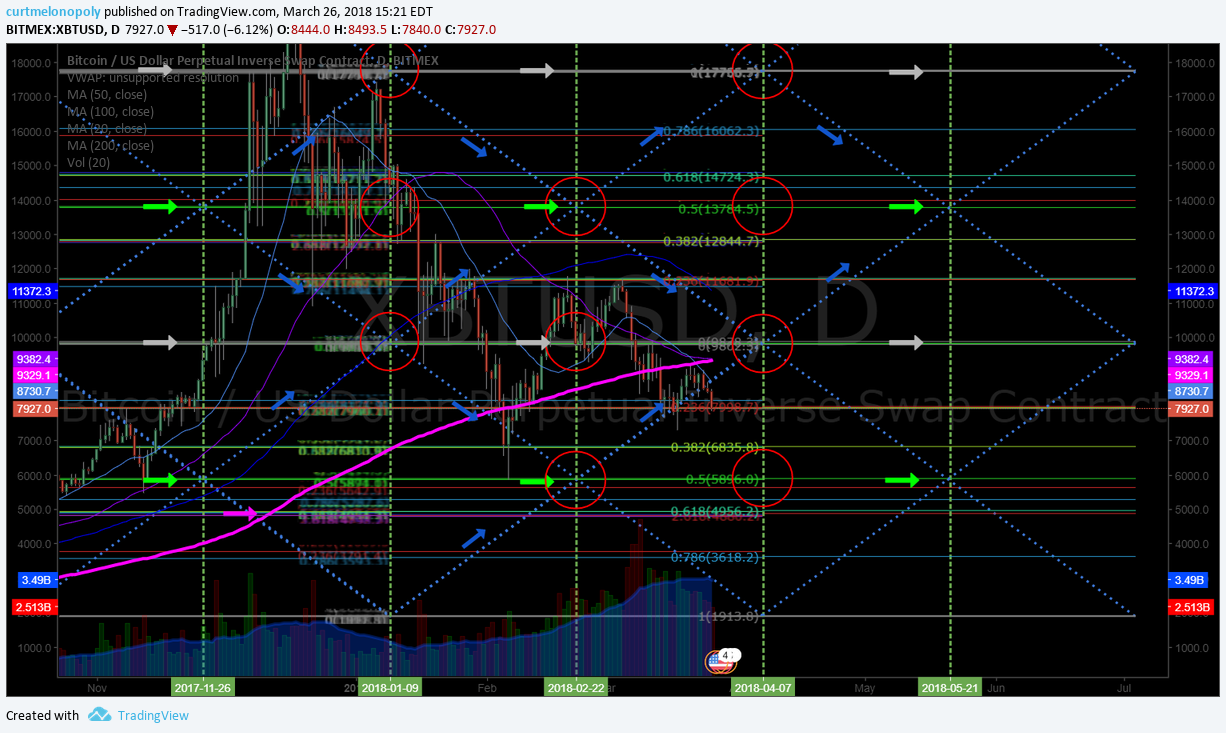

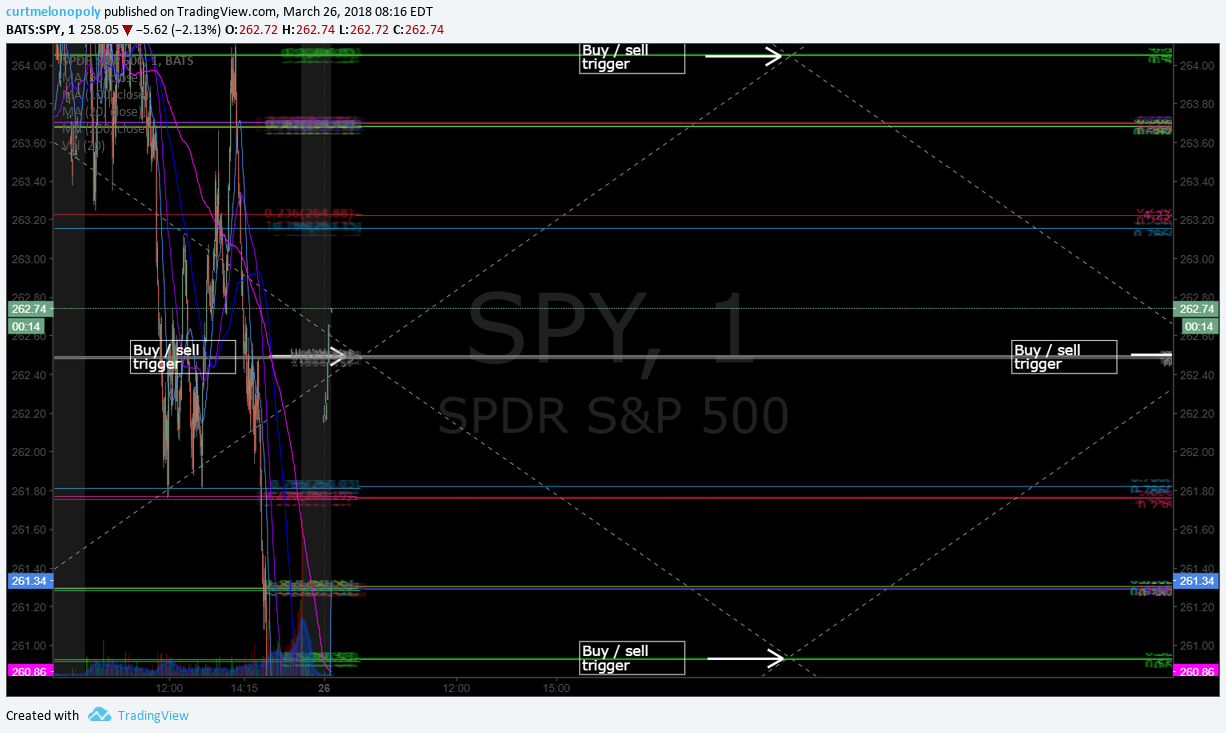

When all those points line up, I check miscellaneous things such as time of day or time of week etc. I also refer to our $SPY algorithmic charting model for proper timing among a number of other details.

Here’s the real-time chart link for the indicators noted: https://www.tradingview.com/chart/TWTR/DCiW9xh2-Twitter-Indicators-I-am-watching/

If you need a hand with your trading plan let me know anytime.

Best of it with your trades!

Curt

———————–

Below is the first post in this series:

Twitter bounced near 200 MA on weekly support. $TWTR

With the recent pressure on related equities I am watching $TWTR $GOOGL $FB and a few others very closely at open on Monday.

Here’s the 4 hour chart post from Friday I alerted (200MA on 4 hour as intra-day resistance) – it did back off near that resistance intra-day.

Here’s a Friday news (Real Money) take on the issues facing Twitter and others: https://realmoney.thestreet.com/articles/03/30/2018/dont-buy-dip-facebook-twitter-and-alphabet?puc=yahoo&cm_ven=YAHOO&yptr=yahoo

I love trading wash-out snap-backs because the returns can be fast and hard if you have the technical set-ups the pros use.

FOR PART II:

For the complete technical analysis / trading plan on this set-up, click here: https://compoundtrading.com/swing-trading-periodical-contact

For those reasons, and of course the chart setup forming my trading plan I will go in to this week extremely bullish unless price action and or media / news tell me to back off.

For more detail on the time cycle peaks for your trade, price targets, and support and resistance points relating to your personal trading plan contact me with any questions you have.

Best and peace!

PS Remember to trade price – if the trade goes against you it is always better to take a small loss than be married to a bad chart / stock.

Monday I will be live broadcasting this trading set-up and other chart set-ups documenting my process in detail for review w/ daily PL’s, video, charting set-ups and alerts.

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Twitter bounce near 200MA on wkly. Trade set-up w/ Chart Notes. by curtmelonopoly on TradingView.com

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmelonopoly/

Facebook: https://www.facebook.com/compoundtrading/

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

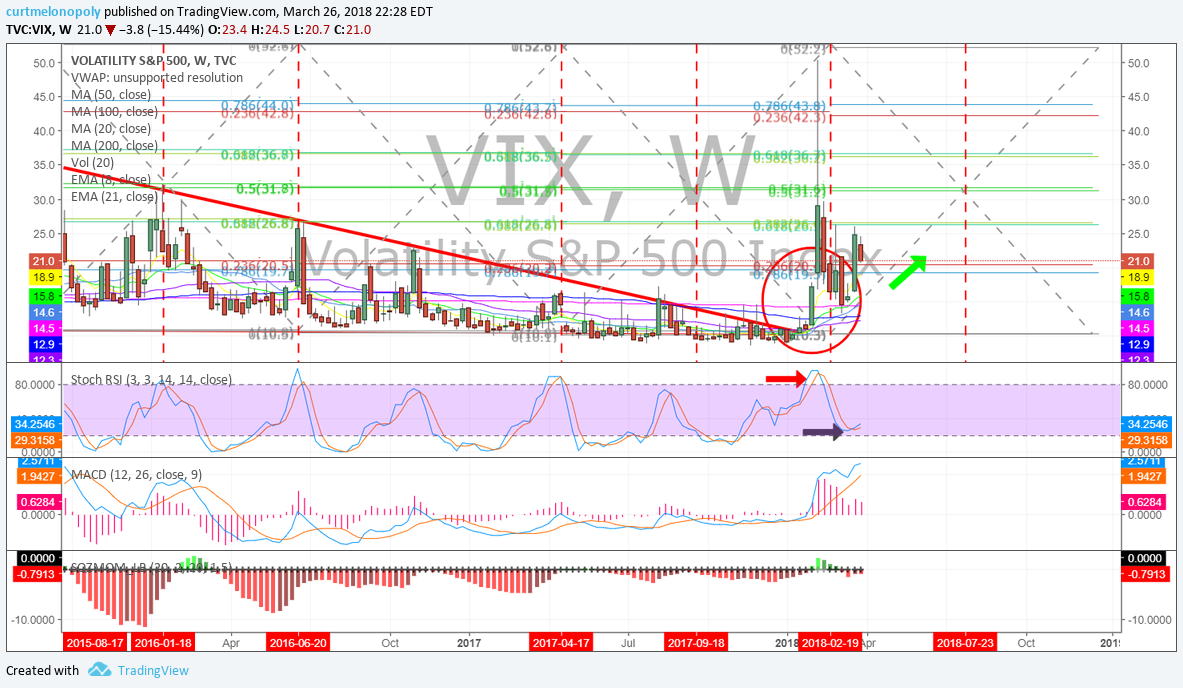

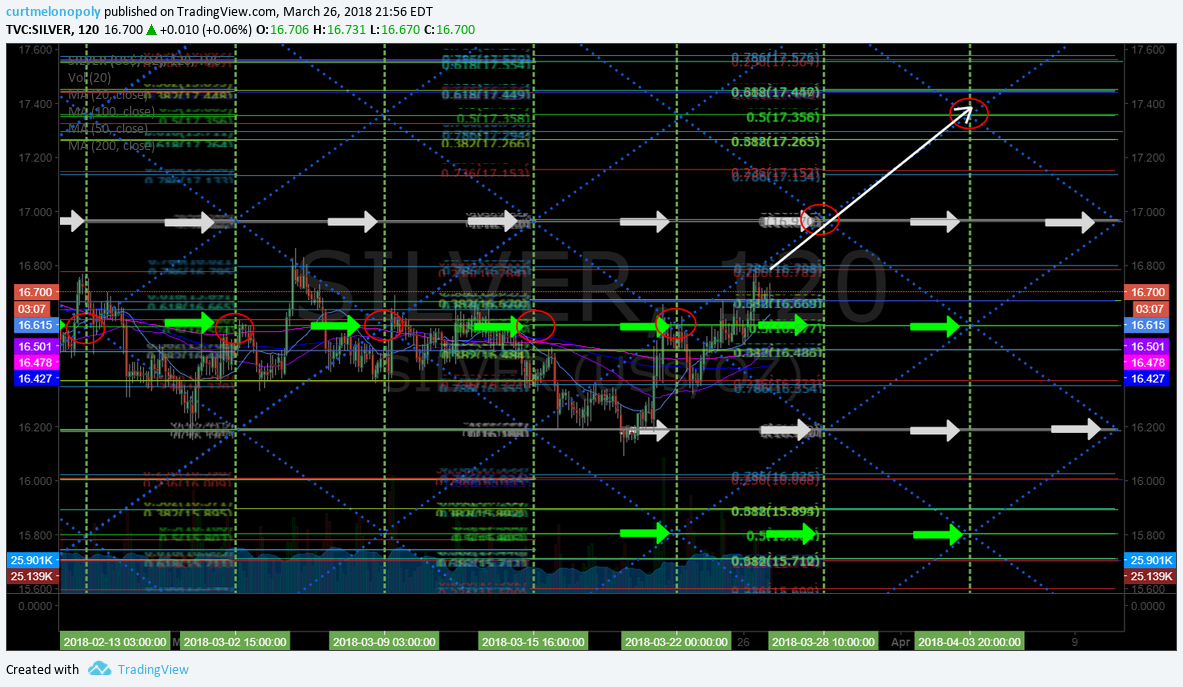

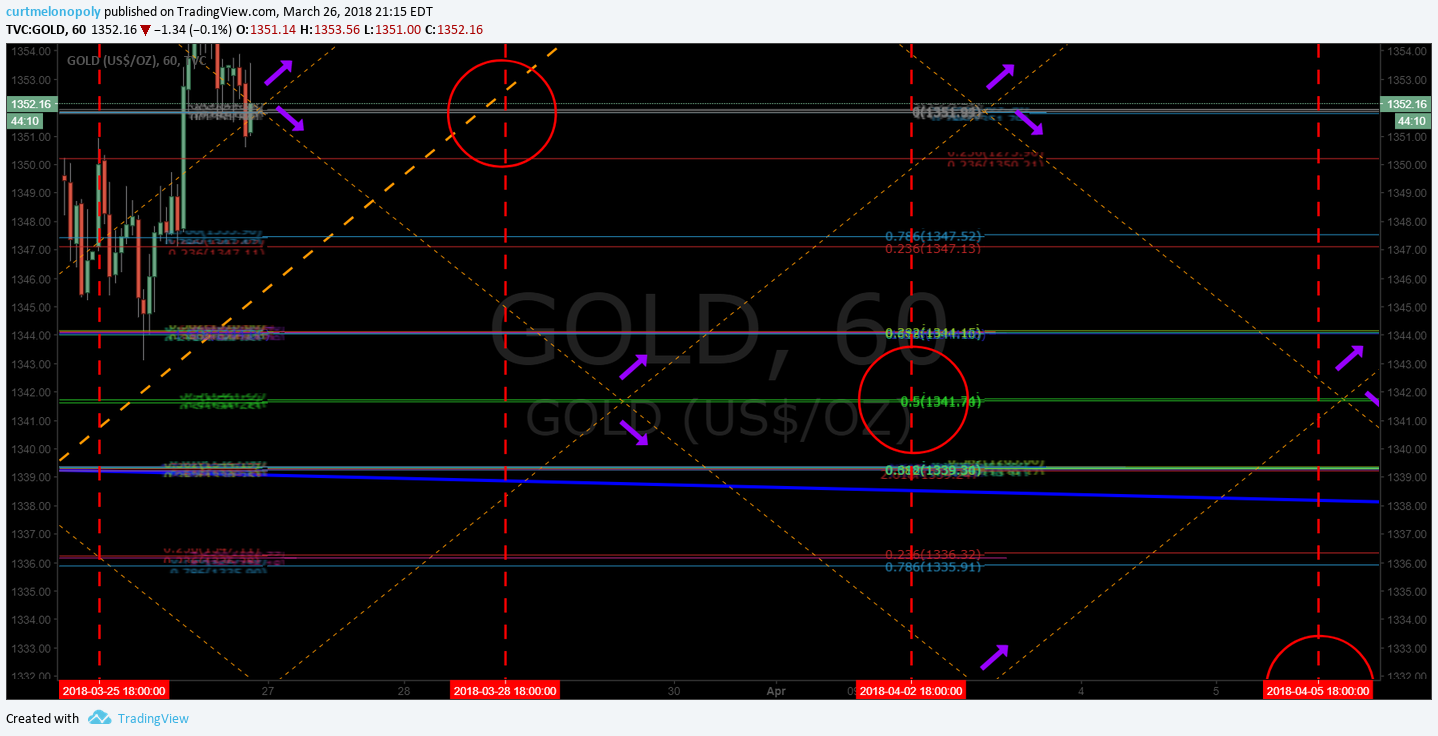

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin -0.37% , $ETH, $LTC, $XRP,) $DXY -0.13% US Dollar -0.13% and Swing Trading Newsletter. Live trading rooms for daytrading and oil 0.82% traders. Private coaching and live alerts.

For the complete technical analysis on this swing trading set-up, click here: https://compoundtrading.com/swing-trading-periodical-contact