Tag: $CBAY

Post-Market Wed Jan 4 $BCEI $EVOK – $WTW $CBAY

Review of my Chat Room Stock Day Trades, Algorithm Charting Calls and Alerts for Wednesday Jan 4, 2107 – $BCEI $EVOK – $WTW $CBAY – $JNUG, $NUGT, $DUST, $JUNO, $CBMX, $SPY, $GLD, $GDX, $USDJPY, $DXY, $USOIL, $WTIC, $SLV, VIX, $NG_F and more.

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/.

Notices:

SMS / Email Alerts: Our system was upgraded yesterday so all members will now start receiving them for each trade.

New Service Option: We now also offer a stand-alone trading room option (vs. bundle w/ trading room, premarket newsletter and alerts) at 59.00.

New Service Option: EPIC the Oil Algo now has an Oil Report only option (vs. bundle w/ 24 hr trading room launching early 2017) at 199.00.

New Service Option: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Feature Post: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are using our algorithms or charting it is a must read.

Overview Perspective & Review of Chat Room, Algo Calls, Trades and Alerts:

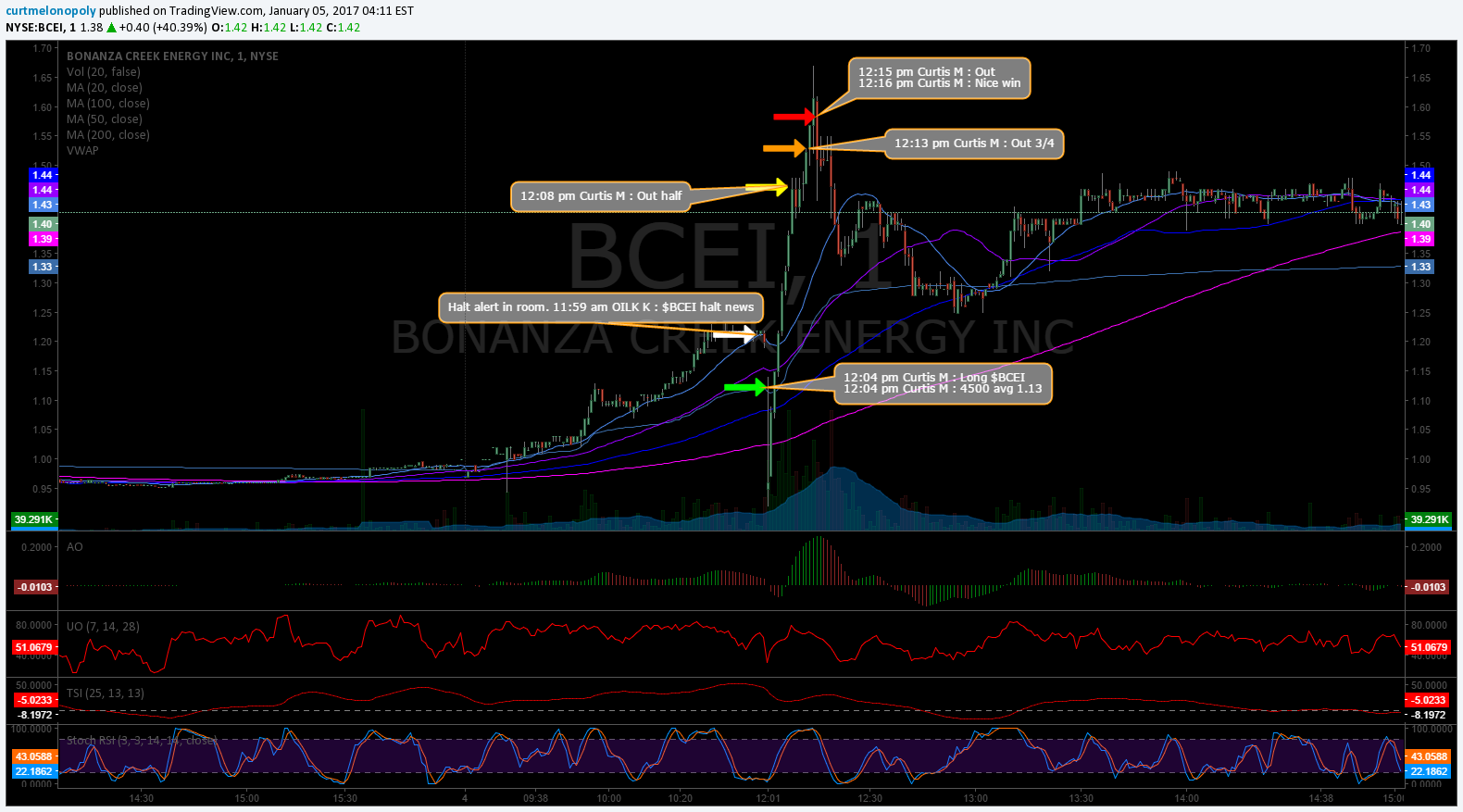

Busy day in the room. Mathew is away until next week for his wedding but we managed. Market looks good so far in 2017. The team banked hard especially on the $BCEI trade. But there were many. The $BCEI trade we were right on top of – the second it went on halt – we nailed the buy near the bottom – scaled out near the top and exited the top almost perfect. The only thing that could have went better was scaling in harder. But a great win along with all the others. I had a small loss trade today to in $EVOK.

Momentum Stocks Today:

Symbol Company Name Price Change % Change Volume 1-Day

OREX Orexigen Therapeutics, Inc. 3.40 -0.05 -1.47% — OREX

EVOK Evoke Pharma, Inc. 2.69 -0.01 -0.37% — EVOK

KODK-WTA Eastman Kodak Company Wt Exp 13 3.64 +0.82 +29.08% 2,332 KODK-WTA

HEBT Hebron Technology Co., Ltd. 5.93 +1.25 +26.79% — HEBT

OIIM O2Micro International Limited 2.38 +0.49 +25.93% — OIIM

MRUS Merus B.V. 25.88 +0.89 +3.44% — MRUS

CBAY Cymabay Therapeutics, Inc. 2.30 0.00 0.00% — CBAY

WTW Weight Watchers International, Inc. 13.40 +2.32 +20.94% 10,676,558 WTW

IMGN ImmunoGen, Inc. 2.49 0.00 0.00% — IMGN

CDNA CareDx, Inc 2.75 +0.45 +19.57% — CDNA

Holding:

$DUST, $CBMX, $JUNO

Looking Forward:

There is a new post from Rosie the Algo here (public edition) :There’s Gold in Them Thar Hills Boy!

Per yesterday (and days prior):

I need to exit $DUST and entered it and held because I was convinced USD/JPY would (at minimum) do a major spike up to end the rally – but not so lucky (yet). $CBMX and $JUNO are holds in to spring if necessary – that was the worst case plan anyway.

We are looking to volatility, bonds, metals and possibly bio at this point short / mid term – but the market will let us know.

The market has a tonne of inflection points now, Silver Gold and Miner’s woke up some today so things should get interesting soon with our algos that you can find here:

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Announcements in Trading Room:

09:15 am Curtis M : Morning! Will watch early momos first at bell then move on to Oil, SPY, Gold, etc. Movers; $CBAY, $BLPH, $EVOK, $OCUL, $PTNR $NVLS $VNR $AKAO $GBT $ECA $SHAK $ASM $DGAZ $REXX $ACHN $GFA $XRX

Stock Chat-room Trading Transcript:

Miscellaneous chatter may be removed.

09:16 am Darnel P : Morning

09:24 am Flash G : $TSLA bidding back up here premarket

09:29 am Tyler H : Like Gold here Curt

09:30 am Curtis M : Watching EVOK at bell

09:31 am Curtis M : Long $EVOK 4.24

09:32 am Curtis M : Correction 3.24 $EVOK 1000

09:33 am Greg L : Long $EVOK 3.32

09:36 am Tyler H : In $REXX

09:37 am Becky b : $BLPH on a nice tear

09:38 am OILQ K : L $CXRX 2000

09:38 am jack d : Out $BLPH scslp

09:39 am Carol B : $CBAY shorting sll pops here

09:40 am Curtis M : $EVOK stop 2.94 was 3.12 but didnt cue

09:41 am Becky b : My $FSNN doing great

09:44 am Curtis M : Stopped $EVOK loss

09:44 am John M : $OREX over 50 MA

09:46 am Carol B : $NVCN on the move $IDGX coming now

09:47 am OILQ K : $OREX VWAP bounce

09:47 am cara r : $IDXG red to green

09:47 am Darnel P : $AKAO rocking

09:48 am Curtis M : I’m setting up for oil at 10:30 fyi

09:48 am Greg L : $IDXG nbanking this morning folks

09:49 am Carol B : $FIT good action

09:50 am Carol B : $GPS short working

09:50 am MarketMaven M : $IDXG 12%

09:51 am MarketMaven M : My $NFLX on the move now

09:57 am Sammy T : In some $DGAZ

09:57 am Sammy T : And some $NUGT

09:58 am Sammy T : And $AVEO for good measure some long

09:58 am John M : $TWTR 16.70 long 2000 shares swing

09:59 am cara r : $BCEI short

10:00 am cara r : Out $PHMD for a win

10:01 am Curtis M : Oil could leave me here lol

10:08 am Sammy T : $LULU momentum

10:09 am Sammy T : $WYNN my friend in again for more swing

10:13 am Sammy T : Yuge $DIS block

10:17 am Flash G : $MRUS 52 Week High

10:20 am Curtis M : dang

10:21 am Carol B : HOD for $TNXP guys

10:28 am Curtis M : watching ol close now

10:32 am Curtis M : Beecause of holdays oil trade is not normal and likely wont be until next week

10:36 am Curtis M : Until it leaves that intra channel I don’t think I’ll look at a trade

10:37 am Curtis M : Going to reset my charts and be back in room in 3 mins

10:46 am Curtis M : $BCEI halt

10:52 am Greg L : $OREX short

10:56 am cara r : %UTI HOD

10:57 am OILQ K : $HST blocks

10:58 am OILQ K : $TRL on move too

11:05 am Michael P : $ACAD spike

11:13 am Becky b : $AMD huge blocks

11:16 am Becky b : Like $VRX here now

11:20 am Curtis M : Taking lunhc back at 12:20 unles alarms go off then back sooner.

11:27 am Flash G : $TLT HOD and $DNAI momo

11:43 am Flash G : 52 Week highs $GFF $VHI

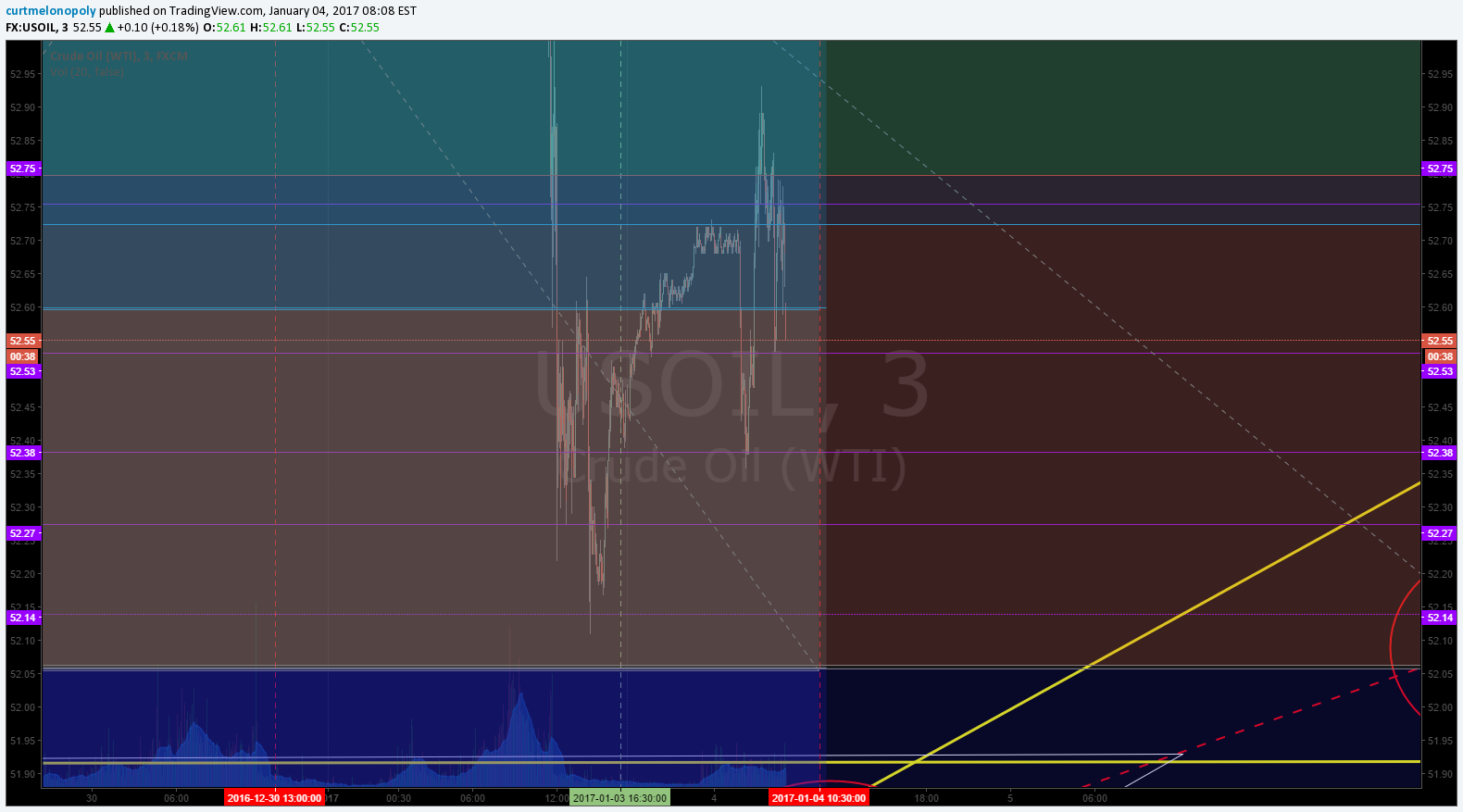

11:46 am Curtis M : Crude on the move wow

11:55 am John M : $TWTR set-up looks good long here

11:59 am OILK K : $BCEI halt news

12:04 pm Curtis M : Long $BCEI

12:04 pm Curtis M : 4500 avg 1.13

12:08 pm Curtis M : Out half

12:13 pm Curtis M : Out 3/4

12:15 pm Curtis M : Out

12:16 pm Curtis M : Nice win

12:16 pm Carol B : Still holding Curt ha

12:17 pm OILQ K : Really? funny me too

12:17 pm OILQ K : But if it fails here oout

12:17 pm Flash G : I’m out $BCEI here not a bg order 2000

12:21 pm Flash G : Nice trade guys

12:21 pm darni m : That worked out really well – in perfect and out perfect

12:22 pm darni m : It may go again

12:22 pm Curtis M : 4500 shares lol should have hammered down hahaha

12:22 pm Curtis M : but 4500 share on that move helps

12:23 pm OILK K : Thanks Curt – paying blls as u state

12:23 pm Curtis M : could go again

12:27 pm Curtis M : Stpid alert didn’t work on that buy – they got the bug out now they say jeez

12:27 pm Curtis M : Technology fark

12:34 pm Curtis M : Techs say they got SMS dialed in lol evil looks helped

12:41 pm darni m : $AXP HOD

12:49 pm Curtis M : NATGAS at support – may not hold but thats support

12:55 pm jack d : $DIS long

12:57 pm Curtis M : I have no excuse for not taking that oil trade

01:03 pm Becky b : $OREX 66%

01:21 pm Curtis M : Blocl $MCIG

01:33 pm Curtis M : $BKLN large block

01:38 pm Curtis M : Momo should start soon – this morning looked decently bullish

01:39 pm Curtis M : Mathew away this week btw

01:53 pm Curtis M : FOMC forgot all about it – 10 mins

02:18 pm Carol B : 52 wk high $BX

02:23 pm Curtis M : BLOCK TRADE: $SPY 502,351 shares @ $225.23 [14:21:52]

02:24 pm Curtis M : $URRE new highs

02:38 pm Curtis M : Thursday EIA NatGas at 9:30 CT EIA Petrol 10:00 CT

03:06 pm Becky b : $CBAK $URRE squeeze plays on deck

03:09 pm OILQ K : $EBIO jiggy

03:25 pm MarketMaven M : Long $TNXP swing

03:28 pm Curtis M : $CARV Volatility Trading Pause. Halt time: 15:27:00.

03:35 pm cara r : $ETRM jig

03:37 pm OILQ K : $EBIO NHOD

03:41 pm Curtis M : BLOCK TRADE: $EEM 1,000,000 shares @ $35.65 [15:40:30]

03:43 pm Curtis M : BLOCK TRADE (Microcap): $GSAT 250,000 shares @ $1.72 [15:42:58]

03:59 pm Curtis M : Good night y’all

Article Topics: $BCEI, $EVOK, $WTW, $CBAY, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $NUGT, $DUST, $JNUG, $JDST, $GC_F, $USO, $UCO, $SCO, $CL_F, $UWT, $DWT, S&P 500

PreMarket Trading Plan Newsletter Wed Jan 4 $CBAY $NVLS $XGTI $CS $VCEL

My Stock Trading Plan for Wednesday Jan 4, 2017 in Trading Chat room. $CBAY $NVLS $XGTI $CS $VCEL $GLD $GDX $NUGT $JNUG $USLV $SLV $UWT, $DWT, $USOIL, $WTI, $GOLD, $USD/JPY, $SPY, $SILVER, $SI_F, $VIX, $UVXY $TVIX $NG_F… more.

Welcome to the morning Wall Street trading day session!

Notices:

Equipment Upgrades: The techs from the local internet company were in our offices yesterday upgrading our systems – good to go now – sorry about the mid day interruption but they insisted there was no way to do it outside of normal business hours – jeez.

Algorithmic charting / service newsletters: The last of them are being finalized over 48 hours and all new 2017 services on our list will be rolling out.

Per previous;

Feature Post: “Why our Stock Algorithms are Different than Most“. If you are using our algorithmic model charting it is a must read.

Review: If you are not reviewing the post market trading results along with this please do so. We assume our trading room subscribers review it everyday. There is often information applicable to and not included in this premarket report. You will find the post market trading result reports on our blog daily.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

New Service Options: EPIC the Oil Algo now has an Oil Report only option vs. bundle w/ 24 hr trading room. Plans from $4.10 per day w/promo code.

New Service Options: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Current Holds:

Per previous;

$CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

Market Outlook:

Per previous;

Early in 2017 I will be watching very closely bonds, $USDJPY, markets in general for direction (of course there are hundreds of variables).

Generally speaking I am looking for some volatility between now and late January. My instinct tells me that even if there is some downdraft in the markets that the Trump train will sweep them up in positive momentum at some point.

Metals, energy and financials are three areas I am looking to for 2017 for trading margin – with bio in fourth place on my list. And per previous we’re expecting some action in bonds to the upside a high probability.

As a trader, it is the margin / volatility I am focused toward and getting on the right side of a market / sector turn and scaling in to that.

Per previous;

All algos (Oil, SPY, Gold, Silver, Dollar, VIX) have hit their targets now (long term since July and short term) so we are running calculation targets for all six algos for all time charting time-frames and expect these reports to start rolling out first week of January 2017.

Morning Momo / News Bits:

Momo Stocks: $CBAY, $NVLS, $XGTI, $CS $VCEL

S&P +0.2%.

10-yr -0.07%.

Euro +0.26% vs. dollar.

Crude +0.48% to $52.58.

Gold +0.33% to $1,165.85.

MarketCurrents: DCP Midstream Partners to merge with Phillips-Spectra joint venture http://seekingalpha.com/news/3233326-dcp-midstream-partners-merge-phillips-spectra-joint-venture?source=feed_f … #premarket $DPM $PSX $SE

Ionis Pharma’s T2D candidate shows positive action in mid-stage study http://seekingalpha.com/news/3233325-ionis-pharmas-t2d-candidate-shows-positive-action-mid-stage-study?source=feed_f … #premarket $IONS

Wall Street set for higher open as investors eye Dow hitting elusive 20,000 mark #BeforeOpeningBell #PreMarket

Amgen prevails over Sanofi and Regeneron in PCSK9 patent case http://seekingalpha.com/news/3233317-amgen-prevails-sanofi-regeneron-pcsk9-patent-case?source=twitter_sa_factset … #premarket $SNY $REGN $AMGN

JPMorgan clients cover their Treasury shorts http://seekingalpha.com/news/3233328-jpmorgan-clients-cover-treasury-shorts?source=twitter_sa_factset … #premarket $TBT $TLT $TMV $TBF

$1,100.00 already. $BTCUSD

MBA Mortgage applications +0.1%, vs -12.1% last week

Purchases -1.4%, after -0.7%

Refis +1.7%, after -23.2%

$APVO Aptevo Therapeutics Resumes IXINITY Manufacturing; Anticipates Re-Entering the Market in the Second Quarter of 2017[+]

$AKAO initiated at Outperform with a price target of $21

Energy Reminder!! – #OOTT API’s today, DoE’s tomorrow alongside NatGas

RedHill Biopharma to present results of the first late-stage study of RHB-105 for H. pylori infe… http://seekingalpha.com/news/3233327-redhill-biopharma-present-results-first-late-stage-study-rhbminus-105-h-pylori-infection?source=feed_f … #premarket $RD…

Encana raises 2017 production growth, margin forecast http://seekingalpha.com/news/3233335-encana-raises-2017-production-growth-margin-forecast?source=feed_f … #premarket $ECA #sitifatimah #malaysia #financialplanning

Hilton spinoffs to start trading http://seekingalpha.com/news/3233333-hilton-spinoffs-start-trading?source=feed_f … #premarket $HLT #sitifatimah #malaysia #financialplanning

If you are new to our trading service you should review recent blog posts and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: Gainers: $CBAY, $NVLS, $XGTI, $CS $VCEL $DEPO $SCON $NAK $ITEK $DB $GBT $GRFS $GFA $JNUG $AUY $RYAAY $XRX $STZ I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: Losers: $IDXG $CASC $NVDA $JDST $STM $RUSL $LPSN $CLVS $MT $TSLA $DWT $CNHI $UNG $DAL $PRGO $FTI I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $CS $MPLX $HTA $CP $HOLX $CNI $GEF $ACM $APO $CBOE $STT $A $EVA $CLNE $NFX $ANF $ON $CDXS $CVX $EOG As time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $NAVI $WCG $ANTM $STM $ZBRA $MHLD $LABL $HIFR $AES $ENSG $AEIS $CLNY $NSAM $EPE $SYRG $TBBK $TEL $MSCC $AMG $BLK $APAM $NVO $AAL As time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Regular Trades:

S & P 500: $SPY $ES_F ($SPXL, $SPXS)

Per previous;

The S&P did exactly what we thought it would last year.

We thought Trump would win and that would cause a rally and that did occur. We also expected some rest before EOY and our algorithm called that to the day and almost penny.

Here forward is more difficult to predict – we are going to assess price action as the year turns over and the Trump era unfolds.

I wouldn’t rule out a sell off and I wouldn’t rule out a rally. I think they are both likely in 2017. We just want to catch the inflection right.

My Trading Plan for $SPY:

Per previous;

Right now I am trading $XIV instead of $SPXL or $SPXS. I do this because we are in a trend of crushed volatility. Now, when that changes and volatility starts to rise again (even if $SPY is rising at the same time) then I’ll flip over to trading $SPXL and $SPXS instead of $XIV.

Volatility: $VIX ($TVIX, $UVXY, $XIV)

Outlook:

Per previous;

As noted above, we expect volatility.

CNN Fear and Greed Index: http://money.cnn.com/data/fear-and-greed/

My Trading Plan for Volatility: I will likely follow that trend with $TVIX $UVXY $XIV buys at range pivots / pending price action, volume and other geo events. SHORT $VIX SPIKES!

Currencies and Other Global Markets: $DXY US Dollar Index ($UUP US Dollar Bull, $UDN British Pound, $USD/JPY, $FXY Japanese Yen Trust, $CNY China, $TZA, $SMK / $EWW Mexico Capped ETF)

Per previous;

We are watching $USD/JPY close of course. We are also watching the Mexico Peso and the Russian markets – both could see significant lift early 2017.

https://twitter.com/CompoundTrading/status/816250593215848448

Per previous:

Watching $USDJPY now close for a top. Symmetry is in play on the chart, there is some divergence (although not broke) and metals are starting to front-run.

Per previous:

BE VERY CAREFUL LISTENING TO THE $USD/JPY bears – they have been feeding misery to followers for many weeks – the chart is not broke – price is currently at support and there could easily be another leg up – nobody knows but the trend is your friend!

My Trading Plan for Currencies / Global Markets:

Per previous;

Waiting, waiting, waiting. $USDJPY CHART IS NOT BROKEN! IT IS A BULL UNTIL IT IS NOT…

Gold: $GLD ($UGLD, $DGLD). Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG)

Per previous;

As you may know, we called the bottom (if it is) almost to the penny (months in advance) and recently Gold and miners did get lift (which we expected / called). Between now and Jan 20 anything is possible.

It would be most logical that miners would rally and Gold may also.

But you need to remember that Trump has surprised everyone since he started campaigning and a significant Trump rally in the markets cannot be ruled out. If that happens, Gold will obviously most likely see new lows to between 800 – 1000.

So be ready, and lets catch the inflection. I was expecting on last run in USDJPY so be cautious.

https://twitter.com/CompoundTrading/status/816251457020182528

Per recent posts:

So we have started to see some action in Gold and Miners so it these are on high watch with me right now.

I am waiting for the trend reversal. We are very close to the price target at the bottom of that quadrant at 1133.00 ish. The initial wide frame target Rosie the algo nailed but there has been a wait and see for a reversal because of one more possible leg down. Getting very close IMO.

I haven’t started to take trades yet because I am waiting for “price – trigger – trade” set-ups. I will start chewing around the edges of stocks like $NUGT and $GLD likely. The idea is to get on the right side of the trade and trend.

WE SHOULD BE ALMOST THERE! GET READY! LIKELY BETWEEN CHRISTMAS AND TRUMP POWER TRANSFER! CHARTS COMING!

Other equities I like for Gold, Miners, Silver Trade: $IAG, $AUY, $AUMN, $ASM, $GRL, $VGZ, $NAK – building more complete list now.

Silver $SI_F: $SLV ($USLV, $DSLV, $SILJ $SLX $EPU $EWZ)

Outlook:

Per previous;

Same with Gold and miners – on high watch.

Same as Gold – we’re waiting for a decision from market so we can get algo targets.

My Plan for Trading Silver:

Per previous;

Same as Gold, I’m waiting for the “price – trigger – trade” set-ups… I am going to start chewing around the edges of stocks when set-up confirms like $USLV and $SLV attempting to get on right side of trend trade.

Other equities I like for Gold, Miners, Silver Trade: $IAG, $AUY, $AUMN, $ASM, $GRL, $VGZ, $NAK – building more complete list now.

Crude Oil FX : $USOIL $WTI ($UWTI, $DWTI, $GUSH, $ERX, $DRIP, $ERY, $USO, $UCO, $SCO, $UWT, $DWT, $CL_F)

Outlook:

Per previous;

At time of writing crude oil has rallied above resistance and is now trading in the next quadrant. Watch for a back test at support.

https://twitter.com/CompoundTrading/status/816249888908267521

Trading Plan:

Price did get to upside of resistance but on a backtest it did not hold. We are watching supports to see if they hold to go long or short.

Other Equities I like for Oil or Energy Trade: Tape / Chart – $ETE, $RIG. High Short Interest – $CRC, $EPE, $WLL, $RES, $JONE, $AREX, $REN, $CLR, $HP, $ATW, $SGY. Fundamentals: $EOG, Pipelines – $XLE: $HEP, $SXE, $KMI, $DPM, $TGS, $ENB, $EEP, $PTRC, $HGT

Natural Gas $NG_F $NATGAS ($UGAZ, $DGAZ):

Chart Per Previous;

Outlook: NA

My Trading Plan for Natural Gas: Watching for confirmation (same as above – new year and Trump phenom make it difficult to future cast).

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $CBAY, $NVLS, $XGTI, $CS, $VCEL, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $CBMX, $JUNO, $GLD, $GDX, $NUGT, $JNUG, $USLV, $DUST, $UWT, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGAS, $DWT, $SLV, $GLD, $DXY