Compound Trading Tuesday April 4, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $INNL, $GNCMA, $BNTC, $USOIL, $WTIC, $GLD, $DXY – $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is trading group involved with day trading, swing trading and algorithmic model chart trading.

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

New lead trader blogpost: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Trade risk management psychology and mechanics is a discipline itself. I am convinced a small study library could be filled on the topic.

— Melonopoly (@curtmelonopoly) April 1, 2017

Big Changes: Even though we post my trades and trading room transcript and video daily (which has been a massive time investment) as of now we are posting intra-day small videos to our Twitter feed and YouTube – every trade as they happen. Each will have details of setup and reasoning for each trade. We will still post complete trading room session to Youtube also.

Even though we post my trades and trading room transcript and video daily (which has been a massive time investment lol) starting Monday…

— Melonopoly (@curtmelonopoly) April 1, 2017

If you missed it, here is the Previous Day Stock Trading Results Monday April 3 (public):

https://twitter.com/CompoundTrading/status/849177189350334464

Premarket Trading Plan – Watchlist (member) for Monday April 3 session can be found here (Tuesday’s was not published and handled live in trading room):

https://twitter.com/CompoundTrading/status/848882029701869568

The Weekly Simple Swing Trade Charting (public) is out. This week however had a lot of indecision in the charts:

Swing Trading Newsletter (member) is Published:

https://twitter.com/CompoundTrading/status/849524916135354368

Review of Markets, Chat Room, Algorithm Charting, Trades and Alerts:

Premarket watch-list for me was all about:

$GNCMA, $GBR, $PRTK, $CYCC $ONTX

$VRX Premarket is up 1% – Could this be the bottom?

— Melonopoly (@curtmelonopoly) April 4, 2017

In play today in chat room and on markets:

Two momentum plays at market open today: $GNCMA and $BNTC. Both worked out for a win.

500 Shares 32.12 $GNCMA and 500 add 32.39 and 33.18 1000 shares add and closed $GNCMA out 33.30 all shares decent win not great but decent. Up 1144.00 and with the small $BNTC win around 1500.00 on the day.

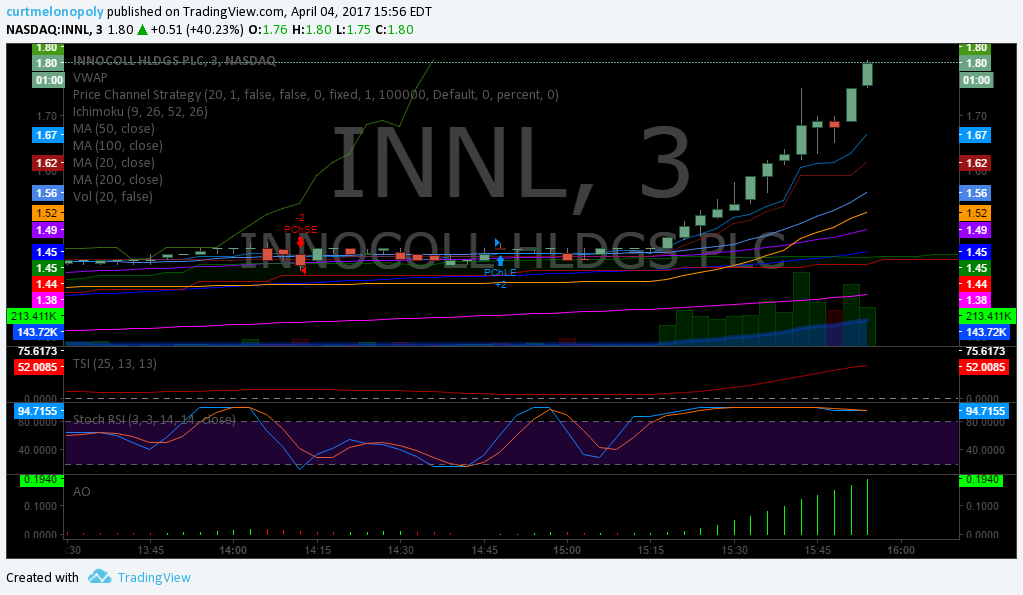

Then late in the day after some research in to chatter, rumors and possible announcements I took a small 1000 share entry long in $INNL at 1.68 and the news hit later that evening.

We also did a $USOIL $WTI, Gold $GLD, and US Dollar $DXY review and recorded it and uploaded to YouTube intra-day you will find below.

Two momentum plays at market open today: $GNCMA and $BNTC. Both worked out for a win.

— Melonopoly (@curtmelonopoly) April 4, 2017

$INNL Had a good day. Holding overnight small position. #swingtrade pic.twitter.com/LUtA4fCHep

— Melonopoly (@curtmelonopoly) April 4, 2017

$INNL Well that swing trade worked out ok! Up 62% after hours – entered before the bell end of day 🔥🎯💥⤴ https://t.co/XnIu3WwcxV

— Melonopoly (@curtmelonopoly) April 5, 2017

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing) – $INNL, $DUST, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so. I am now 95% cash in daytrading account.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| GBSN | 0.01 | 208.70% | 812170592 | Top Gainers | |

| GNCMA | 33.39 | 62.40% | 7801800 | Top Gainers | |

| CALI | 2.85 | 54.89% | 3031741 | Top Gainers | |

| INNL | 1.82 | 42.19% | 6088546 | Top Gainers | |

| BNTC | 4.10 | 34.38% | 19386800 | Top Gainers | |

| CONN | 10.90 | 28.99% | 4749400 | Top Gainers | |

| GNCMA | 33.39 | 62.40% | 7801800 | New High | |

| PRTK | 22.85 | 22.85% | 9115355 | New High | |

| RNN | 0.64 | 15.32% | 18172701 | New High | |

| LVNTA | 50.43 | 13.30% | 7105500 | New High | |

| WHLR | 13.74 | -3.58% | 108460 | Overbought | |

| FIZZ | 85.50 | 1.15% | 248466 | Overbought | |

| QLS | 20.11 | -0.14% | 32700 | Unusual Volume | |

| CRVS | 10.36 | -49.98% | 5599400 | Unusual Volume | |

| CALI | 2.85 | 54.89% | 3031741 | Unusual Volume | |

| TGC | 0.70 | 79.49% | 1183749 | Unusual Volume | |

| ABUS | 3.25 | -1.52% | 350554 | Upgrades | |

| AYI | 173.93 | -14.77% | 5595500 | Earnings Before | |

| OPK | 7.73 | -0.26% | 2535617 | Insider Buying |

The Markets Looking Forward:

$SPY $TLT https://t.co/W9Q6sZDwwy

— Melonopoly (@curtmelonopoly) April 4, 2017

$SPX $SPY Bull https://t.co/ocVCQomqVP

— Melonopoly (@curtmelonopoly) April 4, 2017

$SPY. To rip or not to rip. Conventional charting says it's ready 👌. Great post.⤵ Our models see challenges but doesn't mean it won't rip. https://t.co/O0QWqqn6nH

— Melonopoly (@curtmelonopoly) April 4, 2017

Our issue with a market rip is primarily the once in a decade resistance cluster not far over head for oil, and it’s slowly downtrending.

Our issue with a market rip is primarily the once in a decade resistance cluster not far over head for oil, and it's slowly downtrending.

— Melonopoly (@curtmelonopoly) April 4, 2017

Algorithmic Chart Model Trading / News:

Sorry about the video mic quality in below, but we did fix the mic settings for Wednesday session FYI.

US Dollar $DXY Video Review

Gold $GLD Video Review:

Systematic Algorithmic Modeling 40% ⤴ https://t.co/KYkvBrxUFU

— Melonopoly (@curtmelonopoly) April 4, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

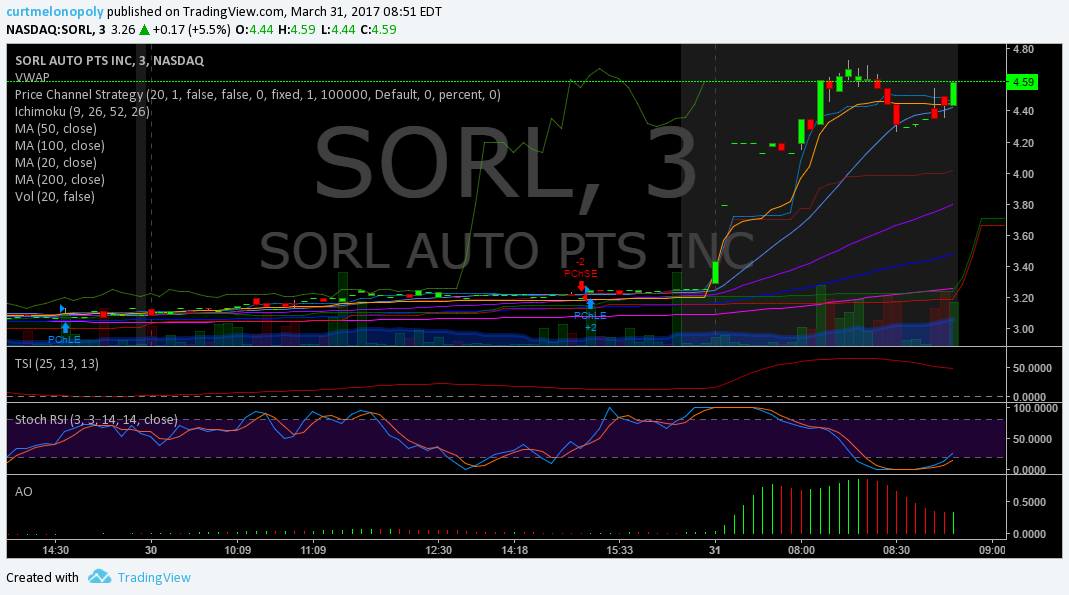

Simple swing charting that keeps me level when looking at the markets (examples below). Simple charting I find grounds you to simple trades which in turn keeps you profitable in toppy or sideways markets.

https://twitter.com/CompoundTrading/status/848756853169283073

$BABA Swing Trade going well. Our Swing Trading side is in at 104.64 trading at 108.17. #swingtrading pic.twitter.com/x2zOezrBQ3

— Melonopoly (@curtmelonopoly) April 4, 2017

$NFLX March 29 we entered swing trade 145.50 when MACD turned, trading 146.82, stop at flat and re-enter if we have to. #swingtrading pic.twitter.com/DI8fiL6nsv

— Melonopoly (@curtmelonopoly) April 4, 2017

$AXP American Express. So close. SQZMOM about to turn, MACD cross on deck just need PTPTRR to line up. Need volume & power. #swingtrading pic.twitter.com/V4dGTTw0T9

— Melonopoly (@curtmelonopoly) April 4, 2017

$ABX Setting up nicely. Above 200 MA, wait for Stoch RSI to turn, SQZMOM green MACD turns up and kapow! Some volume & power would help too. pic.twitter.com/Umdcrc6ffV

— Melonopoly (@curtmelonopoly) April 4, 2017

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

{40 year} Gold Seasonality Chart. #Gold $GLD $SLV $GDX $GDXJ $NUGT $DUST #Silver https://t.co/bJnAoWCHPS

— Melonopoly (@curtmelonopoly) April 2, 2017

#Gold managed money. $GC_F $GLD https://t.co/V6k09rpTww

— Melonopoly (@curtmelonopoly) April 2, 2017

Silver $SLV:

Silver Gold Platinum Palladium money pos. https://t.co/JGMkj0oLb8

— Melonopoly (@curtmelonopoly) April 2, 2017

Crude Oil $USOIL $WTI:

EPIC the Oil Algo Killing it as usual: Price on its way to Tues 430 target. Crude algo intra work sheet 239 PM Apr 4` FX $USOIL $WTIC #OIL $CL_F $USO $UCO $SCO $UWT $DWT #OOTT

Tanker Traffic Points At Much Tighter #Oil Markets | https://t.co/8uM3eZkvEt https://t.co/wIwcqnBfFi #oilprice #OOTT $USOIL $WTI $CL_F

— Melonopoly (@curtmelonopoly) April 5, 2017

https://twitter.com/EPICtheAlgo/status/847857046430953472

$WTI $CL_F $USOIL net long short https://t.co/hpRZPGo4fM

— Melonopoly (@curtmelonopoly) April 2, 2017

Volatility $VIX:

$VIX delay… https://t.co/2aT85XuyXo

— Melonopoly (@curtmelonopoly) April 1, 2017

$SPY S&P 500:

$SPX P/E Ratio above 10 year average. https://t.co/3BzGNUugvs

— Melonopoly (@curtmelonopoly) April 3, 2017

$NG_F Natural Gas:

NA

Live Trading Chat Room Transcript: (on YouTube Live):

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix.

Going to review swing trading set ups and some algorithmic charting in room between 12:00 – 1:00 EST today.

— Melonopoly (@curtmelonopoly) April 4, 2017

Sartaj: Open house today?

Curtis M: Mornin

Curtis M: No 🙂

Curtis M: Going to be a busy trading day 🙂

Curtis M: That video is uploaded to YouTube from yesterday FYI re: $XIV trade

Sartaj: Saw it, thanks. I’ll get to it tonight

Curtis M: kk

Dave: Good morning

Sartaj: Good morning

Sartaj: Welcome

HedgehogTrader: Hi all

Sartaj: Hey Hedgehog

Caide: hello

Curtis M: Premarket is tight so I won’t be on mic for a preamble. I’ll wait until open and see how it looks here. Running scans.

Curtis M: In between action today I am going to review swing trades and some of our algorithm work – an FYI for Sartaj 🙂

Curtis M: $GNCMA, $GBR, $PRTK, $CYCC $ONTX

Curtis M: On mic>>>>>>>>>>>

Curtis M: 500 Shares 32.12 $GNCMA

Curtis M: Stop set at 30.45

Curtis M: Below 8 EMA

Sammy T: $BNTC is running I am in

Curtis M: Long 500 add 32.39

Curtis M: Stop at 32.38 $GNCMA

Curtis M: Long 33.18 1000 shares add

Curtis M: Holding with a stop at 32.38 2000 shares

HedgehogTrader: $EXK smokin again (silver miner)

MarketMaven: In $XXII

Sammy T: Nice Hedge

Flash G: Opened position in $MACK

Flash G: Swing Trade

Flash G: Also a long $AIC here but likely short time frame

Flash G: Market looks like it will turn for a run in next 24 hours or so.

lenny: $BNTC might go parabolic Curt

HedgehogTrader: $MUX looking like it will go (silver and gold miner)

HedgehogTrader: 16% short interest

Curtis M: $ADPT halt

HedgehogTrader: Curtis, take a look at $MUX

Curtis M: ok

lenny: $ADPT tanked

lenny: $BNTC great momo wow

HedgehogTrader: MUX interesting also due to high short interest

HedgehogTrader: 16%

HedgehogTrader: and silver looks really good too

Curtis M: Bulls are in Silver for sure

Curtis M: $MUX looks great IMO

HedgehogTrader: can you pull up a silver chart?

HedgehogTrader: looks dynamite

Curtis M: yup

HedgehogTrader: 🙂

Flash G: market ticks are soft soft soft

Curtis M: Stop on $GNCMA set 32.46 moved up

HedgehogTrader: above 1850s on silver we should see run to 19s

HedgehogTrader: and miners offer the best leverage

Curtis M: Closed $GNCMA out 33.30 all shares decent win not great but decent

Sartaj: Can you go to the volume mixer? Right click on the volume button

Curtis M: $CYCC halt restart 10:29

Curtis M: $CYCC halt restart 10:29

Flash G: $KATE long very small test

HedgehogTrader: $UGAZ +9% and back above 50dma

MarketMaven: $SOL low float might get rippy

HedgehogTrader: something to file away if you are in $UGAZ but my signals suggest the ETF should rally on Friday

Curtis M: 9.56 long 1000 shares $CYCC

Curtis M: on mic>>>>>>>>>>>>>>

Curtis M: Out Flat

MarketMaven: $LIGA one of my fav OTC plays here

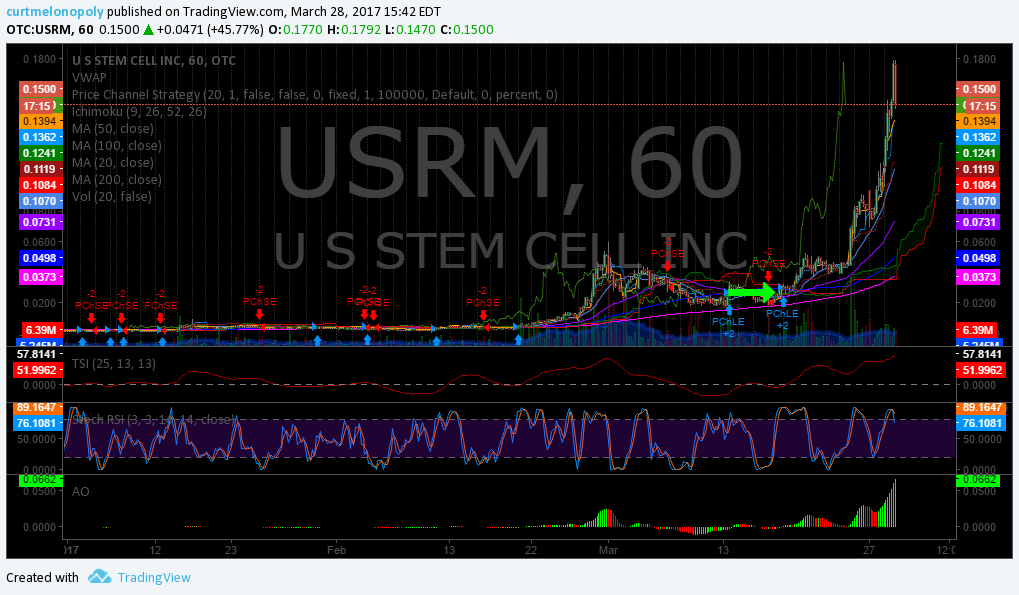

MarketMaven: $LIGA $USRM $MMEX in OTC

Sartaj: Welcome back, Dave

Curtis M: $CYCC I wouldn’t sit in too long FWIW

Curtis M: Going to review swing trade set ups and algo charting between 12:00 and 1:00

lenny: $CYCC bank on top of bank now

Carol B: ha ha

Flash G: $CYCC incredible if you want my opinion

Flash G: I suppose it is lung cancer.

Flash G: $TSLA just keeps paying us Curt

lenny: Adding to $CYCC soon on break

lenny: Adding now $CYCC

Curtis M: Oil nearing resistance – possible short position oil related in $DWT $DWTIF on deck or long over resistance

Curtis M: $SWN over 8.40 held gets interesting

Sartaj: Target about to hit. Epic!

HedgehogTrader: nice!

Sartaj: Random walks aren’t truly “random”… computer scientists’ perspective. 🙂

Sartaj: My old data science prof would probably kill me, though.

Curtis M: I am delayed a few mins Sartaj FYI

Sartaj: No problem, I’ll be here

Sartaj: Welcome back again, Dave. EPIC is close to hitting a price-time target

Sartaj: We were just discussing random walks

Curtis M: Ok got myself settled – sorry – had unexpected conference call – will do swing trading review in 5 mins on mic

Sartaj: Ready

Sartaj: Welcome back, Leanne

Curtis M: What a busy day lol.

Sartaj: Hey, Mat

Curtis M: Ok. Reviewing EPIC the Algo first in 1 min on mic >>>>>>>> Sartaj – please publish video as non public for EPIC and send a link to members and advise on Twitter there is a video update in their email inbox when done thanks.

Sartaj: Done deal.

HedgehogTrader: UGAZ running

Leanne: Thanks Sartaj, just got back from taking kids to school ready to roll now!

Curtis M: I’ll do Gold next in a few mins

Curtis M: You can publish all the rest as public Sartaj

Sartaj: Sounds good

Sartaj: EPIC update will be uploaded in 15 minutes, and then pushed out to our member mailing list

Curtis M: Office hopping with member questions…. on to Gold now…. on mic>>>>>>>>>

Curtis M: we’re going to try and fix the echo first jeez loll

Curtis M: back in a min

Curtis M: haha pretty office heh?

Sartaj: Try that

Curtis M: official on office lol ok in 1 min

Curtis M: On mic re: Gold chart >>>>>>>>

Sartaj: Recording

Curtis M: off mic >>>>>>>>>

Eric: thanks curt, fantastic details

Curtis M: Will do the USD in 5 mins and then take a look at market before doing any swing reviews.>>>>>>>>

Curtis M: no prob 🙂

HedgehogTrader: great commentary on gold Curtis

Curtis M: why thanks 🙂

HedgehogTrader: you can also see $DBC the commodity ETF looking strong, bodes well for hard assets

HedgehogTrader: like oil, gold, etc – $DBC is now back above 200 dma

Curtis M: Nice

Curtis M: Sartaj on mic in 1 min $DXY US Dollar Index >>>>>>>

Curtis M: This can be shared publicly.

HedgehogTrader: and do small stocks give us a heads up? $CDNX is now above 50 dma

Curtis M: I’d like to watch the conventional chartist work on this chart lololol

Sartaj: Ready for broadcast

Curtis M: Echo bad on hold sorry

Leanne: hello

Leanne: very quiet on my end

Sartaj: Now you know why it’s called a “live room”

Leanne: I can hear you now!!!

Leanne: woo hoo

Curtis M: ok thats it for the dollar

Curtis M: Looking at the market to see if there’s a trade then I’ll do swing reviews when and if things slow

Curtis M: Hey Sartaj – why don’t we do a video on Leaderboard stocks and what I’m looking for

Curtis M: What I’m looking for when scanning afternoon leaderboard stock set ups etc…

Sartaj: Sure, we can do that

Curtis M: ok

Curtis M: 1 min on mic >>>>>>>>>>> Scanning Stock Set Ups (leaderboard) for afternoon play.

Sartaj: ready

Curtis M: On mic>>>>>>>>>>>>

HedgehogTrader: odd- i can’t hear a peep

Leanne: i can’t either

Curtis M: Ok working

Leanne: i’ve just been watching and thinking about what you’re saying!

Curtis M: lol

Curtis M: We’re going to delay voice broadcast until tomorrow. Just run chat rest of day and video charts. We’ll fix it tonight.

Curtis M: So looking for volatility play based on $SPY and $VIX – scanning there first then equities for an afternoon play.

Curtis M: Target for $SPY EOD is 235.60 ish

Curtis M: So now take a look at how $VIX is doing to see if I can exploit eone of $XIV $TVIX $UVXY $SPXL $SPXS etc…

Curtis M: $CONN on watch for break of high of day

Curtis M: Watching for volume velocity – power in buying and HOD break

Curtis M: Here we go…. should pop soon

Curtis M: $CONN

Curtis M: lol EPIC

Sartaj: It’s happening

Sartaj: Also, welcome to our newcomers. A pleasure to have you all here

Curtis M: i find it funny now

Sartaj: If you’re just joining us, how did you find out about this room?

tran: internet

Shiela Schmidt: Twitter

Curtis M: Leader Board $GNCMA 64% $CALI 57% $BNTC 44% $CYCC 40% $CONN $PRTK $CETC $AFSI $BGR

Sammy T: Slow afternoon

HedgehogTrader: a small miner to watch $AAU

Flash G: Yes. Did update all my swings and will wait for Curts report tonight. But I think we have setup.

HedgehogTrader: AAU out with a positive prefeasibility study

Sammy T: thanks hedge checking it out

HedgehogTrader: it has a 100M mkt cap and is a nice trader when metals perk up

HedgehogTrader: miners look very positive overall- gold miners are outperforming gold which is what we want to see

Curtis M: It’s looking more and more like the break will be to upside long term – soooo close now

HedgehogTrader: wee nanocap pot stock i like that is running now $UBQU

HedgehogTrader: volume massing last few days

Curtis M: Man, Nich knows how to call em’ pow $EXK

Curtis M: Ya I like $UBQU nice play imo

Sammy T: I’m in it

HedgehogTrader: thanks! 🙂 yup $EXK is beating everything in its sector

Sammy T: Len is too I think

MarketMaven: Great call once again Nich!!

HedgehogTrader: thanks! it’s nice when they do that 🙂 i did have some good conviction due to fundamentals and insider buys from CEO

Curtis M: Good research.

Curtis M: I’m going to try a small flyer here on $INNL for a swing over night .5% position lol 1000 shares 1.67

Curtis M: Sorry 1.68 correction

Curtis M: Long $INNL 1000 share 1.68 for o/n swing

HedgehogTrader: watching for copper to start joining the other rallying commodities

HedgehogTrader: once we see that, eyes will also be on shippers who need to move those heavy materials

Curtis M: Shippers will be a ripper if things set up and go soon here

Curtis M: $EXK squueeeeze

Curtis M: $INNL took a flyer on it because of late day momo and insider buying lately.

lenny: Profitable day. I’m cutting out to get some air. See u guys in morning. Get your mic fixed haha!

Sammy T: Bye Lenny

Curtis M: TY

Leanne: With you on INNL at 1.66

Curtis M: GL on that:)

Curtis M: GL me lol

Leanne: I have not had a winner in a while, thanks Curtis!

Curtis M: Lets hope we get a winner 🙂

Leanne: I have faith

Curtis M: Well have a great night all! I have a ton of work to do to catch so I’m outta here! Best team ever:) Peace.

HedgehogTrader: thanks Curtis, take care

Leanne: you too, take care Curtis

Leanne: hug your loved ones!

Be safe out there!

If this post was of benefit to you, be kind and share it on social media for us please!

Have a great night y'all! Big night in the lab catching up, gotta get at it. Ty! Our daily trade results https://t.co/nGEATPKgUb …. #trading

— Melonopoly (@curtmelonopoly) April 4, 2017

Follow our lead trader on Twitter:

Article Topics: $INNL, $GNCMA, $BNTC, $USOIL, $WTIC, $GLD, $DXY – $XOM, $NE, $ONTX, $DUST, $TRCH, $LGCY, $SSH, $ASM – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500