Tag: Dollar

PreMarket Trading Plan Mon July 16: Market Bull, Earnings, Trump Putin, $CODA, $GENE, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , Dollar $DXY more.

Compound Trading Premarket Trading Plan & Watch List Monday July 16, 2018.

In this edition: $CODA, $GENE, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , Dollar, $DXY and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Lead trader (and/or other team members) will be active in live trading room today as follows (and only as available);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to liver trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it)

- For membership access, options here: https://compoundtrading.com/overview-features/

- Any questions send me an email info@compoundtrading.com

- Daytrading room now re-open to daytrading room members as lead trader alerts via email. If you are not receiving notices please email us at info@compoundtrading.com.

- July 28 – 29, Santo Domingo – #IA Intelligent Assisted Platform (private, internship & staff training / development).

- Aug 25 – 26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14 – 16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

https://twitter.com/CompoundTrading/status/1012166019765370881

May 29 Memo: Important Changes at Compound Trading – Pricing, Trader Services, Trader Procedure, Invoicing.#IA #AI #Algorithms #Coding

Machine Trading Coding Team Mandate: (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning. Official announcement to follow.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Chart / Trade Set-Ups:

See You Tube for other recent video posts. Listed from most recent.

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades. #swingtrading #freedomtraders

Password: IC Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

Password: TRADEAAPL Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Password: SWINGDXY, Protected: Trading US Dollar Index (Part 2 – Member Exclusive) $DXY $UUP #USD #SwingTrading #Daytrading

Password: swing Protected: Trade Set-Ups w/ Video #EIA, Oil, $TSLA, $NFLX, $ESPR, $PG, $AAPL, $SPY, $CARA, $EGY, $GERN, $BPT more. #swingtrading

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm https://compoundtrading.com/feature-post-with-charting-how-to-trade-the-us-dollar-index-move-part-1-dxy-uup-usd-trading-chart-algorithm/

Password: SET Protected: Swing Trade Set-Ups (May 15/16 Member Edition) $WTI, #OIL, $BTC, Bitcoin, $AMBA, $AMD, $BLNK, $ITCI,, $SPY, $DIS, $LAC, $BOX, $AAOI more.

Password: AI Protected: How to Trade Pure Storage Earnings in Six Days (Member Edition) $PSTG

Password: WOW Protected: How to Trade Box Earnings Move (Swing Trade Member Exclusive)

Trading Set-ups $FB, $AMBA, $SDTY, $TSLA, $GDX, $SLV, $BTC, $JD, $VIX, $LITE, $CELG, $FSLR more.

Do Not Ignore This Trade Set-Up | $AMBA Swing Trade | 40% ROE 3 Mos (Part 1 of 2)

Password: ELON Protected: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles $TSLA #swingtrading #daytrading

Password: LONG Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stock-market bull is still on its feet, snorting its way past 1 obstacle after another

https://twitter.com/CompoundTrading/status/1018517770949054464

Market Observation:

Markets as of 9:02 AM: US Dollar $DXY trading 94.52, Oil FX $USOIL ($WTI) trading 69.33, Gold $GLD trading 1242.64, Silver $SLV trading 15.78, $SPY 279.51, Bitcoin $BTC.X $BTCUSD $XBTUSD 6600.50 and $VIX trading 12.6.

Your Monday Morning Speed Read:

– U.S. retail sales for June due @ 8:30am ET $SPY

– Report: Goldman Sachs to name David Solomon as CEO Lloyd Blankfein’s successor this week $GS

– Suffering from #Regrexit? Too bad. UK says there will NOT be another #Brexit referendum $EWU

Your Monday Morning Speed Read:

– U.S. retail sales for June due @ 8:30am ET $SPY

– Report: Goldman Sachs to name David Solomon as CEO Lloyd Blankfein's successor this week $GS

– Suffering from #Regrexit? Too bad. UK says there will NOT be another #Brexit referendum $EWU— Benzinga (@Benzinga) July 16, 2018

Momentum Stocks to Watch: $CODA, $GENE, OIL

Coda Octopus’s stock more than doubles after Navy R&D pact

News:

Iran asks OPEC to keep oil output caps; Trump wants more supply

https://twitter.com/EPICtheAlgo/status/1018831048627671040

$NTRP Announces the Initiation of Enrollment in Phase 2 Trial in Alzheimer’s Disease

Recent SEC Filings:

Insider Buys Of The Week: Energen, Esperion Therapeutics And International Flavors https://benzinga.com/z/12020928 $EGN $ESPR $IFF

Recent IPO’s:

Earnings:

J.B. Hunt’s stock rallies after earnings, revenue beat expectations

#earnings for the week

$NFLX $BAC $MSFT $GE $BLK $GS $UNH $IBM $JNJ $CLF $JBHT $PGR $ABT $MS $ISRG $AXP $SKX $AA $CSX $URI $PM $CDMO $CMA $DPZ $GWW $NUE $BX $HON $EBAY $ASML $FHN $TSM $SLB $NEOG $MLNX $UAL $PLD $TXT $IBKR $ETFC $CTAS $FDEF $KEY $DHR

http://eps.sh/cal

#earnings for the week$NFLX $BAC $MSFT $GE $BLK $GS $UNH $IBM $JNJ $CLF $JBHT $PGR $ABT $MS $ISRG $AXP $SKX $AA $CSX $URI $PM $CDMO $CMA $DPZ $GWW $NUE $BX $HON $EBAY $ASML $FHN $TSM $SLB $NEOG $MLNX $UAL $PLD $TXT $IBKR $ETFC $CTAS $FDEF $KEY $DHR https://t.co/r57QUKKDXL https://t.co/Gj3ALfmyvN

— Melonopoly (@curtmelonopoly) July 16, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date on the top of each chart (they are often carried forward).

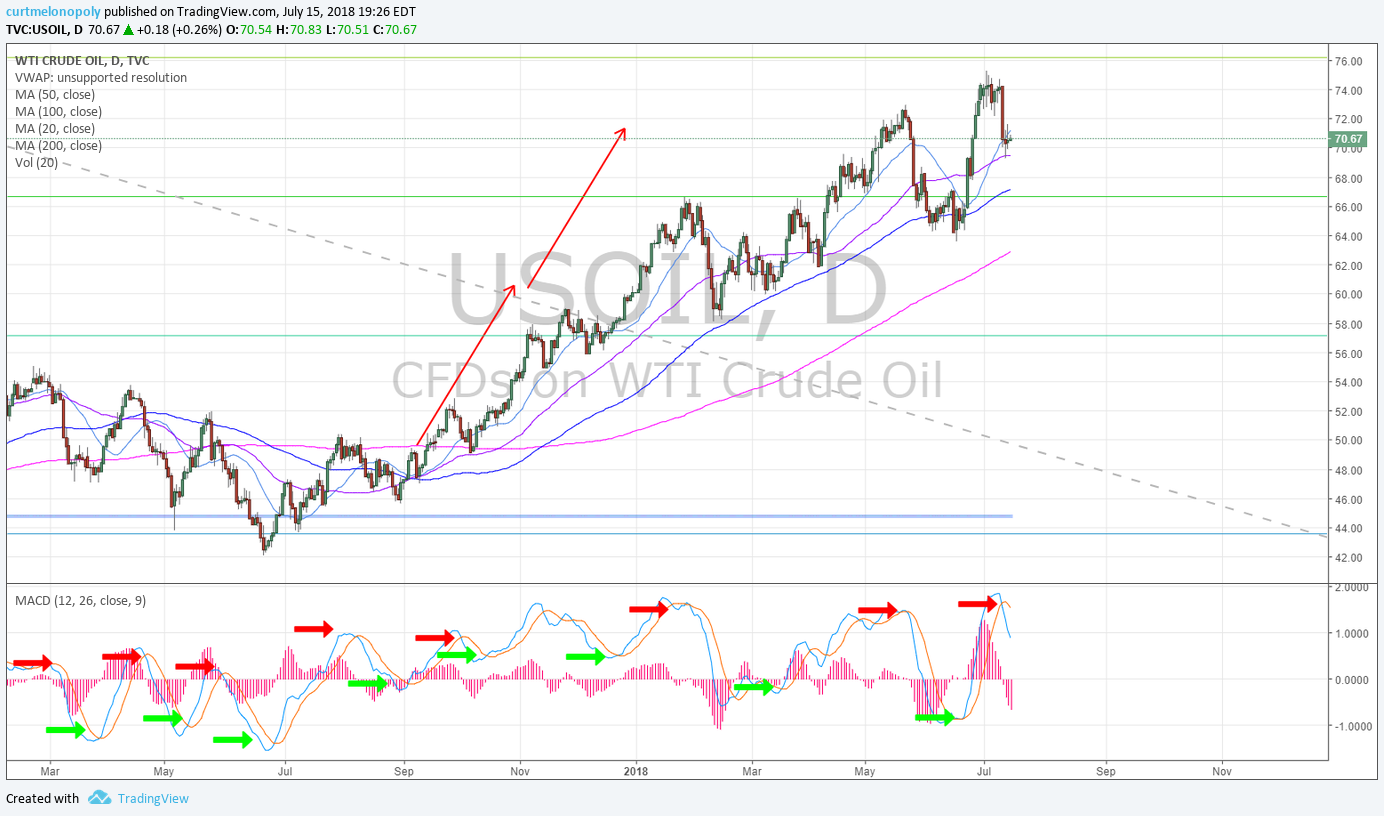

MACD has turned down on the Daily Oil Chart. Bearish indicator to consider. Needs to stay above 20 MA. #OIL $USOIL $WTI

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

ALLERGAN (AGN). Excellent swing trade in progress trading 177s targets 180.21 184.21 189.03 etc. $AGN #chart

TRANSOCEAN (RIG) Trading 13.74 with upside targets 15.63 19.54 with earnings in 27 days. $RIG #swingtrading #chart

NETFLIX (NFLX) Triggering long in premarket over 400.00 targets 412.00 then 422.00 a key range pivot resistance. $NFLX #swingtrading

AMERICAN EXPRESS (AXP) With the 50 MA coming to meet price, will price retrace like it did previous or break out. $AXP

VALEANT (VRX) Time cycle concludes July 9, time to have next trajectory on watch and trade it. $VRX #swingtrading #daytrading

SPECTRUM PHARMA (SPPI) Had a great day up 15.5% trading 21.90. Entries at the arrows. Long play. $SPPI #SwingTrading

DISNEY (DIS) Held mid quad support in sell off, bounce here targets 110.66 Sept 5. On high watch. $DIS #swingtrading

KARI THERAPEUTICS (AKTX) Under 200 MA but significant volume last few days. On high watch. $AKTX #stock #chart

CITIGROUP INC (C) Keeps working that support line. No bias here. Watching. $C #stock #chart

EAGLE BUILDING MATERIALS (EXP) Trading 111.05 trending toward 117.75 Nov 2, 2018 price target. $EXP #swingtrading

ALPHABET (GOOGL) Swing trade setup has been going well. 1213.50 July 3 price target in play. $GOOGL #swingtrading

LIVEPERSON (LPSN) Our $LPSN swing continues 24 intra – over 23.80 targets 24.60, 25.05, 25.90 main resistance. #swingtrading

PACIRA (PCRX) swing trade continues trading 39.40 – over 39.65 tragets 40.50 then 41.80 main resistance. $PCRX #swingtrading

FACEBOOK (FB) swing trade on schedule and target trading 201.15 – over 201.80 bullish targets 202.41 206.58 main 209.97 June 21 or July 6 $FB #swingtrading

150s to 201s Boom $FB We’re in from the 150 s on that great wash-out snap back swing trade set-up trading 201.74 #swingtrading #snapbacktrade #learntotradefear

Market Outlook, Market News and Social Bits From Around the Internet:

#5things

– Trump, Putin meeting

– Big news for big banks

– China headwinds

– Markets mixed

– Coming up…

https://bloom.bg/2L2GNy0

#5things

– Trump, Putin meeting

– Big news for big banks

– China headwinds

– Markets mixed

– Coming up…https://t.co/M4yYsmdSrB https://t.co/CLoNz8t9e7— Melonopoly (@curtmelonopoly) July 16, 2018

Economic Data Scheduled For Monday:

- Data on retail sales for June will be released at 8:30 a.m. ET.

- The Empire State manufacturing index for July is schedule for release at 8:30 a.m. ET.

- Data on business inventories for May will be released at 10:00 a.m. ET.

- The Treasury is set to auction 3-and 6-month bills at 11:30 a.m. ET.

$XLE Energy ETFs May Strike it Big This Earnings Season https://finance.yahoo.com/news/energy-etfs-may-strike-big-190937451.html?soc_src=social-sh&soc_trk=tw … via @YahooFinance

https://twitter.com/EPICtheAlgo/status/1016619175933108224

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $CODA $GENE $MDGS $TNXP $SPCB $ARNC $TANH $ONCS $CLLS $DB $DARE $DWT $DRYS $PEGI

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

AMD’s stock rallies after Stifel analyst boosts price target

Shares of Infosys surged to a record high after analysts shifted their focus on the company’s deals from earnings.

https://goo.gl/vxZqSG

(6) Recent Downgrades:

Buckingham downgrading $NFLX Netflix to Underpeform

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, $CODA, $GENE, OIL, $WTI, GOLD, $GLD, Crypto, $BTC , Dollar, $DXY

US Dollar Index (DXY) Algorithm Report Thurs July 12. $DXY $UUP #USD #Algorithm

DXY US Dollar Algorithm Model Charting Report Thursday July 12, 2018 $DXY $UUP

Welcome to my report for Compound Trading – $DXY the US Dollar algorithm charting model.

I am an early development model – one of seven in development at Compound Trading Group. This work is very early stage generation 1 work. Generation 2 – 5 is scheduled for 2018 and will eventually be coded to a digital dashboard for our traders to use as an intelligent assistant.

This charting is to be used in conjunction with conventional charting as trader assisted signals. The signals in the model (at this point) are simple that each line on the model chart are considered a support and resistance test.

Notices:

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm

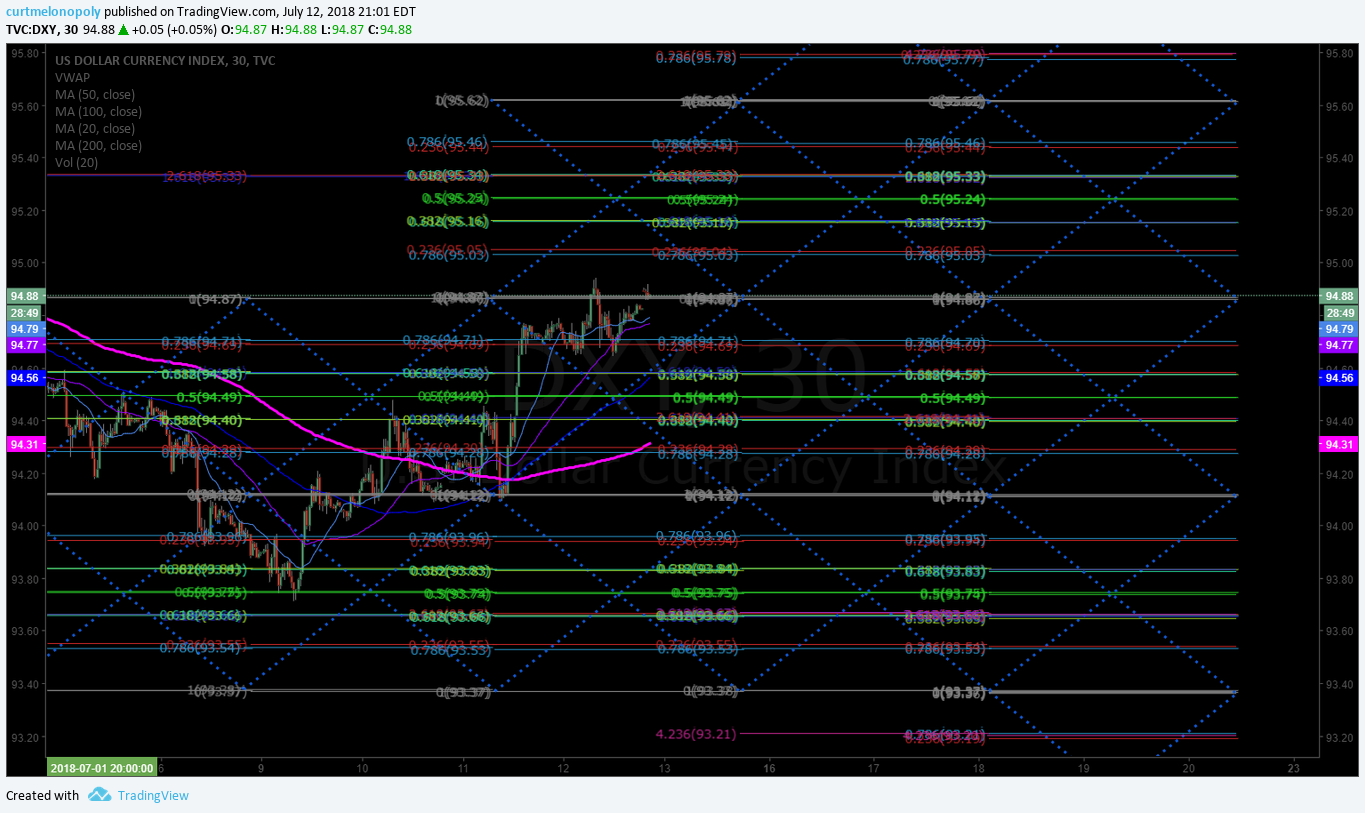

US Dollar Index (DXY) Algorithm. 30 Minute Chart Model $DXY $UUP

US Dollar Index (DXY). Above 200 MA in an upturn on daytrading 30 Min Chart Model. July 12 901 PM $DXY $UUP #algorithm #chart

The mid quad 94.87 area is an important resistance point.

US Dollar Index (DXY). Under pressure from 200 MA on 30 Min Chart Model.June 26 321 AM $DXY $UUP #algorithm #chart

$DXY Geometric Daily Algorithm Chart Model

US Dollar Index (DXY) Algorithm. Above light blue structure resistance is the orange structure on chart. July 12 949 PM #algorithm $DXY #Chart

US Dollar Index (DXY) Algorithm. Structure in play. Trade in geometric structure (light blue). #algorithm $DXY #Chart

Per recent;

US Dollar Index (DXY). Geometric algorithm chart model magnified ith test structure. $DXY #Algorithm #Dollar

US Dollar Index (DXY). Algorithm structure in play on daily chart. Trade inside geometric structure (red). #algorithm $DXY #Chart

Per recent;

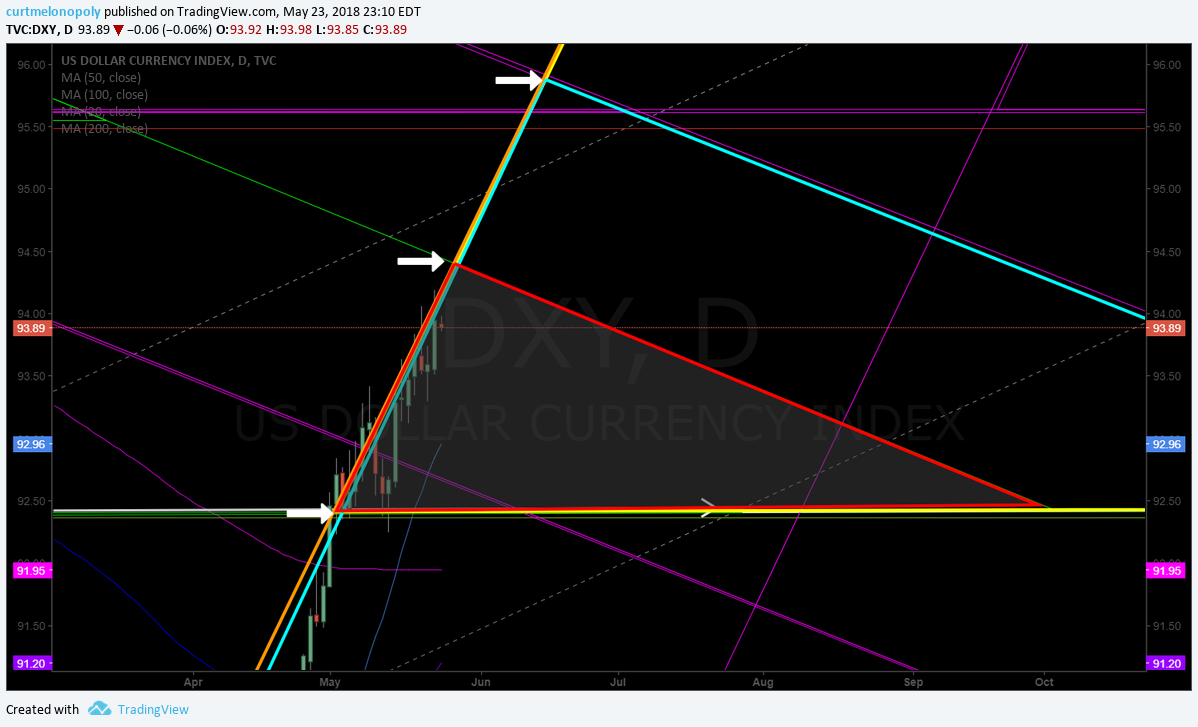

Below is the geometric model for the US Dollar. I’ve provided a close up image and a regular image with chart link.

The most important areas of trade structure are the red, orange, blue, yellow triangles.

The chart needs a significant reset, but for now we are watching the structure of the red triangle to see how it concludes.

Close up of Geometric Algorithmic Model for US Dollar Index $DXY.

https://www.tradingview.com/chart/DXY/GD3huNnE-DXY-Geometric-Model/

Per recent;

May 13 – Big test with the dollar here. Visually intense on the geometric US Dollar model. $UUP $DXY

Use link below from last report to view real time chart.

Per recent;

US Dollar $DXY touched 200 MA on daily and backed off. Geometric model charting.

Conventional Charting Considerations:

July 12 – US Dollar Index (DXY) Chart. Trade continues to pressure 200 MA on weekly chart. #chart $DXY #Dollar

June 25 – No significant structural change to Weekly chart – refer to previous report link below.

Per recent;

US Dollar Index (DXY) Chart. Trade came under pressure at 200 MA on weekly chart as we expected. #chart $DXY #Dollar

Per recent;

US Dollar over 50 MA on its way to 200 MA resistance on Weekly Chart. $DXY $UUP

Per recent;

Bull bear fight is on with dollar closing the week at the 50 MA. Watch that close. $DXY $UUP

Per recent;

If $DXY US Dollar Index builds structured base over main pivot (red line) it’s a long all day long. $UUP.

If $DXY -0.18% US Dollar Index -0.18% builds structured base over main pivot (red line) it’s a long all day long. $UUP.

WATCH the MACD for a turn down. Has it’s 200 MA (pink), but that’s not considerable relatively speaking right now.

Watch the pivot and watch the MACD on the daily. MACD turns down and it will be a retrace 99 in 100 times.

Per recent;

$DXY There it is, reach up and touch to 200 MA and a back off intra. MACD trending on Daily.

Dollar bulls keep an eye on 200 MA overhead on daily. $DXY #USD $UUP #chart #resistance

US Dollar News:

Trump’s trade war is undercutting his hopes for the dollar https://finance.yahoo.com/news/trumps-trade-war-undercutting-hopes-dollar-152345957.html?soc_src=social-sh&soc_trk=tw via @YahooFinance

Dollar falls vs yen as trade disputes intensify, yuan at 6-month lows

Dollar falls vs yen as trade disputes intensify, yuan at 6-month lows https://t.co/kSEM7pvFov

— $DXY US Dollar Algo (@dxyusd_index) June 26, 2018

Best with your trades and look forward to seeing you in the room!

$DXY US Dollar Algo

Article Topics: $DXY, Trading, USD, DXY, Dollar, Algorithm, $UUP, Chart

US Dollar Index (DXY) Algorithm Report Tues June 26. $DXY $UUP #USD #Algorithm

DXY US Dollar Algorithm Model Charting Report Tuesday June 26, 2018 $DXY $UUP

Welcome to my report for Compound Trading – $DXY the US Dollar algorithm charting model.

I am an early development model – one of seven in development at Compound Trading Group. This work is very early stage generation 1 work. Generation 2 – 5 is scheduled for 2018 and will eventually be coded to a digital dashboard for our traders to use as an intelligent assistant.

This charting is to be used in conjunction with conventional charting as trader assisted signals. The signals in the model (at this point) are simple that each line on the model chart are considered a support and resistance test.

Notices:

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm

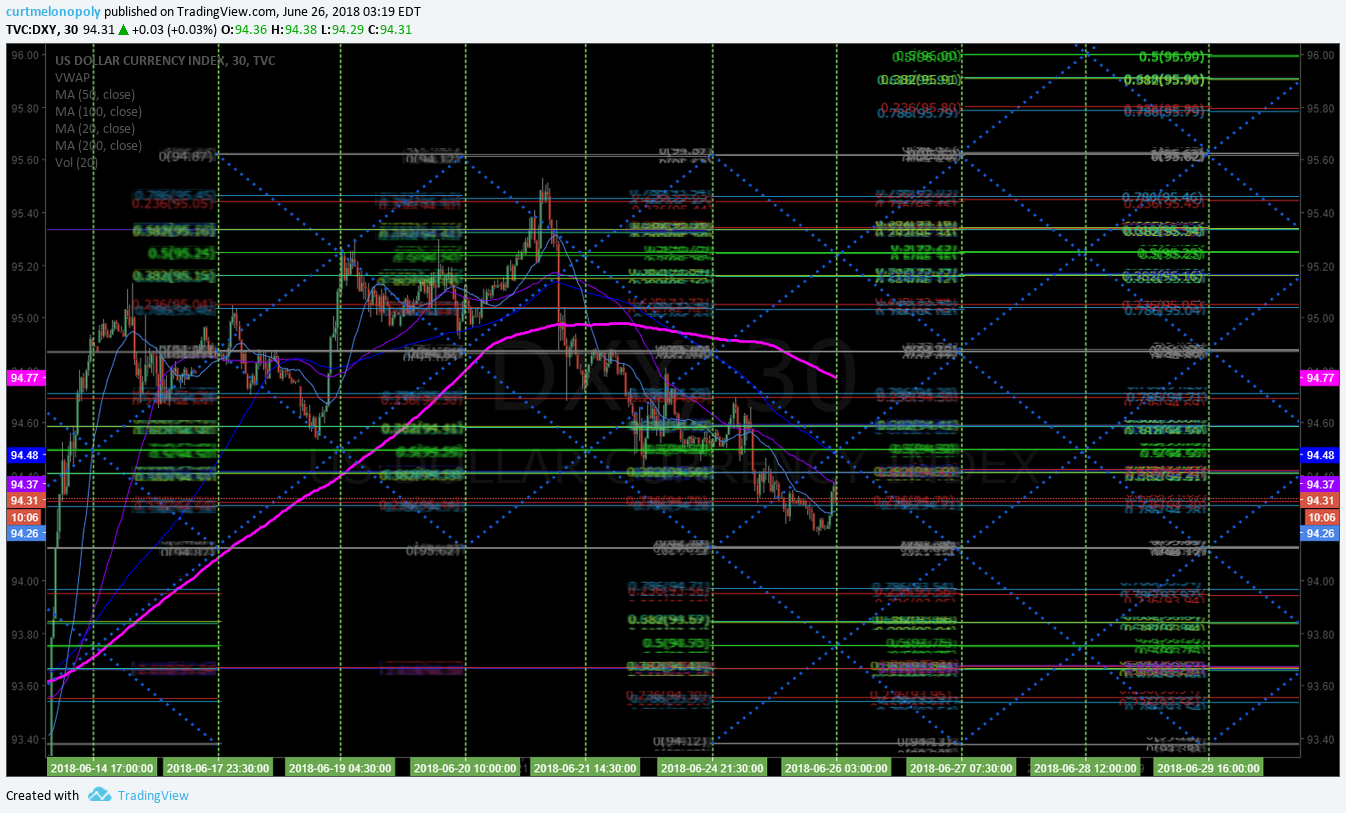

US Dollar Index (DXY) Algorithm. 30 Minute Chart Model $DXY $UUP

US Dollar Index (DXY). Under pressure from 200 MA on 30 Min Chart Model.June 26 321 AM $DXY $UUP #algorithm #chart

Per recent;

US Dollar Index (DXY). Trade under pressure from 200 MA on 30 Minute Chart Model. $DXY $UUP #algorithm #chart

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP May 23 1027 PM

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP May 13 339 PM

If this goes to a sell, the yellow are your prospective channel support and resistance for a down turn.

https://www.tradingview.com/chart/DXY/uL7Ifwwc-DXY-US-Dollar-30-Min-Algorithmic-Model-Chart-with-buy-sell-trig/

$DXY Geometric Daily Algorithm Chart Model

US Dollar Index (DXY) Algorithm. Structure in play. Trade in geometric structure (light blue). #algorithm $DXY #Chart

Per recent;

US Dollar Index (DXY). Geometric algorithm chart model magnified ith test structure. $DXY #Algorithm #Dollar

US Dollar Index (DXY). Algorithm structure in play on daily chart. Trade inside geometric structure (red). #algorithm $DXY #Chart

Per recent;

Below is the geometric model for the US Dollar. I’ve provided a close up image and a regular image with chart link.

The most important areas of trade structure are the red, orange, blue, yellow triangles.

The chart needs a significant reset, but for now we are watching the structure of the red triangle to see how it concludes.

Close up of Geometric Algorithmic Model for US Dollar Index $DXY.

https://www.tradingview.com/chart/DXY/GD3huNnE-DXY-Geometric-Model/

Per recent;

May 13 – Big test with the dollar here. Visually intense on the geometric US Dollar model. $UUP $DXY

Use link below from last report to view real time chart.

Per recent;

US Dollar $DXY touched 200 MA on daily and backed off. Geometric model charting.

Conventional Charting Considerations:

June 25 – No significant structural change to Weekly chart – refer to previous report link below.

Per recent;

US Dollar Index (DXY) Chart. Trade came under pressure at 200 MA on weekly chart as we expected. #chart $DXY #Dollar

Per recent;

US Dollar over 50 MA on its way to 200 MA resistance on Weekly Chart. $DXY $UUP

Per recent;

Bull bear fight is on with dollar closing the week at the 50 MA. Watch that close. $DXY $UUP

Per recent;

If $DXY US Dollar Index builds structured base over main pivot (red line) it’s a long all day long. $UUP.

If $DXY -0.18% US Dollar Index -0.18% builds structured base over main pivot (red line) it’s a long all day long. $UUP.

WATCH the MACD for a turn down. Has it’s 200 MA (pink), but that’s not considerable relatively speaking right now.

Watch the pivot and watch the MACD on the daily. MACD turns down and it will be a retrace 99 in 100 times.

Per recent;

$DXY There it is, reach up and touch to 200 MA and a back off intra. MACD trending on Daily.

Dollar bulls keep an eye on 200 MA overhead on daily. $DXY #USD $UUP #chart #resistance

US Dollar News:

Dollar falls vs yen as trade disputes intensify, yuan at 6-month lows

Dollar falls vs yen as trade disputes intensify, yuan at 6-month lows https://t.co/kSEM7pvFov

— $DXY US Dollar Algo (@dxyusd_index) June 26, 2018

Best with your trades and look forward to seeing you in the room!

$DXY US Dollar Algo

Article Topics: $DXY, Trading, USD, DXY, Dollar, Algorithm, $UUP, Chart

US Dollar Index (DXY) Algorithm Report Tues June 5. $DXY $UUP #USD #Algorithm

DXY US Dollar Algorithm Model Charting Report Tuesday June 5, 2018 $DXY $UUP

Welcome to my report for Compound Trading – $DXY the US Dollar algorithm charting model.

I am an early development model – one of seven in development at Compound Trading Group. This work is very early stage generation 1 work. Generation 2 – 5 is scheduled for 2018 and will eventually be coded to a digital dashboard for our traders to use as an intelligent assistant.

This charting is to be used in conjunction with conventional charting as trader assisted signals. The signals in the model (at this point) are simple that each line on the model chart are considered a support and resistance test.

Notices:

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm

US Dollar Index (DXY) Algorithm. 30 Minute Chart Model $DXY $UUP

US Dollar Index (DXY). Trade under pressure from 200 MA on 30 Minute Chart Model. $DXY $UUP #algorithm #chart

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP May 23 1027 PM

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP May 13 339 PM

If this goes to a sell, the yellow are your prospective channel support and resistance for a down turn.

https://www.tradingview.com/chart/DXY/uL7Ifwwc-DXY-US-Dollar-30-Min-Algorithmic-Model-Chart-with-buy-sell-trig/

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP Apr 30 352 AM

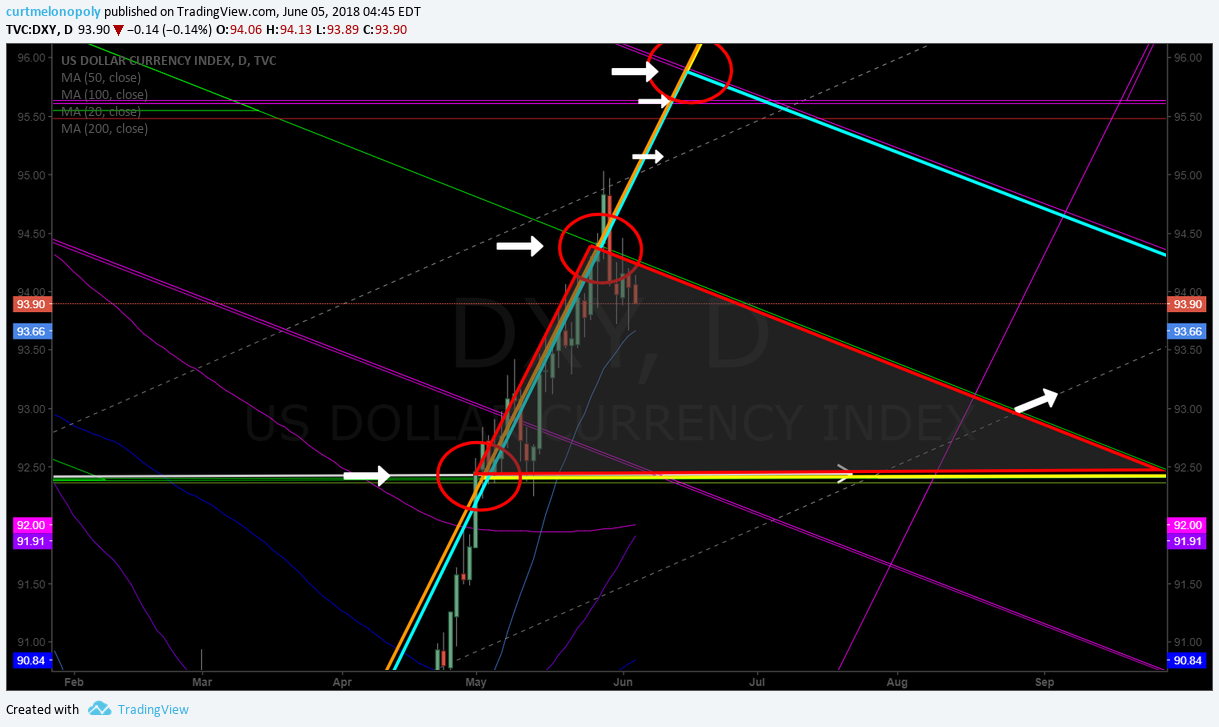

$DXY Geometric Daily Algorithm Chart Model

US Dollar Index (DXY). Geometric algorithm chart model magnified ith test structure. $DXY #Algorithm #Dollar

US Dollar Index (DXY). Algorithm structure in play on daily chart. Trade inside geometric structure (red). #algorithm $DXY #Chart

Per recent;

Below is the geometric model for the US Dollar. I’ve provided a close up image and a regular image with chart link.

The most important areas of trade structure are the red, orange, blue, yellow triangles.

The chart needs a significant reset, but for now we are watching the structure of the red triangle to see how it concludes.

Close up of Geometric Algorithmic Model for US Dollar Index $DXY.

https://www.tradingview.com/chart/DXY/GD3huNnE-DXY-Geometric-Model/

Per recent;

May 13 – Big test with the dollar here. Visually intense on the geometric US Dollar model. $UUP $DXY

Use link below from last report to view real time chart.

Per recent;

US Dollar $DXY touched 200 MA on daily and backed off. Geometric model charting.

Conventional Charting Considerations:

US Dollar Index (DXY) Chart. Trade came under pressure at 200 MA on weekly chart as we expected. #chart $DXY #Dollar

Per recent;

US Dollar over 50 MA on its way to 200 MA resistance on Weekly Chart. $DXY $UUP

Per recent;

Bull bear fight is on with dollar closing the week at the 50 MA. Watch that close. $DXY $UUP

Per recent;

If $DXY US Dollar Index builds structured base over main pivot (red line) it’s a long all day long. $UUP.

If $DXY -0.18% US Dollar Index -0.18% builds structured base over main pivot (red line) it’s a long all day long. $UUP.

WATCH the MACD for a turn down. Has it’s 200 MA (pink), but that’s not considerable relatively speaking right now.

Watch the pivot and watch the MACD on the daily. MACD turns down and it will be a retrace 99 in 100 times.

Per recent;

$DXY There it is, reach up and touch to 200 MA and a back off intra. MACD trending on Daily.

Dollar bulls keep an eye on 200 MA overhead on daily. $DXY #USD $UUP #chart #resistance

Best with your trades and look forward to seeing you in the room!

$DXY US Dollar Algo

Article Topics: $DXY, Trading, USD, DXY, Dollar, Chart, Algorithm, $UUP

US Dollar $DXY Algorithm Model Chart Update Wed May 23 $UUP

$DXY US Dollar Algorithmic Model Chart Update/ Observations Wednesday May 23, 2018 $UUP

Welcome to my report for Compound Trading – $DXY the US Dollar algorithm charting model.

I am an early development model – one of seven in development at Compound Trading. This work is very early stage generation 1 work. Generation 2 – 5 is scheduled for 2018 and will eventually be coded to a digital dashboard for our traders to use as an intelligent assistant.

This charting is to be used in conjunction with conventional charting as trader assisted signals. The signals in the model (at this point) are simple that each line on the model chart are considered a support and resistance test.

Notices:

Feature Post with Charting: How to Trade the US Dollar Index Move (Part 1) $DXY $UUP #USD #trading #chart #algorithm

$DXY US Dollar Algorithm Charting Model $UUP

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP May 23 1027 PM

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP May 13 339 PM

If this goes to a sell, the yellow are your prospective channel support and resistance for a down turn.

https://www.tradingview.com/chart/DXY/uL7Ifwwc-DXY-US-Dollar-30-Min-Algorithmic-Model-Chart-with-buy-sell-trig/

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP Apr 30 352 AM

Per recent;

$DXY US Dollar 30 Min Algorithmic Model Chart with buy sell triggers, trading quads, channel, MAs, price targets. $UUP Apr 24 306 AM

$DXY Geometric Daily Chart Model

Below is the geometric model for the US Dollar. I’ve provided a close up image and a regular image with chart link.

The most important areas of trade structure are the red, orange, blue, yellow triangles.

The chart needs a significant reset, but for now we are watching the structure of the red triangle to see how it concludes.

Close up of Geometric Algorithmic Model for US Dollar Index $DXY.

https://www.tradingview.com/chart/DXY/GD3huNnE-DXY-Geometric-Model/

Per recent;

May 13 – Big test with the dollar here. Visually intense on the geometric US Dollar model. $UUP $DXY

Use link below from last report to view real time chart.

Per recent;

US Dollar $DXY touched 200 MA on daily and backed off. Geometric model charting.

Conventional Charting Considerations:

US Dollar over 50 MA on its way to 200 MA resistance on Weekly Chart. $DXY $UUP

Per recent;

Bull bear fight is on with dollar closing the week at the 50 MA. Watch that close. $DXY $UUP

Per recent;

If $DXY US Dollar Index builds structured base over main pivot (red line) it’s a long all day long. $UUP.

If $DXY -0.18% US Dollar Index -0.18% builds structured base over main pivot (red line) it’s a long all day long. $UUP.

WATCH the MACD for a turn down. Has it’s 200 MA (pink), but that’s not considerable relatively speaking right now.

Watch the pivot and watch the MACD on the daily. MACD turns down and it will be a retrace 99 in 100 times.

Per recent;

$DXY There it is, reach up and touch to 200 MA and a back off intra. MACD trending on Daily.

Dollar bulls keep an eye on 200 MA overhead on daily. $DXY #USD $UUP #chart #resistance

Per recent;

April 9 – $DXY Daily chart range trade stuck with MACD indecisive. $UUP

https://www.tradingview.com/chart/DXY/bgTJqSqy-DXY-range-trade-stuck-with-MACD-indecisive-UUP/

Best with your trades and look forward to seeing you in the room!

$DXY US Dollar Algo

Article Topics: $DXY, Trading, USD, Dollar, Chart, Algorithm, $UUP