2024 Personal Trading Journal / Results

As promised, in 2024 I am trading much more aggressively personally and journaling for our subscribers to follow along.

So far in 2024 my recent oil trade yielded just under 5% in profit (much great because it was leveraged, but for this purpose we’ll leave it at 5%), the $BTC trade yielded 32% upside and the $ETH trade 24%. I’m up on the Dollar trade, and flattish on the $VIX related trade (insurance). Natural Gas long and the SPY / MES short I am positioning with patience (currently very moderately under water but I expect both to be big winners).

My stock swings and day trades along with my crypto trades in various instruments should be significantly more in frequency starting this week.

Compoundtrading.com subscriber trades are alerted live to Swing Trade, Day Trade, Crypto and Oil Trading Servers on Discord and on email. The machine learning trade results are available on their respective websites; https://OilDefi.io , https://SP500defi.io , https://DefiBTC.io , https://ETHDefi.io . The https://Sovoron.com private side machine trading results are not published publicly.

The fraction represented as trade size is the size of the trade entry allowable of the total I will risk in a specific trade (I often swing or position trade ebb and flow and depending on risk and instrument the allowable size will vary). I endeavor to alert all trades and adds and trims but this can be difficult when I am away and many trades are on a 24-hour 7 day clock, so often I will advise subs of the plan in advance and later the trades are executed by myself, staff or automated through buy/sell orders on various platforms.

If I explain a trade set up on video or in Discord or on email please be aware that if I provide a level for executions that we often begin buying in to or selling in to a level (at times with different instruments reflecting the core thesis for a trade on various accounts), it’s almost never an exact price. So, if we are sizing in to a trade and there are many entries – I do not list every micro entry below, I simply average the buy or sells to simplify this journal. I endeavor to explain risk sizing, positioning, stops and adds or trims before and during trades in video scan updates and in alert feeds, every trade is different.

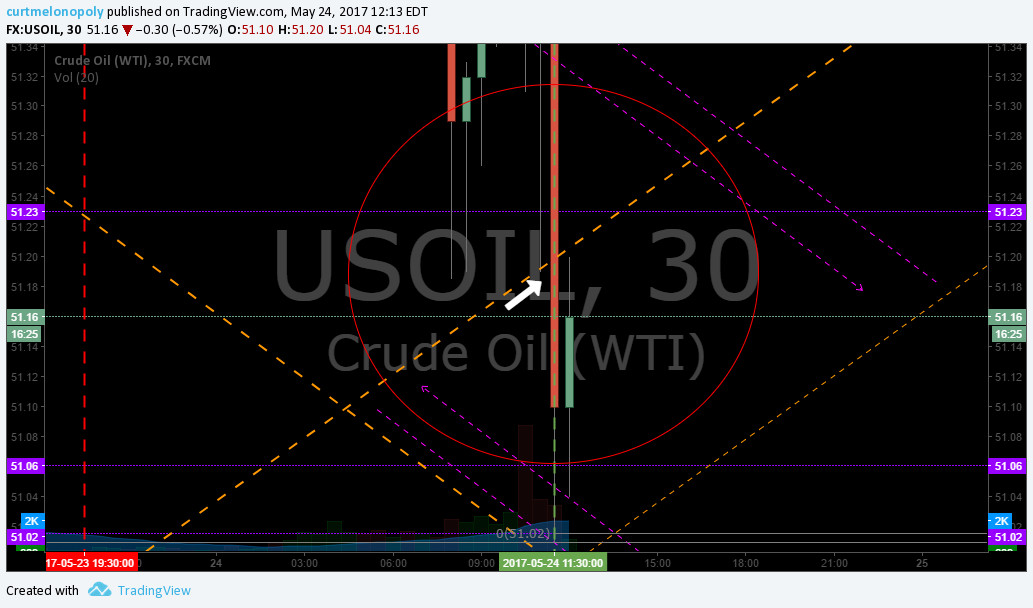

Value is trade value in US Dollars. Leveraged trades (futures, crypto swaps, etc) are not represented in terms of leverage such as with crude oil futures etc. (it is represented as a rounded risk amount in USD dollars, ask privately for more information) to keep the Journal easy and efficient to use and follow (a quick journal guide updated regularly for subscribers to balance personal trades vs risk etc). Oil trade alerts are referenced as FXUSOIL WTI and traded on CL. MCL or USO in rare instances.

As profit or loss is realized in each trade the Position +- $ column is updated to represent (in general terms) each trade performance and at regular intervals I will provide an updated profit / loss for the overall positions.

Audited account statements and or screen shots of trade alerts can be made available as required.

Trade Alert Subscription Links: Swing Trading https://compoundtrading.com/product/swing-trading-alerts/ , Oil Trading https://compoundtrading.com/product/live-oil-trading-alerts/ , Crypto Trading https://compoundtrading.com/product/live-bitcoin-trading-alerts/ , Day Trading (stocks) https://compoundtrading.com/product/day-trading-alerts/ . If you prefer a package with two or more trade alerts included, message Jen at [email protected] and she will provide you with a special discounted bundle price.

| Date | instrument | Long/Short | Avg Price | Size | Value | % +- | Position +- $ | Running Profit/Loss | Notes |

| Feb 14 | $ETH | Sell – Close | 2766.00 | .5/10 | +24.03% | +5711.22 | Holds 0 | ||

| Feb 14 | $BTC | Sell – Close | 52000.00 | .75/10 | +32.36% | +8107.90 | Holds 0 | ||

| Feb 14 | $DXY | Sell 60% | 104.88 | .625/30 | Holds .625/30 | ||||

| Feb 12 | $ETH | Sell 60% | 2381.00 | .75/10 | Holds .5/10 | ||||

| Feb 12 | $BTC | Sell 40% | 49517.00 | .5/10 | Holds .75/10 | ||||

| Feb 9 | $CL_F | Close Long | 77.23 | 2.4/10 | +4.09% | +4916.00 | Avg buy 74.19 | ||

| Feb 9 | $CL_F | Trim Long | 76.96 | -1.6/10 | Holds 2.4/10 long | ||||

| Feb 8 | $CL_F | Trim Long | 75.62 | -2/10 | Holds 4/10 long | ||||

| Feb 7 | $NATGAS | Add long | 1.92 | +1/10 | 2550.00 | Holds 3.5/10 long | |||

| Feb 2 | $CL_F | Add Long | 71.99 | +2/10 | 40000.00 | Holds 6/10 long | |||

| Feb 2 | $MES | Add short | 4993.00 | +3/10 | 30600.00 | Holds 35700.00 short | |||

| Feb 1 | $CL_F | Add long | 75.00 | +3/10 | 60000.00 | Holds 4/10 long | |||

| Jan 31 | $MES | Trim Short | 4920.00 | +.31 of 1.25 /20 | 1700.00 | +50.00 | Holds 5100 short | ||

| Jan 31 | $CL_F | Long – Reversal | 76.18 | +1/10 | 20000.00 | +410.00 | |||

| Jan 31 | $BTC | Long add | 42830.00 | +.25/10 | 5000.00 | ||||

| Jan 31 | $ETH | Long add | 2294.50 | +.25/10 | 5000.00 | ||||

| Jan 31 | $NATGAS | Long add | 2.05 | +.5/10 | 1700.00 | ||||

| Jan 31 | $UVXY | Long add | 7.54 | +.25/30 | 100.00 | ||||

| Jan 31 | $DXY | Long add | 103.10 | +.25/30 | 200.00 | Holds 1.25/30 | |||

| Jan 31 | $MES | Short add | 4923 | -.25/20 | 1700.00 | ||||

| Jan 25 | $MES | Short | 4920 | -1/20 | 5100.00 | ||||

| Jan 25 | $CL_F | Short | 76.57 | -1/20 | 10000.00 | ||||

| Jan 25 | $DXY | Long | 103.25 | +1/30 | 1600.00 | ||||

| Jan 25 | $UVXY | Long | 7.57 | +1/30 | 400.00 | ||||

| Jan 25 | $NATGAS | Long | 2.145 Spot | +2/10 | 5100.00 | ||||

| Jan 23 | $ETH | Long | 2211.80 | +1/10 | 20000.00 | This alert did not get out to all feeds. That was my error. | |||

| Jan 23 | $BTC | Long | 38700.00 | +1/10 | 20000.00 | PT was 38400 and Jen started buying 38900, 38800, 38700, 38600 and it bounced at 38522 |