Compound Trading Chat Room Stock Trading Plan and Watch List Thursday Dec 14, 2017 $OSTK, $MCIG, $IMUC, $SMIT, $ROKU, $COTY, $VRX, $CELG, $AAOI, $SPPI – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Christmas at Compound Trading. We’re emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket

Christmas at Compound Trading. We're emailing select complimentary issues of our algorithm chart models to folks on our mailing list between now and Christmas FYI. $SPY $VIX $WTI #GOLD #SILVER $BTC $DXY and even our swing trading reports. #premarket https://t.co/1CNAfDsAeI

— Melonopoly (@curtmelonopoly) December 5, 2017

Most of the models are complete and out – the few remaining are in process and will be delivered soon. $SPY, $DXY, $VIX, Silver final edits are in process right now. All models including swing trading newsletters will have more refined buy sell triggers implemented between now and Jan 1 and also the $BTC blog post is currently in editing awaiting two important replies from exchange operators (we are giving them a bit of room to respond to us).

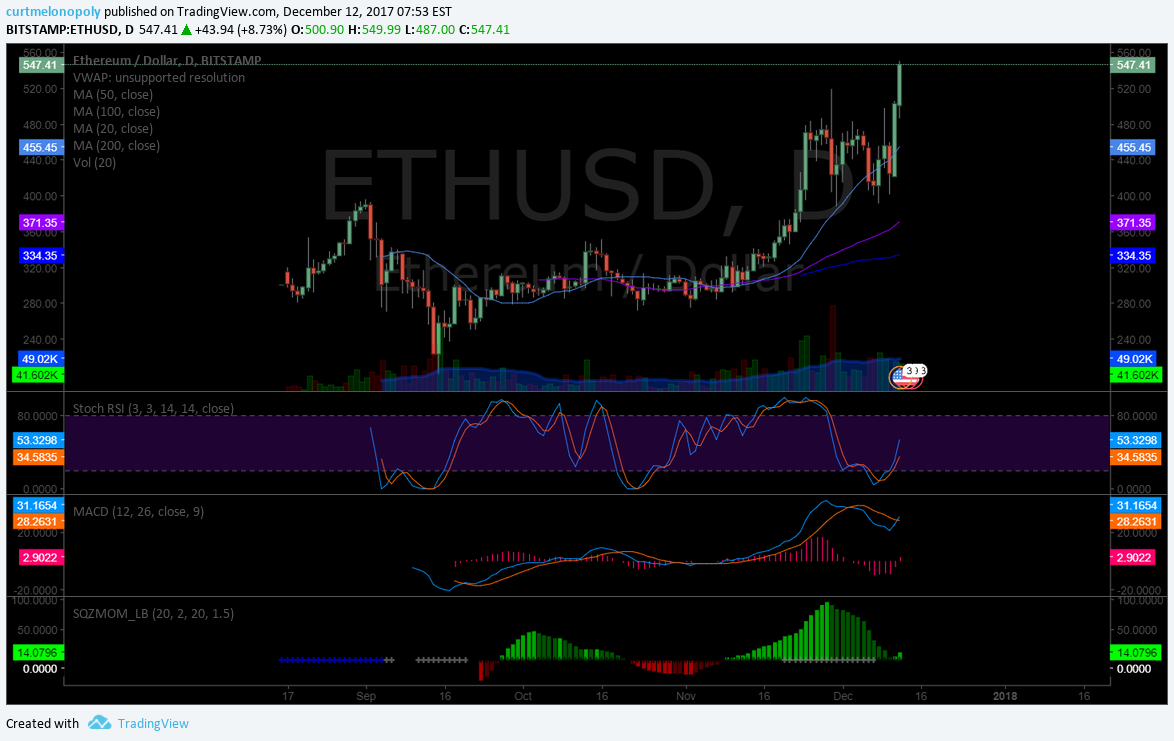

Also $ETH and $LTC models will be done as with other trending cryptos as they come along. Yes.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Dec 13 Swing Trade Set-Ups; $OSTK, Gold, $NUGT, $WTI, OIL, EIA, $VRX, $CELG, $AAOI, $RIOT, $MCIG

If you’re a trader learning, need set-ups, have interest in our 2018 plans, what we see in markets fwd, want to see live trades / on the fly analysis or learn a bit about how we model charts and more…. this video is for you. #premarket #tradingstrategy #trading #video

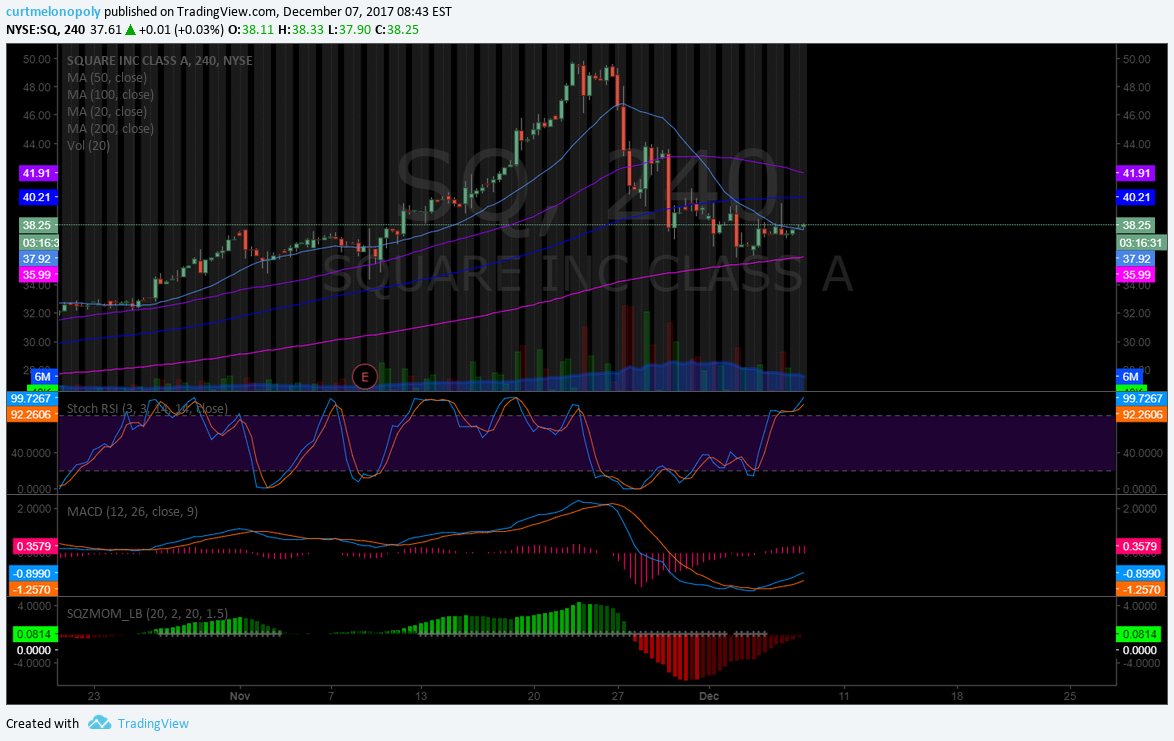

Fri Dec 8 Trade Set-ups $BTC, Crypto Scenarios, Gold, $WTI, OIL, Algorithms, $VRX, $SQ, $MYL …

Dec 7 Swing Trade Chart Set-Ups $OSIS, $SQ, $DPW, $FSLR, $FB, $TVIX, $XIV …

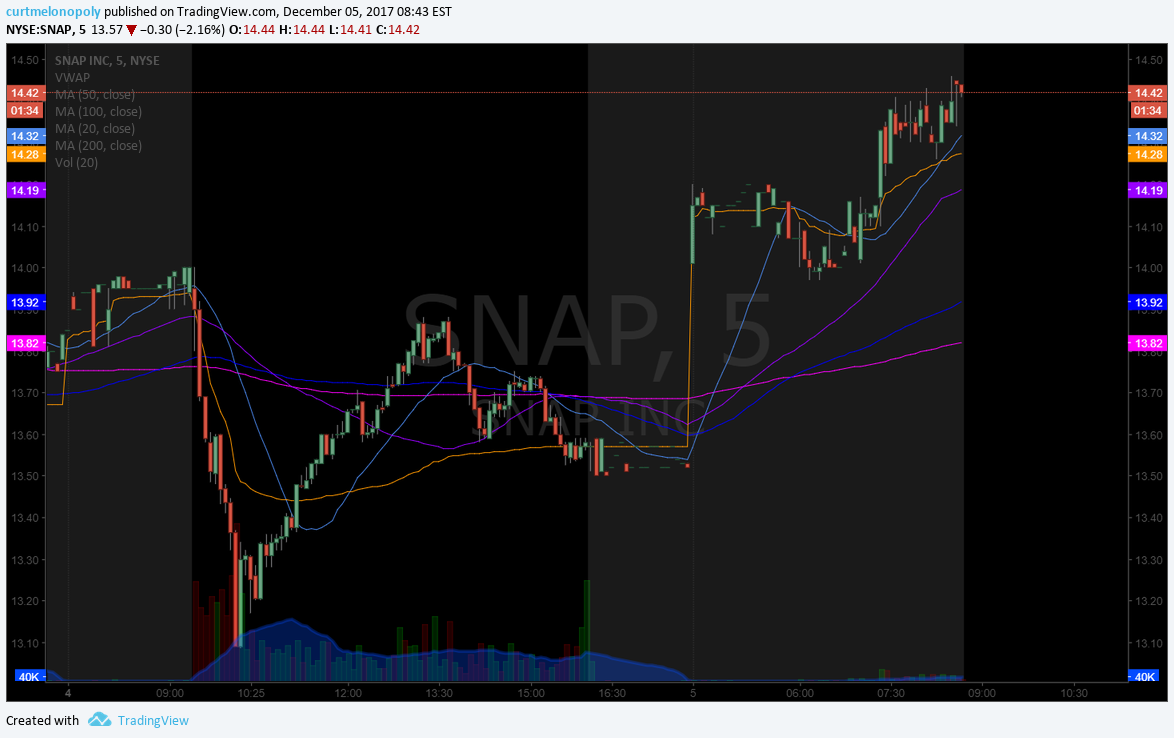

Dec 6 Swing Trading chart set-ups $ETSY, $FSLR, $VTGN, $APTN, $LMFA, $VRA …

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Recent Profit and Loss Performance:

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

$OSTK, $MCIG, $IMUC, $SMIT, $ROKU, $COTY, $VRX, $CELG, $AAOI, $SPPI

Per recent:

Crypto related still on watch. $OSTK, $MARA, $MGTI, $RIOT, $XNET, $BTCS and more.

$AAOI still on watch for the follow-through move after wash out in to gap. Oil watching for a possible large entry in $DWT again (oil short ETN). $SPPI still holding and looking for it to run out of it’s gap and go set-up.

Morning Momentum / Gap / News / PR / IPO Stocks on Watch: $IMUC, $SMIT

Recent IPO’s :

Also watching: $WPRT, $COTY, $FSLR, $VRX, $OSI, $BLUE, $CELG, $ATKX

Market observation / on watch:

US Dollar $DXY off 93.39, Oil $USOIL $WTI 56.30 under pressure, Gold / Silver up – Gold intra day trading 1256.80, $SPY moderate 266.75 and $BTCUSD $XBTUSD 16777.00 continuing in recent daily range and $VIX trading 9.9 moderate.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck: $ADBE $COST $JBL $NQ $ORCL $RICK $UWN

Recent / Current Holds, Open and Closed Trades

Closed rest of $XIV swing trade for a nice win, enter $OSTK 56.50 yesterday trading 62.35 this morning and also entered $MCIG (OTC) yesterday. $NUGT swing up and $AAOI $SPPI still hold. Oh and a flat oil trade overnight and oil trade win yesterday. Looking to enter $BTC at bottom of range.

Per previous;

Overnight trade in oil went really well. Big win.

Small loss on Friday in $SQ and hold small position in $NUGT and previous swings $AAOI and $SPPI. Flat oil trade overnight.

1/10 size Gold and $NUGT still long, yesterday nailed $VIX short at open SS $TVIX and $VIX inverse with $XIV – still hold 50% of $XIV swing position from yesterday and holds over time $AAOI and $SPPI.

In a 1/10 long Gold position under water on, 1/10 $NUGT, hit a morning momo trade yesterday in $FSLR and still holding $AAOI and $SPPI.

Closed my $DWT and CL trades from Friday on Monday when internet got back up for wins.

Wednesday $CMG trade went well for the win, $DWT (oil short) trade went well for the win, and the crypto exchange(s) crash caused some losses on some accounts but we did manage to get out on most accounts. We had a problem with five (more on this soon).

Closed oil short for nice win after adding 2/10. Close $AMMJ swing for small win. $XNET win yesterday was sweet technically. And Bitcoin we are absolutely killing it.

Chart Set-ups on Watch:

Watching set ups in $VRX, $WPRT also and a number of others (see mid day review video from yesterday)

From recent;

$COTY is setting up!!! 200 MA on daily breached!

$CELG From Last Week Gap Fill Swing Trading Set-Up Notes on Chart https://www.tradingview.com/chart/CELG/IaPH3DRj-CELG-News-Gap-Fill-SwingTrade-Set-Up-from-last-wk-see-notes/ … Detailed algorithmic chart model for intra-day trade will be emailed to mailing list subs b4 premarket Mon – so get on our mailing list and it will be sent to you! https://compoundtrading.com/contact/[/url

$CELG From Last Week Gap Fill Swing Trading Set-Up Notes on Chart https://t.co/1ahQ9c5pAk Detailed algorithmic chart model for intra-day trade will be emailed to mailing list subs b4 premarket Mon – so get on our mailing list and it will be sent to you! https://t.co/OxDbJ1HNL4 pic.twitter.com/3tnCwUuxsV

— Melonopoly (@curtmelonopoly) December 10, 2017

$OSI I find the symmetry in this chart almost unbelievable. Mind boggling. #premarket https://www.tradingview.com/chart/OSIS/HIXKIxE6-OSI-I-find-the-symmetry-in-this-chart-almost-unbelievable-Mind/ …

$OSI I find the symmetry in this chart almost unbelievable. Mind boggling. #premarket https://t.co/V0QF3GKcV6 pic.twitter.com/W9XIzGHyGR

— Melonopoly (@curtmelonopoly) December 7, 2017

Market Outlook:

Moderate

Market News and Social Bits From Around the Internet:

Stocks making the biggest moves premarket: FOXA, DIS, CBS, VZ, DAL, KO & more

Stocks making the biggest moves premarket: FOXA, DIS, CBS, VZ, DAL, KO & more https://t.co/sRKRBpNacN

— Melonopoly (@curtmelonopoly) December 14, 2017

8:30am

-Retail Sales

-Import/ Export Prices

-Initial Jobless Claims

9:45am

Bloomberg Consumer Comfort Index

10am

Business Inventories

10:30am

NatGas Report

$TSLA Tesla Model 3 production is increasing to 5,000 units per week, say suppliers

$VRX downgraded from Neutral to Underweight at JPMorgan. PT $12

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $IMUC, $SMIT, $MBOT $TEVA $SRAX $MARK $PSDV $AMPE $MYO $GROW $RIOT $DPW $APRN $ROKU $ARGX $MRNS $HMNY

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $OSTK, $MCIG, $IMUC, $SMIT, $ROKU, $COTY, $VRX, $CELG, $AAOI, $SPPI, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY