Tag: $OSTK

Swing Trade Alerts Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

Swing Trading Alert Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 as Alerted to Member Private Feed, Trading Room and/or Newsletter Reporting. #swingtrading #tradealerts

Tickers Alerted on Swing Trade Feeds: $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC, $APDN, $PD, $KBE, $RCUS, $GC_F, $SI_F, $CL_F, $APO, $CCJ, $CAE, $TECK, $TACO, $VXX, $BIIB, $CLVS,

- Important Summary Detail:

- Period Swing Trade Alert Return (ROI) = 131.26% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=462520&investmenttime=date&investmentlength=2.5&beginbalanceday=04%2F01%2F2020&endbalanceday=04%2F30%2F2020&ctype=1&x=62&y=20

- Our goal is to provide the best swing trading alert and newsletter service available. The highest winning percentage with the most consistent returns.

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 12, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trade Profit Loss. Win 90%. ROI 131.26%. April 1-30, 2020. 200,000-462,520.00 $AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC …

- Swing Trading Profit Loss – Win 100% . ROI 127.34%. Mar 1 – Mar 31, 2020. $200,000.00-$454,676.00. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $COST, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Profit Loss – Win 90% . ROI 131.26%. April 1 – 30, 2020. $200,000.00-$454,676.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1GVMx_8TcMuQglo4IN_oN03VwbcF2WVoG2mHd0gN4G9s/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Size | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

|

* Note: there are a series of oil trades that have to yet be moved to this ledger from lead trader.

|

||||||||||||||||

| 4/30/2020 | 12.05 PM | Long | $LUV | 500 | 30.78 | 0 | ||||||||||

| 4/30/2020 | PRE | Trim 50%: 25 hold 25 | $OSTK | 25 | 8.73 | 14.83 | 152.5 | 462520 | ||||||||

| 4/30/2020 | 8:05 AM | Trim 10% | $BTC | 70 | 5900 | 8878 | 20846 | 462368 | ||||||||

| 4/30/2020 | POST | Trim 25 hold 25 | $AAPL | 25 | 268.1 | 294 | 647.5 | 441522 | ||||||||

| 4/29/2020 | 12:49 PM | Trim 90 hold 370 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 37.15 | 310.5 | 440875 | ||||||||

| 4/29/2020 | 12:17 PM | Trim 90 hold 460 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 36.98 | 295 | 449565 | ||||||||

| 4/29/2020 | Trim 30% 30 of 150 hold 20 | $KBE | 30 | 28.23 | 35.21 | 209 | 440270 | |||||||||

| 4/29/2020 | 10:26 AM | Trim 90 hold 550 of 640 | $SPXL (SPY Bull ETF) | 90 | 33.7 | 36.8 | 279 | 440061 | ||||||||

| 4/29/2020 | PRE | Trim 10% hold 320 | $CAE | 80 | 14.1 | 17.22 | 249.6 | 439782 | ||||||||

| 4/29/2020 | PRE | Take profit to 90% sell 180 hold 30 | $MA | 180 | 247 | 273.2 | 4716 | 438533 | ||||||||

| 4/28/2020 | 11:23 | Add 1/10 size long | $TECK | 300 | 7.71 | 0 | ||||||||||

| 4/28/2020 | PRE | Trim 10% | $IBB | 30 | 123 | 128.7 | 157 | 434817 | ||||||||

| 4/28/2020 | PRE | Trim 10% | $TACO | 240 | 4.4 | 5 | 144 | 434660 | ||||||||

| 4/28/2020 | 7:01 AM | Trim 10% | $AXP | 20 | 84.5 | 86.25 | 35 | 434516 | ||||||||

| 4/28/2020 | 6:57 AM | Trim 10% 20 of 140 hold 120 | $LVS | 20 | 44.5 | 47.8 | 66 | 434481 | ||||||||

| 4/28/2020 | 6:54 AM | Trim 10% 90 of 730 hold 640 | $MA | 90 | 247 | 269.5 | 2025 | 434415 | ||||||||

| 4/28/2020 | PRE | Trim 50% | $CAE | 400 | 14.1 | 17.2 | 1240 | 432390 | ||||||||

| 4/28/2020 | PRE | Trim 50% $KBE | $KBE | 150 | 28.23 | 31.5 | 490.5 | 421150 | ||||||||

| 4/28/2020 | 10:27 AM | Trim 270 of 900 hold 730 | $SPXL (SPY Bull ETF) | 270 | 33.7 | 36.3 | 648 | 430660 | ||||||||

| 4/27/2020 | 3:00 PM | Trim 90 of 300, hold 210 | $MA | 90 | 247 | 264.9 | 1611 | 430012 | ||||||||

| 4/27/2020 | 10:25 AM | Trim 30% 60 of 200 hold 140 | $LVS | 60 | 44.55 | 47.7 | 187 | 428401 | ||||||||

| 4/27/2020 | 9:56 AM | Close $INO | $INO | 20 | 11.03 | 15.22 | 88 | 428214 | ||||||||

| 4/27/2020 | 9:55 AM | Trim 10% 60 of 600 hold 540 | $TLRY | 60 | 8.04 | 9.26 | 70.8 | 428126 | ||||||||

| 4/27/2020 | PRE | Trim 40 hold 50 | $AAPL | 40 | 268.1 | 284.9 | 672 | 428055 | ||||||||

| 4/25/2020 | POST | Close 50 | $RCUS | 50 | 15.5 | 30 | 725 | 427383 | ||||||||

| 4/24/2020 | 3:40 PM | Starter long | $TLRY | 600 | 8.04 | 0 | ||||||||||

| 4/24/2020 | 3:03 PM | Starter long | $LVS | 200 | 44.55 | 0 | ||||||||||

| 4/24/2020 | PRE | Starter long | $CCJ | 600 | 9.83 | 0 | ||||||||||

| 4/24/2020 | PRE | Long | $AXP | 200 | 84.5 | 0 | ||||||||||

| 4/23/2020 | PRE | Trim to 90%, hold 20 | $INO | 130 | 11.03 | 12.49 | 189.8 | 426658 | https://twitter.com/SwingAlerts_CT/status/1253265769372286976 | |||||||

| 4/22/2020 | Trim 25% | $INO | 50 | 11.03 | 11.46 | 21.5 | 426469 | https://twitter.com/SwingAlerts_CT/status/1252974838672691200 | ||||||||

| 4/21/2020 | 11:54 AM | Short starter | $TSLA | 20 | 694.5 | https://twitter.com/SwingAlerts_CT/status/1252627996730707968 | ||||||||||

| 4/21/2020 | 10:00 | Add $APPL 268s per alert hold 90 | $APPL | 85 | 268.1 | 0 | ||||||||||

| 4/21/2020 | 11:00 | Trim $VXX 300 hold 100 | $VXX | 300 | 43 | 47.8 | 1440 | 426448 | ||||||||

| 4/21/2020 | PRE | Trim 50% of position | $OSTK | 50 | 8.73 | 11.89 | 158 | 425008 | https://twitter.com/SwingAlerts_CT/status/1225566766350393345 | https://twitter.com/SwingAlerts_CT/status/1252243687624622085 | https://twitter.com/SwingAlerts_CT/status/1255091263185059841 | |||||

| 4/20/2020 | 11:18 AM | Long Starter | $CLVS | 300 | 11.18 | 0 | https://twitter.com/SwingAlerts_CT/status/1252255241615130629 | |||||||||

| 4/20/2020 | 12:00 | Close | $BIIB | 30 | 335 | 350 | 450 | 424850 | ||||||||

| 4/20/2020 | 10:48 | Long starter | $ACB | 1200 | 0.71 | 0 | https://twitter.com/SwingAlerts_CT/status/1252247665758347264 | |||||||||

| 4/17/2020 | 4:03 PM | Sell 25% | $MA | 100 | 247 | 260 | 1300 | 424400 | ||||||||

| 4/17/2020 | Sell 25% | $TACO | 600 | 4.4 | 4.67 | 162 | 423100 | |||||||||

| 4/17/2020 | PRE | Long | $TACO | 2400 | 4.4 | 0 | ||||||||||

| 4/16/2020 | PRE | Long | $CAE | 800 | 14.1 | 0 | ||||||||||

| 4/16/2020 | POST | Long | $SPXL (SPY Bull ETF) | 900 | 33.7 | 0 | https://twitter.com/SwingAlerts_CT/status/1247072443723845638 | |||||||||

| 4/16/2020 | 1:39 PM | Trim profit to 90% 450 of 500 | $RCUS | 450 | 15.5 | 29.2 | 6165 | 422938 | ||||||||

| 4/16/2020 | 16:42 | Long in Size | $MA | 400 | 247 | 0 | https://twitter.com/SwingAlerts_CT/status/1250887337917243393 | https://twitter.com/SwingAlerts_CT/status/1250463929765187585 | https://twitter.com/SwingAlerts_CT/status/1250463036634251266 | https://twitter.com/SwingAlerts_CT/status/1250444010117726214 | ||||||

| 4/16/2020 | POST | Trim to 90% – 35 of 40 hold 5 | $AAPL | 35 | 261.9 | 296 | 1193.5 | 416773 | ||||||||

| 4/15/2020 | PRE | Trim 100 of 200 | $APDN | 100 | 3.01 | 8.51 | 550 | 415580 | ||||||||

| 4/14/2020 | PRE | Trim profit 25% 75 of 150 | $INTC | 75 | 48.42 | 58.7 | 771 | 415030 | ||||||||

| 4/14/2020 | PRE | Trim 25% profit | $PD | 150 | 17.2 | 19.12 | 288 | 414259 | https://twitter.com/SwingAlerts_CT/status/1249980190769496064 | |||||||

| 4/14/2020 | PRE | Trim 2 hold 2 | $GC_F | 2 | 1516.01 | 1725.77 | 41952 | 413971 | ||||||||

| 4/14/2020 | POST | Trim 90%, trim 180 old 20 | $BABA | 180 | 180.75 | 205 | 4365 | 372019 | https://twitter.com/SwingAlerts_CT/status/1249803532032716801 | |||||||

| 4/13/2020 | 4:14 PM | Trim 10% Long hold 40% | $AAPL | 10 | 261.9 | 272.9 | 110 | 367644 | ||||||||

| 4/9/2020 | Settlement | Close stop at entry | $CL_F | 1 | 24.07 | 24.07 | 0 | |||||||||

| 4/9/2020 | 9:31 AM | Cover short | $TSLA | 20 | 544,33 | 558.2 | -277.4 | 367544 | ||||||||

| 4/9/2020 | 7:14 AM | Trim 45% oil swing profit hold 5% | $CL_F | 5 | 24.07 | 27.3 | 16150 | 367822 | ||||||||

| 4/9/2020 | PRE | $VIX wknd ins adds to 30% $VXX | $VXX | 300 | 43 | 0 | https://twitter.com/SwingAlerts_CT/status/1248206283087503361 | |||||||||

| 4/9/2020 | 9:15 AM | Trim 50% Long hold 50% | $AAPL | 50 | 261.9 | 270 | 405 | 351672 | https://twitter.com/SwingAlerts_CT/status/1247880159010549765 | |||||||

| 4/8/2020 | 11:34 | Long | $KBE | 300 | 28.23 | 0 | https://twitter.com/SwingAlerts_CT/status/1247911880082980864 | https://twitter.com/SwingAlerts_CT/status/1247910820144648195 | ||||||||

| 4/8/2020 | 10:04 | Short (small) | $TSLA | 20 | 544.33 | 0 | https://twitter.com/SwingAlerts_CT/status/1247888116553142272 | https://twitter.com/SwingAlerts_CT/status/1247889336458022912 | ||||||||

| 4/8/2020 | PRE | Long | $AAPL | 100 | 261.9 | 0 | ||||||||||

| 4/7/2020 | 8:07 AM | Trim oil 50% swing profit | $CL_F | 6 | 24.07 | 24.97 | 5400 | 351267 | ||||||||

| 4/7/2020 | 15:06 | Long swing trade oil | $CL_F | 12 | 24.07 | 0 | ||||||||||

| 4/6/2020 | 1:14 PM | Trim profit on swaps 25% | $BTC | 75 | 5900 | 7147 | 1247 | 345867 | ||||||||

| 4/6/2020 | 1:14 PM | Trim Gold Long (2 @ 100) hold 4 | $GC_F | 2 | 1516.01 | 1654 | 27598 | 344620 | ||||||||

| 4/6/2020 | 1:14 PM | Trim Silver Long (2 @ 5000) hold 1 | $SI_F | 2 | 12.7 | 14.82 | 21200 | 317022 | ||||||||

| 4/6/2020 | PRE | Long | $ZM | 100 | 128.2 | 0 | ||||||||||

| 4/6/2020 | PRE | Long | $TWTR | 500 | 23.09 | 0 | ||||||||||

| 4/6/2020 | PRE | Long adds 100 hold 200 | $BABA | 100 | 187.11 | 0 | ||||||||||

| 4/6/2020 | PRE | Long adds | $STNE | 200 | 16 | 0 | ||||||||||

| 4/3/2020 | 2:23 PM | Close | $CL_F | 1 | 20.44 | 27.99 | 7550 | 295822 | ||||||||

| 4/3/2020 | 4:00 AM | Trim oil | $CL_F | 1 | 20.44 | 25.63 | 5190 | 288272 | ||||||||

| 4/2/2020 | 10:45 AM | Trim oil | $CL_F | 2 | 20.44 | 26.6 | 12320 | 283082 | ||||||||

| 4/2/2020 | 10:40 AM | Trim oil 50% of 50% approx | $CL_F | 4 | 20.44 | 26.4 | 23840 | 270762 | ||||||||

| 4/2/2020 | 1:43 AM | Trim oil trade 50% of total | $CL_F | 8 | 20.44 | 21.81 | 10960 | 246922 | ||||||||

| 4/2/2020 | 10:29 AM | Trim Silver Long (2 @ 5000) | $SI_F | 2 | 12.7 | 14.41 | 17100 | 235962 | https://twitter.com/SwingAlerts_CT/status/1245720000817659907 | https://twitter.com/SwingAlerts_CT/status/1245716238954872832 | https://twitter.com/SwingAlerts_CT/status/1245714843761606656 | |||||

| 4/2/2020 | 10:29 AM | Trim Gold Long (2 @ 100) hold 6 | $GC_F | 2 | 1516.01 | 1609 | 18598 | 218862 | https://twitter.com/SwingAlerts_CT/status/1245720000817659907 | https://twitter.com/SwingAlerts_CT/status/1245716238954872832 | https://twitter.com/SwingAlerts_CT/status/1245714843761606656 | |||||

| 4/2/2020 | 4:27 AM | Cover 25% | $APO | 75 | 34.4 | 30.87 | 264.75 | 200264 | ||||||||

| 3/31/2020 | 12:10 | Long oil swing in size | $CL_F | 16 | 20.44 | 200000 | ||||||||||

| 200000 | ||||||||||||||||

|

*The goal has been to keep the alert feed simple to allow traders (subs) to structure their own trades, sizing, instruments etc, however, we will be transitioning to a more specific detailed alerting process in 2020 (digital auto platform).

|

||||||||||||||||

|

*Run the trades, win rate avg return range you see alerted on the spreadsheet with your preferred sizing, risk tolerance, instrument type and see what your returns would be based on the swing alerts of our platform.

|

||||||||||||||||

|

*The trade alert links in spreadsheet will only open for premium subscribers (for use of reference) if you would like a tour of the feed to view the time stamped alerts contact us – the P&L represents alert feed as it was alerted.

|

||||||||||||||||

|

*Subscribers can click on alert link for details of alert and also see charting and links to live Trading View charting, structured models, etc for each set up.

|

||||||||||||||||

|

*See addendum documentation for; Volatility derivative options trading structures/strategies used for $OVX $VIX $USO $SPY $SPX Gold Silver Crude Oil Bitcoin.

|

||||||||||||||||

|

*Many trades in Volatility, Indices, Commodities, Crypto etc are structured as futures or ETF options or lev swaps that take time to detail at intraday alert level – soon trade alerts will include more detail with digital traders platform launch.

|

||||||||||||||||

|

*For these P&Ls (until strategy structures include more detail n alerts) we have kept the entries as simple as possible so traders can execute on the actionable set-up.

|

||||||||||||||||

|

*Crude oil: lead trader primarily uses a 10 bet position trading strategy on day trades and a 30+ bet system on swings (max size can vary) and EPIC V3.1.1 machine trading a fixed 30 bet system on either.

|

||||||||||||||||

|

*Swing clients know in 9/10 trade set ups when lead trade executes a position a profit trim is taken if on right side of trade and then if price returns to buy lead trader has stops there (unless otherwise noted).

|

||||||||||||||||

|

*For specific or itemized trade set-up strategies or instrument stuctures as needed for any of the trades in progress email Jen & Curt at [email protected] or clients can Whatsapp Curt direct.

|

||||||||||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Newsletter, Stocks, Commodities, Crypto, .$AAPL, $OSTK, $LUV, $BTC, $SPY, $TSLA, $BABA, $VIX, $IBB, $MA, $AXP, $LVS, $INO, $TLRY, $INTC, $APDN, $PD, $KBE, $RCUS, $GC_F, $SI_F, $CL_F, $APO, $CCJ, $CAE, $TECK, $TACO, $VXX, $BIIB, $CLVS

Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%. $SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

Swing Trade Alert Profit & Loss ROI 27.06% Feb 1 – Feb 28, 2020. $200,000.00-$254,129.00 as Alerted to Member Private Feed, Trading Room and/or Reporting. #swingtrading #tradealerts

Tickers Alerted: $SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $ADVM, $CVM, $YEXT, $FVRR, $CHGG, $HIIQ, $BTC, $SRPT, $BIIB, $NUAN, $DVA, $TEVA, $BTAI, $PAVM, $TUP, $MOD.

-

- Period Swing Trade Alert Return (ROI) = 27.06% (based on this reporting period only)

- Annualized Return (ROI) = 2962.39% (based on this reporting period only)

- ROI Calculator Link Here: https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=254129.00&investmenttime=date&investmentlength=2.5&beginbalanceday=02%2F01%2F2020&endbalanceday=02%2F28%2F2020&ctype=1&x=62&y=12

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 5, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trading Alert Profit & Loss: Mar 1-31, 2020. Monthly Gain +133,653.00. ROI 66.83%. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Alert Profit Loss – ROI 27.06% Feb 1-Feb 28, 2020. $200,000.00 – $254,129.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1S58PwD-l8HApNIfA4HiwQ-Ra4ONuTU-hWyktRi7auo0/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Shares | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link(s) | |||||||

| 2/27/2020 | POST | Cover | $MA | 200 | 322.3 | 283.34 | 7792 | 254129 | |||||||||

| 2/26/2020 | PRE | Cover | $MA | 200 | 322.3 | 288.5 | 6760 | 246337 | |||||||||

| 2/25/2020 | 12:49 PM | Cover | $MA | 50 | 322.3 | 309.23 | 653.5 | 239577 | |||||||||

| 2/25/2020 | 9:42 AM | Short | $MA | 500 | 322.3 | N/A | 0 | 238923 | https://twitter.com/SwingAlerts_CT/status/1232314876741054464 | ||||||||

| 2/25/2020 | PRE | Long | $IBB | 300 | 123 | N/A | 0 | 238923 | https://twitter.com/SwingAlerts_CT/status/1232307214175657984 | https://twitter.com/SwingAlerts_CT/status/1234710504528121857 | https://twitter.com/SwingAlerts_CT/status/1255093057634082817 | ||||||

| 2/25/2020 | PRE | Trim & Close | $HD | 15 | 225.24 | 245.91 | 310.05 | 238923 | https://twitter.com/SwingAlerts_CT/status/1232272836515041280 | https://twitter.com/SwingAlerts_CT/status/1227258254096359430 | https://twitter.com/SwingAlerts_CT/status/1225645559941197824 | ||||||

| 2/25/2020 | PRE | Close | $NIO | 400 | 1.71 | 5.1 | 1356 | 238613 | https://twitter.com/SwingAlerts_CT/status/1232264947339612160 | https://twitter.com/SwingAlerts_CT/status/1192062609429868545 | https://twitter.com/SwingAlerts_CT/status/1191653884177059843 | ||||||

| 2/24/2020 | PRE | Sell | $CHGG | 200 | 32.7 | 40.03 | 1613 | 237257 | https://twitter.com/SwingAlerts_CT/status/1231691693369516035 | https://twitter.com/SwingAlerts_CT/status/1196231524687007744 | https://twitter.com/SwingAlerts_CT/status/1196231475466768389 | https://twitter.com/SwingAlerts_CT/status/1194658534857879552 | https://twitter.com/SwingAlerts_CT/status/1192397286837497856 | ||||

| 2/23/2020 | PRE | Close hold 10% runner | $DVA | 199 | 55.89 | 84 | 5595.89 | 235644 | https://twitter.com/SwingAlerts_CT/status/1231682646226481153 | ||||||||

| 2/21/2020 | PRE | Trim to 90% | $TEVA | 1100 | 8.15 | 13.31 | 5676 | 230051 | |||||||||

| 2/21/2020 | 4:00 | Long | $PAVM | 1000 | 3.02 | NA | 0 | 224375 | |||||||||

| 2/20/2020 | POST | Trim to 90% | $FVRR | 80 | 26.05 | 35 | 716 | 224375 | |||||||||

| 2/19/2020 | 8:57 | Trim 50% | $FVRR | 100 | 26.05 | 30.75 | 470 | 223659 | |||||||||

| 2/19/2020 | PRE | Trim longs | $TWTR | 200 | 32.52 | 38.5 | 1196 | 223189 | |||||||||

| 2/18/2020 | PM | Adds to long | $TUP | 300 | 5.6 | NA | 0 | 221993 | |||||||||

| 2/18/2020 | PRE | Trim Longs | $SQ | 100 | 70.4 | 84 | 1360 | 221993 | https://twitter.com/SwingAlerts_CT/status/1229786726358507522 | ||||||||

| 2/15/2020 | 11:40 AM | TRIM LONG CHANNEL RES | $XBTUSD, $BTC | 10 | 10174 | 10380 | 2150 | 220633 | https://twitter.com/SwingAlerts_CT/status/1228404039693500419 | https://twitter.com/SwingAlerts_CT/status/1228722463971958785 | https://twitter.com/SwingAlerts_CT/status/1175008496733102089 | ||||||

| 2/13/2020 | 2:15 PM | CLOSE LONG LAST 10% | $BTAI | 100 | 7.05 | 24.3 | 1725 | 218483 | |||||||||

| 2/12/2020 | 10:12 AM | TRIM LONG RESISTANCE | $HIIQ | 200 | 18.8 | 28.8 | 2000 | 216758 | https://twitter.com/SwingAlerts_CT/status/1227793775637999621/photo/1 | https://twitter.com/SwingAlerts_CT/status/1201683744417091584 | |||||||

| 2/13/2020 | PRE | CLOSE LONG LAST 10% | $NFLX | 50 | 292.05 | 380.01 | 4398 | 214758 | |||||||||

| 1/27/2020 | PRE | CLOSE SHORT PT | $SRPT | 50 | 127 | 113 | 700 | 210360 | https://twitter.com/SwingAlerts_CT/status/1227787895102152711 | https://twitter.com/SwingAlerts_CT/status/1207540192623648769 | |||||||

| 2/12/2020 | PRE | TRIM LONG RESISTANCE | $INTC | 100 | 64.03 | 67.5 | 347 | 209660 | https://twitter.com/SwingAlerts_CT/status/1227785298559619074 | https://twitter.com/SwingAlerts_CT/status/1220707343626899456 | |||||||

| 2/12/2020 | 1:00 PM | TRIM LONG RESISTANCE | $YEXT | 300 | 17.18, 15.07 | 16.3 | 51 | 209313 | https://twitter.com/SwingAlerts_CT/status/1227440126550212611 | https://twitter.com/SwingAlerts_CT/status/1199173959327113221 | https://twitter.com/SwingAlerts_CT/status/1196222089696567297 | ||||||

| 2/12/2020 | PRE | TRIM LONG 50% 1st PT | $CVM | 600 | 9.26 | 14.55 | 3174 | 209262 | https://twitter.com/SwingAlerts_CT/status/1227438846238957568 | ||||||||

| 2/12/2020 | PRE | TRIM 90% LONG PT HIT | $UBER | 450 | 36.02 | 41.2 | 2331 | 206088 | |||||||||

| 2/11/2020 | 4:30 PM | LONG STARTER | $ADVM | 300 | 14.3 | NA | 0 | 203757 | |||||||||

| 2/11/2020 | PRE | LONG STARTER | $OSTK | 100 | 8.73 | NA | 0 | 203757 | |||||||||

| 2/10/2020 | PRE | TRIM LONG 90% | $NUAN | 300 | 17.75 | 22.5 | 1425 | 203757 | |||||||||

| 2/10/2020 | PRE | LONG STARTER | $BIIB | 30 | 335 | NA | 0 | 202332 | |||||||||

| 2/10/2020 | PRE | TRIM 90% LONG PT NEAR | $HD | 100 | 225.24 | 239 | 1376 | 202332 | |||||||||

| 2/7/2020 | PRE | TRIM LONG | $TWTR | 200 | 32.52 | 37.3 | 956 | 200956 | https://twitter.com/SwingAlerts_CT/status/1226331087598694400 | ||||||||

| 2/7/2020 | PRE | LONG STARTER | $MOD | 100 | 8.21 | NA | 0 | 200000 | |||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

Weekly Sunday Swing Trading $STUDY Webinars 7-11 PM (10 Week block 100.00, if you can’t make it to webinar videos sent to you before market open Monday).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Stocks, Commodities, Crypto, $SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $ADVM, $CVM, $YEXT, $FVRR, $CHGG, $HIIQ, $BTC, $SRPT, $BIIB, $NUAN, $DVA, $TEVA, $BTAI, $PAVM, $TUP, $MOD

Premarket Trading Watch List: $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY, Fauci and more.

Premarket Trading Watch List

Good morning Traders,

With stocks to watch and trades in play, on day trade alert side I’d like to see TL (diagonal trendline) on $OSTK break for a run. Also the overhead horizontal resistance on $AKBA for a run. We got the $IQ yesterday and first part of $OSTK and $AKBA. Check your charts sent out.

Congrats to $MARK longs, I didn’t get it but here’s your key resistance.

Your resistance mark on $MARK should be 200 MA on weekly (pink) just over 3.00 per beach side video last night #daytrading #premarket https://t.co/Xh0NxErgbn pic.twitter.com/xnpXlMEC4W

— Day Trading Alerts (@DayTrade_Alert) May 12, 2020

On swing trade alert side resistance over head near on $SPY model and $AAPL chart models. Of course we’re swing trading $AKBA and $OSTK also. Managing many others, nothing specifically yet today for new entries, after oil reports API EIA we expect more swing trade positioning / entries. $VIX and $OVX are on close watch for long starts soon-sh (see Sunday Swing Trade $STUDY Webinar video for more). There are countless plays on watch and many in play right now.

Also the $NTRA break out set-up is super interesting here, really strong yesterday – also see the weekend $STUDY videos for this and chart model sent out on Swing Trade Alert feed.

Oil trading alerts Sunday overnight and Monday were super quiet for both myself and EPIC V3.1.1, however, I expect this to change at latest after API could be sooner, for now see hourly for range trade – it’s a range trade because of the time cycle rounding the trajectory per model.

We do have Fauci speak today so go easy.

Will be in live room and will get on mic if active trade starts.

Beach Side Video from yesterday with some comments to above trading.

Beautiful day🙏🌴 $AKBA $IQ $OSTK $AAPL $MARK $$TLRY $GLD $SLV $BTC $$SPY $VIX $TSLA Trade size P&Ls Sunday Swing $STUDY

and more https://t.co/AAfsJkiPq3— Melonopoly (@curtmelonopoly) May 11, 2020

Any questions let me know!

Curt

Article Topics; premarket, stocks, commodities, watchlist, $MARK, $AKBA, $OSTK, $IQ, $NTRA, $VIX, $OVX, $CL_F, $USO, $SPY

Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

Swing Trade Alert Profit & Loss ROI 15.03% Feb 1-21, 2020. $200,000.00 – $230,051.00 as Alerted to Member Private Feed, Trading Room and/or Reporting. #swingtrading #tradealerts

Tickers Alerted: $SQ, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $UBER, $ADVM, $CVM, $YEXT, $FVRR, $HIIQ, $BTC, $SRPT, $BIIB, $NUAN, $TEVA, $BTAI, $PAVM, $TUP, $MOD.

-

- Period Swing Trade Alert Return (ROI) = 15.03% (based on this reporting period only)

- Annualized Return (ROI) = 1543.93%.

- ROI Calculator:https://www.calculator.net/roi-calculator.html?beginbalance=200000&endbalance=230051.00&investmenttime=date&investmentlength=2.5&beginbalanceday=02%2F01%2F2020&endbalanceday=02%2F21%2F2020&ctype=1&x=81&y=11

- The objective of providing a Swing Trade Alert Summary P&L is for the purpose of trader’s investigating whether our alert service is appropriate for their personal trading and also for our existing members to have a reference point of trade alert history.

- Swing trades as applicable are announced on mic live, recorded live in live trading room, alerted to private time stamped Twitter feed and emailed. Some trades are detailed further in the regular swing trade report newsletters (as part of the bundle package), in Sunday Swing Trade $STUDY Webinars or by other methods for guidance that may be sent to subscribers.

- Links are provided in the Trade Alert P&L spreadsheet below to each alert as they occurred on the member trade alert feed for member reference (must be a subscriber to alert feed service to view the links). Most of the alerts on the private member Twitter feed include charting and chart links. Over time we will also include links below in spreadsheet to other trade alert guidance provided to our traders, such as; video recordings to live trades as they occurred in the trading room (our YouTube channel), various commentary on social networks, email trade set up guidance, trading room chat guidance, newsletters, swing trade $STUDY webinars, etc..

- The Trade Alert P&L results in this series are specific only to actionable “alerted” trade set-ups to members and not all trades otherwise executed (non alerted) by our traders. It is impossible to alert every ebb and flow add and trim, the major parts of swing trade set ups are alerted and that is what is represented in the P&L reporting – the actionable parts only, that which a trader using our service can action easily and clearly.

- A historical time stamped spreadsheet of alerts is available (by request and by order from Twitter archive service),

- Results in the swing trade P&L series does not represents machine or futures trading but may reference instruments of trade on equity markets surrounding our futures trading activity when parallel trading is occurring by our traders. More detail here: https://compoundtrading.com/disclosure-disclaimer/.

- Study guides outlining each trade set-up, (how the trade was identified and traded with charting) are being made available to applicable members as time allows. For the study guide only subscription click here. As each study guide is released you will receive a copy via email. Bundle members receive the study guides as part of the bundle package.

- Our swing trade platform is available as subscription (monthly, quarterly, annually): One time 50% discount code available for a trial month for new subscribers, use code: “trial50” for a limited time at check-out.

- 1. Swing Trade Alerts. Swing Trade Alerts to Private Twitter Feed and via Email,

- 2. Swing Trade Newsletter Reports: Ongoing swing trading report articles emailed to members detailing trade set-ups and trade in play,

- 3. Swing Trade Study Guides: Swing Trade Study Guide for in-depth review of select swing trade set-ups and how we traded each set-up.

- 4. Swing Trade Bundled Package: Swing Trading Packaged Bundle Including; Alerts, Study Guides & Reporting.

- 5. Swing Trading Webinar: The next Swing Trading Webinar is Sunday July 5, 2020 7:00 PM – 11:00 PM EST. All registrants receive a video copy after the event if you cannot be in attendance live. The webinars review trade set ups for each upcoming week and as time allows each key swing trade from our P&L statements explaining how the trade set-up was identified and executed. Attendees will receive a copy of the charting used to structure the trade. Time is also allotted for attendee question and answer and trade set-up strategies attendees may need assistance with. Cost for Ten Weeks of $STUDY Webinars (40 hours of trade set-up $STUDY prep): Non members 100.00, current members 50.00. There is a 25 person room limit. To register for the live swing trade webinar event click here or to receive a video copy of the live event afterward click here.

- 6. Trade coaching is also available one on one with our lead trader via Skype, for trade coaching click here.

- We regularly reconcile trading alert profit & loss statements for review (as time allows). Check our Twitter feeds or blog for regular updates as we publish consolidated reports.Important Summary Detail:

- Current Swing Trade Alert P&L List is here (more recent dates are in progress to be released soon):

- Swing Trading Alert Profit & Loss: Mar 1-31, 2020. Monthly Gain +133,653.00. ROI 66.83%. $SQ, $BA, $VIX, $WYNN, $NKE, $BABA, $INTC, $NET, $GLD, $SLV, $BTC …

- Swing Trading Alert Profit & Loss: Feb 1-28, 2020. Monthly Gain +$54,129.00. ROI 27.06%.$SQ, $MA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $IBB, $UBER, $YEXT, $FVRR…

- Swing Trading Performance Summary (Q4 2019, Q1 2020 Interim): Return %, Gain/Loss, Win/Loss Rate, Number of Trade Alerts.

- Swing Trading Alert Profit Loss: Feb 1-21, 2020 3 Week Interim Gain +$30,051.00. ROI 15.03%. $SQ, $TEVA, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $SRPT, $UBER, $YEXT, $FVRR…

- Swing Trading Alert Profit Loss – Annualized ROI 64.45% Jan 1 – Jan 31, 2020. $200,000.00 – $208119.00. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 246.31% Dec 1 – Dec 31, 2019. $200,000.00 – $220,898.50. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 315.32% Nov 1 – Nov 30, 2019. $200,000.00 – $224,130.16. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss – Annualized ROI 62.69% October 2019. $100,000.00 – $103,970.20. #swingtrading #tradealerts

- Swing Trading Alert Profit Loss Annualized 355.22%. March 26 – June 28, 2017. $204,616.60 – $303,443.60. #swingtrading #tradealerts

- Swing Trading Alert (Short Term Trades) Profit Loss Annualized 2,437.96%. April 3 – June 28, 2017. $17,354.69 – $37,713.16 . #swingtrading #tradealerts

- Swing and Day Trading Alert Profit Loss – Annualized 957.90% Dec 26, 2016 – March 26, 2017. $100,000.00 – $180,347.88 . #swingtrading #tradealerts

Swing Trading Alert Profit Loss – ROI 15.03% Feb 1-Feb 21, 2020. $200,000.00 – $230,051.00 #swingtrading #tradealerts

Google Drive Document Link: https://docs.google.com/spreadsheets/d/1S58PwD-l8HApNIfA4HiwQ-Ra4ONuTU-hWyktRi7auo0/edit?usp=sharing

| Date | Entry (EST) | Exit (EST) | Long, Short, Close, Trim, Add | Symbol | Shares | Buying Price | Selling Price | Profit/Loss | Running P/L | Alert Link | ||||||

| 2/21/2019 | PRE | Trim to 90% | $TEVA | 1100 | 8.15 | 13.31 | 5676 | 230051 | ||||||||

| 2/21/2019 | 4:00 | Long | $PAVM | 1000 | 3.02 | NA | 0 | 224375 | ||||||||

| 2/20/2019 | POST | Trim to 90% | $FVRR | 80 | 26.05 | 35 | 716 | 224375 | ||||||||

| 2/19/2019 | 8:57 | Trim 50% | $FVRR | 100 | 26.05 | 30.75 | 470 | 223659 | ||||||||

| 2/19/2019 | PRE | Trim longs | $TWTR | 200 | 32.52 | 38.5 | 1196 | 223189 | ||||||||

| 2/18/2019 | PM | Adds to long | $TUP | 300 | 5.6 | NA | 0 | 221993 | ||||||||

| 2/18/2019 | PRE | Trim Longs | $SQ | 100 | 70.4 | 84 | 1360 | 221993 | https://twitter.com/SwingAlerts_CT/status/1229786726358507522 | |||||||

| 2/15/2020 | 11:40 AM | TRIM LONG CHANNEL RES | $XBTUSD, $BTC | 10 | 10174 | 10380 | 2150 | 220633 | https://twitter.com/SwingAlerts_CT/status/1228404039693500419 | https://twitter.com/SwingAlerts_CT/status/1228722463971958785 | https://twitter.com/SwingAlerts_CT/status/1175008496733102089 | |||||

| 2/13/2020 | 2:15 PM | CLOSE LONG LAST 10% | $BTAI | 100 | 7.05 | 24.3 | 1725 | 218483 | ||||||||

| 2/12/2020 | 10:12 AM | TRIM LONG RESISTANCE | $HIIQ | 200 | 18.8 | 28.8 | 2000 | 216758 | https://twitter.com/SwingAlerts_CT/status/1227793775637999621/photo/1 | https://twitter.com/SwingAlerts_CT/status/1201683744417091584 | ||||||

| 2/13/2020 | PRE | CLOSE LONG LAST 10% | $NFLX | 50 | 292.05 | 380.01 | 4398 | 214758 | ||||||||

| 1/27/2020 | PRE | CLOSE SHORT PT | $SRPT | 50 | 127 | 113 | 700 | 210360 | https://twitter.com/SwingAlerts_CT/status/1227787895102152711 | https://twitter.com/SwingAlerts_CT/status/1207540192623648769 | ||||||

| 2/12/2020 | PRE | TRIM LONG RESISTANCE | $INTC | 100 | 64.03 | 67.5 | 347 | 209660 | https://twitter.com/SwingAlerts_CT/status/1227785298559619074 | https://twitter.com/SwingAlerts_CT/status/1220707343626899456 | ||||||

| 2/12/2020 | 1:00 PM | TRIM LONG RESISTANCE | $YEXT | 300 | 17.18, 15.07 | 16.3 | 51 | 209313 | https://twitter.com/SwingAlerts_CT/status/1227440126550212611 | https://twitter.com/SwingAlerts_CT/status/1199173959327113221 | https://twitter.com/SwingAlerts_CT/status/1196222089696567297 | |||||

| 2/12/2020 | PRE | TRIM LONG 50% 1st PT | $CVM | 600 | 9.26 | 14.55 | 3174 | 209262 | https://twitter.com/SwingAlerts_CT/status/1227438846238957568 | |||||||

| 2/12/2020 | PRE | TRIM 90% LONG PT HIT | $UBER | 450 | 36.02 | 41.2 | 2331 | 206088 | ||||||||

| 2/11/2020 | 4:30 PM | LONG STARTER | $ADVM | 300 | 14.3 | NA | 0 | 203757 | ||||||||

| 2/11/2020 | PRE | LONG STARTER | $OSTK | 100 | 8.73 | NA | 0 | 203757 | ||||||||

| 2/10/2020 | PRE | TRIM LONG 90% | $NUAN | 300 | 17.75 | 22.5 | 1425 | 203757 | ||||||||

| 2/10/2020 | PRE | LONG STARTER | $BIIB | 30 | 335 | NA | 0 | 202332 | ||||||||

| 2/10/2020 | PRE | TRIM 90% LONG PT NEAR | $HD | 100 | 225.24 | 239 | 1376 | 202332 | ||||||||

| 2/7/2020 | PRE | TRIM LONG | $TWTR | 200 | 32.52 | 37.3 | 956 | 200956 | https://twitter.com/SwingAlerts_CT/status/1226331087598694400 | |||||||

| 2/7/2020 | PRE | LONG STARTER | $MOD | 100 | 8.21 | NA | 0 | 200000 | ||||||||

If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter, Live Swing Trade Alerts, Study Guides).

Swing Trading Newsletter (Weekly Newsletter Published for Traders – Trade Set-Ups / Watch List).

Real-Time Swing Trading Alerts (Private Member Twitter Feed and by way of Email).

Swing Trading Study Guide Newsletters (After Trade In-Depth Reviews Including Set-Up Identification, Trading Plan, Sizing, Risk Management, ROI and more).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Profit Loss, Trade, Alerts, Stocks, Commodities, Crypto, $SQ, $NIO, $TWTR, $NFLX, $INTC, $OSTK, $HD, $UBER, $ADVM, $CVM, $YEXT, $FVRR, $HIIQ, $BTC, $SRPT, $BIIB, $NUAN, $TEVA, $BTAI, $PAVM, $TUP, $MOD

Swing Trade Set-Ups (Earnings) Part 5 : $OSTK, $WMT, $TEUM, $MRO, $ARWR, $AU, $TEUM #swingtrading #ER

Swing Trading Strategies, Alerts, Charts, News. August 12, 2019…

Below are Swing Trade Set-Ups Currently On Watch $OSTK, $WMT, $TEUM, $MRO, $ARWR, $AU, $TEUM.

Earnings Season Swing Trade Positions Reporting Special Notes:

Per recent;

July 31 – We entered a new swing trade yesterday in TESLA that is doing excellent, closed the AMD swing trade prior to earnings which was a great call because it lost a lot of value after earnings were posted after market, are trading the Crude Oil move that seen a huge gain after the swing trade alert was issued and today we look at National Oilwell Varco, Trex and Chegg after they had larger than normal earnings price moves.

We’re also working on time cycle trades for SPY, VIX, Gold, Silver, DXY, BTC and more than we will report on soon.

Per recent;

July 22 – Below are some equities in focus this week with earnings, the follow- up reports on deck deal with other earnings focus equities and time cycles for the indices and specific instruments we focus on (GOLD, SILVER, VIX, SPY, OIL, US DOLLAR, BITCOIN).

Per recent;

Over the coming days we will be re-visiting all recent swing trade set-ups, alerts and trades in progress to reconcile the trades in advance of earnings and prepare for the new on other side of each new set up from earnings reports. This will involve a significant number of posts, trade alerts, mid day reviews in the trading room and videos that our members will receive a copy of.

Executing your swing trading strategy with our charting reports and live alerts involves using the key support and resistance areas of the charting, time cycle peaks, trajectory of trade and conventional indicators such as MACD cross-over and Moving Averages.

Alerts are not always issued at each add or trim to positions because that is simply not possible so you do have to manage your trade.

In many instances a clear swing trade strategy is laid out in the newsletter and/or videos so that you can manage the swing trade according to your risk threshold and account size.

If you struggle to establish a trading strategy with the information provided on our reporting, videos and alerts then some trade coaching is recommended to get you started.

Part 5 Earnings Swing Trades:

#earnings for week

$NVDA $BABA $WMT $CSCO $JD $CGC $GOLD $SYY $AMAT $TLRY $M $GOOS $JCP $AAP $EOLS $TSG $STNE $AZRE $LK $TME $ERJ $CSIQ $YY $HUYA $NINE $DE $TDW $CRNT $HYGS $QD $TPR $BRC $BEST $PAGS $VFF $NTAP $RMBL $CACI $BE $CWCO $NEPT $A #swingtrading

#earnings for week$NVDA $BABA $WMT $CSCO $JD $CGC $GOLD $SYY $AMAT $TLRY $M $GOOS $JCP $AAP $EOLS $TSG $STNE $AZRE $LK $TME $ERJ $CSIQ $YY $HUYA $NINE $DE $TDW $CRNT $HYGS $QD $TPR $BRC $BEST $PAGS $VFF $NTAP $RMBL $CACI $BE $CWCO $NEPT $A #swingtrading https://t.co/4Zv7Jukrqo

— Swing Trading (@swingtrading_ct) August 12, 2019

OVERSTOCK (OSTK)

OVERSTOCK (OSTK) Long in premarket post ER for a possible 50% + trade, watch further model reports soon. #swingtrade $OSTK #tradealert

Why Overstock.com’s Stock Jumped 17% Today https://finance.yahoo.com/news/why-overstock-com-apos-stock-171100193.html?soc_src=social-sh&soc_trk=tw

WALLMART (WMT)

WALLMART (WMT) Likes to trade the channels on this model, after earnings it should be a channel trade in the model either way, on watch $WMT #ER

Walmart, Alibaba and some big-name pot companies keep earnings season rolling #swingtrading #ER $WMT $BABA https://on.mktw.net/2Mggc0v https://twitter.com/swingtrading_ct/status/1160861625760583681

Marathon Oil Corporation (MRO)

Swing Trading Alerts

@SwingAlerts_CT

Swing entry starter long in $MRO did trigger in 12.80s, set up will be on weekend report..

9:28 AM · Aug 9, 2019 https://twitter.com/SwingAlerts_CT/status/1159818732329414657

Marathon Oil’s Drilling Machine Delivers Another Profit Gusher in Q2 #swingtrading $MRO

Marathon Oil's Drilling Machine Delivers Another Profit Gusher in Q2 #swingtrading $MRO https://t.co/8TgfJ0zCHu

— Swing Trading (@swingtrading_ct) August 9, 2019

Marathon Oil Risk Reward for this Swing Trade is Very High. The Set-Up is Good at Support, Lets See How a Starter Works Out #swingtrading $MRO

A simple swing trade strategy here; trade is near multi area supports with good earnings season sentiment, risk-reward is significantly in favor of bulls, if it fails exit the trade early and re-enter later. Remember, you can always re-enter.

Arrow Pharmaceuticals (ARWR)

Swing Trading Alerts

@SwingAlerts_CT

Arrow Pharmaceuticals (ARWR) Another double return swing, start trims in to 30.00. Nice trade from 15s. Let a bit run. $ARWR #swingtrading

https://twitter.com/SwingAlerts_CT/status/1159653769744920576

Looking For Growth? Take A Look At These Biotechnology Stocks #swingtrading $ARWR (link: https://www.investors.com/news/technology/biotech-stocks-best-biotech-companies-to-invest-in/) investors.com/news/technolog… vi

Looking For Growth? Take A Look At These Biotechnology Stocks #swingtrading $ARWR https://t.co/Oci9VUsUsp vi

— Swing Trading (@swingtrading_ct) August 9, 2019

Arrow Pharmaceuticals (ARWR) was a great swing trading, however, let it come down to channel support now before re entering long $ARWR #swingtrade

Swing Trading Alerts

@SwingAlerts_CT

AngloGold Ashanti (AU) Near double, if you haven’t already in to time cycle peak, time to take some profits add longs mid way to Oct 21 cycle #swingtrading #Gold $AU

https://twitter.com/SwingAlerts_CT/status/1159469811396685824

Curtis Melonopoly

@curtmelonopoly

While Gold $GLD $XAUUSD $GC_F did get some range for the bulls, we hammered down long on AngloGold Ashanti (AU) $AU for near a double #swingtrading #Gold

While Gold $GLD $XAUUSD $GC_F did get some range for the bulls, we hammered down long on AngloGold Ashanti (AU) $AU for near a double #swingtrading #Gold

— Melonopoly (@curtmelonopoly) August 8, 2019

AngloGold Ashanti (AU) Near double, if you haven’t already in to time cycle peak, time to take some profits add longs nearing Oct 21 time cycle in Gold #swingtrading #Gold $AU

PARTEUM CORP (TEUM)

Swing Trading Alerts

@SwingAlerts_CT

PARTEUM CORP (TEUM) trading 3.60 from 2.60 trade alert, considering ER it’s time to take profit along the way $TEUM #swingtrade #earnings

https://twitter.com/SwingAlerts_CT/status/1158321103418351616

Pareteum Joins Russell 3000 Index https://finance.yahoo.com/news/pareteum-joins-russell-3000-index-100000783.html?soc_src=social-sh&soc_trk=tw

Pareteum Announces Second-Quarter 2019 Financial Results https://finance.yahoo.com/news/pareteum-announces-second-quarter-2019-200500905.html?.tsrc=rss

PARTEUM CORP (TEUM) the trade alert to exit at 3.60 from 2.60 trade alert buys worked, now watch for channel support buys $TEUM #swingtrade #earnings

And finally, be sure to watch our trade alerts on our alert feeds and in live trading room. If you need some trade coaching go to our website and register for a minimum 3 hours.

Email me as needed [email protected].

Thanks,

Curt

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Master Trading Profit & Loss Statement (Most Recent – Updated Regularly – Check Blog for Updates):

Recent Daily Trading Profit & Loss Reports:

Trading Profit & Loss Report (Trades, Alerts) for July 8 $AMD, $BTC, $XBT_F, $CL_F, $USO

Trading Profit & Loss Report (Trades, Alerts) for July 3 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Daily Trading Profit & Loss (Alerts) Report: July 2, 2019 $AMD, $BTC, $XBT_F, $WTI, $CL_F, $USO

Recent Swing Trade and Day Trading Reports (charts can be brought down to Day Trading time frame):

Recent Premarket Notes (published as time allows, what we’re up to with our trading):

Premarket Notes July 31, 2019: FOMC, EIA, #OOTT, $USO, $NOV, $TREX, $CHEGG, $TSLA, $AMD …

Company News:

Oil Machine Trade Software Development Update – v4 vs v3.

SOVORON™ Selects Compound Trading Group Machine Learning Data | Media Release

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow:

Article Topics; Swing Trading, Set Ups, Strategies, Alert, Signals, Earnings, $OSTK, $WMT, $TEUM, $MRO, $ARWR, $AU, $TEUM

PreMarket Trading Plan Fri Aug 10: Semiconductors, Earnings, Tariffs, $MDLY, $AWX, $TTD, $OSTK, $ROKU, $TSLA, $FB, $GOOGL, OIL more.

Compound Trading Premarket Trading Plan & Watch List Friday Aug 10, 2018.

In this edition: Semiconductors, Earnings, Tariffs, $MDLY, $AWX, $TTD, $OSTK, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD and more.

Welcome to the morning Wall Street trading day session at Compound Trading.

Notices:

Notes in red text in this report are more recently important.

Scheduled Events:

- Friday Aug 10 – Live Trading Room with lead trader and/or other team members as follows and as available (constant change in the markets);

- 9:25 Market Open – access limited to live trading room members

- 12:00 Mid Day Trade Review – access limited to live trading room members

- Any other live trading sessions will be notified by email.

- The above listed times are expected live trading time blocks only. Live voice broadcast will only occur if there is a trade set-up to discuss by the lead trader. Screen sharing will be active through-out each time frame.

- Link: https://compoundtrading1.clickmeeting.com/livetrading

- Password: **** (email for access if you do not have it, password changes will be emailed when changed only)

- For membership access, options here: https://compoundtrading.com/overview-features/

- July 23-Aug 14 – Swing trading reports to include video chart analysis recaps for the 100 equities we cover (from mid day swing trading reviews) and sent to our subscribers daily in lieu of the weekly swing trading report (mailing list subscribers receive a delayed complimentary version without algorithmic real-time charting and with or without charts).

- Mid/Late Aug – New pricing published representing next generation algorithm models (existing members no change).

- July 31-Aug 14 – Next generation algorithm models roll out in to August 14, 2018 (machine trading Gen 1).

- Before Sept 1 – Trading Profit and Loss Published for Q1 and Q2 2018 (a report detailing trading / alert performance of our team).

- Aug 25-26, Santo Domingo – Oil Algorithm (EPIC) Multi-User License Trade Execution & Integration (private invitational, institutional).

- Sept 14-16, Cabarete – Trade Coaching Event – Learn How to Trade or Take Your Trading to the Next Level (public, retail).

Machine Trading Coding Team Mandate: In current development and roll-out (1) Intelligent Assisted #IA Trading Platform (Code Algorithm Models), (2) Run 24 Hour Crypto Trading Desk, (3) Alert Trade Set-ups to Member Alert Feeds (for all models) and near future (4) Machine Learning.

Premarket Report: On lead trader availability basis only (the premarket reports are not published every market day).

Promos:

Promo Discounts End Aug 14 (for new members only).

Weekly Swing Trading Newsletter service Reg 119.00. Promo 83.30 (30% off). Promo Code “30P”. #swingtrading

Swing Trading Alerts Reg 99.00. Promo 69.37 (30% off). Promo Code “Deal30”. #swingtradealerts

https://twitter.com/CompoundTrading/status/1025205887034699776

Private Member Discord Server Chat Rooms: BE SURE to get in to each private Discord server specific to your specific subscription type (bundles) – many of the updates as we go forward will be posted in there and detailed trading plans for alerted trades are often discussed by our lead trader in the rooms. This includes the SWING TRADING platform also. IF YOU NEED A LINK / INVITE email us.

https://twitter.com/CompoundTrading/status/880670140454637569

Real-time Trade Alerts:

Real-time Trade Alerts for Oil, Swing Trading, Day Trading, Bitcoin are available to subscribers by following specific alert Twitter feeds. Oil Trading Alerts, Swing Trading Alerts, Day Trading Alerts, Bitcoin Trading Alerts.

Disclaimer / Disclosure:

Subscribers must read disclaimer.

Recent Blog / Video / Social Posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Some Recent Chart / Trade Set-Up Reports:

See You Tube, member email direct reports and blog for other recent videos or blog posts. Listed from most recent. Much of the premium member reporting posted below is delayed and may or may not require password.

Earnings Season Charting July 24 $RIOT, $CELG, $ARWR, $EXTR, $EDIT, $SOHU, $ESPR, $LPSN, $XOMA …

Swing Trading Special Report $CELG, $RIOT, $ARWR, $EXTR, $EDIT, $MBRX, $SOHU, $ESPR, $LPSN, $XOMA.

Swing Trading Special Report $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

Swing Trading Set-ups Special Report; $VIX, $DXY, $SPY, $DIS, $RCL, $RKDA, $SQ, $HEAR, $TGTX, $SMIT

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

How to Swing Trade Like the Pros and Win Most Trades.

Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN

Protected: Trading Apple’s Stock Move (Member Exclusive) $AAPL #swingtrading

Recent Educational Articles / Videos:

I get a lot of Q’s on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

I get a lot of Q's on How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://t.co/oqezvVcn0y … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

— Melonopoly (@curtmelonopoly) May 13, 2018

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

In Play: $HAIR, $TUR, $RDFN, $AWX, $NEO, $DB, $TVIX, $DGAZ High Uncertainty: $INTC, $BRK.B, $AMZN

Market Observation:

Markets as of 8:02 AM: US Dollar $DXY trading 96.07, Oil FX $USOIL ($WTI) trading 67.26, Gold $GLD trading 1212.90, Silver $SLV trading 15.35, $SPY 283.84, Bitcoin $BTC.X $BTCUSD $XBTUSD 6518.00 and $VIX trading 12.1.

Momentum Stocks / GAPS to Watch:

Overstock and The Trade Desk are both trading higher by more than 20% in Friday’s pre-market session. https://benzinga.com/z/12182530 $MDLY $AWX $TTD $OSTK $PBYI $OLED $RDFN $CORT $ELGX $RUN $DBX $XON $MCHP

News:

Your Friday morning Speed Read:

– Stock futures ⬇ on concerns over Turkey’s economic woes $SPY $TUR

– #Trump task force 2day advises on changing Postal Service rates, watch $FDX $UPS $STMP $AMZN

– Citigroup cuts Booking Holdings (formerly Priceline) to Neutral $BKNG

Your Friday morning Speed Read:

– Stock futures ⬇️ on concerns over Turkey's economic woes $SPY $TUR

– #Trump task force 2day advises on changing Postal Service rates, watch $FDX $UPS $STMP $AMZN

– Citigroup cuts Booking Holdings (formerly Priceline) to Neutral $BKNG— Benzinga (@Benzinga) August 10, 2018

Recent SEC Filings:

Recent IPO’s:

Earnings:

#earnings for the week

$SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TA

#earnings for the week $SNAP $ROKU $HEAR $DIS $DBX $CVS $TSN $TWLO $TRXC $WTW $ETSY $CAH $WB $BKNG $AAOI $NWL $LONE $OLED $SRE $JEC $BCC $SRPT $MTCH $AAXN $TEUM $SEAS $TTD $GWPH $DNR $BHC $NKTR $GOOS $ICHR $KORS $CTL $HTZ $MELI $CTB $PLUG $DDD $MAR $TAhttps://t.co/r57QUKKDXL https://t.co/7T3vSl6F34

— Melonopoly (@curtmelonopoly) August 5, 2018

Trade Set-up Alerts, Charts & Reports. Recent / Current Holds, Open and Closed Trades:

Please refer to the date at top left of each chart (charts are often carried forward for sometime).

Good start for a Friday. EPIC the Oil Algorithm – Recorded, time stamped, live alerts. FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading

Good start for a Friday. EPIC the Oil Algorithm – Recorded, time stamped, live alerts. FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading pic.twitter.com/RHWh9I0Pd4

— Melonopoly (@curtmelonopoly) August 10, 2018

Earning my keep with EPIC the Oil Algorithm – still on personal 100% win side for months, ask for a tour of recorded, time stamped, live alerts (a tech had two losses in that time). FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading

Earning my keep with EPIC the Oil Algorithm – still on personal 100% win side for months, ask for a tour of recorded, time stamped, live alerts (a tech had two losses in that time). FX $USOIL $WTI $CL_F $USO #oil #oiltradingalerts #algorithm #OOTT #Machinetrading pic.twitter.com/mfmhip2r0r

— Melonopoly (@curtmelonopoly) August 9, 2018

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

PS Dollar trading HOD $DXY 95.47 and if 95,61 breached held it will rip some faces off.

— Melonopoly (@curtmelonopoly) August 9, 2018

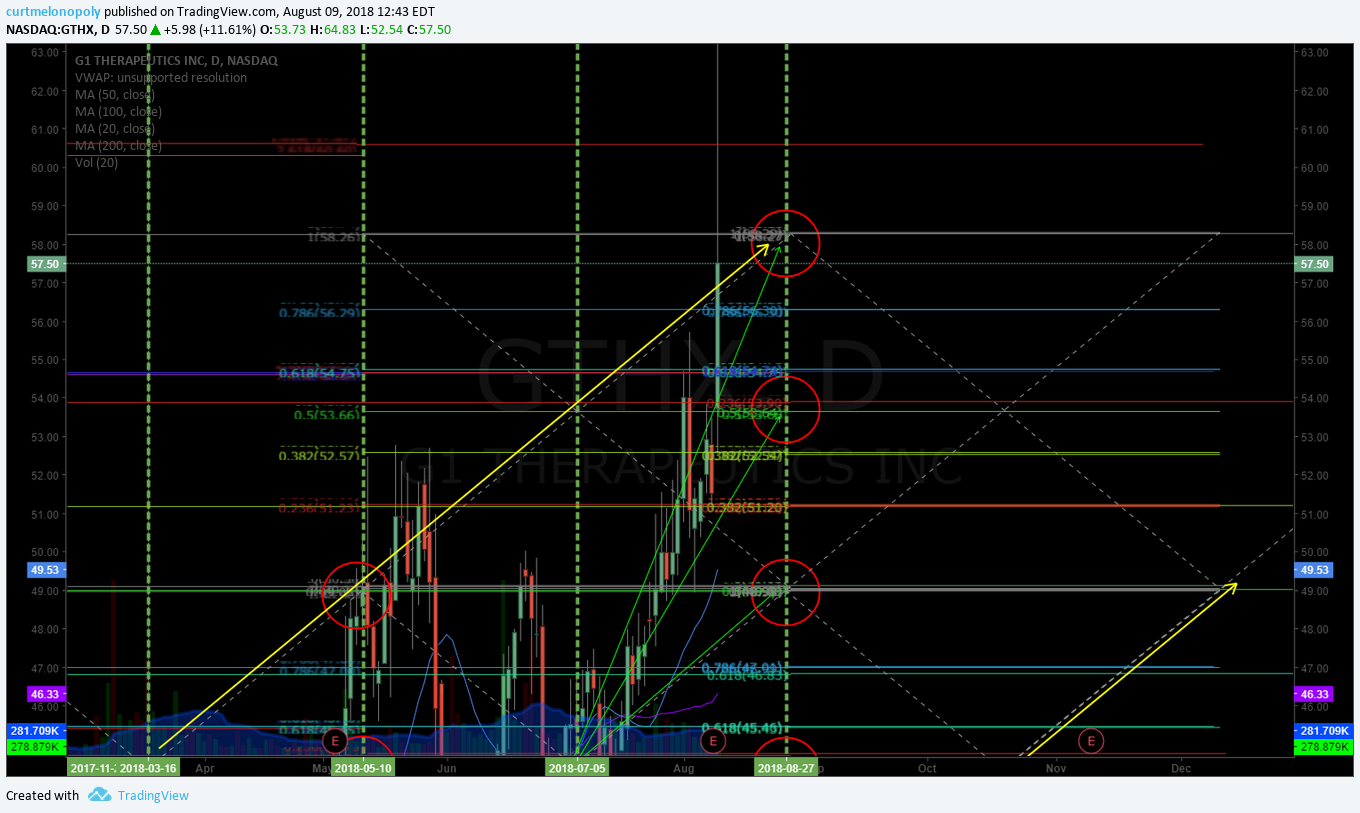

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading

One of our best swing trades of the year by far…. blew through our most bullish target today and then some and more and more some. $GTHX #swingtrading pic.twitter.com/Y9MBk0hE7F

— Melonopoly (@curtmelonopoly) August 9, 2018

ROKU (ROKU) hit the chart model resistance perfect and came off today $ROKU #daytrading

G1 THERAPEUTICS (GTHX) What a fantastic swing trade. Blew through our most bullish price target today. $GTHX #swingtrade #chart

SP500 (SPY) Chart continues trend with MACD flat on high side about to test previous highs. $SPY $ES_F $SPXL $SPXS

Gold on 50 percent retrace, MACD may cross up here. Aug 9 1243 AM #Gold $GLD $GC_F $XAUUSD $UGLD $DGLD #chart

Oil Monthly Chart. Oil has a bounce at 50 MA with MACD pinch possible cross up . Aug 7 551 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL #chart https://www.tradingview.com/chart/USOIL/O13OzkXH-Oil-Monthly-Chart-Oil-has-a-bouonce-at-50-MA-with-MACD-pinch/ …

https://twitter.com/EPICtheAlgo/status/1026768811356286976

It bounced and hasn’t looked back. #swingtrading $AAOI

It bounced and hasn't looked back. #swingtrading $AAOI https://t.co/vhSzw9TK58

— Melonopoly (@curtmelonopoly) August 8, 2018

$TSLA Swing target price hit. #swingtrading

$TSLA Swing target price hit. #swingtrading https://t.co/AoyhwOjYkz

— Melonopoly (@curtmelonopoly) August 8, 2018

The TESLA swing trading report from previous $TSLA #swingtrading #towin

The TESLA swing trading report from previous $TSLA #swingtrading #towin https://t.co/zXi67L3O60

— Melonopoly (@curtmelonopoly) August 8, 2018

FACEBOOK (FB) Closed 177.78 Friday with 181.80 trajectory price target Aug 8 then 195.00 Aug 27. $FB #swingtrade #chart

Health Innovations (HIIQ) ripped through the chart structure in a fantastic way. Careful above channel resistance. $HIIQ chart. #swingtrade

ALPHABET (GOOGL) Daytrading chart with lower time frame support and resistance levels for daytraders. $GOOGL #daytrading #chart

$BTC 8300’s to 6900’s…. always know where that 200MA is. #Bitcoin #premarket #crypto

$BTC 8300's to 6900's…. always know where that 200MA is. #Bitcoin #premarket #crypto pic.twitter.com/HneG44UaSs

— Melonopoly (@curtmelonopoly) August 6, 2018

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm

US Dollar Index (DXY) Pinch in play for the dollar, expect a move near term. $DXY #Chart #USD #Algorithm pic.twitter.com/mrwq8KDiNB

— $DXY US Dollar Algo (@dxyusd_index) August 3, 2018

Oil trade alert to start the week 68.61 long, 68.85 closed. Win rate high 90% – ask for a tour. Time stamped, recorded, live alerts. EPIC Oil Algorithm $USOIL $WTI $CL_F #OilTradeAlerts $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/1026287786113081344

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts

Health Innovations (HIIQ) swing trade. Look at that trajectory. Fantastic structured move. $HIIQ. #swingtrade #earnings #trade #alerts pic.twitter.com/MdiUn2HB5U

— Swing Trading (@swingtrading_ct) August 2, 2018

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY $ES_F $SPXL $SPXS #SPY #SwingTrading #Chart

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

FACEBOOK (FB) Trim longs in to 174.50 main resistance add above trading 174.01 intra 167.50 support 181.50 next resistance. $FB #tradealerts

Oil Chart (Monthly). Trade still working the range between 100 MA and 200 MA on monthly. July 23 1219 AM FX $USOIL $WTI $USO $UWT $DWT $CL_F #OIL

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nove 30 bearish 102.57 $IBB #swingtrading

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo

100% personal alerted oil trade win rate documented, recorded, alerted real time to feed continues for months (we did have one loss alert by a tech a few weeks back). EPIC the Oil Algorithm FX $USOIL $WTI $USO $UWT $DWT #OIl #OOTT #Trading @EPICtheAlgo pic.twitter.com/pKL1iKE5T1

— Melonopoly (@curtmelonopoly) July 25, 2018

The $RIOT daytrade from yesterday went well: 7.30s – 8.40s nice mover and returns.

Working well #daytrading #towin $RIOT #blockchain pic.twitter.com/CyaVAM35UB

— Melonopoly (@curtmelonopoly) July 24, 2018

Arrow Pharmaceuticals (ARWR) Over mid quad resistance. Long side bullish bias. $ARWR #swingtrading #earnings

EDITAS MEDICINE (EDIT) Keeps hitting mid channel targets on chart testing 200 MA $EDIT #pricetargets #chart

SILVER likely to get a bounce at pivot area to test underside of diagonal trend line #onwatch

Market Outlook, Market News and Social Bits From Around the Internet:

Stock Futures Lower, Chips Hit Again As Goldman Downgrades Intel http://dlvr.it/QfRXhs

Stock Futures Lower, Chips Hit Again As Goldman Downgrades Intel https://t.co/AxsCefCtzc pic.twitter.com/FDDUJEePFO

— Investors.com (@IBDinvestors) August 10, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect the math (they have taken me from a 60% hit rate to 80%+ all publicly posted live trade alerts).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $AWX $MDLY $TTD $OSTK $PVG $PBYI $OLED $MCC $MNGA $TVIX $UVXY $PLNT $WPRT

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWT, $DWT, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY), $BTCUSD Bitcoin.

(5) Recent Upgrades:

(6) Recent Downgrades:

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Semiconductors, Earnings, Tariffs, $MDLY, $AWX, $TTD, $OSTK, $ROKU, $YELP, $TSLA, $FB, $GOOGL, OIL, GOLD

PreMarket Trading Plan Wed Jan 31 EIA, OIL, $VIX, $XIV, $AMZN, $SFLY, $GSUM, $OSTK, $BA, $MBOT, $WKHS, $ROKU, $GSUM, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST

Compound Trading Chat Room Stock Trading Plan and Watch List Wednesday Jan 31, 2018 EIA, OIL, $VIX, $XIV, $AMZN, $SFLY, $GSUM, $OSTK, $BA, $MBOT, $WKHS, $ROKU, $GSUM, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST – Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY $DXY, S&P 500, Volatility … more.