Trade Set Ups for Swing Trading Tuesday February 26, 2019.

Swing Trading Signals in this Report: $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL and more. .

Email us at [email protected] anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Investing.com Earnings Calendar: https://www.investing.com/earnings-calendar/

Earnings Whispers #earnings for the Week:

#earnings for the week

$SQ $HD $CHK $ETSY $JD $M $MDR $PCG $FIT $AMRN $LOW $JCP $WTW $KOS $PANW $BKNG $ABB $BBY $SPLK $VEEV $AZO $TEX $TRXC $SHAK $NTNX $ECA $JT $WDAY $CRI $DNR $TNDM $AWI $DORM $GWPH $HTZ $TREE $PLAN $NSA $ICPT $FLXN $BNS $CROX $RRC

Earnings Season Special Reports Thus Far:

Feb 14 – Protected: Swing Trade | Current Positions $GOOGL, $NKE, $ARWR, $XOM, Oil, Gold, Bitcoin, NatGas …

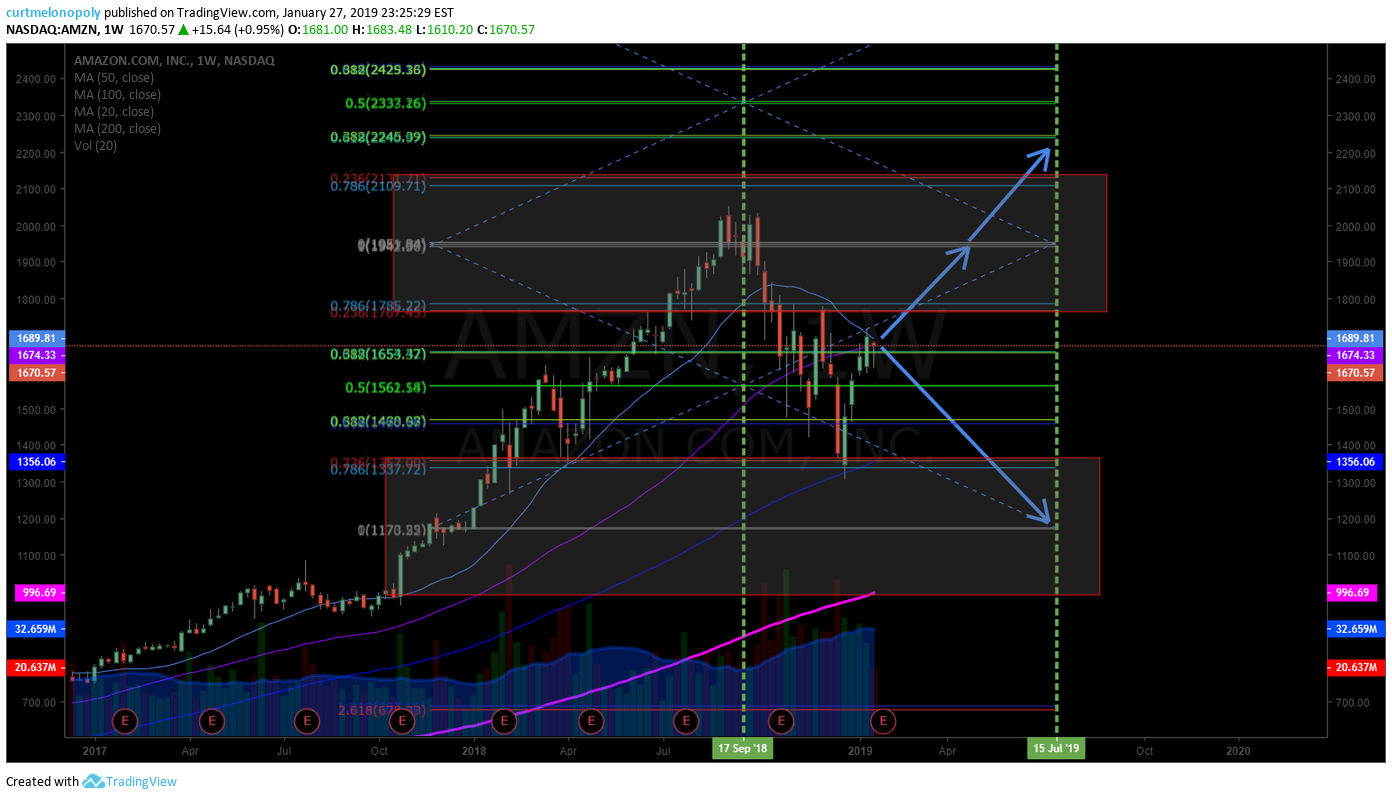

Jan 29 – Protected: Swing Trading. Earnings. Video. $AMZN, $AMD, $TSLA, $FB, $NFLX, $MSFT, $AAPL, $DAL, $BAC, $C…

Jan 28 – Protected: Swing Trading: Earnings Special Report | $AMZN, $MSFT, $FB, $BABA, $TSLA

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Up VIDEO:

#Swingtrading

A Review of Current Swing Trades in First Section Below and Then Other Swing Trade Set Ups I Am Watching for Entries Reviewed Below:

GOLD (GC_F, XAUUSD, GLD) trading 1326.00, entry 1319.78 short 1/20 starter size per previous reporting (starter) looking for a pull-back at resistance levels on chart reviewed on video.

NIKE (NKE) is a break out swing trade play, trading 85.64 I am long 84.84. 99.65 first target then 91.39, 93.31, 101.35 for ultimate target. See chart.

ARROWHEAD (ARWR) swing trade is going well, looking for 27.59 early April 31.34 range after that for a double. Will add at channel support.

GOOGLE (GOOGL) starter position long 1135.00, trading 1117.32, 1158.00 first target then 1214.17 then 1317.72.

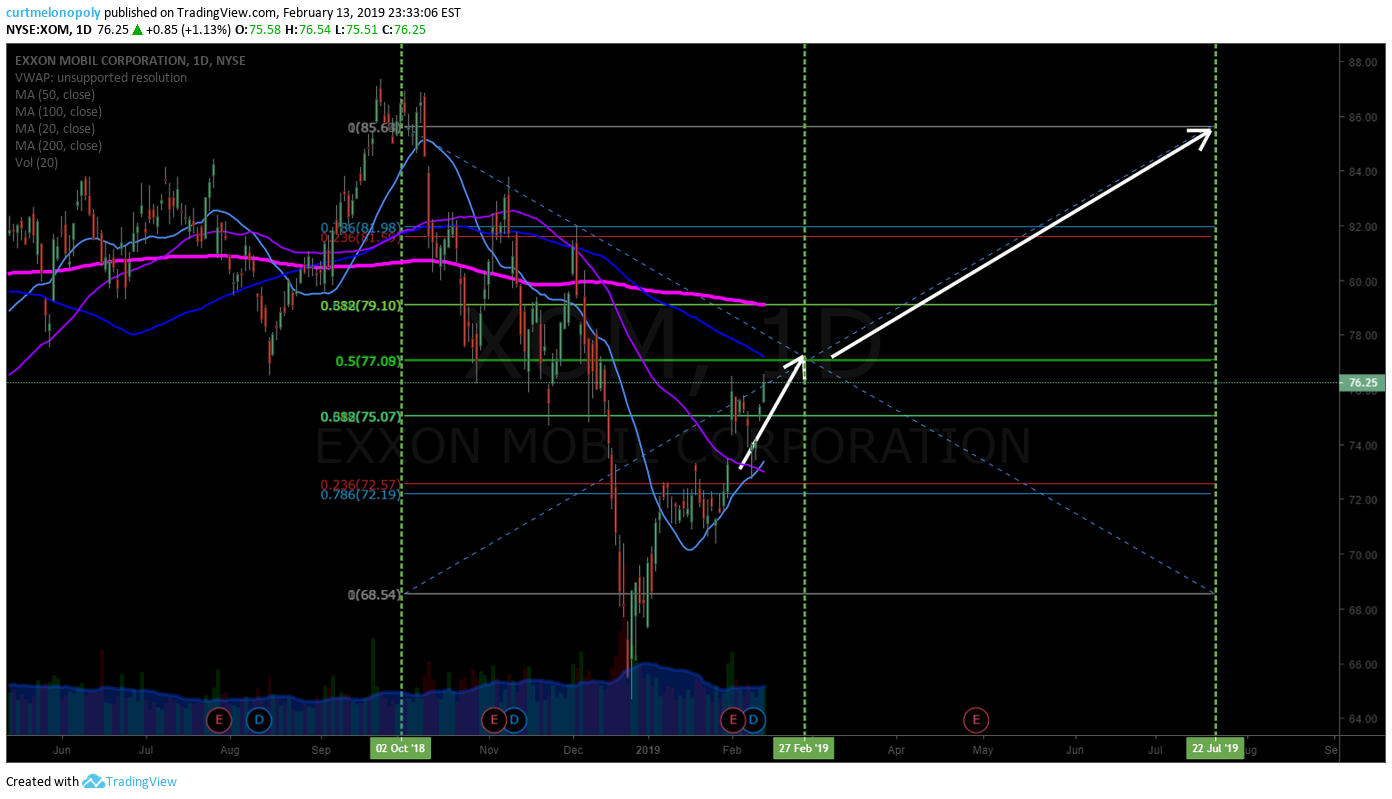

EXXON (XOM) Earnings play going well. Looking for a price target 85.61 area. Trim in to each resistance, add above or at pull backs.

SHORT OIL (DWT) Still in small starter, Trump tweet helps me a bit get more onside than I was.

RETAIL ETF (XRT) Trading 45.43. Price over 100 with 20 MA underneath. Looking for 47.48 upside at 200 MA.

STRYKER (SYK) Break out trade set-up, extension over trade break out is what I am watching. Trading 188.31 with price extension to 192.84 then a retrace – likely scenario.

NVIDIA (NVDA) Price target 208.00 ish possible. First price target 100 MA, 2nd traget 186.85, 188.81 is the third price target. 168.25 HOD and looking at a possible long over that. Video explains set-up in more detail.

APPLE (AAPL) 181.66 is price target and 191.60 range is 200 MA as a possible price target above, trading 174.33 intra day, looking at it long – not the best trade set up of the bunch.

JOHNSON JOHNSON (JNJ) Price against a pivot on daily, over 138.00 is interesting for full extension, will re look at it at 138.00. Might be too late on this one. Was going to take trade a number of times and didn’t.

FINISAR (FNSR) Daily chart, another pivot play with full price extension up possible, over 25.37 I’m interested long for a price extension play long.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Swing, Trading, Stocks, Earnings, $XRT, $SYK, $NVDA, $JNJ, $FNSR, $AAPL, $GOOGL, $XOM, $NKE, GOLD, OIL