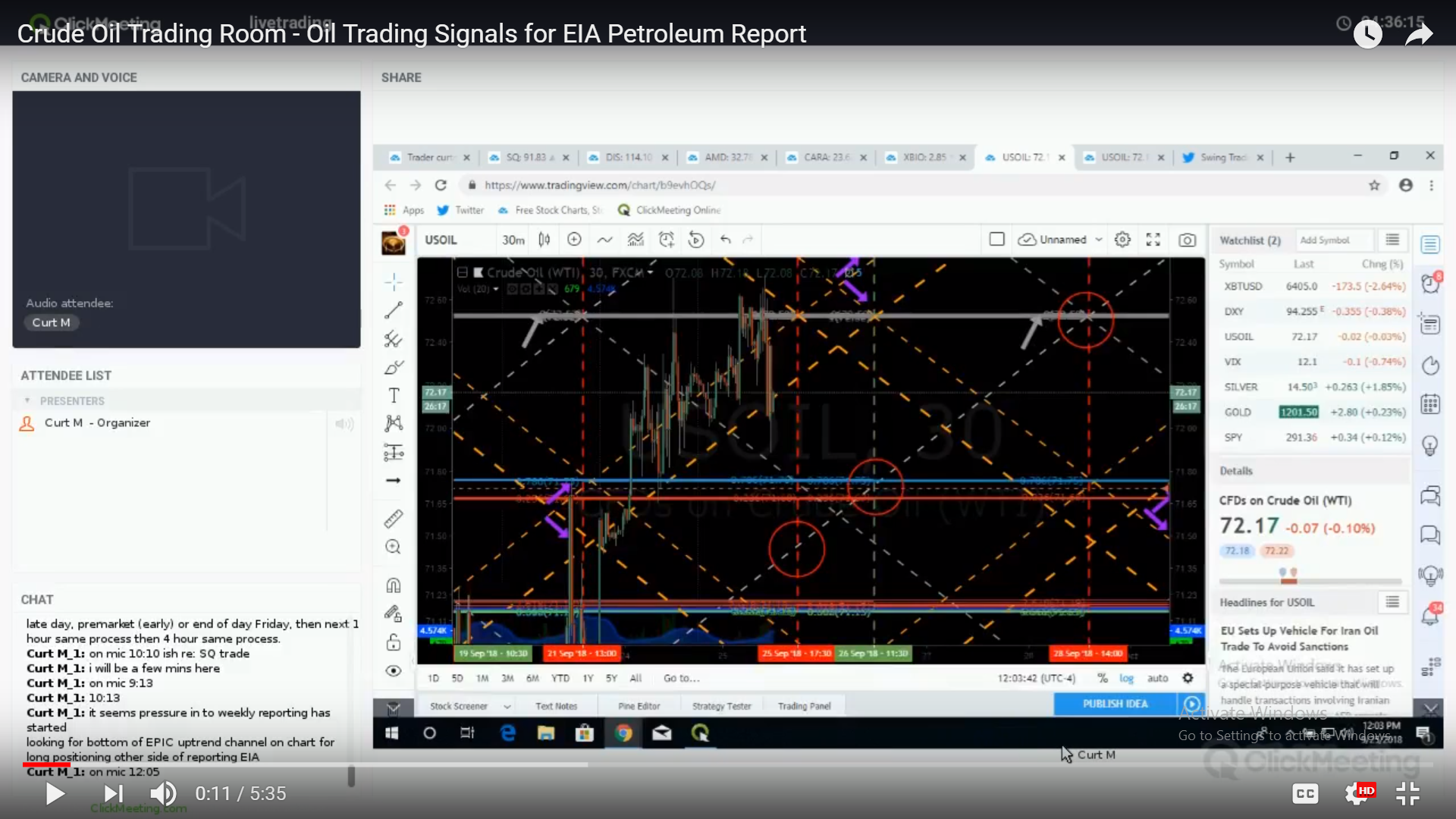

Oil trading room video of lead trader discussing oil trading signals, alerts, price targets and charts that comprise oil trading strategy leading in to the EIA Petroleum Report Wednesday at 10:30 AM.

#OilTradingRoom #OilTradingSignals #OilTradeAlerts FX $USOIL $WTI $CL_F $USO

Transcript summary highlights:

Sept 25, 2018 12:05 PM Oil trading plan.

I am looking for crude oil trade to come off in price in to the lower channel support on the crude oil algorithm (EPIC the Crude Oil Algorithm), or as near as possible.

I am looking for a significant size in trade of crude oil long if I can get a price entry near the bottom of the channel (the main point of my trading plan).

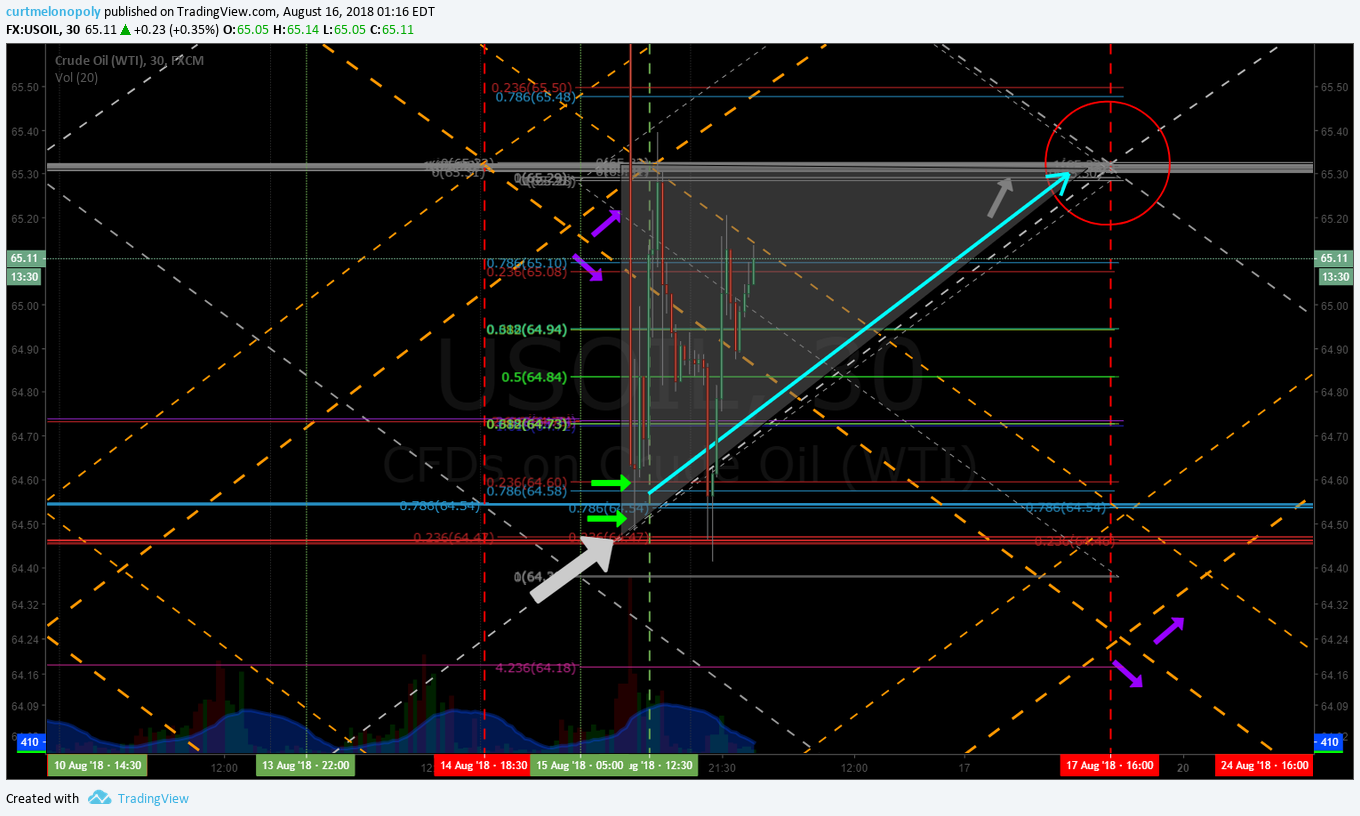

Below is the crude oil charting from the Sunday oil algorithm report sent to members. The channel (orange up trending lines) corresponds with the charting discussed in the video.

Large liquidity in oil trade is leaning in to the long side oil trade now.

There is even talk of 100.00 crude oil possible now – the Market Watch article states;

Amid the fresh enthusiasm, some have even been talking about a return to $100-a-barrel oil.

Read the Bloomberg article here: Major Traders Are Talking About $100 Oil Again.

The video was recorded mid day on Tuesday and I was expecting price pressure in oil coming in to API petroleum reporting Tuesday 4:30.

As it turned out, price did have pressure shortly after this video was recorded in the oil trading room and the API report at 4:30 later in the day did show a build in crude oil stocks larger than traders expected. Read a related article here: Oil Pares Gains As API Reports Surprise Crude Build By Julianne Geiger – Sep 25, 2018, 3:44 PM CDT.

In oil futures trade FX USOIL WTI is trading 71.99 off from 72.60 around the time when this video was recorded in the trading room but price has not achieved the lower channel support as of yet (9:15 EST Tuesday evening).

If I get the entry in oil that I am looking for I will stay in the swing trade for some time and I will day trade oil per the oil algorithm trading signals.

Intra-day oil is trading slightly divergent to the high side in the up trending channel on the algorithm model that was published for members in the weekly Sunday report, but that (divergent upside trade) will happen when trade is bullish.

I had expected price pressure in to upside crude oil price in to the swing trading range provided on the algorithm charting (horizontal gray resistance / pivot line).

Tuesday 4:30, Wednesday 10:30, Friday 1:00 price targets reviewed on the oil algorithm.

Trump has had some problem getting the price of oil to come down and it doesn’t look like that scenario is on his side geo politically. There is an article here that does provide a scenario for lower oil prices however.

https://twitter.com/EPICtheAlgo/status/1044733701421244418

Also reviewed on the video are the 30 minute candles for oil trade. I was looking for a possible intra-day short position.

30 Minute Candles in Oil Trade that is discussed in video (oil chart from trading room video).

Bottom line is that my trading plan for crude oil is a significant long side trade with hard stops and I will re-enter as needed to get my positioning.

Below is a screen shot of the oil trading room chat guidance from earlier today.

If you need more help getting on the winning side of your trades then I would seriously consider 3 hours of private coaching. Even the best traders in the world have a coach because a trading coach will keep your psychological game in check as it relates to following the trading of a rules based process. A trading coach is critical to success as a winning trader.

Best with it and let me know if you need anything.

Curtis

Crude Oil Trading Signals Discussed in Trading Room Here:

Learn More About How to Trade Crude Oil / Feature Reports:

Learning to Trade Links on our Site and/or YouTube.

Oil Trade Alerts: How We Knew Where Oil Sell-Off Bottom Was in Advance. Crude Oil Trading Strategy.

Crude Oil Trading Face-Off Results “Pro Trader” (Man) vs. EPIC Oil Algorithm (Machine Trading Tech)

“The Nut Hand” Today’s Huge Oil Trade Win. Exactly How It Was Done. How I Knew & How You Can Too.

No Crystal Ball? Watch this… EPIC Oil Algorithm #EIA $USOIL $WTI #OIL $USO $CL_F #OOTT #Algo

Oil Trading Room – How to Use EPIC the Oil Algorithm June 21, 2017 (video).

Oil Trading Room – How to Use Oil Algorithm Chart & Recent Trades June 29, 2017 (video).

Here we unlock historical member reports at intervals after time cycles have expired for traders that are learning to trade oil. When you clock on link scroll down at landing page on blog section you will be transferred to so that you can get to reports that are unlocked over time: https://compoundtrading.com/category/epic-the-oil-algo-chart-report/

Subscribe:

Standalone Oil Algorithm Newsletter (member charting sent out weekly).

Real-Time Oil Trading Alerts (Private Twitter feed).

Oil Trading Room / Algorithm Newsletter / Alert Bundle (includes weekly newsletter, trading room, charting and real-time trading alerts on Twitter).

Commercial / Institutional Multi User License (for professional trading groups).

One-on-One Trade Coaching (Via Skype or in person).

Click here to find all information and pricing on Oil Newsletter, Trading Chat Room, Oil Alerts and more.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States

Follow:

Article Topics: Crude Oil Trading Room, Oil Trading Alerts, Oil Trading Signals, Crude, Oil, Trade, Strategy