The Imminent Ambarella (AMBA) Stock Move

How to Trade the $AMBA Move: Price Targets | Buy Sell Triggers | Time Cycles #swingtrading #daytrading

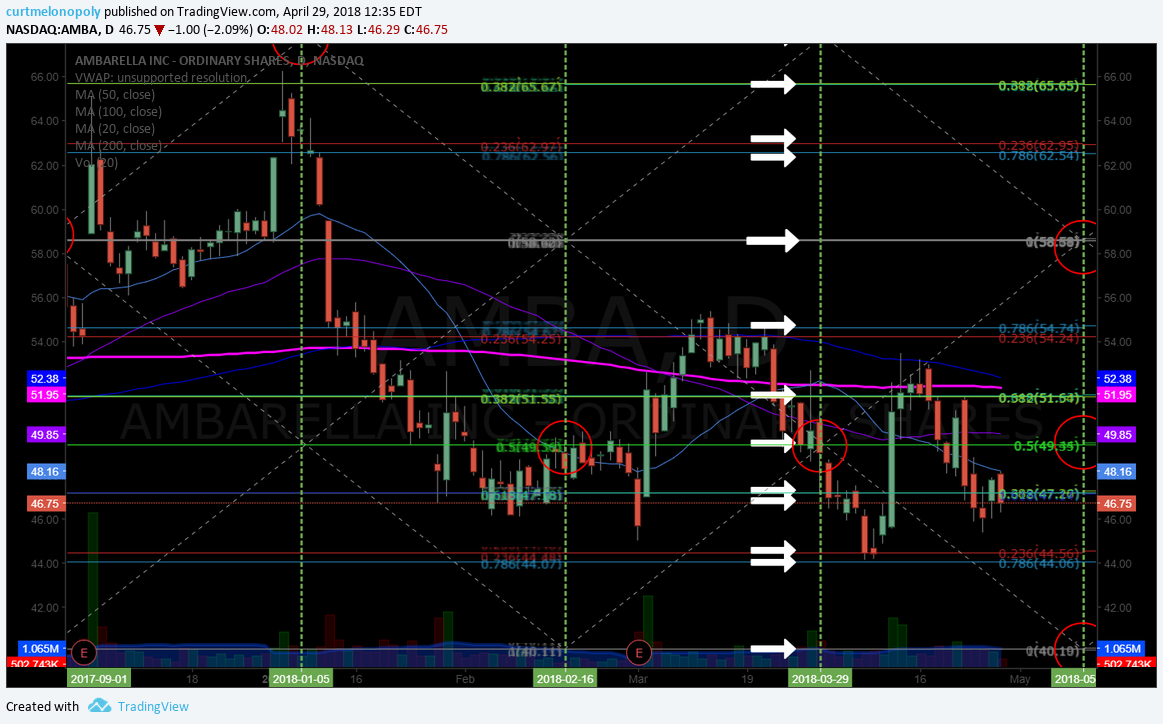

Ambarella (AMBA) stock has dumped from the mid 60’s to the mid 40’s since early January 2018 (a huge short side win – the Trump effect) and is now near recent historical lows (the Trump effect catalyst and run-up from September 2017 to January 2018).

Below is Part 1 of 2 parts for a detailed trading plan for Ambarella. You will find a trading plan for the bullish thesis and levels to watch for a bear thesis leading in to earnings in 39 days (June 5, 2018) and a critical time-cycle completion on the chart model at / or near the same timing (approximately June 9, 2018).

In the trading plan I include price targets, support and resistance levels, buy sell triggers and time cycle completions.

I encourage you to stay on top of this set-up because the gains to the upside on a simple retrace are at least 30% and more likely 40% or more over 3 months (if the bullish thesis plays out).

Check my call record – when I put out an alert do not ignore this trade set-up… the probability of a serious return is extremely high – the proof is in my record.

Using this technical set-up you will know how to exploit the move for a much greater return if are an active trader (of course this is not required for an excellent gain) and you trim long positions in to resistance in anticipation of moderate retrace and add above each resistance after each retrace.

First, what’s new at Compound Trading…

What’s New;

- April 30% Off Sale ends this Monday. Click here for available Sale Promo Codes.

- Interested in more free swing trading setups like this? Sign up here Complimentary Swing Trading Report Mailing List.

- Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

- Now available for serious traders, information here for our exclusive Legacy All Access Membership.

- 24 Hour Crypto Trading Desk opens mid May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

The Ambarella Trading Plan In Detail.

The AMBA chart structure has had my curiosity for some time, it has traded very clean and predictable through the model I have been using. The support and resistance areas at the key Fibonacci levels (price) react well, the time cycles are spot on and the trend is your friend with this stock.

We alerted the run up in late 2017 and the down turn in 2018 – both were fantastic trend trade set-ups. Find below example of the public alerts I put out (not withstanding the member technical alerts fed out in private):

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading pic.twitter.com/1iqGppNGQF

— Melonopoly (@curtmelonopoly) November 13, 2017

$AMBA There it goes. In it to win it #swingtrading

$AMBA There it goes. In it to win it #swingtrading pic.twitter.com/1rRHa2whzt

— Melonopoly (@curtmelonopoly) November 20, 2017

I am expecting we will see yet another turn in price trend leading in to earnings and the time cycle completion in early June, 2018.

Trade Set-Up Catalyst(s):

Earnings: Here you will find the Nasdaq website link for Ambarella earnings: AMBA Earnings Date Earnings announcement* for AMBA: Jun 05, 2018.

Time Cycle: This set-up is excellent in that the timing cycle on the trading range peaks in and around (just after) the scheduled earnings date. From a technical perspective, the dates could not be lined up better (see technical charting below).

Historical Support / Lows: AMBA hit low 40’s in September 2017 and ran up to mid 60’s by January 2018. The September lows were perfect to a time cycle peak and I’m looking at them as a technical catalyst for the trade.

The Trump Effect: The Trump effect was massive on this stock play, a simple Google search and $STUDY will show you the obvious effect on this and related plays.

About Ambarella:

If you are not familiar with Ambarella the company, read about them here at the Wikipedia page link: Ambarella, Inc. (NASDAQ: AMBA) is a fabless semiconductor design company, focusing on low-power, high-definition (HD) and Ultra HD video compression and image processing products.

And This is Why AMBA Could Be a Grand Slam Trade Opportunity | Emotional Investing and Trading.

A quote from this widely read article, “Will Computer Vision Lift Ambarella Higher?” written by Nicholas Rossolillo, and published to The Motley Fool April 23, 2018 sets up the bull wash-out snap-back thesis perfect leading in to earnings… and if you look around some you will see many such media sentiment driven messages to the general investment public.

Here’s the quote;

…leaving Ambarella shareholders with a stock that has been stuck in a rut the last few years…

This is an example of how generally the average market participant will operate in panic and sell low after buying high on emotion (from media messaging) and / or will become excessively short side bias and a retrace rally ensues.

And then…. look around… there are snippets of the turn coming… it may not be this earnings… but it could be, and if it isn’t this earnings season (poor results are more likely), it will be the next or the next. But what is most important is the action of the panicked shareholder in advance of earnings relative to sentiment and the simple science behind the retrace that is imminent – it is only a matter of when.

Here’s is just one example of grains of hope in a turn for future ER;

Force Protection Video Equipment (FPVD) announced today that it is receiving record orders…

Force Protection Video Equipment Reports Record Sales from the Release of New Product Catalog

Whichever way this goes, our duty as swing or day traders is to always trade price and to HAVE A PLAN, so below is your technical chart set-up and trading plan either way for excellent profit for Q2 2018!

The Bottom Line? | Profit

So what’s my bottom line in my thesis? If I’m right (and if I’m not it’s a simple cut fast with a minor cut) there’s a wash-out snap-back trade setting up here that is near epic proportions (relative to market returns for 2018).

At minimum I’m looking for $AMBA to snap back in to the 53s. A trade from the low 40s to the mid 50s is a serious return (if it actually happens and if it happens over the course of the next 3 to 4 months).

Could I be early or wrong? Sure. Trade price. Below is how…

The Technical Chart Set-up for Trading Ambarella $AMBA.

Here is how the technical set-up appears on the daily chart for $AMBA in advance of the earnings trade. This is the playing field for a trade set-up that should easily net 30 – 40 % gains in the next 3 months. In Part 2 of this article I provide a detailed play by play plan for the trade.

Next in part two we will review the chart set-up above and form a specific trading plan (for a turn up or down) including price targets, buy sell triggers, support and resistance and more.

If you are on our mailing list you will receive Part 2 in this article today. If you are not already on our Free Swing Trading Periodical email list follow the link here to get on it to receive this trading set-up and others in the future. Unsubscribe anytime.

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Any questions feel welcome to contact me anytime.

Best with this trade!

Peace and best.

Curt

Connect:

Register to Free Swing Trading Periodicals and Webinar Notices. Contact Form: https://compoundtrading.com/swing-trading-periodical-contact/

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for full-time daytraders. Private coaching and live alerts.

Article Topic; AMBA CHART. How to Trade AMBA, $AMBA, #swingtrading #daytrading